Viking

-

Posts

4,696 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

1 hour ago, Sweet said:

Agree with Spek, don’t think it is wise to have money in China. It could disappear quite easily and I don’t need help losing money

Disagree with comments about the US and education. Not everyone needs to be highly educated. I think risk taking and entrepreneurial spirit in the US remains strong and they will remain the innovators and leader in the global economy for decades provided the politics calms down.

investors KNOW relations with China are the best they will be with the US/West right now (looking out 5-10 years). In other words, political and economic relations are only going to get worse. So as an investor you are trying to guess how much worse they will get (magnitude) and how fast (timing)… Investing is hard enough without having to overlay those two variables on top of everything else.

Its kind of like an investor after WWII was trying to decide if they wanted to invest in the Soviet Union (yes, sounds stupid today and that should tell people something). After WWII the political and economic relationship with Russia kept getting worse year after year and decade after decade. Good luck with that.—————

The pact that China and Russia so publicly signed pre-Ukraine invasion could go down as one of the most significant geopolitical events of the next 50 years. Not unlike when the iron curtain came down. China/Russia (perhaps Saudi Arabia) = authoritarian block = have declared game on with the West.

-

7 hours ago, tede02 said:

All-right guys, 10-year has broken well through 4%. Man, it is going to be interesting to see where things go in the next few months. The inflation numbers in the UK are crazy. US economy remains resilient. Fed will keep hiking short rates. Will balance sheet reduction result on long rates moving up? Or will foreign investors start dumping money into long treasurys? I don't know but what a year it has been.

10 year is presently at highest yield since 2008.

Rising interest rates are doing what they are supposed to do - slow economic activity. Market interest rates increased before the Fed actually started raising the Fed funds rate earlier thiscyear (the jawboning part of Fed policy). The interest sensitive part of the economy got hit first… and no surprise, 8 months later, housing has turned aggressively down. We are just starting to see corporate profits slowing and this should pick up steam in the coming 4-6 months. And the labour market should turn as companies are forced to retrench. The interesting dynamic this time (versus 2008 and 2020) is inflation. How fast does it come down? Inflation prints will likely inform what the Fed does. And what the Fed does will determine if we get a mild, medium or severe recession in 2023. -

2 hours ago, crs223 said:

What would you say is Chinas most fundamental problem? And the US?

China: as economy gets bigger: resource allocation- property bubble blowing up for 20 years is great example of this

- centrally planned economy works great at early stages of development; does terrible in large, sophisticated economy

US: ripping of basic fabric of democracy; it is fragile and very difficult to sew back together. My guess is founders of the country are likely rolling over in their graves at what is going on in country today (on both sides of the aisle).

-

59 minutes ago, UK said:

I have no strong opinion on that myself, but in my investing lifetime there were probably allready two peak oil times and then two peak demand times. Perhaps reallity is somewhere in between.

@UK the Bloomberg article you posted reinforces for me the challenges we will continue to have with the energy transition: the massive disconnect today between the dream and the reality. It is one thing for Norway to decide to do something and then execute it. But to extrapolate that to the rest of the world is simply not realistic. There simply are not enough resources available and there will not be for at least another 10 years - for the simple reason we are not building the mines on the scale needed today (it takes a minimum of 7 years to build a copper mine). Lyn Alden wrote that in every past energy transition the old energy usage never actually falls… it just slows and the new forms of energy drive the majority of incremental energy demand (leading to higher global standard of living).

I continue to be bullish on commodities over the next 5 years. I see demand increasing at the same times supply will remain constrained.

- underinvestment for years; ESG guarantees future supply growth will be muted

- increasing demand driven by mega trends: developing world, deglobalization, move to EV and clean energy sources etc.- war & geopolitical split into West vs authoritarian blocks adds more complexity

We expect world governments to thread the needle moving forward?

-

-

Clearly, the energy crisis in Europe is not nearly as bad as i thought…

The three-week strike at Exxon’s facilities is over for now, but the strike at TotalEnergies’ refineries continues after the hard-left CGT trade union walked out of wage increase talks with TotalEnergies early on Friday, vowing to continue the strike at refineries that has crippled France’s fuel supply.

Two other trade unions found the offer for a 7% pay rise “rather favorable,” including the staff at Exxon’s refineries.

Workers are back to work at Exxon’s facilities, and it will take “10-15 days to first restart the units, and then to produce finished gasoline, diesel,” the GCT trade union told Argus on Monday.

The weeks of strikes at refineries in France have left more than 70% of the country’s refining capacity offline while gas stations in and around Paris and in the northern part of the country began to run out of at least one type of fuel. France moved last week to requisition essential workers to staff Exxon’s French oil depot and threatened to do the same for TotalEnergies’ French refineries if talks failed to progress.

-

1 hour ago, james22 said:

If 25% of what the author suggests is accurate… Wow! The gloves are off. So how does China respond? Taiwan is the obvious move. It becomes even more important to bring Taiwan back into the family. And when does this shit show hit Apple right between the eyes? Might want to buy that favourite Apple device while they are still available. -

21 hours ago, scorpioncapital said:

Was Lynch talking about 20-25% cagr on revenues or profits? I can find a dime a dozen of money losing fast growers.

I don't think any really big company will meet this expectation. As for smaller ones, how do you know it will grow 20% cagr? easier said than done.

also I think the search of fast growth and low price may be a bad screen. We all know growth is gonna cost more. If you see a low p/e I am highly skeptical something isn't wrong with the growth rate.

@scorpioncapital i think Lynch’s reference to ‘20-25%’ growth is kind of a holistic thing:1.) significant revenue growth

2.) driving significant profit growth

3.) driving share price increase

With his fast growers, he was focussed on finding companies doing 1.) and 2.) which should lead to 3.) over time. With the caveat of paying a fair price for the stock up front.

-

On 10/16/2022 at 6:14 PM, stahleyp said:

Am I dreaming? Viking is thinking about buying???

@stahleyp i am sitting at about 30% cash today. Today I lightened up on some of the stuff i bought last week (like US banks) given the nice pop we have seen the last 2 days (i was down to 15% cash at COB Friday). I am trying to keep my cash balance at min 20% so i can be opportunistic on the sell offs when they come. I am patiently waiting for oil to get taken out behind the woodshed again; would love to pick up CNQ under C$65 and SU under C$39 (again). Rinse and repeat (in my tax free accounts).

—————thanks to everyone for the ideas they posted… lots of interesting opportunities to learn more about…

-

I meant to write Amazon. Thanks for catching that. I do own a little META, given how hard it has been crushed and how much it is hated right now; but i would not have META as a top 5.

-

The stock market has sold off big time YTD, with the S&P down +25% and the Nasdaq down +30%. So we know stocks are cheap. Yes, they could get cheaper. But for an investor with a 5 year time horizon, buying stocks at current prices should deliver acceptable returns.

i am re-reading Peter Lynch’s One Up On Wall Street. When constructing his portfolio his largest weighting went to “fast growers” and he set a limit of 30-40%. He defines fast growers as “small, aggressive new enterprises that grow at 20-25% per year.” This is the land of the multi-baggers.

Here is what i am looking for:

1.) growth target to 15-20% per year (i am watering down Lynch’s target a little).

2.) quality management - considered among the best in their industry

3.) stock selling at good price - my guess is most companies pass this hurdle today

So what are your top picks? Do you have 5 you think are super well positioned? The problem i have is most of the companies i follow closely today fall into other Lynch buckets like cyclicals (oil), stallwarts or turnarounds (this is where i would put Fairfax). So i am looking for ideas of companies to start to research (companies others on the board have pretty high conviction in going forward).

Here is where i have started to put some money over the past week:

1.) Alphabet

2.) Amazon (not Google)

- are these two picks large enough in size that they should now be considered stallwarts?

3.) cyber etf - CIBR

4.) cloud etf - SKYY (includes 1 and 2 above)

5.) semiconductor etf - SOXX (Should this by in Lynch’s cyclical bucket?)

- i am cheating with the above three picks… because i like the sectors (full of fast growers) but have no idea who the best positioned companies are.

————-

i have begun a starter position in CSU - constellation software. Canadian company with pretty impressive track record. Not terribly cheap.

-

Just re-reading a couple chapters in Peter Lynch’s One Up on Wall Street. Scariest time for him was between July 1981 and November 1982. This was a period when there was 14% unemployment, 15% inflation and a 20% prime rate. (Funny how people today are freaking out with Fed funds rate forecast to go to 4.5% and unemployment going to 4% or horrors 5%.)

“Then at the moment of greatest pessimism, when eight out of 10 investors would have sworn we were headed into the 1930s, the stock market rebounded with a vengeance, and suddenly all was right with the world.”

-

On 9/23/2022 at 9:13 PM, Viking said:

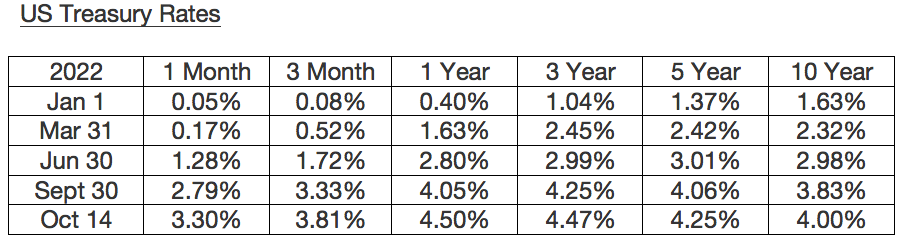

@longlake95 I agree. The increase in US Treasury rates, across the curve, continues its upward march:

2022

1 Mth

1 Yr

3 Yr

5 Yr

10 Yr

Jan 1

0.05%

0.40%

1.04%

1.37%

1.63%

Mar 31

0.17%

1.63%

2.45%

2.42%

2.32%

Jun 30

1.28%

2.80%

2.99%

3.01%

2.98%

Sep23

2.67%

4.15%

4.21%

3.96%

3.69%

This is a big, big win for Fairfax. How much of a win will depend on a couple of factors:

1.) how high do rates ultimately go?

2.) how long do rates stay high?

Treasury rates are already higher than I thought possible. But Powell just said rates will be going higher and staying higher well into 2023. Now I don't necessarily believe that is what will happen. Lets hope I continue to be wrong.

3.) does Fairfax increase duration? Not as of June 30 (still at 1.2 years). This will be perhaps the key piece of information I will be looking for when they report Q3 results. If they start to push the average duration out then that will give investors more certainty regarding the future path of interest income.

4.) do credit spreads blow wider? Not yet. But if the economy starts to roll over we likely will get a credit event. The Fed looks like it is going to keep raising rates until something breaks... I wonder if credit markets blowing out (and volatility soaring) will be the trigger for the Fed to stop and eventually reverse course.

----------

There is a short term negative to rising interest rates. And that is the significant market-to-market loss that gets booked at the end of the quarter as the fixed income portfolio gets re-valued:

- Quarter 2 = ($445 million)

- YTD 2022 = ($1.008 bilion)

- small offset: U.S. treasury bond forward contracts gain Q2 = +$32 million and YTD = +$100 million

Given the move in rates so far, it loos like the hit in Q3 will again be large: $500 million? Still, rising interest rates is a very good news story for Fairfax in 2 important ways:

1.) much higher interest income earned for years into the future

2.) potential for significant mark-to-market gains should interest rates ever come down again. Especially if Fairfax increases duration at attractive interest rates.

Well, the one way interest rate train just keeps chugging higher up the mountain... the Little Train that Could! However, we are starting to see some cracks internationally (UK and Japan). It will be very interesting to see if Fairfax has made any changes to their bond portfolio when they report Q3 results in early Nov.

-----------

Hard to see how interest rates can stay this high for too long (more than a year or so). Western governments have so much short term national debt that will need to be rolled over the next 12 -24 months and now at much, much higher interest rates. If the interest burden on national debt starts to spike what do Western governments do? Spend more (which will be inflationary)? Or retrench and spend less (not popular)?

Given what we have seen in the UK the past week, I wonder if markets will (finally) not force governments to be somewhat rational. (What a disaster monetary policy has been the past 10 years - specifically, the negative interest rate experiment.)

The most likely option the next couple of years is financial repression - actual inflation running @2 or 3 or 4% above government interest rates. So we slowly deflate the too much debt away over years (in real terms) like was achieved in the late 1940's and early 1950's.

------------

The big difference today has from the 1970's is the amount of debt that is in the system. What is an investor to do? Perhaps commodities (oil and gas) can provide a partial solution. I wonder if this is not a big part of the thinking behind Buffett's aggressive move this year into energy (Chevron and Oxy).

-

23 hours ago, TwoCitiesCapital said:

Maybe we'll see some nice buybacks executed after a hopeful dip following Q3 results

For me the pet insurance sale actually closing is a big deal. Just because it is so large. And cash is king right now (the timing of this sale could not be any better). US$1.4 billion in total, split as follows:

1.) $250 million in seller promissory notes - this will start compounding likely at a decent interest rate adding to interest income moving forward.

2.) $200 million in JCP V, a JAB consumer fund - a new investment in a company with a solid long term track record. Fairfax continues to increase the amount of their equity holdings that are managed by private equity types. Looks like a solid decision for those of us who want to see Fairfax move up the quality scale with its equity holdings.

3.) $950 million in cash.

So what do board members think Fairfax will do with the $950 million in cash?

- Shortly after the deal closes Oct 31, do they announce another large dutch auction buyback? Prem has telegraphed he wants to do this. Fairfax stock is dirt cheap. But will other uses trump this use?

- Will losses from Hurricane Ike be large enough for Fairfax to need to keep some of this cash internally?

- Will the current geopolitical turmoil (creating lots of uncertainly in financial markets) cause Fairfax to keep a higher cash balance at HO the next couple of quarters?

- Is the hard market still going strong... does funding growth at the sub level, especially re-insurance, becomes the priority for use of excess cash?

What a great problem to have

The after tax gain from the pet insurance sale will be $975 million = $40/share. That should push BV back over $600 when they report Q4/YE numbers. Market cap for Fairfax is only $10.6 billion.

The after tax gain from the pet insurance sale will be $975 million = $40/share. That should push BV back over $600 when they report Q4/YE numbers. Market cap for Fairfax is only $10.6 billion.

----------

From FFH Q2 report:

On June 18, 2022 the company entered into a transaction with JAB Holding Company (“JAB”) in which certain affiliates of JAB agreed to acquire all of the company’s interests in the Crum & Forster Pet Insurance Group and Pethealth, including all of their worldwide operations. As part of the transaction, the company will receive approximately $1.4 billion in the form of approximately $1.15 billion in cash and $250.0 million in seller promissory notes, and the company will also invest $200.0 million in JCP V, a JAB consumer fund. The transaction is subject to customary closing conditions, including various regulatory approvals, and is expected to close in the second half of 2022. The company did not record any gains in the second quarter of 2022 on the sale of the Pet Insurance Operations and on closing of the transaction expects to record an after-tax gain of approximately $975 million.

-

BAM, GOOG, AMZN

-

2 hours ago, Dean said:

@Viking I've taken a similar approach. A bit boring and may actually underperform if we rocket from a bottom but should do reasonably well as a sleep easy portfolio. One name I have been adding you didn't mention was FORTIS. Thoughts on that ? It's in a yield range traditionally that does well as a signal to long term buy. We can expect YOY div increases as well.

@Dean Fortis is on my watch list… i will likely add it to my collection if it sells off another 10% from here. In the past month 4% bond yields look like they are causing a sell off in the ‘utility type’ (higher dividend yield) part of the stock market. Makes sense. But what i have learned over the years is what looks obvious to me can take weeks or months to actually play out in financial markets (markets are reasonably efficient but it can take big funds a considerable amount of time to reconfigure their portfolios). If bond yields continue higher i expect my basket of stocks listed above to also sell off. So i am keeping my weighting such that i can add on weakness.

—————In terms or portfolio strategy, we sold our house last year (big tax free gain). And i had my best year ever return wise with my portfolio (thank you Fairfax). So my portfolio is about 3 times the size it was 18 months ago. As a result, i have decided my old way of investing no longer fits my current life situation. Bottom line i have decided to keep 1/3 of my portfolio and invest as per usual (perhaps concentrate with stocks like Fairfax etc). And take the other 2/3 of what i have and create my own ETF (collection of stocks). Most have been purchased over the past week. I am about 1/2 done and will continue adding to current positions on weakness and starting new positions that make sense. So much stuff is on sale. And i may get lucky and we might see one more big swoosh down (who knows).

1.) Bond substitute (listed above)

2.) Energy: CNQ, SU, CVE

2.) Tech: GOOG, AMZN, MSFT, META, SOXX

3.) US Financials: BAC, JPM, C, BAM

4.) Misc: NKE, LEVI, DIS, UPS, FIH—————

I did something similar in March 2020 but sold when they popped and then watched them scream higher. @dealraker ‘s posts on the ‘is the bottom here?’ thread have certainly resonated with me

And my life situation is also quite different now (all of my financial assets are now ‘paper’).

And my life situation is also quite different now (all of my financial assets are now ‘paper’).

-

Pepsi released results today. Volume was down 1.5%. Revenue was up 16%. Can anyone say super-sized ‘price increase’. I wonder if that will be inflationary?

—————

Also of interest. What do Starbucks, Apple and Amazon all have in common? Workers attempting to unionize (and not just in the US but globally). 1970’s all over again? I wonder if this will be inflationary?

—————

In Canada, companies are getting very creative. Campbell’s soup redesign their popular Chunky soup line… new can (taller) is 515ml vs the old one that was 540ml. Same list price. And less discounting. Inflationary?

—————

Getting the inflation genie back in the bottle without a severe recession is looking increasingly unlikely. Perhaps inflation is transitory. I really have no idea. But it looks to me like either ‘path’ is possible (transitory vs persistently high).

-

Put about 15% of my portfolio the last couple of days into what i loosely call ‘Canadian bond substitutes’. Most stocks are trading near 5 year lows (lower band of trading range). The average yield on the portfolio of holdings is around 5.5%.

- Canadian banks: RY, BNS, TD, CIBC (regulated oligopoly)- Canadian telco’s: Telus, BCE, Rogers (regulated oligopoly)

- Pipelines: ENB, TRP

- Life Insurance: SLF, GWO

- Utilities: AQN

i have weighted the holdings based on companies i like more. For banks, RY is my biggest weighting. For Telco’s i have Telus as my biggest weighting. I decided to do a basket approach to get exposure to each of the sectors.

i will be adding a few more names. For Canadians on the board what companies am i missing? I am after companies with +4% dividend with reasonable prospect it will grow in future years.

—————i also own BAC, JPM, C (US financials) and CNQ, SU (energy). There are a very large universe of companies out there who pay very large dividends and have solid prospects to grow earnings (as we get through the current snow storm). It reminds me a little of 1995-2005 before and after the dot com bust. Old economy stuff was dirt cheap.

-

Great discussion of where financial markets are at today. Harley Bassman is one smart dude (sounds like he grew up in the late ‘60’s). Joseph is solid, as usual.

-

The big story today is the spike in bond yields in Europe/UK. In the UK the 30 year is up 30 basis points. Bond yields are up across the curve. The UK and Europe are a mess. What is the solution? Much lower currencies. Pound at parity to the US$ and the Euro at 0.9 is probably the optimistic scenario in the next 3-4 months.

The UK economic/fiscal/currency situation now resembles that of an emerging market:

1.) exit Euro: kill your economy

2.) bad long term public policy around energy: energy prices through the roof

3.) political system in disarray: increasingly desperate measures by governments leading to deterioration of confidence in financial markets

What is the end result? A slow moving train wreck. The next 6 months things could really get ugly. Europe is in better shape than the EU. But not by much.

—————The ‘winner’? The US. And Canada to a lesser extent.

—————i was joking with my nephew who lives in France that the Canadian $ might hit parity with the Euro in 1H of 2023. Needless to say, he was not amused (at some point i do expect the oil/energy angle to push the Can$ higher).

-

During the GFC, Warren Buffet’s big purchase was a railroad stock. The reasons to buy railroad stocks is likely stronger today than when Buffett bought BNSF in 2009.

1.) railroads have a strong moat - i think we can safely say another railroad will never get built.

2.) railroads offer growth: US economy looks strongest of all major global economies; in 2009 it was the weakest by far. With deglobalization and cheap energy the future of the US economy looks brighter than major competitors.

3.) railroads are profitable - putting more business over an existing fixed cost infrastructure is good for profitability (revenue increases faster than costs).

- Oligopoly helps: with Buffett now owning one of the major players, likely we will see continued focus on profitability not market share. Very important in an inflationary environment = pricing power.

4.) ESG approved: railroads are one of the most fuel-efficient means of transporting freight by land.

- if oil prices stay high (or go higher) it will keep fuel prices elevated hurting the competitiveness of trucking

5.) stocks are available at a fair price.

Is the debt burden a big problem in a higher interest rate environment?

Living in Canada, i am looking at CN and CP. US based companies also look interesting. Does anyone have a strong opinion of who the top one or two operators are? Of course perhaps the easy decision is to simply buy Berkshire Hathaway.

—————Investing in Railroad Stocks

A guide to the businesses that keep America rolling.

-

3 hours ago, StevieV said:

I'm not sure what there is to disagree with in this statement. War is bad and we should all want it to end.

I'm not sure you've thought this through Viking. I think the WWII/Hitler comparisons to this conflict are poor for a ton of reasons. Regardless, uh, that opposition was a world war, and you can't be advocating world war, but this time with nukes.

i agree 100% with your statement: “War is bad and we should all want it to end.”I agree, my mention of Hitler in a previous post was not well done. To be more clear, what i tried to get across is some people are not interested in negotiating. That is my read of Putin. And to try and get a deal at all cost with someone like that will likely not end well. Yes, just my opinion as Putin has not divulged to me his thoughts on the matter

My analogy to what was tried, and not tried, during WW2 was a bad example.

My analogy to what was tried, and not tried, during WW2 was a bad example.

-

14 minutes ago, Dinar said:

How do you know? Seriously, you compare Hitler and Putin? How many people Putin killed? Tens of thousands? Hitler - 100 million. Do I like President Putin? Hell no, and I had the same opinion nearly 25 years ago when he gained power, I thought that no normal/honourable person joins KGB voluntarily. But to compare him to Hitler? Again, I do not know what Putin truly wants and I do not know whether the Putin or the West tried to negotiate. But to claim that Putin refuses to negotiate is absurd, have you talked to him and did he tell you that himself?

The main point with my post was not try and compare and contrast Putin and Hitler as people, leaders and their impact on Europe and the world. Hard to do that in a few lines of text. Also, you are correct, i have no idea what Putin might want to do. -

23 minutes ago, Dinar said:

I agree, the top priority for the West should be to find a way for Putin to save face and end this war as soon as possible.

How do you negotiate with someone who doesn’t want to negotiate? Just imagine if Churchill had decided the best course of action was to negotiate with Hitler (and sue for peace)? Yes, the war would have been over much earlier. And the world would look very different today, especially in Europe. Looking with hindsight, i think Churchill made the right decision.

Joseph Wang - the Fed Guy

in General Discussion

Posted · Edited by Viking

Joseph Wang delivers so much value i thought it would be beneficial to start his own thread. Adam (the interviewer) is a doom and gloomer. Probably good for business. Adam asks great questions - often peddling the ‘victim’ narrative. And Joseph does an absolute superb job in this interview of redirecting Adam… and suggesting that perhaps the world will not end… with his well thought out and articulate answers.

—————

One question i have today concerns how long interest rates can stay high. My thinking has been that there is too much debt in the system , especially government debt, and interest costs would explode. And therefore, high interest rates were not sustainable. Joseph has a very different take. He says private and government debt are very different animals. With private debt, consumers have refinanced mortgages at very low rates so most are not affected by rising interest rates; they are getting 6% wage increases and paying 3-4% on their long term mortgage. Lots of corporate borrowers also extended maturities when rates were crazy low so, overall, the corporate bond market will be somewhat insulated from rising rates. What about government? Higher interest costs are not a problem at all. They will simply issue more treasuries. Higher deficit spending on the part of the government will be inflationary. Joseph sees lots of near term trends that are inflationary (versus a return to deflation). And the fact Fed policy has no impact of government spending and debt levels also limits the effectiveness of Fed policy today (raising interest rates to control inflation). Super interesting stuff to think about.