Thrifty3000

Member-

Posts

637 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by Thrifty3000

-

Yup. Agree with everything you’re saying. Comes down to those earnings, margins, growth rates, and multiples. Influenced heavily by interest rates, taxes, etc. We know what the earnings are. No one can convince me they have any clue what interest rates, taxes, profit margins or multiples will look like 10 or 20 years from now. All we can really do is look back at a hundred years of data and come up with a range based on long term averages. So if earnings will be around $220 this year, will grow 6% annually (being optimistic), and will be worth a 20 multiple in 10 years we’re looking at an S&P worth $7,879 in a decade. That’s about a 5% annualized return from today’s price (not counting dividends). Just gotta keep those fingers crossed that government won’t raise taxes, competition won’t create downward pricing pressures, productivity growth doesn’t remain as low as it has the last decade, and most importantly, that interest rates are permanently on the mat. If you look back at the last time interest rates were this low - in the 1940s - people believed rates had permanently reset to the near zero bound. Little did they know, the rates climbed and climbed for the next 4 decades. But, hey, let’s all say it together now, this time is different. Haha

-

Oh! Another fun fact to spook your friends with! When you have a minute check out the US’s total market cap as a percentage of worldwide market cap over time. Then check out Japan’s total market cap as a percentage of worldwide market cap over time. Something has probably gone a bit haywire when a country has less than 5% of the world’s population and produces a quarter or less of the world’s GDP, yet accounts for over half the world’s market cap. (Lets just say a healthy amount of optimism has probably been baked in to some prices.)

-

Yes, it’s easy to get distracted by S&P 500 fun facts - like the percentage of zombie companies (that couldn’t survive if interest rates returned to long term averages). Ultimately if you invest in the S&P 500 it comes down to: - dividend yield - growth rate - multiple at time of purchase and time of sell Over the next 10 (or even 20) years it’s very hard to predict what return an investor could expect. But, over the next 40 or 50 years the compounding of low fees and deferred taxes becomes pretty formidable.

-

I have a stingy friend who refinanced his mortgage via JP Morgan, and then he turned around and bought a bunch of JPM stock when it was cheap because he wanted to feel like JPM was paying for his house.

-

You're right, there's a big difference between the WeWorks of the world and a unicorn SaaS company doubling revenues every year with a gigantic untapped TAM. And, as long as more of the 10x revenue companies are unicorns than WeWorks then it shouldn't be a big concern. I do like this quote regarding 10x revenue valuations from the co-founder of Sun Microsystems from back in 2002: "Two years ago, we were selling at 10 times revenues when we were at $64 [a share]. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero research and development for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?" (Source: I pulled the chart and quote from an Almost Daily Grant's email)

-

Well color me impressed. That's a bunch.

-

@gregmal I feel like you rattle off more investments than Jim Cramer. Haha. How many positions are in your portfolio?

-

Oil is definitely in his circle of competence. He knows the industry data better than a lot of C level execs in the space. He has talked about oil a few times at annual meetings. He knows all the macro supply and demand trends over time. He knows how many active rigs are drilling. He calls them “straws”. He knows the estimated reserves underground. He knows the industry cost curve, etc. As you alluded, he projects a company’s average cost per barrel to get oil out of the ground and to market. He breaks everything down to the per barrel cost. And, he likes to buy the lowest cost producers when he expects supply to be tight. He said he was shocked when he read a company’s annual report one time and they didn’t provide their per-barrel extraction cost. He has made some mistakes in oil, though. You can’t copy his individual oil investments blindly. But, if you copied 100% of his oil investments you’d probably have more hits than misses.

-

-

One thing that actually does strike me as a bit "on tilt" for Munger is why he broke from he and WEB's usual approach to betting on an oversold industry (with an unclear winner), which is to buy a basket. It's a waste of time to speculate on the reason, but I can only assume that he has had Baba set in his mind as a long term winner from his prior conversations with Li. And, he probably has overwhelmingly positive China bias after his trips to China and his heroic BYD experience. Munger has a healthy amount of hubris - to put it mildly - so I'd honestly be surprised if he has read more than a handful of pages of the annual reports of any of the Daily Journal's portfolio holdings in recent years.

-

Very good question. Depends on your time horizon and investment appraisal abilities. If you have eff-you money and can comfortably live off the annual dividends from the Vanguard All World index then just set it and forget it. (You can’t really get anymore diversified for the money than that.) If you’re an amateur investor with a 50-year horizon and plan to dollar cost average for the rest of your career then continuing to invest in the S&P 500 (and never selling when it tanks) is probably about as good as you can hope to do. Today’s high valuation will be barely detectable on a historical chart 50 years from now. The cost and tax benefits of buying and holding a continuously evolving group of America’s 500 strongest companies will almost certainly beat any other tactics long term. Plus, you’ll get to spend your life doing whatever you most enjoy rather than stressing about individual investment decisions. If you want to beat the S&P 500 long term (after taxes and fees) then you have to invest in assets whose value will outpace the value of the S&P 500. Therefore you have to be able to correctly appraise the value of assets, pay a reasonable price for them AND have the temperament to hang on to the investment when Mr. Market tries to convince you you misjudged it. (Not easy!) I think Bloomstran laid out the clearest explanation I’ve ever seen on how Buffett and other value investors consider investment opportunities (in terms of earnings, growth/return on equity, earnings multiples, etc.). I believe it was his 2018 annual letter, but it could have been the year before or after. Bloomstran creates simplified financial statements comparing the S&P to his portfolio to make the point that his portfolio has higher cash flow margins, less leverage, higher roe, a lower PE multiple, and therefore better long term prospects than the S&P. And, I think that’s the ticket. If you think the S&P is dangerously overvalued then invest in assets that aren’t. Personally, right now I don’t own any S&P, and I prefer Vanguard’s all world index excluding the S&P 500 (VXUS). I think the earnings and dividends will chug along in similar fashion to the S&P, however, it has been selling for a much lower multiple than the S&P in recent years. I picked up a pretty big chunk of the VXUS back during the 2018 interest rate tantrum, and it has been slightly outpacing my expected 8% to 10% annual growth ever since. And, these days Vanguard is even advising having 40 to 50% of your portfolio invested outside the US (because of the US’s lofty valuations). In summary and in summation, buy low, sell high and never lose money.

-

Here’s a famous 1999 article in Fortune where Warren Buffett predicted returns for the next 17 years. (Spoiler alert, he nailed the prediction.) And, more importantly, he lays out all the key factors you need to consider to make the prediction. In short, don’t expect the next 20 years to look like the last 20. https://archive.fortune.com/magazines/fortune/fortune_archive/1999/11/22/269071/index.htm

-

Is there a value rotation going on today?

Thrifty3000 replied to BG2008's topic in General Discussion

I have a friend whose mom has boxes of Beanie Babies sitting in an attic that originally cost something like $16,000. Every time I see her mom I have the smart assed thought to ask how many divvies those babies paid out last quarter. I refrain. -

Added JD yesterday to round out my China basket. The basket is about 4% of my portfolio.

-

Is there a value rotation going on today?

Thrifty3000 replied to BG2008's topic in General Discussion

Don’t forget the impending crypto bust that will happen as soon as the greatest greater fool has placed their bet - and the crypto cult finally figures out how to discount all future cryptocurrency dividends to the present. -

Bought a basket of beat up AF Chinese stocks over the last few days. Around 1% position each. Will check back on how they’re doing in 5 or 10 years: BABA PDD TCEHY

-

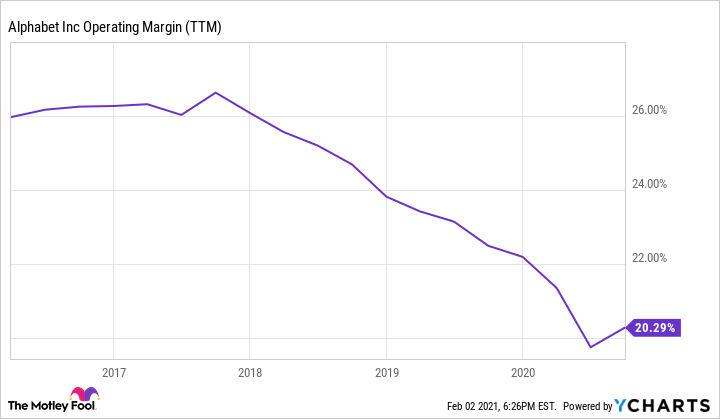

Here are some charts of Google’s margins. If Google’s price had dropped 50% in the last year I bet we’d be hearing a lot more about Google’s margins declining to zero.

-

-

Thanks @ValueMaven! Yes, that’s what I’m talking about. I know bonds are a minuscule percentage of the portfolio today, but there was a time back when interest rates were a real thing - pre-2010 - when bonds regularly amounted to over 10% of the portfolio. And, yes, Buffett has been able to work some magic with special bond situations over the years. So, it occurred to me that if the whole interest rate concept ever becomes a thing again that we don’t really know who will be qualified to take the reins. Oh well.

-

I haven't looked into this in a while. Who is handling the day to day bond portfolio management for Berkshire Hathaway? Has there been any discussion of whether Todd and Ted will have any say in bond portfolio allocation post-Buffett? (I know Ted made a lot of money buying distressed debt pre-Berkshire.)

-

My bankers are amazing. I’m having them draw something up by COB. (Totally joking. I don’t have bankers. Haha.) My comment about selling puts was just some good-natured ribbing from one investor nerd to another - an attempt to goad mcliu into digging deeper on a contrarian thesis. Gosh knows this board could use some serious contrarian argument to combat the optimistic groupthink (count myself among the guilty optimists). But, at this point we have to dig deeper than superficial statements about the last decade’s performance. To improve our financial models I think we need to delve deeper into things like: - Prem’s succession plan - mid-cycle (post hard market) insurance earnings potential - reasonable/deserved conglomerate discount - reasonable/deserved discount for Watsa ownership structure Those are the kinds of factors that can materially impact future valuation. (And they make it hard for me to assign a value greater than 1x book until resolved or better understood.) The missteps and corrections made over the last decade have been pretty thoroughly debated in this and the other FFH threads.

-

If you keep that up you’re going to convince me to start selling puts.

-

I think normalized $60 per share earnings is reasonable. I also think $1000 per share valuation in the next 3 to 5 years is a decent bet.

-

Based on recent commentary on the Stelco board it sounds like we can conservatively pencil in, say, $.80 of look through EPS for Stelco. So, I’m updating the running list. Below are the estimated look through earnings per FFH share for 12 of the common stock positions (representing a bit over half the common stock carrying value): FFH Look Through Atlas: $7 per FFH share Eurobank: $6 Resolute: $2.4 Fairfax India ???: $2 BDT (Byron Trott): $1.5 CIB: $1.5 Kennedy Wilson: $1 EXCO: $1 Recipe: $1 Stelco: $.70 Quess: $.50 Blackberry: $0 Total: $24.60 USD