glider3834

Member-

Posts

1,024 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

BIAL passenger traffic 3.2M in Apr-23 vs 2.7M in 2019 (up 17%) domestic 2.86M vs 2.32M in 2019 (up 23%) international 0.35M vs 0.42M in 2019 (down 17%) https://www.aai.aero/sites/default/files/traffic-news/Apr2k23Annex3.pdf all-time record for BIAL in total passenger volume, but international still recovering post covid - running at 83% of 2019 levels international passengers are higher spending (on shopping/duty free etc) than domestic & they pay higher tariff rate, so if they can increase international passenger volume further with T2 up & running - this will be important from a margin perspective.

-

They recently announced looking to buy up to 10% of BIAL - so I think their strategy is to increase rather than reduce their BIAL ownership & then hopefully IPO at a more favourable valuation later on.

-

yes increases likelihood with a second round vote PM & ND will have an outright majority (courtesy of the bonus seats) to govern for another 4 year term and won't be forced to partner with a coalition partner that may not be on the same page. So I think that will be a positive from rating agencies viewpoint and for all investors in Greece . I am pleased for the Greek people too - they have an excellent PM who has done a lot for the country.

-

Grivalia Hospitality Grivalia appears to have had operating loss in Q1'23 but it looks like they are still in build out phase - they are aiming for completion on three projects According to Chryssikos, the third (three?) projects under construction will open as pilot operations very soon; Avantmar in June; the Glyfada project in early August; and the Voula Project in early 2024. but have additional ones planned, so I assume once they ramp up there would be revenue contribution there. https://www.ekathimerini.com/economy/1210801/aiming-for-wealthy-guests/ 'For the Grivalia CEO, there is a great market for 5- and 6-star resorts in Greece. Demand is high and, so far, supply is low. And the targeted cliented is high value: people with considerable disposable income who are going to spend large sums that will benefit the whole tourism ecosystem.'

-

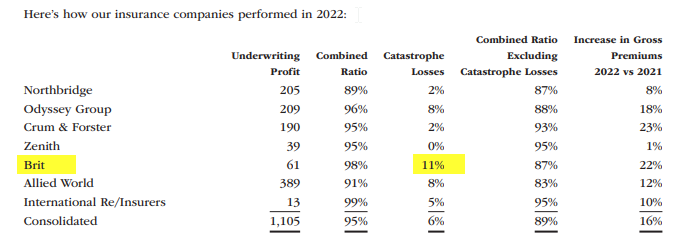

yes cats were more elevated - underlying CR (ex cats) in Q1'23 was around same level as Q1'22

-

https://www.fairfaxindia.ca/news/press-releases/press-release-details/2023/Fairfax-India-to-Acquire-Additional-Interest-in-Bangalore-International-Airport-Limited/default.aspx

-

also viking I think we can say the reinsurance hard market conditions IMHO are a bigger tailwind for Fairfax's underwriting profitability than they are for Markel or WR Berkley which I believe have smaller reinsurance businesses. Take Allied World for example, its insurance business wrote an 86.2% combined ratio(CR) in 2022 but the 102% combined ratio from its reinsurance business took its overall CR to 90.9% (see below) Higher reinsurance pricing provides opportunity for Allied to bring down its reinsurance CR & derive more underwriting profit. 2022 2021

-

Now for Moodys & S&P - Lets wait & see

-

https://www.businesswire.com/news/home/20230503005889/en/AM-Best-Upgrades-Issuer-Credit-Ratings-of-Fairfax-Financial-Holdings-Limited-Its-Subsidiaries-and-Allied-World-Assurance-Company-Holdings-Ltd.

-

https://www.theglobeandmail.com/business/article-blackberry-exploring-potential-breakup-of-company/

-

If you look at overall GPW growth rate for Fairfax at 17% in 2022 versus around 15% for Markel - not too different. Fairfax is emphasising E&S with lines that have been in a hard market - if you listen to RB on WRB calls over course of 2022 he has been calling out the standard market while seeing more opportunities in E&S -so thats interesting - also if Fairfax were growing a lot in a soft market I would be concerned. IN recent quarters, Fairfax has been dialing down growth (& they talked about that at 2023 AGM) & that has been in line with moderating price increases - so appears to make sense. It does appear that property insurance is starting see more hardening conditions in recent months so that could open up more opportunity. All of Fairfax's growth in 2022 is organic - so this is not acquisition led growth where they are buying new books Berkshire grew DPW by 17.6% in E&S in 2022 - so looks more opportunistic than cautious to me and Fairfax was 26% but they are also coming off a smaller base.

-

viking suggested I put up a post on this subject - buyout of 12% stake from Allied minority shareholders - I won't detail all the background here but just the key points - just to qualify I am not an expert on IFRS accounting, I have cobbled this info together from filings and we are missing shareholder agreement bw minority investors & Fairfax. I guess the purpose of this post is to try and look at the mechanics of this deal and how future transactions with minority interests in Allied, Odyssey, Brit or other subs might look. So here we go 1. What did Fairfax pay for the 12% stake in Allied? Fairfax paid $650M cash to minority shareholders for their 12% stake in Allied in Sep-22, this is actually equal to the minority shareholders original investment in July 2017. Here is the calculation (12%/29.1%) x $1580M = $650M So we could infer that its likely Fairfax will need to spend $930M to acquire the remaining 17.1% stake in Allied now held by minority shareholders. Question: Can we also infer that this is the buyout price template for Odyssey & Brit minority stakes as well? 2. What was Fairfax's equity financing cost for this deal? Minority shareholders received a priority, fixed 8% annual dividend (or $126.4M on $1580M investment) from Allied. Putting 1. & 2. together - both the equity financing and buyout price are fixed. Fairfax benefit is that it retains all the upside from Allied's revenue, net income and shareholder equity growth. 3. What is the immediate cash benefit to Fairfax of this deal? By my estimate = $22.7M per annum Calculation 8% dividend paid on 12% stake = $52M less $29.3M (after-tax interest cost on senior notes used to fund deal ie $650M x 5.63% x (1-0.2) - lets assume a 20% tax rate Any further upside that Fairfax receives from this acquired 12% share of Allied over & above $52M is gravy. 4. How is fair value of consideration (including accrued dividend) of $733.5M calculated? This is equal to $650M cash paid plus $38.5M accrued dividend paid (on 12% stake for 1 Jan to 27 Sep) plus (I am estimating) $45M fair value of call option exercised. 5. Does the 12% Allied buyout impact earnings or book value? It increases Fairfax's share of Allied's operating earning & going forward EPS - common shares It reduced BVPS as the fair value of consideration (excluding accrued dividend paid) = $695M was more than $467M carrying value of 12% stake in Allied - so the difference is a $228M reduction in common shareholder equity (important point this impacts shareholders equity (specifically its a loss of retained earnings) and it doesn't run through the earnings statement). I hope I haven't given anyone a headache! lol

-

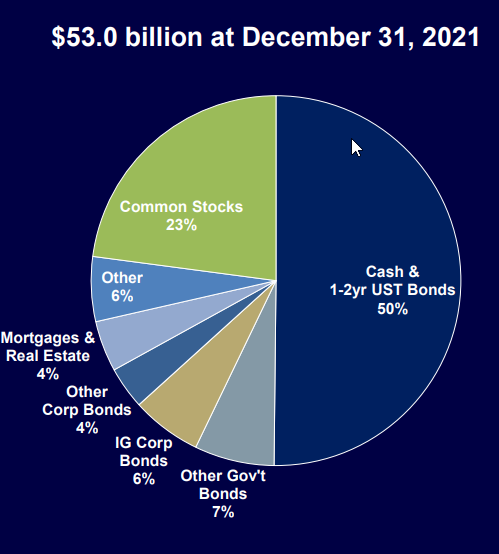

my sense is Fairfax has taken a full pivot by moving to lock in a lot more duration at the beginning of 1Q'23 suggesting inflation has peaked and rates to come down. If you look at chart below their timing has been driven by data - a very large cash position at beginning of 2022 with 1.2 yrs duration & hedges to protect from further increases in rates, and then with inflation peaking July 2022, they continued pushing out to 1.6 years by end of 2022 & substantially reducing their interest rate hedges & then pushing to 2 yrs and over in 1 Q 2023.

-

usually they just publish the meeting presentation - but agree they should record the meeting and make it available

-

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-wednesdays-analyst-upgrades-and-downgrades-for-april-19/ * In response to its Tuesday release on the effect of IFRS 17 on common shareholders’ equity, BMO Nesbitt Burns’ Tom MacKinnon raised his Fairfax Financial Holdings Ltd. (FFH-T) target to $1,225 from $1,150, reiterating an “outperform” rating. The average is $1,169.64. “FFH is by far the biggest beneficiary amongst its Canadian P&C peers on the transition to IFRS 17 (which calls for discounting), largely because of its current conservative practice of not discounting its reserves—IFC, DFY, and TSU currently discount,” he said. “The substantial increase in interest rates is primary driver of the bigger increase at Q4/22 versus the Q4/21 guide. Unlike its Canadian peers (IFC, DFY, TSU), FFH conservatively does not currently discount its claim liabilities under IFRS 4 to reflect expected yields earned on its assets. We expect the increase in Q4/22 BVPS upon transition to IFRS 17 to be similar to the impact provided in company guidance for Q4/21, which was a 2.9-per-cent increase for IFC (already in our estimates), a 5.0-6.0-per-cent increase for DFY (already in our estimates), and a 1.0-5.0-per-cent increase for TSU, with these increases driven by the deferral of additional insurance acquisition expenses, and, in the case of DFY and TSU, a lower risk adjustment due to the change in methodology for calculating the risk adjustment on reserves. “Now on an apples-to-apples basis FFH appears even more attractive relative its Canadian peers.”

-

I am deleting my IFRS 17 post - need to take futher look at it

-

thanks viking as always for your posts & hard work agree I think in adding to existing positions, they are already familiar with is probably a lower risk approach compared to starting completely new positions also they have increased their positions in Sporting Life & Thomas Cook as well.

-

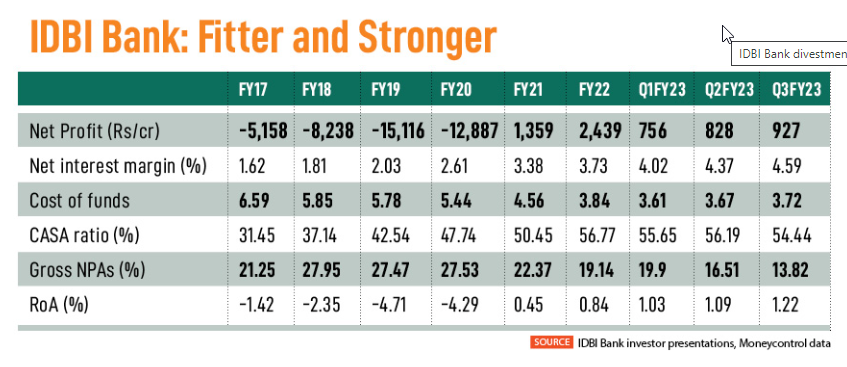

viking on Q1, media reports I have read suggest IDBI has been de-risked with profitability growing & other operating metrics improving . I am also wondering if Go Digit life is a consideration here, IDBI could offer bancassurance distribution opportunity. https://www.forbesindia.com/article/take-one-big-story-of-the-day/idbi-bank-divestment-strong-optics-and-no-hidden-surprises-lure-potential-buyers/83369/1 https://www.reuters.com/markets/asia/indias-idbi-bank-posts-record-high-q3-profit-lower-provisions-2023-01-23/

-

GIG is included in investments in associates - on B/S in brackets Fairfax shows fair value of all associates 6772 vs 6091 carrying value - this includes both insurance associates and non-insurance associates. The excess of fair value number that Fairfax reports is for non-insurance associates and non-insurance subs. So it appears to exclude insurance associates like GIG or Digit.

-

-

At current mkt cap of around $1.3B USD - Fairfax stake in GIG looks to have increased to 573M currently from 425M (31 Dec-22) https://www.zawya.com/en/press-release/companies-news/gulf-insurance-group-announces-a-net-profit-of-kd-382mln-us-1247mln-for-the-year-2022-iim2lbrw

-

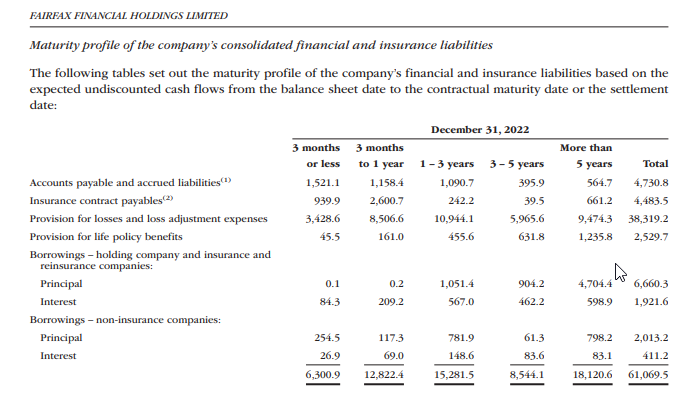

Fairfax's avg interest rate is 4.4% on its holdco debt & its mostly fixed and long term with staggered maturities and looks like no '23 maturities- it looks attractive from a funding/cost of capital standpoint at the moment considering the current Fed funds rate is around 4.5%. I think Fairfax should continue buying back shares held by minorities at Allied -they are paying an 8% preferred div to Allied minorities, so it makes sense to me to eliminate this plus they have a time limit - the option to buyout minorities expires Sep-24. Apart from debt, Fairfax can also target & reduce cat exposure as it is currently doing at Brit. 'Catastrophe losses continued to take their toll on Brit’s loss ratio, adding almost 11 points in 2022. Under new CEO Martin Thompson, actions are being taken to reduce the catastrophe exposure in the future.' (AR 2022) 'Only Brit has had a combined ratio greater than 100% since our purchase – due to larger than expected catastrophe losses. We expect this not to be repeated as Brit is reducing its catastrophe exposure significantly.' (AR 2022) (I have highlighted in bold)

-

https://www.hollywoodreporter.com/business/business-news/antenna-plus-stream-investment-fairfax-greece-expansion-1235357456/

-

looking at their portfolio slide from last years AGM, I suspect that the common stock positions, real estate etc are being used to match the longer duration, 5 yr plus maturing liabilities