Thrifty3000

Member-

Posts

637 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by Thrifty3000

-

Man, I hope it does languish at $450. And, I hope FFH buys back 2 million shares a year at that price for the next 12 years. And, after that I hope they start paying out a $450 per share annual dividend on the last remaining 1 million shares (in perpetuity). Haha.

-

I agree. No way that deal is interest free. I’m hoping it’s more in the 5% or 6% range though.

-

Would be nice to know what kind of annual interest payment is attached to that Odyssey deal. if there’s no interest then this increases look through earnings per remaining FFH share by $4 or so dollars. (A very good outcome. Spending $40 per share to pick up a growing $4 per share.) If the interest rate is in the 10% range then look through only increases by maybe $1 per share. (A good outcome if non-Odyssey earnings grow a lot faster than Odyssey’s earnings.)

-

Ok, here’s what we have so far on rough look through earnings for 11 of the common stock positions (representing a bit over half the common stock carrying value): FFH Look Through Atlas: $7 per FFH share Eurobank: $6 Resolute: $2.4 Fairfax India ???: $2 BDT (Byron Trott): $1.5 CIB: $1.5 Kennedy Wilson: $1 EXCO: $1 Recipe: $1 Quess: $.50 Blackberry: $0 Total: $23.90 USD

-

Is that in USD? So, shall we say Resolute = $2.40 USD (look through earnings per FFH share)? That’s a pretty solid number.

-

Ok, so what number should we plug in for FFH’s look through earnings from Resolute? (Resolute earnings * Fairfax’s ownership percentage) / 25,000,000 shares = ?

-

I completely agree. I’ll definitely break it down per share if I can wrap my mind around it. I know Prem has offered clues for what to expect. For example, I believe he said in a normal market they’ll write premiums of around 1x book value (I think it’s book value). And, in hard markets they’ll ramp volume up to 1.5x book value. So, out of curiosity, I was trying to see what their premium volumes looked like after prior hard markets. Was there an obvious decline in premium volume from 1.5x book back to 1x book? Or did they hold premium volume steady and let book value grow to 1x? I know it’s getting in the weeds. I was just surprised to see a decade of completely flat premium volume, followed by a decade of a 10% CAGR (and 15% annually in the last 5 years). In the big picture we really just need a conservative growth rate estimate on premiums and a mid-cycle CR estimate in order to project normalized per share earnings potential.

-

Yeah, I started to go down that road, but I was actually trying to see if I could get a better sense of what to expect with the insurance ops and earnings after the hard market ends. So I’ll probably be looking at several other things pretty soon.

-

For those who think FFH should be judged on their last decade of performance check out the growth in net premiums written from 2000 to 2009 vs. 2010 to today. What if the lessons they learned from 10 years constructing their insurance capital allocation machine were applied over the last 10 years to non-insurance capital allocation? Step 1) Attract and retain great capital allocators over the course of several years. Step 2) Shovel free cash in the direction of the best performers.

-

So I was talking to a friend a couple days ago who is a major Boglehead-Vanguard-fanboy. He says Vanguard just shared the highlights of its upcoming annual global outlook report (my friend swears it’s a must read). Apparently Vanguard is warning that the current consensus expectation of the fed’s neutral interest rate staying in the 1.5% range over the next few years is too low. Vanguard research suggests rates will more likely land in the 2.5% range - to stave off inflation, etc. “Market expectations for a terminal rate around 1.5% are more than a percentage point higher than the Fed's current federal funds rate target of 0% to 0.25%. But they're below the Fed's 2.5% neutral-rate estimate and Vanguard's 2% to 3% neutral-rate estimate.“ I take interest rate projections with a grain of salt, but I’m assuming higher than expected rates will likely be mitigated by FFH on the whole via higher bond portfolio earnings, while knocking fifty to a hundred million of annual earnings off of Atco’s projections (I believe Atco was assuming 1.7% rates in their projected earnings).

-

I guess I didn’t make clear enough that I was just throwing out $30 as a random number for Digit and Ki - just to help make the point of how I think about wild cards. I probably should have said $X. Lesson learned. Haha. TBH, I haven’t gone through the trouble of putting an actual number on Digit or Ki yet (I just remember getting excited when learning about them during the annual meeting - and realizing they could be game changers). I owned a token amount of FFH for over a decade and watched closely as they fought to put together a solid non-insurance investment strategy. (I’ve written pretty extensively about their non-insurance strategy in the past). I loaded up on FFH during the Covid scare while FFH was in the mid 300’s. My original thesis didn’t factor wild card assets or hard markets in at all. Those are just icing on the cake as far as I’m concerned. I originally invested based on lower earnings and growth expectations than I have now (I also expected fairly heavy stock issuance/dilution to continue - which I don’t anymore). If FFH’s stock price ran up to maybe $1,400 per share in pretty short order (which ain’t happening, btw), that’s probably about the time I’d start taking a real hard look at the wild cards and assets like the Kennedy Wilson real estate, etc to see whether the stock was getting too far ahead of itself. Otherwise, as long as it’s priced somewhere south of $1400 per share, and it’s looking like earnings will average somewhere between $60 and $100 per share over the next 5 years, then I’m plenty happy to collect a nice div, defer taxes and hang on while book value and earnings grow. As always, I’ll expect the stock price to eventually catch up. I’m perfectly happy to ride this thing out long term - as long as shorts remain off the table and the business keeps developing the way it has been in recent years.

-

Great question. I definitely factor low earnings, high-growth, high-potential, assets like Digit and Ki into the valuation. I just look at those after I’ve nailed down all the predictable earnings streams. So, with FFH I start by estimating there’s $70 or so of predictable/knowable/quality look through earnings power in their portfolio. AND, it’s usually a good idea to spend some time looking at the sources of those earnings and make judgment calls about growth rates and ability to reinvest at decent returns. Is that $70 growing, stagnant or shrinking? After that I’ll look at the wild card assets like Digit and Ki. For those I have to rely on recent arms length transactions, management communications and expert analysis to gauge what the asset is worth and could be worth in the future. If I feel the valuations are purely speculative then I may choose to ignore them. If I feel there’s real and growing value, but no earnings yet, I’ll probably come up with a pretty heavily discounted per-share value. Just making up a number for Digit and Ki, let’s say I think they’re worth $30 per share. With an estimate of the predictable per-share earnings power, and a rough idea of the present value per-share of the non-earning growth assets, I feel pretty good about being able to look at the share price and decide whether a stock is a bargain or not. For example, if FFH is selling for $450 per share, and for that $450 you’re able to buy $30 worth of wild card high growth assets and $70 of real, relatively predictable, annual, growing, diversified, look through earnings it’s pretty easy to see that Mr. Market isn’t serving up all that many other opportunities like that these days. (And, as we value investors know, when you see opportunity you gotta be ready to act in a big way. Elephant guns.)

-

YASSS!! Now we’re talkin!

-

The dividend interest from bonds is baked into the $30 of after tax insurance earnings (which I discounted in attempt to strip out the dividends from the common stock holdings). It would probably be more useful if I separated insurance operating earnings from the dividends, but Viking has already done that in a couple of his recent posts forecasting 2022 insurance and dividend income. I believe his posts had something like $31 per share from insurance and $19 per share from dividends. But, I believe those estimates were pre-tax and I believe his dividend estimate included common stock dividends, which need to be removed if using the common stock look through earnings. So I felt like $30 per share was a reasonably conservative estimate of those two sources, but I'm open to suggestions.

-

Another one I wrestled with is Byron Trott's contribution. He has contributed an average of something close to $2 per share annually going back to 2009. I'm not sure if that can be baked into the go forward earnings or not. Byron still manages a FFH portfolio that was worth over $600 million at year end 2020. So, maybe $1 to $2 per share of look through going forward is reasonable.

-

I didn't include it because Resolute happens to be pretty far down the list in terms of carrying value. I'll be happy to edit my post and add Resolute's or any others' look through earnings that anyone wants to toss out. I do prefer normal or mid-cycle earnings for cyclical investments. Do you have any sense of what Resolute's "normal," mid-cycle, earnings might look like? (I know the TTM earnings have been pretty nuts.)

-

Aight, continuing down my FFH per share look through earnings line of thinking, I came up with rough look through earnings per FFH share estimates for FFH's 9 largest common stock positions (which constituted roughly half the 2020 YE carrying value of FFH's common stock portfolio). I quickly dug up comments on earnings - or free cash flow - from various sources (including this message board), and I divided by 26 million shares (because I'm optimistic on repurchases). Because it's really quick and dirty estimation, if I had a reasonable estimate of 2022 earnings I'd use that (thanks @Viking), if I only had Prem's comments on 2020 results I'd try to pin down the 2019 results and make a judgment call. On EXCO and Recipe I started with 2020 free cash flow and simply assumed 2022 would be 1 or 2 times better than their Armageddon performance (why I'll never be an accountant). And, for Fairfax India I just had to go with a crazy conservative number, because I've never been disciplined enough to pin look through earnings on that one down (believe me, I've tried). So, I'm basically throwing this out there in hopes someone far more disciplined than me will be frustrated by my inaccuracy and offer a more precise estimation (in other words I'm trying to provoke somebody else to do the hard work, which makes me just a slightly more sophisticated troll than Liberty is on the Altius board. Haha, love you buddy - you know it's true). I'll spare you my per-holding logic and just get to the point, here goes: (look through USD per FFH share - assuming 26 million shares. To add margin of safety I usually round down to the nearest $.50.) Atlas: $7 per FFH share Eurobank: $6 Fairfax India (???): $2 CIB 290: $1.5 Kennedy Wilson: $1 per EXCO: $1 Recipe: $1 Quess $.50 per Blackberry: $0 Total: $20 per share So, in addition to the $20 above, if we conservatively assume the after tax 2022 insurance earnings per share (without double counting dividend interest from the companies above) is $30 per share (see @Viking's recent analysis) then the look through earnings power from insurance and the 9 holdings above is approximately $50 per FFH share. Now, the 9 holdings above account for only half of FFH's common stock carrying value. The big question is what is the rest of the portfolio capable of earning on a per share basis. And, this is where I have a bit of a thesis... If the rest of FFH's assets (including the other half of the common stock portfolio) can earn as much as the 9 holdings above, then you are looking at total look through earnings per share in the neighborhood of $70 per FFH share. If you can assume Prem is a reasonably disciplined value investor determined to earn a 15% return over time then if you divide the estimated $70 look through EPS by the $450 share price you get a year 1 look through earnings return of 15.5% - thus exceeding the investment hurdle rate. In sum, a meaningful billion dollar buyback is looking like a gift from the investment gods, and Mr. Market is dumber than a brick on this one. EDITS: The Following Estimates Added After The Original Post BDT (Byron Trott): $1.5 Resolute: $2.4

-

So that’s another $6 of look through earnings per FFH share. Add that to expected earnings for the insurance ops and ATCO and FFH shares are beyond crazy-stupid-cheap (not to mention the earnings power of all the other assets). Hmm, could that be why FFH is trying to buy a huge chunk of shares back?

-

@Viking Do you know if anyone has been crazy enough to attempt a “normalized” look through earnings per FFH share forecast on the non-insurance investments? I mean, FFH’s portion of ATCO’s expected 2024 earnings alone is pretty interesting. If you add just that one to your insurance ops’ per share contribution then the current share price starts looking pretty nuts.

-

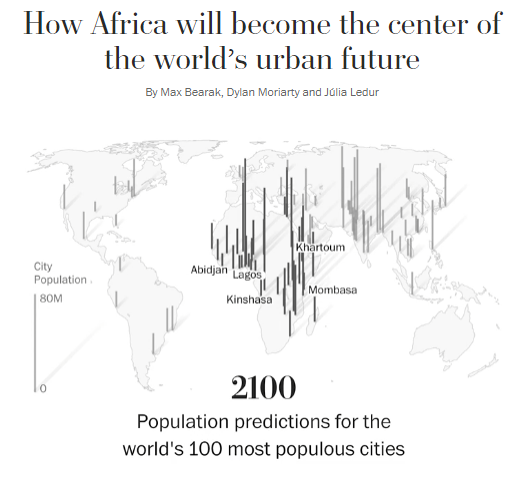

The next 80 years look pretty bright for Fairfax Africa and India. This graphic was in today's Washington Post...

-

Aww shucks. #Blushing Thanks for the shout-out @Viking! Given the continued progress on the non-insurance capital allocation strategy, the thesis on FFH still seems like a no brainer: a) FFH generates and allocates hundreds of millions of dollars of free cash annually, among b) a portfolio of insurance businesses capable of generating solid long term returns on capital c) a stable of non-insurance capital allocators that can earn double digit returns in their sleep - Burton, Sokol, Trott, etc. d) stock repurchases at a steep discount to intrinsic value ^ In a yield starved world full of greedy capitalists, can you guess which of those conditions I'm betting will no longer exist a few years from now? Haha.

-

@Viking and @Parsad how are you factoring in share count/dilution going forward? From 2009 to 2019 dilution was a pretty serious tax on EPS. Are those days behind us? I get they may have changed course on that recently, and some of the dilution may have been one time stock awards to incentivize long term managers. But, I dug up some of my notes from last year on this and the trend isn't in our favor: Annualized Share Growth Rate Approx 4% Diluted Share Count: 2009: 18,397,898 2010: 20,534,572 2011: 20,405,427 2012: 20,566,866 2013: 20,360,251 2014: 21,598,139 2015: 22,564,816 2016: 23,017,184 2017: 26,100,817 2018: 28,396,881 2019: 28,060,536 Share Based Awards 2009: 96,765 2010: 98,226 2011: - 2012: 240,178 2013: - 2014: 411,814 2015: 494,874 2016: - 2017: 689,571 2018: 890,985 2019: 1,159,352

-

Yeah, but who in the year 2000 DIDN’T see Amazon worth a few trillion by 2021?! Probably the same idiots that don’t know that in the year 2041 Amazon will be bought in bankruptcy court by HP-Neuralink! $hit I may have said too much.

-

Market Disconnect is One of the Craziest I've Seen in 23 Years!

Thrifty3000 replied to Parsad's topic in Fairfax Financial

Parsad! Shhhhh, you're spoiling the fun! Buy 'em back, Prem! -

It sounds 100% consistent with the strategy they've been executing over the last decade - establishing a diversified "portfolio" of capital allocators, each having demonstrated potential to outperform at multi-billion dollar scale (Fairfax India, Fairfax Africa, David Sokol, Byron Trott, Wade Burton, etc, etc). Out of a dozen or so allocators some will fail to impress. But, that doesn't matter. Fairfax only needs three or four to become true rock stars, and Fairfax will be able to shovel loads of free cash into the rock stars' piles for decades. The lackluster performers will fade out. It's the same strategy they implemented to build a handful of outstanding insurance companies. Consolidating capital and authority among a handful of the most talented insurance managers they could find. Now they're doing it with their portfolio of non-insurance capital allocators. I think it's brilliant. Definitely fun to watch. And, I think so few people get it. Imagine if you're Prem. Hmm... Do I give my next free dollar to a great insurance company in a hard market, or do I give it to Wade Burton, Byron Trott, David Sokol, and so on? Which proven opportunity to compound our investment at a high rate do we pick? What an incredible situation to be in! It's different than Berkshire's strategy, where Buffett was the primary capital allocator for most of the company's existence. Berkshire will soon be handing the capital allocation reigns to a portfolio of TWO capital allocators - Todd and Ted - of whom only one has shown an ability to outperform. This idea of nurturing a larger portfolio of capital allocators has been in the works for years at Fairfax. A beautiful example of ultra long term strategic thinking, IMHO.