Viking

Member-

Posts

4,930 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

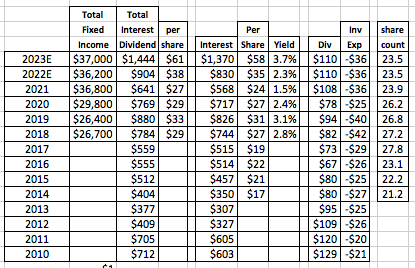

When I did my last update on Fairfax's earnings estimates for 2023 a couple of days ago, I noticed my spreadsheet had bunch of errors in it (mostly the historical information). I also: - added a few more years of history - added 2022 YTD numbers (to help forecast 2022 YE) - made a few tweaks to my 2022 & 2023 estimates ---------- Below is a short summary of what is included in each row. 1.) underwriting profit: is just insurance and reinsurance. Not runoff and life insurance (which is captured a couple of lines down). 2.) interest and dividends: for all of Fairfax 3.) share of profit of associates: for all of Fairfax; includes associate equity, real estate and insurance holdings 4.) life insurance and runoff: just underwriting results 5.) Other: captures Fairfax's consolidated equity holdings 6.) Interest expense: for all of Fairfax 7.) Corporate overhead 8.) Net gains (losses) on investments: captures realized and unrealized gains on Fairfax's fixed income and mark to market equity holdings (including derivatives like the TRS on FFH) 10.) Non-controlling interests: primarily the parts of Allied, Odyssey and Brit that Fairfax does not own I am least confident in my estimates for two buckets: Non-controlling interests and Income taxes. ---------- Below is a summary of Fairfax's equity holdings broken out by size and accounting treatment. A.) Mark to market is captured in 8.) Net gains (losses) on investments B.) Associates is captured in 3.) Share of profit of associates C.) Consolidated is captured in 5.) Other (revenue - expenses)

-

@newtovalue good question. I like to look at multiple measures when valuing any company. My primary method is earnings. When it comes to insurers, book value appears to also be super important (for insurance analysts and other investors). Of course all methods have their weaknesses. For example, where the earnings are coming from is important: asset revaluation (happens a lot with Fairfax) or from underwriting and/or interest and dividend income? One of the reasons i like Fairfax so much right now is the quality of the earnings coming in 2023 is very high: primarily underwriting profit and interest and dividend income, with a smattering of realized gains (like pet insurance and Resolute sales in 2022). Book value is hard with a 37 year old company like Fairfax. They have bought so many companies over the years and nurtured many of them for decades. None of the insurance companies they purchased over the years come close to resembling the businesses they are today (except perhaps Zenith). Most were poorly run (the pre-2000 purchases), with CR usually over 100; Fairfax probably bought them to get their float. Today pretty much all the insurance companies are very well run, many now with large specialty businesses, with CR’s well under 100. They have all grown nicely over the years and their earnings power has increased significantly. Part of the problem at Fairfax is the equity hedges eviscerated billions of earnings from 2010-2017 (with a final $500 million loss in 2020 when the last short position was finally closed). The insurance operations significantly increased in quality and size from 2010-2020 and little of this earnings potential is captured in BV today. As an example, Fairfax just sold an asset (small pet insurance business) for $1.4 billion and booked a pre-tax gain of close to $1.3 billion… a big miss for reported BV. My guess is Fairfax has lots of other assets that are worth much more than the value they are currently captured at in Fairfax’s reported BV. And a few more will be likely be sold in 2023 and some nice realized gains will be booked. I have been saying for some time now (I likely sound like a broken record) that Fairfax’s past results tell an investor very little about what Fairfax’s future results will be. There is too much noise in past results. That is why i focus so much on understanding each of the businesses Fairfax owns as they exist today. And what each of those businesses are likely to earn in 2023 and 2024. The turnaround at Fairfax was largely completed in 2019. In 2020, covid threw a wrench into the progress that Fairfax had been making. However, in 2021 Fairfax came roaring back and delivered an outstanding year. In 2022 the greatest bear market in bonds happened and, surprise, surprise, Fairfax will likely finish the year with a small profit. Pretty impressive. Despite the economic backdrop, 2023 is poised to be a very good year for Fairfax. The super tanker has turned, is going in the right direction and is picking up speed. We will see.

-

Here is another stab at 2023 earnings for Fairfax. Would love to hear what others think. I am at about US$110/share for 2023 (see below for my rough math). With Fairfax currently trading at $560, forward PE ratio = 5. My guess is YE 2023 BV will be around $750 = forward P/BV = 0.75. - underwriting: 95CR - interest and dividend income: 3.7% portfolio yield - share of profit of associated: $1 billion. I do need to spend more time on this bucket. if Fairfax can consistently earn $1 billion per year moving forward that will be another game changer. Compare 2022 to 2018, 2019 and 2020 (see my table below). You can really see the improvement in earnings from equity holdings, especially Eurobank. - operating income from non-insurance: now includes Grivalia Hospitality and 84% owned Recipe. This bucket could start to generate a consistent +$150 to $200 million per year. - net gains on investments: estimate of 5% on $15 billion = $750 million. This assumes no mark to market gains on bonds. Just mark to market gains on equities plus any realized gains. This assumes Fairfax will monetize one or more positions in 2023; perhaps EXCO? The really really nice thing with Fairfax is the improvement in the business fundamentals is outpacing the increase in the share price. We could see the 'trifecta' in 2023: 1.) growing earnings - with the increase driven by operating earnings 2.) lower share count 3.) higher multiple - as Mr Market gets more comfortable with the earnings story of 'new Fairfax' When the trifecta happens at the same time it is not crazy to see the stock price increase +20% each year for a couple of years. For example, If my estimate for 2023 is close, Fairfax's BV will be around US$750 at YE 2023. Given the increase in operating earnings, a multiple of 1X BV would be reasonable. From $560 today to $750 YE 2023 = 33% increase over 13 months. One can dream ---------- The biggest risks? 1.) a higher than normal year for catastrophes. 2.) a severe global recession 3.) a bear market in stocks (tied to 2.) 4.) asset write downs (if we get 2.) and 3.) above): Farmers Edge got written down in 2022. I wonder if we get a write down on Recipe in Q4. ---------- The biggest opportunities? 1.) share buybacks: Fairfax could be aggressive with NCIB... taking out 1% or even 2% of shares each and every quarter moving forward. With high operating income, they now should be generating the cash on a consistent basis. 2.) Fairfax could pull another rabbit out of its hat - like when it sold pet insurance or Resolute Forest Products or runoff or First Capital... 3.) Digit could IPO at $3.5 billion 4.) India / Anchorage... sounds like something is going on. Edit: my old spreadsheet had a bunch of errors so I replaced it with a more accurate version (Nov 23)

-

It certainly has been encouraging to see the spike in Fairfax’s share price over the past month. Fairfax closed today at $563 which is near a new 52 week high. In the coming month or two it looks poised to take out its all time high of around US$590 in Sept 2016. The interesting thing is Fairfax as a company is much, much better positioned today than 2016 when you look at all important metrics. - net premiums written - underwriting profit (total) - interest and dividend income (total) - share of profit of associates - quality of equity holdings (taken as a whole) - float Yes, total debt is quite a bit higher. I think share count is a little higher today than 2016. I don’t have the exact numbers on me (i am not at home as i write this), but Fairfax is probably worth 2X what it was worth in 2016. Was Fairfax overvalued at its high in 2016? Looking back with hindsight, clearly yes. I also think Fairfax continues to be undervalued. How much is it undervalued? Given we are approaching year end, now would be good to do an updated earnings forecast for 2023. My guess is US $100/share is a good baseline. ————- Q4 earnings should be very good = $60-$70/share - 20% top line growth - underwriting income = +$300 million (94CR, probably lower) - interest and div income = +$330 million (incl Stelco special) - positive mark to market gains from both stocks and bonds - $40/share after tax gain from pet insurance sale - 1 or perhaps 2% lower share count - lots of great tailwinds

-

@RedLion i really like the set up over the next 5 years for a bunch of different commodities. The problem is, despite the concerns over a slowing economy, resource stocks don’t look particularly cheap today. As we get into the new year, if the US enters a recession, then we might get another big sell off. My problem is i often get way too cute in trying to time my entry point. In terms of what sectors and what companies, i have a Canadian focus (easier for me, being Canadian). US has lots of good options too. ETF’s are also a good way to get exposure. I trade in and out of most positions (most of my investments are in tax free accounts so there are no tax consequences when i sell positions). I would love to hear others ideas (sectors and stocks). 1.) energy: this is my favourite sector today. Demand continues to grow and supply is constrained (years of underinvestment, now ESG and governments treating sector like it is the devil). My 3 core holdings are usually CNQ, CVE and SU. MEG was my pick to play volatility. I only hold CVE and SU today. I am hoping for a pull back so i can re-load again. - CNQ: the best managed Canadian energy company; decent nat gas exposure. - CVE: new kid on the block. Not sure how good management is. Will hit their net debt target around year end. Starting Jan, 100% of excess free cash flow will be returned to investors. - SU: cheapest of the three. Management issues in past. Very good at refining/retail which seems to be a sweet spot (with high crack spreads). They will be deciding in next 2 weeks if they will selling their Petro-Canada gas stations. If yes, the stock will pop. - MEG: smaller, well managed oil sands producer. Very volatile. I bought a couple of times under C$16 and sold over C$18. Rinse and repeat. 2.) Forestry (lumber/OSB): i also love the supply/demand imbalance here. Once we get to the other side of the slowdown the Fed is trying to engineer (late 2023?), i think housing in the US is going to pop again. Demand will grow for years and supply will likely struggle to keep pace (lumber supply is falling in BC). My favourite stock is West Fraser. Interfor has been the most aggressive consolidator. - WFG: best managed, superior long term track record, shareholder friendly, Norbord acquisition (OSB) was brilliantly timed (founded in my home town of Quesnel, BC… i put myself through university pulling lumber on the green chain in their plywood plant for 4 summers). 3.) Steel: it seems like a bunch of secular trends are in play right now that will drive a massive capex cycle moving forward: deglobalization, decarbonization, EV transition, resource build out, etc. North America has cheap energy so i can see more industrial business coming here. All of will need lots of steel. - STLC.TO: has been my usual go to. - NUE: would probably be my ‘set and forget’ US pick - CLF: volatility play 4.) Copper: it looks like lots of metals will be needed for the EV transition to become a reality. I need to do more work here but copper looks like a good place to start. I have traded Teck a couple of times this year. An ETF might be a better way to play this (not just copper). Not sure right now. - TECK: they have a very large copper mine coming on stream soon. 5.) Uranium: nuclear really is the only viable solution for the world to deal with climate change. China is aggressively expanding. Looks like Japan is coming to its senses. The rest of the world will likely come around… they will have no choice. Not sure the best way to get exposure. Cameco? ETF like URNM? Or something else? - https://sprott.com/insights/sprott-uranium-report-uraniums-october-optimism/ 6.) Agriculture: the outlook for potash looks interesting. Russia and Belarus are big producers. Natural gas is an important input; high nat gas prices in Europe are affecting supply coming from Germany (I think). I need to do more work. Mosaic (MOS) and Nutrien (NTR) are on my watch list. - https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/minerals-metals-facts/potash-facts/20521

-

I continue to think a number of secular changes are happening to global economies that will lead to higher average inflation over the next 5 years (as far as my crystal ball looks out). Inflation will ebb and flow. We are moving from a world of abundance to a world of constraints. That will be inflationary. 1.) globalization is dead. Replaced by onshoring/friendshoring. - CCP China is now a pariah. Most CEO’s are figuring out how to do less business in China. The Ukraine invasion cemented the fact we live in a new geopolitical reality: West vs authoritarian regimes lead by China/Russia. 2.) the world, especially Western countries, will see a historically large capex cycle over the next 5 years - see 1.) - at the same time, investments to deal with climate change will be enormous. Transition to EV. Industry reducing carbon emissions. Catch-up investment in production of most commodities to deal with expected shortages. 3.) Western countries already have a shortage of labour. Who is going to do all the work? More investment in automation (even more capex) will be needed as not enough people exist to do the work. I was listening to the Cenovus Q3 conference call and something like $24 billion needs to be invested in Alberta for big oil to hit their long term greenhouse gas emission targets. All sorts of things will need to be built. The question was asked: “where are all the skilled workers going to come from when everyone is trying to do this at the same time”. Houston, we have a problem. Well, we already have a labour problem. It is only going to get worse. i continue to love the set up for commodities. I see robust demand. And with ESG, increasing supply will be a challenge. Cha ching. With lots of volatility of course.

-

@Gregmal, you have a far better example than SBF. Trump is in a class of his own when it comes lying/doing unethical & questionable things. All the while being “shamelessly unapologetic and blaming everyone else”. Come on… Trump is the GOAT. Every once in a while we get a glimpse into how rotten the US political system is. Its not a liberal or conservative thing.

-

In the end putting money into crypto is like going to Vegas. People view a Vegas trip as entertainment and an expense (well, most people). Not as a revenue opportunity and an investment. And as entertainment, we got a first class stable of outstanding commercials from crypto that we can now enjoy forever. Priceless. ————— Crypto is just an other chapter in the long book/history of moments of insanity/madness of crowds. I suspect the chapter has not yet been fully written. The next 6 months will be interesting as we learn more fully who has been swimming naked.

-

Yes, great news. Kestenbaum first took out every share he could at about C$35. Share count at Stelco at the end of 2020 was 88.7 million. Now it is 55.13 million = decrease of 33.57 million or 38%. With a much lower share count, now Kestenbaum starts with the special dividend. Smart capital allocation. One way to evaluate the quality of Fairfax’s equity portfolio is to look at the performance of the largest individual equity holdings and their management teams over the past couple of years. Kestenbaum/Stelco would get an A+ from me. ————— Looks like the special dividend is about what Stelco earned in Q3. Not too shabby. And perhaps we see more. - Adjusted Net Income* of $163 million and Adjusted Net Income* per share of $2.40, down 74% from Q3 2021 and 54% from Q2 2022 ————— special dividend 55.13 million share outstanding x C$3 = C$166 million total cost. regular quarterly dividend 55.13 million share outstanding x C$0.42 = C$23 million/quarter total cost. ————— Fairfax owns 13 million shares of Stelco 13 x $3.42 = C44 million = US$33.5 million. I think Kestenbaum is the second largest shareholder at Stelco. Cha ching!

-

You are assuming it was an accident. Or that it is not the beginning of some part of Russia’s plan. it could also be from Ukrainian defense systems. I have no idea. But i have also not ruled anything out. Stay inquisitive. Stay open minded. ————— We also recently had the explosion of the Nordstream pipeline. No idea what the significance of that will ultimately prove to be. If anything. ————— Bottom line, the longer the Ukraine war continues the greater the likelihood it spreads in an unanticipated/unwelcome direction. Especially if Russia is losing (like today).

-

If Russia has attacked NATO then this is a big deal. That military alliance thing… Do we need more information? Of course. The problem with wars is they often move in unpredictable directions. The bottom line, there is no way Russia will let Ukraine win the war. And it looks like Ukraine is winning the war. So Russia will need to get creative.

-

i do greatly respect Munger’s views on investing… his clip in the video on China sounded pretty unsophisticated. The West and China (CCP) have different values. And under Xi, China has publicly proclaimed that it wants to take its value system international. They are upping their game.

-

a) Why do you think China is an ally of Russia? 1.) They both signed a very public agreement in Feb. These things happen every, what, 40 or 50 years? Big deal. And it is long term in nature. - https://www.newyorker.com/news/daily-comment/russia-and-china-unveil-a-pact-against-america-and-the-west 2.) China is essentially bankrolling Russia right now. That follow the money thing. Without China’s financial support today, Russia would be screwed. Is this good for China? Well, China is getting raw materials on the cheap. But their marriage partner is not holding up their end of the bargain. I think it is safe to say the marriage has started out more than a little on the rocks. b) Why are you surprised by Saudi behavior? I am having a hard time keeping up with exactly what the US / Saudi / middle east relationship was/is under Obama, Trump and now Biden. And what it will be in 1 year and after the next presidential election in the US. And how OPEC overlays over this. And exactly what Saudi Arabia’s relationship with Russia is.

-

@Xerxes my post was not to suggest the West was a victim. One of the most important lessons i am trying to teach my kids is ‘actions / consequences’. Do dumb things… bad things often follow. I also tell them if their world is not going well to start by looking in the mirror. If change is needed that is the best place to start. i also tell them to be rational. And to be rational you have to be able to properly analyze the situation. What i love is China is no longer pretending. Same with Russia. Even a dummy can figure out what is going on. So the West is slowly figuring it out. Brave new world. ————— i have an enormous amount of respect for China, their history, what they have accomplished the past 40 years and what they are capable of. ‘China’s got game.’ Russia, on the other hand, i am not so sure.

-

Europe has severed its relationship with Russia on energy and pretty much everything else. Finland/Sweden are joining NATO. Eastern European nations (bordering Russia) understand Putin/Russia and understand they are next on the menu should Russia have any lasting success in Ukraine. So they will play an important role moving forward in keeping Europe focussed on the task at hand (getting Russia out of Ukraine and weakening Russia as much as possible). Moving forward, Europe’s energy future will now rest more on decisions Europe makes and less on developments in Ukraine. European energy policy has been a disaster for decades. If Europe continues to do dumb things (like closing down nuclear)… well that is not on Ukraine. Driven by supply issues, the spike in oil prices happened well before the Ukraine invasion. Did the Russian invasion make a bad situation worse? Of course. But that is now spilt milk. The real story of Ukraine: The West is now at war with Russia and China. The authoritarian model, lead by China/Russia (Saudi Arabia?), versus the liberal democracy model, led by US/Europe/Japan/Canada/Australia/South Korea etc. China/Russia, when they signed their pact in Feb, made their aims clear for all to see. Weeks later Ukraine happened. We are not even a year in to something that is going to run for decades… China has staying power. But the West is slowly catching on. Our world has fundamentally changed. I am not sure where Saudi Arabia sits… but the very public decision to materially cut production right before US mid-terms was certainly interesting. There is no going back. Thats because the last 20 years was largely a fiction. It never really existed (except in peoples imaginations). The Disney version of communist China was brilliantly marketed by Chinese leaders and gobbled up by a naive West. Of course, the reality of communist China, is much, much different - and much worse. Just ask anyone trying desperately to get out of Hong Hong right now. Xi has revealed himself over the past year for all to see. China is diametrically opposed to the West (that communism vs capitalism thing… not hard to understand). The West got completely played by China the past 20 years. Smart bastards. But is looks to me like Xi/China might have miscalculated. Their partner, Russia, has completely messed up in Ukraine. And the final outcome is unclear. China still needs the West… this was recently highlighted by the chips act (good luck developing your economy without access to high end semiconductors). The game has just started - the initial moved have just been made. Settle in, it is likely going to take decades before a winner is declared. Your grandchildren will probably be the ones who decide the final outcome.

-

The interesting part of the Ukraine war the past 2-3 months is the success the Ukrainian army is having reclaiming significant chunks territory back from Russia. Complete shocker for me. My guess is if Ukraine does not take the territory back by force then it will be permanently gone. Russia has already made a legal claim to large swaths of Ukraine. And Putin desperately wants Odessa. So the war will continue because the Russian bear is still hungry for more. ————— My guess is Putin is playing the long game (years of war) and counting on the West losing interest at some point a year or two from now. Putin understands his adversary well. Perhaps this is why Ukraine is taking more of an offensive approach the last few months. Ukraine realizes popular/public opinion in the West can be fickle so time is not on its side. ————— My guess is Crimea is gone. I would be shocked if Ukraine aggressively went in to Crimea. Unless to use it as leverage to get the rest of its territory back. ———-—- Hard to see how this ends unless 1.) Ukraine gives Russia mostly what Russia wants… starting with all the territory it has already claimed. 2.) Ukraine takes it back by force. Not much of a middle ground.

-

People need to find an investing strategy that works for them. Paying attention to macro has worked out very well for me over a 25 year time frame. It also fits with my interests: business, economics, politics, history, global developments.

-

I don’t follow Algonquin closely, but it looks like higher interest costs are lowing earnings. There is a pass through mechanism but it takes some time to play out. There are lots of high dividend yielding companies out there with a lot of short term debt. If interest rates stay high we likely will see more companies warn on earnings. Lots of REIT’s have significant amounts of short term debt that will need to get rolled over at much higher rates over the next couple of years.

-

Fairfax has certainly hit the ball out of the park with its commodity holdings. They currently total around $1.9 billion = 12.5% of total equity holdings of about $15 billion. The holdings are very diversified and certainly look well positioned to deliver significant value to Fairfax in the coming years (they stand a good chance of hitting Fairfax’s 15% return hurdle rate). - Resolute ($600 million): Selling Resolute for +$600 million (plus $180 million CVA) in a bear market was brilliant. It will be interesting to see where they redeploy the funds when the deal closes in 1H 2023. - Stelco ($384 million): this has also turned into a home run investment. Given all the share buybacks, Fairfax has increased its ownership the past 18 months from 14% to almost 24%. And Kestenbaum is still sitting on some crazy amount of cash ($800 or $900 million?). Another great asset to own. I expect steel to do well as we get to the other side of the economy in another year or so. Like Exco, with Fairfax now owning >20%, this is now an Equity Accounted holding. - Foran Mining ($140 million): Fairfax owns 23% of Foran, which is developing a copper mine in Canada that should begin production in a couple of years right when sales of EV’s should be taking off… and a shortage of copper develops. Most analysts are forecasting much higher prices for copper looking out a couple of years. This investment will be one to watch moving forward as it has the potential to be a another big winner for Fairfax. - Altius Minerals ($106 million): Fairfax owns 14% of this diversified royalty company with exposure to potash, iron, copper etc. Quality company… chug, chug, chug. Fairfax also has a pretty sizeable exposure to energy: - Exco ($195 million carrying value Dec 31). @nwoodman yes, it will be very interesting to see what EXCO resources can deliver as they work off their nat gas hedges. Fairfax’s share of profits for Exco was $44 million in Q3. Great asset to own in the current environment. - Limited partnerships/private equity funds - investment funds managed by third party fund managers:($252.1 - oil and gas extraction- at Dec 31, 2021). @glider3834 mentioned this investment in the past. - Ensign Energy Services ($59 million): Fairfax owns 13% of this oil and gas services company. Certainly looks well positioned. - Big Oil: OXY ($62 million) and CVX ($57 million): Fairfax was a big buyer in Q2. Will be interesting to see if they added more in Q3.

-

Once a year I find it is useful/interesting to rank Fairfax's equity holdings by size. Learnings? 1.) each year, for the past 5 years, the overall quality of the collection of holdings has been steadily improving. This is very subjective. Some, like Eurobank, keep getting better (management doing what its supposed to do). Others, like Resolute, got lucky and stumbled into a bull market in lumber (they did buy two lumber mills at the bottom of the cycle so it was not all luck). Most of the resource plays look very well positioned (this was a very different picture 5 years ago). Atlas continues to execute its aggressive growth business model. New add Grivalia Hospitality looks solid. Other new adds like BAC, OXY and CVX are solid. More money is going to private equity (ShawKwei and more recently JAB) where there is a proven, successful, long term track record. Fairfax continues to grow ownership in existing holdings (Fairfax India, Stelco, Recipe). I could go on. Bottom line, i like the progression we are seeing over the past 5 years to an overall higher quality group of holdings. This bodes well for future returns from the equity portfolio. 2.) there is concentration at the top: top 3 positions = 30% (top 10 positions = 55%) - but this is a little misleading as Fairfax India, BDT and ShawKwei are very diversified. 3.) after the top 10 positions you really have a lot of diversification. Well over 40 positions represent the remaining 45%. 4.) there is also a lot of diversification of the holdings by: - region: US/Canada, India, Greece, Asia - sector: financials, commodities, hospitality, etc - 13% managed by private equity funds (BDT, ShawKwei etc) and JAB will take this higher. 5.) Big changes year over year? - Resolute will be coming off the list; monetization of a top 5 holding at a premium price is a big deal. - Recipe take private roughly doubled its size. - Given how far out of the money they are I did not include the Blackberry debentures in the Blackberry total (my subconscious just wanted to get BB out of the top 10 . - BAC, OXY and CVX were sizable adds in Q2; has more been added in Q3? (In the 2008 bear market Fairfax loaded up with purchases like these… quality US big cap. Will they do the same thing over the next year?) ————— EA: equity accounted; MM: mark-to-market; CE: consolidated equity

-

@nwoodman and @glider3834 thanks for the links/comments on Eurobank. It looks to me like the turnaround at Eurobank was largely finished in 2021. We are now seeing the bank execute. The management team has done a great job, especially the last few years. I am still amazed at how opportunistic they were in getting non-performing loans significantly lower over the last 2 years (while the market was open to those type of transactions). Smart buggers. Prem has stated the expectation at Fairfax is that all equity holdings will deliver returns of 15% per year. This looks achievable for Eurobank. This is great news for Fairfax shareholders as Eurobank is Fairfax’s second largest equity holding with a value today of $1.3 billion (9% share of Fairfax’s total equity book). 15% return = @$200 million benefit to Fairfax = $9/Fairfax share (pretax). The expected slowdown in the economies of Europe over the next 6 months will likely be a headwind for Greece and Eurobank. But as we get to the other side (late 2023?) Eurobank certainly looks well positioned. ————— Morgan Stanley is estimating Eurobank will earn about €0.19/share in 2023 and €$.20/share in 2024. PE of 5.5? Wow.

-

Here is a mid quarter update on Fairfax's equity holdings. As a reminder, Fairfax has an investment portfolio of about $51 billion = about $36 billion in fixed income and $15 billion in 'equities' (loosely defined). So how is the $15 billion in equities performing so far in Q4? Pretty well. Total increase = $875 million. Of this, about $340 million is mark-to-market = $14.40/share. All numbers are pre-tax. If we get a continuation of the current rally into year end, we should see a nice rebound in the valuation of Fairfax's equity holdings. Movers: 1.) Eurobank +$313 million 2.) Atlas +$178 3.) FFH TRS +$158 PS: please let me know if you see any material errors in the Excel spreadsheet attached below. Fairfax Equity Holdings Nov 10 2022.xlsx

-

What a bloodbath in crypto. Billions $ are getting eviscerated. What is the next shoe to fall? Where are the skeletons? There is no transparency/oversight in this ‘industry’ which makes the path forward pretty much impossible to call. And so much of this industry is intertwined. ————- i wonder how much windfall gains in crypto was fuelling economic growth in 2021. How does this now work in reverse? Is the crypto crash now bigger than the .com crash? ————— Trust is gone. How does crypto work without trust?

-

Who is the big buyer of FFH shares right now? Share volume is very high in both Canadian and US markets. And this, of course, is spiking the stock price as Fairfax is usually pretty thinly traded. One buyer could be Fairfax. Perhaps we see them take out a material number of shares over the next 7 weeks via the NCIB. If so, the shares could keep running higher into year end. ————— Fairfax will be paying a US$10/share dividend in January. Something that is typically supportive of the share price. ————— One of Fairfax’s largest investments is the 1.95 million shares of Fairfax it holds via the TRS. FFH shares were US$457 on Sept 30. Today they are $550. That is a $180 million mark to market gain in 5 weeks (shares are up 20%). I like the TRS position… it definitely motivates FFH management to want a higher stock price and i like that (given FFH is my largest position).

-

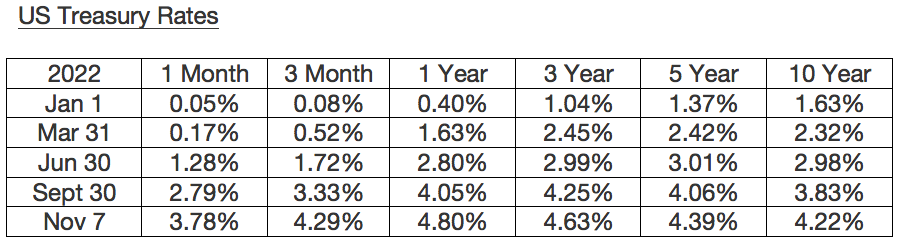

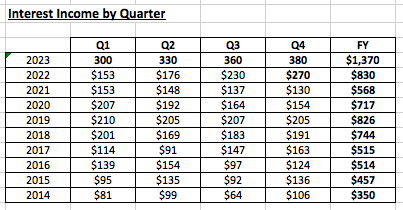

Earlier today I provided an update on how underwriting profit was tracking at Fairfax. Let’s now take a look at interest and dividend income. Of all of the many positive developments at Fairfax in 2022, the increase in interest rates (and interest income) is one of the most exciting. ————— Summary: Fairfax earned $568 million ($24/share) in interest income in 2021. For 2022, my estimate is $830 million ($35/share). For 2023, my estimate is $1.37 billion ($58/share) = $800 million increase over 2 years (2021 to 2023). Dividends will come in at around $110 million per year (not included in the numbers above). ————— In 2021, Fairfax earned $568 million in interest income = 1.5% yield on $36.8 billion fixed income portfolio. In 2022, Fairfax is on track to earn $830 million in interest income = 2.3% yield on $36.3 billion fixed income portfolio. This will be a record amount of interest income for Fairfax; the previous record was $826 million achieved in 2019 = yield of 3.1% on a fixed income portfolio of $26.4 billion. When it reported Q2 results, Fairfax said the then run-rate for interest and dividend income was $950 million. When it reported Q3 results, Fairfax said the current run-rate for interest and dividend income is $1.2 billion. This is a significant increase of $250 million in just 3 months. Of the $1.2 billion total, about $100 million is dividends and $1.1 billion is interest income - after estimated expenses of about $35 million. The $1.1 billion in interest income = 3.0% yield on $36.3 billion fixed income portfolio. So at the end of Q3 Fairfax was tracking to a 3% yield on its fixed income portfolio which is double what it was in 2021. Of interest, Fairfax confirmed with Q3 results that they are starting to extend the duration of their fixed income portfolio. At the end of Q2 it was 1.2 years. At the end of Q3 it was 1.6 years. Fairfax said they were buying primarily 3 year US treasuries in Q3. For 2023 my current estimate is Fairfax will earn $1.37 billion in interest income = 3.7% yield on $37 billion fixed income portfolio. Current expectations are for the Fed Funds rate to get close to 5.25% in Q1, 2023. If this happens my 3.7% estimate for Fairfax for 2023 will be way low. ————— Interest & dividends = interest income + dividends - investment expenses.