-

Posts

2,522 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Dalal.Holdings

-

The difference is that Elon is not a politician. His opinions on EVs, rocketry, and free speech (Tesla, SpaceX, X) are pretty robust. His opinions outside those fields may not be, but they are not relevant because he does not operate in those areas. Just like a brilliant neurosurgeon may have some weird views outside of neurosurgery. Politicians should be under much closer scrutiny because they devise policy in areas that encompass vast swaths of society, far outside each's individual expertise.

-

The launch was great. The media spun and even FAA trying to spin it as some sort of failure. Bias against Elon and inability to understand iterative process that SpaceX takes is the culprit. Meanwhile, SpaceX's competitors (Boeing/Lockheed/ULA) are nowhere to be seen in this race...(though the size of their government contracts are orders of magnitude greater)

-

Public Company Share Repurchase-Cannibals

Dalal.Holdings replied to nickenumbers's topic in General Discussion

COF will have to shift its customer FICO profile to achieve high returns. But yeah the DFS assets are potent and as a DFS shareholder I think totally being undervalued -

Public Company Share Repurchase-Cannibals

Dalal.Holdings replied to nickenumbers's topic in General Discussion

A great business getting acquired by a much worse one that's also much more vulnerable to economic shocks... -

Bill true to form

-

Slick Willie providing a live demonstration of the Streisand Effect. His wife must be thrilled with him. His long winded posts evoke Shakespeare: "Brevity is the soul of wit"

-

Even better is that if Aducanumab got full medicare support, it would become the most expensive drug ever for medicare at tens of thousands of dollars per year per patient (and medicare is already a massive expenditure as it is)...a massively expensive drug that probably doesn't work paid for by the U.S. taxpayer...absolutely disgusting. https://www.nia.nih.gov/news/experts-estimate-future-spending-medicare-aducanumab-treatment#:~:text=The analysis revealed that if,impact on Medicare's annual budget. I remember supposedly intelligent investor types were pumping BIIB when it was approved. Reminds me in many ways of Valeant...

-

Some people claim that Presidents who are Democrats are bad for oil production. The last five Presidents contradict that notion completely.

-

Joe Biden needs them gas prices to go down, not up, for 2024

-

https://www.bloomberg.com/news/articles/2023-12-16/red-sea-shipping-chaos-as-us-military-defends-threat-to-commercial-vessels?srnd=premium U.S. and UK militaries involved in repelling attacks

-

Unlike the Gulf War, Maduro will need a strong navy to gain and hold control of offshore fields. It won’t be as simple as rolling across a desert into Kuwait and taking its onshore fields. He would simply be blown out of the water by the U.S. if he tried to make a play for Guyana’s offshore fields. It would be child’s play for the overpowered U.S. Navy to defend Guyana’s offshore oil.

-

https://www.statista.com/statistics/266292/number-of-pirate-attacks-worldwide-since-2006/ Piracy attacks have fallen precipitously over the years, likely due to anti-piracy measures taken by USA/etc since the Maersk Alabama incident (the Djibouti bases are evidence of this). I think a few recent headlines of Houthis taking ships are leading to overestimation of the impact to trade in the strait.

-

Look across the Strait...there are many countries with interests and capabilities to respond to piracy/threats to trade in Bab-el-Mandeb. Some rebels are not going to credibly be able to harm trade for long with so many of the world's powers able & ready to take them on. Maduro's threats are a red herring. He's got Chevron coming in to help rebuild his exports and Biden helping bail him out so long as he plays ball. A hot incursion into Guyana is not feasible. Even Brazil and other Latin/Caribbean nations would oppose and the U.S. would most definitely respond switfly and militarily (& Brazil might join). His popularity is a mirage and his economy in tatters with millions fleeing. Any confrontation would end faster than you can say "Desert Storm".

-

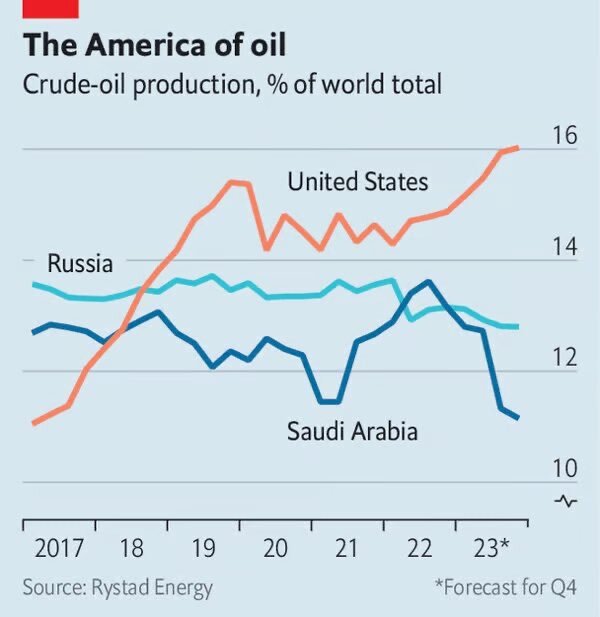

https://www.nytimes.com/2023/12/01/business/energy-environment/us-oil-production-record-climate.html Anyone want to venture a guess as to what happens to oil prices if USA continues on track to producing 15M barrels/day and more production also comes online in Guyana, Venezuela, etc ?

-

Oxy buying Crown Rock for $12B. Stock and debt issuance. These oil guys and gals can’t help themselves…

-

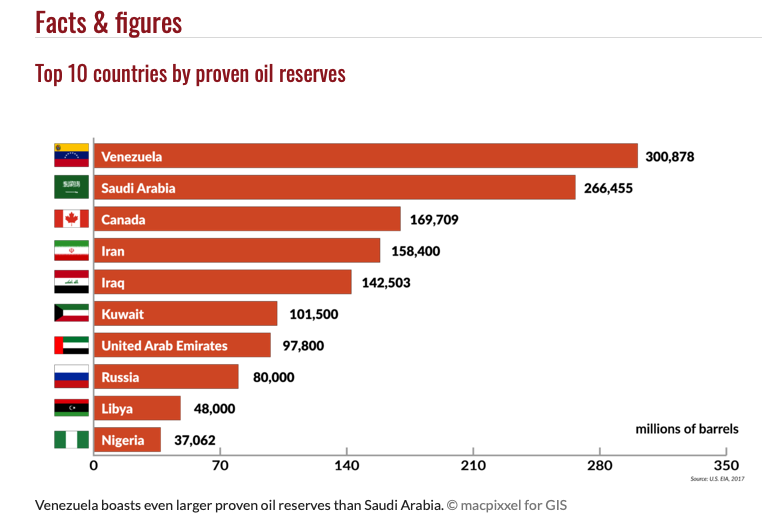

The irony of the leadership of Venezuela wanting its people believe that acquiring more oil reserves will solve their problems... Severe case of Dutch Disease along with a strong dose of socialism. https://www.gisreportsonline.com/r/venezuela-oil/

-

The majors are buying US shale basins in large recently announced transactions that will take some time to clear regulatory hurdles and close. From then on, it too will take time for the wells to deplete where it might be supportive to oil prices. In the meantime there are still independents out there including private ones. There is more and more oil coming out of Guyana, there is talk of reducing sanctions on Venezuela, etc. Additionally USA gasoline demand has yet to breach 2018 peak due to EVs/vehicle fuel efficiency. In the meantime, you have major economies cooling off from a bout of inflation heading into a possible downturn. OPEC+ has taken production offline temporarily and yet prices continue to fall. And yet many in OPEC+ need the revenue (to fund wars, etc) so it is only a matter of time until they too boost production (indeed there are already disagreement within OPEC+ about cutting and the details of the cuts have not been revealed). I don't think the majors nor OPEC+ have enough control to maintain prices. I think shale drillers will have to learn the hard way (again). I'm too skeptical of high oil prices to buy oil stocks here. Shale oil has successfully put a ceiling on oil prices now for over a decade.

-

U.S. producers are doing a good amount of flooding on their own...

-

When I see what has happened to U.S. oil production--supposedly in an era of rising cost of capital and "decreasing capex", I'm not too excited about buying oil producers These guys never learn Drill baby drill!

-

SBF found guilty on all counts after less than 5 hrs of jury deliberations... These Ackman tweets have aged like fine wine

-

Depends--if the downside comes with decades spent in a prison cell, it's certainly not 100%. If you can be the CEO of a big bank circa 2007, then the downside is much more favorable and you can lever up far beyond 100%. Also, SBF and his crew had pretty much all of their own net worths invested in the scheme, so they were fully exposed as well. Another clear indication that they were not aware of Kelly.

-

For anyone interested, here's the thread that definitively shows how SBF has no idea what Kelly Criterion means: It's amazing to me that an MIT graduate with a bachelor's in physics and a minor in mathematics doesn't understand Kelly. It also shows the dangers of people mindlessly wielding economic theories which are full of assumptions and caveats.

-

He was totally wrong about "positive EV" way of thinking and failed to understand Kelly Criterion as well as ergodicity. This is pretty crazy because that's how he based all his decisions. Destined to blow up... He's no genius & is out of touch with reality. Even some of his lines in the book such as those about Shakespeare reek of someone who was playing the "aloof genius" character (in addition to the hair, outfit, etc). Just given his answers in the court room as well as to Michael Lewis, one can see a habitual "fudging the truth" and "evasive answers" modus operandi & the guy even admits he just says things that people want to hear to win them over (while "multitasking" on some computer game). Amazing how many "professionals" put their faith in this guy and were enthralled from the moment they met him...Michael Lewis included.

-

https://www.pacwestbancorp.com/news-market-data/news/news-details/2023/Banc-of-California-and-PacWest-Announce-Transformational-Mergerand-400-Million-Equity-Raise-from-Warburg-Pincus-and-Centerbridge/default.aspx PACW and Banc of California to merge. $400M equity raise included. Wholesale funding reduction. PACWP preferred stock becomes Banc of California Preferreds under the same terms. Halted after hrs. Seems like PACWP holders might make out well..surging after hrs. Even the common holders don't get washed with this one. Deals like this one can breathe a lot more confidence back into bank equities (common and preferred) than the FDIC mediated sweetheart deals of earlier this yr.