-

Posts

3,485 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

Yes, in a way there is already Keynesian intervention happening and the system is getting floated continuously.

-

But instead of everybody working less and consuming more, you had capital form a sort of "rental class" that lives paycheck to paycheck, being forced to rent most things instead of owning them and never joining the post fordist aristocrat party!

-

US is not going down the flames at all, just the amount of capital existing in that country will do wonders, never bet against america. BUT China is not to ignore and they deploy a lot of positive things that the west lacks IMO, they are a serious competitor and that also explains the serious anxiety by western governments. My point was that the US more and more outsourced manufacturing, has few very high paying jobs in finance and technology sectors and LOTS of service jobs of whom many can be put into the bullshit job category. Does the whole country REALLY still need to work 50 hours a week and maintain that work ethic? Its hilarious if you look at it from above, many many people could probably work 15 hours a week and call it a day but thats not how the contracts are set up, most people are also not willing to share that they spend at least 1/3 of their time unproductive just browsing the web or working very slowly, its just not necessary anymore and it will be even less in the future.

-

That "App Developer" is surely the average employee in the US!

-

Problem is that much of the value creation has been outsourced out of the US, the US is only a custodian to that creation. Thats why you have either shitty service jobs or all of these bullshit jobs as David Graeber put it well: In the year 1930, John Maynard Keynes predicted that, by century's end, technology would have advanced sufficiently that countries like Great Britain or the United States would have achieved a 15-hour work week. There's every reason to believe he was right. In technological terms, we are quite capable of this. And yet it didn't happen. Instead, technology has been marshaled, if anything, to figure out ways to make us all work more. In order to achieve this, jobs have had to be created that are, effectively, pointless. Huge swathes of people, in Europe and North America in particular, spend their entire working lives performing tasks they secretly believe do not really need to be performed. The moral and spiritual damage that comes from this situation is profound. It is a scar across our collective soul. Yet virtually no one talks about it. So what are these new jobs, precisely? A recent report comparing employment in the US between 1910 and 2000 gives us a clear picture (and I note, one pretty much exactly echoed in the UK). Over the course of the last century, the number of workers employed as domestic servants, in industry, and in the farm sector has collapsed dramatically. At the same time, ‘professional, managerial, clerical, sales, and service workers’ tripled, growing ‘from one-quarter to three-quarters of total employment.’ In other words, productive jobs have, just as predicted, been largely automated away (even if you count industrial workers globally, including the toiling masses in India and China, such workers are still not nearly so large a percentage of the world population as they used to be.) But rather than allowing a massive reduction of working hours to free the world's population to pursue their own projects, pleasures, visions, and ideas, we have seen the ballooning of not even so much of the ‘service’ sector as of the administrative sector, up to and including the creation of whole new industries like financial services or telemarketing, or the unprecedented expansion of sectors like corporate law, academic and health administration, human resources, and public relations. And these numbers do not even reflect on all those people whose job is to provide administrative, technical, or security support for these industries, or for that matter the whole host of ancillary industries (dog-washers, all-night pizza delivery) that only exist because everyone else is spending so much of their time working in all the other ones. These are what I propose to call ‘bullshit jobs’. While corporations may engage in ruthless downsizing, the layoffs and speed-ups invariably fall on that class of people who are actually making, moving, fixing and maintaining things; through some strange alchemy no one can quite explain, the number of salaried paper-pushers ultimately seems to expand, and more and more employees find themselves, not unlike Soviet workers actually, working 40 or even 50 hour weeks on paper, but effectively working 15 hours just as Keynes predicted, since the rest of their time is spent organizing or attending motivational seminars, updating their facebook profiles or downloading TV box-sets.

-

-

IF the ETF approved, will you make Bitcoin a NEW position?

Luke replied to james22's topic in General Discussion

What wealth gain will the bottom 50% get with bitcoin over the lets say next 5-10 years when it will replace the dollar and why? What do you mean by this new "freedom"? How will lives changes for people that had their money invested in assets before anyways? (stock based pension fund, owning house etc)? If you own bitcoin why would you "move your wealth"? Isn't decentralization making that unnecessary? Okay, most people invest in assets anyway? Will cash (bitcoin) be now better than assets? Why? Will the state not be able to get any taxes anymore when the bitcoiners replace the dollar? How will the country function? -

Whats the fair value for bitcoin right now, i.e at which value should I load up the truck?

-

Yes, if anybody can recommend me good restaurants and other good things to do in Japan/Osaka and Kyoto Area, out with it!

-

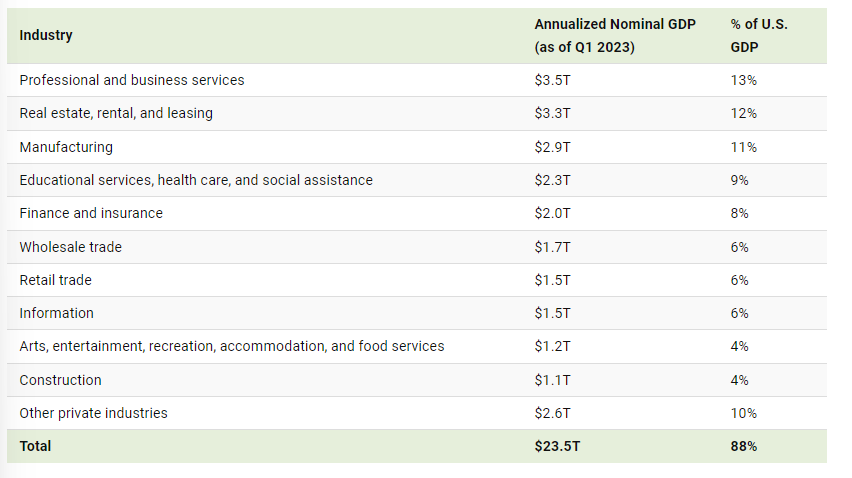

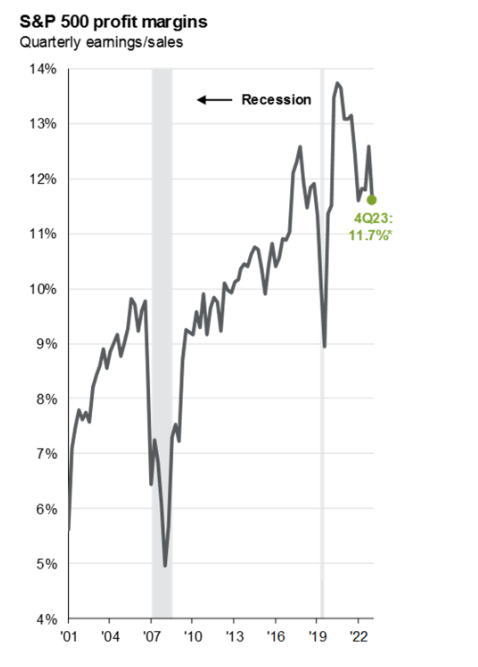

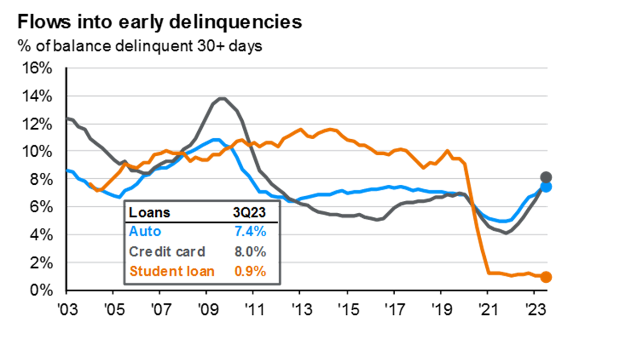

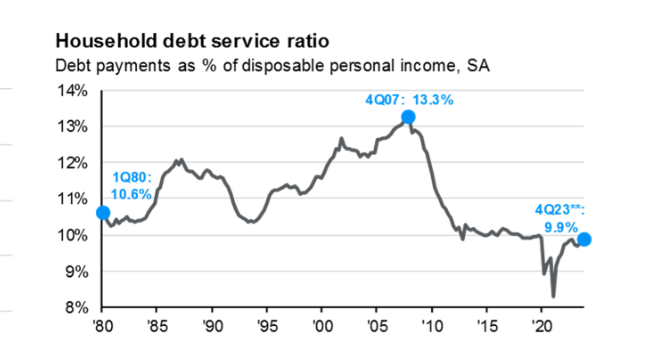

JPM guide to the markets 2024: Valuations close to 1 STD above 30 year average. Returns at these valuations historically not amazing Profit margins: Fundamentals Value vs Growth: Top 10 performance vs rest: Early delinquencies: Debt: The consumer: Inflation cooling: Expected rate cuts: Outperformance EM? EM markets cheap!: Interestingly higher buyback announcements in Japan and relative higher discount to US:

-

Great clip by the DPP, the PR department hit it on the nail, havent seen such a good election video ever in germany.

-

Have been there a lot when I was a child, great place, enjoy!!

-

BUT there would be a very strong hard market after it too and the cashflow that comes in is still significant, so from today's position even that seems to be not AS bad as it would have been some time ago IMO

-

The most worrying risk would be a multi billion loss due to a once in a century hurricane/earthquake. So huge catastrophe losses that will kill returns for multiple years or even lead to some selling of assets to recover. Although unlikely, we never know by how much climate change will fuck things up or maybe just not. Its a swan risk one has to live with in insurance unfortunately

-

Yes, all the berkshire superinvestor holders can only be jealous!

-

Haha yes agree with everything, it was and still is madness. Ironically my GF bought some gambling bitcoin a year ago on one of these online banking apps, i didnt even know. She came to me a few days ago and said that she made 50% gain on like 300€ or so. I told her to sell it and never look back and she did...

-

Bought some more Prosus on margin...

-

Liquidated BRK, added to Consol Energy

-

Lol, me too...its one of the few things i open early in the morning, checking at lunch, then after dinner...so much good input and knowledge base. Then all the fintwit, listening to financial news online, reading financial news...it doesnt stop

-

Another day, another dollar! By Size: FAIRFAX PROSUS AMR NINTENDO ALIBABA EVO AB OXY TENCENT VALARIS EXOR PDD LUFAX CONSOL BERKSHIRE I have tried a lot of things and compared to last year a lot of stuff went out and a lot of stuff went in

-

Exactly, higher than average margins, lower than average taxes etc etc. higher tensed macro, onshoring, increasing global hostility. Wouldn't want to take the bet.

-

Taiwan attack, war with China etc are an easy -50% drawdown, if not more.

-

Considering there is almost no sharecount shrinkage in the index and margins peaked 2021, youd need 4 years to recover of that drawdown (4% sales growth+2% dividend+19x earnings)

-

SP 500 trades at a PE ratio of 26'35 as of 29th DEC. Getting back to 19 is a 30% crash, very significant.

-

Happy new year to everyone on the board, lots of prosperity and good fortune!