nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

Brilliant interview, thanks for posting. The commentary around inflation and then their hesitancy around providing reinsurance to “a lot of new entrants” was telling. Will have to listen again and take some proper notes.

-

+1 Happy to make a contribution to get rid of the ads. Thanks again Sanjeev

-

Agree the shares will already have been bought. The payer charges FFH, the receiver, a finance charge with downside protection if the price of the asset, in this case FFH shares drops. When the TRS is unwound, it is likely the IB would sell the shares back into the market. In a TRS contract, the party receiving the total return gets any income generated by the financial asset without actually owning it. The receiving party benefits from any price increases in the value of the assets during the lifetime of the contract. The receiver must then pay the asset owner the base interest rate during the life of the TRS. The asset owner forfeits the risk associated with the asset but absorbs the credit exposure risk that the asset is subjected to. For example, if the asset price falls during the lifetime of the TRS, the receiver will pay the asset owner a sum equal to the amount of the asset price decline. https://corporatefinanceinstitute.com/resources/knowledge/finance/total-return-swap-trs/

-

Perhaps. Maybe I am being too optimistic but it looks like classic horse trading to me. What they asked for (ambit claim) versus what they got doesn’t appear too far apart, especially when it is compared to the UDF they are currently charging. The public hand wringing also was a bit strange. Classic India?

-

A little background on the National Monetisation Pipeline Indian asset monetization plan boosts ABB Power Products and Systems (capital.com) India aims to raise INR6tn (US81bn) by monetising its assets. But the plan, the largest ever announced by any government since the country’s independence, includes caveats. The regime will grant firms the right to develop road projects, stadiums, airports, railway stations, power transmission lines and gas pipelines for a specified period, akin to a lease, according to guidelines published by government think tank.

-

Agree entirely on the confusing wording. I guess we will see how it gets reported in a quarter or two.

-

Based on the press release I figured it was a wash. Currently, Fairfax India, through its wholly-owned subsidiary, FIH Mauritius Investments Ltd, owns a 54.0% equity interest in Bangalore International Airport (“BIAL”). As previously disclosed by Fairfax India, as part of the transaction, Fairfax India will restructure approximately 43.6% of its equity interest in BIAL such that it shall be held through Anchorage, implying an equity valuation for 100% of BIAL of approximately INR 189.7 billion (approximately $2.6 billion at current exchange rates), which is the same valuation implied in Fairfax India’s June 30, 2021 consolidated financial statements. Upon closing of the transaction, Fairfax India’s effective ownership interest in BIAL will decrease to approximately 49.0% on a fully-diluted basis, while its actual ownership will remain unchanged. https://www.fairfaxindia.ca/news/press-releases/press-release-details/2021/Fairfax-India-Receives-All-Regulatory-Approvals-to-Complete-Sale-of-Minority-Position-of-Anchorage-Infrastructure/default.aspx

-

Same as it is today as far as I know, the key is “on a look through basis”. Happily proven wrong, but my take is that is a repackaging of their stake into Anchorage.

-

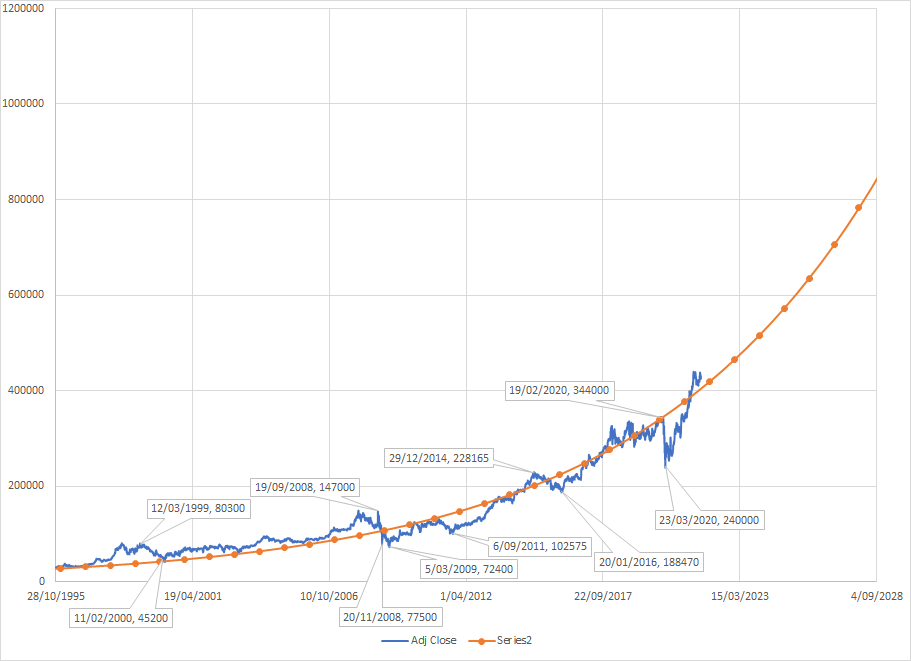

Over a 10 year horizon it probably doesn't matter for an individual's purchase today (10% or 11% CAGR). However, for Berkshire, I actually hope the reason that the price is correcting is because he has reduced repurchases. This an OK price but not worthy of 5%+ repurchases. Let the price fall and lose a few weak hands. Very simplistic I know, but for those with a longer term horizon, this is where we are currently at on a 11% CAGR journey. That CAGR increases by 1 or 2% if the old boy and subsequent management can do buybacks at the right price. The big one, is an option on capitalism actually having a role going forwards.

-

I recall something similar also, but the India IPO market is hot which must make it tempting. Perhaps the disclosure around financials of insurance companies is an Indian thing. If that is the case then it is pretty amazing as it provides quite a window into your soul for competitors. On the other hand it may also speak volumes about the value of a hunting license in the Indian insurance market. I think we all agree that Prem knows via Kamesh and team, he has captured lightning in a bottle. I am sure they will get the timing of an IPO roughly right.

-

Glider, that could well be right. In addition for me you have highlighted a couple of things. If many of the associates just move to break even then the numbers rise materially, highlighting the economics of the jewels in the crown. I have been elevator pitching Fairfax (to those that will listen) on the basis that I can see three investments, Atlas , Eurobank and Digit that in 7-10 years time could well be worth today's market cap. What your post has highlighted is that there is a fourth, BIA, that had kind of fallen off my valuation radar. The elevator pitch just got easier. Whether these investments ever get reflected in the share price is another matter but if you were an owner you would want to hoover up such mispricing at a clipping rate

-

Thanks Glider, the delta in CR is very promising considering their growth. As said many times if this company was listed on the NASDAQ as an insuretech then it would be valued much higher than even what Fairfax is claiming. Just reading through the article you posted I found it fascinating that Fairfax was not mentioned at all, I wonder if this was by design . Anyway keep up the great work, we certainly appreciate your posts. I wasn't even aware that Digit made their financials public. Following your post, I was able to find them with a google search but could not for the life me find them on their website until I scrolled all the way down and there in the fine print was "public disclosures". The way this is all laid out, plus a bunch of new micro investors, makes me think that an IPO is in the offing sooner rather than later.

-

It would be very unlike FFH to miss an opportunity to take a +ve mark

-

The latest 13/D shows Fairfax now owns 130,932,826 shares of ATCO common. A net change of 31.7m. So the warrants were converted and then some? Atlas Corp. Investor Relations - SEC Filings (atlascorporation.com) 25 August 2021 Thanks again Viking for all your work on this Cheers nwoodman

-

Apologies if this has already been posted, it was new to me. Prem looks well. I think the importance of the advocate cannot be understated. If you don't get a seat at the table it doesn't matter how good you think you are.

-

Are you referring to this: BlackBerry patent sale could be announced as soon as next month - 27th August 2021 Nine months after IAM first broke the story of a potential sale of BlackBerry’s patent portfolio, the deal to get it done may now be entering the endgame It’s almost exactly five months since BlackBerry confirmed in a press release about its Q4 and full year 2021 financials that the company was looking to sell a large section of its patent portfolio: During the quarter BlackBerry entered into an exclusive negotiation with a North American entity for the potential sale of part of the patent portfolio relating primarily to mobile devices, messaging and wireless networking. The Company has limited its patent monetization activities due to the ongoing negotiations. If the Company had not been in negotiations during the quarter, we believe that Licensing revenue would have been higher. This came four months after IAM had broken the news that such a sale was being considered by the Canadian telecoms business. Since that March announcement, though, and the contents of a 10K release, there has been very little public or, indeed, private comment on the state of play in how the transaction negotiations are panning out. So, while it was known that the possible deal was with a North American entity and involved that part of BlackBerry’s 38,000-strong portfolio of patents “relating primarily to non-core or legacy mobile devices, messaging and wireless networking technologies”, there was no mention of a price, the stage the negotiations had reached or the identity of the possible buyer. Inevitably, rumour finds its way into such a knowledge vacuum. Over recent months, IAM has heard all manner of things, including, most often of all, that the deal is going nowhere because the parties are so far apart on pricing; or, alternatively, that a deal is imminent and involves a single, big, Silicon Valley tech player, possibly Facebook. Our understanding, though, is that neither of these – or the many other stories doing the rounds – are correct. Instead, although parties close to the negotiations are staying tight-lipped, we believe that things are reaching a conclusion, to the extent that an agreement could be announced around the time BlackBerry releases its FY 2022 Q2 financials towards the end of September. The pricing has been more or less agreed, and the numbers are material. Meanwhile, the buyer is actually a group of entities that have been negotiating without an intermediary. That has created a level of complexity around the deal structure which explains why it is taking so long to finalise. However, while there may be an announcement in the last week of next month, closure will take longer as the deal is going to require clearance from regulatory authorities in at least two countries: Canada and the US. If everything goes well, though, the sale will be signed, sealed and delivered by the end of this year. Note – the above is not definitive, it could be wrong in places. However, what IAM is confident in saying is that the deal is progressing, pricing is not an issue, the potential buyer is not a single company and the aim is to go public with an agreement on or around the day that BlackBerry announces its next set of financials towards the end of September. Famous last words!

-

Don‘t underestimate ego and hubris in this position. The underlying premise in this investment was the value of the patents. That was tested earlier this year and was a wash, sorry “undisclosed”. They need to move on.

-

Name The Biggest Losing Investments By Fairfax In Their History

nwoodman replied to Parsad's topic in Fairfax Financial

They are all to ready to take a +ve mark. I actually hope they take hits to BV commensurate with the Digit accretion or more. I think this would speak volumes to the market who are non-believers in the current BV anyway. An inflated BV impairs their ROE going forward unless everyone is a true believer in their past misallocations. I thought this years reports were the most clear and concise ever. Take the hit and move forward. If it was a new CEO he would take the hit then turn around and say what a legend he was in a few years anyway. Don’t live in the past Prem we actually think from this point forward the company is well positioned but take the hit on the legacy crap. -

While small, this round actually gives me more confidence in the price discovery process. Previously my fear was that it was a bit self referential.

-

Name The Biggest Losing Investments By Fairfax In Their History

nwoodman replied to Parsad's topic in Fairfax Financial

1. My vote goes to Recipe (Cara). The whole consolidating the restaurant thing has been pretty much a donut so far. Again a bunch of so so business tying up capital, with no real end game in mind. I reckon 5 years is long enough to say Meh. Sure Covid hasn't helped but it was hardly shooting the lights out pre-pandemic 2. Fairfax Africa in general was about as crap as you could get. I would argue this was just another macro bet and poorly executed, especially betting on Bob Diamond's Atlas Mara. Not sure who decided that was a good idea, if it was Prem betting on a jockey then it was sloppy thinking at it's worse. -

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Agree to a certain extent but we are still enjoying it. Not even sure how I came across it, but I was reading an exchange on Twitter or similar where someone involved with the show was explaining/countering your exact criticism, and advised that this season builds. Apparently the show was pitched with a three season arc, FWIW -

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Yeah, that’s correct -

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Glad you enjoyed it. I had kind of ignored this thread but starting to work my way thru it. There are some excellent suggestions -

Thanks for posting, would have missed this otherwise. The above quote made me smile

-

Excellent Glider, shows the massive loss of market faith in their capital allocation capability nicely. The switcheroo between poor insurance underwriters/ good allocators and vice versa has been quite profound. The bet moving forward is simply they will “do no harm” on the capital side, if they achieve this, then the returns should be good indeed.