glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

I suspect this helps provide an inflation hedge along with their real estate exposure & their short duration positioning (to take advantage of higher interest rates) on the fixed income side India is probably the #1 EM globally https://asia.nikkei.com/Opinion/Global-investors-should-start-paying-attention-to-India-s-rise But the real story is that India has unfailingly delivered higher annualized returns than the Emerging Markets Index across all time periods. India has also performed better than China, for the most part. Cumulatively, over the past 10 years, in dollar terms, MSCI India has returned 124% as against 66% for the Emerging Markets Index, and 106% for the CSI 300, which includes the top 300 stocks traded on the Shanghai and Shenzhen stock exchanges. & around 9% of their total investment portfolio (including fixed income)

-

Are Q3 results usually on last Thursday of month - I think that would be next Thurs 28 Oct ? No CC announcement yet ...

-

thanks Sanjeev for sharing - family succession is common in insurance industry - Markel Corp, WR Berkley I remember Prem saying at some point he told both his kids that he didn't want them working for him early on in their careers & encouraged them to find their own way in life working for external employers - I am sure that has shaped them as well. Fairfax has a great team on investment & ops side so I think the key thing is maintaining that right culture within Fairfax which is,as a shareholder I would be looking for from Ben & Christine - but lets hope Prem isn't going to disappear on us just yet

-

thanks nwoodman

-

I am optimistic on India economy recovering post-covid but market valuations look very hot in India compared to other emerging markets- a lot of Fairfax India's holdings & FFH's holdings have had large run ups over the last 12 mths - I think we should all be prepared for more volatility & downside risk but given the wide FFH/FFH India valuation discounts IMO I am not worried so much if we see some downside here on individual holdings https://economictimes.indiatimes.com/markets/expert-view/market-very-frothy-exit-and-take-out-some-money-now-sandip-sabharwal/articleshow/86473289.cms

-

Yep I remember investing in Sears years ago following that same train of thought & it was that big red CFO number that kept repeating itself that ultimately caused me to exit. Its interesting Fairfax has a a lot of real estate indirectly owned via Common Stock holdings whose primary business is not real estate investment - just three that come to mind - via Eurobank equity holding - (ex Grivalia) real estate portfolio has asset value of €1.4 bil (FFH 31% share worth approx $504 mil) -via Stelco (FFH 15% share $37 mil??) - Stelco also is preparing to sell a parcel of land adjacent to its operations in Hamilton, Ontario that could be worth $250 million.https://www.barrons.com/articles/canadian-steelmaker-stelco-is-a-low-cost-producer-and-has-an-investor-friendly-ceo-how-that-could-boost-the-stock-51633365262 - via BIAL (via Fairfax India 54% ownership of BIAL) - 460 acres - (FFH stake assuming Riverstone buyback 460 x 54% x 36.6% = 90 acres - value???) Real Estate Monetization: BIAL has approximately 460 acres of land adjoining the airport that can be developed. Most of this land is undeveloped and Bangalore’s historical population areas are getting congested, so the city is expanding in the airport’s direction. BIAL anticipates significant upside, over time, from monetization of this real estate. We provide below an update on the significant progress made in the actions to monetize the land available for development. • A 100% owned special purpose vehicle (SPV) subsidiary of BIAL was incorporated to carry on the real estate activities of BIAL. This entity, Bangalore Airport City Limited (BACL), is now capitalized and staffed and is expected to be self-funding as we move forward. Plans to develop the first 176 acres of land have 9 FAIRFAX INDIA HOLDINGS CORPORATION been advanced and several deals are being negotiated. Infrastructure planning and detailed design for this parcel have been completed. • Anchored on the principles of a smart city, BACL will focus on four asset classes – business parks; a retail, dining and entertainment village (RDE); hospitality; and convention and exhibition centres. • Despite potential partners’ and investors’ inability to visit the site because of the pandemic, significant progress has been made in project plans. • A land lease for a 3D printing facility has been completed and the first payment received. • A land lease for a large central kitchen for the premier airline services company has been agreed, although payment has been delayed because of pandemic related disruptions. • A term sheet has been signed for a joint development ‘‘built to suit’’ campus for a multinational corporation. • A term sheet has been signed for a joint development trade centre.

-

no worries different - Davos brands was sold in 2020 Exco an equity accounted associate & has different carrying value - this oil & gas business (one business not a collection) sits under limited partnerships so sits under 'Common Stocks' that are MTM on Balance sheet Looks like Quantum are managing around 3bil USD & HWIC (Fairfax) own around 49% https://www.quantumamc.com/about-us/our-sponsor/95 - I had a quick look at SEBI to confirm but got lost & now my partner is calling me for dinner

-

great podcast thanks nwoodman

-

great work too Viking - will check it out

-

thanks Viking - on the limited partnerships - AR 2020 At December 31, 2020 limited partnerships and other consisted of 51 investments, the three largest being $299.5 (beverage manufacturing), $191.8 (industrials) and $146.4 (oil and gas extraction) BDT Capital partners do have a $4 bil position in Keurig Dr Pepper, so could this be the mystery beverage manufacturer investment ? https://www.sec.gov/Archives/edgar/data/1510974/000095012321011542/xslForm13F_X01/0000950123-21-011542-5304.xml The oil & gas extraction business appeared as 3rd largest for the first time in 2020 - opportunistic timing perhaps

-

article on Eurobank - sorry the English translation is not great https://www.mononews.gr/trapezes/chrimatistirio-ti-odigise-tin-eurobank-se-ipsila-21-minon Estimates are already circulating in the market for the dividend that Eurobank is going to distribute, which is estimated to be between three and four cents, which, if it happens, justifies a dividend yield of about 4% . The revenue for the dividend that Fairfax should expect, without the 5% tax, should be estimated between 37-49 million euros . As recorded by foreign reports, such as Morgan Stanley a month ago, Eurobank aims at 2022, and in the first months of next year may have managed to reduce the percentage of red loans from its balance sheet to its levels European average, which provides for 5% . Already after the agreement with DoValue , the NPE's index is expected to fall to just over 7%. The prospect of a dividend, however, is what fuels investment interest today, as foreign analysts give a target price above 1 euro (1.07 euros according to Morgan Stanley).

-

good summary Viking on 1. thats probably the main one - negative impact from Q3 catastrophes on insurance result - how much? on 11. I am curious if any changes - apart from Atlas Corp warrants which appear to have been exercised , they don't appear to have really added any new significant equity positions up to Q2 - what about Q3? on 12. if the premium growth rates are still good, I suspect they will want to keep allocating capital to subs but good question viking - how much capital do the subs actually need? Because as the discount to book keeps growing I think it raises the stakes around share buybacks - if, when & how much??

-

Kamesh Goyal said they are waiting on regulatory approval for Digit's capital raising & expecting by end of this month - could be delaying the timing so they can basically say this is done??

-

Another Fairfax insurtech investment which appears to be off to a good start is Ki insurance - below from Brit's 1H 2021 report KI: Underwriting traction and continued development In its first six months of trading, Ki, the first algorithmically driven Lloyd’s of London syndicate, has gained excellent traction, with GWP recorded during the period of US$114.2m. It has had a very positive reception from its broking partners since launch, and has transacted with each of its broking partners and in all of its planned classes of business. It has also significantly expanded its market presence by onboarding the reinsurance divisions of its partner brokers. Working closely with its partner brokers, Ki has continued to update and enhance the platform, further streamlining the placement of risks. Enhanced by the launch of version two of its platform, Ki now has over 1,000 active users and is generating approximately 40 quotes per day. Interim Report – 30 June 2021 12 Ki has also developed and released its first broker API. This transformative step will allow partner brokers to integrate digitally with Ki and create a totally seamless connection to Ki’s algorithm to obtain quotes within their own broking platform. This will further accelerate access to Ki’s capacity, providing straight-through processing of data and a fully integrated end-to-end quotation process between market participants at Lloyd’s. We were delighted that Ki won the Digital Insurance Award at the 2021 National Insurance Awards. https://www.artemis.bm/news/blackstone-puts-weight-behind-ki-as-brits-algorithmic-syndicate-raises-500m/

-

yes it is - S&P500 div yield is around 1.4%

-

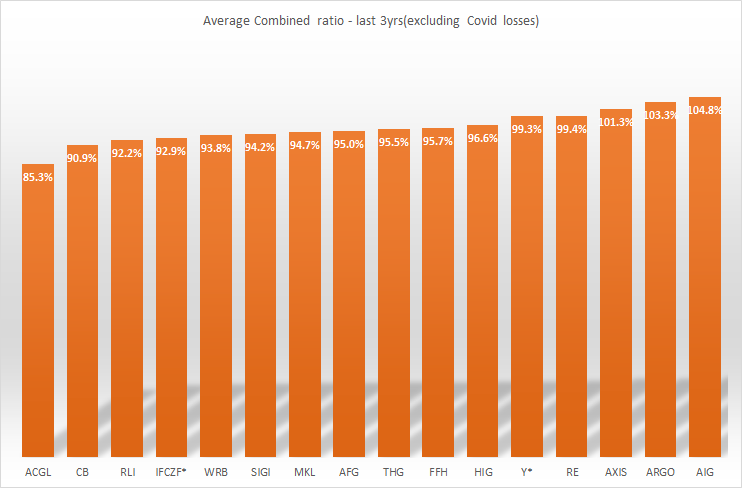

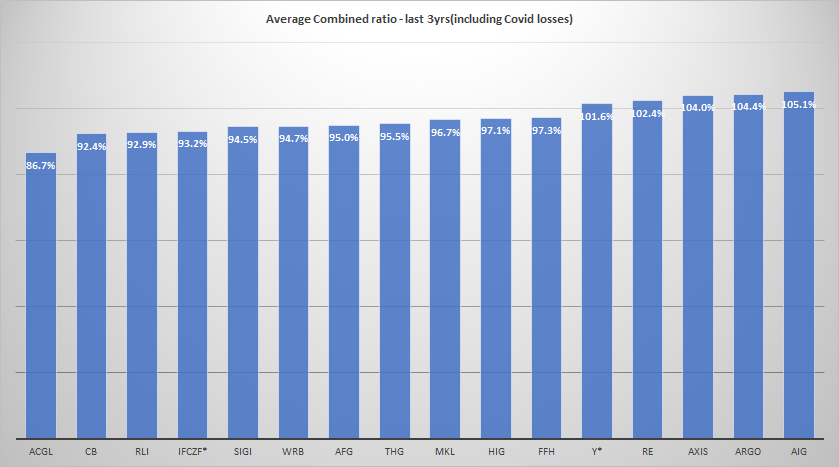

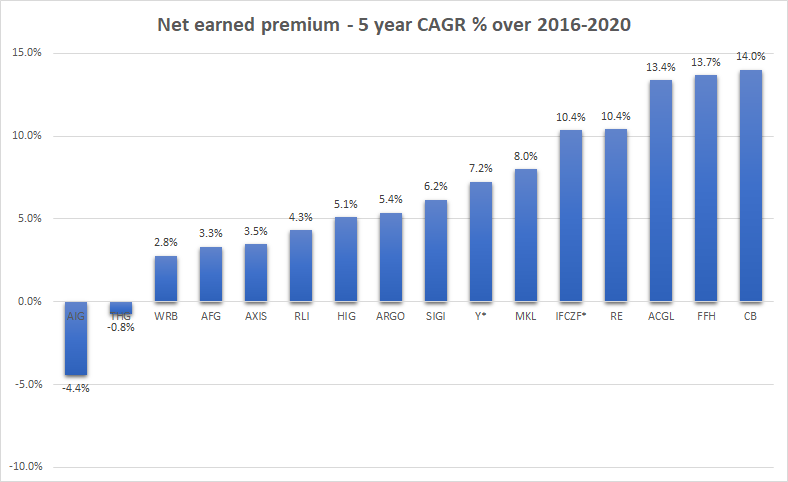

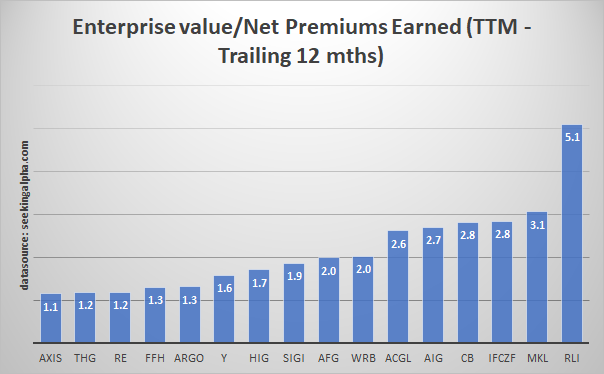

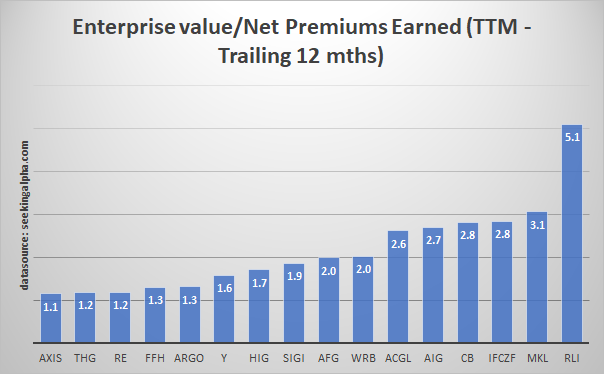

I think this might be an under-appreciated part of Fairfax - underwriting profit & growth rate - is a function of both the combined ratio & the net earned premium growth rate. I have put some more charts together - 1. combined ratio I have done two charts, sourcing data from sec.gov comparing Fairfax to 15 insurer peers - making estimates where insurer is not disclosing the % point impact on combined ratio from Covid. (note below as well that ACGL's combined ratio is skewed lower due to its mortgage insurance business that has a much lower combined ratio than P&C ops) Fairfax's has averaged a combined ratio (excluding covid losses) of 95.7% over last 3 years (2018-2020) which is close to, albeit slightly above, peer group median of 95% and less than its peer group average of 96.6%. (note this combined ratio is only for Fairfax's consolidated insurance ops which represent around 88% of its GWP) Next the combined ratio if we include impact of covid losses on combined ratio - Fairfax is sitting at 97.3% which is above Peer median of 95.5% but below the peer average of 97.8%. Assuming covid losses continue to fall, I would expect Fairfax's combined ratio (excluding covid losses) is probably a better proxy moving forward. 2. Net earned premium growth Sourcing data from seeking alpha - appears that Fairfax appears to be growing net earned premium faster than majority of its peers on a 5 year CAGR% (however, note that Fairfax's net earned premium growth includes positive impact from Allied World acquisition in 2017) Looking at trailing 12 mths ending 30 June 2021, Fairfax's net earned premium growth looks high again relative to peers From the above, Fairfax's underwriting profit (looking at combined ratio) on each $1 of earned premium appears to be close to peer median, but Fairfax looks to be growing its net earned premium at a faster rate than many of its peers. Yet on an enterprise value to net earned premium multiple - Fairfax looks to be cheap at 1.3 x its net earned premium, which is a large discount to its peer median of 2.0 x . I have put this chart up before, but including again to illustrate Further, this net earned premium multiple above is based on consolidated net earned premium & excludes impact of net earned premium from Fairfax's non-consolidated subs (GIG, Digit).

-

Kamesh Goyal is estimating they can get to an annualised run-rate of 6,500 crore (approx US$850 mil) in GWP by Oct-22 & expects to cross the 2% market share. Looks like they grew approx 4x faster than the rest of the industry in 1H FY22 https://economictimes.indiatimes.com/industry/banking/finance/insure/digit-insurance-eyes-rs-6500-cr-in-premia-sales-by-october-2022/articleshow/87081261.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst Fairfax-promoted Digit Insurance is confident of taking its premia sales to over Rs 6,500 crore when it completes five years of operations in the next October, a top official of the Bengaluru-based general insurer has said. While the industry grew 16-17 per cent in the first half, Digit has grown over 67 per cent to Rs 2,196 crore, driven primarily by the health segment, Goyal said. "Going by the company's faster growth rate so far at close to Rs 2,200 crore in premia sales in the first half of FY22, we will easily cross the FY21's Rs 3,243 crore with a minor profit which was crimped by the pandemic claims," Goyal said. He added that given a high base, "I hope to scale past Rs 6,500 crore with premia sales by the time we enter the sixth year of operation next October". Goyal expects to cross the two per cent market share by then, from the current 1.68 per cent of the over Rs 2.2 lakh crore as of June 2021.

-

thanks nwoodman re Digit capital raise Q. How is your solvency ratio looking like? It was 180 as of June 30. After the approval of the recent capital raise I would expect it to be more than 300 by December 31. It will be one of the highest in the industry. Hoping the approval should come sometime this month and we will close the transaction within thirty days. from Q2 2021 results as previously reported, upon closing of the Digit Insurance equity issuance in the third quarter, and upon final approval by the Indian government of its previously announced intention to increase foreign ownership limits, we anticipate recording an additional gain of approximately $1.4 billion or $46 in book value per basic share.

-

thanks Viking!

-

Agree Viking I just watched the interview - interesting to hear from investor psychology perspective that there are shareholders out there who 'bought in the 600s'' and who now might be just looking to cut their losses - that negative sentiment is obviously going to affect the share price which creates opportunity for others. I think maybe it does further highlight maybe the need to Fairfax to better articulate their value proposition and their approach to capital allocation/investment framework to fund managers who maybe have limited time to get their 'sound bites' from companies they are interested in investing in.

-

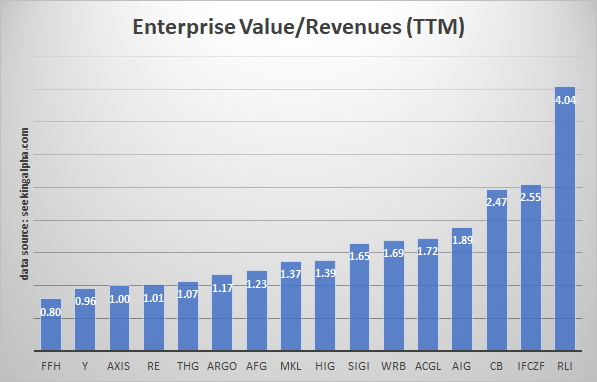

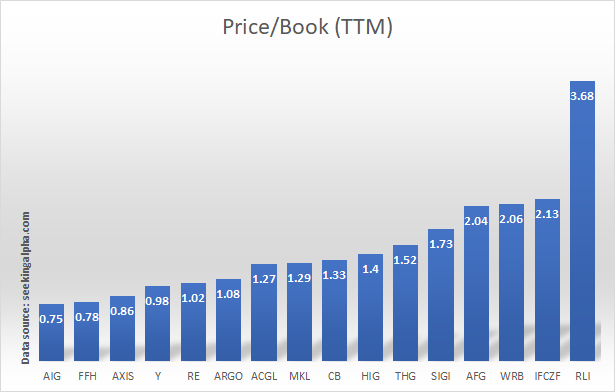

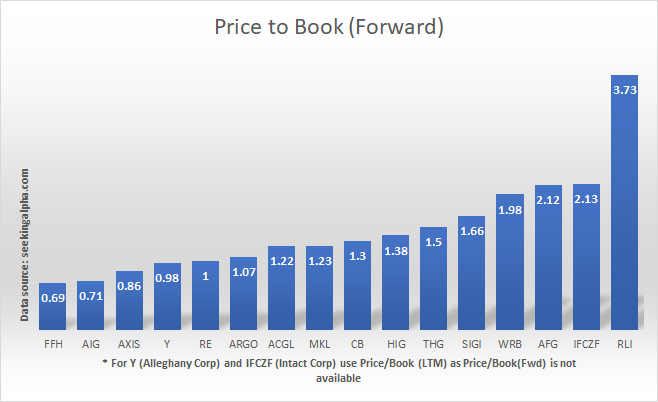

no worries Viking - I agree the set-up looks excellent for Fairfax. Mr Market just doesn't agree with us at the moment but agree its just being patient. I was actually thinking about this for the last few days I knew I wanted to do a peer comparison & share it with everyone here, but I wasn't sure how to get the data easily. I would have probably preferred to use NPW but NPE data was bit easier to get my hands on. I wanted to show visually how cheap I felt Fairfax was versus its peers (not just in terms of P/B) but in terms of the size of the insurance business relative to Fairfax's current market valuation. I just worked out yesterday that Fairfax's net earned premium in the first 6 mths of 2021 was 23% the size of Berkshire's - so its getting pretty big! And thats just their consolidated net earned premium so excludes non-consolidated investees like Digit. Also when you look at above charts, first chart showing EV/Net Premiums Earned - two insurers that have 1.2x versus Fairfax at 1.3x - namely Everest Re & Axis Capital both have been running combined ratios over 100% - so their insurance businesses are not as profitable as Fairfax - so when you start to weigh up these qualitative factors it gives even more colour to Fairfax's relative valuation advantage over peers IMO. Yep I think the catalysts are now there in terms of insurance & investment performance & they need to show consistency to earn that multiple re-rating. Unless we get a pretty big market correction or major shock to the economy & we need to re-set our expectations, I agree the set up looks great for Fairfax. -

-

following on from this comment I have put together a few charts using data I sourced from seeking alpha - again I have tried to be careful with data but if any mistakes I apologise - as always please do your own due diligence Cheers! So I am comparing Fairfax to 15 of their insurance peers using data from 13/10/21. Just looking at valuation from a couple of different angles EV to net earned premium EV to revenues Price to Book Not considering other valuation measures such as combined ratios, premium growth, business mix, bvps growth rate expected etc but these are all relevant to valuation - we have talked about these on this forum. First chart - enterprise value to net premiums earned (side note on FFH - this reflects net earned premium that is consolidated & doesn't include their non-consolidated subs including Digit, Gulf Insurance etc) Now comparing enterprise value to last 12 mths of revenues (incl investment income & gains etc) Next Price to Book (TTM) Next Price to Book (Forward)

-

cheers nwoodman

-

Fairfax appears mentioned but I don't have a sub https://www.theglobeandmail.com/investing/markets/inside-the-market/article-three-stock-picks-from-matco-financials-anil-tahiliani/

-