-

Posts

3,485 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

Could be possible they have some, i am not sure -

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

-

The board remains moderately bullish for this year and the index, interesting!

-

Haven't found any thread that discusses this, quick question: Do you remember by how much margin requirements increased during the covid drop in 2020? I know they increase margin requirements by about 35% for Reg-T accounts during US election volatility, how is that for portfolio margin accounts? Maybe someone can let me know, haven't used it back then. Any help is much appreciated.

-

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

If only taiwan could get nuclear weapons -

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

And this is 100% not what the CCP wants. I guess with mutually assured destruction we can easily see this conflict drag on through the generations and maybe even find a peaceful happy ending at some point. -

What are you listening to ? (Music thread)

Luke replied to Spekulatius's topic in General Discussion

Pretty amazing piece and voice, Arvo Pärt is worth checking out, amazing composer: The harmonic sequence from 2:00 to 2:30 is gold -

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

This is a very good point in mentality difference, if their first born son gets absolutely destroyed by the defensive wall when entering taiwan and these pictures go on live telly, there will be absolutely massive unrest. China could just bombard taiwan from distance with rockets but what good does it do to them if they kill 15m and have an empty island without any important ressources, supply chain broken, forever ruined national reputation etc -

Thanks for sharing John, it surely is a bedrock of a company. Id also put it on my 30 year list, including Exor.

-

Any concerns that they throw the money out the drain when they turn 18/21? Id probably not make any account for kids but allocate my money if it makes sense (inviting them on trips, paying expensive uni etc). When I was 18 I certainly wasn't old enough to get 6 figures that I can spend on anything. If id have an account for kids id also use index funds probably, enough energy to take care of one portfolio.

-

Thanks for sharing, i never bothered doing deep DD on JOE, is the general consensus of the board that this is still value with decent upside/downside relations? Agree also with the other businesses, all strong moats.

-

At todays valuations, for a 30 year period, id be relatively comfortable to put my money into these stocks at equal weights: 1. Berkshire 2. Fairfax 3. Prosus/Tencent 4. Nintendo 5. LVMH Not sure if you will beat the index with that because over 30 years many things can change but those would be my best long term horses

-

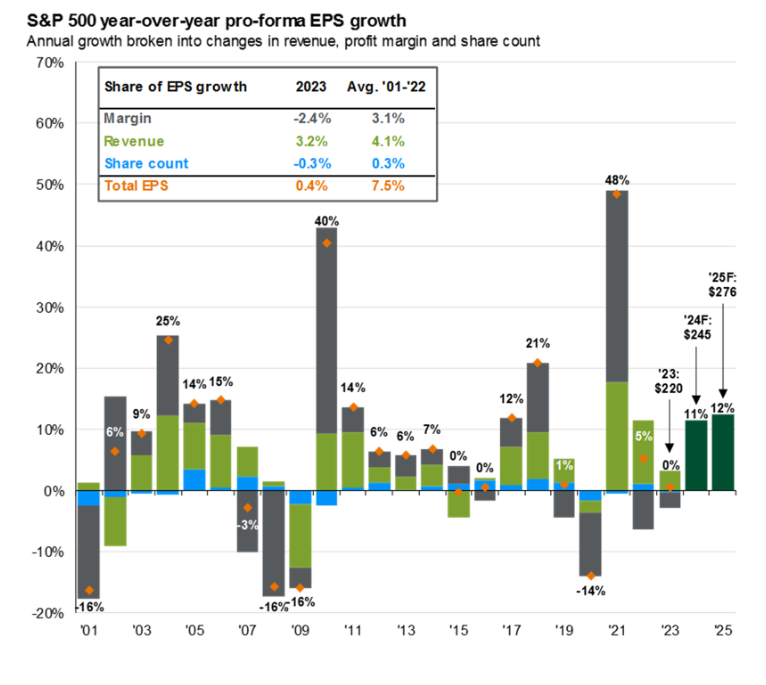

With a stable multiple of todays 26x and JPMs estimates coming in true at 245 USD Earnings for 2024, the SP 500 will stand at 6.370 end of this year, a 32% return Then another 10% for the year after! TTM Earnings for the SP 500 is at 182, well see what happens Q4!

-

https://www.bloomberg.com/news/live-blog/2024-01-13/taiwan-presidential-election Ruling DPP’s Lai to Claim Taiwan Election Win With KMT Set to Concede DPP’s Lai to claim victory as rival KMT, TPP to concede Taiwan is electing new president in three-way race DPP appears set to extend eight-year grip on power Election set to shape relations with China, US

-

https://www.bloomberg.com/news/articles/2024-01-12/tencent-added-back-by-3-billion-top-asia-fund-despite-china-s-gaming-rules?srnd=technology-vp $3 Billion Top Asia Fund Bets on Tencent Again Despite China Gaming Rules Federated Hermes Asia Ex-Japan Equity Fund, which beat 83% of its peers for the past three years, made the purchase in the new year, even after China released a draft rule on gaming restrictions in December. The investment reflects the fund’s optimism over the nation’s beaten-down market, where valuations are “absolutely incredible,” said Jonathan Pines, who manages the $3.1 billion fund. “We are buying it now because of its very cheap value,” he said in an interview Wednesday, referring to Tencent’s shares. Pines’ fund sold most of its shares in Tencent as well as in Taiwan Semiconductor Manufacturing Co. about a year ago.

-

What are you listening to ? (Music thread)

Luke replied to Spekulatius's topic in General Discussion

Very nice one! -

https://www.scmp.com/news/china/diplomacy/article/3248301/belgian-prime-minister-meets-xi-jinping-beijing-vows-oppose-decoupling

-

Looking forward to results!

-

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

https://www.scmp.com/news/china/article/3248296/us-house-passes-finance-bills-bolstering-taiwan-and-squeezing-china-ahead-islands-presidential -

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

Will check after work -

POLL - Likelihood of Taiwan Invasion by China before 2030

Luke replied to Luke's topic in General Discussion

Taiwan elections tomorrow! -

Looking forward to results!

-

https://www.bloomberg.com/news/features/2024-01-09/if-china-invades-taiwan-it-would-cost-world-economy-10-trillion https://www.taiwannews.com.tw/en/news/5075352 TAIPEI (Taiwan News) — A Chinese invasion of Taiwan would cost the global economy US$10 trillion (NT$311 trillion), equivalent to 10% of global GDP, higher than the Ukraine war, COVID-19 pandemic, and the 2009 global financial crisis, according to a Bloomberg Economics estimate. China's relations with major trading partners will be disrupted and it will be unable to obtain advanced semiconductors. As a result, its GDP is expected to suffer a 16.7% slide in the first year. The U.S. GDP is expected to slump by 6.7% in the first year. Despite being far from the center of the conflict, the U.S. faces significant risks due to its reliance on the Asian electronic supply chain, particularly with companies like Apple Inc. The world's GDP is projected to drop by 10.2% in the first year, with South Korea, Japan, and other East Asian economies suffering the greatest harm. According to Bloomberg Economics research, if a war breaks out in the Taiwan Strait, the potential global GDP losses could surpass those incurred by the 2020 COVID-19 pandemic, the 2009 global financial crisis, the 1991 Gulf War, the 2001 U.S. 9/11 terrorist attacks, and the 2023 Israel-Hamas war.