Viking

Member-

Posts

4,936 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

i am reading pretty bullish commentary about super hard market in reinsurance. This looks to be an emerging opportunity. Not sure if Fairfax needs to fund anything meaningful here to be able to fully participate. I would support this sort of ‘investment’. Regardless, i also expect Fairfax to do something meaningful with share buybacks.

-

Fairfax India is trading today at $9.70/share. On Dec 31, Fairfax India closed at $12.61/share. Shares are down 23%. Makes sense… we are in a bear market and most stocks are down +20%. But does it make sense? Fairfax India owns a collection of stocks from India. And stock averages in India are flat YTD. Taking a quick look, the publicly traded stocks that Fairfax owns are also up YTD in local currency. With the return of air travel and the impending opening of T2, one would expect BIAL’s value to be similar, if not higher, than at Jan 1. So what is causing the decline in Fairfax India shares? 1.) currency: the India rupee is down to the US$; high single digits i think 2.) risk off? Investors shunning EM? Regardless, given the YTD strength of the stock market in India, the sell off in Fairfax India share price is looking overdone. ————— BV Dec 31 = $19.65 BV June 30 = $18.50 (with decline driven by currency) BV Sept 30? My guess is it will be in $18.50 range. Stock price Oct 25 = $9.70 P/BV = 0.52 Potential catalysts: 1.) big buyback from Fairfax India, when IIFL Wealth sale closes 2.) strength in US$ reverses Longer term, with China becoming a pariah, India is the obvious beneficiary. Apple announcing shift of some production from China to India is a canary in the coal mine.

-

If anyone is wondering if Canada is in a real estate bubble all you have to do is listen to 15:90-22:30 and 31:40-32.30 for some clues in the video posted below. These are some of the top producing real estate agents in the Vancouver/Toronto markets. Parts of their discussion reminded me of the real estate agent driving in the car (“its just a gully”) and later, the two mortgage brokers, from The Big Short movie (from the Florida scenes). Sorry, no strippers in my video below. - “Investors are used to cash flow negative”. - Investors feel downturn “is temporary; will come roaring back.” - Investors “are not buying for cash flow… are buying for appreciation”. - “…when are we going to see fire sales? Already are in the assignment market.” What i heard from listening is it sounds like lots of people who own real estate today are bleeding cash (cash flow negative). And with rising interest rates it is getting worse for them (more cash flow negative). At the same time the property they own is also now falling in value. But time is on their side. They think the situation is temporary - Bank of Canada will see their pain and bail them out with much lower interest rates soon (they are too important to the Canadian economy). Yikes. As we peel back the onion this actually looks really frightening.

-

Recipe take private has received shareholder approval and should be completed Oct 28. That was quick! Another outstanding piece of business at Fairfax getting completed prior to the Q3 earnings release (along with pet insurance sale). Lots to discuss on the conference call. FYI, last year Fairfax released results on Nov 4, 2021. —————- My guess is Recipe will post pretty good results in Q3. This is the first quarter since 2019 that results at full service restaurants in Canada were not significantly impacted by covid (primarily lockdowns). It will be interesting to see how Recipe performs for Fairfax in the coming years… how much cash does it generate? —————-— - https://recipeunlimited.investorroom.com/2022-10-21-RECIPE-UNLIMITED-OBTAINS-SHAREHOLDER-APPROVAL-FOR-GOING-PRIVATE-TRANSACTION-WITH-FAIRFAX-FINANCIAL-HOLDINGS-LIMITED TORONTO, Oct. 21, 2022 /CNW/ - Recipe Unlimited Corporation ("Recipe" or the "Company") (TSX: RECP) announced today that at the Company's special meeting (the "Meeting") of its shareholders (the "Shareholders") held earlier today, an overwhelming majority of Shareholders voted in favour of the special resolution (the "Arrangement Resolution") approving the previously announced statutory plan of arrangement involving the Company and 1000297337 Ontario Inc. (the "Purchaser"), a newly-formed subsidiary of Fairfax Financial Holdings Limited ("FFHL"), pursuant to which the Purchaser will acquire all of the issued and outstanding multiple voting shares ("MVS") and subordinate voting shares ("SVS", and together with MVS, the "Shares") in the capital of the Company (other than those Shares owned by FFHL and its affiliates (collectively, "Fairfax") and 9,398,729 MVS owned by Cara Holdings Limited ("CHL")) at a price of $20.73 in cash per Share, subject to the terms and conditions of the arrangement agreement dated August 31, 2022 (the "Arrangement Agreement") between the Company, the Purchaser and FFHL (the "Arrangement"). Recipe anticipates returning to the Ontario Superior Court of Justice (Commercial List) (the "Court") on October 25, 2022 to seek a final order of the court approving the Arrangement. Completion of the Arrangement remains subject to closing conditions as set forth in the Arrangement Agreement, including approval of the Court. Assuming that the conditions to closing are satisfied or waived (if permitted), it is expected that the Arrangement will be completed on or about October 28, 2022. Following completion of the going private transaction, Recipe will be de-listed from the Toronto Stock Exchange and applications will be made for Recipe to cease to be a reporting issuer.

-

Glider, thanks for posting. I have been trying to understand Grivalia Properties difference from Grivalia Hospitality and this helps. Some takeaways: 1.) on page 8 of the presentation you linked they summarized what Fairfax earned on their investment in Grivalia Properties = 24% per year (2011-2020). From initial purchase to when Grivalia Properties were merged with Eurobank. Not too shabby. 2.) I wonder what else Fairfax owns that we know nothing about. Prior to the Q2 release i never knew they owned a large chunk of Grivalia Hospitality. - From the Q2 release: “On July 5, 2022 the company increased its interest in Grivalia Hospitality S.A. ("Grivalia Hospitality") to 78.4% from 33.5% by acquiring additional shares for cash consideration of $194.6 million (€190.0 million). The company will commence consolidating Grivalia Hospitality in the third quarter of 2022. Grivalia Hospitality acquires, develops and manages hospitality real estate in Greece, Cyprus and Panama.” 3.) with a total value of about $340 million, Grivalia Hospitality is now a top 10 equity investment for Fairfax. It is worth about what Stelco is worth. 4.) the new investment spend of $195 million on Grivalia Hospitality is significant: - take advantage of weak Euro (to US$) - increase exposure to real estate - considered a good inflation hedge - hospitality segment - high net worth individuals (any trophy properties?) 5.) The majority of Fairfax’s new investment spend in 2022 is going to increasing positions in businesses they already own a large stake in and therefore understand exceptionally well: - Fairfax India - $65 million ($12/share) - John Keels - $75 million (convertible debenture) - Grivalia Hospitality - $195 million - Recipe take private - @ US$330 million? - Allied World - reduce minority interest; funded with $750 million in debt - Fairfax has also exercised warrants to increase stakes in Ensign Energy and Altius Minerals - Fairfax shares - my guess is we will see buybacks increase in Q4 2022 (once pet insurance deal closes Oct 31). So Fairfax has been greedy during the current bear market. In companies it understands very well. At what look to be attractive prices (some look very attractive).

-

RBC sends out an insurance update out each week (summary of what they are seeing). Here is what they said about insurance results reported last week: “We would say earnings season is off to a largely ‘as expected’ start. Pricing remains good and there haven’t been any notable earnings surprises. One thing we’d observe broadly with respect to P&C companies, and we think it showed a bit this quarter, is that while pricing has been decidedly good for going on 4 years running and margins have definitively improved over that time, there is still relatively little follow-though to reported earnings and ROE since cat losses, adverse bond marks, pandemic losses and inflationary headwinds have sucked up a lot of the benefit that would normally be flowing into profits and building balance sheets. We think it’s fair to say that while managements are rightly ‘pleased’ with their results, they can’t be overly enamored with not realizing any book value growth or seeing a payback with a really strong earnings year. We view this as an underappreciated factor in why pricing could remain firm for a good bit longer.”

-

I am not an insurance expert so i really have no idea how inflation hits Fairfax and the industry in the coming years. My guess is every earnings call will have a focus on this issue so we should learn more over the next 2 weeks. We have been in a hard market since 2H 2019. So we are beginning year 4 of the current hard market. I would think with all the price increase we have seen there is some protection against inflation. And it there are deficiencies then we should see the current hard market extend another year or two. There are so many important moving pieces right now. ————— But no doubt about it we are seeing more cracks developing in the P&C market: 1.) record level of catastrophe losses year after year. 2.) acceleration of hard market for reinsurance. 3.) inflation stressing loss picks; creating future uncertainty. 4.) investment portfolios are declining in all asset classes and by a lot. 5.) spiking interest rates resulting in double digit declines in BV.

-

@kab60 here is how i look at a few of the risks of investing in Fairfax. Sorry, the post is long and rambling (yes, i know, not my first : 1.) very near term, what is the hit from Hurricane Ian? RBC is estimating $500 million but this is simply a guess. Could it be higher? Yes. If it is materially higher that would not be good short term. This could also be a big nothing-burger (losses from Ian come in at expectations or even below). We will know more in a couple of weeks. - the interesting thing is Ian will likely accelerate and extend the hard market for re-insurance. Pain today. Gains tomorrow. 2.) big bets: my biggest watch-out is if Fairfax makes a big bold bet with its investment portfolio - that i don’t like. Like the ‘equity hedges’ from 2010-2016. I am not concerned today… but my eyes are wide open. - the duration and composition of the bond portfolio is what i am monitoring most closely today… but i only see opportunity here right now. I can understand if they made no changes in Q3. - what Fairfax does in India bears watching. Prem has mentioned repeatedly that he wants to invest billions in India in the next 5 or so years. Fairfax is rumoured to be one of the state owned banks. Not sure how i would feel if they took a big bet on India right now. 3.) capital allocation. Do they get it right? Prem has repeatedly said priorities are: - support insurance subs to grow in hard market - conservative financial position (reasonable amount of debt) - share buybacks Fairfax announced in Aug they would be raising US$750 million to buy back a portion of minority interest in Allied World. Given we are in the middle of a bear market, with both equity and bond portfolio’s getting hit, it did surprise me that Fairfax decided this was a good time to lever up and add a significant amount of debt. They are paying 5.6%, which is looking very reasonable given the spike in bond yields since the deal was announced 2 months ago. Was this simply another example of Fairfax being opportunistic - thinking interest rates were going to stick higher for longer - so go get some debt while it is still available and at a reasonable rate? I am really interested to see what they do with the proceeds from the pet insurance business. Do they take out a slug of Fairfax shares? Or do they use it in other ways - like more deals like the take private for Recipe. I will be disappointed if they do not stay aggressive with Fairfax share buybacks. Buybacks are what Prem has flagged so my guess is this is what we see. Perhaps not a big dutch auction like last year. Perhaps they just get active with the previously announced NCIB. 4.) inflation: how does this affect CR? This is a watch-out, but not a concern right now. I am sure there will be lots of discussion on this topic with all insurance companies. I wonder if inflation concerns simply extend the current hard market into 2023 and possibly 2024. - if loss picks start to pick up in 2023 and 2024 (due to unexpectedly high inflation) then we should expect lower underwriting income (a higher CR). - high inflation into 2024 likely means we also see higher interest rates into 2024. With such a low duration Fairfax will see a spike in interest income, which will mitigate the drop in underwriting income (caused by inflation). Perhaps this keeps Fairfax at low duration (as an offset to what happens on the underwriting side of the business). 5.) spiking interest rates: I wonder how the spiking of interest rates and the subsequent hit to the bond portfolios of all insurers impacts the industry in the short term (over the next year). Regulators do not seem to care today (significant hit to BV from rising interest rates). Imagine this scenario: 1.) interest rates move higher from where they are today 2.) interest rates stay high - inflation continues to roar well into 2023 3.) underwriting results start to weaken, due to inflation 4.) we get a record year of catastrophe losses in 2023 Insurers with long duration bond portfolios are going to be locked in to low returns on their fixed income portfolio for years… At the same time their underwriting results get worse (due to unexpectedly higher loss picks). And if we get a really bad catastrophe year (hello global warming) then some insurers could really start to sweat. This just suggests to me the hard market in insurance will continue. And well capitalized insurers like Fairfax could continue to grow at 20% well into 2023 and possibly longer. So many interesting things going on right now with P&C insurers.

-

Joseph Wang delivers so much value i thought it would be beneficial to start his own thread. Adam (the interviewer) is a doom and gloomer. Probably good for business. Adam asks great questions - often peddling the ‘victim’ narrative. And Joseph does an absolute superb job in this interview of redirecting Adam… and suggesting that perhaps the world will not end… with his well thought out and articulate answers. ————— One question i have today concerns how long interest rates can stay high. My thinking has been that there is too much debt in the system , especially government debt, and interest costs would explode. And therefore, high interest rates were not sustainable. Joseph has a very different take. He says private and government debt are very different animals. With private debt, consumers have refinanced mortgages at very low rates so most are not affected by rising interest rates; they are getting 6% wage increases and paying 3-4% on their long term mortgage. Lots of corporate borrowers also extended maturities when rates were crazy low so, overall, the corporate bond market will be somewhat insulated from rising rates. What about government? Higher interest costs are not a problem at all. They will simply issue more treasuries. Higher deficit spending on the part of the government will be inflationary. Joseph sees lots of near term trends that are inflationary (versus a return to deflation). And the fact Fed policy has no impact of government spending and debt levels also limits the effectiveness of Fed policy today (raising interest rates to control inflation). Super interesting stuff to think about.

-

investors KNOW relations with China are the best they will be with the US/West right now (looking out 5-10 years). In other words, political and economic relations are only going to get worse. So as an investor you are trying to guess how much worse they will get (magnitude) and how fast (timing)… Investing is hard enough without having to overlay those two variables on top of everything else. Its kind of like an investor after WWII was trying to decide if they wanted to invest in the Soviet Union (yes, sounds stupid today and that should tell people something). After WWII the political and economic relationship with Russia kept getting worse year after year and decade after decade. Good luck with that. ————— The pact that China and Russia so publicly signed pre-Ukraine invasion could go down as one of the most significant geopolitical events of the next 50 years. Not unlike when the iron curtain came down. China/Russia (perhaps Saudi Arabia) = authoritarian block = have declared game on with the West.

-

Rising interest rates are doing what they are supposed to do - slow economic activity. Market interest rates increased before the Fed actually started raising the Fed funds rate earlier thiscyear (the jawboning part of Fed policy). The interest sensitive part of the economy got hit first… and no surprise, 8 months later, housing has turned aggressively down. We are just starting to see corporate profits slowing and this should pick up steam in the coming 4-6 months. And the labour market should turn as companies are forced to retrench. The interesting dynamic this time (versus 2008 and 2020) is inflation. How fast does it come down? Inflation prints will likely inform what the Fed does. And what the Fed does will determine if we get a mild, medium or severe recession in 2023.

-

China: as economy gets bigger: resource allocation - property bubble blowing up for 20 years is great example of this - centrally planned economy works great at early stages of development; does terrible in large, sophisticated economy US: ripping of basic fabric of democracy; it is fragile and very difficult to sew back together. My guess is founders of the country are likely rolling over in their graves at what is going on in country today (on both sides of the aisle).

-

@UK the Bloomberg article you posted reinforces for me the challenges we will continue to have with the energy transition: the massive disconnect today between the dream and the reality. It is one thing for Norway to decide to do something and then execute it. But to extrapolate that to the rest of the world is simply not realistic. There simply are not enough resources available and there will not be for at least another 10 years - for the simple reason we are not building the mines on the scale needed today (it takes a minimum of 7 years to build a copper mine). Lyn Alden wrote that in every past energy transition the old energy usage never actually falls… it just slows and the new forms of energy drive the majority of incremental energy demand (leading to higher global standard of living). I continue to be bullish on commodities over the next 5 years. I see demand increasing at the same times supply will remain constrained. - underinvestment for years; ESG guarantees future supply growth will be muted - increasing demand driven by mega trends: developing world, deglobalization, move to EV and clean energy sources etc. - war & geopolitical split into West vs authoritarian blocks adds more complexity We expect world governments to thread the needle moving forward?

-

Fast Growers - What Are Your Top 5 Picks Today?

Viking replied to Viking's topic in General Discussion

-

Clearly, the energy crisis in Europe is not nearly as bad as i thought… https://oilprice.com/Latest-Energy-News/World-News/Exxons-Refineries-In-France-Will-Take-Weeks-To-Restart.html The three-week strike at Exxon’s facilities is over for now, but the strike at TotalEnergies’ refineries continues after the hard-left CGT trade union walked out of wage increase talks with TotalEnergies early on Friday, vowing to continue the strike at refineries that has crippled France’s fuel supply. Two other trade unions found the offer for a 7% pay rise “rather favorable,” including the staff at Exxon’s refineries. Workers are back to work at Exxon’s facilities, and it will take “10-15 days to first restart the units, and then to produce finished gasoline, diesel,” the GCT trade union told Argus on Monday. The weeks of strikes at refineries in France have left more than 70% of the country’s refining capacity offline while gas stations in and around Paris and in the northern part of the country began to run out of at least one type of fuel. France moved last week to requisition essential workers to staff Exxon’s French oil depot and threatened to do the same for TotalEnergies’ French refineries if talks failed to progress.

-

If 25% of what the author suggests is accurate… Wow! The gloves are off. So how does China respond? Taiwan is the obvious move. It becomes even more important to bring Taiwan back into the family. And when does this shit show hit Apple right between the eyes? Might want to buy that favourite Apple device while they are still available.

-

Fast Growers - What Are Your Top 5 Picks Today?

Viking replied to Viking's topic in General Discussion

@scorpioncapital i think Lynch’s reference to ‘20-25%’ growth is kind of a holistic thing: 1.) significant revenue growth 2.) driving significant profit growth 3.) driving share price increase With his fast growers, he was focussed on finding companies doing 1.) and 2.) which should lead to 3.) over time. With the caveat of paying a fair price for the stock up front. -

Fast Growers - What Are Your Top 5 Picks Today?

Viking replied to Viking's topic in General Discussion

@stahleyp i am sitting at about 30% cash today. Today I lightened up on some of the stuff i bought last week (like US banks) given the nice pop we have seen the last 2 days (i was down to 15% cash at COB Friday). I am trying to keep my cash balance at min 20% so i can be opportunistic on the sell offs when they come. I am patiently waiting for oil to get taken out behind the woodshed again; would love to pick up CNQ under C$65 and SU under C$39 (again). Rinse and repeat (in my tax free accounts). ————— thanks to everyone for the ideas they posted… lots of interesting opportunities to learn more about… -

Fast Growers - What Are Your Top 5 Picks Today?

Viking replied to Viking's topic in General Discussion

I meant to write Amazon. Thanks for catching that. I do own a little META, given how hard it has been crushed and how much it is hated right now; but i would not have META as a top 5. -

The stock market has sold off big time YTD, with the S&P down +25% and the Nasdaq down +30%. So we know stocks are cheap. Yes, they could get cheaper. But for an investor with a 5 year time horizon, buying stocks at current prices should deliver acceptable returns. i am re-reading Peter Lynch’s One Up On Wall Street. When constructing his portfolio his largest weighting went to “fast growers” and he set a limit of 30-40%. He defines fast growers as “small, aggressive new enterprises that grow at 20-25% per year.” This is the land of the multi-baggers. Here is what i am looking for: 1.) growth target to 15-20% per year (i am watering down Lynch’s target a little). 2.) quality management - considered among the best in their industry 3.) stock selling at good price - my guess is most companies pass this hurdle today So what are your top picks? Do you have 5 you think are super well positioned? The problem i have is most of the companies i follow closely today fall into other Lynch buckets like cyclicals (oil), stallwarts or turnarounds (this is where i would put Fairfax). So i am looking for ideas of companies to start to research (companies others on the board have pretty high conviction in going forward). Here is where i have started to put some money over the past week: 1.) Alphabet 2.) Amazon (not Google) - are these two picks large enough in size that they should now be considered stallwarts? 3.) cyber etf - CIBR 4.) cloud etf - SKYY (includes 1 and 2 above) 5.) semiconductor etf - SOXX (Should this by in Lynch’s cyclical bucket?) - i am cheating with the above three picks… because i like the sectors (full of fast growers) but have no idea who the best positioned companies are. ————- i have begun a starter position in CSU - constellation software. Canadian company with pretty impressive track record. Not terribly cheap.

-

Just re-reading a couple chapters in Peter Lynch’s One Up on Wall Street. Scariest time for him was between July 1981 and November 1982. This was a period when there was 14% unemployment, 15% inflation and a 20% prime rate. (Funny how people today are freaking out with Fed funds rate forecast to go to 4.5% and unemployment going to 4% or horrors 5%.) “Then at the moment of greatest pessimism, when eight out of 10 investors would have sworn we were headed into the 1930s, the stock market rebounded with a vengeance, and suddenly all was right with the world.”

-

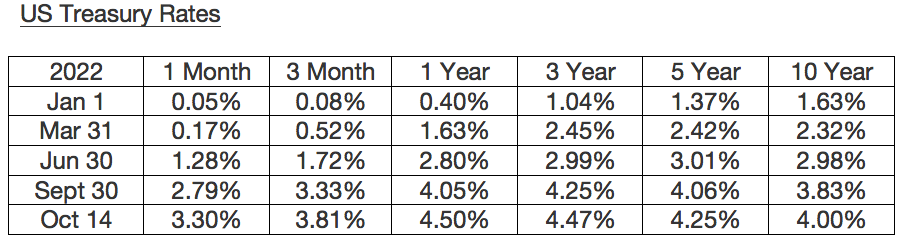

Well, the one way interest rate train just keeps chugging higher up the mountain... the Little Train that Could! However, we are starting to see some cracks internationally (UK and Japan). It will be very interesting to see if Fairfax has made any changes to their bond portfolio when they report Q3 results in early Nov. ----------- Hard to see how interest rates can stay this high for too long (more than a year or so). Western governments have so much short term national debt that will need to be rolled over the next 12 -24 months and now at much, much higher interest rates. If the interest burden on national debt starts to spike what do Western governments do? Spend more (which will be inflationary)? Or retrench and spend less (not popular)? Given what we have seen in the UK the past week, I wonder if markets will (finally) not force governments to be somewhat rational. (What a disaster monetary policy has been the past 10 years - specifically, the negative interest rate experiment.) The most likely option the next couple of years is financial repression - actual inflation running @2 or 3 or 4% above government interest rates. So we slowly deflate the too much debt away over years (in real terms) like was achieved in the late 1940's and early 1950's. ------------ The big difference today has from the 1970's is the amount of debt that is in the system. What is an investor to do? Perhaps commodities (oil and gas) can provide a partial solution. I wonder if this is not a big part of the thinking behind Buffett's aggressive move this year into energy (Chevron and Oxy).

-

For me the pet insurance sale actually closing is a big deal. Just because it is so large. And cash is king right now (the timing of this sale could not be any better). US$1.4 billion in total, split as follows: 1.) $250 million in seller promissory notes - this will start compounding likely at a decent interest rate adding to interest income moving forward. 2.) $200 million in JCP V, a JAB consumer fund - a new investment in a company with a solid long term track record. Fairfax continues to increase the amount of their equity holdings that are managed by private equity types. Looks like a solid decision for those of us who want to see Fairfax move up the quality scale with its equity holdings. 3.) $950 million in cash. So what do board members think Fairfax will do with the $950 million in cash? - Shortly after the deal closes Oct 31, do they announce another large dutch auction buyback? Prem has telegraphed he wants to do this. Fairfax stock is dirt cheap. But will other uses trump this use? - Will losses from Hurricane Ike be large enough for Fairfax to need to keep some of this cash internally? - Will the current geopolitical turmoil (creating lots of uncertainly in financial markets) cause Fairfax to keep a higher cash balance at HO the next couple of quarters? - Is the hard market still going strong... does funding growth at the sub level, especially re-insurance, becomes the priority for use of excess cash? What a great problem to have The after tax gain from the pet insurance sale will be $975 million = $40/share. That should push BV back over $600 when they report Q4/YE numbers. Market cap for Fairfax is only $10.6 billion. ---------- From FFH Q2 report: On June 18, 2022 the company entered into a transaction with JAB Holding Company (“JAB”) in which certain affiliates of JAB agreed to acquire all of the company’s interests in the Crum & Forster Pet Insurance Group and Pethealth, including all of their worldwide operations. As part of the transaction, the company will receive approximately $1.4 billion in the form of approximately $1.15 billion in cash and $250.0 million in seller promissory notes, and the company will also invest $200.0 million in JCP V, a JAB consumer fund. The transaction is subject to customary closing conditions, including various regulatory approvals, and is expected to close in the second half of 2022. The company did not record any gains in the second quarter of 2022 on the sale of the Pet Insurance Operations and on closing of the transaction expects to record an after-tax gain of approximately $975 million.

-

BAM, GOOG, AMZN

-

@Dean Fortis is on my watch list… i will likely add it to my collection if it sells off another 10% from here. In the past month 4% bond yields look like they are causing a sell off in the ‘utility type’ (higher dividend yield) part of the stock market. Makes sense. But what i have learned over the years is what looks obvious to me can take weeks or months to actually play out in financial markets (markets are reasonably efficient but it can take big funds a considerable amount of time to reconfigure their portfolios). If bond yields continue higher i expect my basket of stocks listed above to also sell off. So i am keeping my weighting such that i can add on weakness. ————— In terms or portfolio strategy, we sold our house last year (big tax free gain). And i had my best year ever return wise with my portfolio (thank you Fairfax). So my portfolio is about 3 times the size it was 18 months ago. As a result, i have decided my old way of investing no longer fits my current life situation. Bottom line i have decided to keep 1/3 of my portfolio and invest as per usual (perhaps concentrate with stocks like Fairfax etc). And take the other 2/3 of what i have and create my own ETF (collection of stocks). Most have been purchased over the past week. I am about 1/2 done and will continue adding to current positions on weakness and starting new positions that make sense. So much stuff is on sale. And i may get lucky and we might see one more big swoosh down (who knows). 1.) Bond substitute (listed above) 2.) Energy: CNQ, SU, CVE 2.) Tech: GOOG, AMZN, MSFT, META, SOXX 3.) US Financials: BAC, JPM, C, BAM 4.) Misc: NKE, LEVI, DIS, UPS, FIH ————— I did something similar in March 2020 but sold when they popped and then watched them scream higher. @dealraker ‘s posts on the ‘is the bottom here?’ thread have certainly resonated with me And my life situation is also quite different now (all of my financial assets are now ‘paper’).