glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

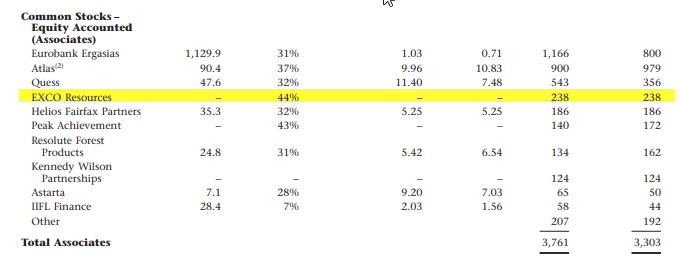

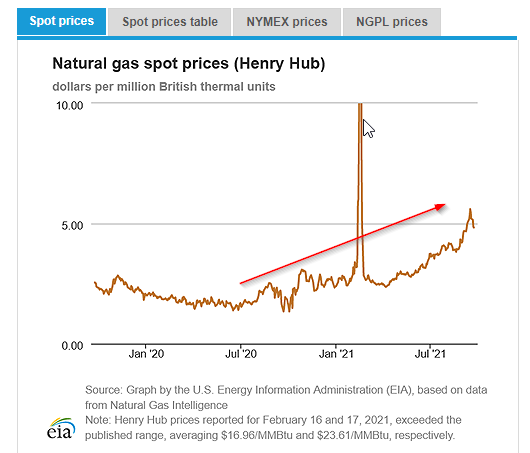

good find petec Fairfax were carrying Exco at $238 mil at 31 Dec-20 based on 44% ownership (see below). So that implies equity value of $540 mil for whole business. Then net debt is 140 mil (1.1x EBITDA at 31 Dec-20). So Enterprise value(EV=equity + net debt) would be around 680mil. Exco generated EBITDA of128mil in 2020. So EV/EBITDA of around 5.3. Since mid 2020 natural gas price has basically doubled (see below) & industry appears to be keeping production tight through fiscal restraint & that combined with increasing natural gas demand should support pricing https://www.texasmonthly.com/news-politics/natural-gas-prices-surging-drillers/ Are Exco fully hedged or if partially hedged/not hedged they would be in a great position to increase EBITDA & so could we expect a higher fair value versus carrying?? I guess we will have to wait & see annual results - not much publicly available info in Exco. (from AR2020) Fairfax owns 44% of Exco, a U.S. oil and gas producer. Despite weak energy prices in 2020, Exco generated $128 million in EBITDA and $36 million in free cash flow. Net debt fell to $145 million (1.1 times EBITDA). Led by 28 Chairman John Wilder and CEO Hal Hickey, Exco achieved these results through high field level productivity and company-wide cost control. In December, Exco recorded its 73rd month without a lost time incident. Exco’s Chairman, John Wilder, is a great partner. We are well served by his leadership.

-

I think the counterparty who has entered into this TRS with Fairfax would most likely be hedged (eg by owning the underlying shares) - so they would make their money from the floating rate payment (libor + spread) from Fairfax rather than any short sales TRS position is a calculated risk in terms of timing but looks really cheap at around US$372, if Fairfax's book value hits US$600 per share by year end (factoring in Q2 was $545 plus $46 (Digit transaction Q3/Q4 closing) plus Q3/Q4 results) & adjust BV for excess of fair value over book value of their non-insurance subs, effective TRS entry price will likely sit between 50-60% of Fairfax's adjusted y/e book value - so there is very low downside risk, high potential return IMO

-

Just thinking about Digit valuation purely in terms of P/S (ignoring P/B or combined ratios) - I am going to use GWP to compare with ICICI Lombard Looking at the Digit valuation recently US$3.5 bil (around 7.8x GWP for 2021) versus peer ICICI Lombard market cap around US$10.2 bil (around 5.2 x GWP for 2021) Digit GWP growth for 2021 around 40% versus 9.4% for ICICI If we look out to 31 March 2025, lets assume Digit can continue to compound GWP at average rate of 30% over next 4 years to reach US$1.26 bil Then lets apply a multiple of GWP to estimate valuation - lets say 6.5x (which is lower than recent valuation at 7.8x 2021 GWP) but which is bit higher than ICICI Lombard current level & also factors in slowdown in GWP growth rate (Note: appears Price to GWP multiples in INdia generally are higher & that ties into higher GDP growth rate, higher investment return yields available etc) 6.5 x US$ 1.26 bil = US $8.19bil Now to get to US$1.26 bil in GWP, Digit will need to raise regulatory capital & could go the IPO route or continue to raise funding from VC - either way Fairfax's stake will get diluted but lets assume they dilute from 70% area down to 60% Fairfax's stake then is worth US$4.9 bil or around US$190 per share by 31 Mar-25. So making quite a few assumptions here but lets say Fairfax could generate another US$100 in BVPS growth over next 4 years from Digit or US$25 per year (or US$650 mil) or around 4% BVPS per year. Potentially then Fairfax could hit 4% out of the magic 15% BVPS growth target, just from their Digit investment over the next 4 years. Is that reasonable?? Or maybe they will IPO earlier & hit that valuation earlier - there have been some eye popping valuations in Insurtech listed stocks globally The big risk with India at the moment is that tech valuations pullback at some point - the flip side is that India is attracting more VC capital due to the situation in China - in a way the Country is getting a multiple re-rating.

-

yes they wouldn't disclose the price viking with negotiation ongoing - I guess we have to put Blackberry in the portfolio context of Fairfax's other stuff they own - if all Fairfax's holdings looked like Blackberry (with more of the valuation being placed on future cash flows from untested business like Ivy) I would be worried , but having Blackberry in there gives Fairfax this business with disruptive potential (Ivy), future Cyber/iOT growth plus potentially decent payoff with patents - if everything comes together over the next 12-24 mths it could work out well.

-

I agree SJ - BB is not a buy when you do the numbers on it & probably deserves to be reduced at least to a smaller position for Fairfax but maybe they see greater value for reasons which are not in reported numbers (patent deal, Ivy potential, wins in Cyber,iOT) or maybe Fairfax are locked out from selling (due to patent negotiation)

-

thats an interesting point petec - JC said in CC they have agreed on the price, so assuming this is also discussed at Board level (& I can't see why it wouldn't be) then in that situation Prem would know what it is - the price would probably be material non-public information IMO & regardless of the 'quiet periods' that Blackberry has - if Prem is aware of the price then I think that would prevent Fairfax trading their position until the negotiation done & deal announced.

-

All good points petec - I just listened to the call too as well Here is interesting background on Ivy & would recommend reading Frost & Sullivan paper as well https://www.autofutures.tv/2021/07/13/why-blackberry-qnx-is-in-the-ivy-league-of-cross-industry-platforms-grant-courville-vp-of-product-strategy/ I agree that Fairfax should hold BB but I see as a higher risk play with a lot of goodwill built in - it also has this asymmetrical risk/reward aspect to it & Fairfax have a habit of liking these sorts of bets (like the GFC CDS short bet that worked & the deflation bet that didn't). Its not a strategic hold they have admitted that on conference calls, Prem tried to sell it in Q1 but couldn't for legal reasons, they obviously have a price target in mind & its not $10-$11. Going back to Ivy & excuse my ramble. If Ivy becomes the dominant digital ecosystem for automotive/smart cities with majority of car manufacturers and car users (eventually as new intelligent connected vehicles are sold) utilising this data platform - - and every time an app is downloaded - like Car iQ (digital wallet) or a battery efficiency management app or service sold (car insurance) or payment made (from car through a bank) using Ivy platform then Blackberry takes a cut each time - you can start to visualise how massive Ivy could become. First mover advantage is important, if Ivy becomes dominant software data platform in connected vehicles/smart cities they will be hard to displace (like Android or iOS) & all the apps will be built on there - they will build a defensible moat & Blackberry could be a very different & more valuable company. At the moment Ivy is still a blank canvas, use case still needs to be developed and proven - early version being released in October. The use case for Ivy will only be realised through the building process & a lot more apps will need to be built - this is really the advantage of teaming up with AWS developer community. I agree petec that if Fairfax sticks around with Blackberry at least for the next 12 mths we will have a lot more visiblity around the potential for the business - of course if they get a great price tomorrow like the Q1 pop then I am sure they will take it - lets see anyway There is another side to Blackberry - now I am a value investor at heart but bear with me Blackberry is a meme stock and it pains me to say but people want to own it for that reason - its a social media stock - meme ETFs are now also a thing. Now I am not suggesting Fairfax should continue to hold it for that reason but lets put our 'trader' hat here - they have to consider that as a 'meme stock' you have the potential for really skewed stock price returns & this higher volatility could potentially play into Fairfax's hands - it almost did in Q1! For example, Blackberry apparently had the highest sentiment rating on WSB today https://swaggystocks.com/dashboard/wallstreetbets/ticker-sentiment & 40 mil shares traded versus 10 mil avg & share price rose over 10% on a pretty small revenue beat IMO. So there is other 'meme stock' aspect to it, now if Blackberry actually can also deliver tangible results (from Ivy,Cyber) then you potentially could get a very skewed return outcome. Will the meme stock craze end - well I thought it would earlier this year - but it hasn't and maybe its because of bigger trends at play - social media/community growth, retail investor growth, prevalence now of free trading etc

-

just noticed this updated SEC filing from 17 Sep in connection with Fairfax issuing 2031 Notes https://www.sec.gov/Archives/edgar/data/0000915191/000110465921116747/tm2127687-3_f10.htm#tDOTB Factoring in adjustments below, I estimate BVPS at 30 June increases to US$545.51 per share ($14,142 Common equity as adjusted below/25.924 mils shares at 30 June) - I suspect most of this is coming from Eurolife consolidation which is adjusted into this number along with Riverstone Barbados & Brit sales. What looks good are the debt/capital ratios which all showing significant improvement. Net Debt drops by $924mil with Adjusted 30 June figures. (Sale of Brit 375 plus sale of Riverstone of 700 less purchase of Eurolife 142 equals 933 which looks close to this number)

-

From a reward/risk point of view I think so & Fairfax's shares are cheap on a relative (compared to insurance peers) and absolute basis (vs historical ratios & based on potential BV growth rates IMO) Now the risks are better known (Jun 2020 no guarantee we would have a vaccine that would actually work or how much economic damage covid would do - now we have a lot more visibility around vaccination rates & improving economic conditions.) Reward/value is there as you have indicated BV has grown faster than share price. Also Fairfax have significantly bolstered their cash/capital position with sale of Riverstone insurance - credit line is paid off. Plus have also been some unexpected 'windfalls' (Digit,Stelco,Atlas) that may not have been as visible in June 2020. Look there are risks in play - lower commodity pricing , delta, recent slowing in economic recovery - but offsetting these risks IMO is a pretty decent margin of safety - its frustrating seeing the Fairfax share price really not moving at all despite recent earnings report or Digit revaluation which is pretty material in my view - but I guess its results & Fairfax needs to keep delivering results

-

good points petec

-

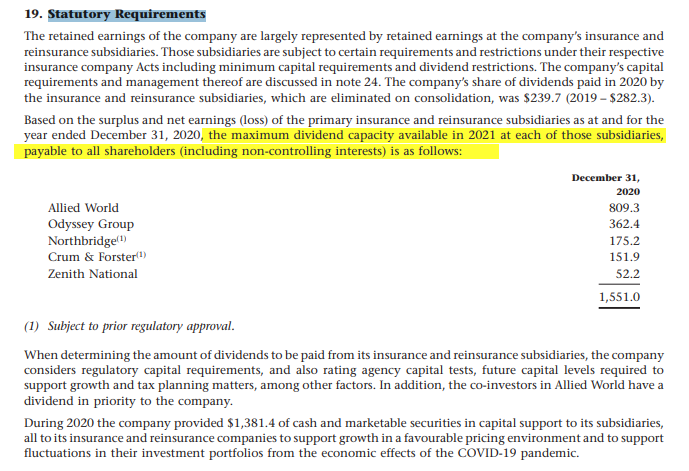

I agree Viking - I just hope they can buyback more shares at these levels - being able to extract divs from the subs would help I noticed in the 2020 annual report the maximum dividend paying capacity of insurance subs below is around 1.55 bil (includes non-controlling interests) but we don't have an update of what this level is at 30 June 2021. We have had a strong 1H2021 so that should bolster this number but is offset by divs of 212 that subs have already made to holdco in 1H21. At same time, Holdco cash position is stronger with Brit & Riverstone sales. Anyway I suspect they can increase the pace of share buybacks but we will have to wait & see. Could they also consider reducing the pace of premium growth to free up capital from insur subs & dividend back to the holdco to buyback shares. Plus also have a large total return swap whose value potentially will be increased by share buybacks & that will further increase BVPS.

-

Atlas closed $16.28 a share - assuming 122 mil shares (excluding Riverstone Europe 9 mil shares) - looks to be close to a $2 bil position now for Fairfax

-

https://www.theinsurer.com/fairfax-celebrates-odysseys-landmark-25th-anniversary/16231.article

-

I thought Brian's comments they are not expanding in critical cat interesting - if that is the case at Odyssey then I suspect it would be the same strategic positioning throughout the rest of Fairfax's insur/reinsur businesses - I expect them to be hit by Ida losses but hopefully this will help to reduce some of the impact While Young said Odyssey has also enjoyed some growth within the property space, the company has stayed away from expanding in what he called “critical cat”. “We find the cat markets generally speaking rather frustrating if I’m honest,” Young said. “There’s a lot of unmodelled loss that’s affected the market. If it’s not unmodelled, it’s [an] under-modelled loss. We think we need to see a material correction in cat for us to have more interest for us to expand in that area,” he stated.

-

very useful Cheers

-

Here is a presso today from Blackberry - I thought Blackberry Ivy insights were interesting & some pieces from transcript below https://wsw.com/webcast/jeff195/bb/1520040 Charles Eagan So there's quite a bit of future potential being achieved by Ivy. And, and the potential for applications being developed on Ivy is almost endless. I think of imagine when we first were awful offered Google play and Android, and we asked people, what, what would the useful apps be on, on your, on your phone? I don't think we could have said, we're all going to have 50 apps on our phone, and we couldn't even name what they are today. So this invention is being enabled by this platform. But recently we announced for, for example, recently we announced the development of an app through a partner called car IQ that, that enables in vehicle payment. Obviously we want our car to, to be able to help us you know, acquire services. So this leverage is to have IVs key differentiators. The first is that Ivy has direct access to sensor data in the car. It uses this data to create a digital fingerprint of the car allowing for the highly secure payment authentication. It can also do a highly secure authentication of the user by looking at the patterns that it user like you are, what you do and what you do in the car can be determined by ID to give identity management. So and rely on pulling data from the cloud is nowhere near as secure as having direct access to these sensors. And then secondly, IVY pro provides edge compute analysis of the data is performed on a real-time basis in the car. Joe Gallo Switching gears you talked about it briefly, but just what's the value add of the partnership with AWS as it relates to IVY? Charles Eagan Yeah, so, but I think we compliment each other very well. So AWS is obviously a extremely large game changer in the cloud space, but there's lots of cloud technologies, but the ability to take that and combine the down into the automotive platform, the automotive platform access is equally strategic. So, together, we call it car to cloud. That stack is really unique. AWS has quite a lot of success bringing plat traffic into the AWS platform. Without this kind of partnership, obviously we're co-developing it. So we have a group of engineers working with Amazon engineers and doing this very unique. co-development. So basically we're trusted by the OEMs and tier ones. AWS has I don't know, 150 features that are available in the AWS cloud that now become applicable in, into the, into the connected vehicle via Blackberry Ivy. So, so this means app developers who are already well equipped at working within AWS cloud and AWS developer tools are now automotive developers. So as the vehicle becomes you know, rich in software features, we're opening up development potential to all of these cloud developers which is extremely strategic, the volume of developers that now have access to the vehicle in the future, compared to the automotive OEM software developers, it's orders of magnitude, more feature driving positive. So, the other thing I want to mention too, just from a IVY ecosystem evolution into the future that we designed IVY, Amazon and Blackberry to be OS agnostic and cloud agnostic. So, that means you don't have to be running QNX in your vehicle to run IVY. Although we think, we'd like it, if you would, let's say. It's also cloud agnostic. So it doesn't have to be an AWS cloud. You could pick another big cloud provider or a small cloud provider, Azure or Google, or some other cloud. We really wanted IVY to be this ubiquitous platform for the vehicle data. So we wanted to make it as flexible as possible. So, this, this is a massive potential for what we're, we're stitching together here. And it's really, I like to say it's a one plus one equals 10. So, extremely excited. I was in the first AWS Blackberry strategy session years ago, and what we pitched there was exciting and it's still exciting to see it come into fruition.

-

interesting insights on Recipe's business/restaurant environment thanks guys - sounds like we will see improving results but will take time

-

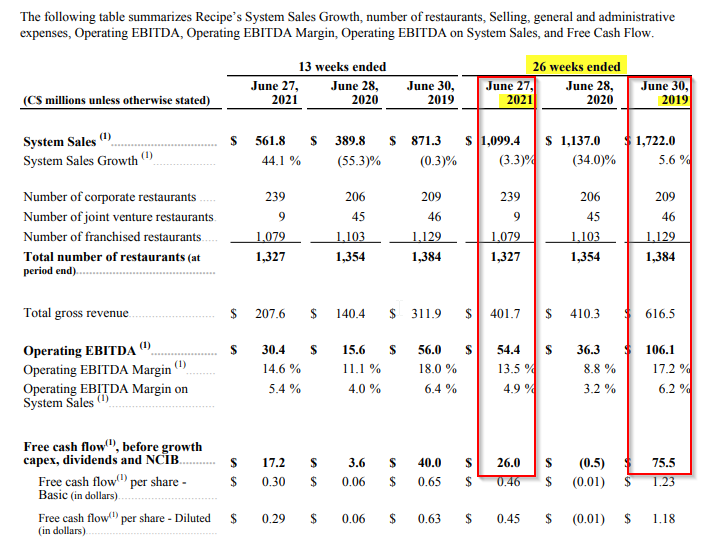

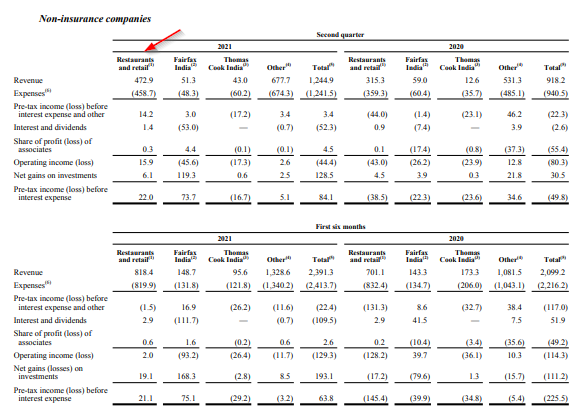

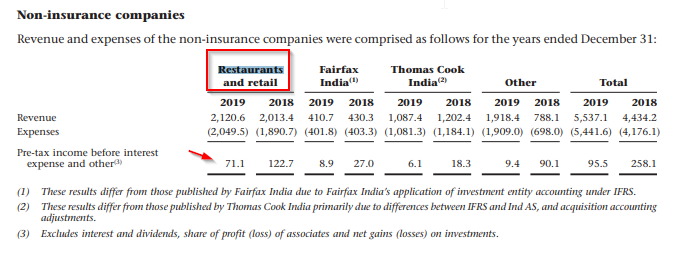

I don't live in Canada I am Sydney based - but has anyone visited any of the Recipe owned/franchised restaurants since the covid dining restrictions were eased in Jun-21 - would be interesting to get some feedback on how busy they are? Recipe is a significant non-insurance subsidiary for Fairfax & Prem mentioned on the Q2 2021 conference call he expected they could get back to 2019 sales levels Prem Watsa Yes, Jaeme. All of those things, including the restaurants, we think the revenues will be through 2019 levels once we back up. And unfortunately, lots of smaller restaurants have gone out of business. And so, if you want to go out dining, the big restaurant chains are where the action is going to be and our Recipe expects in the years to come to do well. (from Q2 2021 MD&A - Recipe) Looking at the Restaurants & Retail segment, I estimate around 40-45% of revenue is from Recipe and I expect Recipe to contribute most of the pre-tax income (before interest expense & other). In 2019, Restaurants & Retail generated around $71 mil in pre-tax income before interest & other (see below) versus the first 6 months of 2021 where it has only generated -$1.5mil (see above) while under the effects of Covid. Also worth mentioning that these revenue & income numbers are not pro-rata for Fairfax's share ie. non-controlling interests are subtracted out further down the Consolidated Earnings Statement.

-

thanks Twocities thats a nice summary & makes sense If we have a hypothetical situation where there is a large sudden increase (I wish:) in the price of Fairfax shares - could there be situation for example where hedge funds (who are short Fairfax via total return swaps) become buyers of common stock to offset their exposure OR where the counterparties that are writing OTM (over-the counter) call options start buying the underlying shares to also offset their risk. Could there be a feedback loop or squeeze type situation or would all these parties (hedge funds or option writers) again use derivatives to manage their exposures to effectively avoid buying the underlying shares where liquidity may be limited? Sorry if I am rambling but this TRS investment is unusual & I am trying to understand how it could impact the share price potentially ....:)

-

Looks like BIAL UDF fee rate increases will be postponed to start of March 2022 - would expect a negative impact on BIAL valuation - probably have to wait for Q3 to see. https://bangaloremirror.indiatimes.com/bangalore/others/from-april-2022-flying-to-become-a-tad-pricier/articleshow/85964418.cms At June 30, 2021 negotiations between BIAL and AERA in setting tariffs for the third control period were ongoing. In the event that these negotiations develop unfavourably, this may result in a negative impact to the fair value of the company's investment in BIAL.

-

just to put in context 1.96 mil shares - thats a CAD 1.1 billion position

-

Agree , although I would still probably continue to hold most of my position in shares due to the timing risk with options, I would also like to be able to buy OTM calls. I am super curious about how this total return swap on Fairfax shares has been structured. Its on around 1.96mil shares and there is no institution or fund that appears to own that many shares https://www.morningstar.ca/ca/report/stocks/ownership.aspx?t=0P00006821&lang=en-CA - if the payer (of this equity swap) wants to fully hedge their exposure, I assume they own the underlying share position in Fairfax?

-

no worries nwoodman yep I was the same I had to hunt around to find those quarterly reports today I think Prem at AGM said they don't want to IPO just yet & want to work toward a 10% market share in general non-life and are currently in 1.6-1.7% area - so I think they want to build it to a mature business at hopefully a bigger valuation. But I agree it would be a very attractive IPO given it is insurtech/high growth . There has been a muted reaction so far (buts lets see!) to revaluation of Digit which surprises me because if they were to IPO it , I suspect the Fairfax share price would probably jump with value recognition through IPO.

-

in terms of Digit valuation I have no unique insights but the last two fundraising rounds have both been at 3.5 bil level so we have had price discovery twice there now & if you look at Digit's current operating metrics (Jun21 Qtr) there doesn't appear to any let up in the pace or quality of growth (higher premiums & lower combined ratio).

-

Yep Viking honestly its a head-scratcher for me too given the sheer size relative to Fairfax's market cap but I think the market will come around eventually:) maybe the conclusion of the deal with regulatory approval & recognition in reported financials will help act as catalysts.