-

Posts

2,990 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

Raising rates even further consolidates the status quo, a final squeeze! In Germany politicians are not willing to spend much at all, meanwhile we have a completely dysfunctional health sector, public mobility sector, public institutions are absolutely broken etc...and liberals continue running this country as a private household. The left is completely useless too because of a crazy immigrant strategy and boosting social safety nets instead of boosting wages and willingness to work. We just lack good leaders here, i am personally hoping the newly formed BSW party lead by Wagenknecht can find a balance in our political spectrum.

-

Yes, it was a catastrophic underfunding of everything and tax breaks particularly for people well off in the west. Everything starts crumbling now, hospitals dont have places, trains not running on time, not enough educated personnel in many sectors, underinvestment in diversified energy (europe, russia), underinvestment in local industry (industry too much in china), its crazy. Private capital wont invest because returns are difficult to be made because of the huge consolidation in many sectors over the last decades and there is a lack of demand because the bottom got squeezed out. Only solution would be a large scale keynesian boost+regulation IMO.

-

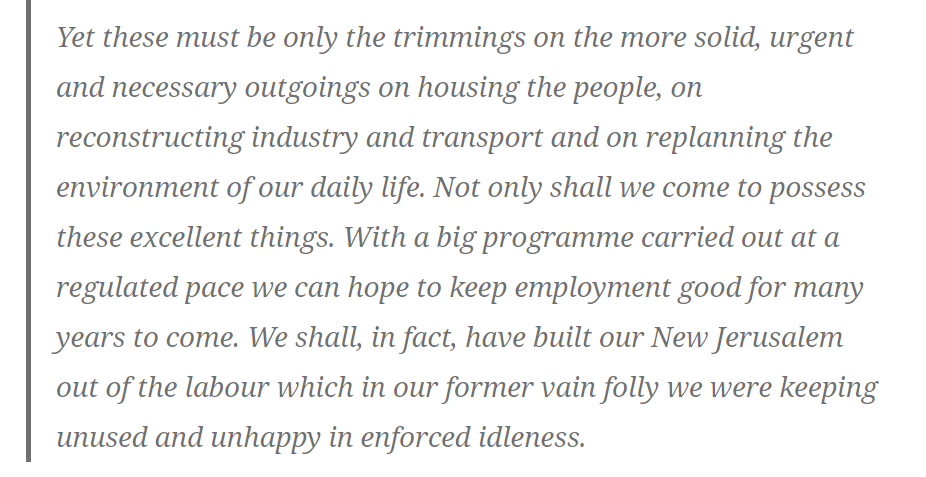

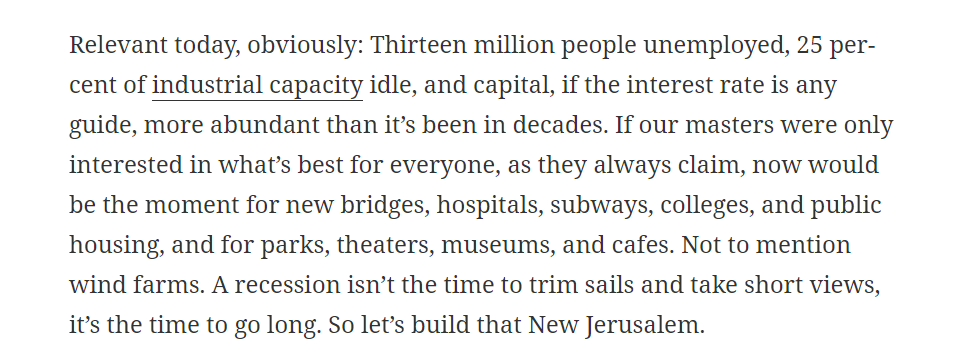

Stumbled on this nice Keynes quote again today, really relevant still today. "Anything we can do, we can afford." Its time to go long!

-

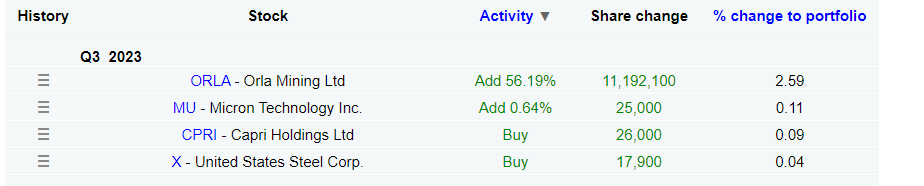

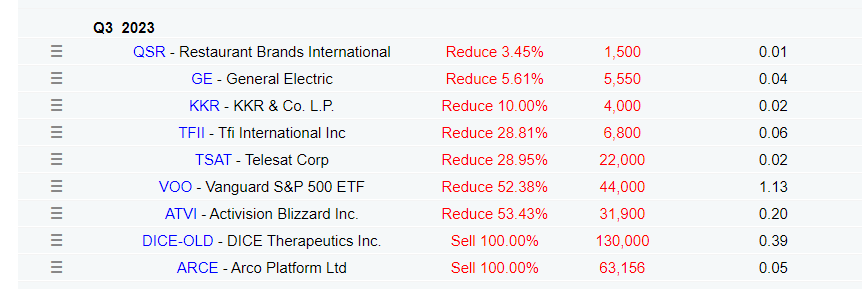

13F from FFH. That SP 500 position got cut in half, no idea what that was....and significant add to Orla Mining.

-

Added to AMR, getting close to full position now

-

I left BRK and Markel for FFH around a year ago, BRK only a 5% position left (sry @buffett)

-

The question will be, how will the wealth that is produced by robots be shared through the population? Right now the vast majority of capital flows into few hands and many are sitting on 0 and on debt. If more and more jobs fall away, there needs to be a redistribution program of some kind to catch up the people who own no stocks or are in debt via big mortgages etc.

-

Well, he said it himself, its not about the fundamentals but past mistakes and "complexity". I would have expected their analysis was based on fundamentals haha!

-

Thanks, will have a look!

-

Considering buffett is bound to buy large cap oil, what are some of the smaller oil players that are maybe even cheaper and have a similiar story as oxy? Could somebody point me towards the right threads, would be much appreciated

-

OXY and AMR!

-

After reading more today, i sold my remaining stake in TSMC and added proceeds to AMR and OXY.

-

Excited for the reply, very precise and great email!

-

Yes, the rejection stems from previous mistakes, unknowns in insurance with proper underwriting, previous investing mistakes that shade their reputation, then also the little following (Markel CEO on every podcast, Berkshire on many podcasts too but FFH? Nope....). If they have managed to make 7% even with the mistakes that have been done, if they learned (which i think), investment returns will be significantly above 7%. Id like to hear how watsa thinks about the stock in an interview, obviously in the earnings call he sounds excited with his 3b+ operating income, its almost as if he is chuckling a bit and hinting on how meaningful the performance actually is. Cheering for the underdog FFH! and as said before, easily thinkable that the market will realize in a couple of years down the road that they are one of the best.

-

Its psychologically difficult to buy a business that had almost 0 optical returns (dividends obviously came in) from 2014 till only last year. Then fairfax is also not the easiest business to understand for people who havent invested in insurers before...

-

Yeah, i still think we are all here only a super nieche forum with not much following, overall market doesnt know or appreciate fairfax. I have pitched the idea to friends who are also seriously investing, so far nobody bought in. They dont trust insurance, stock portfolio looks weird on first glance for them, stock chart too haha, then they saw blackberry, then you read about some of prems mistakes, its easy to put it off.

-

"Cuck asset management" xD

-

Wise man, bought at market open, i am just getting into oil now, late to the party but had time to read up and listen to interviews etc, i am still seing value

-

Opened a position in OXY and added to AMR

-

Movies and TV shows (general recommendation thread)

Luke replied to Liberty's topic in General Discussion

-

Movies and TV shows (general recommendation thread)

Luke replied to Liberty's topic in General Discussion

Interesting Movie, worth watching for SciFi/Horror Fans, watched a week ago and was impressed but it also lacks a bit detail. Anyways, still decent watch. Dont watch the trailer because it spoils so much -

My biggest worry is that deals become harder and harder to find due to the size of assets, which stand at a Trillion now. They are basically unable to buy big positions in businesses below 20b Marketcap and even then it will be hard to buy enough shares over time. Those positions also dont do much of a dent to the performance either, even if they 10x.