glider3834

Member-

Posts

1,017 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

this looks like an interesting article if you are a subscriber https://www.insuranceinsider.com/article/2csob28o7eht496cy1tz4/london-market-section/brits-thompson-resetting-for-a-lead-position

-

in the interview Jamie L mentions a book he gave to Prem W on Teledyne - A Distant Force - ~$521 at Amazon - too expensive for me but I would like to read it https://www.amazon.com.au/Distant-Force-Teledyne-Corporation-Created/dp/097913630X

-

Cheers! @Maverick47 @nwoodman

-

podcast with European investment team at Fairfax

-

-

They now have significant control of Swan Topco - shareholding % not available - which in turn owns 100% of Meadow Foods which is the main subsidiary Below excerpts from Mar-23 consolidated financials publicly available here for Swan Topco https://find-and-update.company-information.service.gov.uk/company/11436426/filing-history It looks to be generating positive & growing net operating cash flows YoY which are being used to repay interest and repay debt (but not sure what capital structure will be post Fairfax acquisition). Swan Topco appears to have a non-cash acquisition related, goodwill amortisation exp of GBP26M , which is depressing operating profit, but gets added back to operating cash flows.

-

re your questions - might find useful this interview with Ben Watsa https://vimeo.com/862872315

-

+1 my thoughts are - it rewards Prem, FFH mgmt & staff who own FFH shares after excellent operating results in a way that is shareholder aligned - thats positive - it attracts investors to Fairfax that are focused on dividend yield and/or companies that are increasing dividends - that potentially impacts multiple & potentially could increase the value of the TRS position - it suggests confidence by Fairfax mgmt in earnings forecasts and cash generation going forward - again that can impact investor psychology and impact Fairfax multiple & the value of TRS position - 8.5% of the dividend should effectively flow back to Fairfax due to TRS on 1.96M shares the benefits above outweigh any additional tax considerations IMHO

-

yes T2 funded mostly with debt and to lesser extent operating cash flow over FY22 & FY23 (see below) . Going forward, Operating cash inflow /EBITDA should grow with traffic increasing. Its tricky looking at BIAL valuation through a PE lens because the reality is most of the profitability is likely to happen further out - airport project finance naturally has significant capex upfront (to build new terminals, runways etc) & significant fixed overhead as a result with depreciation, insurances etc. So we currently have these high overhead costs spread over lower (than potential) passenger numbers (T2 I gather is around 50% of passenger volume capacity) & so in the short term that impacts profitability (note the FY23 profit uplift was impacted by a tax benefit). As passenger numbers build over time, we should see lower fixed overhead per passenger as operating leverage comes into play.

-

https://www.travelandtourworld.com/news/article/blr-airport-best-domestic-airport-2023/

-

Underlying ownership Fairfax has 59% and OMERS 5% - it gets consolidated in FIH books with 64% BIAL controlling stake as Asset and 5% non-controlling interest in Equity.

-

+1 their TRS has generated ~US$600M YTD before swap fees & assuming its still open - so I would add that to list

-

thats close to my guesstimate - I got $42M or so - there may also be tax $ impact - I guess we will find out all numbers when Q4 results are out

-

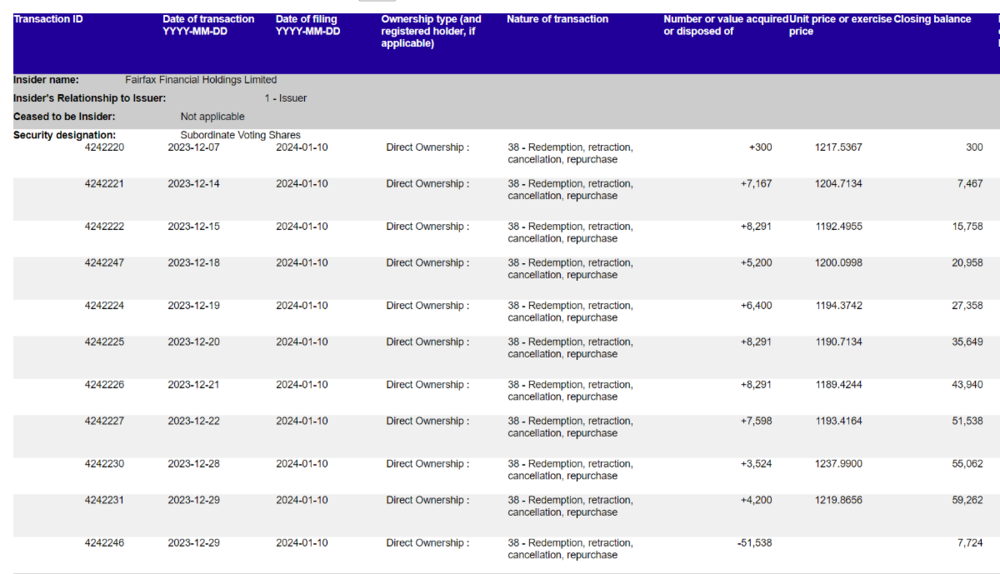

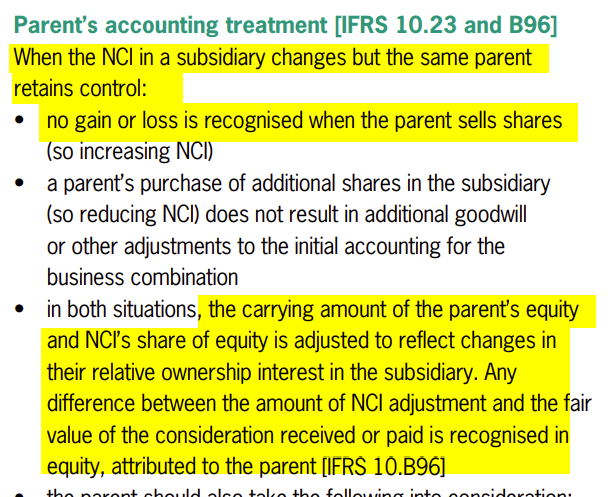

viking I think this will be an equity adjustment transaction for Fairfax based on any difference bw fair value & carrying value of the % interest sold to NCI(assuming I am reading IFRS guidance below correctly) & so with no earnings statement impact https://www.grantthornton.global/globalassets/1.-member-firms/global/insights/article-pdfs/2017/ifrs-10-guide-under-control.pdf I believe Fairfax expect a mark up gain on their existing GIG interest when they close as they are acquiring control, but here Thomas Cook was already a controlled sub before & after this transaction.

-

yes looks like it Fairfax intends to use substantially all of the net proceeds of this offering to repay outstanding indebtedness with upcoming maturities and use any remainder for repayment of other outstanding indebtedness of Fairfax or its subsidiaries and for general corporate purposes.

-

https://travel.economictimes.indiatimes.com/news/travel-agents/fairbridge-capital-reduces-stake-in-thomas-cook-india-as-company-sells-8-5-stake-via-ofs/105731200

-

https://www.fairfax.ca/press-releases/fairfax-announces-pricing-of-senior-notes-offering-2023-12-01/

-

unfortunately I am paywalled too now

-

another article https://www.ft.com/content/227514cd-426f-4b1a-a9cd-5652f8c6abc0

-

RIP Charlie Munger “The first rule of a happy life is low expectations. That’s one you can easily arrange. And if you have unrealistic expectations, you’re going to be miserable all your life."

-

I think FFH probably gains more from being public than private (eg liquidity for staff restricted share awards or funding optionality eg Allied acquisition or investment optionality eg TRS on FFH shares) & I think if Prem wanted to take it private then it would have likely happened already - Fairfax is now in its 38th year or so. With stock buybacks, there is shareholder alignment IMHO.

-

some history on Markel's acquisitions here & interestingly they also were in advanced talks to acquire Allied World before it was acquired by Fairfax https://www.slipcase.com/view/inside-in-full-markel-trying-to-be-berkshire-without-buffett/12

-

Just on this subject of competitive advantages I would say their dealmaking in their core insurance business has resulted in a lot of shareholder value since they started. - they will trade in & out of insurance businesses & have generated billions in capital gains from ICICI Lombard, First Capital, Eurolife FFH, C&F Pet, Ambridge, Digit etc.