glider3834

Member-

Posts

978 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

I agree spekulatius that complexity is playing its part, Prem & Co are working harder on that front through better communication (look at Ar 2020 breakdown on their portfolio) as well as monetising assets which are otherwise hidden on their balance sheet.

-

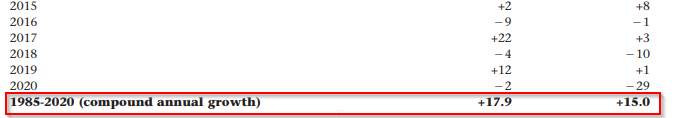

Are interest rates the 'silver bullet' explanation for Fairfax's share price underperformance? Yes they are a contributor but they are not the primary driver IMO. Interest rates affect all insurers including Fairfax's peers, yet Fairfax's share price performance over the last 5 years has still substantially underperformed against these insurance peers. The flip side of lower interest rates is a lower discount rate, lower funding costs and higher equity valuations. Fairfax in Dec-20 had around 27% of its portfolio invested in equities, which is higher than most of P&C insurers. So in theory lower interest rates should result in better equity performance for Fairfax and compensate for the lost performance on the fixed income side. However, Covid, a short/hedging strategy and a concentrated positioning in equity holdings that have underperformed in recent years , have all hurt Fairfax's equity performance and lowered book value growth (see table below showing book value growth 2015-2020 from AR 2020). We are on the recovery track from covid now, the short/hedging strategy has gone and Fairfax's concentrated position performance this year have been outstanding this due to their pro cyclical, economic recovery exposure. In short, Fairfax's equity performance has greatly improved. On the fixed income side, Fairfax is staying mostly short duration & high quality(treasuries) - basically a very conservative stance because they want to be prepared to take full advantage of higher interest rates. They could very easily increase their interest income if they wanted to by raising their corporate bond exposure, but then they would be a lot more vulnerable to higher interest rates. If we are looking for a 'silver bullet' theory for Fairfax's share price underperformance, IMO it is not low interest rates, its lack of book value growth. They key point I want to make is that there is a strong correlation between Fairfax's book value growth and share price performance over the last 35 years - see below. Now there have been times when share price growth has exceeded book value growth & vica versa - but there is a strong correlation between the two regardless. In 2020 AR prem notes that 'we think our intrinsic value far exceeds our book value.' This also makes intuitive sense when you consider that valuation gap between the fair value of their non-insurance businesses and their carrying value. So price to book as a valuation measure for Fairfax needs to modified to allow for this IMO as Fairfax is no longer a pure insurance business. A limitation in using price to book as a valuation measure can be seen with their Fairfax India stake. Fairfax India market price is $14.51 and Fairfax is carrying this position at around $9.66. But Fairfax India's book value is around $20 per share. Fairfax India have been compounding their book value at around 11% p.a, so a price to book closer to 1x would be justified. If Fairfax was to consolidate this investment then its carrying value would double - so accounting is playing its part in obscuring the value of the underlying investment. So I would argue the intrinsic value of Fairfax India stake far exceeds its carrying value on Fairfax's books - which supports Prem's point above.

-

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yes I agree Viking - they have been buying back in both Q1 & Q2, they could increase the size of these buybacks whilst still keeping well in excess of US$1 bil at holdco. I am not surethe $ buyback amount but the insurance subs are travelling well & have been sending divs to the holdco. They will want to balance these buybacks with lowering their leverage ratios at holdco & we have hurricane season underway obviously with Hurricane Ida & others I am sure to come - but this is all part of the business. Still I think Fairfax will look to be opportunistic and their shares are trading at a historically low P/B ratio - its an easy choice in my view. -

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yes totally agree - I believe they have an accounting impairment test process which they would need to follow & gets audited -

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yep - here are some home runs since 2008/09 First Capital ‘By the way, Mr. Athappan has had an incredible record with us in building First Capital. We provided $35 million in 2002 to let him establish First Capital; 15 years later, with no additional capital having been added, he had grown First Capital to be the largest P&C company in Singapore and with the Mitsui Sumitomo deal, gave us back $1.7 billion. That’s a compound rate of return of approximately 30% annually.’ (AR 2017) ICICI Lombard ‘ICICI Lombard is an Indian insurance company that we began in 2001 from scratch as a minority partner with ICICI Bank. Over the following 16 years, ICICI Lombard went on to become the largest non-government-owned property and casualty insurance company in India. The reduction in our equity interest in ICICI Lombard from 35% to 9.9% resulted in cash proceeds of $909 million plus our continuing to own 45 million shares of ICICI Lombard worth $450 million at the IPO (now worth about $550 million) resulting in an after-tax gain of $930 million.’ (AR 2017) Digit insurance US $154 million cost basis in 2017 & current valuation $2.3 bil (subject to closing & Indian Govt approval expected in Q3’21) (198% compounded annual return) Ridley ‘We had acquired 73.6% of Ridley, mostly in November 2008 at the bottom of the great recession, at Cdn$8.44 per share and over the years received Cdn$5.50 per share in dividends. Since that time, Steve Van Roekel, Ridley’s CEO, and his management team, without interference from us but under the oversight of Brad Martin as Chairman, did an outstanding job building Ridley and hugely increasing its profits and cash flow. In 2015, Pearce Lyons, the founder of Alltech, made an offer for all of the shares of Ridley at Cdn$40.75 per share. Under Alltech’s ownership, Steve and his team will continue to run the company. This was a win-win transaction for Ridley, Alltech and Fairfax. Our total realized gain was Cdn$304.1 million, representing a compound annual return of 31% including dividends’ (AR 2015) Kennedy Wilson ‘We have an outstanding partnership with Kennedy Wilson, led by its founder and CEO Bill McMorrow and Bill’s partners, Mary Ricks and Matt Windisch. Since we met them in 2010 we have invested $1,130 million in real estate, received cash proceeds of $1,054 million and still have real estate worth about $582 million. Our average annual realized return on completed projects is approximately 20%. We also own 9% of the company’ (AR 2020) Bank of Ireland ‘We purchased 2.8 billion shares of Bank of Ireland stock in late 2011 at 10 euro cents per share. As of today, we have sold 85% of our position at 32 euro cents per share, for a total realized and unrealized gain of approximately $806 million. Richie has produced outstanding results for us and we are fortunate that he consented to join the Eurobank Board. Bank of Ireland is expected to announce its first dividend in the last eight years in 2017!’ (AR 2016) Bangalore International Airport (via Fairfax India) Bangalore International Airport March 2017 54.0% (ownership) 653.0 cost (Mar-17) 1,396.1 Fair value (31 Dec-20) 23.8% CAGR Quess Thomas Cook India invested $47 million in Quess in 2013, sold a 5.4% interest in 2017 for $97 million and retained a 49% interest. We have had a phenomenal run with Quess and because of Quess’ great success, Thomas Cook India decided during 2018 to spin its holding in Quess out to its shareholders so that Quess could be run independently as a public company under the leadership of Ajit Isaac. The spinoff took place in December 2019 and Fairfax now directly owns 33% of Quess with a market value of $332 million (AR2019) recent one looking like a home run is Stelco ‘We purchased 12.2 million shares (13.7%) of Stelco in 2018 at Cdn$20.50 per share’ (AR 2019) (current share price C $49.52) & one on the fixed income side Muni bond bets during GFC ‘…in the midst of the great financial crisis, Brian Bradstreet purchased California taxable bonds in 2009 when the state was on the brink of being downgraded to ‘‘junk’’ status, and was able to acquire a very large position (in excess of $1 billion at cost) at a cash coupon annual yield in excess of 7.3%. Fast forward seven years: the net capital gain on that position is approximately $490 million, with about 45% of that realized and the balance significantly protected with a treasury lock at year-end (the balance has since been sold and the treasury lock removed). Also during the crisis, a large position in Berkshire Hathaway-insured long dated tax exempt bonds was purchased as numerous leveraged muni funds were subject to adverse margin calls in a very illiquid environment. We jumped at the opportunity when such insured bonds became available, investing approximately $3.6 billion at significant discounts to par and very attractive after-tax-equivalent yields. The net capital gain on these bonds is approximately $550 million, with 49% of that realized and the balance either pre-refunded or significantly protected with the treasury lock.’ (AR 2016) -

Another smaller funding round at approx US$ 16 mil at around same valuation as last time - I suspect lot of these individual investors would want to see some sort of liquidity via an IPO at some stage - lets wait & see what happens:) https://www.investindianews.com/digit-insurance-has-raised-rs-121-crore-from-tvs-growth-fund-and-hni/ Existing investor TVS Growth Fund has led the round with an investment of Rs 56 crore. Notable individuals include Kunal Shah, Saujanya Shrivastava ( CBO, MMT), Susheel Tejuja (owner Landmark Insurance brokers), Sachin Pillai (MD & CEO Hinduja Leyland Finance), Anil Arora (CEO Ace Insurance Brokers) also participated in the round. About 110 other individual investors have also put in money this round, filings show. According to Fintrackr’s estimate, the company has been valued at $3.47 billion (post-money) after this fresh tranche.

-

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

Yep but wasn't this essentially a hedge -

Name The Biggest Losing Investments By Fairfax In Their History

glider3834 replied to Parsad's topic in Fairfax Financial

probably one that is recent & not looking great is Farmers Edge (invested CAD 376, carried at 303 & market value CAD 151) -60% on investment cost - they may not fully impair this one which is consolidated but there might be some impairment needed here. Not every investment Fairfax is going to work out - and thats the same for any investor really. Also we are all talking about Prem but when we look at how investment performance will be managed for Fairfax going forward- something to consider is the increasing impact other members of investment team will have on Fairfax's investment performance - some comments on Wade Burton & Lawrence Chin from AR 2020 'Wade and Lawrence had an excellent year in 2020 managing $1.5 billion in invested assets. They did so well that we will give them another $1.5 billion to manage in 2021. At that rate, they will soon be managing the whole portfolio! (No clapping please!)' from AR 2019 'Wade has achieved outstanding results since he began managing portfolios for us in 2008. Over that period, up to June 2018, Wade had a 19.5% compound return on his stock portfolio. Since June 2018, Wade and Lawrence Chin, who joined us in 2016, have compounded a stock and bond portfolio at 9.8% annually. We are looking forward to Wade’s increasing impact on Fairfax’s investment portfolios over time.' Wade was also smart & opportunistic in selling his Blackberry shares in Jan-21 -

Yes I believe thats correct petec - under the short swing profit rule - explained here https://www.investopedia.com/terms/s/shortswingprofitrule.asp as an insider (10%+ owner) they couldn't sell Blackberry shares with the first spike. With the second spike (up to around US$15 I believe), Blackberry had just entered the quiet period & they couldn't sell either. I don't think they are going to sell under US$12 - because they have had opportunities (during non-quiet periods) but haven't sold any shares. Which then leads to the next question - why are they holding? I think SP is right - they are not going to cut & run - they want the optimum price for their BB position - they want the market to see the full earnings potential in the business. They have invested a lot of R&D developing Blackberry Ivy their open data platform for cars & this is what is the key around valuation. What is its potential? What revenues could it generate? There is a beta launch due Oct-21 & product launch due Feb-22. I think Prem & co. must be putting a big number on the value of Blackberry Ivy & that is only way I can rationalise why they are continuing to hold. We will see if they are right over 6-12 mths. Blackberry ivy is conceptually very exciting and but its the execution that we are most concerned about. Blackberry are also making equity investments in developers who are building apps on the Ivy platform - like a VC fund & I would expect there are a lot more investments to come - here are two they have made Car iQ (turning car into mobile wallet) https://autobala.com/blackberry-turns-a-car-into-a-mobile-wallet-that-pays-for-fuel-tolls-etc/141126/ Electra vehicles (using AI to optimise car battery performance) https://blogs.blackberry.com/en/2021/06/blackberry-amps-up-blackberry-ivy-with-investment-in-electra-vehicles

-

India on Wednesday approved Canada’s Fairfax Financial Holdings Ltd’s proposal to invest ₹15,000 crore in infrastructure projects through its local arm, boosting the government’s efforts to kick-start its ambitious ₹6 lakh crore infrastructure asset monetization programme. The government statement said the investment will be a significant boost to the recently announced national monetization pipeline (NMP). “Anchorage Infrastructure Investment is proposing to make downstream investment in some of the sectors covered under the NMP,” according to the statement. It said the investment will considerably substantiate the Indian government’s plan to develop world-class airports and transport-related infrastructure through private partnerships. https://www.hindustantimes.com/business/govt-okays-15-000-cr-fdi-plan-101629925826989.html

-

Just having a look at Eurolife transaction - it looks like it will be a net positive for shareholder equity & earnings. Fairfax will increase its ownership from 50% to 80% & will consolidate Eurolife. So instead of carrying as 50% equity investee at cost plus net earnings (CV 303 (at 31 Dec-20) plus 143 for additional 30%) = US$446mil They now consolidate 80% interest x Eurolife shareholder equity US$863 mil approx (at 31 Dec'20 was €738 mil) = US$690 mil https://www.eurolife.gr/gnoriste-mas/eurolife-group/Financial-Data/ Then possibly a fair value adjustment (?) (Fairfax looks like it showing FV for Eurolife at approx 90% of Eurolife's shareholder equity) I get 621 mil for Fairfax 80% interest - so would mean potentially 175 mil increase in shareholder equity (621 -446) in Q3 for Fairfax. Any thoughts/comments :)? some details on Eurolife transaction Q2 2021 interim - see below Acquisition of Eurolife FFH Insurance Group Holdings S.A. On July 14, 2021 the company increased its interest in Eurolife FFH Insurance Group Holdings S.A. ("Eurolife") to 80.0% from 50.0% by acquiring the joint venture interest of OMERS, the pension plan for Ontario’s municipal employees, for cash consideration of $142.6 (€120.7). The remaining 20.0% equity interest in Eurolife continues to be owned by the company's associate Eurobank. The company will commence consolidating the assets, liabilities and results of operations of Eurolife in its consolidated financial reporting in the third quarter of 2021. Eurolife is a Greek insurer which distributes its life and non-life insurance products and services through Eurobank’s network.

-

Agree Viking - this does give Fairfax flexibility to step up the pace of share repurchases & I would be expecting this. They will balance with continuing to build cash/capital position. These sales (Riverstone & Brit stake scheduled for Q3'21) plus Digit revaluation (closing scheduled Q3'21)should meaningfully reduce Fairfax's leverage ratios - which is a big positive. I need to look into the AVLNs & how they work with Riverstone Europe sale & any financial commitment here. Would agree the insurance subs appear not to need any cash - over first 6 mths of 2021 - they sent net divs to hold co. of $122 mil ($212 from insurance and reinsurance companies less $90 mil to US Run-off) With the TRS I do have a question for the board, is it correct to say the payer of this equity swap to perfectly hedge their exposure to Fairfax, would be siting on 1.964 million Fairfax shares or 7.5% of the outstanding float in Fairfax? Given the low liquidity in Fairfax's shares I am guessing it would be difficult to purchase this size stake on open market without significantly moving the share price - so if they haven't done this, would they have purchased these shares off market? Alternatively, could they bought call options to buy equivalent amount of shares in Fairfax for the same spot price as the TRS - but then I don't believe you can actually buy call options on Fairfax shares? Curious if anyone has insights in this

-

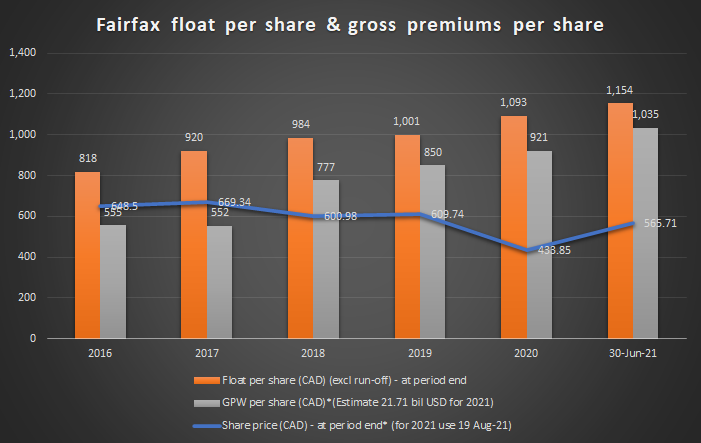

Here is another chart I have done - shows float per share (which drives investment return) & gross premiums per share (which drives underwriting profit) Both have increased substantially over the last 5 years - given these are both profit drivers you would normally expect the share price to follow - but it hasn't!

-

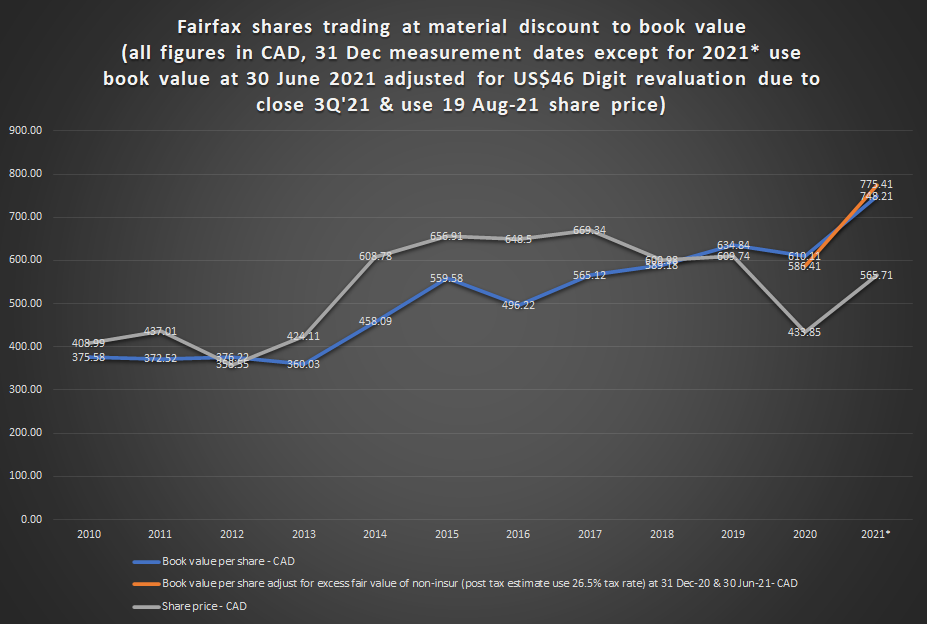

Just sharing this chart I put together - really just to visualise the significant discount that Fairfax now trades relative to book value. I notice now that Fairfax is reporting the excess of fair value over carrying value of non-insurance investments under 'Book value per basic share'. IMO Prem & mgmt would like investors to measure their progress not just in terms of BVPS growth, but also factor in this excess of fair value for non-insurance investments.

-

'Financial terms of this latest deal were not disclosed, but Fairfax will retain the real estate acquired in its original purchase, as well as a continuing royalty stream, according to a news release.' Seems to make sense but we don't have financial terms - Putnam appear to have experience in retail turnarounds, Fairfax retaining interest in upside (royalty stream) and keeping the real estate.

-

doesn't appear to be any changes in their top 15 positions apart from an 80% reduction in MCFT holding - you can see quarterly changes here https://fintel.io/i13f/fairfax-financial-holdings-ltd-can/2021-06-30-0

-

no worries Viking - yes if there is a silver lining with covid, it has resulted in greater focus on operating efficiency/cost reductions (like your good example of Recipe) or opportunity to do important upgrade work (Bangalore International Airport, Stelco) - so these businesses will be leaner, more efficient & hopefully more profitable. Yes agreed that Farmers Edge, Boat rocker have been strengthened through the IPO process & that was the right move. Really impressed by Stelco results too - after listening to conference call, looking at (very smart) recent share buyback which should take Fairfax's shareholding closer to 17% - management doing outstanding job - I can see why Fairfax are sticking to their guns & holding this one.

-

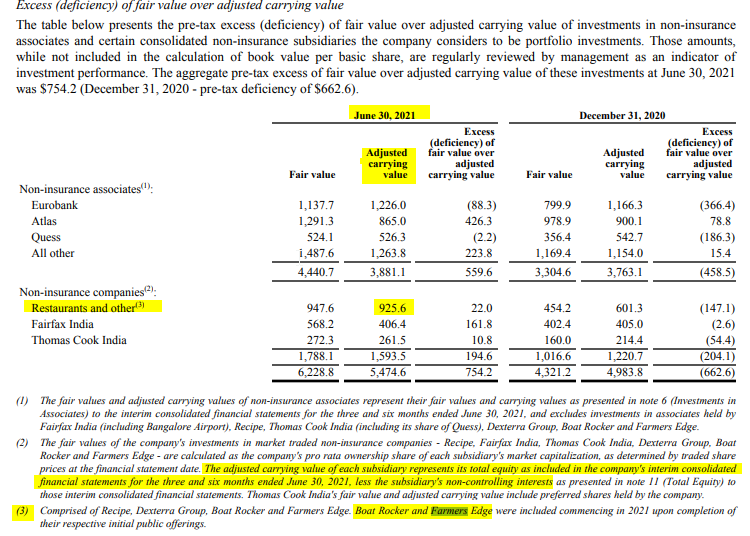

all good nwoodman - its tricky because Fairfax don't always break out figures for non-insurance subs but put them into buckets like "restaurants & other' (I guess that simplifies the reporting). I have also found this a challenge in estimating normalised earnings for non-insurance subs too , for example with AGT - I have been unable to determine their pre-tax income. I guess we can use the excess fair value over adjusted carrying value, which is how Fairfax reports, to make any adjustments to book value without trying to pull out the normalised earnings.

-

sorry Viking I have to correct my estimate- I just looked at the 2020 AR here is quote from Prem 'At the IPO value, our investment is worth Cdn$425 million but due to Farmers Edge’s losses over the years, it is carried on our balance sheet at only Cdn$303 million.' I think when Fairfax are looking at adjusted carrying value it is based on total equity in Fairfax's financial statements (not the equity in subsidiary's financial statements) - my mistake! So looks like carrying value CAD303m versus CAD110 market value now on FFH ownership share - potentially an impairment here but maybe too early to say & any impairment depends on FFH valuation/methodology Agreed not every FFH investment will work out , the overall result is really what matters & a lot of earnings report positives from ATCO, STELCO etc

-

@Viking see below - it looks like Farmers Edge is included under non-insurance companies with Restaurants & Other & adjusted carrying value appears to be calculated as total equity less non-controlling interests of subsidiary (note 2) Farmers Edge shareholder equity at Q2 2021 was around $142 mil https://www.businesswire.com/news/home/20210812005924/en/Farmers-Edge-Reports-Second-Quarter-2021-Results So would estimate carrying value as Fairfax ownership share 59.9% x $142 mil = $85 mil

-

Just listened to the Atlas earnings call & few points on this guidance - appears to exclude potential earnings growth from APR energy - they are using APR 2021 Adjusted ebitda and adjusted earnings for years 2022-24 'For the long-term guidance provided above, APR’s Adjusted EBITDA and Adjusted Net Earnings contributions to Atlas are forecasted to be ~$103mn and ~$24mn, respectively (consistent with 2021 revised guidance)' - includes current contracted cash flows only (but does not factor in any future contract wins) 'The guidance is based on the 55 newbuild vessels that we have contracted to acquire with no further vessel acquisitions assumed.' On interest/op lease expenses - does anyone have any insights around Atlas assumed libor rates & risk aspects here? Appears they are using interest rate swaps to fix rates & mitigate their variable interest rate risk exposure.

-

Out of interest - was Prem's insider buy on open market of US$150 mil one of the largest ever - I have never seen an executive insider buy of this size before?

-

I have a small indirect position in BRK but honestly I don't see a stronger investment case for BRK over FFH at the moment - a big reason for that is just the law of large numbers - how many investment options does BRK that could really turn the needle versus FFH? Also where do you see fair value for BRK? And why?

-

One of the key reasons why I made FFH my largest position end of last year Its turned into a pretty good investment for Prem so far too - perhaps that speaks volumes on his ability as an investor as well