nwoodman

Member-

Posts

1,390 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

Astellas Pharma 4503.T

-

I haven’t followed it closely but I believe the stakes were disclosed in the Q3 2020 13F AbbVie, Bristol-Myers Squibb Merck, Pfizer He exited Q1 2022. So hardly buy and hold short article discussing the fact that he brought up in the idea of the pharma basket in the 2000’s https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-buy-4-pharma-stocks-20-years-2020-11-1029815931 Exit article https://www.fiercepharma.com/pharma/buffetts-berkshire-backs-out-three-big-pharma-holdings

-

@glider3834 thanks for that. There is a good reason why we all think it is the jewel in the crown. 19x’s EBITDA of $120m to get to a valuation of FY22 $2.3bn is getting up there in terms valuation but not completely egregious given the growth this year and the future prospects. Cargo is another area that may surprise on the upside, it seemed to figure prominently in the recent Foxconn announcement. airlines_20230906_0440.pdf

-

MS out with a note on August figures for Indian Life…industry growing like a weed. Looking forward to seeing Digit in this table ASAP india_20230907_1625.pdf

-

Small (<1%) positions in each of Buffett’s 5 Sogo Shosha 8001.T, 8002.T, 8031.T 8053.T, 8058.T

-

Thanks hadn’t seen that one. Even 1x’s P/TBV doesn’t sound stretched. Very bullish indeed. Short of some catastrophe, Eurobank alone should get written up by around USD1B in the next couple of years. I was always a little suspicious of FFH’s stated book value but there is certainly no shortage of examples to the contrary.

-

Thanks for this. Seems like a good deal. I was surprised there wasn’t a mild increase in MS PT but as you point out it is more a 2025 story. Love that deferred gratification. Foran Mining hitting ATH too. Have a great weekend all

-

Added to 7974.T Nintendo (now 5%) New position 6758.T Sony (~1%)

-

After the horrendous fires this is a real kick in the teeth “Torrential rains have flooded homes and roads in Greece. Storm Daniel has battered western and central parts of the country, prompting hundreds of calls to emergency services to pump out water” https://x.com/reuters/status/1699082462754668929?s=61&t=DXjj7hLwsZeynV3C6VIPzA “And it may only be getting worse for the region in the coming days. Weather forecasting site Severe Weather Europe says that Daniel could lead to the development of a medicane, a "tropical-like cyclone" in the Mediterranean. Weather models show such a system could form over the Ionian Sea this week, the forecasters said, as an ongoing marine heat wave fuels extreme weather. Medicanes usually need ocean temperatures of 26 degrees Celsius, just under 79 degrees Fahrenehit, to form, the forecasters said, and there has recently been "more than enough warmth in place to support the sub-tropical development." Weather models show that if it does form, it could bring wind gusts of roughly 62 miles per hour. It's unclear if it would be closer to Sicily and Malta or the Libyan coast. “ https://www.cbsnews.com/news/greece-historic-flooding-more-than-2-feet-of-rain-in-just-a-few-hours/

-

A couple of pro India (or should I say Bharat) pieces from Bloomberg today, they are positively ebullient 1. India Has Become a Beacon of Macro Stability: Chinoy Sajjid Chinoy, chief India economist at JPMorgan, discusses India’s economy and the upcoming G-20 and inflation in the country. He speaks on Bloomberg Television. https://youtu.be/Rlu53BOEwWo?si=AuuJH7gcKaT5_BNx 2.Foreign Funds Reverse $17 Billion Record Exodus in India Stocks Stocks in India are in the midst of a multi-year rally with the key benchmarks S&P BSE Sensex and NSE Nifty 50 Index headed for their eighth consecutive year of advances. A strong corporate earnings performance, robust economic growth and political stability are drawing investors even as they flee other Asian emerging markets. https://www.bloomberg.com/news/articles/2023-09-05/foreign-funds-reverse-17-billion-record-exodus-in-india-stocks?srnd=india-v2#xj4y7vzkg

-

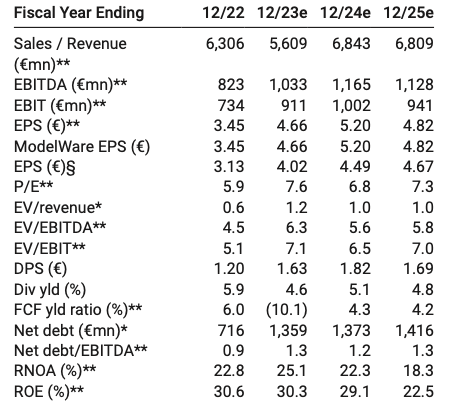

For those who like digging around in Fairfax's equity positions, MS released an updated earnings model for Mytilineos (attached). I agree with all you analyst haters, so treat it in the spirit of "entertainment". MYTIL, including options, is closing in on being a $US400m position for Fairfax and small in the grander scheme of things. See it as another example of an FFH asset rapidly regressing to the mean (+89% YTD). MYTIL share price is currently €38.01, MS PT is €45. "MYTIL offers a unique trifecta - multi-faceted Energy growth, unique aluminium business, and highly synergistic business model. These attributes coupled with an undemanding valuation point to a compelling risk-reward." MYTILINEOS_20230824_2100.pdf

-

It seems strange to me that Fairfax groups bond returns and equity returns together to create an average return on “investments’. I think this actually does their investment framework a disservice. I am sure HWIC are acutely aware that the only returns that matter are real returns and that guides a lot of their investment positioning. Might be a fun job on a rainy day to back out inflation and to get their “real return on investments” which is likely more telling of their investment prowess. Their bond positioning this time around has been fantastic, some of the best in the business for my money. Capital allocation going forwards, is why/was the discount applied. A full re-rating will occur if they can demonstrate to the market that they are re-investing this windfall in quality assets.

-

What are you listening to ? (Music thread)

nwoodman replied to Spekulatius's topic in General Discussion

New puppy day in our house. We named him Louis. Obviously started our listening this evening with this one…..indeed it is. Looking forward to laughing off every chewed cable, shoe etc for the next year or so, but a small price to pay -

0669.HK Techtronic Industries. Love Milwaukee tools but the shorts may be more right than wrong on this one. Proceeds go to JPY margin.

-

Brilliant, many thanks

-

Recent interview with Dennis Shen, lead analyst for Greece, after Scope Ratings’ (European Ratings Agency) upgrade of Greece to an investment-grade (IG) rating of BBB-. Quite the feat. In terms of risks moving forwards this response was interesting: DS: Greece’s ratings are constrained at BBB- by several meaningful credit challenges. The elevated level of government debt remains a core challenge. High debt exposes Greece to ongoing risk whenever there is a pivot of market sentiment towards questioning the debt sustainability of the euro area’s more-indebted sovereign borrowers. Further reducing this debt could make Greece more resilient. Furthermore, policy risks prevail as Greece transitions from dependence on conditional official-sector credit towards favouring less-conditional market-based funding. Thirdly, the banks and external sector display fragilities. Another challenge is modest long-run potential growth of around 1%. Environmental challenges are relevant here as climate risk curtails long-run growth if heatwaves and wildfires damage Greece’s crucial tourism and agriculture sectors. A Bank of Greece-commissioned analysis from 2011 concluded climate change may cost the Greek economy anywhere from EUR 577bn to EUR 701bn by 2100. That is three times the size of the Greek economy today. Climate risk represents a meaningful long-run risk relevant for Greece’s ratings as the most exposed economy of the European Union. https://www.fxempire.com/news/article/greece-qa-investment-grade-is-an-exceptional-achievement-but-multiple-challenges-remain-1368772 Link to Scopes upgrade note https://www.scopegroup.com/ScopeGroupApi/api/analysis?id=097c203b-4b26-4fed-8117-b2086e3afdda Bloomberg coverage https://www.bloomberg.com/news/articles/2023-08-07/greece-and-its-banks-are-one-step-closer-to-wider-investor-pool?utm_campaign=socialflow-organic&cmpid%3D=socialflow-twitter-economics&utm_content=economics&utm_medium=social&utm_source=twitter#xj4y7vzkg

-

A recent interview with MS emerging market analyst Marshall Stocker on why Greece is their top holding https://www.cnbc.com/video/2023/08/15/morgan-stanley-says-greece-is-its-top-holding-in-its-em-fund.html

-

Greece continues to power ahead. Hard to believe it is the shining light of Europe, but there you have it. “Optimism about manufacturing’s prospect in the index of purchasing managers (PMI) reached 53.5 in July.” “By contrast, the PMI in the 20 eurozone countries averaged 42.7, its lowest level since May 2020, at the height of the pandemic lockdown. In Austria and Germany, for example, July PMI stood at 38.8 and was underwater in France 45.1 and Ireland 47.0.” https://www.ekathimerini.com/economy/1217515/greek-industrial-production-expands-prospects-are-deemed-good/#

-

That’s a big weighting to OXY. Don’t disapprove, as I was kind of kicking myself I didn’t buy some in the mid 50’s. However, I do prefer these type of positions in my long term compounders. The index position is a head scratcher at these levels though. It’s funny, a lot of people have bagged Gaynor at MKL for his myriad of holdings and argued why not just have an ETF position. FFH seem to think so. All appears more rump, less tail albeit with a slight inflationary bias and in the case of OXY leveraging the implied BRK put.

-

What are you listening to ? (Music thread)

nwoodman replied to Spekulatius's topic in General Discussion

Died Pretty - Doughboy Hollow - one of my favourite albums of the 90’s. RIP Ron Peno, who passed away yesterday after a brave fight with the big C. -

Thanks doesn't quite do it justice, but thanks anyway

-

It is a bit of an island, I agree. On a more nostalgic note, it was only a few years ago that we were all talking about coiled springs. It kind of feels like the entire mattress is exploding. I just had to get that crap analogy out of my system; apologies for making you the recipient.

-

Anyone watching Thomas Cook. I know the Indian markets are on fire but THOMASCOOK.BO is up around 8% today and 35% since June 30 when it was around a $300M position. Even after this run it is around 60% off it's 2018 highs. Another position to add to the regression to the mean list.

-

Trimmed some more AAPL AND BRK.B and reduced USD margin

-

Greatly appreciated