gfp

Member-

Posts

5,347 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

-

So end of Q3 the duration was still 2.3 years. The best part of the extended duration to 3.1 years (current situation) is that it occurred in October! An excellent time to grab those 3 and 5 year notes.

-

To be clear, this footnote only applies to Brit, not Fairfax as a whole

-

Because they are keeping the capital in the insurance subs. There isn't much excess capital at the holding company level

-

https://www.globenewswire.com/news-release/2023/11/02/2772911/0/en/Fairfax-India-Holdings-Corporation-Third-Quarter-Financial-Results.html "At September 30, 2023 common shareholders' equity was $2,833.4 million, or book value per share of $20.89" " The company continued to buy back shares under its normal course issuer bid and during the first nine months of 2023 purchased for cancellation 2,609,481 subordinate voting shares at a net cost of $33.9 million ($12.98 per subordinate voting share)."

-

https://www.globenewswire.com/news-release/2023/11/02/2772905/0/en/Fairfax-Financial-Holdings-Limited-Financial-Results-for-the-Third-Quarter.html "Book value per basic share at September 30, 2023 was $876.55" "We achieved an underwriting profit of $291.6 million on an undiscounted basis and a consolidated combined ratio of 95.0% for the quarter, reflecting significantly lower catastrophe losses and excellent current accident year underwriting margins. Gross premiums written grew by 5.0% and net premiums written grew by 4.8%, primarily reflecting new business and continued incremental rate increases in certain lines of business." "At September 30, 2023 the company's insurance and reinsurance companies held portfolio investments of $56.8 billion (excluding Fairfax India's portfolio of $2.0 billion), of which $6.4 billion was in cash and short term investments representing 11.2% of those portfolio investments. During the first nine months of 2023 the company used cash and net proceeds from sales and maturities of U.S. treasury and other government short term investments and short-dated U.S. treasuries to purchase $5.8 billion of U.S. treasuries with maturities between 3 to 5 years and $2.4 billion of U.S. treasuries with maturities between 5 to 7 years, and to make net purchases of $2.1 billion of short-dated first mortgage loans and $1.6 billion of corporate and other bonds with maturities primarily between 2 to 5 years. These actions should result in continued higher levels of interest income for approximately the next 4 years." "At September 30, 2023 there were 23,115,838 common shares effectively outstanding." FFH_-_2023_Q3_Interim_Report_.pdf FFH_-_2023_Q3_MD&A_section.pdf

-

At the time they were ramping up their balance sheet doing quantitative easing, it was actually functionally the opposite of money printing. The net effect was like a tax - the opposite of stimulus. QE exchanges one form of government liability (which is "money") for another. The Fed buys treasury securities and the seller of treasury securities gets reserves. Both are government liabilities, both are "money," but at the time, the treasury security paid more interest than the reserve account at the Fed. So the Fed removes that interest income from the private sector and replaces it with reserves which at the time earned basically zero. That is why during QE the Fed was reporting large profits on their balance sheet that they would remit to the Treasury (which reduces the deficit like a tax). Today, however, the long dated treasuries on the Fed's balance sheet earn less than cash and the Fed is running a loss on their balance sheet. This is stimulus - the Fed is paying net interest into the private sector. Much closer to money printing today than when they were building up the balance sheet doing QE.

-

I agree with all of that except that it IS "money printing" when the Fed runs a loss on their balance sheet like they are currently. Just like it is a form of tax when they were building up their balance sheet with QE and had a positive carry and were remitting the "profits" to the treasury each quarter (lowering the deficit). So ironically, QE acted as a tax because the Fed took interest income out of the hands of the private sector, made a profit on the carry, and remitted that profit to the treasury.

-

I mean look at this chart of reserves. We barely needed any (relatively speaking) and then this: https://fred.stlouisfed.org/series/TOTRESNS

-

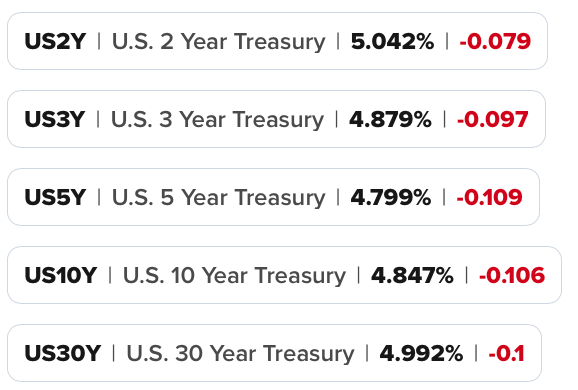

Aaaannnd the 30 year yield is back in the 4's! Will the 2 year yield also lose the 5-handle? I will say it again: There is a lot of demand for US treasury securities with a 5 handle across the entire yield curve.

-

I don't think QE does much of anything and I think the Fed is starting to realize that themselves. Hopefully they won't bother with it anymore going forward. "Money Printing" is deficit spending. That is what we are currently doing that people claim is causing the big unsustainable debt problem. Just remember when you hear folks handwringing over "who is going to buy our debt??!!!" that the government spends the new USD money into the economy first. edit to add: What we saw happen with quantitative easing is just the exchange of securities for a shit-ton of excess bank reserves. We operated without all those excess bank reserves just fine for 100 years and lending by large commercial banks is in no way constrained by the level of bank reserves in the system. So all those excess reserves just got parked at the Fed or reverse repo and basically accomplished nothing except the signaling effect of "QE! QE!." (and according to the Fed's own research paper maybe a few basis points of difference in long term yields for a short period of time) And now that the short term reserves are earning over 5% and the long dated paper on the Fed's balance sheet from QE is earning way less, the Fed is running a huge loss, paying net interest into the economy - which is another form of stimulus at the moment. Net interest paid by the Fed on their upside down balance sheet should be added to deficit spending to get the total (highly regressive to rich people) stimulus figures... Nobody can explain it better than Mosler - https://www.youtube.com/watch?v=CO6GS13rEuE

-

So I had this curve steepener trade on as a hedge and have closed it out. The CME came out with a product called "Micro" yield futures that make the trade a lot more straightforward to put on. The contracts are sized by CME to automatically match size ($10 per basis point of yield) so you don't have to figure out a proper ratio of contracts to trade a spread like 2s-10s. The interesting thing about this trade, as a hedge or otherwise, was that I was wrong on my thesis and the inversion still went away and I made the same profit. I fully expected the 2-10 inversion to flatten because the 2 year would be very responsive to recession and the market's re-evaluation of short term interest rate direction - a "bull steepener". The opposite occurred - we had a stronger economy than I expected (wabuffo was not surprised), and the 2 year stayed flat while the 10 year and 30 year yields moved up - a "bear steepener." So the hedge designed to pay me in the event of recession ended up also paying me for the opposite outcome.

-

Berkshire Hathaway Energy has continued to sell some BYD shares in Hong Kong. We know now that these sales have been used to purchase a $3.3 Billion interest in the Cove Point LNG business. Since June 19th (the last update), they have sold an additional ~$335 million worth of BYD shares (an estimate based on average prices). The media will of course misreport the sale as only 820,500 shares when the report is actually showing the sale of 10.99 million shares. https://di.hkex.com.hk/di/NSAllFormList.aspx?sa2=an&sid=2508&corpn=BYD+Co.+Ltd.++-+H+Shares&sd=31/10/2022&ed=31/10/2023&cid=2&sa1=cl&scsd=31%2f10%2f2022&sced=31%2f10%2f2023&sc=1211&src=MAIN&lang=EN&g_lang=en&

-

It is worth listening to if you skip the long Tiny ad at the beginning- it is a rare well edited audio feed of Charlie. But if you need to read it, this is what I found - https://app.podscribe.ai/episode/89341322

-

At this time, the total share count is 506 million plus the potential for 28 million more shares granted as RSUs or underwater options to management. The 28m potentially dilutive shares are not currently included in the share count because they would be "anti-dilutive." As with every company, the company can always dilute you in the future by issuing more shares. Be careful with investing in individual equities until you get a handle on share counts and market values.

-

Always get your share counts and market capitalization figures from the SEC's website. The share count is 506 million. At 1.62/share the entire company's market cap is $820m. https://www.sec.gov/ix?doc=/Archives/edgar/data/1705110/000170511023000068/angi-20230630.htm

-

I wouldn't be surprised to see BRK.B trade down to the 315/sh range on this move. Everything is going A-OK for Berkshire the company, with 5.5% T-bill yields and a great super-cat outcome in Florida this year. Berkshire will probably show a lot more "cash" in t-bills at quarter end than people expect - since they have been trimming uninspiring equities and probably didn't repurchase much stock during Q3. Berkshire is doing great. But the share price will head where the indices and ETFs that dominate the daily trading of BRK go. Most Berkshire shares just don't trade.

-

You know how people get when the S&P goes down... Don't neglect your daily dose of Wabuffo https://twitter.com/wabuffo

-

If I had to guess, I would guess this: The second tranche of equity Berkshire purchased was extremely expensive and the price paid was based on a formula that was laid out in a contract years earlier. Berkshire paid what the formula spit out but Buffett was not happy about the way the game was played. But he honored his commitment. Then immediately Greg fires the Pilot CEO and CFO, brings in BHE and former BHE executives, and immediately exits a few of Pilot's newer lines of business. Now this disagreement over accounting methods / treatments comes public. I think it is clear that Buffett didn't love what he saw and Greg is now in control cleaning it up. (notice the first listed defendant in the lawsuit is Abel) Buffett overpaid for the recent chunk of equity (much of which did not go to the Haslams, but to the other family). His reputation for honoring his commitments was more important than a few billion dollars. Further confirmation would be when we see the goodwill write down on Pilot. I'm sure he contrasts this behavior with the way the Pritzkers handled the multi-stage Marmon deal and this behavior compares unfavorably. Charlie would say that this (gaming of the system based on incentives in a contract) is exactly what we should expect and take it as a learning experience towards the next similar contract that MTO writes up for BRK. edit: just to update this, the main dispute seems to be over the huge depreciation and amortization that depresses the reported net income of Pilot post-acquisition by Berkshire. This huge jump in non-cash D&A was mentioned in Berkshire's 10Q: "Operating and other expenses include depreciation and amortization expense of $243 million in the second quarter of 2023 and $411 million in the five months ending June 30, 2023, a significant portion of which derives from property, plant and equipment and finite-lived intangible asset fair value remeasurements in connection with our application of the acquisition accounting method in 2023. "

-

Interesting - https://finance.yahoo.com/news/berkshire-sued-changing-accounting-rules-221454765.html

-

-

Everybody knows the government numbers under report actual inflation huh? Sounds like you got it all buttoned down Mr Thebeau

-

I don't know why everybody seems convinced that inflation is still a big deal. The difference between the current inflation rate and the Fed's target is basically going to be determined by OPEC+. Mission accomplished. The new wage inflation is getting to keep your job / hours. https://fred.stlouisfed.org/series/T10YIE