-

Posts

477 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by Blugolds

-

I literally just did the same thing 2 days ago, was meaning to post also and yours reminded me. Cut my premium IN HALF for 3 vehicles. I was expecting maybe 20-30% difference, and i was lazy about shopping but the latest renewal ticked me off and it was time to go. I have been a GIECO customer for at least a Decade, never had a claim other than when a Semi plowed into me and it was their fault, their insurance. I signed up for GIECO at a shareholder meeting as well as my then girlfriend, now wife. I actually felt a little guilt leaving LOL, I can still remember clearly the booth and signing up. At the end of the day it just didn’t make sense. Still a very long BRKA.B shareholder but no longer a GIECO customer.

-

That is also the way I understood it. RFK Jr is a tough guy to read, some of the things he talks about and complains about are spot on, and you dont hear the other two candidates say a peep about those problems/issues, so in that regard I think he’s great..but then sometimes some of the things he comes out of left field with, its like WTF are you talking about man, you sound like the crazy uncle who spends too much time in the conspiracy corners of the internet. I think in many other election years he would get an automatic pass from most voters, but since this year we have, yet again, two horrible and embarrassing choices, all of a sudden RFK looks more normal/rational than he probably would otherwise. No way RFK wins, but I would like to see numbers higher than Ross Perot at least in hopes that maybe someday we can get away from the two party system, especially since over time that division has become so drastic, there used to be left leaning conservatives and more right leaning liberals, it was more of a grey line…but that line is pretty well established now and it doesn’t seem to really represent what the majority are looking for.

-

I came to the realization on my own, but also have to give some credit to Andrew Carnegie, I read a biography about him years ago and came across a letter he wrote to himself. Obviously the sums are quite different, but the age was pretty close and the sentiment was the same. At age 33, Andrew Carnegie took an inventory of his own heart and wrote this note to himself:

-

^^ Basically my experience as well. The disproportionate amount of time/effort it takes for results that Uncle Sam benefits so handsomely from took fun out of it, for me at least. Plugged in, eat breathe and sleep all the info, early early mornings, late late nights, have the intestinal fortitude to stomach the occasional wrong calls, and you will make wrong calls, and even sometimes when its the right call the market can stay irrational longer than you can stay solvent etc...and after ALL that, if you do win, Uncle Sam is there to pat you on the back and stick his hand in your pocket. Your sweat, your risk and if you win, you're feeding yourself and the tax man. I think of the MIT Blackjack teams, even with statistical advantage, playing absolutely perfect there were runs that they would be down incredible amounts, but with a big enough bankroll and playing long enough, statistically it worked out in their favor. I remember reading and watching interviews where the "slump" was so long and so drastic that they began to question if they had made mistakes or were playing right, they were but there is a mental/emotional element to it also. Mental/emotional fatigue. It can be exhausting. I think it was fine when younger and hungry, hell being plugged in 24/7 in those days didnt seem exhausting because it was all I wanted to do anyway, the majority of the time I was thinking about it anyway, but as I got older and the numbers got larger, the fun/interest/passion waned. Life priorities shift, family/kids etc. The advantage of having a larger port is that eventually, when it gets big enough (hopefully everyone can quantify what is "enough") that you dont have to focus on getting the snowball as large as you can, you can pick solid performers that you can reasonably assume will continue to be solid performers for an extended period of time and produce satisfactory returns and look for times when they are at least reasonably priced and take positions. I guess it comes down to personal goals, and what the purpose of money is, is it the means? Because if you have "enough" or close, if your goal is to get as rich as possible and you're willing to sacrifice every other aspect of your life to further that, then do what you think you gotta do, but if you get to a point where even less than satisfactory, impressive or "sexy" returns still amount to more than your yearly liberal spending can burn through doing everything you want to do...spending all your time trying to increase that just for the sake of a better score at the end, seems like you're missing out on other joys/experiences of life because for me personally it couldnt be both, it was either one or the other.

-

Currently a Gieco customer, but am looking at Costco auto ins offers, seems like its about half the cost or so, anybody have any experience with Costco Ins offerings? https://www.costco.com/auto-home-insurance-services.html

-

Biggest regrets of the older posters here?

Blugolds replied to yadayada's topic in General Discussion

Also have 2 twin boys, 14mo, they sleep well through the night since about 10 mo old, but man...the thought of starting all over again is A LOT...to put it mildly. I couldnt imagine it. I was at Target the other day with both the boys, a guy came up to me and made a comment about them being twins, and cute etc and I said, yup they can be a handful...he said his sister also had twins, and that they decided to have one more, she got pregnant with...gulp....TRIPLETS. No joke. I couldnt tell if he was expressing his sentiment that he knows twins are a different ball game, or if it was a friendly reminder that a next one doesnt always mean a single and that things can always be more hectic LOL. The thought of having 5, or even 4 kids under the age of 2 running around the house.... Even without considering finances, logistics, childcare, diapers etc, I think our household is about maxed as it is, even with help from an Au Pair. We both have demanding careers that consume a significant amount of time, even after trying to prioritize family/home over work as much as possible, in some instances depending on roles, its tough. To those who would like to enter back into the fray..I'll share why my mother asked me when I was considering having kids for the first time...she said, "what are you more afraid of, having a kid (or a 3rd in your case) or being 60 yrs old and the regret of not having one (or the 3rd)". Its a big step, but when I thought about it, if I pictured myself at 60, sitting on a pile of money with nobody to share life with or mentor, personally I would feel like I missed out. Even with all the hard work I still feel that way. I will say that the fear of being 60 and not having 3+ vs the fear of being 60 with just the 2 I have now, not the same sentiment, personally Im content with the current roster. -

+1 I've said it before, "The lion doesnt concern himself with the opinions of the gazelle". If $50 is all it takes to keep out this kind of riffraff, at twice the price thats still a smokin deal. What he wrote says way more about him, than it does you, or this forum. "there are more (and most importantly, superior) alternatives for investment-related content as each day passes....Substack, Twitter, etc..." ^ this one made me laugh, he forgot Seeking Alpha! The quality of content and discussion on these alternatives compared to COBF is not even close. Its like comparing the National Enquirer to an academic journal..

-

If someone had standing orders placed for limits of say $250 would those have filled? How quickly was it caught? And IF they were filled would they then be retracted? I think this obviously would be corrected. I remember when I was younger someone at the bank (teller?) made a deposit mistake of something like $500 into my account (that was a lot for me at 16) and I thought it was great...but it was caught obviously by the end of the day or the next and they pulled the money back out. Who knew all those years playing Monopoly, there actually never is a "bank error in your favor" !

-

78% of Americans live paycheck to paycheck

Blugolds replied to Blake Hampton's topic in General Discussion

Social media, combined with every tick tock and YouTuber driving Ferraris and living in mansions telling every kid that its easy and totally normal. Then you have all the “investment bros” telling them that they made millions “with this one simple trick Wall street doesn’t want you to know about” and that secret can be yours for a membership to our community or joining my online training, buy my book/coaching etc. Its constant bombardment by luxury in your face and its easy! If you cant do it there is something wrong with you. I dont know if there has ever been a time in history with as much constant bombardment of get rich quick schemes, or at least the access to the influenceable like there is now. Its no wonder the author of “the algebra of happiness” I forget his name, but he is a professor, said that in polling his students that the majority expect to be making like $750k/yr out of college or within a few years of graduation. Social media et al creates these unrealistic expectations and when they fall short they feel like a failure and give up. Everyone wants to get rich quick, live in the mansion, buy the Ferrari just to trash it in a corn field for a video etc basically every single thing besides what actually works, acquiring a skill to make themselves marketable and command a premium wage, starting a business and making money off other peoples time working for you, developing a product or service with a competitive advantage etc. And then comes the hardest of all that they never see, plain old fashioned hard work, they never see that in videos/social media. Delayed gratification, hard work, intelligent allocation, decent runway and sticking to the plan isnt sexy, and doesn’t get millions of views on YouTube. It used to be “keeping up with the Joneses” maybe meant your immediate next door neighbor or group of friends, there may have been a slight income disparity but was still relatively close, now the “Jones’” has evolved into the entire world around you with people that they feel an attachment to by viewing every new video drop every week or multiple times a week. Kinda wild when you think about it. -

The comments that this is unethical, to me, are ridiculous. Only an employer would think that. If you are in a position to do it, more power to you. I'll also add, in honor of Charlie...invert! Lets make a "wild" assumption that you work for an employer and they pay you a salary for your job duties and another employee quits or gets fired. Rather than hiring a replacement, they simply add that previous employee's workload on to your current responsibilities...I know I know this is a crazy notion that likely would NEVER happen (sarcasm)...but does that mean that you get your previous salary for previous agreed upon job duties, PLUS the ex-employee salary for ALSO essentially working their role/responsibilities? Absolutely not! That would be absurd! Workers have been getting fleeced for decades. More work, stagnant growth in wages, despite increased worker production. Some workers find a "hack" to slightly tip the scales back in their favor and all of a sudden its unethical. ALSO, this detracts from the real problem...a CEO comes out saying that working two jobs is unethical all while giving themselves a fat bonus when the company is floundering, (likely a bonus larger than the overemployed will make working two jobs in their entire LIFETIME), running the business into the ground while taking a golden parachute with severance and benefits never having to work again...or sitting on multiple company boards and offering no value and never disagreeing with a CEO, just YES men. "THEY" are doing the same thing! They've been fat and happy for generations, but the worker bees finally find a way to play the same game and its horribly unethical....gimmie a break. Greg has mentioned this many times, the good ol boys network that got them the position because of pedigree despite inadequate qualifications. Go to ivy league, nepotism etc gets you a cush job in the C-suite, sit on several boards, CEO role or other alphabet title, run it into the ground and its ok because you already have your seat at the big boys table, take your bonus and severance and that is accepted and standard practice. Do the same thing essentially, outside the C-suite and its immoral and unethical...LOL This notion that upper echelon commonplace behavior is praised and somehow when the avg joe finds a way to get a taste it isnt right blows my mind. They really have a lot of people fooled and distracted if they think a workers entire goal should be to be a good little employee and take what they give you. There is no loyalty company → employee...but expect 100% employee → company.

-

Sounds like a knock off of a book I read years ago.”The Gift of Fear” https://www.amazon.com/Gift-Fear-Survival-Signals-Violence/dp/0440226198 Was required reading for State Patrol academy at the time I read it and recommended by someone I knew attending. There is something to be said about listening to that “little voice” in your head that whispers something isnt right. I credit this book for a few things, one of which was noticing abnormal behavior of a fella standing behind an elderly lady on the street in Rome, after I walked past him I turned to watch him crawl up behind the woman and reach in and take her cellphone from her pocket. I’ll just say, she got her cellphone back…I dont speak Italian, and he didnt seem to speak English..but there is a “universal language”….

-

Assholes, the good the bad and the ugly

Blugolds replied to DooDiligence's topic in General Discussion

The personality qualities of being an Ahole (or sometimes coming across as an Ahole) go hand in hand with other personality traits. There is a reason that Myers-Briggs, MMPI and several others when taken will yield results that are shared among many of the most "successful" people in human history (depending on how you define successful.) Aholes are capable of getting results out of people and getting what they want, sometimes voluntarily, sometimes under duress. I think its certainly possible to get results without the need to be an Ahole. Several traits of narcissism ie lack of empathy, sense of entitlement, grandiose feeling, dismissive attitude, willingness to exploit others, dominating conversations, manipulation, controlling and commanding all tend to do fairly well in a capitalistic setting. People like Jobs, Musk, certain military commanders in history, any leadership position know clearly what they want, have a vision and will not accept anything less than that coming to fruition and are willing to do whatever it takes to make that happen, and if that means hurting a few feelings that is acceptable. Also depends on context and priority, Warren said if you lose money for the firm he would be forgiving, but if you lost reputation he would be ruthless. He prioritized the reputation and made that clear, some prioritize results and revenue over everything else, but the sentiment is the same. I also think that the people that are underachieving many times view the person demanding more as an Ahole, that is probably just human nature, if you have a boss thats an Ahole but you are producing you might view it as less than pleasant but its not a huge problem because you arent on the chopping block. We had a football coach that was known to be an Ahole, certainly new players would call him an Ahole, he was brutal and demanded the best and was wiling to push everyone to the limit and find out where that was and then go a little more, no excuses. Regardless of your personal opinion, it yielded results and landed him in the coaching HOF with the most winning record. Guys that got cut said to heck with him, hes an Ahole...those of us that staid thought it was tough and sucked, but at the end of the year and now later in life, can look back and understand why he did what he did, and can think about it now removed and realize that there is a reason for the track record and that it would not have been what it was, and we wouldnt have been as good as we were if he hadnt been an Ahole. Are Navy Seal trainers Aholes during hell week? Sure, but its necessary to get the results they need/want. -

I'm sure everyone already has seen it, but just incase someone missed it over the weekend. Yahoo: Berkshire Hathaway speeds up stock buybacks In its proxy filing on Friday, Berkshire said it repurchased the equivalent of 3,808 Class A shares this year through March 6, spending approximately $2.2 billion to $2.4 billion depending on the dates of the buybacks. Nearly three-quarters of the repurchases took place after Feb. 12. Berkshire repurchased $2.2 billion of its own stock in last year's fourth quarter, and $9.2 billion in all of 2023. Its peak year for buybacks was 2021, when they totaled $27 billion. Through Friday, Berkshire's share price was up 14% this year, about twice the gain for the Standard & Poor's 500. https://finance.yahoo.com/news/berkshire-hathaway-speeds-stock-buybacks-185257424.html

-

The Lion doesn’t concern himself with the opinions of the gazelle

-

I agree, I would love to see the equivalent of Jon Stewart Daily show but for finance, Make fun of both sides, call a spade a spade, entire show is basically making a mockery of the hypocrisy that is so blatant. There certainly wouldnt be a lack of targets or material to use. Something that illustrated our own personal monologue when watching all these jokers who are self proclaimed industry "experts".

-

Movies and TV shows (general recommendation thread)

Blugolds replied to Liberty's topic in General Discussion

I remember seeing a crime show that had a story about a guy that did this in Toys R Us, wasnt the scale these fellas had and not for as long but remember thinking about it...hmmmm Also worked in a hospital in college, had full access to the entire facility that included several buildings with basements and I had the only keys, several basements had HVAC equipment in them, warm, a little loud, but could have totally built a "nest" and as a broke college kid, save some of that rent money and buy beer LOL, obviously never did it, but the imagination def ran a little bit! -

You wont get an argument from me on that...but I've also never heard of cartels rolling over and allowing another cartel to take over control without a fight...especially when it would be easy for them to stop/prevent it.

-

^ good explanation @LearningMachine Obviously Buffett has said very clearly multiple times, their #1 priority is to protect the base

-

Was thinking the same thing, also how he italicized that Abel is ready to take over as CEO "now". Taking an opportunity to again instill confidence in the future and eventual handoff. Other things from the letter, yes BNSF issues, but he reiterated that it will still be vital to the country and BRK will still own it. "A century from now, BNSF will continue to be a major asset of the country and of Berkshire. You can count on that." BHE is concerning and legislation disappointing. I have always viewed that as the "perpetual Elephant" a place to park nearly as much cash as they want for as long as they want with tremendous market share and guaranteed "satisfactory" returns, nothing sexy, but with BRK size, and reasonable stable returns, I have always thought of BHE as cruise control and the future crown jewel. That has now come into question and it confuses me because it seems that "going green" is the new mantra, all these things require significant investment in infrastructure, generation, distribution and reliability, either politicians are going to get on board with this and make it attractive to investors or take away all incentive and its just not going to happen. Doesnt give me warm fuzzys and triggers trauma from my local gov actions regarding affordable housing. Attempting to attract investors to build/provide affordable housing and invest, then pulling the rug out from under them by capping rents, taking all the tools away from investors to screen tenants, evict losers etc. The incentives for investors have COMPLETLEY disappeared and the result is obvious, the provision for affordable housing is probably worse now than when they attempted to "fix" it. Never underestimate the gov ability to F something up. I liked his comments regarding Japanese investments. These companies and their management sound very honorable, everything from CEO compensation, cash balances held, hesitation to issue shares and discretion regarding buybacks etc. I think this is a great relationship and I think/hope that the Japanese feel the same. There was a hint of admiration there compared to the way most companies do things here in the States (at least that is how I interpreted it) sounds like they run a tight ship. I was curious how he would mention or pay homage to Charlie, could just be my own emotions around the loss, but I thought it was touching. Ajit continues to prove his worth. Overall tone of the letter I felt was better than years past, at least I enjoyed it more. I also agree that he is setting Greg up, under promise and over deliver, but thats always been his style.

-

I watched a Youtube video regarding major drug dealers who had been caught, they said a significant portion of their transactions were in BTC. Imagine hypothetically that a cartel has a large amount of BTC, that then balloons to $1M+ each...that is a tremendous amount of power, for drugs, for gangs, for weapons, to say nothing of terrorists who evidently dabble themselves. What is the general consensus on how/when the gov steps in. For every "benefit" I hear of an unregulated currency I always think about the dangers involved and I dont hear much about the threats/potential problems it would cause. I almost think of it as allowed for now, but could/would/should be addressed before it is allowed to cause serious consequences. At what point does that become an issue/concern? Does anyone consider this? What can be done to address it.

-

Why did Sriracha disappear from the stores?

Blugolds replied to Hektor's topic in General Discussion

Heard about this also, but then also have seen it in multiple stores, additionally there are several suppliers that offer alternatives, for instance Trader Joe’s sells an alternative, to the Siracha purist, perhaps its not spot on, but for someone like myself that uses it on eggs occasionally or other things, it’s certainly close enough. I do find it interesting that it has a cult following, including people dressing upo for Halloween as Siracha, and kids wearing t-shirts with the chicken logo on it. -

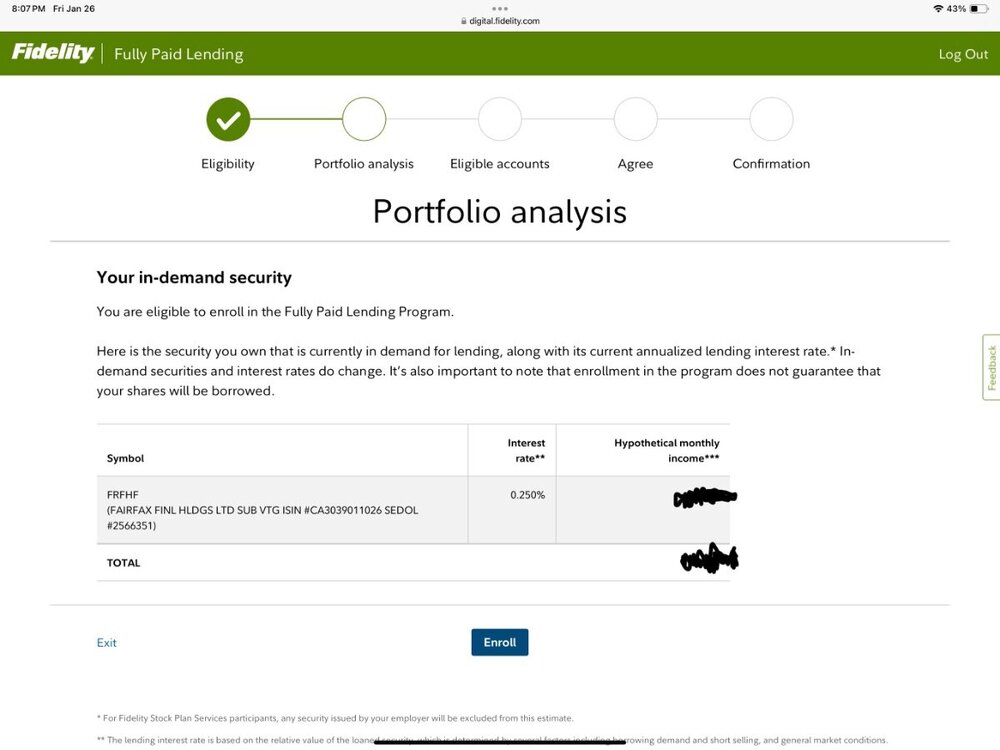

Fairfax interest rate on lending shares @ Fidelity up to .375% from .25 LOL

-

LOL was thinking the same thing...the Fins resistance to USSR is what legends are made of.

-

Logged into my Fidelity account and saw something at the top of the screen telling me that I am eligible for additional income by lending shares of a security. Happened to be Fairfax…Anyone else see this? I didnt enroll, but have never seen that before….thoughts? Not necessarily as to if I should, but why they are doing it? Due to daily volume?

-

G-Shock FTW, but I have always liked the speedmasters..always wanted one when I was a kid and told myself I’d buy one when I cracked 7 figs, then got there and didnt care. Just not really my style.