Viking

Member-

Posts

4,930 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

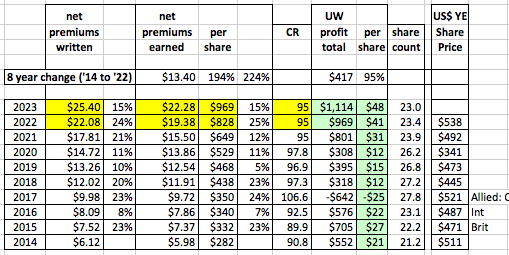

At its core, Fairfax Financial is an insurance company. With Q3 results just reported we can update some estimates for Fairfax that capture actual Q3 results and the outlook for 2023. The size of Fairfax's insurance businesses have increased dramatically. Over the past 8 years net premiums earned have increased 224% from $5.98 billion in 2014 to $19.4 billion in 2022 (my estimate) for a compounded growth rate of 16% per year. On a per share basis Fairfax has grown net premiums earned by 194% = 14% per year compounded over the past 8 years. The share count is up 10.4% over this time. What has driven this significant growth? For the first 3 years acquisitions drove a large part of the growth: Brit (2015), International (2016) and Allied World (2017). For the past 5 years (2018-2022) the growth has been organic and driven by the hard market of the past 3 years. Looking back, Fairfax timed their large insurance acquisitions perfectly (right before the hard market set in). The hard market in insurance looks set to continue for a 4th year and is spreading to reinsurance (which is a big business for Fairfax). 2023 could see net premiums earned grow to $22.3 billion, up $3 billion, or 15%, from 2022. Why do we care what net premiums earned are? Because this is a key input in determining underwriting profit. And underwriting profit is one of the critical inputs in determining what an insurance company is worth. Fairfax is on pace to earn an underwriting profit of $970 million in 2022 ($41/share). A new record. My estimate for 2023 is for Fairfax to earn $1.1 billion in 2023 ($48/share). Another record. The previous record was $801 million in 2021 ($31/share). Bottom line, the significant growth in net premiums earned the past 8 years is resulting in Fairfax earning record underwriting profit. And the record underwriting profit party is just getting started. Now we all know financial markets are extremely efficient when pricing equities. Everything that is know about a company is already priced into its equity price. (Yes, I say this in jest So where was Fairfax stock trading at Dec 31 2014? About US$510. Where is Fairfax stock trading today? US$525. Wow! Really? So was Fairfax overvalued in 2014? Or is Fairfax undervalued Nov 7, 2022? Of course, we can’t just look at net premiums earned and underwriting profit to answer this question. Future posts will look into the trend of interest and dividend income and returns on the equity holdings. ---------- Note: my numbers above do NOT include runoff. My guess is the cost of runoff will come in at about $150 million per year.

-

@Parsad Historical information is useful only to the extent that it helps inform an investor what future results will be. If past results do not help an investor estimate what future earnings will be then they are worse than useless. Because they will give an investor an inaccurate view of future results. And this will lead to poor decisions regarding share ownership. My view is your analysis above does very little to actually inform an investor what Fairfax earnings or growth in BV are likely to be in the next 1, 2 and 3 years. And I say this with all due respect (I am not trying to be adversarial). There has been enormous changes at Fairfax the past 5-6 years. The company today does not remotely resemble the company that existed in 2015, let alone 2010. And, most importantly for an investor, its future earnings power is completely misunderstood. Because investors are still stuck in the past. Druckenmiller suggests an investor should look out 12-18 months and find situations where the narrative is completely wrong (leading to a stock being mis-priced today). I believe Fairfax is a great example today of where the narrative is completely wrong. Investors, largely looking through the rear view mirror, are way underestimating the earnings momentum at Fairfax that has been building for the past 5-6 years.

-

@Parsad i almost spit up my drink when i read that what do you think Fairfax will earn in a ‘normal’ year moving forward? My guess is more than US$100/share. With shares trading at $510 that puts the PE at about 5x. That is dirt cheap to me. We are still in a hard market which means top line growth will be solid in 2023. Interest rates are expected to continue increasing into 2023. Fairfax’s various equity holdings look well positioned. This suggests to me that $100/share in normalized earnings will likely increase nicely in the future. Yes, with stock markets selling off significantly in 2022, lots of stocks are much cheaper. However, despite the sell off, i don’t see many that are cheaper than Fairfax (or even close).

-

@This2ShallPass i fully agree that ‘trust’ issues are one of the primary reason for Fairfax’s current super cheap valuation. The ‘equity hedge’ bet was an epic fail. Fairfax’s communication over the years at times has been poor. And Prem has his own unique style. However, i have followed Fairfax pretty closely for 20 years. And the communication issues have been around all 20. They ebb and flow. Fairfax is not going to change in this regard. It is a fact of investing in Fairfax. And i am ok with that as an investor. It is something i have no control over. For me, today, the benefits far out-weight the risks. So i am happy to own a significant number of Fairfax shares. i view the share buyback topic differently than you. My view is Fairfax has delivered on this front over the past couple of years. They exceeded my expectations in Q3. I am pretty certain they will be buying back shares in Q4. Is it dutch auction or bust? No. Not for me. I will wait and see what they do. If they don’t repurchase a bunch of shares what do they do instead? They have so many good options available today. I like, taken as a whole, the decisions the company has made the past 5 or so years. I reaaly like how the company is positioned today. Given the performance i have seen in recent years, i am going to cut the company some slack.

-

Fairfax did re-purchase 0.9% of shares outstanding in Q3. That was a pretty good number given Q3 is the high catastrophe quarter. If they keep this pace up that would be close to 4% over 12 months… I think they will continue to buy back shares in Q4, perhaps something in the 1.5-2% range. I would love to see them keep on doing this every quarter = 6 to 8% over 12 months. Add in a 2% dividend and that is a pretty solid shareholder return of 8-10%… especially if they can continue it for a couple of years. ————— We all, including Fairfax, have learned more over the past 3 months (since the Q2 call). I am not sure anyone expected the re-insurance market to harden like it has. Or for the hard market in insurance to remain this hard. ————— Bottom line, Prem has been saying for years that capital allocation priorities are: 1.) maintain solid financial position 2.) grow insurance top line in hard market 3.) buy back stock We will see what they do with capital allocation in Q4. It is not a concern for me (although i will be paying attention).

-

My guess is FFH will significantly outperform both BAM and BRK over the next 3 years. Why? 1.) valuation. At US$510, Fairfax is crazy cheap. Much cheaper than either BAM or BRK. 2.) growth in profitability: Fairfax will grow profitability much faster than BAM or BRK. - rising interest rates IS spiking interest income - 20% top line growth/hard market IS spiking underwriting profit - realized and unrealized gains in the equity portfolio will continue to be significant - but lumpy. - bottom line, historical Fairfax profitability is understated. Its future profitability is way underestimated. Profitability at Fairfax is a coiled spring right now. 3.) Fairfax has needle moving investments: pet insurance sale great example. Digit is another. There will be more. 4.) FFH share count will continue to come down significantly; BRK might be close here, BAM will lag significantly 5.) size: Fairfax has a big advantage here, being much smaller; both BAM and especially BRK are elephants. If this was a 100 meter race, Fairfax would be starting on the 20 yard line. Fairfax would also be a much faster runner than the other 2 sprinters (BAM and BRK). As long as they do not trip and fall, i think Fairfax will easily win the race.

-

Below are some answers to the questions i asked before earnings were released. How did Fairfax do? In short, very well. The earnings power of this company keeps increasing every quarter. At US$510, the stock is wicked cheap. The outlook for Fairfax has rarely ever looked better. That last statement is not hyperbole. Insurance: 1.) does top line growth remain close to 20%? - Net premiums written increased 18.6%. Simply outstanding. And poised to continue into 2023. Odyssey Group = +32%. Crum and Forster = +34.5%. 2.) what is Q3 CR? How much over 100? - CR came in at 100.3. Catastrophe losses were $803 million = 15.0 CR points. CR, ex cat losses, was 85.3... the lowest such number in Fairfax's history? - Losses from Hurricane Ian were $560.6 million. - YTD CR = 96.0. Was 97.3 YTD 2021. My guess is full year 2022 CR comes in around 95 which will deliver record underwriting profit. - expense ratio came in 1.7 points lower than PY. 3.) hard market expected to run well into 2023? Expectations for hard market for reinsurance? - Yes. And the hard market in reinsurance should power outsized growth at Odyssey Group in 2023 (in 30% growth attainable?). Other developments: - We have a new CEO at Brit. Former CEO recently stepped down due to health reasons (he will remain with Fairfax in an advisory role) - we all hope he gets better! Brit, like lots of Lloyds insurers, has been having its challenges for the past couple of years. My guess is Andy Barnard will find a way to get Brit back on track. Interesting that net of Ki, growth at Brit was low single digit. Bond portfolio 4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income? (Was $950 million end of Q2.) - interest and dividends came in at $256.5 million (versus $167.2 million in Q3 2021). - The new run rate for interest and dividend income is $1.2 billion = 3.2% yield on $37 billion portfolio. WOW! 5.) what changes, if any, do we see in bond portfolio? Buying and muni’s? - Fairfax has started to move out a little in duration. Great news. Hopefully we see more of this in Q4. - "During the third quarter of 2022 the company used existing cash and the proceeds from sales and maturities of short dated investments to purchase $7.2 billion of U.S. treasuries and Canadian government bonds, and short dated high quality corporate bonds, benefiting interest and dividend income." 6.) what is average duration? (1.2 years at June 30) - average duration increased to 1.6 years on fixed income portfolio. 7.) what is amount of mark to market loss? Another US$400 million? - mark to market losses on bonds was only $242.4 million. Impressive given the significant increase in interest rates across the curve in Q3. - "Net losses on bonds of $242.4 million included net losses on U.S. treasuries of $193.8 million and net losses of $90.0 million on corporate and other bonds (principally U.S. and other corporate bonds), partially offset by net gains on U.S. treasury bond forward contracts of $59.7 million." Equity Portfolio 8.) what is amount of mark to market loss? (My estimate is around $300 million) - market to market losses on equities was $141.9 million. Much lower than I expected. The stocks I track were off $300 million. So Fairfax did something of significance to offset a much bigger loss. What? No idea. It will be interesting to see what the Q3 13F reveals. - "Net losses on equity exposures of $154.8 million was primarily comprised of unrealized depreciation of common stocks, equity warrants and convertible bonds and net losses on long equity total return swaps. At September 30, 2022 the company continued to hold equity total return swaps on 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 million (Cdn$935.0 million) or approximately $372.96 (Cdn$476.03) per share, on which the company recorded $82.3 million of net losses in the third quarter of 2022 and has recorded cumulative net unrealized gains of $233.7 million since inception." 9.) any commentary on completed Recipe take private? Funded how? - done. No commentary of how it was funded. 10.) any commentary on Atlas take private? - minimal commentary. Fairfax will not be putting new money in to Poseidon (other than converting about $100 million in existing debentures). Other 11.) share of profits of associates? $200 million? - came in at $241.5 million. Was $172.2 million in Q3 2021. 12.) Book value? (Was US$588/share at June 30.) - came in at $570. Outstanding. Add in proceeds from the pet insurance sale ($40) and BV = $610. With the shares trading at $510, P/BV = 0.84 is stupid low. - BV also reflects spike in bond yields AND bear market lows in mark to market equities. BV is not overstated. 13.) share buybacks during quarter? - Fairfax bought back 210,000 shares in Q3 = 0.9% - "There were 23.6 million and 25.9 million weighted average common shares effectively outstanding during the third quarters of 2022 and 2021 respectively. At September 30, 2022 there were 23,445,778 common shares effectively outstanding." - "At June 30, 2022 there were 23,654,827 common shares effectively outstanding." 14.) increase in debt in Q3 of $750 million. How much of minority interest in Allied is purchased? What is outstanding balance? - "On September 27, 2022 the company increased its ownership interest in Allied World to 82.9% from 70.9% for total consideration of $733.5 million, inclusive of the fair value of a call option exercised and an accrued dividend paid, and recorded a loss in retained earnings of $228.1 million." 15.) capital allocation priority moving forward? i.) financial stability of company ii.) fund growth of subs in hard market iii.) buy back Fairfax stock - Holding company finished Q3 with $900 million in cash which is below $1 billion minimum. Additional $900 million in proceeds from pet insurance sale are now at hold co = $1.8 billion in cash. - listening to Prem on the conference call I am not sure if we get another dutch auction. I think NCIB re-purchases might be what they do moving forward. Updates/Commentary: 16.) pet insurance sale closed Oct 31: proceeds to be used for? - See previous comment above. 17.) Resolute Forest Products sale: to close when? 2023? - 1H 2023. Valuation was updated in Q3 so no increase will be booked when sale closes. 18.) Stelco dutch auction: did Fairfax be tender any shares? (Likely not.) - no commentary. Likely no. 19.) update: regulatory approval to take control of Digit? Status of IPO? - regulatory approval will happen. Timing is uncertain as Fairfax needs to figure out a solution and get regulators to approve it. ————— Looking ahead, is Fairfax on glide path to earn $2 billion from underwriting income + interest and dividend income in 2023? - NO. Fairfax is not on a glide path to earn $2 billion. They are on a glide path to earn something closer to $2.4 billion from underwriting income + interest and dividend income in 2023 = $100/share.

-

Looks like very good results to me. My comments are going to be brief tonight. (I am sitting in an airport in Chicago on my way back to Vancouver - was in Annapolis for a wedding.) 1.) CR of 100 is ‘win’. Allied is the star right now. Brit the goat. - CR of 95’ish looks pretty doable for 2022. 2.) interest and dividend of +$250 million… 2023 estimate of $1.2 billion is likely way low 3.) Mark to market losses on both bonds and stocks were about 1/2 my estimates for Q3. Love it! - book value at Fairfax now reflects bear market low equity prices and +4% treasury yields. Lots of upside surprise potential in the years to come. 4.) Allied ownership is now over 80% (from 70%)… love it given how well they are performing right now. 5.) might find out on the call tomorrow what the plan is for the proceeds from pet insurance… but looking at the growth in business at Crum, we might have our answer

-

My pain level is zero. Portfolio is up a little over 15%. 1.) went big into oil in Dec; Jan + Feb gains represent most of my gains this year (exited all my positions in Feb). 2.) got very defensive earlier in the year when it became clear Fed was going hard QT 3.) have done a lot of trading the past 6 months for minimal gain 4.) have been in and out of oil (smaller positions) 3 times since my initial purchase in Dec for nice gains. sold my SU today for a tidy 8% gain. Bottom line, oil has powered most of my gains YTD. Getting defensive early in the year largely saved me from the downdraft in the stock market. Fairfax, from this point forward, will likely determine how i finish the year. Currently Fairfax is my largest position. If the stock sells off post earnings - and i like earnings - i will add more. I have started to build out a position in big tech (GOOG, AMZN, Facebook, MSFT) - adding again today. Cash is a little over 40%. My guess is i will get lots of great opportunities to deploy more cash in the next 3 months.

-

Canada has had a 20 year housing boom. In recent years housing has become a massive % of total GDP. Look at all the condo development in Toronto (i think it leads North America). Building has been robust (single and multi family). Where are all the housing units going? Yes, building will slow moving forward. But i wonder how much of current supply is under-utilized. I just have a hard time understanding how we have had a housing bubble of epic proportions for 2 decades and still have a shortage. And i readily admit - i am a real estate idiot.

-

@Castanza i do not understand this comment: “Non-interventionism is a core tenant of US history”. Since WWII, the US has been very involved in pretty much every part of the globe. Countries with open economies are very good for US business interests. China and Russia have just decided it is time for dictatorships to take their rightful place in the world. I am nor sure that this is a great time for the US and US businesses for the US to become isolationist (like pre WW1).

-

With the Fairfax Q3 report set to be released after markets close on Thursday here are a few of the things i will be watching. What am i missing? Insurance: 1.) does top line growth remain close to 20%? 2.) what is Q3 CR? How much over 100? Impact of Hurricane Ian will be a big deal. How big? 3.) hard market expected to run well into 2023? Expectations for hard market for reinsurance? Bond portfolio 4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income? (Was $950 million end of Q2.) 5.) what changes, if any, do we see in bond portfolio? Buying and muni’s? 6.) what is average duration? (1.2 years at June 30) 7.) what is amount of mark to market loss? Another US$400 million? Equity Portfolio 8.) what is amount of mark to market loss? (My estimate is around $300 million) 9.) any commentary on completed Recipe take private? Funded how? 10.) any commentary on Atlas take private? Other 11.) share of profits of associates? $200 million? 12.) Book value? (Was US$588/share at June 30.) 13.) share buybacks during quarter? (At June 30 there were 23.7 million common shares effectively outstanding.) 14.) increase in debt in Q3 of $750 million. How much of minority interest in Allied is purchased? What is outstanding balance? 15.) capital allocation priority moving forward? - level of debt is ok (although $750 million just added) - continue to fund growth at subs in hard market? - buy back stock? - continue to buy out minority shareholders in Allied World? Updates/Commentary: 16.) pet insurance sale closed Oct 31: proceeds to be used for? 17.) Resolute Forest Products sale: to close when? 2023? 18.) Stelco dutch auction: did Fairfax be tender any shares? (Likely not.) 19.) update: regulatory approval to take control of Digit? Status of IPO? ————— Looking ahead, is Fairfax on glide path to earn $2 billion from underwriting income + interest and dividend income in 2023?

-

@glider3834 GREAT NEWS! Let the speculation begin as to what they are going to do with the proceeds! 1.) another dutch auction at YE for Fairfax shares 2.) re-invest into insurance/re-insurance subs to grow in hard market 3.) buy out minority partners (Allied) 4.) invest in equities 5.) all of the above (so no big dutch auction, just NCIB for share repurchases 6.) none of the above… what else?

-

Just finished listening to the Chubb Q3 conference call. Some take aways: - re-investment rate is currently 5.8% - current portfolio yield is 3.4% - significant unrealized loss in fixed income portfolio will accrete back to BV over 2 year period - p&c market conditions continue to be quite favourable ————— If Fairfax is able to get anywhere near a 5.8% re-investment rate we should see interest income continue to increase in a meaningful way. A 4% yield of their fixed income portfolio is not a crazy number (if new funds can be invested at an average 5.8% yield). $35 billion x 4% = $1.4 billion = @$60/share.

-

Stocks are off 20-25%. Bonds are off 15-20%. The opportunity set for investors is much, much better today than it was in January. There are way more bargains today than 9 months ago. every month this year the stock market has found another asset class and beaten it silly. Last week it was big tech. i also continue to think the Fed is a big driver of all asset classes. The Fed needs to tighten financial conditions (still). That means a lower stock market and a higher US$. Inflation continues to run too hot. Employment continues to run hot. Bottom line, i expect the Fed to continue to be more hawkish than Mr Market expects. Because the day the Fed ‘pivots’ the stock market is going to scream higher. And that will drive spending (wealth effect), which will drive inflation (again). And i think the Fed is smart enough to know this. Bottom line, the Fed needs a recession. But they can’t actually say that (Bank of Canada kind of just did). What is an investor to do? Buy stuff they understand when it gets cheap. But don’t go all in. More/better bargains likely lie ahead… we are in likely the middle of a bear market. Because a recession is likely coming in 2023.

-

Well, we can put a pitchfork in that rumour. Kind of crazy to think what would motivate someone to speculate on something like that Maybe someone got tired of holding the shares and was hoping to get a pop. If so, didn’t work out.

-

@hobbit great point. A bunch of speculation right now. What is interesting is the share price has not really moved. Why? 1.) Fairfax India is not followed - so outside of a few on this board - no one knows what might be going on 2.) sale/value of BIAL for $1.5 billion is already baked into the share price of Fairfax India 3.) sale of BIAL is hoax - pure misinformation being spread by some unknown entity for unknown reasons Also, sales like BIAL are likely to take an enormous amount of time to close… so perhaps Mr Market is shrugging and saying “we’ll believe it only when something official is announced”. ————— it looks to me like we have a set up right now with Fairfax India shares that Stanley Druckenmiller would like like. Nice new upside catalyst being priced at zero right now by Mr Market. I added some shares today

-

Some thoughts: 1.) Fairfax’s track record in India is very good. 2.) in particular, the team at Fairfax India’s track record, with its collection of businesses, has been very good. 3.) Fairfax has owned BIAL for some time. They understand the asset very well. And they understand the regulatory situation. 4.) i think the plan, all along, has been to monetize the asset to invest in other more undervalued opportunities. A number of Fairfax India’s holding have been monetized over the past 15 months - all at significant gains. We also saw a partial sale to OMERS via Anchorage. 5.) my understanding is BIAL has a contract in place with the government where their returns are somewhat guaranteed. I think the government recently decided those returns were too high. If that type of logic continues into the next control period then the economics for BIAL deteriorate materially. Yes, it is a trophy asset. But it might not actually earn much money. This is a very real risk. 6.) BIAL cost $653 million. If Fairfax India can sell it for $1.5 billion that represents a pretty significant increase in value over a fairly short period of time (couple of years) for Fairfax India shareholders. 7.) the government of India is currently selling off some pretty significant assets. This is a unique situation. If Fairfax and Fairfax India think they have found a large asset that will compound at a much higher rate than BIAL then i will give them the benefit of the doubt for now. Of course, we need much more information, but given their track record in India i am inclined to go with management on this one.

-

What a shocker. No idea what to think (need more information). BIAL has a fair value of $1.292 billion. Fair value of all investments of Fairfax India is around $3.3 billion. So BIAL is around 40% of Fairfax India’s total valuation. I have always thought that the key reason for Fairfax India’s low stock price has been because no one believed BIAL was actually worth $1.3 billion. If it is actually sold for $1.5 billion… well my theory will be put to the test… we will see what Fairfax India’s stock price does (if the deal is confirmed). Fairfax India has been selling a lot of positions the past 12 months. IIFL Wealth has not closed yet. Fairchem Organics might also be up for sale. What to do with $2 billion in cash? ————— If BIAL is sold i wonder what happens to Anchorage and OMERS?

-

i am reading pretty bullish commentary about super hard market in reinsurance. This looks to be an emerging opportunity. Not sure if Fairfax needs to fund anything meaningful here to be able to fully participate. I would support this sort of ‘investment’. Regardless, i also expect Fairfax to do something meaningful with share buybacks.

-

Fairfax India is trading today at $9.70/share. On Dec 31, Fairfax India closed at $12.61/share. Shares are down 23%. Makes sense… we are in a bear market and most stocks are down +20%. But does it make sense? Fairfax India owns a collection of stocks from India. And stock averages in India are flat YTD. Taking a quick look, the publicly traded stocks that Fairfax owns are also up YTD in local currency. With the return of air travel and the impending opening of T2, one would expect BIAL’s value to be similar, if not higher, than at Jan 1. So what is causing the decline in Fairfax India shares? 1.) currency: the India rupee is down to the US$; high single digits i think 2.) risk off? Investors shunning EM? Regardless, given the YTD strength of the stock market in India, the sell off in Fairfax India share price is looking overdone. ————— BV Dec 31 = $19.65 BV June 30 = $18.50 (with decline driven by currency) BV Sept 30? My guess is it will be in $18.50 range. Stock price Oct 25 = $9.70 P/BV = 0.52 Potential catalysts: 1.) big buyback from Fairfax India, when IIFL Wealth sale closes 2.) strength in US$ reverses Longer term, with China becoming a pariah, India is the obvious beneficiary. Apple announcing shift of some production from China to India is a canary in the coal mine.

-

If anyone is wondering if Canada is in a real estate bubble all you have to do is listen to 15:90-22:30 and 31:40-32.30 for some clues in the video posted below. These are some of the top producing real estate agents in the Vancouver/Toronto markets. Parts of their discussion reminded me of the real estate agent driving in the car (“its just a gully”) and later, the two mortgage brokers, from The Big Short movie (from the Florida scenes). Sorry, no strippers in my video below. - “Investors are used to cash flow negative”. - Investors feel downturn “is temporary; will come roaring back.” - Investors “are not buying for cash flow… are buying for appreciation”. - “…when are we going to see fire sales? Already are in the assignment market.” What i heard from listening is it sounds like lots of people who own real estate today are bleeding cash (cash flow negative). And with rising interest rates it is getting worse for them (more cash flow negative). At the same time the property they own is also now falling in value. But time is on their side. They think the situation is temporary - Bank of Canada will see their pain and bail them out with much lower interest rates soon (they are too important to the Canadian economy). Yikes. As we peel back the onion this actually looks really frightening.

-

Recipe take private has received shareholder approval and should be completed Oct 28. That was quick! Another outstanding piece of business at Fairfax getting completed prior to the Q3 earnings release (along with pet insurance sale). Lots to discuss on the conference call. FYI, last year Fairfax released results on Nov 4, 2021. —————- My guess is Recipe will post pretty good results in Q3. This is the first quarter since 2019 that results at full service restaurants in Canada were not significantly impacted by covid (primarily lockdowns). It will be interesting to see how Recipe performs for Fairfax in the coming years… how much cash does it generate? —————-— - https://recipeunlimited.investorroom.com/2022-10-21-RECIPE-UNLIMITED-OBTAINS-SHAREHOLDER-APPROVAL-FOR-GOING-PRIVATE-TRANSACTION-WITH-FAIRFAX-FINANCIAL-HOLDINGS-LIMITED TORONTO, Oct. 21, 2022 /CNW/ - Recipe Unlimited Corporation ("Recipe" or the "Company") (TSX: RECP) announced today that at the Company's special meeting (the "Meeting") of its shareholders (the "Shareholders") held earlier today, an overwhelming majority of Shareholders voted in favour of the special resolution (the "Arrangement Resolution") approving the previously announced statutory plan of arrangement involving the Company and 1000297337 Ontario Inc. (the "Purchaser"), a newly-formed subsidiary of Fairfax Financial Holdings Limited ("FFHL"), pursuant to which the Purchaser will acquire all of the issued and outstanding multiple voting shares ("MVS") and subordinate voting shares ("SVS", and together with MVS, the "Shares") in the capital of the Company (other than those Shares owned by FFHL and its affiliates (collectively, "Fairfax") and 9,398,729 MVS owned by Cara Holdings Limited ("CHL")) at a price of $20.73 in cash per Share, subject to the terms and conditions of the arrangement agreement dated August 31, 2022 (the "Arrangement Agreement") between the Company, the Purchaser and FFHL (the "Arrangement"). Recipe anticipates returning to the Ontario Superior Court of Justice (Commercial List) (the "Court") on October 25, 2022 to seek a final order of the court approving the Arrangement. Completion of the Arrangement remains subject to closing conditions as set forth in the Arrangement Agreement, including approval of the Court. Assuming that the conditions to closing are satisfied or waived (if permitted), it is expected that the Arrangement will be completed on or about October 28, 2022. Following completion of the going private transaction, Recipe will be de-listed from the Toronto Stock Exchange and applications will be made for Recipe to cease to be a reporting issuer.

-

Glider, thanks for posting. I have been trying to understand Grivalia Properties difference from Grivalia Hospitality and this helps. Some takeaways: 1.) on page 8 of the presentation you linked they summarized what Fairfax earned on their investment in Grivalia Properties = 24% per year (2011-2020). From initial purchase to when Grivalia Properties were merged with Eurobank. Not too shabby. 2.) I wonder what else Fairfax owns that we know nothing about. Prior to the Q2 release i never knew they owned a large chunk of Grivalia Hospitality. - From the Q2 release: “On July 5, 2022 the company increased its interest in Grivalia Hospitality S.A. ("Grivalia Hospitality") to 78.4% from 33.5% by acquiring additional shares for cash consideration of $194.6 million (€190.0 million). The company will commence consolidating Grivalia Hospitality in the third quarter of 2022. Grivalia Hospitality acquires, develops and manages hospitality real estate in Greece, Cyprus and Panama.” 3.) with a total value of about $340 million, Grivalia Hospitality is now a top 10 equity investment for Fairfax. It is worth about what Stelco is worth. 4.) the new investment spend of $195 million on Grivalia Hospitality is significant: - take advantage of weak Euro (to US$) - increase exposure to real estate - considered a good inflation hedge - hospitality segment - high net worth individuals (any trophy properties?) 5.) The majority of Fairfax’s new investment spend in 2022 is going to increasing positions in businesses they already own a large stake in and therefore understand exceptionally well: - Fairfax India - $65 million ($12/share) - John Keels - $75 million (convertible debenture) - Grivalia Hospitality - $195 million - Recipe take private - @ US$330 million? - Allied World - reduce minority interest; funded with $750 million in debt - Fairfax has also exercised warrants to increase stakes in Ensign Energy and Altius Minerals - Fairfax shares - my guess is we will see buybacks increase in Q4 2022 (once pet insurance deal closes Oct 31). So Fairfax has been greedy during the current bear market. In companies it understands very well. At what look to be attractive prices (some look very attractive).

-

RBC sends out an insurance update out each week (summary of what they are seeing). Here is what they said about insurance results reported last week: “We would say earnings season is off to a largely ‘as expected’ start. Pricing remains good and there haven’t been any notable earnings surprises. One thing we’d observe broadly with respect to P&C companies, and we think it showed a bit this quarter, is that while pricing has been decidedly good for going on 4 years running and margins have definitively improved over that time, there is still relatively little follow-though to reported earnings and ROE since cat losses, adverse bond marks, pandemic losses and inflationary headwinds have sucked up a lot of the benefit that would normally be flowing into profits and building balance sheets. We think it’s fair to say that while managements are rightly ‘pleased’ with their results, they can’t be overly enamored with not realizing any book value growth or seeing a payback with a really strong earnings year. We view this as an underappreciated factor in why pricing could remain firm for a good bit longer.”