glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

https://www.fortuneindia.com/venture/we-knew-if-we-give-good-service-and-products-we-will-pull-through/106016

-

article on Eurobank The head of Eurobank underlined the very positive climate for the economy, the consolidation of the banks and the large amount of available funds for investments. https://www.businessdaily.gr/english-edition/50561_eurobank-ceo-greece-see-strongest-growth-sixties

-

interesting thanks Viking

-

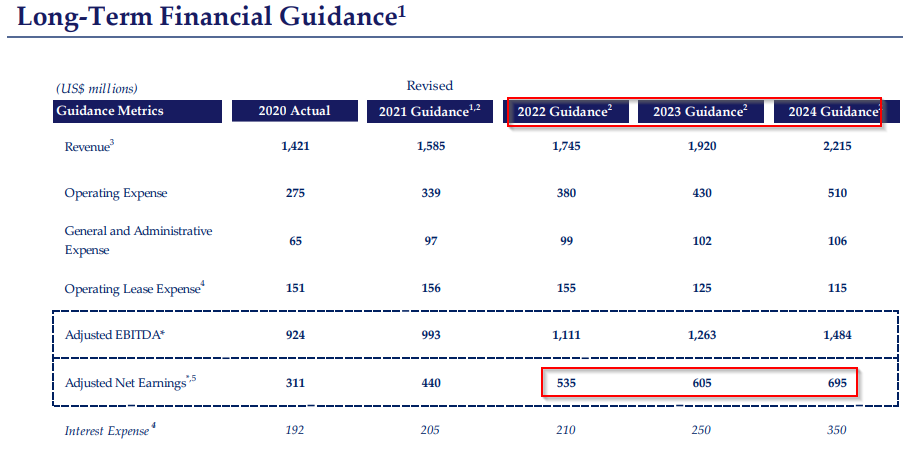

omagh your calcs look wrong - they issued 5.1 mil shares at a 6% premium to BV to buy Allied World which effectively increased their BVPS by 1%, but you are suggesting they received a 20% approx boost to BVPS (4.6% compounded over 4 years) from issuing those shares. I would also say capital management & how you fund your business (with equity or debt) matters and I don't think BVPS growth that occurs, as result of buybacks or share issues, should be ignored when we evaluate performance. But I would probably agree that BVPS growth that is result of organic operating performance should be given a greater value weighting than BVPS growth that comes from equity issues at premium to BV. I think if you look across Fairfax's business in 2017 & compare it operationally/financial performance wise to 2021 you are comparing two different animals. Digit - 2017 had just opened its doors, in 2021 Digit was ranked for the 3rd year in the top 250 fintechs in the world. Atlas - 2017 first debt investment, over next 3 years 2022-2024 Fairfax could potentially receive a profit share (approx 47% stake unchanged) averaging around $280 mil based Atlas profit forecasts (below from Atlas Q2 21 presentation) on cash flows that are already contracted to their customers. From Mar-20 until now we have been dealing with a covid pandemic & just starting to get vaccination levels to a point where countries can start open up & get back to normal - this has had a huge impact on Fairfax's insurance underwriting and investments - the negative impact over next 4 years from covid will in all probably be a lot less So I think looking at the annual report & grabbing a few numbers & extrapolating that based on those numbers the next 4 years will look the same, without considering any of the business drivers (eg hard market, less impact from covid, investee performance etc) that will actually generate that BVPS growth, its unlikely to provide IMO the right insights you need to predict Fairfax's likely valuation/performance. Yes history matters but you need to put it in a context.

-

Digit Insurance, a general insurance company offering health, car, bike and travel insurance, has been named one of the top 250 fintech companies globally using technology to transform financial services by CB Insights, a US-based market intelligence agency. Digit is the only Indian insurance company featured in the CB Insights Fintech 250 list. https://www.apnnews.com/digit-an-indian-insurance-company-to-make-it-to-cb-insights-fintech-250-list/

-

Has anyone tried out Onlia to buy insurance? Onlia is digital insurer JV between Fairfax & Achmea https://www.onlia.ca/about

-

spek Its definitely a risk I think about - to what extent will withdrawing stimulus/higher taxes weigh on economy - we have had this sugar hit post covid (eg high commodity pricing) which has driven stock prices of commodity producers up a lot but we all know its unsustainable - we have to be mindful. On the other hand, we are just about to come out of lockdown in Sydney, people are going to start going to restaurants, travelling etc the economy here & globally has been hurt by delta but we are going to reach the end of that eventually . So thinking about all of this I see positives & negatives but yes if we relapse into recession this would hurt Fairfax. But I guess I come back to this question - in buying FFH now am I being compensated for these risks with the company, industry & economy. Its then a 'bird in the hand' argument. Fairfax is at a historically very low 2/3 of BV, do I sell now & pay tax (in my case its held under a year & would be in the 30% area), in the hope I can buy it back next year at an even lower price plus I have to be compensated for tax paid etc? It just doesn't make sense to me. A lot of financials are trading much closer to fair value than Fairfax & I am not interested in them. As well as P/B I also look at the total enterprise value/revenue ratio which ignores debt in comparing insurers. When I checked tikr this week Fairfax is in the mid 0.7 area & the avg was 1.1 but then you have specialty insurers on much higher levels- but then also you have to compare on other metrics like product focus, geographic focus - an insurer that operates exclusively in US - how comparable is this to Fairfax that has this significant international business with higher growth rates & insurtech investments in Digit, Ki Yes you can trade FFH - I am not a technical trader but I could see there was probably a double bottom reached last week & then you can see a series of higher highs & higher lows earlier in the week - basically enough momentum for technical traders to jump in to earn a couple of percentage points.

-

this might be reason for jump today https://timesofindia.indiatimes.com/india/india-to-issue-tourist-visas-from-october-15/articleshow/86854319.cms

-

Thomas Cook India & SOTC survey reveals Significant travel intent for last quarter 2021 https://www.equitybulls.com/admin/news2006/news_det.asp?id=299178 Also looks like shares up around 23% since 30 Jun-21 based on mid-day trade - not a huge position but a circa $45 mil or so bump Even though we are in a bull run caution is setting in. Is it time to skew the portfolio towards deep value stocks? Are you sensing this change in mood? Right now, we are seeing a return to normalcy in India. The economy is beginning to revive, unlocking is happening and therefore whether it is the hotel companies like Chalet, Indian Hotels or Thomas Cook, all these are certainly seeing a lot of bookings. When they report the next quarter, you would see really strong numbers. .. Read more at: https://economictimes.indiatimes.com/markets/expert-view/has-the-market-mood-shifted-in-favour-of-deep-value-stocks-chakri-lokapriya-answers/articleshow/86840374.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

-

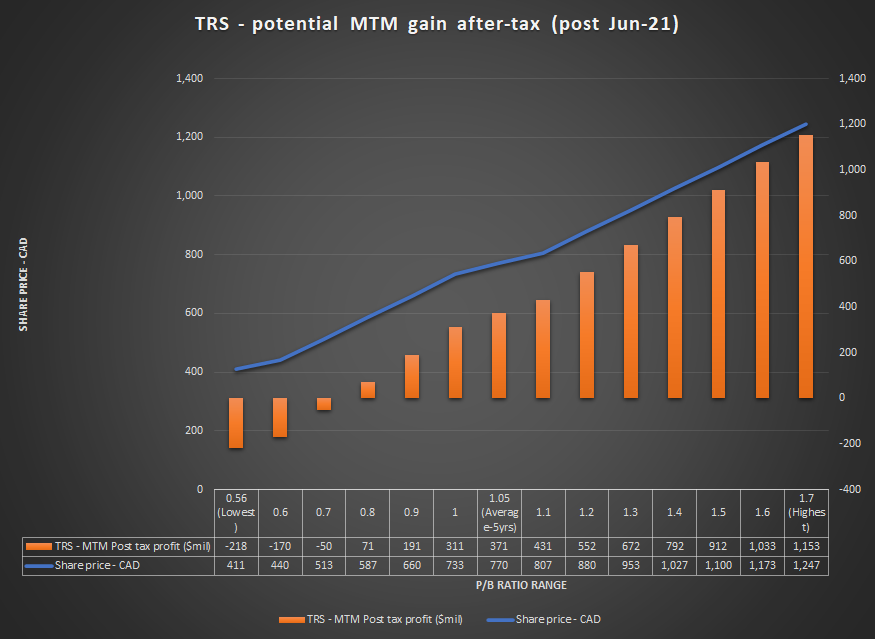

I would add that most of the time, valuation just becomes its own catalyst NYSE listing - is it really necessary? main reasons they gave were inconvenient, costly, US investors can buy on TSX anyway & doesn't impact their capital raising capability https://www.theglobeandmail.com/globe-investor/fairfax-financial-delisting-shares-from-nyse/article4215526/ Fairfax bought over 1.5% of their shares in last 12 mths but yes I would like to see hopefully more + bigger buybacks in future - the swaps are a synthetic buyback as well - fyi for those who are interested, here are my calc estimates if Fairfax returns to avg P/B in last 5 years, Fairfax will make around $370 mil after tax (@16.5% estimated tax - could change??) on these swaps (this is on top of any MTM gains up to 30 Jun-21) . Here are my estimates on potential return on swaps based on market price trading at different P/B ratios - hope its not too confusing Yes I am mindful they need to take advantage of monetising equity or wholly owned positions in an opportunitistic way this is something I am watching - RFP maybe they could have trimmed/ sold at $16 but I checked & apparently there is an analyst with an $18 price target on RFP & median price target of $16 - I haven't done a deep dive on this one but is it clear cut??. With BB the most they could have trimmed/sold at was around US$12.50 IMO - see my last post on reasons why. BB Is one I am more concerned about but in the context of everything else going on, at least BB is a smaller % of the overall pie now. On the flip side, there have been a lot of monetisations by Fairfax this year more so across their operating subs but still they are being opportunistic - Viking has done a good job covering these so no need to repeat.

-

I agree Viking - lets put BB in context - Fairfax are firing this year on so many fronts.

-

Also even though FFH was unable to sell - BB did have opportunity to raise capital at high price when meme stocks spiked - that would have benefited FFH -why didn't JC do it.

-

couple of things to jump in probably not saying anything new but - Prem implied that they would have sold BB in Q1 but couldn't due to an SEC rule & during the second spike this year (near US$15) it occured during a quiet period. - in renegotating the convertible debentures they brought down their average cost - they do have intent to exit BB but only at the right price. Fairfax investment team sold their BB positons in Q1 (Wade,Lace) - I don't think their methodology for investing in BB was wrong (JC had a good track record & BB had significant assets) at the beginning but sitting on it for such a long time was a big mistake - as gregmal said they have domain experience in insurance & so they have invested successfully in insurtech but they probably need a partner like a VC/fund/partnership specialist in tech investing to basically manage their tech investments outside of insurance like they do with property (eg Kennedy Wilson) - if BB had started off as a small position & stayed that way we probably wouldn't be talking about it much but it was a big, concentrated position & that is the issue. - it does raise issues around portfolio positioning (sector,geography) - how do Fairfax think about this in the context of their insurance liabilities - maybe I will submit this one to next AGM.

-

I think Fairfax see their AGM as their investor day - format was different this year with Covid - I went along time ago so not sure what the last 'in person' meeting was like. Yes agree would be great to hear their 5 year future plans for both insurance & investments also to hear from Wade Burton & other members of investment team. I agree that the website needs improvement (needs to be optimised for mobile so its easier for investors to use) & an IR email contact would be great. I did appreciate Prem answering 3 of my questions I submitted to this years AGM on Digit, the swaps & Blackberry - I am going to acknowledge that its not always easy for an individual investor to have your questions answered by the CEO directly.

-

so I think that would put FIH's stake of 1% on implied valuation of around US$234 mil versus carrying value of US$99 mil at 30 Jun-21 Calc total implied valuation 1.75 lakh crore = 1.75 tril INR USD/INR 74.77 USD 23.4 bil (FIH has 1% share) Looks like when they marked in June they might have applied a discount for lack of liquidity as unlisted - so so if the unlisted price has nearly doubled from 1750in March to around 3300INR-3500 they might mark up by around 80-100mil from 30 Jun-21 valuation - thats my guesstimate assuming they think that unlisted price is reasonable Cheers.

-

Yes petec agree - I think they are in Digit for the long term & its strategic investment, however, I think they will want to provide some liquidity to their retail individual shareholders, employee investors & VC funds at some point - but maybe they can do both via an IPO but retain majority control. They have also said they are aiming for 10% market share in GWP in India - probably will take them 3-4 yrs to get to 5% (up from their current 1.7% share) assuming mid 30% GWP growth rate. So if they are going to get to 10% - at least 7-8 years I am thinking. If they get to 5% market share & maintain their growth trajectory, I think it couldpotentially double Digit's valuation to around 7bil based on their current value of 3.5 bil with a 1.7% share If they can double Digit's valuation then assuming dilution is not excessive Fairfax's stake could be worth around $4.5 bil. But maybe an IPO route could help them get to that valuation earlier. I checked IRDAI and among insurers that have over 1% share - they are far & away the fastest growing, non-life insurer in India. There are a couple of digital insurers under 1% share including Acko that are growing at faster percentage rate but off a much lower premium level. They are also sharing the tech know-how from Digit through the rest of the Fairfax insurance business - so I think it has strategic importance - digitalisation in insurance sector is happening at a fast rate & I think Digit is a key part of Fairfax's strategy in capitalising on this. They have also talked about expanding Digit beyond India - nothing has happened yet but maybe something to watch.

-

another one https://www.barrons.com/articles/steel-stocks-industry-revival-51633128537?tesla=y

-

I would even suggest that is probably a daily conversation at Fairfax HQ with share price where it is - they are getting to a point where their operating performance will start to throw off a lot more cash over time & potentially greater divs from subs to holdco (as subs are in much stronger capital positions than last year) but if they want a more short term solution bearing in in mind they want to sit on their $1.7 bil cash position, they would need to sell something else like they did with Riverstone to give them $1-$2 bil to make the share buyback meaningful otherwise smaller buybacks will have to do for now.

-

petec I didn't see any value in FFH when I sold my shares in 2016 for approx CAD 700 at a premium to BV - I just couldn't see how a 15% return was even possible with a fully hedged equity portfolio. Then covid hit, FFH shares got beaten up and my view changed - look at some of the positive reactions to the Digit announcement in July from some of the posters on this board who have entrenched negative views on FFH With sustained positive performance from FFH, those negative viewpoints will change IMO

-

Yep agree - its now a case of watching how that story plays out

-

I am a bit more long term focused, at least 1-2 yrs, then I will see how FFH positions themselves to decide longer term what I will do. I just like the reward/risk set up now.

-

thanks bearprowler - so I guess you are saying its share price is undervalued but probably not as much as I do - thats cool we all have a different viewpoint.

-

Yes agree 2021 is a start but needs to be more. You are right - it is all about results in the end.

-

Sure but is it family control that is the primary driver of that BV discount? I don't think thats the main driver - there are other family/majority controlled insurance/investment businesses that trade at a premium to book. The difference with Fairfax is that these other businesses have a better financial/operating performance over the last few years than Fairfax. Fairfax is working on that & I think results in 2021 show they are on right path. In terms of comparison, ELF is a investment company with a Canadian life insurance subsidiary. Fairfax is mostly a global, property casualty insurer & reinsurer with large interests in non-insurance companies. So two different businesses operating in different product segments & different geographically- not really an apples to apples comparison IMO Few other observations from looking at Morningstar is that ELF offers a low income yield with limited revenue growth. ELF pays a 0.8% div yield & Fairfax pays a 2.58% div yield ELF 3 year annualised revenue growth is 3% but trades at 1.58x sales (vs 1.75 x 5 yr avg) . Fairfax's 3 year annualised revenue growth is 12.3% & trades at 0.46x sales (versus 0.79 x 5 year avg) I don't mean to imply ELF is a bad investment - have not done a deep dive so no comment on this front - I just don't think its a peer that FFH should be benchmarked against.

-

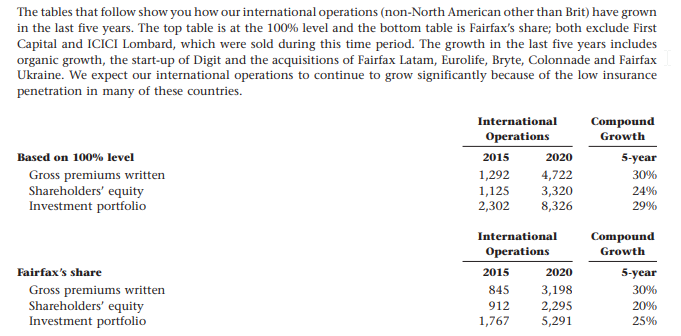

Fairfax paid $240 mil cash for AIG Europe, South America and AIG Turkey. Fairfax then onsold AIG Turkey to GIG for $48 mil https://www.xprimm.com/TURKEY-GIG-aquired-AIG-Sigorta-for-USD-48-million-articol-2,143,11-9427.htm So net purchase cost $192 mil 1. With AIG Europe, looks like Fairfax (via their sub Colonnade) bought the renewal rights & operating assets plus staff from AIG but not the liabilities, but offered to help AIG manage them (for an additional fee? not sure) Through an ongoing partnership, the company is providing claims handling and run-off management services to AIG in the European countries where business operations were acquired. Colonnade appears to have been underwriting profitably every year since 2017 & in 2020 had NPW $150mil & combined ratio 93%. 2. With AIG Latam, they bought the whole business with shareholder equity of $145 mil & GPW $580 mil in 2017. Looks like they have had issues (Chilean riots, Argentina inflation) which caused underwriting losses in 2018 (CR 119%) & 2019 (CR 117), but they appear to have focused on not growing top line just the bottom line - in 2020 they wrote $616 mil GPW ($219 NPW) with a CR 98% & had shareholder equity of $137mil. So I guess they paid $192 mil & 4 years on receiving NPW $369 mil with both subs generating underwriting profit in 2020. We can look at the acquisitions in $ terms, but I think Fairfax look at these more strategically - it costs money & time to set up an insurance business in a foreign country from scratch, apply for insurance licences etc - they got all of this with these acquisitions. In terms of Fairfax's growth internationally & their record, I think it is more useful to look at their performance across the entire international business - see below