Thrifty3000

Member-

Posts

637 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by Thrifty3000

-

I'm pretty sure I heard Ben say the company would always be professionally managed. If memory serves, I believe Warren Buffett once wrote that one of the most effective, if not the most effective, form of corporate governance stems from a controlling owner (like a family) hiring/overseeing a professional manager. It makes sense to me. The controlling owner has plenty of incentive to have the most effective manager possible, and therefore can hold the manager accountable for performance. It's much better than the alternative situations: - where the controlling shareholder runs the company personally and doesn't answer to anyone. - or where a group of disinterested board members care more about board compensation and notoriety (elephant bumping) than they care about holding the CEO accountable (see the majority of S&P 500 boards for examples).

-

Interesting you point that out, as I actually made a mental note recently that I’ve been seeing a pattern of deals valued around 1x premiums. I believe FFH has had some in this neighborhood recently. But, I’ve been meaning to follow up to confirm that it’s not just my imagination. I have a hunch you’re probably right on the valuation front. It actually makes perfect sense to have a valuation around 1x premiums if you assume the insurance income, investment income and growth will provide a reasonable long term return.

-

Ah, good point.

-

Here's how FFH's price to book value compares to 30 of its largest publicly traded insurer peers. FFH is right around 1x while the average is north of 1.5x.

-

I believe Morningstar analysts are required to base their fair value estimates on a DCF analysis. If you look at Morningstar's historical table of FFH's Income Statement you can see that FFH has averaged EPS of around $35 per year for the last 10 years. If you simply capitalize $35 per share at a modest growth rate it's pretty easy to come up with a fair value in the neighborhood of $750 per share. He's clearly phoning it in on the analysis, but as long as he can defend his work to his boss (who cares less about Fairfax than he does), and as long as he keeps collecting that fat paycheck every couple of weeks, then bully for him. The historical price to fair value chart shows he has largely gotten it right on Fairfax since 2016, and that he even held pretty strong during the covid scare, however, the price has recently made a statistically significant move outside of his fair value range, which should prompt him to dig deeper on this one.

-

$9 bil is a non-event compared to Ian last year. Reinsurers are not only getting much better pricing this year, but also they’re getting much more favorable terms in their contracts (attachment points, etc). So, whatever FFH ends up paying, maybe $90 mil, I’m sure they’ve been well compensated for it.

-

Yes! I recently created a watchlist in Morningstar of about 40 of the top 100 insurance companies, and I’ve been going through 1 by 1, reading the annual & quarterly letters/reports/call transcripts. And, I’ve been sorting and filtering the watchlist by every metric possible. My goal has been to find at least one company as undervalued as Fairfax. I haven’t come close. It’s really eye opening.

-

According to Morningstar Travelers is currently valued at about 1.7X book value.

-

How about the Travelers bond portfolio? Woof. Travelers has started inventing terms in their annual report like "core income" and "core book value" where they get to exclude unrealized portfolio losses! Ha ha. It appears this concept of "core" reporting is fairly new for Travelers (how convenient). Talk about moving the goalposts (after reaching for yield).

-

@Viking FYI as of the end of the second quarter the portfolio value had already surpassed your estimate for next year. I think you'll probably have to bump those numbers up, especially - as you mentioned - with GIG. (And, the portfolio excludes the spare billion sitting at the holding company, which is earning another $50 mil annually these days.)

-

People who have mortgages or loans against their property will be required by the lender to have insurance. Only people who own property free and clear will be able to self insure.

-

Yes. You and @treasurehunt are thinking about this correctly. The investment portfolio earnings are pre-interest, taxes, overhead, runoff… And it’s just the earning from the portfolio, so it doesn’t include earnings from underwriting or from “miracles” pulled out of a hat like the billion dollar pet insurance companies or Digit going public. The purpose was to show how powerful the investment portfolio is on a per-share basis even under a hyper-conservative, dare I say, pessimistic ROI scenario. Keep in mind, the 2027 table I provided assumed what would be the second lowest investment returns (on a five year rolling basis) in the company’s nearly 40 year history! Second only to the brief period where they hedged their entire equity portfolio! (Oops) It defies logic to project such a pessimistic future given Fairfax has the strongest investment team, the strongest global network and the strongest portfolio in its history. Every 1% increase in the portfolio’s ROI increases per share earnings by $30! My 2027 table projects 4.68% ROI. I think Fairfax’s investment team assumes the portfolio will earn 7% long term (please correct me if I’m wrong). Since inception the portfolio has averaged 7.7% ROI. A 7% portfolio return equates to over $200 per share in 2027!! And, yes, you would still have to add up to $50 of underwriting earnings and then deduct taxes and overhead, etc. This is not the time to give Fairfax a no confidence vote on future prospects. The stock price should be at least 50% higher. And, it will be soon enough. I won’t be surprised if the stock price hits $2,400 USD within 5 years.

-

Now, if we fast forward to 2027, and project a scenario where the hard market has cooled and short term interest rates have moderated, we could easily be looking at something more like this (I simply increased each asset class by a total of 15% to account for 3 years of conservative growth, and I reduced the share count a bit)... 4 years from now, after the cliff of locked in near term interest rates has past us by, the portfolio will still be able to produce $140+ per share without needing to do anything spectacular from an investment standpoint! You can add, say, $10 to $50 per share for insurance underwriting profits and we really are looking at the normalized 20% returns @Viking has been proclaiming. And, again, the all star investment team barely has to show up to work to produce the kinds of returns I'm forecasting. These estimates are probably too conservative.

-

By gum, I think I'm starting to see eye to eye with @Viking on this argument that FFH is selling for around 5X normal earnings - and not 5X temporary hard-market-induced inflated earnings! Here is what the current investment portfolio would look like with very conservative ROI estimates for each asset class (ie. 1% ROI on cash instead of today's 5%). Notice that even with conservative ROI estimates the contribution per share would be $116.

-

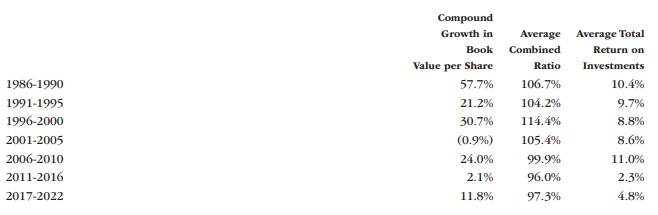

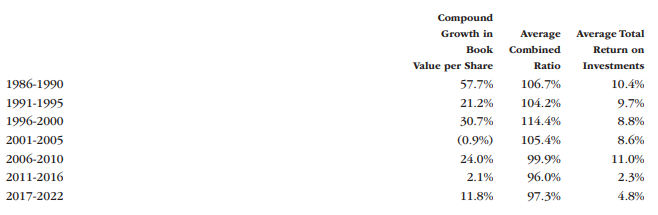

When thinking about FFH's longer term EPS potential I have to frame it more like... Over the next 10 years will average annual EPS exceed: $100 USD (almost certainly) $150 USD (likely) $200 USD (possibly) I think we can safely assume the "normalized" earning power of the business is currently in the neighborhood of $100 to $150 per share. Working for us we have roughly: $2,500 of Investments Per Share $1,000 of Insurance Premiums Per Share Slap a reasonable ROI on those investments, a reasonable CR on those premiums, and assume a reasonable growth rate over time, and FFH easily earns an average of $150+ annually per share over the next decade. Now, what can we expect over the next decade for earnings and growth? Well, Prem gave us his version of guidance on each of these things in his annual letter. He provided charts of FFH's key historical trends, explained that profitable growth has always been in FFH's DNA, and argued we should expect profitable growth going forward. In the 2 charts attached and in his accompanying commentary Prem essentially laid out the most important guiderails for investor assumptions: ROI on the investment portfolio will likely fall somewhere between 2.3% and 11%, and Prem believes the miserable days of 2.3% ROI are well behind us. Combined ratios will likely fall between 96% and 114%, and Prem believes the last 17 years of sub-100% CRs are more indicative of likely future performance. Revenue will grow, as it has in every 10 year period since 1985, almost certainly by no less than 50% and very likely by more than 100%. (I will be surprised if premiums aren't at least $50 billion a decade from now.) Reasonable Assumptions? After reviewing the historical charts and reading the annual report would it be unreasonable to assume normalized: 5% ROI on Investment Portfolio = $125 per share 97.5% Combined Ratio = $25 per share 7% annual growth $150 USD of normalized annual per share earning power growing to $300 USD per share by 2033. I don't think it's that hard to make the case that those assumptions are too conservative, and I think @Viking and Prem are doing a good job of making that case.

-

If there’s a major crisis they can suspend dividend payments which would alleviate pressure.

-

I don’t think they would have to liquidate investments at sub cos and take a tax hit. They have hundreds of millions worth of bonds rolling over every month. They can simply not reinvest the bond proceeds and dividend that cash.

-

I thought they had over a billion at the holdco. But, in addition to that keep in mind: FFH has a $2 billion undrawn revolver. FFH has lots of operating income flowing in every month. The subs operate autonomously and should only need holdco money in an emergency. The subs appear to have plenty of dividend capacity right now (it's in the annual report).

-

What are you listening to ? (Music thread)

Thrifty3000 replied to Spekulatius's topic in General Discussion

^ if you want to hear what god sounds like on the guitar fast forward to the 3 minute mark. -

Regarding Digit, according to this footnote on page 69 of the annual report it sounds to me like Digit is stuck in the regulatory mud… Digit Insurance and the company applied to the Insurance Regulatory and Development Authority of India ("IRDAI") for approval to convert the company's holdings in compulsory convertible preferred shares issued by Digit ("Digit CCPS") into equity shares of Digit. The IRDAI subsequently communicated that the application could not be considered in its current form as conversion of the Digit CCS would result in Digit (currently classified as an "Indian promoter" of Digit Insurance) becoming a subsidiary of the company, which was, at such time, prohibited under the then prevailing Indian insurance regulations. Since then, the IRDAI has enacted new regulations that have introduced a definition of a "Foreign Promoter", which would permit an Indian insurance company (like Digit Insurance) to be a subsidiary of a "Foreign Promoter". However, Digit does not currently qualify as a "Foreign Promoter" under these new regulations. Digit, Digit Insurance and the company intend to continue to explore all avenues under applicable law to achieve the company's majority ownership of Digit through conversion of the company's Digit CCPS.

-

Aha, here is the exact statement from the annual report. He didn't specify that $1,375 was the buyback bogey. Today's statement that $1,375 is the bogey is new, important, news... "Over our 37 years, excluding dividends, we have compounded book value by 17.8% annually and our stock price has compounded by 16.1% annually. Over these 37 years, there are only 55 companies of the 6,000 companies listed in 1985 on the U.S. exchanges (NYSE, NASDAQ and American) – i.e., only 1% – that have had an annual return above 15%. For our stock price to match our book value’s compound rate of 17.8%, our stock price in Canadian dollars should be $1,375. And our intrinsic value exceeds book value, a principal reason being that our insurance companies generate huge amounts of float at no cost. This is the reason we continue to buy back our shares as we continue to think they are very cheap."

-

Is Warren Buffett or Charlie Munger Smarter?

Thrifty3000 replied to nickenumbers's topic in Berkshire Hathaway

Alice Schroeder has the IQ test results of Warren Buffett and his sisters. She will not make them public while they are still living. I think it’s safe to assume Buffett’s and Munger’s IQs are at least 150. The big difference between the two men’s intellect, expertise and business skill is less a function of IQ and very much a result of FOCUS. Buffett is an investment encyclopedia. I think it’s safe to say his focus and detailed memory of all things relevant to compounding capital is probably unmatched. Munger was interested in being wealthy, but never as obsessed with business as Buffett. Munger is interested in broadly understanding how things work, the people who shaped the world, and in leading tangible projects that have tangible results - like designing his sailboat and designing/funding college dorms. One thing that is especially rare and impressive, that we can all witness, is their recall of specific details from distant memories when responding to UNIQUE questions during annual meetings. I’m not talking about the questions they get asked every year. I’m talking about the one offs where they will recount specific names, examples, and details of relatively inconsequential events that happened decades in the past. Even more impressive are the events that didn’t involve them, but were simply stories or news events they learned about second hand. There’s no doubt their minds are especially powerful. (I think Munger was more impressive than ever this year given his age.) In summary and in summation: When a Harvard Business School interviewer once asked a young prospect named Jeffrey Skilling how smart he is, the answer given was “I’m fu@king smart.” Warren Buffett and Charlie Munger are both fu@king smart! Haha -

Their stated goal is to compound book value by 15%. It sounds like they assume the stock price will sustain at least 1.2x book over the long term. So buying back at below 1.2x book will benefit shareholders (relative to book value). I don’t think they are committing to 18% long term per share growth. However, 18% can be achieved if they allocate capital exceptionally well, which can include buying back shares at a discount to intrinsic value. Currently the share price is 20% below their buyback threshold, however, they are choosing to invest in growth rather than buy back shares. That indicates they believe they can deploy capital at returns of at least 15%, which is a great sign. Fairfax is in the ultimate investor catbird seat and we’re enjoying the ride. (This is easily the most exciting ride of my 2 decade investment career. I’ve never had this much conviction in a long term opportunity.)

-

I think it’s essentially following Berkshire’s buyback rule of thumb of paying up to 1.2x book value.