thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

yea, I don't have a garage / side yard that could fit a boat (or a car capable of towing something > aluminum jon boat [not chesepeake bay worthy] for that matter)....or the maintenance skills. I'm a useless suburban millennial -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

I looked into buying a boat recently. For a center console that I could fish the bay with, whether i spent $20k or $200k on the boat, fuel maintainance, winter storage, slip fees, insurance m, etc would be $10-$20k/year in my area. Decided to forget about it and charter/rent from other owners for $500-600/day. Do it 20x / year, it’s still cheaper. -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

agreed. our neighborhood is not expensive as SB, but pretty expensive. it's practically an Uppababy showroom and teeming with an increasing % of "young" (early to late 30's) first time homebuyers/families. in no world should Santa Barbara (a paradise by all accounts) be affordable. -

lol, that's just an unsecured installment loan lol (to a good credit)

-

I bought $7,000 of March 2023 calls on ZROZ which trades at $102 ($105 call for $7). this basically gives me the upside (but not the first ~10% move) on $100K of long term zero coupon tsy bonds which have duration of about 27, so it gives me (in a big move down in LT rates) about as much duration as owning $350-$400K of the bond index (though index more diversified across curve). they'll probably expire worthless in which case, I'll lose $4000-$7000 after tax. I will continue to buy these as long rates blow out as i think they provide some upside participation on inflation normalization, as well as depression / deflation hedge (though if that happens, won't make enough to matter). starting small. doubt i have the chance to get big because I'm not in the "6% tsy's" camp.

-

Citadel is moving to Miami, which is an 8.5 hour drive from Panama City Beach.

-

House near me. 3/3, 1800 sf, 40's build, updated but nothing spectacular, would have been $850-$900K pre-covid. Listed at $1.05mm, sold $1.15mm w/ 3 days of listing w/ multiple offers. the zestimate was about that price as of January 2022, but peaked at $1.3mm in May 2022. appreciation in my area was always a bit slower than the hottest of markets and i'd expect things to stagnate for a little given where rates are, but disaster has yet to hit the aspirational early to mid 30's beltway bandits. EDIT: all of this is driven by close to zero supply for something like this which is about 70% of the median SFH price in the area. Overall Inventory in the zipcode is down 20% YoY and probably much lower than 2 years ago.

-

I am impressed with your problems. Well done!

-

downsides: 1) the industry is in secular decline and has less obviously transferable skills than others. 2) there's probably a less equal distribution of good jobs than tech/consulting/corporate. there's just a huge amount of SWE's at FAANG's and other tech co's making very good money, have nice lives, etc. i have a very good job in investment management. it's pretty niche and opportunities are few and far between. 3) the bureaucracy, politics, and bullshit that exists wherever you have well paid people focused on self preservation and advancement / careerism exists in investment management. i think this is true of almost any hard charging high paying field. upsides: 1) no real formal education requirements. I've made money every years since undergrad and never had to get an advanced degree (this doesn't apply to someone going to b school) 2) high pay per unit of stress/effort across the entire stress/effort/elite spectrum. you can make millions at the most elite of jobs that will run you ragged, but even at the lower end, the field pays well. 3) see number 2. 4) see number 2.

-

that's more believable to me. thought you were talking about South Florida.

-

i'm from south florida and have had many friend/family in market (albeit more in the $1-$2mm range than $4mm range) and south florida resi real estate is the largest holding of the (extended) Pupil family. i feel like i have a decent but not super close pulse on the market. it's the $700K in 2016 that doesn't make sense to me. a house that's worth $4mm today was worth $1.8-$2.2mm in 2016, not $700K.

-

you gotta post the link. I don't find this sequence believable. home prices are up, but they haven't 6x'd in 6 years.

-

Does how much money a person has reflect their value to society?

thepupil replied to Gregmal's topic in General Discussion

hahaha, ouch -

WEB owns $92 billion of stock The Gates foundation owns about $7.5B (28mm B shares) Collectively they own about $100 billion. Berkshire's market cap is $590 billion. Buffett and the Gates foundation collectively are a 17% owner, not a majority shareholder. My understanding is that Buffett donates about $3-$6B /year in total about 85% of which goes to the Gates Foundation. They buyback has been $24B in 2020 and $27B in 2021 and Berkshire is and has been reducing shares outstanding. I don't think you should be necessarily concerned about this given the shares are not all donated/sold at once and Berkshire is indeed buying back the donated shares (and then some). I think a more relevant concern is the governance implications as Buffett's A shares go away, the non-Buffett A shares become very powerful. https://twitter.com/thepupil11/status/1394304208313098248?s=20&t=kOspZ81fvpypQOVm-yYwAA

-

I see cash HY at about 8.5% yield / $87 avg dollar price and CDX at +590 today. Getting closer to buying high yield bonds....

-

I respect Chanos, long term he's got a good record of short selling. He plays fast and loose with the numbers that he throws out on REITs and uses different definitions/analytical methods that make things incomparable. My 4.5 cap is his 3.0 cap. He never adjusts for development always subtracts full s,g&a (we can debate this one ad nauseum), only quotes trailing even if we knwo of material changes that will happen w/ the go forward (like a building coming online or somehting)...he generally has a bearish bias and things each cycle is the next s&L crisis and that we're going back to 10 caps. from interactions he seems very focused on the filings / reported financials rather than looking thorugh to the substance with respect to things like joint ventures for example. his and others views helped me sell office at what were in hindsight good prices, but i pretty much disagree with every single number the guy ever throws out. I don't think he's "lying" so much as he has his view as to what's the right way to analyze these things and that view vastly differs from mine. over time the market will decide who's right. Listen to what he says. Note the reasons and look into them, but run your own numbers. It's one dude's view.

-

US Investment-Grade Bond Yields Surge to the Highest Since 2009 High-grade yields have more than doubled this year to 4.89% Higher rates, global economic worries push borrowing costs up By Josyana Joshua (Bloomberg) -- A fresh selloff in the world’s biggest bond market is ramping up funding costs across Corporate America as investment-grade yields spike to the highest since October 2009. The yield on the benchmark Bloomberg high-grade index closed at 4.89% on Monday amid the rout in Treasuries -- recalling levels last seen in the depths of the global financial crisis and higher than than the 4.58% rate in the March 2020 pandemic rout.

-

yes, the bond index yields about 4% now with duration of 6.4. 1 year ago it was 1.45% with 6.6 duration. the index is getting a little shorter in duration and the yield is getting much better. I think the risk / reward on bond index on the whole is quite reasonable. there's a lot of hullabaloo about the MBS market right now as fed tightens...I think MBS are very interesting right now w/ 4% yield, virtually no credit risk and prices below par, such that prepays/defaults are actually a good thing now. MBS is 2nd largest portion of bond index. bonds down 3% since beginning of thread, but much better than stocks. think that bonds will continue to outperform if rates rise (but be down).

-

I am thinking of buying a basket of KRC / VNO / PGRE / SLG

-

Twilio bonds @ 6.9% yield. $5B of cash, $1.3B of debt, market cap ~15x the debt value. Had previously bought at $86 and sold at $92 over 8 days. then < month later at $82. nice volatility in the bond market. there's tail risk with anything, but i think the company would be hard pressed to be worth <$1.3B.

-

I don't think long term rates beyond that which we have now are in anyone's interest and also would be out of line with long term demographic/indebtedness trends. I'd also note that significantly higher US yields (across the curve) will make continue to make US FI very yieldy relative to the rest of the developed world. Austrian 2117's trade at 2.5%, German 30 yr at 1.5%, 40 year JGB's at 1.1%. German 2 yr at 0.6%, Japan 2 yr at -0.08% bonds are about flat since the start of this thread, I remain hopeful that I'm wrong and that rates (moderately) increase and allow for safe bonds to earn higher returns (getting there will of course entail some losses). But I think it's more likely than not that we're closer to bottom in bonds than most think. we'll see...many people think i'm very wrong on this...

-

for those subject to state taxation, taxes on dividends can be 25 - 33%. it's a major factor,. I don't really love dividend paying C corps for the taxable account...until the dems tax repo's same as divvies, I think corps that pay a dividend are doing taxable shareholders a disservice (and this kind of makes sense because taxable shareholders aren't the dominant portion of equity holders)...if i were a low income florida resident i'd feel differently...I prefer pass through entities (partnerships/REITs etc) or earnings retainers for taxable. $100 of pretax earnigns $80 post tax (20% corp tax rate) $80 dividend $56 post tax dividend (30% tax rate) 44% effective tax rate on dividended earnings. forced incidence of tax $100 pretax earnigns $80 post tax buy back $80 of stock. shareholder chooses when tax is realized (and may defer quasi perpetually via borrowing/margin) think we'll have to agree to disagree here...i don't really see any real difference between 2014/2022 with regards to whether or not berkshir eshould pay a divvy. in fact, the capital return has become far more satisfactory (the repo program is more sensible, flexible, and material) so if anything, I see even less of need for a divvy now than before i also think WEB has cultivated a shareholder base that would very much not want a divvy...though that will depend on how a few big holders of a shares feel.

-

Business Week - 1979 - The Death of Equities

thepupil replied to Viking's topic in General Discussion

-

Business Week - 1979 - The Death of Equities

thepupil replied to Viking's topic in General Discussion

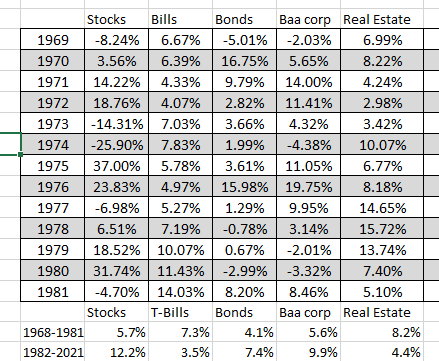

stocks returned less than t-bills in the 70's (5.4% vs 7% 1968-1981), and abouyt the same as high quality bonds.... but of course that massive decade long de-rating set things up for a hell of a next 40 years. the equivalent of t-bills in the 70's is i-bonds since normal t-bills don't yield 7%.