thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

i sold all my remaining Berkshire yesterday.

-

I disagree. 100's of managers shut down a year without committing fraud. Him losing AUM and shutting down and the management company being worthless is completely normal. Even highly successful fund managers shut down. I can think of a few who voluntarily returned billions and just quit as well as many more who lost their AUM because they failed from an investment standpoint or failed from a sales standpoint. the vast majority of fund managers have no terminal value beyond the founder's career. having your management company become worthless is not equivalent to fraud and not equivalent to your investment funds going to zero. the disagreement re the loan payments is sketchy and deserves scrutiny. my gut is chanos would not commit such blatant fraud, but we'll see. courts will figure out.

-

i don't really get that, I think the goal of his long/short fund was absolutely to make money (it allegedly made quite a lot for a very long time). the goal of his short only vehicles was to make money (when combined with the long investments of his underlying investors). goal of any GP is to make money off fees in addition to the investment returns. all sources indicate he's sucked for a while. He ran a long/short fund. - there's a 2017 and 2020 article in media (II and FT) claiming spectacular long term moneymaking performance by said fund. its so good, that as I've noted in the past, I'm skeptical and think it's probably VERY front loaded or erroneously quoted or even somehow mistated. either he WAS an amazing investor or something amiss. - and in fact using the 2017 /2020 claimed record you can deduce he hasn't done well for a long time he ran a short only fund - there's a track record 1985-2005 floating around on here that you/parsad/et all think is very bad and I'd regard as phenomenal if short only and if true. the type of short return that when combined with long book would compound at high rate (as claimed by the long/short fund) there's some public info on the performance of a European UCITS fund he launched in 2022 and shut down in November 2023. it did poorly. https://greenash-partners.com/documents/Chanos/Monthly-Factsheets/Chanos Feb 2023.pdf https://www.hedgeweek.com/swiss-boutique-green-ash-to-close-chanos-long-short-equity-fund/ So putting it all together - II / FT have reported returns of the l/s fund. they report very very very good moneymaking performance from inception to 2017 and 2020. from the short only fund track record and the description of the l/s strategy (which says they index on long side) this was driven by short alpha / effective short selling. - all publicly available info, including the words of chanos himself, indicate he's had a rough go of it for a long time, since the mid 2010's and not made money, AUM collapsed (from $7B to "family office" alpha generative short selling helps a fund compound capital. negative alpha generative short selling destroys capital. some third parties corroborate very very good early returns for chanos. ALL sources of information are consistent on him sucking of late, including him.

-

Chanos haters will take joy in this amusing e-mail thread regarding the state of the firm's investment strategy as of late 22 From a Mike Salem at Kynikos From a guy invested in Chanos & Co and angry about it in response.

-

I read the minority investor's complaint (a bit cumbersome to screenshot, but the juiciest parts are in public domain. it sounds pretty bad. below is Chanos defense. the biggest point of disagreement seems to be whether the money that Chanos put into the mgt co (Chanos & Co) was a repayment of the loan to him or merely a capital contribution to the mgt company that did not in fact repay the loan. here's Chanos defense. they allege Chanos & Co's CFO mischaracterized these as capital contributions. CFO says Chanos still had loan on 2022 tax returns and they were not repayments. a bit of a he said / she said. As an aside, it's a nice window into tax efficiency. Chanos runs an investment firm. he owns several trophy properties. the investment firm makes a loan to him secured by the properties, nice tax efficient monetization of the company (i assume that's why structured this way).

-

that’s not my interpretation. from what I read - Colson bought a minority stake in the HF manager (Chanos & Co) in 2020. At the time, AUM was $1.5B, down from a peak of $7B+ - Chanos & Co’s AUM has collapsed since; they shut down funds in late ‘23 All else equal, I’d expect a minority stake in GP/mgt company to be worthless when AUM collapses. An important nuance is that from what I read, Chanos was removed as GP from the LP that held the minority stake in Chanos and Co, and not the GP of the institutional funds he managed. I have been unable to find the full suit though, so happy to be proven wrong. As Cohodes points out the bar for LP’s removing GP is incredibly high. If I’m fact that LP was not constituted by a diverse group of institutional investors, but instead by 1-2 people who bought a GP/mgt company stake that’s now worthless, it makes more sense that he’d be removed as GP. regarding the loan to Chanos, the repayment or lack thereof, the story is conflicting so not sure what do do with that without more information sale of condo seems kosher if realtor paid market rate and condo got fair value. Bad optics of course, but not clearly wrong to me as with all things Chanos, we’re feeling one part of the elephant and have imperfect information.

-

that's what makes a market. from my standpoint, long term real rates at >2% are the highest they've been since 2010 and is a very reasonable rate to lend to the sovereign. long term nominal rates offer one the ability to defease legacy debt at a discount and a disaster deflation hedge w/ punch. i worry more about reinvestment risk / rates going away and not making money on that, then about rates going up more. but hey, I'm the guy who startged the "Bonds!" thread in April 2022 and has seen bonds underperform bills so far.

-

Let's say for whatever reason, you need $100 in 30 years. you have a choice between 2 instrument to get that $100. You can buy a 30 year zero coupon bond for $28.75 / 4.3% yield. At maturity, it will be worth $100. or you can buy $28.75 t-bills @ >5% Let's say you buy t-bills and make an extra 1% / yr for the next 10 years. rates don't change at all. In 10 years you will have about $48 dollars. If you bought the 30 year zero, you'd have ~$43. Now let's say there's a global depression and short term rates drop to 0 for the next decade. (years 11-20) and long term rates go to 2%. Your t-bill option is now making nothing and risks not making it to the $100. Your 30 year zero would rocket to $67.5 (it's a 20 year now) and you'd make up far more than the carry you lost in the first 10 years by not going in the higher yielding t-bills. And you know you can just hold and it will be $100 in 20 years. there's no reinvestment risk. you are promised your $100 nominal in 2054. an extreme example using the longest treasury and the shortest for affect, but the people buying treasuries are doing so to fill some need and the next 12 month's yield is certainly not the only need. think if you're a pension seeking to mathc LT liabilities, an individual seeking deflation / depression hedge, an individual defeasing one's mortgage, an insurance company looking to lock in a known yield over 5,7,10,20 years. the t-bill provides more yield and has no duration risk, but it has FAR more reinvestment risk than other bonds. rates go down and you make nothing. no compensation for your yield going away. I'm happy to underperform bills by owning bonds in exchange for a little punch if rates decline.

-

i mean the end game is to issue as absolutely much as they can while there stock is where it is. I'd view it as absolutely devastating those who were short @ prices pre this most recent run. they just massively increased intrinsic value per share (assuming they don't completely incinerate the cash).

-

this is why God created IRA's, TIPS, and munis.

-

78% of Americans live paycheck to paycheck

thepupil replied to Blake Hampton's topic in General Discussion

#lifegoals (though maybe I’ll be earning some carry every now and then) -

78% of Americans live paycheck to paycheck

thepupil replied to Blake Hampton's topic in General Discussion

I'm in this camp as well. being mortgage free would stress me the fuck out. I'm simply not rich enough to forego the $xxxK of liquidity afforded to me by my mortgage. maybe if i had assets in excess of say 10x my mortgage, I'd pay it off. even if the rate were high ish (say 6-7%), I wouldn't want to give up the liqudiity/flexibility/diversity of having a mortgage offset by a bunch of different kind of assets. I've gotten to point where cars are low single digit % of NW...I don't bother financing those even when cheap, so I understand at a point, it becomes a "who cares about optimizing" but need like $6,8,$10mm to just casually pay off my mortgage to have one fewer bill. -

78% of Americans live paycheck to paycheck

thepupil replied to Blake Hampton's topic in General Discussion

agreed! I've said this before, but I think the degree to which people bought at low rates really creates an impressive amount of transaction cost for selling one's home. Let's settle on a low rate mortgage being worth 80% of par. If you move (and prepay) you are buying back a mortgage worth 80% at 100%, so you're losing 20% of par. At 40-70% LTV, that's 8-14% of asset value. Tack on the usual realtor fees and shit of 8% and you're talking about 16-24% of ASSET value in transaction costs of moving and even bigger % of your equity. I think if I moved sold my house, I'd instantly be worth $300K less. in other words, my liquidation value is much less than my Gross NAV. -

78% of Americans live paycheck to paycheck

thepupil replied to Blake Hampton's topic in General Discussion

a couple of quibbles. - in spitball you changed $250K / $500K (50% of par) to $337K / $500K = 67% of par, so i agree with the direction - A 30 year mortgage at 3% does not exist today. There are plenty of 23-26 year mortgages at 3% but no 30 year mortgages. Using the treasury curve, a 26 year 3% mortgage (which exists) is worth 85% of par. a 30 year 30% mortgage (which does not exist) is worth 78% - Your discount rate of 6% is about 130 bps higher than treasuries. a 26 year using tsy curve + 130 bps is worth 74% of par. a 30 year using tsy 130 bps is worth 69% of par (in line with your calculation...close to your 67%). By using a term that's 4 years longer (low rate mortgages were originated 3+ years ago) and a discount rate that's about 130 bps higher than the treasury curve, you are coming up w/ a discount that's significantly higher. 15% (85% of par) to 31% (69% of par). we can all make various assumptions and come up with a range of values, low mortgages definitely have value to the borrower...it's just not quite as high as people think. to be clear, there’s nothing wrong with using a 6% discount rate, just explaining reasons for different view on what the PV is. -

78% of Americans live paycheck to paycheck

thepupil replied to Blake Hampton's topic in General Discussion

I agree with this, but would point out that the value of that bond is much higher than $250K. Because I'm a complete nerd about this, I have a spreadsheet that automatically imports the yield curve and discounts each future mortgage P&I payment at the relevant zero coupon rate. My mortgage has 316 months left on it, has a 2.875% rate, and is worth about 83% of par using the treasury curve 75% at tsy curve + 100 68% at +200 63% at +300 50% at +600 38% at +1000. The weighted average life of the principal payments on my mortgage is 177 months, so while it was a 30 year mortgage in its now a 26.33 mortgage and the principal payments are on average just 15 years away so rates have not made 30 year mortgages worth 50 cents on the dollar. More like 80%. So the way i see it is that a risk averse person with my mortgage should just buy bonds (I buy about $5K / month in my 401k) as a way to slowly defease the low cost mortgage. An enterprising investor should buy riskier assets do do so. There's a tax angle as well. Assuming full taxability of the treasury interest, at the maximum federal rate, the return on treasuries is actually treasuries MINUS 1.5%. At that discount rate, my mortgage is worth a full 97% on the dollar (assuming no mortgage interest deduction). It's here where the argument for simplicity and just paying off the mortgage is strongest. If the choice is between treasuries in a taxable account and paying off mortgage where taking the standard deduction and there's zero tolerance for market risk,and no value placed on liquidity flexibility, then just pay off the mortgage. I value flexibility, liquidity, think i'll make more than treasuries (but am buying those in a tax advantaged account) and don't envision paying off the mortgage until i move or 2050 -

Nothing is without risk and things that we can't contemplate can happen, but for the on the run 30 year bond to fall 50% in price, yields would have to go to 9.9%. duration risk is dynamic and has changed drastically since the 30 yr yielded 1.2%. as rates move up, duration risk decreases (modified duration of 30 yr bond is now like 16)

-

agreed, have some for my parents IRA.

-

regardless of whether i hold any, I think the CLO AAA ETF's are a great way to make a decent pre-tax return without taking duration risk, but with taking some incremental mark to market risk and credit relative to t-bills. it's pretty simple, you make SOFR + 100 -150 (5.3% +100-150 =6.3-6.8%), SEC yield on JAAA is 6.7% and you're betting on CLO's having <40% ish cumulative loss from defaults (which won't happen unless, to quote Jamie Dimon, the earth hits the moon). for a portion of someone who wants something safe, but wants to make more than bills, seems pretty good to me.

-

haha, strangely, despite having little knowledge in the sector, my timing and IRR on energy investments has been excellent over the years. mainly a bit of contrarianism and, because of lack of knowledge, a focus on lower debt/high quality co's that were around for upcycle.

-

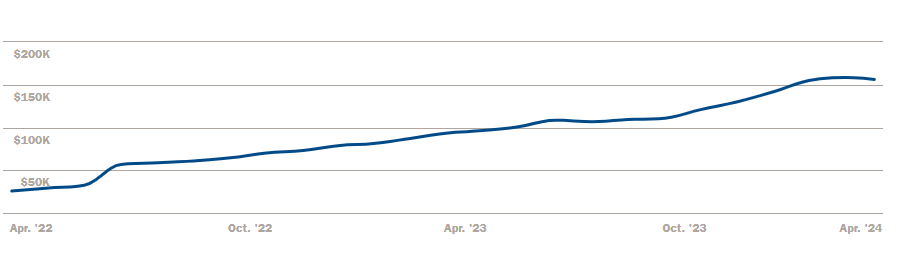

it's small for me too. here's my 401k, was it "gutsy" to just be buying bonds instead of bills/stocks as they made 0% while i contributed to this thing which is not a huge % of my NW?...at beginning of thread i said, "time to start building and I'll be way too early and wrong". so far I've been right on being wrong lol. the below is just boring, rather than gutsy...just buying something where it's really hard to lose nominal $$$'s on as rates rise because you just keep re-investing at higher rates and duration keeps dropping as your coupons get fatter. is it gutsy to have recently bought like 10% on mgn in 20-30 yrs outside of this account over the last week or 2? I really don't think its gutsy at all. the downside is really easy to think about/model (outside weimar like debasement*) and i actually think portfolio is incrementally safer layering in a little duration. maybe that makes me a baggie risk parity bro... gutsy would be going full risk parity bro and having like 100% stocks 100% of account in LT bonds. gutsy would be getting long millions of 30 yr futs. I'm not gutsy. I'm just trying to survive/ be ready for a variety of environments. to that end, I think that 4 / 5 / 6 handles on safe no default bonds demands an allocation >0%, whereas 2011-2022, for me at least, 0% was the right bond allocation. *which is why we have 2 jobs, a mortgage that exceeds all my nominal bonds, and the other 80-90% of the portfolio. but so far wrong, underperformed t-bills, should have waited two years to start. alas, I'm not good at timing.

-

yea, above example assumes one cannot (I've had years where it's made sense and years where it hasn't). if you can then tsy yield 4.8%, 3.0% after tax mgn rate 6.3%, 3.96% after tax -96 bps of carry on 30% of your portfolio you're losing ~1%/yr, only 30 bps / yr of negative carry to the whole portfolio to own some punchy recession/deflation hedges that will make you a good bit if LT rates go down.

-

2 years later after start of thread and bonds have underperformed t-bills by 4%/yr and SPY by 8%/yr as the index's yield has increased from 3.5% to 5.25% (actually yields more since that's YTW and MBS will yield more than their YTW) I'm continuing to plow the entirety of my 401k into bonds and have recently started to buy long term tsy's on margin in my taxable (having sold most of my IG corporates after the late 2023 rally). credit risk free MBS >6%, LT tsy's approaching 5%. good stuff. I'm a buyer. no corporates. IG spreads way too low in my opinion. not for everyone but if you buy say 30% in LT tsy's at 4.8% on margin at interactive brokers, at top federal tax rate, you're making 3% after tax yield, fund w/ 6.2% margin and you have negative carry of 3% on 30% of your portfolio. At constant yields you lose 90 bps/yr on the portfolio. But in a recession where rates drop just 1%, you get 30% of your portfolio going up 20%, 2% =42% for 600 - 1200 bps of PnL when you want it most from liquid monetizable instrument. if rates go up another % you lose 15% on your 30% / -450 bps. almost no mgn requirement. JPow is making bonds great again.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

this one is out of blackstone's $30B fund BREP X which closed in 2023. I think the lower premium / price reflects the fact that this one is being bought by higher cost of capital institutional PE fund rather than the retail BREIT fee machine. While the 20% premium isn't some giant payday, it shows that public MF REITs clear private "opportunistic" hurdles (at least in this case, it clears BREP X's). this looks like a $6 billion equity check which seems pretty big for a $30B fund. Perhaps this will be done in conjunction w/ co-investment from say a SWF or they'll rapidly decrease the equity consideration with sales of some portion of the portfolio (a la the classic Equity Office Properties txn).....actually they'll probably put a bit more debt on it than AIRC has on it now so that's another way to decrease the equity check lol. https://www.wealthmanagement.com/investment-strategies/blackstone-raises-more-30-billion-giant-real-estate-fund -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

$AIRC -

How is the Fed going to cut rates with inflation over 3%?

thepupil replied to ratiman's topic in General Discussion

SPX sales/share for last 20 years is in high 3's-4's, EPS / share high 6's (average of 10 yr CAGR's). So I'd say the history/empirical observation is the reason. If you don't put stock in margin expansion continuing then sales/share which seems roughly in line w/ nominal GDP seems fairly predictive over long term (with lots of noise of course). there's been absolutely zero mean reversion in margins over the course of my (going on 15) year career despite people calling for it and in fact market has been more weighted to higher margin businesses, so I'm not entirely dismissing your point, but for S&P 500 at least (profitable large caps) long term per share sales growth has empirically not been to high. the Nasdaq 100 index does have higher sales growth. last 10 years for example (2023/2013), = 11% per year per share sales growth and 12% per share operating earnings growth. it trades for 35x 2023 29x 2024E and 25x 2025E