mcliu

Member-

Posts

1,201 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by mcliu

-

Interesting. The fact that anecdotes like that exist seems to points to a frothy market. I mean in how many other cities can you flip a house in a day for a 10% gain?

-

Thanks wisdom. Would the yield be before or after CAM/opex, taxes, maintenance capex?

-

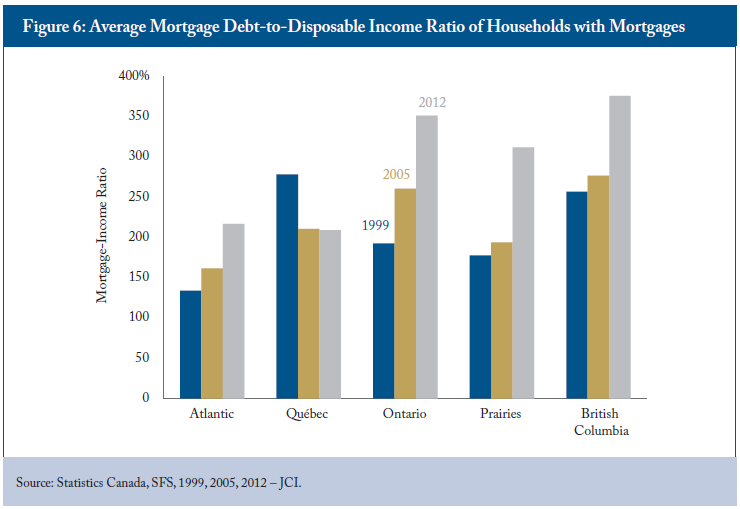

I attached the "Mortgaged to the Hilt" report that was mentioned in the Fairfax annual letter. Some of the findings are downright scary. ex. Household Debt to Disposable Income has risen from 200% in 1999 to over 350% in 2012 for Ontario. The percentage of households with Debt-to-Income >500% has risen from ~2.5% to ~12.5% in Ontario and ~7.5% to >20% in BC over the same period. Interestingly, while total debt has gone up significantly, RBC's affordability report suggests that ownership costs have not risen as a result of lower interest payments. I wonder how much further this can continue, I mean at some point, you have to wonder whether households can afford to repay the principal amounts. On the bright side, if housing does ever wobble and consumers face a balance sheet recession, BoC can always keep cutting rates now that there's no zero bound. ;D 0% mortgages anyone? Also, does anyone here actually invest in Vancouver/Toronto residential real estate and have some data on unlevered/levered rental yields? february_2015_rbc_housing_affordability_report.pdf Mortgaged_to_the_Hilt.pdf

-

I wonder about that too. It just seems like the housing market is too big for foreign capital to have such a big impact. Too bad there's no data on this. I was looking at this BBC article on Australian housing: "Last year Chinese buyers spent a record A$12bn on Australian property, boosting house prices at a time when locals were already feeling anxious about the rocketing cost of property." http://www.bbc.com/news/world-australia-35601102 Not sure if that's accurate, but if it is, then it's tiny compared to Australia's outstanding housing-related debt of $1.5 trillion. The growth in housing credit (7.6%) last year or $108 billion is significantly higher than the $12 billion of Chinese buyers. http://www.rba.gov.au/statistics/tables/xls/d02hist.xls?v=2016-03-09-11-13-12

-

I guess another question is: at what prices would make you believe that a bubble has formed? Would it considered a bubble if median prices were $3 million, $5 million, $10 million or is there no limit? Are there some similarities between what's happening in Toronto/Vancouver and Sydney/Auckland/Melbourne. (Would they be considered global cities too?) It seems like Australian prices were fuelled by a combination of foreign demand and lax lending. Thoughts? http://www.bloomberg.com/news/articles/2016-02-22/one-sign-australia-s-housing-market-is-due-for-a-2008-moment What about major cities like Chicago, Houston, why aren't they experiencing such elevated home prices. Apparently, prices in Milton, Ontario(?) Increased by 42% yoy.. Is that even part of the GTA? http://www.theglobeandmail.com/report-on-business/economy/housing/the-real-estate-beat/torontos-hot-housing-market-drives-big-bidding-wars-in-suburbs/article29053048/&ved=0ahUKEwihx4K8s7HLAhWHhywKHTKZA-oQqQIIGigAMAA&usg=AFQjCNHWv6ncMw0Mqn5oVkISEeBae2NXuQ&sig2=ajPFoh6gjTEmrtEBapiJpQ

-

At least one of your assumptions is incorrect. http://www.thestar.com/business/real_estate/2015/10/24/the-rise-of-willowdale-torontos-hottest-new-neighbourhood.html "Land values alone have escalated so dramatically the last couple of years in this area just east of the North York Civic Centre that Jalali says banks are appraising most original homes at 97 per cent land value." Is there some sort of land constraint or zoning regulation in the GTA area? When I look at Google Maps, there's so much land.. :o The article you pointed out seems to be land that's pre-built. What about values for land for new construction? It just seems like, out of all the countries in the world, Canada should be the last one having a shortage of land problem. Also, is there a big pricing discrepancy between residential land and farmland? Is it hard to get farmland re-zoned to residential? Just trying to understand the market here. At these million+ prices, it still seems very profitable to buy a couple of acres of land, convert it to residential, built a stack of homes.. Are there any publicly-traded Canadian home builders? Would be nice to look at the financials..

-

With homes trading so far above replacement value, why aren't there people building homes like crazy in Toronto and Vancouver? The margins must be huge. And it's not like there's a shortage of land..

-

Do you have to be a permanent residence to buy a house?

-

What was his performance? Was it that dire? Market really isn't off by that much from its highs.. ???

-

What do you think is true, that most everyone believe the opposite?

mcliu replied to LongHaul's topic in General Discussion

Don't forget Vancouver Real Estate. Everyone thinks Vancouver RE is not a bubble since it's land constrained and there will always be demand from Chinese buyers. ::) -

You would add the minority interest to your equity to get EV and compare multiples based on that EV.

-

-

rb is right. You can't claim the small business deduction if your corporation is solely set up to hold investments. That said, it's actually not that bad to invest through an IHC due to tax integration. As long as you dividend out your gains to the individual, the tax rates are about the same whether you invest through a corporation or as an individual. However, if you plan on retaining those dividends in the corporation, they will be taxed at the highest marginal tax rate.

-

Does anyone know what Michael Burry has been up to recently?

-

Sounds like you're having one of those years. I've had them, and it sucks. What you have to wonder is: Are you having bad luck despite a good investing process, or do you need to rethink your approach? Personally, I ended up rethinking my approach. Maybe you can also see whether your YTD results are due to share price fluctuation or an actual impairment in underlying value. I mean even if you're an amazing investor you can't possibly make money every year because stock prices fluctuate a lot more than underlying values. Likewise, for the same reason, some bad investors can outperform the market in the short-run. Over time though, the good investor will prevail. Anyways, long-winded way of saying short-term price fluctuations shouldn't matter.

-

I do agree that the article presents too many anecdotes as evidence. On the other hand, the author probably had limitations since it was probably hard to find and aggregate data on these private firms. Plus he has to write for an audience that may not be sophisticated financial types. In the article, the author does mention that even some VC guys like Bill Gurley (that do have access to the data) express concerns at the excesses. I was hoping that maybe there's someone close to the action here that could prove/disprove some of the things in the article. I'm on the fence on this one since there seems to be a lot of genuine innovation but a lot of stupid-apps. I guess the other question is, how much is too much? Also, I do admit, "Silicon Valley" and "Bubble" are pretty vague terms. I'm not posing this as a serious question as much as a rehash of the title of the article. Just wanted to generate some discussion. (Didn't want to post a question like "Do you think the latest post-money Series B valuations are too high given historical averages?") Plus, the data on these things seems to be quite sparse. I would be happy to change the question into something more "appropriate" if you could give me some suggestions.

-

What's a better way of putting it?

-

http://www.vanityfair.com/news/2015/08/is-silicon-valley-in-another-bubble Valuations for SaaS and mobile companies seem to be very high. Are we in another bubble like the dot-com bubble? Your thoughts?

-

Another incredible data point, approximately 70 billion square feet of real estate currently under construction in China. "In the first seven months, the floor space under construction by the real estate development enterprises accounted for 6,541.72 million square meters, up by 3.4 percent year-on-year, dropped 0.9 percentage points over the first six months. Of which, the floor space of residential building construction area was 4,560.08 million square meters, up by 1.0 percent. The floor space started this year was 817.31 millions square meters, down by 16.8 percent, and the pace of decline expanded by 1.0 percentage points. Specifically, the floor space of residential buildings started in the year amounted to 566.84 million square meters, down by 17.9 percent. The floor space of buildings completed stood at 378.33 million square meters, went down by 13.1 percent, and the pace of decline narrowed by 0.7 percentage points. Of which, the floor space completed of residential buildings stood at 280.77 million square meters, went down by 15.6 percent." http://www.stats.gov.cn/english/PressRelease/201508/t20150813_1229936.html

-

My question is, if monetary policy is so powerful and printing money is so easy, why did Japan have such a hard time getting out of deflation? Japanese M2 is up almost 30% since 2007 and BOJ balance sheet has tripled, but CPI has essentially gone nowhere. Is the BOJ so incompetent that they just can't print enough money to revive inflation? and are the other central banks around the world more competent than the BOJ? Well as I said before there are certain fundamental differences between the western economies and Japan. One of them being that the Japanese are prodigious savers and not very consumerist. The Americans are about the opposite of that. This results in chronically weak domestic demand in Japan. If you want to disregards that fact go ahead. There is more to creating inflation than printing money. You need to have people that want to spend it. You have more of those in America than Japan. It's also easier to prevent an economy from going into deflation than to pull it out. Is that true though? Velocity of M2 shows a different story. https://research.stlouisfed.org/fred2/series/M2V/ I would recommend reading this piece: https://www.stlouisfed.org/On-The-Economy/2014/September/What-Does-Money-Velocity-Tell-Us-about-Low-Inflation-in-the-US So why did the monetary base increase not cause a proportionate increase in either the general price level or GDP? The answer lies in the private sector’s dramatic increase in their willingness to hoard money instead of spend it.

-

My question is, if monetary policy is so powerful and printing money is so easy, why did Japan have such a hard time getting out of deflation? Japanese M2 is up almost 30% since 2007 and BOJ balance sheet has tripled, but CPI has essentially gone nowhere. Is the BOJ so incompetent that they just can't print enough money to revive inflation? and are the other central banks around the world more competent than the BOJ?

-

I think the tax paid would be the same as any other company in that jurisdiction. What you should see is the deferred revenue balance shrinking as the amount is earned and booked into the income statement as revenue with accompanying expenses. The tax should be based on the earned income of the year adjusted for whatever tax accrual/deferrals..

-

Seems like maverick's the argument for equities is: Slow growth -> low rates -> higher multiples -> buy equities [because higher multiples > slower growth] High growth -> higher rates -> lower multiples -> buy equities [because higher growth > lower multiples] but it seems like you can make the same argument for: Slow growth -> low rates -> higher multiples -> sell equities [because higher multiples < slower growth] High growth -> higher rates -> lower multiples -> sell equities [because higher growth < lower multiples] Conclusion: inconclusive ::)

-

Given that the company is in liquidation, I think your thinking is correct. You've basically collected the $100 million upfront, but have not earned it yet. The true cash flows would be the $100 million net of the costs that would be incurred to provide the good or service to the customer. The current cash balance is likely much lower since you would be earning it over the next few years.