-

Posts

505 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by Blugolds

-

You wont get an argument from me on that...but I've also never heard of cartels rolling over and allowing another cartel to take over control without a fight...especially when it would be easy for them to stop/prevent it.

-

^ good explanation @LearningMachine Obviously Buffett has said very clearly multiple times, their #1 priority is to protect the base

-

Was thinking the same thing, also how he italicized that Abel is ready to take over as CEO "now". Taking an opportunity to again instill confidence in the future and eventual handoff. Other things from the letter, yes BNSF issues, but he reiterated that it will still be vital to the country and BRK will still own it. "A century from now, BNSF will continue to be a major asset of the country and of Berkshire. You can count on that." BHE is concerning and legislation disappointing. I have always viewed that as the "perpetual Elephant" a place to park nearly as much cash as they want for as long as they want with tremendous market share and guaranteed "satisfactory" returns, nothing sexy, but with BRK size, and reasonable stable returns, I have always thought of BHE as cruise control and the future crown jewel. That has now come into question and it confuses me because it seems that "going green" is the new mantra, all these things require significant investment in infrastructure, generation, distribution and reliability, either politicians are going to get on board with this and make it attractive to investors or take away all incentive and its just not going to happen. Doesnt give me warm fuzzys and triggers trauma from my local gov actions regarding affordable housing. Attempting to attract investors to build/provide affordable housing and invest, then pulling the rug out from under them by capping rents, taking all the tools away from investors to screen tenants, evict losers etc. The incentives for investors have COMPLETLEY disappeared and the result is obvious, the provision for affordable housing is probably worse now than when they attempted to "fix" it. Never underestimate the gov ability to F something up. I liked his comments regarding Japanese investments. These companies and their management sound very honorable, everything from CEO compensation, cash balances held, hesitation to issue shares and discretion regarding buybacks etc. I think this is a great relationship and I think/hope that the Japanese feel the same. There was a hint of admiration there compared to the way most companies do things here in the States (at least that is how I interpreted it) sounds like they run a tight ship. I was curious how he would mention or pay homage to Charlie, could just be my own emotions around the loss, but I thought it was touching. Ajit continues to prove his worth. Overall tone of the letter I felt was better than years past, at least I enjoyed it more. I also agree that he is setting Greg up, under promise and over deliver, but thats always been his style.

-

I watched a Youtube video regarding major drug dealers who had been caught, they said a significant portion of their transactions were in BTC. Imagine hypothetically that a cartel has a large amount of BTC, that then balloons to $1M+ each...that is a tremendous amount of power, for drugs, for gangs, for weapons, to say nothing of terrorists who evidently dabble themselves. What is the general consensus on how/when the gov steps in. For every "benefit" I hear of an unregulated currency I always think about the dangers involved and I dont hear much about the threats/potential problems it would cause. I almost think of it as allowed for now, but could/would/should be addressed before it is allowed to cause serious consequences. At what point does that become an issue/concern? Does anyone consider this? What can be done to address it.

-

Why did Sriracha disappear from the stores?

Blugolds replied to Hektor's topic in General Discussion

Heard about this also, but then also have seen it in multiple stores, additionally there are several suppliers that offer alternatives, for instance Trader Joe’s sells an alternative, to the Siracha purist, perhaps its not spot on, but for someone like myself that uses it on eggs occasionally or other things, it’s certainly close enough. I do find it interesting that it has a cult following, including people dressing upo for Halloween as Siracha, and kids wearing t-shirts with the chicken logo on it. -

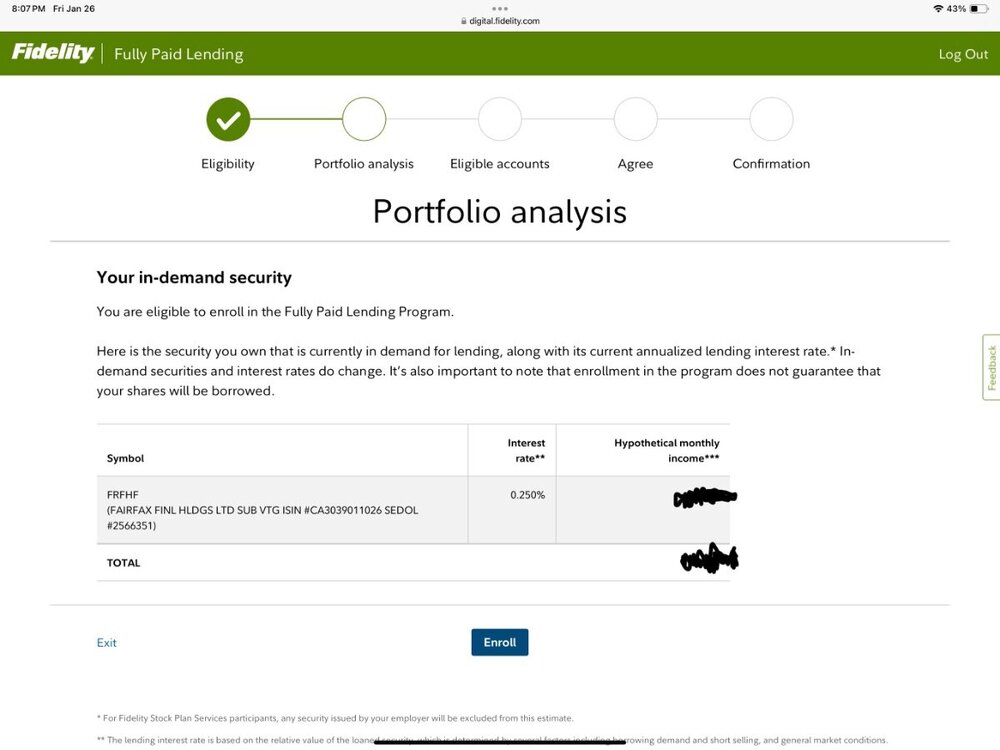

Fairfax interest rate on lending shares @ Fidelity up to .375% from .25 LOL

-

LOL was thinking the same thing...the Fins resistance to USSR is what legends are made of.

-

Logged into my Fidelity account and saw something at the top of the screen telling me that I am eligible for additional income by lending shares of a security. Happened to be Fairfax…Anyone else see this? I didnt enroll, but have never seen that before….thoughts? Not necessarily as to if I should, but why they are doing it? Due to daily volume?

-

G-Shock FTW, but I have always liked the speedmasters..always wanted one when I was a kid and told myself I’d buy one when I cracked 7 figs, then got there and didnt care. Just not really my style.

-

You have two of the best investment minds in history with Warren and Charlie, who had their pick of probably anyone in the world to choose as CEO and they picked Greg, to me that says a lot. Also, I happen to like Gregs personality, he's not overly flashy, mostly low profile, coaches his kids hockey team, seen around town regularly, he comes across as an average guy, majority of his net worth in BRK and has the same values as WB and CM. You cant replace the ultimate duo, but I think they made a good choice. Also he's probably one of the best in the world in terms of energy knowledge and heading BHE I think that is the area with the most potential moving forward for BRK investment with satisfactory returns, especially if the push for more green energy continues going forward. I dont think BRK will have stellar returns going forward, but I think they will be satisfactory, and even if there arent adequate elephants available, coasting would be fine too, protect the base, target that 7-10% return and plump it up with buybacks when opportunity presents, I dont think he has to be a genius to do well. I do believe that Omaha considers shareholders as partners, and Warren certainly values the relationship and trust from many of the families who initially invested with him and still hold the majority of their family wealth in BRK, I dont believe he would squander that with poor succession planning.

-

Elon needs more Tesla stock to motivate him

Blugolds replied to ValueArb's topic in General Discussion

Cracks me up, everyone gets mad/angry at greedy Union labor or blue collar workers asking for a raise that keeps up with inflation when it was running 10% and the 2.5% or less raises werent gonna cut it, but then when CEOs try to strongarm the board with threats to GIVE them billions, thats just CEOs...CEO'ing. Gimmie a break. Like you said, whats preventing him from doing this again down the road. Its like a kid who blew his allowance on a toy that broke, or wasnt as cool as he thought and now he is threatening not to do any more chores unless you double his allowance...as a parent I know what I tell him. The entire goal/point of having a board is to have checks/balance on decisions in the best interest of shareholders (obviously that isnt always the case) but if Elon can just go to the board and demand that they do/give him what he wants or else, then what is the point of even having a BOD? -

POLL - Likelihood of Taiwan Invasion by China before 2030

Blugolds replied to Luke's topic in General Discussion

+1 It's like arguing about who is the best WWF wrestler, it doesnt matter, they're all characters. The country deserves better than Biden or Trump, who that is I dont know. -

What Is the Best Investment That You've Ever Made?

Blugolds replied to Blake Hampton's topic in General Discussion

My first foray was a penny stock LOL pure pump and dump and I was one of the marks. Very very low dollar amount at the time but also at the time…it was enough to sting. Watched that sucker go to zero and figured I better figure out how to “play the game”. Very similar story as to the research. Your return was better by going to the library, I had a local Goodwill that would basically turnover the shelves every Tuesday back in the day, 10 books for $1.99. I bought every book on investing/business/finance I could, including textbooks on business/management/accounting and in there was a book about Buffett. Some of the stuff was over my head of course at the time but I couldnt get enough. I wouldnt say that “investment” has created any 10 baggers for me, but it got me into BRK much earlier than I would have otherwise and gave me conviction to make it a much larger position than I would have been comfortable with back then. What it also gave me was the a better understanding and ability to detect BS as it relates to money/investing and contributed to red flags popping up on a couple occasions when others I knew were investing significant money (for them at the time) into things I knew were bogus but they had a “hot tip” or “good feeling” about. It defined investing for me and allowed me to differentiate between investing, speculation, and outright gambling. #1 rule is dont lose money right? So I guess if I look at it that way, although I didnt 10x my port, I also didnt blow it up like some I knew and didnt continue down the path I was on before my Goodwill education, in that regard the return was phenomenal. -

RIP Charlie, I’ve literally never given a celebrity death a second thought, but then again none of them have ever truly impacted my life, certainly not in a positive way. I agree with the quotes above, Charlie contributed to me having a better life and that is the greatest compliment one can give another. The last time in my life when I felt like I had witnessed the end of an era that I thought I was lucky to have experienced/witnessed was the Chicago Bulls, and “Felt something” when I knew I would never see Jordan wear the red 23 again. I was a spectator, and somehow now, as a BRK shareholder, it felt more like we were teammates, watching the interviews, seeing him in Omaha, reading books, his wit/wisdom will be missed and I consider myself fortunate to have benefited from being alive in his era.

-

I think the article is making mountains out of mole hills. Chastises him for potentially violating his own policy? Gimme a break. He said he doesn’t want to even provide a hint of front running BRK moves in his personal account. So it would make sense that he would exit WMT if BRK took or increased position in a security he held. Honestly, I think WB is a lighthouse of integrity in rough seas of deceit that is Wall Street. Is he perfect? Nope, does he get it right 99% of the time. Yup. Does he go above and beyond to maintain trust and integrity, absolutely. His reputation is better than anyone else on Wall Street, without a doubt, and a significant reason that Omaha gets calls that others dont. I think some people just have such a hard time acknowledging that he is the real deal that they look for chinks in the armor. If he knew BRK was gonna double WMT it’s reasonable to assume he would exit in his personal account. Not to mention I think they said like a half billion in his personal account as an estimate and they are critical of $25M, thats insignificant percentage holding, to insinuate there is some kind of shady or questionable behavior is a joke. There are so many LEGIT liars/cheats on Wall Street that are actually worthy of scrutiny they would be better off spending time on those. For instance, insider trading via politicians on both sides of the aisle. There is enough there to keep them busy writing articles for decades LOL. No sense in even wasting time in Omaha, Washington has all they could handle. They lost me with: in August 2009, Buffett appeared to move, in his personal portfolio, in the opposite direction of Berkshire’s portfolio. He sold $25 million of Walmart stock in his personal account, even as Berkshire almost doubled its stake (which had previously held steady for 15 quarters) during the same quarter. It’s unclear which transaction came first, but no matter the order of events, it raises the question of why Buffett made one choice for his own portfolio and the opposite choice for Berkshire’s investors. And if he knew Berkshire had or was considering making a move, and still traded, Buffett again risked violating his own insider trading policy.

-

Yup, thats why I like the fast stuff, see something and react. The funny thing was, when I did once years ago try to learn an opening, say the “London” and get a pieces to their “spot” there are so many variables, and I was concerned with playing “theory” or what I was “supposed” to play that it took away my gut reaction and instinct, I actually played worse because I was concerned with the absolute best way to play. That probably is more important when you get into the higher ELOs, one slip up and you’re done, but at my paltry 1400 ish level, sooner or later I…or the other guy is gonna goof and open the door for the tides to turn. I sometimes use chess.com game review just to see how well I played, accuracy levels and sometimes Im high 90’s and sometimes Im low 70’s, low 70’s could still win the game often times, but I figure it depends on who I’m playing. Also I’ve noticed at certain times, weekdays vs weekends, nights, vs mid day you get a lot of people from around the world and often similar locations. For instance if I am 1300-1400 and play at one time I might go on a 7 win streak and think wow, Im on fire today…and then play on a mid day and lose 7 in a row, and get smoked doing it. But like you said, memorizing 10 openings, and their variations, and the names, and the counters, to me seems like work and takes the fun out of it. Probably why I’ll always be stuck in that 14-1500 range, with a little more effort sure I could increase and ELO but would I have more fun doing it? I dont think so personally because IM having fun where Im at now. @Cod Liver Oil I remember Bobby talking about a new type of chess he was proposing, random starting type of stuff, basically removing the ability to have homogenized moves and play more from instinct. Would probably be more fun to watch. I do understand what he is saying about them basically reducing chess to what they are “supposed” to play. Removes that element of creativity and randomness. You will literally never ever see another game like this at the highest levels. https://www.youtube.com/watch?v=ObmFR5Dz7Ac The engines and ability to back test 50 different openings/moves and look for the best move based on probability 50 moves deep has changed the game. Its not really all that different than Gary or Bobby used to do years ago, they just did it from past games played, with pen/paper or a board and it took 20x longer because they had to test manually. So maybe they are a little salty that it comes easier for the newer generation via technology rather than back in their day. There are some interests that I have that I enjoy going 110% into, learning it inside and out, because that increases enjoyment, but some things are fine just being middle of the pack. Take for instance fishing, some guys have 100K boat, 50 rods for every possible presentation and scenario, could go tit for tat with a wildlife biologist and a Navy sonar man, some people just sit on a bank and throw a line out with a worm. Im somewhere in the middle and love it. Would be fun to set up some chess games with members online, or a tournament, even if Im dead last LOL. Usually just play whoever they assign me to but might be fun if anyone is interested. Haven’t tried lichess, just chess.com.

-

I play daily on chess.com, Im not a whiz but I enjoy it. I play 3 min games and sometimes 1 min because I like the “instinctual moves”. I enjoy the game. I have never taken it seriously enough to start to memorize the numerous named openings and its counter etc. I almost feel like that would take a little bit of the fun away from it for me, everything I have learned to recognize has come from falling for it multiple times until I figured out something that worked most of the time. Start to recognize patterns, much of the opening moves and counters are very similar after a while, the middle comes fluctuate, and the end game comes back to tactics that help if they are learned. (something I should spend more time on haha)

-

Agree, thanks to @Viking for pounding the table on this, and his above and beyond work/write ups.

-

Just like lotto winnings (aka sneak tax on the poor), Uncle Sam is the REAL winner. RE winners…. Realtors higher commissions the last couple years? Pssh, land owners? No, title companies? HA, lenders, nah, builders/remodelers? NOPE…Good ol’ Uncle Sam adjusting property taxes up and up (some in our area doubled) in perpetuity. Oh wait though, primary residence capital gains exclusion right? That’s great, unless you’re a single guy who already had equity in his property knocking on that $250k and now either pays the higher property taxes, or sells and pays the tax to Uncle Sam on the “new equity” value. Heads they win, tails you lose. Who do these things hit hardest? Middle/lower class.

-

Wow, the American dream of….”apartment living”? Significant portion of the US population, working class, only path to any kind of financial win is derived from the “forced saving/investing” of a mortgage…if eventually even that is gone….

-

There are options that many explore. Social media either shows you the kid in the McManison…or the hipster in the “tiny house” who lives debt free. Both extremes. The tiny house movement is viable, affordable, but nobody dreams of living in a 8.5x22 footprint and those on the shows or social media have always “only been living in it for 6 mo” or so, I dont know that it is a long term solution for the majority. To compound the challenge, many municipalities dont really want small footprint homes to go in, covenants, requiring rezoning etc land prices high enough to make it not viable for someone looking for cheap housing even if the house is relatively “cheap” and mobile vs normal SFH. A lot of people dont want to live around these “fancy trailer parks”:Also, when looking at cost analysis of these tiny homes, if someone isn’t building themselves, they’re still pretty pricey in comparison to what you are actually getting with a normal SFH, that you can actually get a mortgage on for 30 years (in US) and will theoretically appreciate vs depreciation of a “fancy trailer home”. Utilities are basically fixed albeit smaller heating bills, still costs the same to put septic in and drill a well and many “Communities” charge lot rent. Often what seems like a cheap alternative really isnt that much different without the opportunity to appreciate and finance. Doesn’t seem like the juice is worth the squeeze. Living in something slightly bigger than a college dorm or prison cell, no matter how nice the finishes are vs a standard 2k sq ft SFH, sure you can maybe pay cash for the tiny home but monthly expenses aren’t much different. There really is no incentive for those with available means to create mass affordable housing. Period. My local area proposed an incentive plan for ADU in the city to increase affordable housing and then made it so restrictive via various means that it made it unattractive for anyone that wanted to actually make a decent return on the investment that everyone canceled their plans, at least the majority that I have talked to in area, including myself, we own a duplex that we rent out that happens to be on a double lot and had plans to build an ADU. One gal and her husband moved to the city to be closer to her parents from the west coast, she had experience with ADU, her husband is a GC and she is an architect/designer, had plans and permits and several projects waiting to go for themselves and clients, only to get the rug pulled out from under them. Everything comes full circle, increase affordable housing means allowing those who have the ability to rapidly provide quality options to make a decent return on that investment, when municipalities view major investors as evil or outsiders and make it so restrictive that it removes the incentives and whittles margins down to nothing, they dont bite. Individuals (majority) cant do it themselves also because of said restrictions, rules, laws, permits, approvals without the volume and in-house expertise of the big players. But the big players want a decent return, like they are evidently getting on SFH, MFH, and apartments with high rents, otherwise why would they change course. Nobody is going to provide mass affordable housing out of the goodness of their heart, and if they ARE willing to do it for nothing or break even, they better be on the Forbes list, or they aren’t going to get very far. When local law makers realize this and start making it easier/quicker to get things done, increasing incentives and viewing investors as allies rather than opposition that might change but I dont think its going to happen on a significant scale any time soon. AND that is assuming that the majority of the population would even be willing to let go of their social media McMansion dreams. Nobody dreams of living in those 1950’s SFH with 1 car detached garage and 1100sq ft, the times have changed people expect more. Granite countertops, SS appliances, floor coverings, hardware, lighting etc all orders of magnitude more than even the 1980s. THe same with vehicles, look at pickups from the 1980’s, even 1990’s. Hand crank windows, bench seats, AM/FM radio maybe a tap player, regular cab, may or may not be 4x4, zero comforts. Now heated/cooled leather, crew cab is a must, 13” touch screen all have become expected. Avg consumer doesn’t want less, they want more, and they want more…affordably, and that just isn’t realistic. Rather than wondering how to increase affordable housing but mass producing cheaper homes etc if rates stay higher and people continue to have a hard time buying, similar to vehicles getting more expensive, recreational toys…they couldnt or didn’t want to stop increasing prices, and the consumer wanted the products even if they couldnt afford it, so what was the only string to pull? The term. 60mo max on vehicles increases to 72 or more, boats can go 15-20, when does the 30 years mortgage start to come into question? Why not 40-50? They go 35 in Japan and had heard longer in some instances.

-

Movies and TV shows (general recommendation thread)

Blugolds replied to Liberty's topic in General Discussion

I enjoyed Sopranos, The Wire, Breaking Bad, Band of Brothers, Pacific, GOT Yellowstone is OK, I think it had potential but focuses more on drama than the lifestyle, I liked the spin offs better, 1883, 1923. Also for those that like the mob type shows, check out Boardwalk Empire, been a while since I watched it but thought it was pretty decent and as I recall its based on real characters and the Atlantic City mob, Capone is in there also. I don’t watch a lot of TV, and I wouldn’t consider myself a huge Sci-fi fan, but I watched the seasons of Star Trek Next Gen and the storylines were pretty good, written well, all the other ST series I thought were kinda lame and never watched them all, couldn’t get into it. Also recently I’ve been on a Gunsmoke kick. Black and white, and old, but I love westerns and the episodes are written well I think, enjoy watching them. Generally I get kinda bored watching TV and has to be a decent show for me to sit down and actually watch without doing something else at the same time, other than sports. -

Secret Billionaire: The Chuck Feeney Story

Blugolds replied to farnamstreet's topic in General Discussion

Missed news that he passed, RIP, I read the book probably 4-5 years ago, good easy read and very interesting. Was a remarkable guy and I enjoyed the book, never let the money change him. -

Have You Bought a Hostess Product in the Last Year?

Blugolds replied to Parsad's topic in General Discussion

Don’t remember the last time I had a Hostess product. Been decades. When I was younger I never liked Twinkies. I was more of a Zebra cake kinda guy, Ding Dongs were Swiss cake rolls and Nutty Buddies. I didnt mind the Hostess cupcakes but preferred the orange flavor over chocolate. We shopped a lot at WMT and they had their great value brand alternative that copied the Little Debbie and Hostess products and I never could tell a difference. -

@SharperDingaan Good post above, I agree. "Everybody eventually croaks, & you can't take your wealth with you. Hence your 'mission', should you choose to accept it; is to lead a happy/healthy life well past 100, & demonstrate to those behind you, a life well lived. " I think of all the people I've known personally in my life and really really admired (so nobody from Omaha in this instance).... by any reasonable standard, they didnt have much/any financial wealth. Had nothing to do with what I admired. It can be tricky to remember that sometimes. I remember reading a book on Andrew Carnegie, at age 33 he wrote a note to himself: When a guy has that much wealth (it was staggering)to then be that self aware, I found that impressive. Basically saying making money consumed his life to that point and if he doesnt turn it around hes gonna lose himself. WOW. With examples from Warren and the excerpt from Carnegie, I think its why I struggle with those ultra wealthy that are making $50-100M/yr, those already Billionaires, that always want more, even if it means sticking it to their workers, wages and purchasing power has gone down for the last 4 decades while the gap widens...what does more get you? When you already have more wealth than some countries GDP, you've already "won the game" and secured your own future and that of future generations, how do you transition to making a positive impact in the world? Many at that level I think view political funding/power as a way to push the changes they think need to happen and that takes more money, I think thats the only conclusion I come to, that and human nature that its "never enough". Stumbled on this video the other day, just thought it was interesting. As for the UPS drivers making $170k/yr. If you look at the data, and the charts/graphs posted in this forum regarding cost of living, wealth gap, purchasing power, income of the avg worker I dont think that $170k is too high for the job, I think that everyone else THINKS its too high because they have been conditioned over the decades to think struggle is normal. I'm happy they are making that much and hope they make more! Them making a decent living isnt the problem, the problem is that the majority in the country arent making a decent living. These arent jobs they got from connections at an Ivy league school, or because of their last name etc. They are blue collar jobs that earn their wages and IMO they deserve it, and so do many others that work/create value that is not reflected in their yearly income (teachers come to mind). My thinking is "play the game" as a necessary evil (and it can be enjoyable along the way) and when you have enough to be comfortable with a margin of safety, start to focus on other things that are more important with your time, time limited for all of us. Charlie said he never wanted to be wealthy to buy Ferraris, he wanted the freedom, why? Because the time you have in your life with days comprised of what YOU dictate is relatively short, super short for many folks who have to work till they are 70+ Set yourself up and then spend time with family/friends/volunteer/ something positive and enjoyable. If I had a family negatively impacted by my relentless pursuit of more financial assets than needed I would feel like I messed up, and that is time you cant get back, damage would already be done. If that means there is a slight chance that I have to pull the parachute cord and go back to work at some point for an extra margin of safety I'd be ok with that. It's also different I think if you went back to "work" to not have to dip into your savings but you didnt really "need" to work. For instance maybe it isnt UPS, maybe its something fun, maybe you like the outdoors so you get a gig at a sporting goods store, maybe you work at a marine dealership, maybe you find something else that you have an interest in and work doing it to combine making a couple bucks and a hobby at the same time. I did this for a while myself in addition to my normal career. I found a guy in my area that restores antique boats, Chris Craft, Hacker Craft etc all wood boats and after some discussion started working for him on the side. I love every minute of it. I didnt have room for my own woodworking shop, but got my fix for woodworking and the wooden boat scene and made a couple bucks that I just put into more tools. Wasnt even about the money (he paid me way more than I would have taken to do the job) I genuinely enjoy it. Plenty of options out there if you are creative and have a diverse skillset, makes the possibility of an encore less scary.