-

Posts

3,264 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Dalal.Holdings

-

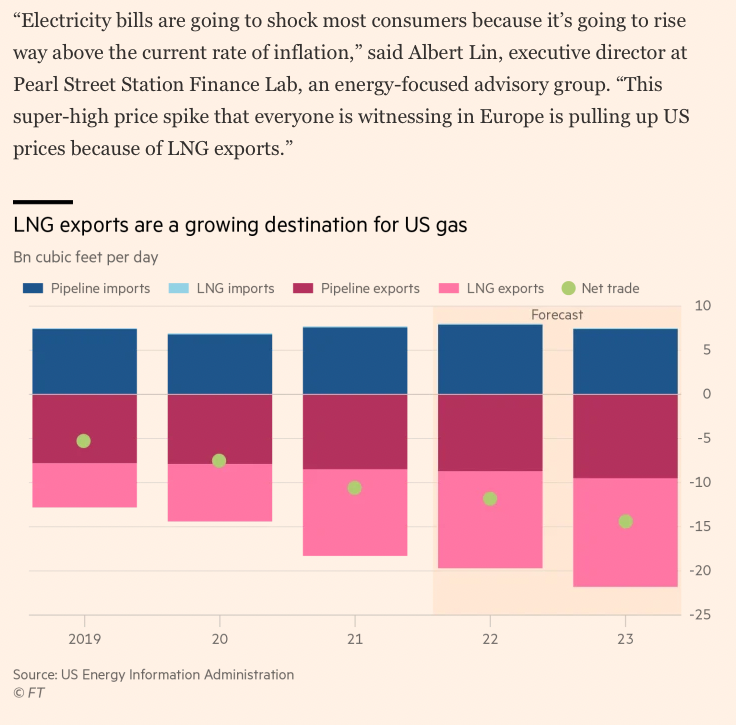

I agree that European prices are too high to be sustained in the long term; however I also think <$4 per mcf henry hub price of the last decade was way too low, so I'm betting more on U.S. nat gas producers than anything ($AR, for instance). The issue is that pipeline gas (Nord Stream) will always be cheaper than LNG which requires extremely expensive infrastructure and processes (cooling something to negative 160 celsius and storing it there and transporting it across the world will never be cheap like a pipeline). Not to mention if LNG supply is low relative to demand (due to lack of adequate LNG export terminals around the world), it will further increase the price. The other issue is that nat gas is no longer mainly used for heating, but also widely used for power generation year round thanks to the conversion of coal plants. So I think the long term picture for nat gas is highly supportive and it is unlikely we see the U.S. nat gas prices of the last decade (barring deep recession/depression).

-

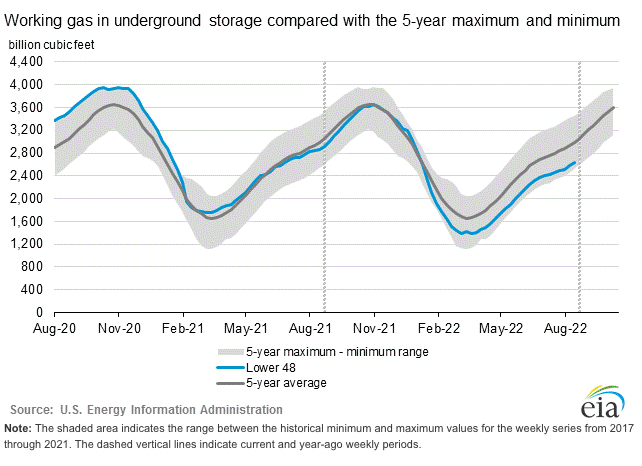

Even with full storage, Nordstream 1 being completely turned off will lead to depletion of Nat Gas and continued high pricing throughout the winter at least. And LNG will raise the premium they have to pay. https://www.reuters.com/business/energy/full-gas-storage-no-fix-europes-winter-energy-crunch-2022-08-31/ Right now, Germany and European industry is being asked to cut consumption as are households (which meanwhile are facing enormous energy costs). We all know what that portends for the economy. Fertilizer production is another major red flag, particularly in light of Ukraine-Russia war hampering grain exports from those countries. I'm not sure about economic collapse/depression, but Europe does not look enticing to me. At all. Europeans have a long history of shrugging in the face of impending doom, so I'm not sure I'd put too much weight on current sentiment. And EU leadership? I wouldn't put any weight on that at all.

-

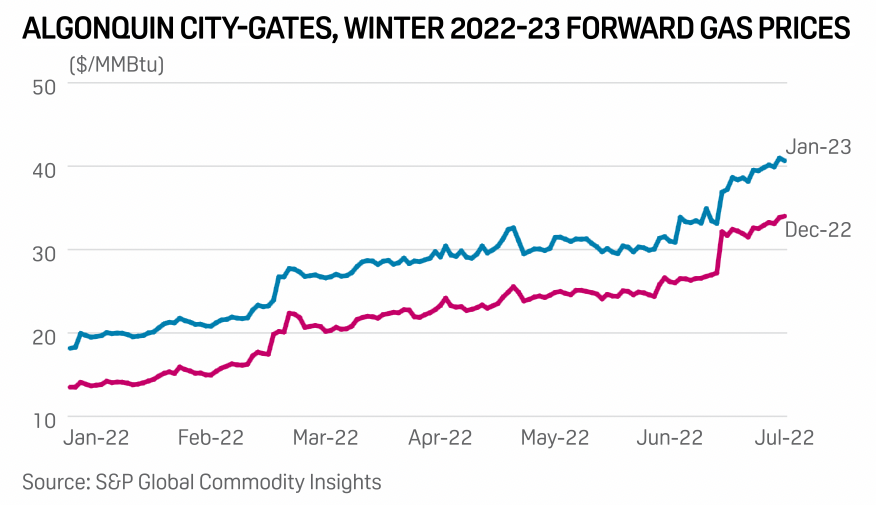

I wonder how this will work in New England which imports LNG because they've resisted pipeline development. I mean once LNG is loaded on a ship, where would you want to sell it? Obviously to the highest bidder (in this case Europe). Does this mean that New England will have to pay something in the vicinity of Europeans to get nat gas? That would be a massive premium to henry hub... https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2022/01_20/ https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/072222-new-england-winter-natural-gas-prices-top-40-as-global-lng-market-tightens

-

https://www.wsj.com/amp/articles/federal-oil-leases-slow-to-a-trickle-under-biden-11662230816 “President Biden’s Interior Department leased 126,228 acres for drilling through Aug. 20, his first 19 months in office, the analysis found. No other president since Richard Nixon in 1969-70 leased out fewer than 4.4 million acres at this stage in his first term.” This administration is creating a setup for reduced U.S. supply in the coming years. I believe most federal lands are conventional wells and supply still up on existing leased land, but there’s been a big shift by this administration.

-

Winter will be cold more likely than not and Russia-Ukraine will continue for much longer than people think (wars are fat tailed—see Iraq and Afghanistan and Syria Yemen etc). I’m just talking about the potential downsides to nat gas in the near term. I think there are far bigger tail winds and status quo/a normal winter would cause prices to rise. I think EU’s energy crisis is a culmination of decades of EU policy failure—in securing their energy sources, overdosing on ESG, underinvesting in defense, and over-reliance on Putin (Trump was right about this).

-

I've invested in Antero Resources and I think what's happening in the Nat Gas space right now *could* mark the beginning of a new era for the commodity which has spent over a decade in a shale induced glut (famous last words). I've been thinking a lot along the lines of this post: https://thelastbearstanding.substack.com/p/loads-of-natural-gas The export of gas to Mexico & upcoming start of export terminals (to supply Europe, Asia) may indeed make U.S. domestic consumers the marginal buyers of the commodity. On top of that, misguided (liberal) policies curtailing drilling and pipeline development may put upward pressure on prices. A lot of it will depend on winter and, for the time being, geopolitical events. If there is a warm winter or a sudden resolution of Russia-Ukraine, prices will head south for the time being.

-

Thanks, that's helpful (more to chew on).

-

I don't know much about plumbing, but this guy seems to think the opposite: Basically--if I understand correctly-- what he's saying is pre-SLR change, banks needed tier 1 requirements of 3% of assets but SLR change decreased that to 1%. By ditching the SLR change, it will raise that back up to 3% and banks will be net buyers of US Treasuries...

-

Custom orbits seems like a good edge to have for this co as ride-sharing doesn't optimize the orbit. This company seems more focused on getting satellites up, they even have a platform to develop satellites, sell them to the customer, and launch them for them (Photon). Neutron seems like it will move the game to constellations. Unlike SpaceX, they seem to be more of a "do more with less" type of culture which I think can keep costs low and competitive. Looking at total amount of capital they've raised thus far and all that they've accomplished, I think the results speak loudly. Ignoring SpaceX for a moment, I can't understand why SPCE would have a market cap of twice this thing. I think the accomplishments of this company are far beyond Virgin Galactic. And they have customers and revenue today... Overall it's probably one of the most attractive SPACs I've seen (I do not think highly of SPACs)...at this price and EV of just $4.1B, it could easily be a target for a big firm or some egomaniac billionaire (there are plenty) looking for a platform to get into orbit quickly. Edit: the EV of $4.1B (market cap of $4.8B - ~750M cash) is implied by a $10 price for VACQ. Adjust accordingly.

-

This is exactly what concerns me--that inflation will not be something that occurs gradually, but in a highly nonlinear fashion that is "unpredictable", black swan like. A lot of economic phenomena occur like this thanks to lots of interconnectedness and feedback loops existing in our modern system. I say it's better to prepare for it than to ignore the risk due to extreme asset price sensitivity to rates at these levels.

-

I think of a project that is extremely delayed, vastly over budget (>$1 Trillion) as a failure. The fact that the USAF is relying on old fighters like the F-15 and F-16 is due to the failures of these contractors in developing a cheap, viable next gen fighter on time. The DoD is partly to blame for some of these problems, but I put more blame on the contractors. The risk is black swan type: eventually America's adversaries develop better fighters because their defense firms are vastly more nimble and competent. Or there is another black swan type risk like what SpaceX did to Boeing and LMT's space program (ULA): a much nimbler challenger emerges to disrupt them. My view is ULA will eventually be folded thanks to SpaceX. But lots of barriers to entry in defense and an Elon Musk type doesn't come around often...

-

These are great businesses because even when they do a bad job, their main customer is a captive customer. And Congress just keeps writing the checks. Bad for taxpayers which is a shame. F-35 is a great example. I think I prefer LHX to the big names because their products are involved in an array of different projects rather than having single contract risk. F-35, NASA Mars Perseverance Rover, Satellites, Drones, etc etc. Because of this "diversification" of revenue streams, LHX also seems to have a lot lower risk of single big failures sinking its prospects (i.e. Boeing and 737). Edit: and there's a lot less risk of LHX's sensor/antennae/avionic malfunctions becoming a huge potentially systemic headache for the co vs a large, complex project like an F-35 or 737 failing. A lot more simplicity to their biz.

-

I'm not sure why we are trying to read the price of gold as a predictor of inflation. Clearly the equity and bond markets are not foreseeing much inflation, so why should we expect gold investors to? Does the efficient market hypothesis apply to gold? Are gold investors somehow accurate predictors of the future? My thoughts are that all markets may be mis-pricing the risk of inflation/rate uptick (that includes gold), so there is no asset out there that would provide insight on that. Also, as I pointed out, rates merely need to rise to 3-4% to cause big problems for equities. You don't need hyperinflation to cause problems for equities, just moderate inflation. Gold might not even move much if that happens because inflation could be 5% in that scenario. As far as reserve currency, the U.S. has a lot of goodwill and many nations benefit from its hegemony. I think an alternative rising in the next decades is unlikely unless the U.S. abuses its position significantly beyond current levels. There are major political barriers that prevent the others from being accepted as a reserve. And clearly if you look here, it's not just the U.S. that is engaging in this grand experiment, so why would the Euro or Yuan be preferred here when they are behaving just like the Fed: https://www.yardeni.com/pub/peacockfedecbassets.pdf

-

Since 1971, we are slowly finding out, through trial and error, that the fiscal capacity of the United States is much larger than anyone ever thought since we are a sovereign issuer of our currency (which also happens to be the reserve currency). So I think comparisons are difficult between today and pre-1971. I would even say they are difficult pre-GFC and post-GFC because of vastly different Fed monetary regimes in place since the GFC. Still chewing on this... The fear in this scenario is that as U.S. politicians grow accustomed to lack of limits ("through trial and error"), eventually they push it too far which threatens the reserve currency status...maybe we are far from that point, but surely there is a limit.

-

Wabuffo, your take on today's reserve currency status vs historical pegging to gold is interesting. Quite a bit to chew on. The post is gone?

-

I think Burry, et al. are overdoing it with the Weimar talk, but putting aside "hyperinflation" how can we be so sure there will be no inflation of significance? Here is one historical parallel I keep thinking about: Looking at other periods--for example, the 1940s: The 1930s has deflation/low inflation due to long shadow of Great Depression The 1940s had high inflation due to WW2/massive fiscal spend And now: The 2010s had deflation/low inflation due to long shadow of GFC 2020-2021 massive fiscal spend due to Covid pandemic, so... ?

-

A potential win/not-lose aspect is that: "One pill every two weeks fights diabetes, cancers, heart failure, and 18 other diseases". :) Covid-19 was recently added to this list. Isn't there an analytical risk here? Disclosure 1: over the years, i've had to periodically participate in committees which had to decide if the single payer should pay for certain propositions (there was typically a few participants whose main line of argument was: what is there to lose? a similar line of argument is used now to justify the 2T fiscal shot in the arm). Apologies: i tend to focus (too much?) on second and other higher order effects (the 'unseen' ones). Disclosure 2: i'm in the process of being enrolled in a study (based on strong foundations) which will follow people at relatively high risk to be exposed and to contract covid over the next few months. One arm of the study will receive vitamin D supplementation and the other arm will get a placebo. (i may receive a placebo but will watch for the side effects; you must be aware that the placebo group will also report side effects?) Though Vitamin D may be beneficial and there is an asymmetry to supplementation (low downside, potentially good upside), this is classic correlation does not necessarily imply causation fallacy. You have to be very careful in medicine from making wild associations like this and concluding that Vitamin D is some kind of silver bullet. What is more likely to be the ultimate source in the graph you posted of healthiness and Vitamin D levels? Remember, sunlight --> increased Vitamin D. So what is really likely happening is you are looking at people who get more sunlight. Is the sunlight the reason they are healthier? Unlikely, unless they utilize photosynthesis. Sunlight is another correlation, not necessarily causation. But people who get more sunlight are likely to be a certain type of person: these are people who are likely to be more active, "not sick", and physically fit. So the causation is likely to be: better physical fitness --> less risk for medical conditions (which we already know: exercise is good for you); but also: better physical fitness --> more time in sunlight --> more vitamin D (the true causality for health likely comes from the physical fitness, not the Vitamin D which is merely an association). We also know that lighter skin tone people produce more vitamin D in sunlight. We know in a lot of countries that ethnic minorities who are darker are more at risk of many medical conditions, partly due to socioeconomic status impacting lifestyle with genetics contributing as well (particularly in the countries where a lot of Vitamin D research is done). SO the true causation is likely to be: pale skin tone --> better socioeconomic status --> healthier lifestyle --> less risk for medical conditions but also: pale skin tone --> more vitamin D generated due to less melanin in the skin (again, the vitamin D likely just a mere association) And none of the above considers the bias present in "Grassroots Health", an organization likely heavily biased on the topic...

-

Yeah, corporate rates going 22% to 29% would reduce earnings by 9% bringing the earnings yield to 2.25%... It’s astonishing how nonlinear the trend gets as you get down closer to zero rates: interest rate sensitivity of asset prices becomes very high in the regions closer to zero. I hope no one is using the 10 year yield as a discount rate in computing intrinsic value... If the S&P earnings yield goes to 5% without a change in earnings, that means the index is cut in half.

-

The other steep curve: With the current ttm earnings yield of the S&P at 2.5%, any spike in rates would have large implications. One must consider the tail event -- even if low in probability, the magnitude of loss would be quite large with a rise in rates even to 3-4%. When rates are low, asset prices are much more sensitive to increases in interest rates due to the steepness of the curve... Even though I usually don't care about macro, this might be one of the few times where macro has a huge effect on equity pricing...

-

It's all social media manipulation/marketing and about preserving reputation whilst bilking followers. The "woke" folks are forced to give him a pass. He even did a live event with AOC (after promoting GME). Just social media manipulation (hey, he did get his start working at Facebook doing the same exact thing, didn't he?). If he really cared about climate, he wouldn't be all in one of the biggest energy wasters out there today: crypto.

-

Now do what happens when returns are negative... ;D So is he the next Buffett or what? Old fart Buffett is using dated math. Unlike Chamath, old Warren is out of touch and just "doesn't get it anymore". :o

-

"It's been a super tough week for me..." Imagine what a real bear market in tech will do to these folks.

-

Investing Lessons/"Mistakes" from 2020?

Dalal.Holdings replied to valueinvestor's topic in General Discussion

Obviously we disagree about certain individual issues, but this is a good assessment. It's very easy to fool yourself into thinking you made a mistake in the immediate past. Only in the long run do mistakes become apparent. Many folks would have called it a mistake to sit out in 1999-2000 ... You have to think -- given what was known at the time, was my action a mistake or wise? And ignore the outcome especially if it's a short term outcome. I too missed out on RUBI/MGNI, but the jury is still out on whether it will be a long term success story if you ask me -

This This play, which he only held for 1 day, was a 5x and more importantly helped him build goodwill with the next generation of investors. These are the investors who will be buying his holding company when it goes public. It was a smart business move that communicated to retail investors "I'm on your side." Well, your statement again highlights the contrast with Warren. You know who didn't need to "build goodwill" with investors but could just build book value from capital allocation decisions and investors would come along based on actual returns? Buffett. Berkshire was very obscure in the early days.