Thrifty3000

Member-

Posts

637 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by Thrifty3000

-

Fair enough, let's double interest income from $20 to $40 EPS in Year 4. That gives us a total year 4 EPS estimate of $130... Year 5 EPS: $143 Year 10 EPS: $230 15X Multiple: Year 5: $2,145 Year 10: $3,450 If you double the interest rate assumption it increases the 10 year return from 15% to 17%.

-

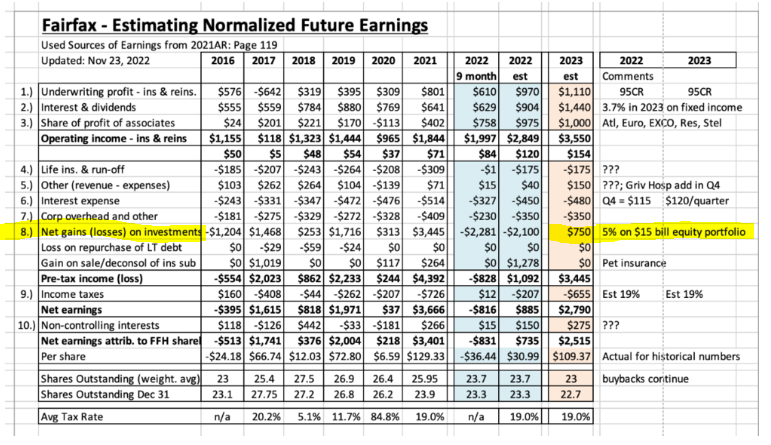

I think it's reasonable to model a normalized EPS of $100 USD going forward, which is clearly not priced into the shares. Where I get stuck is on growth rate and where normalized EPS will land in year 4 and beyond ( @Viking focuses on 2 to 3 years out, but I happen to enjoy wasting brain cells on rough 5 and 10 year forecasts). Let's oversimplify and say after tax EPS breaks down neatly into 3 factors: $40 per share of insurance underwriting earnings at a combined ratio of 95 $40 per share of interest income at an average yield of 3.5% $20 per share of non-insurance/interest earnings growing 10% annually Total Baseline EPS: $100 ^ Notice $80 of earnings is tied to two CRITICAL variables entirely out of FFH's control; the insurance cycle and interest rates. Now let's setup a conservative scenario for EPS in year 4. First, for simplicity's sake, let's assume that in years 1 through 3 a total of $300 per share was reinvested and results in additional earnings of $30 per share in year 4 (we'll call this 'earnings on reinvested cash'. Then, let's assume we're in a soft, mid-cycle, insurance rate environment, and that short term interest rates have declined to a level more in line with long term GDP growth potential. Year 4 EPS Scenario: $30 per share of insurance underwriting earnings assuming modest premium volume growth and a CR of 98 $20 per share of interest income at an average yield of 1.5% $60 per share of non-insurance/interest earnings (including $30 EPS from cash reinvested in yrs 1-3) Total Year 4 EPS: $110 ^ Under that highly conservative, highly oversimplified, set of assumptions I can see a scenario where earnings remain relatively flat for at least the next 4 years. From years 4 to 10 let's assume EPS grows 10% annually. That gives us the following EPS projections for years 5 and 10: Year 5 EPS: $121 Year 10 EPS: $195 If we slap a 15x multiple on those conservative estimates we're looking at: Year 5 Share Price: $1,815 Year 10 Share Price: $2,925 If you buy at $700 per share you're looking at a decent shot at a 15% return over the next 10 years. Not too shabby.

-

Yes! Cultivating the network/portfolio of non-insurance capital allocators has been a big part of the strategy over the last decade. They placed a lot of bets on an array of people/opportunities to see which ones could perform. Several flamed out, which provided plenty of fuel for the doubters. Now the ones that worked out are not only providing solid growth, but they’re also providing more opportunities for additional investment than Fairfax can afford to fund. So, now Fairfax gets to allocate its billions of cash annually among the highest return opportunities afforded by a solid group of insurers AND a solid group of non-insurers. Amazing position to be in.

-

I can see EPS of $100 per share being the new lower bound for FFH. And, the share price obviously doesn't reflect that. However, I'm not sure I can confidently forecast when we might hit a normalized EPS beyond $150, so for now I'll be inclined to reduce my stake as Fairfax approaches my estimation of fair value on a modestly growing $100 per share earnings stream. Let's call it somewhere between $1,200 and $1,500 USD per share as of today. Fairfax is experiencing some incredible tailwinds right now. But, the following headwinds 3 years from now aren't unthinkable: - much softer insurance market - much lower interest rates - fairly valued share price (no more buybacks) Each of those headwinds could act as gravity on the current $100 EPS, which means any new earnings from the invested free cash may only supplant rather than enhance EPS in the future. I'm not suggesting another 7 year famine as much as I'm saying it's in the realm of possibility that normal earnings could be hovering somewhere below $150 per share in 3 years, and we could be staring at a sub $1,500 share price. Don't get me wrong, when it comes to FFH I'm still jacked to the tits!

-

I love the deep dive analysis! Thanks. Some back of the envelope analysis on Allied makes it look to me like FFH paid a very good price for the 12% stake... A simple ROE analysis: Allied's book value = $4.6 billion A 15% ROE = $700 million of earnings power A simple analysis of Allied's underwriting profitability and investment portfolio (to sanity check the ROE estimate): Allied's Net Premiums Written in 2022: $4.5 billion Allied's Average Combined Ratio since 2017: 94% Allied's Combined Ratio in 2022: 91% Allied's Underwriting Profit in 2022: $380 million Allied's Investment Portfolio: $11.5 billion Conclusion, Allied's solid underwriting profitability and $11.5 billion investment portfolio appears to provide ample horsepower to deliver a 15% ROE. Add continued premium volume growth to the equation and it looks to me like FFH got a very good deal on its 12% purchase. And, I'm thrilled there's another 17% left for them to buy!

-

-

^ @Parsad What’s the beef with Robert Gunn? 42% of subordinate shares voted against him is pretty aggressive.

-

Also, if there is a major catastrophe year wouldn’t these insurers have to liquidate HTM assets, book the incurred losses, and essentially have the same effect as what’s happening to the banks? A magnified hit to book value. It seems insurers with large unrealized losses will have to underwrite more conservatively to minimize risk of liquidating HTM assets. That would extend the hard market.

-

+1 adding duration risk is pure speculation. God bless the likes of Prem, Buffett and Jamie Dimon for recognizing that and having the discipline to not reach for yield. That’s truly acting like an owner with a long term perspective. Complete opposite of how the bonus-hungry “managers” of SVB, BAC, etc behaved.

-

I’m all for reduced leverage in general. If I look at HOW they’re using debt case by case I can’t get too mad at them for borrowing at historically low rates to buy out minority owners of existing, growing, insurance operations. I’m sure the insurance earnings will cover the debt servicing costs by a sound and growing margin. And, the way their portfolio is structured, any rising interest expense over the next few years should be offset by rising interest income and insurance rates. Now if they were levering up to take a big short position in Tesla I’d be out, haha.

-

In the annual report’s historical performance chart they’ve been using USD for book value and CAD for share price for at least 10 years. I’m not sure why they do it that way, but I can’t fault them for doing it again this year. I would be irked if this was the first year they had done that.

-

I’m in my early 40s and my family of 5 lives off our investment portfolio. FFH now makes up roughly a third of the portfolio at an average cost of ~$400 per share. I think about my portfolio differently than most. I buy solid and growing look through earnings. Full stop. I want my portfolio’s look through earnings to exceed my family’s annual expenditures by a WIDE margin (several times over). I try to buy look through earnings for the lowest cost possible. Even at the current stock price Fairfax produces the highest look through earnings for the price of any investment in my portfolio or watchlist. So it would make me sad to sell those earnings - equivalent to a pay cut. Focusing on look through earnings helps me not obsess over the share price short term. It does make me obsess over the quality and sustainability of those earnings in relationship to my family’s expenditures. In short, FFH is still my favorite.

-

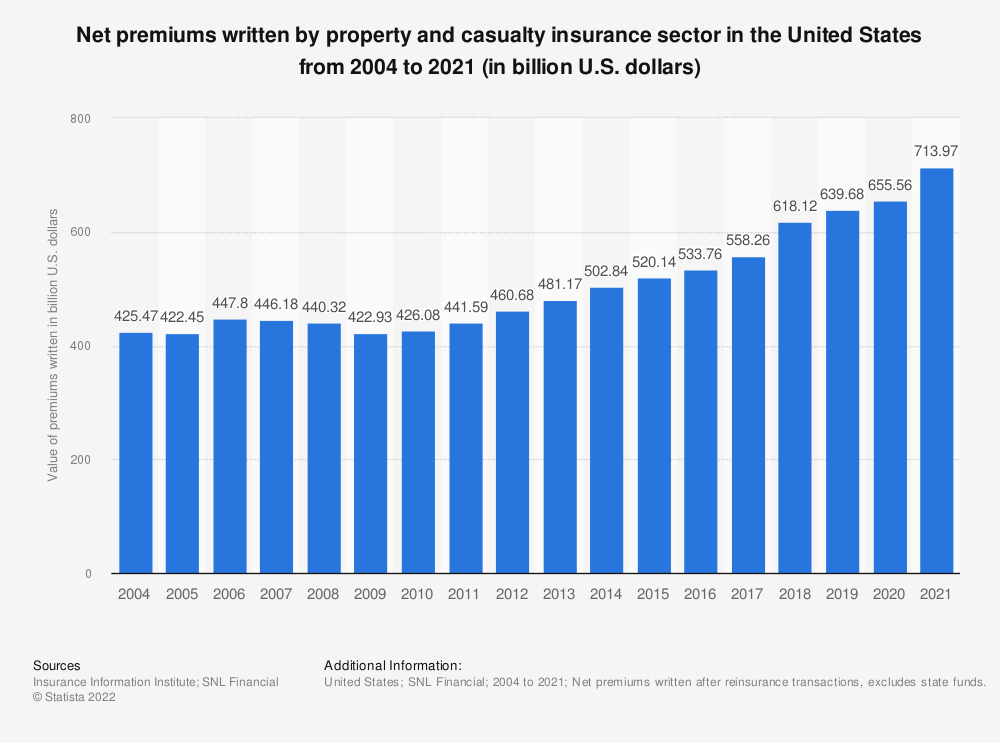

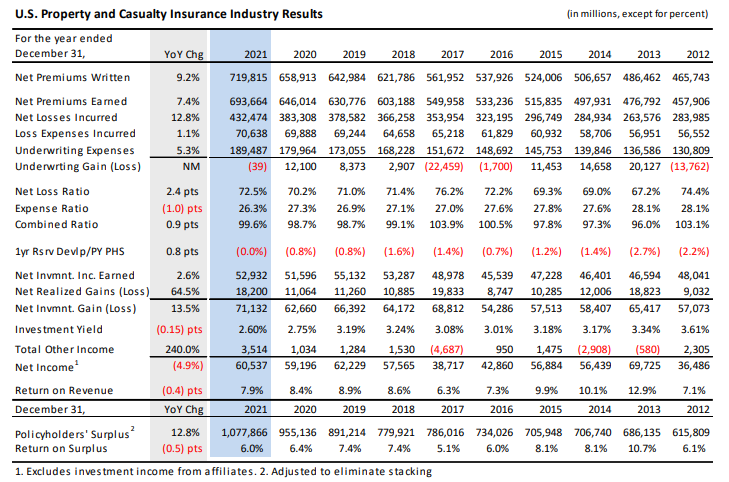

Total P&C sector annual premiums written continue marching higher. Combined ratio fluctuates cyclically (largely due to cycles of capital availability and risk appetite).

-

Or that they keep buying back bigly. As long as the business keeps improving I'll be sitting on my hands.

-

Hold the phone a second. We're talking about an amount that's over 50% of tangible book value. (And, that's assuming stock markets don't tank after said 1 in 250 year event, which would further tank book value.) I understand claims would be paid out over time, but the loss would be booked immediately. Wouldn't that trip debt covenants and force an equity raise - at a huge discount to the pre-event stock price? If the $8 bil estimate is legit, it's sounds like FFH is accepting a very low-probability existential risk to me. That's a different game from Berkshire's bulletproof balance sheet stance. (I'm not sure it makes sense to accept a 1 in 250 year existential risk if Fairfax is supposed to be the Watsa family's investment vehicle for the next 250 years. Sounds like some future set of Watsa heirs would pretty much be guaranteed to suffer a wealth reset.)

-

@Parsad what’s the rough dollar amount of the largest exposure FFH might have? Like, if California fell into the ocean or NYC got leveled by a sharknado? Are we talking $2 billion? I think Buffett has said BRK could presumably see a $5 bil loss event. Curious what FFH’s extreme mega cat exposure is.

-

Don’t forget FFH is the Watsa Family Office disguised as a public company. FFH is the Watsas’ investment vehicle. Excess cash will stockpile and be deployed in the investment vehicle in the most tax efficient way. If what’s best for the Watsas is good for you then all is well.

-

I did some rough math on whether buybacks are better than increasing premiums. Looks to me like buybacks are the winner while share prices and interest rates are around the current levels. My rough logic: If FFH has a spare $1 billion should it write premiums or buy back shares? Premiums: With $1 bil in a hard market it can write $1.5 bil in premiums and invest the float. Let’s assume 95 CR and around 4% interest on invested float. Let’s call it around $120 million of pre-tax earnings potential. Divide that by 23 million shares and the pre-tax earnings per share is roughly $5. Buybacks: With $1 bil FFH could buy back about 1.66 million shares at $600 USD per share. If we assume $2 billion of earnings potential then the buyback would increase earnings potential per share from roughly $85 per share pre buy back to around $92 per share post buy back. A $7 per share increase. $7 per share from buybacks > $5 per share from insurance so by my math buybacks wins.

-

@Viking I'm not an accountant by any stretch. One thing jumped out at me. In section 8. there's an assumption of a 5% gain on the entire equity portfolio. Are you assuming the value of the non-mark to market equities will be revised upward or profitably divested over time? Otherwise, I'm curious if expecting $750 from the equities is a bit aggressive if the $6,851 mtm portfolio will have to produce the lion's share of that growth.

-

I’ve been curious about this too. I’ve heard Prem talk about a relationship between hard/soft markets and book value. How they’ll ramp premiums to around 1.5x book value during hard markets. Seems they’ve gone higher than that in this one. My assumption is during soft markets premiums will drop back down to somewhere around book value depending on how soft. So, conservatively modeling a full cycle run rate in the neighborhood of maybe 1 or 1.2 times book might be appropriate. After that it’s a matter of growth rate over time.

-

Buffett/Berkshire - general news

Thrifty3000 replied to fareastwarriors's topic in Berkshire Hathaway

+1 love the “behind the scenes” insights into convos with WEB and Chuck -

Buffett/Berkshire - general news

Thrifty3000 replied to fareastwarriors's topic in Berkshire Hathaway

Last time the shares were in this price range he was scooping up $5 to $6 billion per quarter. I assume he's buying back that amount again now. -

Trading Fairfax Financial (FRFHF) on Vanguard

Thrifty3000 replied to JGBRK's topic in Fairfax Financial

Ah, got it. Im slow. Haha -

Trading Fairfax Financial (FRFHF) on Vanguard

Thrifty3000 replied to JGBRK's topic in Fairfax Financial

@gregmal I don’t have an interactive account. What is the 50% look through earnings yield you mentioned? Does interactive provide their own analysis?