glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

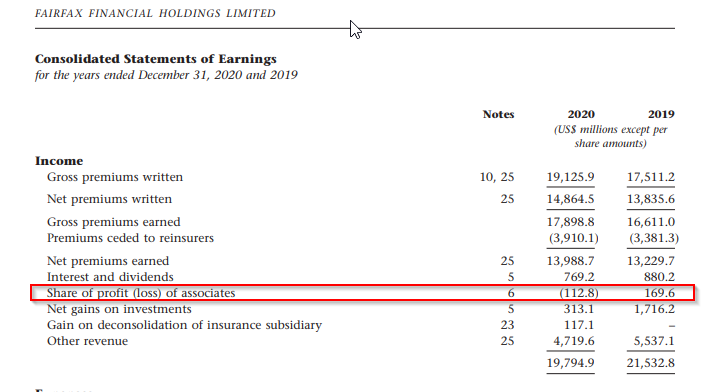

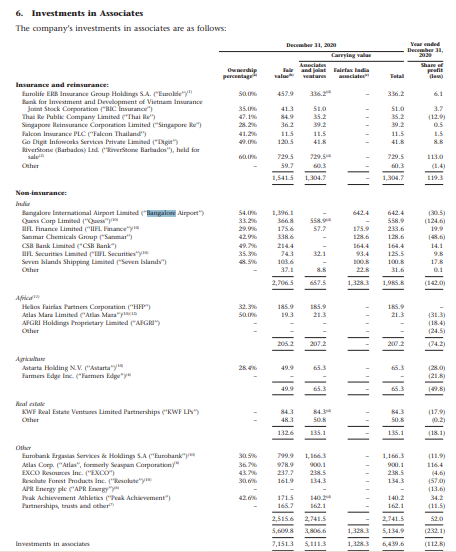

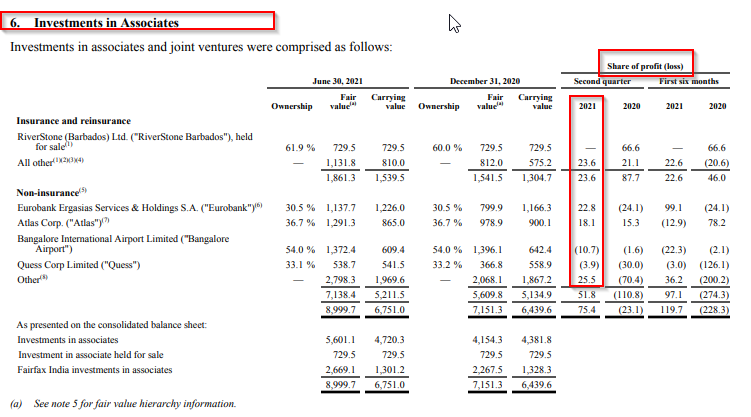

We are half way through 2021 but looking ahead to FY2022, I wanted to try & estimate potential income from Share of Profit of Associates. These estimates could change if Fairfax monetises positions (quite possible)and key risk includes any deterioration in economic recovery from Covid. Anyway here goes Two largest associates for Fairfax by carrying value are Eurobank & Atlas Corp Atlas Corp are forecasting $535 mil profit for Fy 2022 (see Q2 2021 presentation), I estimate Fairfax's shareholding (excluding Riverstone Europe) at around 44% based on 25 Aug-21 update (see SEC filing) - if Atlas Corp hit their forecast then Fairfax's profit share could be around $235 mil. Eurobank did 7.7% approx ROTE in most recent Jun-21 Qtr, lets assume they can do slightly improved 8.5% ROE on their tangible equity circa 5bil euro at 30 Jun21 as they emerge from Covid -their target is 10% ROE but lets be conservative. Lets assume EUR USD 1.2 & Fairfax ownership of 30.5%. Fairfax profit share would be $155mil. So lets say we have a potential contribution of around $390 mil to Share of Profit of Assoc from Eurobank & Atlas Corp in FY22 (compared to $104 mil from these holdings in FY20) Looking at 1HFY21 results from associates , if BIAL (international flights resuming from Sep-21) & Quess ((3) loss for 1H21 but covid still impacting demand for staffing & business process outsourcing) can move to break even in FY22, 'Other' category can contribute around 100mil in FY22 (was 25mil in Q221, & 36.2 mil in 1H21), $390 mil from Eurobank & Atlas (as above) & $10mil contrib from Insurance associates -we could get to $500 mil for Share of Profit from Associates (& I think the highest it previously reached was 221 mil in 2018) I am curious to hear other peoples' thoughts? Cheers

-

https://www.fairfaxindia.ca/news/press-releases/press-release-details/2021/Fairfax-India-Receives-All-Regulatory-Approvals-to-Complete-Sale-of-Minority-Position-of-Anchorage-Infrastructure/default.aspx

-

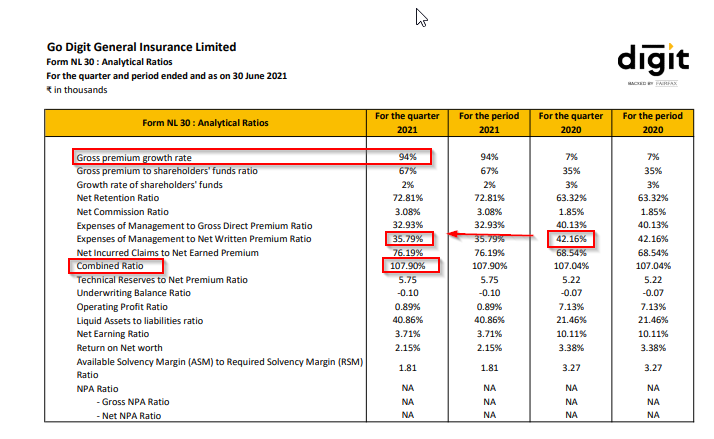

for Jun-21 Qtr - looks like around 76% increase in net premiums earned (vs Jun-20 Qtr) 94% growth in GWP (QoQ) & Expenses of Mgmt to Net premium written continue to fall nicely while net incurred claims to net earned premium are 76% (see table below avg 74% in FY 2021 & 75% in FY 2020) slightly on higher side not sure if one off factors or a trend or mgmt are content to target this mid 70% level but combined ratio is the key one below. Combined ratio (CR) now sitting around 107.9 up slightly QoQ, but improving on 2021 FY (CR109) & 2020 (CR117) - see below from Digit annual report.

-

article on Digit & podcast https://ajuniorvc.com/digit-insurance-lic-unicorn-india-startup-tech-general-acko/

-

thanks petec well if they can hit their 10% ROE target then there would probably be significant upside for Eurobank given current price/TBV level IMO- I noticed this ECB article which interestingly notes that banks with higher valuations also tended to have higher dividend payout ratios https://www.ecb.europa.eu/pub/financial-stability/fsr/focus/2020/html/ecb.fsrbox202005_05~d3679873d3.en.html I guess regulators will have to balance dividends with ensuring Eurobank continues to maintain its capital strength, but I suspect any dividend reinstatement would be a net positive for Eurobank shares.

-

thats interesting - how did you get to 15% for 'potential' dividend - that would be around 0.12 euro per share?

-

I agree petec I think Eurobank share price at 0.82 euro is at around 0.58 x TBV & looking at recent earnings report on nearly every metric from operating profitability through to capital strength they are showing great progress with a dividend potentially starting in 2022. I think provided economic recovery continues in Greece & Europe, then with a bit of multiple expansion, a 15% annualised return for next few years is possible for this investment for Fairfax. If Eurobank averages 7.5% ROTBV over next 3 years (it was 7.7% for 1H21) , then ignoring dividends TBV would move from 1.40 to 1.73 over 3 years. Then if shares trade at 1.24 or 0.71 x TBV (a pretty modest multiple) in 3 years, then that would give us that 15% compounded return.

-

I just checked I believe any fair value marks/gains on these warrants up to 30 June have already been taken up by Fairfax in their consolidated earnings - so any gains will be for this current quarter.

-

viking I believe if the warrants were exercised at 8.05 per warrant then that should lower the carrying value/cost per share.

-

Would make sense to exercise the original 25 mil warrants with exercise price of $8.05 - so cost around $201 mil and shares trading at around $15 so now worth $375 mil plus they will now be able to scoop up a $12.5 mil div approx on those shares.

-

Just saw this article https://www.investmentexecutive.com/newspaper_/focus-on-products/values-time-to-shine/ Within the past six months, Simpson bought shares in Fairfax Financial Holdings Ltd., a company with interests in insurance and investment management. Simpson said the company has a solid balance sheet, good execution capabilities and the potential for healthy growth. Further, its insurance business will benefit from higher prices.

-

https://www.fitchratings.com/research/insurance/hurricane-ida-not-capital-event-for-louisiana-re-insurance-market-30-08-2021

-

thanks bearprowler6 interesting insights - well if any country was to benefit from foreign investment shifts resulting from China's regulatory mis-steps it would be India & Fairfax is long India. https://economictimes.indiatimes.com/tech/startups/more-fuel-for-indian-startups-as-global-capital-shifts-from-china/articleshow/85547173.cms

-

My view is 1.1 to 1.2 x BV so taking the mid-point - I am sitting on a fair value of around 1.15 x BV (noting that Fairfax's median P/B over the last 5 years was around 1.09) My assumptions here are - Fairfax can achieve a double digit avg compounded return on book at least in the 10-15% range (mid-point 12.5%) over time & - Fairfax's book value per share understates fair value ( for example - market value of non-insurance investments exceed carrying value by around US$29 at 30 Jun-21) Now if interest rates were to increase in a measured way, allowing higher fixed income returns possibly Fairfax could trade at even higher price/book levels as it has done historically but I am not assuming this will happen - it would just be a bonus.

-

I agree spekulatius that complexity is playing its part, Prem & Co are working harder on that front through better communication (look at Ar 2020 breakdown on their portfolio) as well as monetising assets which are otherwise hidden on their balance sheet.

-

Are interest rates the 'silver bullet' explanation for Fairfax's share price underperformance? Yes they are a contributor but they are not the primary driver IMO. Interest rates affect all insurers including Fairfax's peers, yet Fairfax's share price performance over the last 5 years has still substantially underperformed against these insurance peers. The flip side of lower interest rates is a lower discount rate, lower funding costs and higher equity valuations. Fairfax in Dec-20 had around 27% of its portfolio invested in equities, which is higher than most of P&C insurers. So in theory lower interest rates should result in better equity performance for Fairfax and compensate for the lost performance on the fixed income side. However, Covid, a short/hedging strategy and a concentrated positioning in equity holdings that have underperformed in recent years , have all hurt Fairfax's equity performance and lowered book value growth (see table below showing book value growth 2015-2020 from AR 2020). We are on the recovery track from covid now, the short/hedging strategy has gone and Fairfax's concentrated position performance this year have been outstanding this due to their pro cyclical, economic recovery exposure. In short, Fairfax's equity performance has greatly improved. On the fixed income side, Fairfax is staying mostly short duration & high quality(treasuries) - basically a very conservative stance because they want to be prepared to take full advantage of higher interest rates. They could very easily increase their interest income if they wanted to by raising their corporate bond exposure, but then they would be a lot more vulnerable to higher interest rates. If we are looking for a 'silver bullet' theory for Fairfax's share price underperformance, IMO it is not low interest rates, its lack of book value growth. They key point I want to make is that there is a strong correlation between Fairfax's book value growth and share price performance over the last 35 years - see below. Now there have been times when share price growth has exceeded book value growth & vica versa - but there is a strong correlation between the two regardless. In 2020 AR prem notes that 'we think our intrinsic value far exceeds our book value.' This also makes intuitive sense when you consider that valuation gap between the fair value of their non-insurance businesses and their carrying value. So price to book as a valuation measure for Fairfax needs to modified to allow for this IMO as Fairfax is no longer a pure insurance business. A limitation in using price to book as a valuation measure can be seen with their Fairfax India stake. Fairfax India market price is $14.51 and Fairfax is carrying this position at around $9.66. But Fairfax India's book value is around $20 per share. Fairfax India have been compounding their book value at around 11% p.a, so a price to book closer to 1x would be justified. If Fairfax was to consolidate this investment then its carrying value would double - so accounting is playing its part in obscuring the value of the underlying investment. So I would argue the intrinsic value of Fairfax India stake far exceeds its carrying value on Fairfax's books - which supports Prem's point above.

-

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yes I agree Viking - they have been buying back in both Q1 & Q2, they could increase the size of these buybacks whilst still keeping well in excess of US$1 bil at holdco. I am not surethe $ buyback amount but the insurance subs are travelling well & have been sending divs to the holdco. They will want to balance these buybacks with lowering their leverage ratios at holdco & we have hurricane season underway obviously with Hurricane Ida & others I am sure to come - but this is all part of the business. Still I think Fairfax will look to be opportunistic and their shares are trading at a historically low P/B ratio - its an easy choice in my view. -

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yes totally agree - I believe they have an accounting impairment test process which they would need to follow & gets audited -

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yep - here are some home runs since 2008/09 First Capital ‘By the way, Mr. Athappan has had an incredible record with us in building First Capital. We provided $35 million in 2002 to let him establish First Capital; 15 years later, with no additional capital having been added, he had grown First Capital to be the largest P&C company in Singapore and with the Mitsui Sumitomo deal, gave us back $1.7 billion. That’s a compound rate of return of approximately 30% annually.’ (AR 2017) ICICI Lombard ‘ICICI Lombard is an Indian insurance company that we began in 2001 from scratch as a minority partner with ICICI Bank. Over the following 16 years, ICICI Lombard went on to become the largest non-government-owned property and casualty insurance company in India. The reduction in our equity interest in ICICI Lombard from 35% to 9.9% resulted in cash proceeds of $909 million plus our continuing to own 45 million shares of ICICI Lombard worth $450 million at the IPO (now worth about $550 million) resulting in an after-tax gain of $930 million.’ (AR 2017) Digit insurance US $154 million cost basis in 2017 & current valuation $2.3 bil (subject to closing & Indian Govt approval expected in Q3’21) (198% compounded annual return) Ridley ‘We had acquired 73.6% of Ridley, mostly in November 2008 at the bottom of the great recession, at Cdn$8.44 per share and over the years received Cdn$5.50 per share in dividends. Since that time, Steve Van Roekel, Ridley’s CEO, and his management team, without interference from us but under the oversight of Brad Martin as Chairman, did an outstanding job building Ridley and hugely increasing its profits and cash flow. In 2015, Pearce Lyons, the founder of Alltech, made an offer for all of the shares of Ridley at Cdn$40.75 per share. Under Alltech’s ownership, Steve and his team will continue to run the company. This was a win-win transaction for Ridley, Alltech and Fairfax. Our total realized gain was Cdn$304.1 million, representing a compound annual return of 31% including dividends’ (AR 2015) Kennedy Wilson ‘We have an outstanding partnership with Kennedy Wilson, led by its founder and CEO Bill McMorrow and Bill’s partners, Mary Ricks and Matt Windisch. Since we met them in 2010 we have invested $1,130 million in real estate, received cash proceeds of $1,054 million and still have real estate worth about $582 million. Our average annual realized return on completed projects is approximately 20%. We also own 9% of the company’ (AR 2020) Bank of Ireland ‘We purchased 2.8 billion shares of Bank of Ireland stock in late 2011 at 10 euro cents per share. As of today, we have sold 85% of our position at 32 euro cents per share, for a total realized and unrealized gain of approximately $806 million. Richie has produced outstanding results for us and we are fortunate that he consented to join the Eurobank Board. Bank of Ireland is expected to announce its first dividend in the last eight years in 2017!’ (AR 2016) Bangalore International Airport (via Fairfax India) Bangalore International Airport March 2017 54.0% (ownership) 653.0 cost (Mar-17) 1,396.1 Fair value (31 Dec-20) 23.8% CAGR Quess Thomas Cook India invested $47 million in Quess in 2013, sold a 5.4% interest in 2017 for $97 million and retained a 49% interest. We have had a phenomenal run with Quess and because of Quess’ great success, Thomas Cook India decided during 2018 to spin its holding in Quess out to its shareholders so that Quess could be run independently as a public company under the leadership of Ajit Isaac. The spinoff took place in December 2019 and Fairfax now directly owns 33% of Quess with a market value of $332 million (AR2019) recent one looking like a home run is Stelco ‘We purchased 12.2 million shares (13.7%) of Stelco in 2018 at Cdn$20.50 per share’ (AR 2019) (current share price C $49.52) & one on the fixed income side Muni bond bets during GFC ‘…in the midst of the great financial crisis, Brian Bradstreet purchased California taxable bonds in 2009 when the state was on the brink of being downgraded to ‘‘junk’’ status, and was able to acquire a very large position (in excess of $1 billion at cost) at a cash coupon annual yield in excess of 7.3%. Fast forward seven years: the net capital gain on that position is approximately $490 million, with about 45% of that realized and the balance significantly protected with a treasury lock at year-end (the balance has since been sold and the treasury lock removed). Also during the crisis, a large position in Berkshire Hathaway-insured long dated tax exempt bonds was purchased as numerous leveraged muni funds were subject to adverse margin calls in a very illiquid environment. We jumped at the opportunity when such insured bonds became available, investing approximately $3.6 billion at significant discounts to par and very attractive after-tax-equivalent yields. The net capital gain on these bonds is approximately $550 million, with 49% of that realized and the balance either pre-refunded or significantly protected with the treasury lock.’ (AR 2016) -

Another smaller funding round at approx US$ 16 mil at around same valuation as last time - I suspect lot of these individual investors would want to see some sort of liquidity via an IPO at some stage - lets wait & see what happens:) https://www.investindianews.com/digit-insurance-has-raised-rs-121-crore-from-tvs-growth-fund-and-hni/ Existing investor TVS Growth Fund has led the round with an investment of Rs 56 crore. Notable individuals include Kunal Shah, Saujanya Shrivastava ( CBO, MMT), Susheel Tejuja (owner Landmark Insurance brokers), Sachin Pillai (MD & CEO Hinduja Leyland Finance), Anil Arora (CEO Ace Insurance Brokers) also participated in the round. About 110 other individual investors have also put in money this round, filings show. According to Fintrackr’s estimate, the company has been valued at $3.47 billion (post-money) after this fresh tranche.

-

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yep but wasn't this essentially a hedge -

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

probably one that is recent & not looking great is Farmers Edge (invested CAD 376, carried at 303 & market value CAD 151) -60% on investment cost - they may not fully impair this one which is consolidated but there might be some impairment needed here. Not every investment Fairfax is going to work out - and thats the same for any investor really. Also we are all talking about Prem but when we look at how investment performance will be managed for Fairfax going forward- something to consider is the increasing impact other members of investment team will have on Fairfax's investment performance - some comments on Wade Burton & Lawrence Chin from AR 2020 'Wade and Lawrence had an excellent year in 2020 managing $1.5 billion in invested assets. They did so well that we will give them another $1.5 billion to manage in 2021. At that rate, they will soon be managing the whole portfolio! (No clapping please!)' from AR 2019 'Wade has achieved outstanding results since he began managing portfolios for us in 2008. Over that period, up to June 2018, Wade had a 19.5% compound return on his stock portfolio. Since June 2018, Wade and Lawrence Chin, who joined us in 2016, have compounded a stock and bond portfolio at 9.8% annually. We are looking forward to Wade’s increasing impact on Fairfax’s investment portfolios over time.' Wade was also smart & opportunistic in selling his Blackberry shares in Jan-21 -

Yes I believe thats correct petec - under the short swing profit rule - explained here https://www.investopedia.com/terms/s/shortswingprofitrule.asp as an insider (10%+ owner) they couldn't sell Blackberry shares with the first spike. With the second spike (up to around US$15 I believe), Blackberry had just entered the quiet period & they couldn't sell either. I don't think they are going to sell under US$12 - because they have had opportunities (during non-quiet periods) but haven't sold any shares. Which then leads to the next question - why are they holding? I think SP is right - they are not going to cut & run - they want the optimum price for their BB position - they want the market to see the full earnings potential in the business. They have invested a lot of R&D developing Blackberry Ivy their open data platform for cars & this is what is the key around valuation. What is its potential? What revenues could it generate? There is a beta launch due Oct-21 & product launch due Feb-22. I think Prem & co. must be putting a big number on the value of Blackberry Ivy & that is only way I can rationalise why they are continuing to hold. We will see if they are right over 6-12 mths. Blackberry ivy is conceptually very exciting and but its the execution that we are most concerned about. Blackberry are also making equity investments in developers who are building apps on the Ivy platform - like a VC fund & I would expect there are a lot more investments to come - here are two they have made Car iQ (turning car into mobile wallet) https://autobala.com/blackberry-turns-a-car-into-a-mobile-wallet-that-pays-for-fuel-tolls-etc/141126/ Electra vehicles (using AI to optimise car battery performance) https://blogs.blackberry.com/en/2021/06/blackberry-amps-up-blackberry-ivy-with-investment-in-electra-vehicles

-

India on Wednesday approved Canada’s Fairfax Financial Holdings Ltd’s proposal to invest ₹15,000 crore in infrastructure projects through its local arm, boosting the government’s efforts to kick-start its ambitious ₹6 lakh crore infrastructure asset monetization programme. The government statement said the investment will be a significant boost to the recently announced national monetization pipeline (NMP). “Anchorage Infrastructure Investment is proposing to make downstream investment in some of the sectors covered under the NMP,” according to the statement. It said the investment will considerably substantiate the Indian government’s plan to develop world-class airports and transport-related infrastructure through private partnerships. https://www.hindustantimes.com/business/govt-okays-15-000-cr-fdi-plan-101629925826989.html

-

Just having a look at Eurolife transaction - it looks like it will be a net positive for shareholder equity & earnings. Fairfax will increase its ownership from 50% to 80% & will consolidate Eurolife. So instead of carrying as 50% equity investee at cost plus net earnings (CV 303 (at 31 Dec-20) plus 143 for additional 30%) = US$446mil They now consolidate 80% interest x Eurolife shareholder equity US$863 mil approx (at 31 Dec'20 was €738 mil) = US$690 mil https://www.eurolife.gr/gnoriste-mas/eurolife-group/Financial-Data/ Then possibly a fair value adjustment (?) (Fairfax looks like it showing FV for Eurolife at approx 90% of Eurolife's shareholder equity) I get 621 mil for Fairfax 80% interest - so would mean potentially 175 mil increase in shareholder equity (621 -446) in Q3 for Fairfax. Any thoughts/comments :)? some details on Eurolife transaction Q2 2021 interim - see below Acquisition of Eurolife FFH Insurance Group Holdings S.A. On July 14, 2021 the company increased its interest in Eurolife FFH Insurance Group Holdings S.A. ("Eurolife") to 80.0% from 50.0% by acquiring the joint venture interest of OMERS, the pension plan for Ontario’s municipal employees, for cash consideration of $142.6 (€120.7). The remaining 20.0% equity interest in Eurolife continues to be owned by the company's associate Eurobank. The company will commence consolidating the assets, liabilities and results of operations of Eurolife in its consolidated financial reporting in the third quarter of 2021. Eurolife is a Greek insurer which distributes its life and non-life insurance products and services through Eurobank’s network.