MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

What’s FFH’s incentive to ever unwind the TRS? Even if it’s taxable why not just let it ride and let the deferred tax liability grow indefinitely?

-

@Viking have you heard back from these analysts when you’ve contacted them in the past? My understanding is you shouldn’t expect a response (at least not much more than a sentence) unless you’re managing $100mm+ and/or paying RBC a whole lot of commissions. But anyway, that email is a great summary of the situation.

-

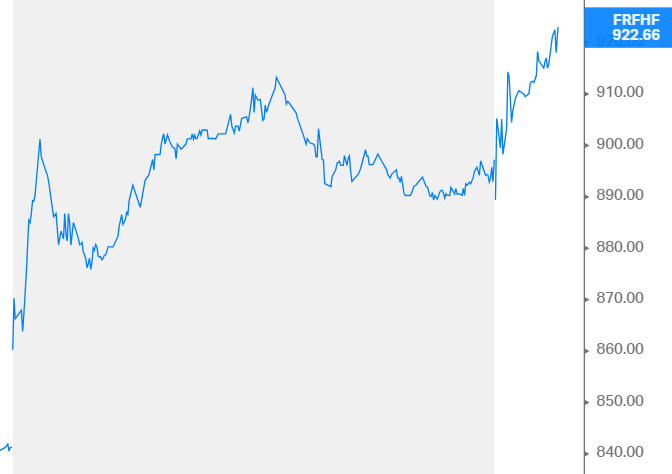

It took only another hour this time... call it ~1.1 days. Can we now say Mr Market is waking up to reality at FFH?

-

Well if it works you should make that 30% required return or something like 15x over a decade, right?

-

I think the best rebuttal is that the "bullish assumption" is from our odd crowd that represents ~1% of the composition of the market. It's still crickets from the 99%. And the opposite of love is not hate but indifference, right? I just can't see (though I guess that's your point!) how is this close to bullish sentiment just b/c like 12 of us on this niche value nerd forum are bulled up and while it still trades at what seems to me at least like a pretty depressed (or at least nothing close to stretched) valuation and with 2 questions on the call. As far as I can tell, we started off ~2-3 years ago at "child slave labor strip mine" sentiment and are like ~25% of the way to "generally recognized as the next BRK" levels. That's my proprietary scientific scale.

-

I think the really compelling thing now is that even with this massive ~3x run, the valuation relative to earnings power and peers hasn't really changed much over the past couple years, if I'm analyzing it correctly. I still think we're trading at high single digits normalized earnings, a ~50%+ discount to almost any reasonable comp. Those of us buying a couple years ago look smart in retrospect with the way things have played out so far. I bought it in large part as a hedge to my generally longer duration portfolio (see? I'm dumb), so I know I was lucky at least. But frankly there's a reasonable argument to be made that the risk/reward is better now looking forward than it was ~2-3 years ago. We've been through an all-time sharp hiking cycle with ideal positioning on the fixed income side, which certainly wasn't a given outcome ~2-3 years ago. We've also now clearly seen that they in fact haven't lost their mojo on the investment side, and now they're in a huge position of strength with their balance sheet and really attractive reinvestment opportunities, not least of which is the potential to take out a quarter to upwards of half of the shares out of cash flows, proper Teledyne-style, over the next few years, if they so choose and if the stock keeps trading at such a discount. I think only a sliver of the market is made up true value investors with the structure and/or temperament to buy at a discount to intrinsic value in an expected value, scenario-weighted, probabilistic sense, agnostic to flows and timing of narrative shifts... at least that's how I'd define it. So now you start to get interest from the value investors who are more comfortable buying something that's inflected recently, with proof that the thesis is "working" and yet still screams cheap. And then you still have the, what, ~80%? ~90%? of capital managed by indexers (h/t @SafetyinNumbers), momentum types, GARP/growth, and day traders / pure FOMOers. So the "setup" might be better now than it was a couple years ago, and we're seeing more interest on the margin. I think that's just getting started, really. So maybe the time to sell your last share when we get 15 fawning questions on a conference call and Prem is back on the cover of Canadian Forbes (is that still a thing?) Anyway, I still like the stock and, after sleeping well enough on it, sticking with the way too big position.

-

It was just really bad luck that they were locked up at that exact point in time, wasn't it? I'm personally grateful for that b/c it's what made me take a harder look at FFH and I think continues to contribute to keeping the stock cheap even as it now shrunk to what, ~1% of GAV? ~2%? All the major drivers have gone so right for FFH and yet we still hear about BB from people who gave up on Fairfax last decade. Hopefully we'll look back in a few more years and realize that whole thing was a huge blessing in disguise for newcomers, even now.

-

Not to get off topic here but do you mean the mortgage market looks oversold at 8%? Can you explain the mechanics of how mortgage rates spike higher if the market is anticipating rates dropping and mass refinancings? (If that’s even true.) I guess it’s sorta relevant to Fairfax’s big deal with Kennedy Wilson.

-

Give it two or three days. There's often a lag for some reason. Efficient markets!

-

To be clear, I'm talking about trimming FFH ~20-30% higher to buy back FIH at today's price. 100% counting my chickens before they hatch.

-

I am still in this camp and occasionally lose sleep over it, if I'm being honest with myself. The one thing that keeps me up at night is that FFH is not truly anti-fragile and we're still overdue for The Big One. I might just trim ~10% to buy some FIH. Hard to go too wrong.

-

I've just been a tad bit early with these things, giving Mr Market a little too much credit. Can I toot my own horn yet on some of the more aggressively bullish posts in '21 / early '22? Famous last words, but I think this is shaping up to a ~6-10x over ~4-6 years sort of return from when Prem loaded up on shares personally and the market reaction was a mix of indifference, disdain, and "what's that crazy old canadian doing now? he did blackberry lol." I'm still here for the narrative shift and 1.5-2x BVPS...inject it into my veins. That said, even with all the strength in these results and the still seemingly super cheap valuation...is it time to start taking a little risk off the table if this pricing cycle is finally nearing its last legs? Are we finally at/near the peak of the hard market? If so, will Fairfax properly adjust and free up gobs of capital to return to shareholders? Has the real Teledyne-ing begun? Thank you all for sharing your ideas and work. This has been a massive ballast for my portfolio over the past couple years. Now back to keeping the emotion and horn tooting out of it.

-

Should be +30% tomorrow. I’ll settle for +10%.

-

Fair enough. Just amazed that investors are still willing to lend the Greek govt money at ~4% ish with e.g. US mortgages at ~8%. But I guess I shouldn’t throw rocks from my American glass house. Gonna be interesting to watch Eurobank’s contribution to FFH over the next few years.

-

Via https://www.hamiltonlane.com/insight/weekly-research-briefing/current-animal-spirits Pretty incredible that the UST 10yr > Greece 10yr

-

So what are the odds FFH trades at a premium to MKL by, let's say, year end 2024? I hear rates are still going up

-

I respect the full Kelly criterion sizing. I don’t have the risk tolerance for that. Anything about FFH at 75% keep you up at night? What do you think could go wrong? How do you know when to cut it down or exit? I’m constantly a bit paranoid I’m missing something. “It ain’t what you don’t know that kills you…”

-

I added ~10% to my already way too big position today and about ready to pound the table again to friends in the industry. No one will listen this time too

-

Voting machine in the short run.

-

"Overall, it's still a tough environment for our insurance risk-bearing partners. They are grappling with stubbornly high loss cost inflation and more catastrophe losses at higher reinsurance attachment points. So when I roll it all together, we are not seeing and don't expect a meaningful slowdown in primary P/C rate increases. And thus, we remain steadfast and focused on helping our clients navigate and mitigate premium increases." - Arthur J Gallagher (AJG ) CEO Patrick Gallagher

-

@UK yeah my bad, I should've quoted or tagged @Spooky @Jaygo

-

Are those prefs a better risk/reward than the common at a ~18-20% earnings yield? I agree they look good (especially vs. FFH's fixed rate prefs @ ~6%) but I think Fairfax has a long runway for ROIC > WACC (most of which, again I'm a broken record, is float-based leverage at ~0% cost) so I still want 100% common.

-

I'm just trying to understand what point @Spooky @Jaygo were making

-

Is the concern here that foreign flows out of Canadian equities would put technical pressure on FFH stock in the coming years? Sounds like it would be a buying opportunity given that Fairfax is a global business but maybe I'm missing the point. Thx.