Dinar

-

Posts

1,829 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by Dinar

-

-

9 minutes ago, Malmqky said:

Yep, I’m still in the research phase here, really just want a few shares to motivate me to continue to learn and look deeper.

Doesn’t fill, oh well.There are a number of write-ups on VIC over the last two decades

-

18 minutes ago, Malmqky said:

Starter/tracker sized positions in CROX and NEN (if it fills lol).

Lots of REITS are starting to like decent value.

You are competing with the company - they bought back 0.5% (18K shares in Q3)

-

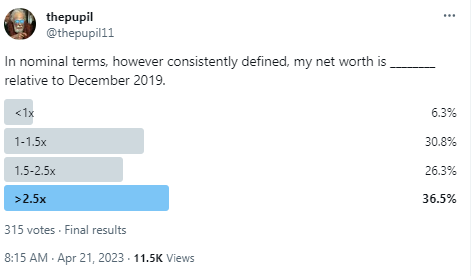

2 hours ago, thepupil said:

I struggle to think of one example in my admittedly small circle of folks of this being the case. Honestly, don't know anyone who would describe what's occured thus far as damage.

maybe that's my bubble talking, but to me it's like we have much higher risk free returns (real and nominal) with almost no damage, whchi feels like a free lunch. There is no free lunch of course.

people lie on social media, but this graph is closer to my personal experience and those around me than your characterization of "very few" being better off today than a few years ago. To me it's going to take years of malaise to unwind the glorious and ongoing boom in household wealth that's occured over last few years.

Wow, you got some pretty impressive friends. None of my friends have seen net worth 2.5x since 12/31/2019. Hell, I do not think anybody's net worth doubled since then. Most people cluster around 1.5x or below.

-

15 minutes ago, no_free_lunch said:

I don't disagree with much you said. I, Canadian perspective, just don't want to get involved. Risk of Iran involvement.

Iran is already involved. Keep in mind, as Hamas figures have stated before, Israel is just the first domino. The rest of the world is next.

-

3 minutes ago, no_free_lunch said:

They are now threatening to execute hostages. Throws a wrench in the plans. I guess Israel can just ignore the threats in which case Hamas is really screwed but I'm not sure that's palatable.

Why? Ground invasion will cost a lot more in casualties than all the hostages. By the way, here is a take from a Russian paper:

https://www.gazeta.ru/army/2023/10/09/17706481.shtml

For those who do not read Russian, the military observer for the paper states that the only solution is to destroy Gaza and deport the entire population, otherwise this continue forever.

By the way, if you read interviews with people from Gaza and West Bank, they don't want just Gaza and West Bank. They want the entire state of Israel, including all the territory that UN assigned to the Jewish state during the partition. I don't know what the Israeli government is thinking, but how can peace be possible with people who consider themselves occupied as long as one inch of the Holy Land is in Jewish hands? There will always be war unless either all the Jews are kicked out of the Holy Land or all the Muslims are kicked out of Israel, including Gaza and the West Bank.

Look, Czechoslovakia deported all Sudeten Germans post WWII, King Hussein did the same during Black September (although he killed like 25K). It is not as if this is without precedent.

-

@Spekulatius, why do you think defense stocks should go up on this? Heck, if the Israelies are smart, which I doubt, they would hardly need to replace any equipment. Ammunition yes, but no tanks, planes, artillery, et all. Just blockade Gaza, and watch it surrender, tactics used successfully for millennia.

-

3 minutes ago, no_free_lunch said:

I think it's probably closer to 100k. If you assume 3 wounded for every dead that's still around 400k or 1 percent of the entire pre war population. They would have collapsed with the larger number.

Anyways the number doesn't matter, what matters is Ukraine still would rather fight than be enslaved.

I know this has gotten old and repetitive but that is part of it. This is an endurance event.

The sad part, aside obviously from all death and destruction, is that Russia has a lot more ability to endure than Ukraine.

-

26 minutes ago, cubsfan said:

Yeah 500k dead and 6M refugees is a catastrophe. 100K sounds way too low.

Is it really 500K dead? Not that 100K is too little, 100K dead is a tragedy, I hope it is not 500K dead.

-

5 minutes ago, Gamecock-YT said:

and all the politicians that vote for that immediately being thrown out of office next time they are up for re-election. No incentive to stop the gravy train. They get to keep cashing them checks. It’ll be someone else’s problem.When in January of 2020 (before Covid), in NYC, with every block posting job openings offering $20 per hour + benefits for unskilled work, 25% of the city was on food stamps, it has to stop. It cannot continue on this trajectory much longer. Bill Clinton did his welfare reform and was re-elected, Giuliani made welfare recipients clean parks and was re-elected.

-

The best solution to the government deficit problem is to slash welfare, food stamps, Medicaid and similar programs, including end government guarantee of student loans. The result will be a reduction in government spending (a very substantial one), increase in taxes as employment will increase materially, lower inflation as the wages will not have to compete with very generous social benefits. In addition, it is better for society when people work rather than collect welfare, including fewer children born to unwed mothers.

-

-

He is absolutely correct, however I think that there are a couple of nuances that ought to be addresses.

a) If and when in say five to ten years, you no longer can get ten percent on super high quality private credit, will that cause the equity market to reprice higher, and will the returns be higher in equities over that five to ten year period than in private credit?

b) When PM is borrowing at say 6-6.5% for ten year paper, I wonder how good credits are that are paying ten percent plus?

c) Lastly, I am not sure that ten percent plus is available for the investors. OCSL, which is an Oaktree vehicle is not generating ten percent on unlevered capital, it is generating much less due to rather high in my opinion, management fees.

So he is essentially comparing apples and oranges: credit product before fee (which is only available on a post fee basis) and equity product that can be purchased with no fees (index.) While returns on credit product might be competitive with equities, what investors will receive will probably be much less and not competitive with equities.

-

@Gmthebeau, sure, if you hold bonds to maturity, you don't lose money in nominal terms, you actually make money. However I presume that most people care about purchasing power=real wealth, and once you take inflation and taxes into account, you can easily end up with a huge loss in real terms even if you hold long term bonds to maturity. TIPS, in my opinion, are a different story.

-

@thepupil, so I would agree with you that bonds are beginning to look interesting, particularly TIPS - 2.4% real yield, although I would still prefer to own PM or L'Oreal than TIPS.

However, where I disagree with you is your point that it is very hard to lose money in bonds. In your 08/06/2020 example, in real terms, you are down another 20%+. To be down 35% after-tax is gigantic for supposedly a "safe" asset. By the way, that's probably for the index. The long bond is down 50% before inflation and 60% after.

From here yes, I think you will do well in TIPS in a tax indifferent account or to preserve wealth. To grow wealth for a taxpayer, I don't see how it can be done given 40.8% marginal tax rate (37%+3.8% Obama surtax) when say 30 year pays 4.85% (so 2.9% post tax but before inflation.)

-

23 minutes ago, yesman182 said:

What kind of sales? I haven’t seen them out their kitchen cabinets on sales in years, but they seem to always have a few couches and lamps and what not on sale.

What one would describe as office furniture - desk, et all

-

21 minutes ago, John Hjorth said:

Certainly interesting.

I wonder if market participants are sobering up.

... I mean I don't think we have seen any pics of CoBF members friday afternoon shopping cart contents lately, so everybody in the industry are putting robes in their sails, reducing credit times for customers, reducing sizes of inventories, looking with a comb on staffing, and trowing a critical view on the base of fixed costs.

IKEA is now running sales in NY, I have not seen that in years.

-

Sold MSGE Nov 30 puts at $1.15 today.

-

53 minutes ago, sleepydragon said:

I think what investors are getting wrong is most are expecting a recession, in particular a mild one, which will lead to lower interest rate, thus market hasn’t tanked yet.

what if we don’t have a recession, just a very slow growth economy, and we keep have inflation and Feds have to keep raise interest rate? In that case, what will happen to the stock market? I think it will tank but who knows…

Yes, people know the drivers of inflation - deglobalization, increased government spending in the US, rising oil price, aging population, more aggressive labor unions and workers, green new deal.

What about drivers of deflation in the US? Reduced demand for goods and services in the US driven by student loan repayments - $70bn per year as well as higher interest rates (car payments are going up, so are new mortgages), perhaps flat government spending in the US in nominal terms if Republicans can hold the line on spending. Automation. Perhaps if the pendulum starts swinging the other way and soft on crime policies reverse, then losses & inflation due to theft will go down, and people might actually need to get a job rather than steal with no consequences?

Rising debt burden - inflationary or deflationary?

Inflation is almost always with us due to loose fiscal and monetary policy (look at Switzerland to see how to avoid inflation). I think raising rates here is a huge mistake, the full impacts have not worked through the economy yet. Between increase in rates & Fed shrinking portfolio, tightening has been faster than due Paul Volcker era if I am not mistaken.

-

Where did you see that major weapons budgets are doubling over the next four years? Thank you.

-

38 minutes ago, no_free_lunch said:

John,

If you watch the video, the conditions to NOT invade was removal of all allies from the block that had joined since 1997, this includes Poland, Romania, Hungary, and other Eastern European countries. Why does it matter to him so much, this is not his territory. and these territories were not traditionally part of the Russian empire. They can join up with whoever they want to. The EU needs to be a little bit assertive, you are up against a tyrant, you do not need to bow to his rules or demands.

Putin is a degenerate, and should not have invaded, nor has he any right to dictate to free nations how to behave, but you lose all credibility with posts like this. Poland was part of the Russian empire, so were the Baltic States and Finland. Western Ukraine (Galicia) was not.

-

@John Hjorth, as US taxpayer, I do not have a problem with welcoming Ukrainian refugees to the US. I think US will gain mightily from these mostly highly educated and hardworking people. I do have a problem with a porous border, that allows millions of people from Haiti, Yemen, Africa, Pakistan, Uzbekistan, Tajikistan, and Latin America to cross into the US, people who at best will be a drain on society, and at worst will commit crimes and terrorist acts. Keep in mind, unskilled immigrants also destroy job prospects and wage growth for unskilled Americans, creating all sorts of social problems - alcoholism, drug addiction, broken families, fatherless children, and the list goes on.

-

2 minutes ago, thepupil said:

not sure I understand this math. if FFO is going to grow by inflation +2-3%/yr, then wouldn't total return be 8-9% inclusive of inflation?

Let's say inflaiton = 3%. So FFO growth = 6%. So at a constant FFO payout ratio, wouldn't dividend growth be 6%? Ergo wouldn't total return be current yield of 3% + 6% growth = 9% (just simplified DDM, assuming no kind of re-rating).

how do you get to 8-9% + inflation?

You are right, I should have been more explicit. I am assuming that all FFO gets paid out as either dividends or share buy-backs, and there will be no more acquisitions. In reality, they have opportunities to invest some capital at 10%+ yield on development, and they will probably acquire property over time. Assuming acquisitions are not very big and value destroying my approximation should hold.

-

@thepupilSUI has been real good at selling shares.... I agree with you, I hate dilution, but love the assets. In retrospect, good share sales by the company: 9.2MM at $139.5 on 09/30/2020, 8.05MM at $140 on 03/04/2021, and 4.03MM at $185 on 11/15/2021. I just think on a same store basis, it can raise prices at 1% above inflation, so call it inflation + 1.5% EBITDA growth, so say inflation + 2-3% FFO growth per year, assuming no acquisition, so total return = 8-9% + inflation per annum.

-

23 minutes ago, no_free_lunch said:

Right now, it feels a little like early 2008. Back then they were raising rates, home prices were shaky but still stable, the stock market was doing ok, just a little dip here and there.

I am watching Canada to see what happens here. 5 year mortgages (or less) are the norm and by most metrics we have higher mortgage debt levels, so we should see sooner the impact of rising rates. Perhaps though, rates will push through to commodity prices and that will soften the blow but I think this Canada is a good bellweather.

No way this is early 2008 in the US. There like 5 bids for every home that comes on the market, half from cash only buyers. There was very strict mortgage underwriting in the US over the past decade.

Energy Sector

in General Discussion

Posted

@Viking, why do you think it will become a wider war and who do you think gets involved? Also, why would that impact world economy? @Sweet, what makes you think that Israel will let hundreds of murdered civilians go unavenged? Moreover, there is an argument to be made that past policies did not work and either some drastic has to be done, or the massacre that we saw on Saturday will recur.