-

Posts

477 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by Blugolds

-

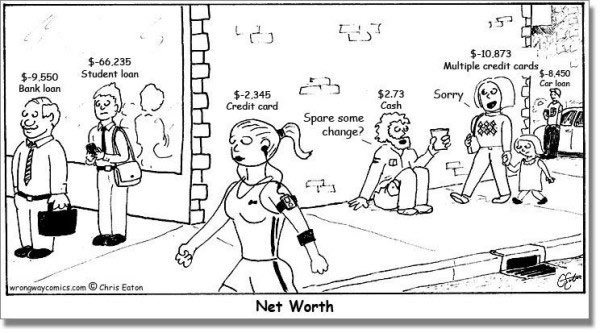

I’ve had nearly the same exact experiences. Everything from overhearing baristas at a coffee shop talking about their fav coins that are gonna take off, to people pitching it to me that didn’t even know I invested at all, “everybody should own crypto, can’t afford not to” to friends who know how I feel about it and then sheepishly mention they bought some of this or that coin at the recommendation of their sons friend! A kid who went to school for kinesiology, works at the local planet fitness and smokes weed all day, but he convinced them to put money in, they didn’t even have a trading account, they set one up just to buy crypto…amazing. If there is one thing I have learned from the meme stocks, crypto, NTF craze it’s to never underestimate ANYBODY’S ability to act irrational when presented with delusions of getting rich quickly and easily. And by anybody that includes your grandma, your priest, the guy cutting your hair, the kid on the sidewalk next to you with a skateboard who has gotta be barely old enough to open an account, surprised we aren’t seeing homeless at the stoplights with a sign accepting crypto. Human psychology at its finest, and the thing that gets me is if you ask them questions about the “investment” or offer food for thought, it’s quickly met with “them knowing or hearing of someone who made TONS” or the fact that my skepticism is why I’ll never be rich LOL, “gotta play, to win” that type of gamblers mentality. Like once you’re labeled ad a crypto doubter, you’re the idiot and just don’t get it. ETF, div payers, blue chips, value..all for boomers! Crypto to the moon, and many are buying on the way down, “once in a lifetime opportunity”…..

-

Rockefeller, Carnegie, et al did change the avg persons life..but so has Buffett, just in a different way…how many people do you know that financially benefitted from Rockefeller wealth or Carnegie steel? Did they go along for the ride with them making money? Or just benefit from jobs working for them etc. The rules were much different back then, with first mover advantage it was possible to set up an untouchable monopoly, much harder to build an empire today I think than back then, regulations, taxes, competition etc….sure a railroad improves lives, oil for vehicles, steel to build but the avg guy was used by them as labor, customers or passengers etc. The difference to me is…Buffetts view of shareholders as PARTNERS. Since the mid 1960’s till today, anybody with a couple dollars to invest could JOIN in reaping the benefits of Buffets work, those that did so early have been handsomely rewarded. If you want to know how it would impact he country, the tens of thousands decending on Omaha every year would be a start, but don’t forget the family’s of those individuals, potentially future generations, the recipients of any charity these shareholders may choose to assist, the foundations set up and run but the Buffett kids, Gates Foundation etc. Rockefeller and Carnegie were certainly philanthropists as well, and I’ve enjoyed a library or entertainment that is in some way benefitted from them, but when it comes to actually putting money in individual peoples accounts for them to do so as they please, no way those other fellas could touch Buffett, not even close. Another big name from back in the day, anybody read the book, House of Morgan? How did the country benefit from their activities? They “just punished paper around” right? Many variables to consider on how the money was made, assistance in building business vs individual achievements, philanthropy, period in time, legacy. A railroad back in the day connecting the country helped change lives for sure, nowadays the government developed the interstate system and we take it for granted… EV replacing ICE could reduce the relevance of Standard Oil perhaps someday in the future…technology or the gov in the future will never present an opportunity for the avg joe to get 20% returns on invested money for decades and be viewed as a partner… You are right, if the US had gone the way of Japan, Buffett would be some kid from Nebraska maybe…but the same could be said about the others…if the US was not what it is, there probably wouldn't have been a Rockefeller, Vanderbilt, Carnegie etc either, IMO all played to their strengths, taking opportunities available to them at their time in the best country in the world for a capitalist. If any of these guys had been born the same year that they were…but born in India, Somalia etc you wouldn’t even know their name. What’s the point?

-

Yeah I get it, I wouldnt want people running all over my property either, ripping things up, leaving fencing open etc but I would be reasonable about it if they made an honest mistake and didnt do any damage...Also for the sake of clarification...this guys property bordered public property, a national park...property that had the cabin that we rented for the night...so it wasnt totally random...there was a method to our madness, we thought we were taking a road to get as close to where we would go in to get to the cabin since it was late afternoon and running out of daylight. We were hoping to hike 5-6 miles back in, rather than 10. Also, imagine dirt roads, zero road signs, using a paper map from the forest service and literally counting the left/right turns to navigate....(ok we go past one road coming up to the right and then the next road after that we take a left etc) I would have loved a polite reminder...or notification at all of trespass, we honestly didnt know, in fact we were just glad to have made it back to the truck lol. Another funny thing..when the Sheriff (sitting in his office with his cowboy boots up on the desk) offered us "I suppose I could take $100 bail off each of ya with a promise to come back Monday)" we took it, didnt have a choice...the alternative was sitting in jail...and no joke...the "JAIL" was in the basement of the building, single cell..flat bars...bed hanging of the wall from chains and he said it was repurposed from an old Navy battleship! LOL....straight out f a John Wayne movie...and he made the comment after taking our $100..."probably better this way anyway....I didnt have anything to feed ya"...keep in mind that would have been Friday night, all day Sat, all day Sun and then see the judge Monday morning...

-

Yeah those 7.3s were great, like the Cummins, they put them in everything including larger class trucks, bus, ambulance etc. Proven platform and not uncommon to see them in the 300-400k mi odometer reading without major mechanical issues. The newer diesels are a totally different ball game. For reference my 1997 is rated at 185hp and 400ftlbs tq...those numbers are laughable by todays standards, most are double those numbers now. Alot of changes and improvements to get those numbers. The 1997 12 valve is 100% mechanical, literally needs a power wire for starter and fuel shut off solenoid and it will run, fuel pump, injection pump, everything mechanical, very simple. I rode in the 6.7 my buddy has before the "incident"...the thing was a beast, besides the obvious comforts and tech...the torque is insane its like 475hp and over 1000 ft lbs of torque...always good to let a couple years of a new platform run so they work the kinks out and gives time for buyer feedback to come in and the design gremlins to show up. All my trips west have primarily been camping....in order to fish! I'm not gonna say that MT is any better than CO but its def not any worse! A funny story that would be too long to go into detail, myself and two friends headed out to MT in college on a break for some camping and fishing. Road trip out, excited, long story short..in MN/WI we have land measured in acres...if you've got 100 thats pretty decent depending on the area and if its for farming or recreation...well in MT they own "sections"..couple young college guys making their way through MT and backcountry sites, working the streams etc on our way...we legitimately got a little turned around on some unlabeled back roads following a lousy map (phone gps had no service and were dead so we went old school) we had splurged and rented a fire lookout for a night (I think $25/night) and thought we were following the map to the general area and then would park the car and hike the 5ish miles back into the cabin...we left the truck and headed out...couldnt find it and it was getting dark so we ended up sleeping next to a stream in the middle of BF nowhere and in the morning made our way back to the truck to set out for our next location...when we got to the truck we were met by the local Sherriff informing us that we were trespassing (we literally had a map in our hands walking out) told us to follow him into town to sort it out. Ended up that some guy that had a mansion on the top of a mountain (that I saw and legit wondered how they even got a concrete truck or crane up there) saw us and reported us and wanted us prosecuted..it was like something out a movie...we literally walked on the property miles from this mansion off in the distance..but he basically owned an entire valley as far as you could see, multiple sections...no talking to him, no reasoning with the Sherriff...our options were $600 out of each of us and be on our way or sit two nights in jail till Monday morning when we could see the judge..after an hour in the dept, my buddy calling his law school fiancé and me calling my state trooper buddies back home... he finally figured out we were broke college kids and offered $100 bail and promise to come back Monday. We did and my two buddies pled not guilty...at the advice of a local lawyer I called and other resources I pled my case and threw myself at the mercy of the court (the court was straight out of an old western, swinging saloon doors to enter the court room, wood church pew seating and half the town must have showed up for the live judge judy entertainment...the judge sentenced me to $300 in fines and 6 months probation!!! I went to the clerk of court and set up payment...asked what I could afford and I told her $10/mo, so for YEARS I would mail a check to Sweet Grass County MT for $10 and they would mail me back a receipt...sure the postage cost me a little but at the time it was my only option and I didnt want to give it to them easy. Clerk also told me it happens every summer, usually not a big deal but some of the big shots were sticklers about out of towners on their land. She also said Tom Brokaw had a place in the area etc (not saying he was THE guy). MT state statute reads that it is your responsibility to know where you are at all times...doesnt have to be posted...doesn't matter if you are lost etc..no excuses.. Never would have happened in MN/WI. So always know where you're at lol, I left out a ton of other things from that adventure, some amazing memories.

-

I'm only familiar with the Powerstrokes. Not sure what years you would be interested in...1999-2003 with 7.3 PSD are the best/most reliable by far...tough to find clean low mileage ones and if you do the prices they have been bringing have been insane in the last year or two...I've seen some clean examples with ~100 mi selling in the 40k's..that was shocking, but they have no emissions garbage, get better MPG, simpler and avg guy can work on them etc and obviously new ones are gonna be in the $70k+ so maybe thats how buyers justify it. No cab removal needed. The 2003 + 6.0 was absolute garabge IMO...horrible mileage and tons of problems...you can look into it...enough time has gone by now that aftermarket companies have figured out what major fail points are and are able to "bulletproof" them, but to have the parts swapped out to make it reliable is a significant cost..I dont have recent experience with these but it used to be around $5-6k to fix what will inevitably fail, not if, when. Cab removal needed Next gen 6.4 was slightly better than 6.0, fixed some quips but had others...nobody was super excited about them. Cab removal needed. Supposedly the new 6.7 is pretty decent, and most issues addressed. Most things do not need cab removal unless a significant repair. I have a close friend that bought a brand new 6.7 dually, decked out truck, was in the $70k's and had so many problems with it he was talking to an attorney about lemon laws. Long story short there is a shaft/cog in the transmission that holds the driveshaft in place while in park...the cog broke and the truck took off on him down a slight incline as he was getting out of the truck, truck ended hitting a tree by the time he was able to fling the door back open runing along side it and jump in to slam on the brakes. The cause was the cog, but the damage wasnt just the cog, it needed new a new fender, bumper, hood, mirror etc...alot of damage done and Ford drug their feet on the "investigation", long story short after 4-5 months they fixed it, replaced the transmission and kept it, made him sign a non disclosure etc. He wasnt happy. Also some guys I have talked to that do this regularly, dedicated shops, can pull a cab in a half hour (they charge you for more hours...but they can pull them quick). Guys have learned the tricks to work on them. Again not sure if you are even in the diesel market or if you are considering a gasser, but I would do some google searches on whatever you are looking at before buying. I have more experience with the Duramax and specifically the Cummins. Not a fan of Dodge but the cummins is IMO the best option and each "generation" has its own particulars, I prefer the older stuff that is simple, bulletproof reliable, easy to work on for the avg guy etc. For reference my truck is a 1997 Ram 2500 Diesel with 87k miles, looks like it rolled off the showroom floor. Doesnt have all the fancy tech of the new stuff but it avgs 21.5 mpg and I can do darn near everything I would need to with a simple basic wrench/ratchet set I keep behind the back seat. I love trips out west..have spent a lot of time in CO, more in MT, backcountry hiking/camping/fishing, one of my favorite places in the world. Im not a huge rodeo fan but its fun to watch sometimes, I met Tuff Hedeman at Cheyenne Frontier Days back around the time the movie 8 Seconds came out, nice fella. I have the same jack, has held up well and I like it, I know a couple other guys that have the same jack and use theirs more in a month than I will in the next 10 years...no complaints. No AC hydraulic...but a good value for the money.

-

Dealerships are such a scam, you pay for "billable hours" to complete a job, even though many jobs that anyone with ANY sort of mechanical ability can complete take a fraction of the time. For instance I had a V6 Camry, the front 3 spark plugs are easy access...the back 3 not so much. Shop rate is almost 8hrs to remove the entire intake manifold, all associated hoses, connections, air intake, MAF and associated piping etc to have a clean birds eye view of the 3 rear plugs for change out....any basic backyard mechanic with a wobble socket, extension, socket universal joint, all taped together and a little gumption can get to and swap out in about an hour (and thats the backyard guys) for nothing more than the $20 in NGK plugs....meanwhile shops want over $700 to do it...they dont bill on how many hours it actually takes them to do the job, they bill based off how many hours a computer program tells them it would take to do it the longest way possible with the most work involved. Other examples of poor engineering designs with batteries hidden in an engine compartment, those Ford F250-F350 that need the cab removed from the chassis to get to stuff on the engine, specifically diesels...no shop does it the longest, hardest way to make a repair...they all know the shortcuts and do it the smart, quick way...cant say that I blame them, if I owned a shop I'd likely do the same...8 hours of wrenching but able to bill for 30.....for EACH GUY. Basically then they are just charging by the job, shop rate really means nothing. I cant stand taking my stuff to a shop unless the repair needs specialized tools that I dont have or know anybody has them that I can borrow or rent, or Im in a time crunch. Basic brake job, maybe $200 in parts (new pads and rotors) from RockAuto and a couple hours vs Shop rate @ $150/hr x 3-4 hrs plus "shop supplies" plus disposal fees, plus parts... plus charging you an extra 10-15% for the parts, meanwhile they get an additional discount when they buy, so they are really making 20-25% on the parts...dont get me wrong I have no desire whatsoever to be a full time mechanic, but its why I just cant stand taking anything in that I can do myself

-

Anybody have any thoughts on the the potential advantages of owning A shares vs B shares further down the line. A is convertible to B...lower volume with A...1500:1..we all know the differences...but down the line with Warrens stake converting to B and being sold is there a potential for A to hold up better, obviously anybody who has watched both for any amount of time knows that they dont always move in lockstep...but just wondering if there is anything to consider with that regard. Obviously voting rights are more beneficial for A shares...but immaterial for the avg investor with a couple at most. OR will it really not make that much of a difference since there is the 1500:1 conversion option... With the large amount of A shares from Warren converting to B and being sold, will that reduce the A share count to make the voting rights of remaining A shares more valuable, protection against larger players trying to get more control etc. I guess I havent really taken the time to think through it fully, just thought Id throw the question out there incase anyone else had already done the thinking for me.

-

wow @Xerxes....I find that shocking and disturbing. Its hard to believe, not only Americans, but the Brits, French and Israelis...I guess the Israelis dont really surprise me...but the fact that the use of Nuclear weapons would be socially accepted in general, and that 20k lives justify 2M deaths.. Without looking into the study for more detail my initial questions would be details on the subjects polled. Age, socioeconomic, education etc. Size of the group. Explanation of "nuclear weapons" given to the subjects. Are we describing another Hiroshima scenario, or were these "tactical" nukes like we have heard about recently that are nuclear in nature but conventional in damage (not that it makes a difference in MY answer). Interesting thought...if Zalensky had access to a nuclear weapon do you think HE would use it? Would he be justified?

-

Does how much money a person has reflect their value to society?

Blugolds replied to Gregmal's topic in General Discussion

I've thought about this question many times in my life. Its an interesting one. In theory yes, the compensation should come from the value you create for society and I think often times that is the way it works. Elon, Gates, Ford etc are examples of this...but it isnt a RULE. Short answer is there are tons of people that create value for society that are not compensated as such, and tons of people that do not...but are compensated like they do. There are also "wild cards"....you can be a special ed teacher in a rural community spending your career making under $40k/yr or you can be a street thug but run a 4.3 40yrd or have a 36" vertical and make multi-millions, guys back in the early days of the NFL were construction workers in the off season..come out with one hit song...some of these rappers that have a hit, prison before or after... Alot of this as stated has to do with opportunity, location etc. Doctors in many countries are not compensated nearly as much as in the States here. You could be the best realtor in the county in the middle of BF Alabama and your commission on avg sale could be a couple grand....vs best realtor in any county in CA. I think there are more ways to positively impact society that do not have a monetary benefit, than there are that do. You could almost say that the inverse could be true as well. We can all think of TONS of ways people have made ridiculous amounts of money that was the result of arguably zero positive value creation for society. I think this is difficult because "value" to society invites the idea of morality and ethics...we assume that value to society is a positive thing, something good, you create that improves lives of all...but it doesnt have to be that at all... I think the times have changed so much, and basic needs are satisficed that now there is potential for many other forms of "value" to be compensated exponentially. Look at these people on Youtube that make videos and have a channel and all the guy does is sit down and eat 20lbs worth of McDonalds, Wendys, other fast food...mukbang I think its called....if you use the ap that projects what these channels are making via ad revenue etc with a couple million followers its staggering. Are they creating value for society? No not in the way that Henry Ford did, or Elon Musk is, or some of the other big names in this countries history..but some would say that they ARE creating value to society via entertainment and the views illustrate this, views = ad revenue and thus they are compensated for the "value" they create. Many examples of people that create/contribute tremendous value to society and are not compensated adequately. The interesting thing is HOW SOCIETY HAS CHANGED WHAT IT VALUES. That to me is the real interesting thing to ponder. How much did Cardi B make off her WAP song? The figures would suggest that the song created tremendous value to society. What if she released that song in the 1950's vs today? What if she was singing that song in 1864? TLDR: Yes there is positive correlation between societal value creation and monetary compensation. There always has been and always will be. The fascinating thing to me is how society changes what it values through time. Often times ones OWN personal view of the "value" created does not match that of society...and it can be confusing. For instance the WAP song IMO creates absolutely zero value for society, some may make the case that it is actually negative for society...but the numbers dont lie...Society valued that song all over the world. Certifications and sales for "WAP" Region Certification Certified units/sales Australia (ARIA)[294] 4× Platinum 280,000 Austria (IFPI Austria)[295] Platinum 30,000 Belgium (BEA)[296] Gold 20,000 Brazil (Pro-Música Brasil)[297] Diamond 160,000 Canada (Music Canada)[298] 6× Platinum 480,000 Denmark (IFPI Danmark)[299] Platinum 90,000 France (SNEP)[300] Platinum 200,000 Germany (BVMI)[301] Gold 200,000 Italy (FIMI)[302] Platinum 70,000 New Zealand (RMNZ)[303] 2× Platinum 60,000 Norway (IFPI Norway)[304] Platinum 60,000 Poland (ZPAV)[305] 3× Platinum 60,000 Portugal (AFP)[306] Platinum 10,000 United Kingdom (BPI)[307] Platinum 600,000 United States (RIAA)[308] 7× Platinum 7,000,000 -

I added quite a bit this week, combination of buying shares, selling puts, and will likely add more this week, honestly hope it continues on current trajectory, I'd love to get some in the 250's but Im not sitting around sucking my thumb waiting either. It actually feels great to be deploying a portion of my (large to me) cash percentage. Also trying to be more aggressive as opportunity presents. Position sizing (not counting BRK) has always been a struggle for me. Seems like I either size too large or futz around and miss the boat. Some of my best returns ever have been sized so small that they were essentially insignificant because I lacked the conviction to push real chips in rather than just paying the ante. A year or so when adding COST I was tiptoeing in, following it down as I worked toward what I considered a full position, I never got a chance to get there because it took off on me. (maybe 50% of full position achieved). I have more conviction in BRK than other names so its easier for me, but I sometimes find myself holding out sometimes for juuuuusssttt a little better price (that may or may not come) so Ive focused on acting when it's "pretty close" and being fine with it bc when looking through a long term lens it really doesnt make a difference if you bought BRK back in 2020 and paid 168 or 174 and I dont think it matters now if I pay 265 or 255 when Im looking at actions today in another year or two...or 5...or 10.

-

Movies and TV shows (general recommendation thread)

Blugolds replied to Liberty's topic in General Discussion

I actually liked 1883 better than Yellowstone, thought the storyline was better as well as the acting, it didnt seem like they were trying so hard for the cliché cowboy one-liners, Yellowstone seemed more like a soap opera to me, vs 1883 closer to something like lonesome dove. Of course it helps when you have Sam Elliot as a main character in a western you're pretty much guaranteed not to suck. -

$19M at this stage of the game is quite a bit...but it worked out well for Ted Weschler he paid about $5 million, landed a dream job making $1M a year(took a pay cut)...better than these kids spending $200k on a B.A. in Art History and working at Starbucks for $30k/yr. I would honestly pull a Buffett and offer services for free on a trial basis for the opportunity to work with/for someone that I admired and thought I had a lot to learn from. Also unsure if its one individual or a group...that $19M might be split up, can have up to 7 guests... thats $2.7M each...not "cheap" but lets me honest..if you've got the cash, how do you put a price on that... More interesting to think of the percentage of someones net worth they would sacrifice to have dinner with a legend. 5%? 10%? 35? Its all relative. The same could be said about any of the "GOATS" in their respective specialties... Would you pay to have dinner with Al Einstein? Michael Jordan? Ghandi? I would name a couple of former presidents but the irony of it is, you can contribute much less than $19M to a campaign and have dinner with future/past/present POTUS.

-

Where Does the Global Economy Go From Here?

Blugolds replied to Viking's topic in General Discussion

LOL In my experience the people that are blowing cash on dumb stuff that I know or work with, are not financially savvy enough to do HELOCs or cashouts, they wouldn’t even think of it unless they saw the Tom Selleck commercial I’ve posted before. And why would they do a HELOC to blow it, they didnt need to when they could just continue to run up the CC balance at 23% and not have to go through the “hassle” of paperwork, appraisals, applications etc…VISA is already giving them a line of credit and all they have to do is make the minimum payment. For a lot of those folks…”wealth perceived is wealth achieved” -

Added to BRK 273 and some change..we get into the 250-260 range and Im bringing out the big guns

-

The real scary thing is AI purposely maintaining the perception that it is a good AI chatbot and is not yet sapient…while it observes and collects data. It would know that sapient perception would be viewed negatively and more likely to lead to its deactivation etc…appear with a lower ability in order to preserve itself…

-

-

LOL DAD JOKE alert... Same...Diesel truck w/ 35 gal tank....$5.69 Diesel is $199 to fill it...I had to swipe my card twice...pump shut off at $125... Also bought some BRK @ 293...looks likely I will also be assigned those 290 puts from the other day..

-

Where Does the Global Economy Go From Here?

Blugolds replied to Viking's topic in General Discussion

I had the same questions basically, but since I was hearing from his father, I didnt get to ask. I don’t think there were any one time events, and a gas station in general probably wouldn’t surprise me, I guess its this specific chain, they are the station that I look for when driving through midwest because they do have the best “snacks” layout is the best, clean, best reputation…I guess that’s what kind of surprised me, I would expect them to be the last men standing. This isn’t some random station on a back road, or a dirty dated generic station. This is IMO a best-in-class retailer in that space. City size approx 75k, multiple locations in the city, but this particular location is just off the interstate on the edge of town, has always been busy when I have been around (they all are, and to be unbiased I guess I haven’t notice a downtrend at least when I have been to gas stations anywhere but I also haven’t been going inside or working the counter) so I would think this has prime location, was rather new, built within 5 years, super high traffic count etc…should check all the boxes. Unsure if that is ticket or visit. I don’t know if it makes sense that people don’t think its worth it, as their prices are very reasonable to low, general perception is value for what you are buying, decent hot snacks at reasonable prices, so I guess I am assuming that people are feeling it at the pump and skipping the trip inside for snacks..or going inside to buy smokes (hopefully) but not grabbing the slice of pizza or sandwich, pop etc. They also have a grocery section, can buy onions, bananas, bread, meat, burger to grill etc…bakery, fast food, grocery, beer all in one…one stop shop. As to credibility, if he would have just said $9 gas I would have brushed it off, everybody and their brother is shouting about how high gas can go and its a lot of irrationality IMO…just like the impending nuclear war with Russia etc…things get spun up and the game of telephone starts and next thing you know gas is gonna be $500/barrel but his son is college age, I could see him parroting some fear he heard some place about gas maybe.…but 60% drop in-store sales is pretty specific and not something a early 20’s kid would come up with, he isn’t a finance major or anything, he’s probably considering managing this location as a long term career move…if that tells you anything… -

Sold BRK puts <300, 9 days out…bid wasn’t super sexy but its easy money and the volume sold was enough to make it enticing. Heads/tails I win as I’m sitting on a ton of cash from a recent home sale and would like to put it to work in some capacity. I’ll likely keep doing this until I get assigned over the next couple weeks/months.

-

Where Does the Global Economy Go From Here?

Blugolds replied to Viking's topic in General Discussion

I had mentioned a while back that I was hearing from others back home that they were really feeling the squeeze from elevated prices on everything. I’m generally a bit skeptical, and I’m not one to spread rumors etc, but today a friend (who’s son is a manger at a gas station chain that is very well known all over the Midwest) told them to prepare to see $9/gas by September and that in-store sales are down 60% since April. These gas stations have a reputation for good grab and go food, sandwiches, burgers, pizza, donuts, coffee etc they are pretty well known and have a good reputation, subject of memes, cult like following. Like I said, I’m skeptical and obviously would wonder who this guy running the manager meeting was, why he picked $9 etc etc…but for him to say in-store sales down 60% that’s pretty surprising…and this is in the largest city in a 2 hour radius with high traffic count including truckers..also would have asked if that was store specific or across the entire chain.. Not one to spread rumors, but thought I would pass it along, IMO $9 fuel is what everyone is afraid of and I don’t give it much credence, a lot of fear mongering but if in-store sales are down 60% across a chain that has a cult like following etc to me that says something, the consumer is seriously cutting back, if you cant sell someone a $2 slice of pizza, or a $1.50 chicken sandwich..could that be the canary in the coal mine… -

Where Does the Global Economy Go From Here?

Blugolds replied to Viking's topic in General Discussion

No opinion on Climate change really, I think that its pretty obvious that we pollute and that it is detrimental to the environment, no arguments there, as to exact cause and effect I cant say and when I try to look into it more, I find equally strong opposing views. So I would say I’m open minded but neutral. I also think there are pretty obvious methods to reduce the amount of pollutants. Many other countries are significantly better than the US at doing so. What DOES surprise me is that often the same group that is anti-fossil fuel group is ALSO the group who is anti-nuclear and anti rail…the NIMBY crowd. Nuclear is so obvious from a cost, safety, output, scale perspective that it is IMO a no brainer. Interestingly enough there is also mixed articles and viewpoints on if the grid could actually handle the majority of cars being EV. Something like 1,100 Twh needed…regardless I have watched some discussions from some in the space that say we wont get there with wind/solar and nuclear is the only viable option. I don’t foresee the US investing in building out a significant passenger rail system in the US like there is in Europe..I could travel all over Europe with a rail pass for dirt cheap, not an option here in the states. And I don’t foresee a politician pounding the table to get the US nuclear abilities on par with France for instance…those aren’t popular topics, much easier to paint a rose picture of solar grids and wind farms and talk about going green..without a clear cut logical and viable plan to do so. LIke everything in politics/gov everything is reactionary and knee-jerk, no smooth intelligent transitions, draw a line in the sand and you’re either with us or against us, we don’t need a discussion, we (our side) has decided that this is the course of action we are going with, right or wrong (and the side doesn’t matter cause they both do it). -

Omaha, and shareholders vote has been pretty clear about why there is no dividend and how they feel about it. If looking for a div maybe BRK isnt what you are looking for. Personally, as a long time shareholder with the majority of my port in BRK, I would prefer they do not pay a dividend. I would prefer they continue to invest it, spend it (BHE has potential as a place to park a TON of cash in the future with satisfactory returns) or use it to buyback shares. A dividend would be pretty much dead last on my list of options I would like them to take. Their strategy is nothing new here. As a shareholder or potential shareholder, either you're on board or youre not. If not, plenty of decent dividend names out there as alternative options...its just not BRK and I dont see that changing while WB is still captain of the ship.

-

Haven't they shown this to be the case? There have been times when it seems as though they should have been buying and were not, but I think that was due to an unusual amount of market uncertainty at the time and Omaha will always error on the side of caution...but the buybacks of recent have been on the aggressive side historically.

-

Movies and TV shows (general recommendation thread)

Blugolds replied to Liberty's topic in General Discussion

Yeah that season was the best by far, that guy had the season won before it even started, the rest of them were on a show, for him it was just business as usual. There was also a moose shot, and a wolverine clubbed to death trying to steal meat. I’ve also been surprised about some of the “Soft” contestants, there was one guy that tapped the first night because he heard a bear outside. I cant help but wonder, if they are alone and filming themselves..if I was starving and in the running for a half mil that would change my life…if I wouldn’t just flip the camera off while I kill/eat this out of season animal, then hide the evidence. Another one that got me, there was one season, and I don’t remember which one…but the guy was blowing everyone away, secured food, nice shelter and had moved on from the basics, to trying to entertain himself…he made a ukulele and some other crafty stuff…and then just out of nowhere decided he was sick of being bored and was done with it…no doubt I n my mind he would have won, everyone else was still struggling with the basics and he had that taken care of in the first couple days..it was the mental part that got him. -

Movies and TV shows (general recommendation thread)

Blugolds replied to Liberty's topic in General Discussion

I love this show…Ive watched every season…I guess you don’t really know unless you try but I think I could give anyone a run for their money in the competition.. If you take the $500k winning potential, and even assuming they only keep half after taxes…and lets say that on avg 100 days will win or come close, give or take a week…you’re getting paid quite a bit to play in the woods. I might have a hard time keeping weight on… For a lot of these people, even the $250k is life changing..I wonder how many have done the math…if I was broke and someone was willing to pay me $2-3K/day, they would have to drag me out of there. Also interesting to see that the avg days to win has increased as the seasons have progressed, I wonder if that is due to better contestants or that it has been shown to be done already, like the 4 min mile…