MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

I was also correct that something shady was going on. Unless the timing of a spike - mid-day ahead of the announcement after the close - was pure coincidence

-

Similar perspective to https://frank-k-martin.com/2024/11/18/cash-as-trash-or-king/ Buffett’s “not-so-secret weapon,” as noted in the 2023 annual letter excerpt above, is to sell on good news so you have cash to buy on bad news. Only a tiny fraction of investors have the willpower to walk away from the table when they have a hot hand.

-

Cost of capital headed down across the board?

-

With respect to all the Canadians here (I love your country!), Occam's razor = something shady and borderline illegal involving the hedge fund community up there. Maybe I'm wrong about exactly what it is.

-

Let me be the first to wildly speculate that someone's leaking the news about index inclusion and funds are buying the prefs to get around insider trading laws.

-

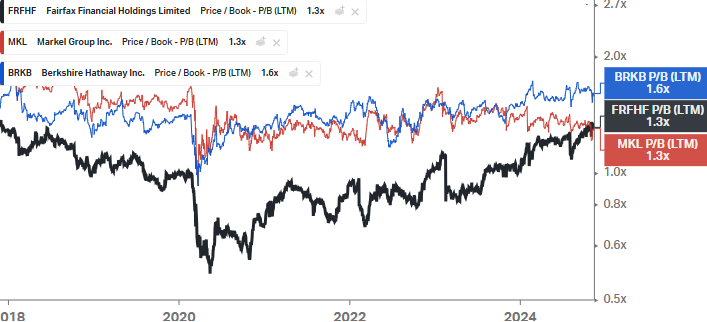

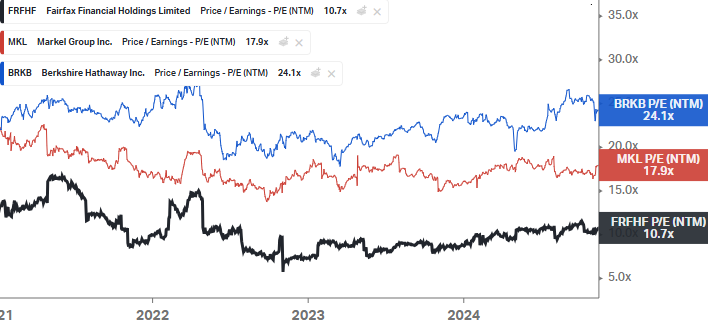

It's hard to separate the concentration / asset allocation question from the sell decision. Some of us think of our FFH investment as a "core" position and a "tactical" component that has been big for the past couple years. I sold MKL (and index funds) to load up on FFH in 2021. Now that the expected return differential between the two seems less extreme (and Gayner has been buying a bit recently), I'm starting to think about swapping some back. Maybe any pop on index inclusion would be a reasonable opportunity to do so. I wouldn't be doing this if I didn't still have that big "tactical" chunk of FFH and very little in the way of core / plain vanilla / index-ish US equities. FFH is still trading at less than half of intrinsic value though and would still be my biggest position and ~3-4x what I'd allocate to MKL.

-

In your example, if home values are -50%, you can hand the keys to the bank and only lose your 3% down payment. Fairfax has always been on the hook for the full notional amount of the swaps, right? I think you're technically correct but if we're trying to evaluate the capital allocation decision across scenarios it's conceptually/economically a different story.

-

I'll have to think harder about this. I just don't see it as functionally equivalent to a call option... maybe a call option with an open-ended duration where you're on the hook for the full amount of the underlying change if the stock goes -100% against you. In other words, just like buying the stock, but if a bank lent you almost 100% of the capital and needed to be paid back either way. If you calculate the IRR off FFH's initial outlay, you basically get an infinite IRR - that can't be right in general. It only looks like that in this case b/c the stock basically went straight up. Were they not truly risking the full notional amount of the swaps? Maybe I'm missing something. Thanks!

-

I mean, sure, but there’s no free lunch. Wasn’t the whole point that it was economically equivalent to buying their own stock? They didn’t have enough free cash on hand at the time so they found a way around it. Seems like the best way to think about the ROIC is to use the full notional amount in the denominator. And then account for the extra costs like the borrowing costs. Maybe I’m missing something?

-

Why not treat it like a full outlay (ie buyback) at t0 and just incorporate some borrowing cost?

-

-

-

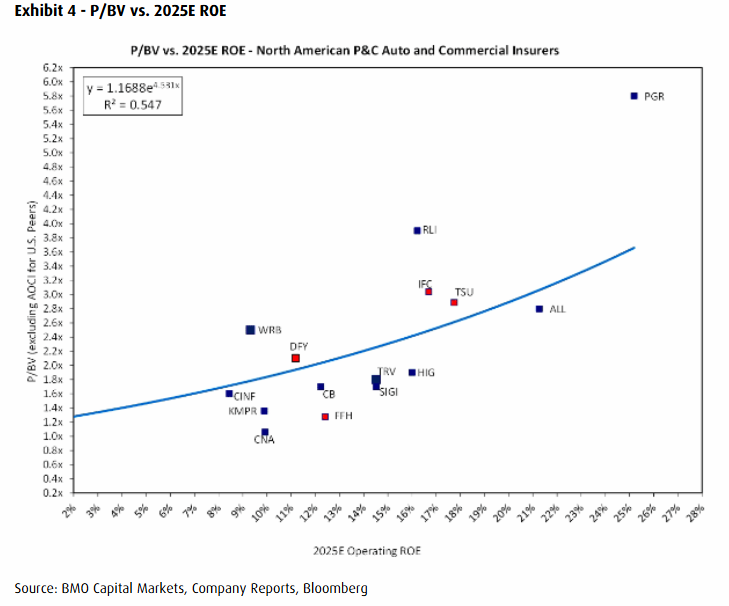

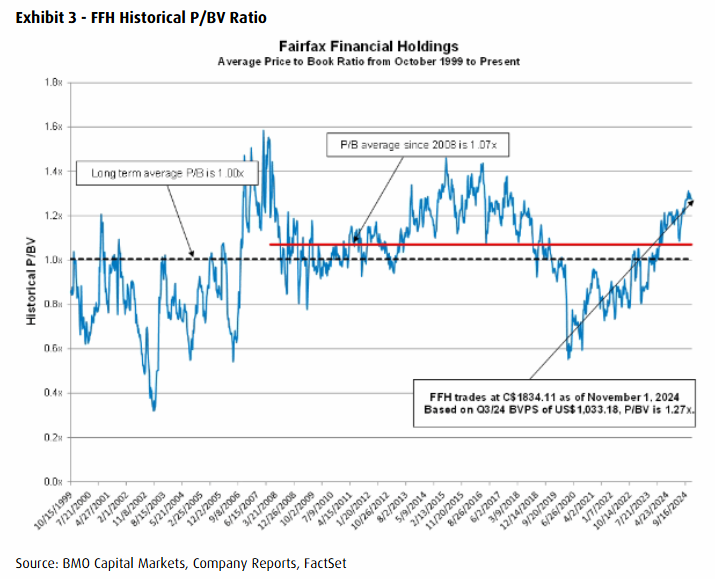

Has anyone seen a version of this chart that adjusts for fair value in excess of carrying value over time? If not, I'll probably create it myself. My sense is that when you look at it that way, the multiple hasn't changed much over the past few years.

-

I told myself I’d sell when we started seeing this again, but something tells me he’s still ahead of the curve.

-

It's not repeatable, insanely volatile and driven by FFH.TO since Jan '21, GLASF common and prefs/warrants since Aug '22, a few mostly lucky one-offs like TPL this year, and no big mistakes (yet). I'd be thrilled with ~10% compounding for the next few decades. I'm happy to see the "Fairfax as a hybrid deep value investor and endowment-style capital allocator" thesis proving out and the stock still cheap. You're better off with Prem.

-

I love it but there’s no way it’s sustainable and I’m waiting for Fairfax and a few other things to fully play out so I can index and take a long sabbatical. I have no clue how’s he’s still doing it. Or Prem for that matter.

-

Hey Prem, I’m 30%+ over the same period and uncorrelated. Call me.

-

I’m prob one of the few here to admit selling some over the past couple quarters but that took it from a 40% to 30% position to pass the sleep at night test and fund other ideas. Of course something could derail things but they’re now seemingly firing on all cylinders and it’s clearly compelling from a short term trade perspective too - let’s see what happens in December. I still think it’s worth better than 2x book or mid/high teens normalized earnings. I know others have thrown out 1.5x book and of course it will never be a straight line up even if index buyers. This is no CVNA after all

-

"For the Indian government, the stakes could scarcely be higher. India is in the midst of a partial rapprochement with China, but anyone who thinks New Delhi can afford to alienate the West is delusional. If India is seen as seeking to undermine freedom of speech and rule of law in the West, it risks being clubbed together with such adversaries as China, Russia and Iran." Unlocked article https://www.wsj.com/opinion/the-india-canada-breakdown-sikh-seperatist-murder-dispute-e74ed8c4?st=fYxjUC&reflink=desktopwebshare_permalink

-

Could you share more? Maybe I'm the opposite as I get uncomfortable when things start trading closer to fair value and I feel like I have a decision to make, which is probably why I sold some at ~$1,200 to bring it down to ~30% position (even though I think the risk/reward has gotten better and we're still nowhere near fair value - yes, I know that makes little sense on its face). Maybe it's a constitutional defect but I'm always looking what could go wrong and get no inherent joy from concentration in best ideas. It's constant tension between discomfort with the sizing and confidence in the analysis. The "sleep at night" test is all I've got. Any thoughts?

-

I was sleeping too well so I bought some more SNDL over the past couple days. My average cost is now <$2 on a ~9% position.

-

I missed this last week. CIBC's "index specialist" now thinks FFH is #1 in the queue for inclusion in the TSX 60, which would bring "close to 1mm shares of demand into the stock, representing ~15x its 30-day average daily volume." I'm guessing this is music to @SafetyinNumbers's ears and explains the recent strength. Here's hoping we eventually get to sell at a big premium to intrinsic value to know-nothing index investors. Sorry, grandma!