glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

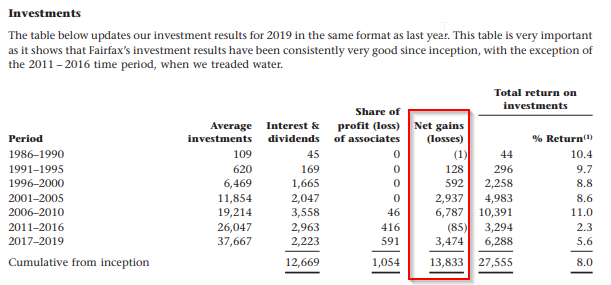

Good discussion guys - appreciate different perspectives bearprowler you said Out of curiosity, what is your valuation & target price for Fairfax? I bought CAD shares in Fairfax so paid in USD equivalent around the US$350s range (buying mostly over late last year & early this year) versus a book value which could potentially hit US$600 by this year end provided we don't see any blow up in the market. I didn't expect that operating performance and happy to sit on my hands. I agree that The Market needs to see consistent operating performance from Fairfax - but as BUffett says you pay a high price for certainty & this significant discount to book wouldn't be available if they were crushing it. More importantly, its not the discount to book that matters but knowing what percentage return they can compound that book at - its looking like 25% for this year Fy21. Is that repeatable in FY22? Probably not but I estimate over time a double digit avg compounded return of at least 12% is doable & anything on top is a bonus(also I would use an adjusted BVPS as Fairfax is carrying significant positions now well below market value eg Atlas Corp, Fairfax INdia) The BV valuation perspective has been discussed here, but lets look from another angle at Fairfax - from an earnings perspective. I estimate they can do around US1.2 bil in pre-tax profit in FY22 (excluding any investment gains) Here I have broken it down - Revenue $800 mil (UWP) based on 16 bil in net earned premium at a 95% combined ratio (see my other forum post on underlying combined ratio breakdown) $650 mil interest & dividends ( approx 2 x 1H 2021 result) $500 mil profit from associates (see my previous forum post for breakdown) $50 mil profit from non-insurance segment $2 bil - revenue less Expenses -$450 mil interest exp -$330 mil corp overhead $1.22 bil - pre tax profit If we then subtract taxes & allow for non-controlling interests we get a net result of close to $1 bil or around $38.61 per share. My estimate is forward PE of approx 10x factoring in no net investment gains plus - included in associates result is a break even result from two of their most valuable associates (Bangalore Airport & Quess) in FY22 - but these two associates are trading on depressed multiples and FY23 & FY 24 will likely improve considerably - Fairfax's fixed income positioning short duration & high quality is also depressing that PE if you believe that interest rates have the potential to move up from here. The 10 year treasury is already hinting at that possibility. With the above , I am just looking at earnings potential contribution to BVPS growth, but more than 50% of Fairfax's BVPS growth since inception has come from net investment gains (see below) - in FY21 Fairfax net investment gains of $3 bil looks a real possibility( consider up to 2bil to Q221 & Digit revaluation subject to approvals will add $1.3 bil approx more). Would you bet against Fairfax continuing to generate decent net investment gains in the next few years?

-

I was thinking about Fairfax India as well - FFH are carrying Fairfax India at around $10 per share but sitting on $20 in book value, if you can buy FFH at 30% or greater discount to book ,then provided you can say rest of FFH's book value is at a minimum at fair value (ie all else being equal) you are effectively buying Fairfax India at at 30% discount to its carrying cost or around $7 per share (compared to its share price in $13 range & its book value at around $20)

-

yep saw that too, I hope he is ok no idea either - maybe some algo traders selling on technical weakness - of course this type of trading can cut both ways, to the upside as well. Yes markets might be weak but provided we don't have some major stuff up in world economy, isn't the margin of safety looking pretty decent - I just keep scratching my head, you can buy the whole business now for 10.2 bil USD take out Digit ok lets round it down to 2bil from 2.3 = 8 bil - they paid 4.9 bil for Allied world in 2017 & it only generated 25% of their GWP premiums last year! Whichever way you start pulling the pieces apart & look at the market price - this doesn't make sense IMO. The private valuation looks totally divorced from public valuation to me. I am sure Prem & Co will find a way to get creative & take advantage (even small buybacks will be advantageous). I can't fault them operationally this year - they have done everything they can do. I am starting to think if Prem gets a great offer (& I might get in trouble for saying this) for one their key insurance businesses like Zenith for example- he should take it & maybe take out 20% of the share float at around 2/3 book value and it would also ignite the TRS position.

-

they will get around $5 per share gain (which they reported in Sep) from consolidation of Eurolife & sales of Brit & Riverstone. Also would there be a small realised gain on sale of effectively a 5% BIAL stake to OMERS?

-

thanks Viking So looks like potentially a small investment loss for Q3, unless Digit is included in which case will be large investment gain. I am guessing they would report when they receive regulatory approval to increase ownership in Digit - it may also happen early Q4 before results come out but I am not holding my breath - regulatory process in India can be slow. I am interested to see Q3 profit results from associates (Eurobank, Atlas) & consolidated non-insurance subs (Recipe) - would expect to see further improvement here. We also had impact from hurricanes that will probably hurt the CR in insurance business but lets see. Unless Digit gain is included, Q3 looks to be a more muted quarter but we need to put in context of big gains in Q1 & Q2.

-

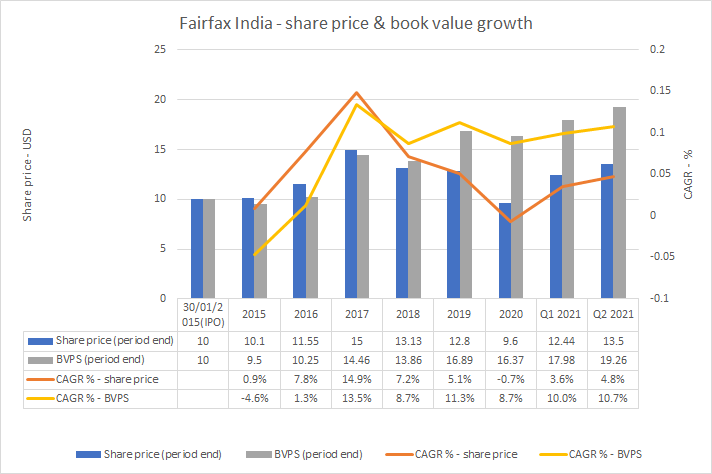

I did this chart for Fairfax India showing CAGR in share price & book value - notice how they have diverged since 2017 - some narrowing since end of 2020 but still a gap Is there a magic CAGR in BVPS gets them to trade at book value? It is also consistency in results as well. Ignoring the post IPO excitement & ratios in 2015 & 2016, if we look at 2017 the CAGR in BVPS hit 13.5% & they traded at small premium to book (1.04x book value). However, they have mostly traded at a discount to book since 2017 hitting a low point of 0.59 x book value at end of 2020 although in a 'covid' affected market when their CAGR in BVPS fell to 8.7%. If they can move that CAGR in BVPS needle above 12% & do it consistently, is it reasonable to expect the shares to trade at least at book value?

-

this is a good point Xerxes I would think longer term FFH have an incentive to own as much of Fairfax India as they can, at the widest possible discount to book value. They can do this through FIH buybacks or by taking their performance fee in 'cheap' shares. If that discount then narrows over time, FFH stands to gain. I think the IPO of Anchorage as well as providing NAV visibility also has the benefit they can potentially raise capital at or around Anchorage's NAV which they can't do now with Fairfax India - could this then enable a bigger capital base that FFH can potentially earn a performance fee on - is this a fair comment?

-

Do we know if Fairfax India or FFH will charge Anchorage a separate performance/investment management fee %?

-

actually thinking about it FFH are not taking their performance fee in cash but in shares - it sounds like they are not interested in a cash dividend but I guess they could also do dividend reinvestment - anyway going a a hypothetical rant...

-

True - could this be one factor behind the discount? Dividends The company did not pay any dividends on its outstanding multiple and subordinate voting shares during 2020 and 2019. But if investors own the underlying shares of listed stocks that Fairfax India owns, they would receive dividends & avoid management fees. So maybe thats a disincentive to own via Fairfax India. Paying dividends would also mean cash flow for Fairfax Financial. They could change the performance fee calc to total shareholder return in terms of BVPS growth plus dividends - just a thought??

-

Has anyone found the multiples on these? How do they compare to BIAL?

-

agreed Viking

-

Yes correct consolidate because they have 93% voting control even though they have less than 50% ownership

-

Yep thats right

-

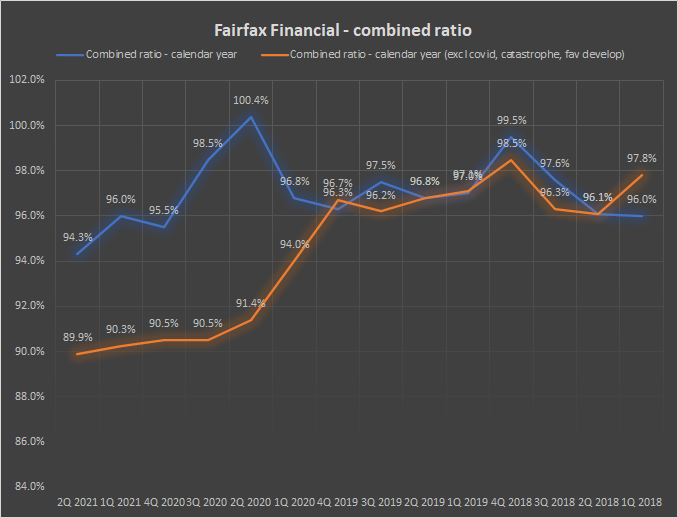

Yes also think average favourable development 2013 to 2017 was around 7.7 & avg CR looks to be around 91.5 & for 2019-2020 average fav development was 3.6 & avg CR was 97.5 - so I think that might explain part of the difference. But also need to factor in the impact of covid in 2020 - if you take covid away, the CR for 2020 drops to 93.

-

Higher than expected & transitory (consensus view) - impacts short tail more - less of a problem Higher than expected but longer term - impacts long tail more - would be more of a problem but not consensus view I believe Fairfax are expecting higher inflation than market is expecting - on fixed income side they are high quality & short duration. So if over longer term we get incremental inflation with incremental increases in interest rates, this would be beneficial for Fairfax is my read. And if we follow through with that logic, they should also be factoring in their higher inflation expectation into their insurance pricing & liability reserves. Having said all of this, if we get really high, unexpected & sustained inflation that would be a big negative for Fairfax & the whoel P&C industry. I think this is a lower probability because you can tie a lot of the price pressure to covid which is causing supply chain disruption. Here is a good article on impacts https://www.insurancejournal.com/news/national/2021/03/23/606467.htm What Does This Mean for the Property/Casualty Industry? As with most financial institutions, higher-than-expected inflation has adverse effects on the results of property/casualty insurers. The risk to insurers falls in three buckets: Liabilities. Insurers carry liabilities in the form of loss reserves that are intended to pay claims in the future. If inflation is higher than the rate built into the loss reserves, then future payments will be greater than expected. The impact of inflation varies by line of business, but an increase of 1 percent in inflation can raise the P/C industry combined ratio by two to three points. For personal lines of business, where liabilities are short in duration, a 1 percent increase in inflation may increase the combined ratio by less than one point. For a long-tailed line of business such as medical professional liability, the same 1 percent hike in inflation may increase the combined ratio by more than five points. Pricing. Insurers charge prices today that will pay for future claims. If inflation proves to be greater than the inflation rate anticipated in the prices, then insurers may not have sufficient funds to pay claims. The dynamics of underestimating the inflation rate built into prices is like that of liabilities—i.e., a 1 percent increase in inflation will result in overall prices inadequacies of 2-3 percent (which varies by line of business). When setting liabilities and pricing business, insurers must be sure to look at the components of the losses and use inflation rates that reflect the payments that will be made. For example, workers compensation losses, on average, consist of 50 percent for medical payments and 50 percent for lost wages. If the overall annual CPI inflation rates for medical costs and wages are 3 percent and 2 percent, respectively, then an annual trend rate of 2.5 percent is reasonable. However, if the insurer writes more professional services classes of business in areas with high costs of living, then the inflation rate for wages may be closer to 4 percent and the average annual trend rate should be 3.5 percent. Investments. Approximately 80 percent of the assets held by the P/C industry are in fixed income instruments such as Treasury, municipal and other bonds. These assets are structured to match the payments (cash flows) of the loss reserve liabilities they support. If companies sell current bonds so they can invest in newer, higher-yielding bonds, they will have to book losses upon the sale because higher interest rates drive down bond prices. However, if they hold onto current assets while the ultimate values of the underlying loss liabilities are increasing, then companies will have a mismatch between their assets and liabilities. This mismatch would have to be accounted for by a reduction in the company’s surplus. There is no efficient way for companies to hedge inflation risk, but they can try to dampen the risk through holding assets such as stocks and real estate (which bring their own inherent risks to a balance sheet).

-

I suspect Prem & Co are ideally targeting a 95% overall CR (see AR 2019 quote below) for the business while expecting it will be lumpy - so that would mean if they run a base line CR of 90, then they would want no more than 5 point of CR from a a combination of catastrophes & other events less any add back they might get from favourable development. Recently, we have mentioned to you that we could achieve our target of a 15% annual return on our shareholders’ equity by producing a 95% combined ratio in our insurance operations and earning a 7% return on our investment portfolio. In 2019, we achieved a 97% combined ratio and a 6.9% return on our investment portfolio, which would have produced a 15% return except that some unrealized foreign exchange losses, which go directly though book value, resulted in us coming in at 14.8%, just below our long term target.

-

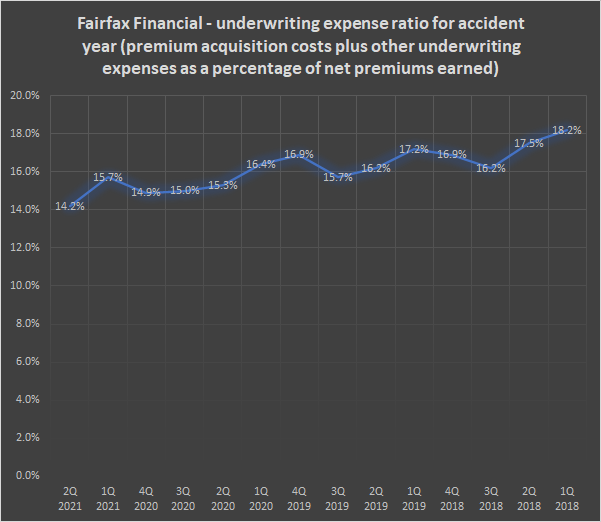

I did a chart to estimate Fairfax's underlying combined ratio - I was curious if we strip out catastrophes, covid & favourable development what does it look like? I am not ignoring these but just trying to find the base line before we put in estimates for these costs. Obviously with any of these charts I am posting, I try not to make mistakes but either way please do your own DD Anyway here it is - whats interesting is that their reported combined ratio doesn't look like it has fallen that much if we say compare Q1 & Q2 for 2018 (avg 96%) to Q1 & Q2 of 2021 (Avg 95%) but if we look at the underlying CR it has fallen a lot more - up to 6 percentage points if we are comparing these same time periods! I think in this chart you are seeing the benefits of the hard market, higher premium pricing & so they are operating more profitably with lower loss & LAE expense & lower underwriting expense ratio (see next chart below) I found doing the above chart useful because if we are doing the math - we can say their base line CR looks to be around 90%. Then you can put in a estimate for catastrophes (avg around 5 point of CR over 2018-2020) - Q32021 will probably be higher with Ida - I guess we are trying to think of an average number which is never going to be exact. Favourable development averaged around 1% over Q1 & Q2 (after taking out prior year adverse development for covid) while Current year covid averaged 0.35% over Q1 & Q2. The average CR for Q1 & Q2 2021 sits at around 95.2 - we will have to see the full effects of hurricane season & other events over Q3 & Q4 to see where they end up & if there is a bigger favourable development adjustment it will probably happen in Q4 although it has been trending lower over 2018 to 2020 period. Anyway the underlying CR I think is a useful one to keep an eye on - if they can continue to bring this down it will make the business more resilient to future shocks from catastrophes etc .

-

thanks for the update Viking

-

Me too - I am invested in FFH so indirectly in FIH I would not rule out a negative mark on BIAL this qtr due to delayed tariff implementation, but then there is the buyback & unrealised gain on share portfolio that would potentially counter-weight book value impact. Fairfax are betting big on infra in India & see potential here & the NMP rollout will be a key test for Govt - these things are never easy to do with complex social/economic considerations - lets hope they get it right for the most part

-

fair point I think the risk of public pressure on politicans is always there with infra assets in any country & Fairfax India team would be aware of that & a consideration when doing a valuation - AERA did push back on BIAL increasing on user tariffs from October to April 2022 but did get the rest of tariff request through - that potentially could affect BIAL valuation although Fairfax have said they believe the valuation is likely to be higher if they IPO. Will have to wait and see in Q3 results if any impact. Is an airport comparable to a toll road though - I see other stakeholders here for example international tourists/workers & local businesses that benefit from international tourism? Are there higher & lower risk infra assets? I am not familiar with Noida toll road facts but I would think there would be a lot more potential social impact with a toll bridge or road particularly where people have no choice but to use that road to get to work, shops, schools etc. than say an airport where people are using the airport to fly to another country for a holiday or an international visitor who is returning to US, Europe etc. Also I just read that the Noida toll road is basically a mess so it sounds like a public experiment that has failed - would this be a precedent or a reminder of what happens when commitments are not honoured? https://timesofindia.indiatimes.com/city/noida/once-an-infrastructure-showpiece-dnd-flyway-is-no-ones-child-now/articleshow/81383601.cms Also with an airport there are key passenger safety & security considerations & these costs that have to be met plus it is a key entry point for international tourists - does the public/international tourists want a safe & secure airport? does the public want their parcels delivered from efficiently from overseas? does the public want attractive gateway for international tourists/workers to attract tourism $s?

-

what a great personal story too - his family were refugees and now he is the PM of Greece!

-

I have put this chart together to show quarterly movements in Fairfax's price (USD) to book value - my estimate current book value per share (BVPS) of $591 includes $46 Digit revaluation expected close Q3/Q4 - my estimate of current adjusted BVPS, I am including $24 (after tax) estimate of excess of fair value over carrying value for non-insurance subs at 30 Jun-21. Not trying to get exact numbers (Q3 numbers not available, we can debate exact value for Digit etc) Anyway looks to me like the discount to fair value has widened further & using price to adjusted book value measure Fairfax shares look nearly as cheap as they were at Q3 2020.

-

yes agree Viking - I guess patience is key

-

yes looks like they have a headstart https://www.reuters.com/business/autos-transportation/exclusive-wejo-go-public-deal-values-auto-data-startup-800-mln-sources-2021-05-28/ & Otonomo appears to be a serious competitor as well Otonomo was founded in 2015 and provides a connected-car data marketplace, enabling manufacturers, mobility service providers, and app developers to share and integrate car-generated data to make vehicles safe, smart, and convenient. Today, it has 40 million cars connected and is “the biggest center for automotive data in the world. There’s no other place with so much knowledge about transportation, mobility, and automotive - and we live in a world where data is king.” https://www.calcalistech.com/ctech/articles/0,7340,L-3904451,00.html I couldn't find really much google searching comparing these different platforms & Ivy is still pre-release but it looks like they are coming at this market from different approaches - here is Charles Eagan CTO Blackberry Charlie Erlikh Interesting, got it. And then maybe sticking with IoT, but now going to the IVY product. How does IVY compete against [Autonomo] Continental and any other biggest competitors out there? Charles Eagan So, this is an emerging market. So, I think the market is quite large, and we do expect there to be competition, but there's room for competition. BlackBerry plus AWS brings a pretty unique, right from the electrons firing up in the car up to 150 AWS features running in the cloud. That's a very comprehensive and compelling stack that is very hard to compete with. So we have the experience of getting this technology into the embedded part of the vehicle and we know how to make data secure. So, AWS is driving AI tools and they introduced -- the introduction where AI meets the edge of the car is a great potential area that we're bringing together. So Autonomo and others do part of this, but they rely on data being -- they rely on the data being made available by the OEMs. So where IVY's OS and hardware and cloud agnostic doesn't need to be in AWS cloud, so we think it's a very, very competitive offering. And also, I'll point out, in our typical BlackBerry value, we don't aim to own the data. We present a solution to OEMs that allows them to use the data as they choose in a very secure way. Other players are trying to make a data place. So, we're sort of making sure the data moves securely, but we're not looking at insights into that data directly.