MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

I've felt this way every quarter for the past few years. And yet. Give it a couple months. Or at least a couple days!

-

wait, did I imagine him saying “goddammit” before they cut off his mic?

-

"We maintain our C$1,600.00 target price based on 1.1x but see potential upside should FFH begin to be valued off of earnings, where the peer group median is ~12x in 2024 vs. FFH currently below 8x."

-

Don't get lost in the weeds. They're expecting interest and dividend income alone of ~$2B for the next four years. That is up from ~$1.5B previously. That's just interest and dividend income.

-

Looks like another nothingburger.

-

The stock should be +50% tomorrow. Again, to be clear, it won’t be, but it should be. Anything below US$1500 is a farce with these results and outlook.

-

Don't we want them buying back as many shares as possible (without stretching too thin from a liquidity POV) at the current discount to intrinsic value - even if it makes them a bit less likely to get into the TSX 60? Would getting into the TSX 60 be so meaningful as to push the stock well above IV, giving them a good opportunity to issue shares? Does that tend to be the effect of TSX 60 inclusion? Idk what to root for.

-

Once you have the platform to pull off a few of these and make tens of millions, who cares? You ride off into the sunset or just hang out on your Texas ranch with your tigers and shoot at cans or whatever. You see the incentive to manipulate markets without repercussion. We should eventually see a crackdown on this sort of behavior.

-

Fair enough, and that's why I just read Bloomstran's opuses breaking down intrinsic value in gory detail. I guess therein lies the opportunity.

-

Our guy @hardcorevalue with a great summary https://tidefall.substack.com/p/short-attacks-and-tobacco-stocks

-

The question is if/when this ever becomes the consensus view. Maybe a fool's errand to even think about.

-

Maybe I’m not honorable enough but this didn’t bother me. I don’t check my facts with management before broadcasting an idea (even shorts) most of the time. What bothered me was pretty much entirely the whole “using your big platform to spread misinformation to move the market for a few days” thing.

-

@Viking so in this analogy is Carson Block sitting at home with a big bet on Atlanta screaming at his TV the whole fourth quarter? Or some prominent Pats hater on TV screaming “DEFLATEGATE!* SPYGATE!*” as they march to victory? Or a ref who throws a flag on the last drive only to get overruled on replay review? Or maybe just a drunk who passed out in his truck in the stadium parking lot before the Super Bowl even started? *both wildly overhyped nothingburgers

-

So when you do the analysis yourself to come up with an economic fair value, not accounting book value, what do you come up with? And how much did it change after MW’s report? Please let us know.

-

Sounds like might be news to you that accounting is only ever a crude approximation. “And it's not that hard to understand. But you have to know enough about it to understand its limitations because although accounting is the starting place, it's only a crude approximation. And it's not very hard to understand its limitations.” -Charlie Munger I’ve been arguing for years that FFH investors were being overly backward looking and book value accounting focused, missing the firehose of cold hard cash about to start spraying them in the face. But sure, let’s quibble over how the accountants value things a few % points in either direction when Fairfax have quite clearly lined themselves up to generate nearly the entire current market cap in cash flows over the next few years. It’s asinine.

-

BTW what they’re accused of is marking a $94 business at $100. The idea that that business is earning $15-20 in annual cash flow isn’t even in dispute.

-

I'd prefer that FFH not end up forced to sell another piece of a sub (even if it's at ~2x book). They're not running with some massive cushion at the holdco. Yes, they are generating a whole lot of cash right now - but if short sellers pile on, spread misinformation, and force them to post cash for the TRS going against them, then it's not just about meaningless volatility b/c anything can happen with stock prices in the short run - especially if short sellers smell blood in a relatively complex, volatile and illiquid one. I don't think it plays out this way, but that's why it's hard to just wave away as the bush league manipulative nonsense it seems to be. Maybe I'm off base? I think many of us have big positions and just trying to make sure we're not missing something stupid.

-

-

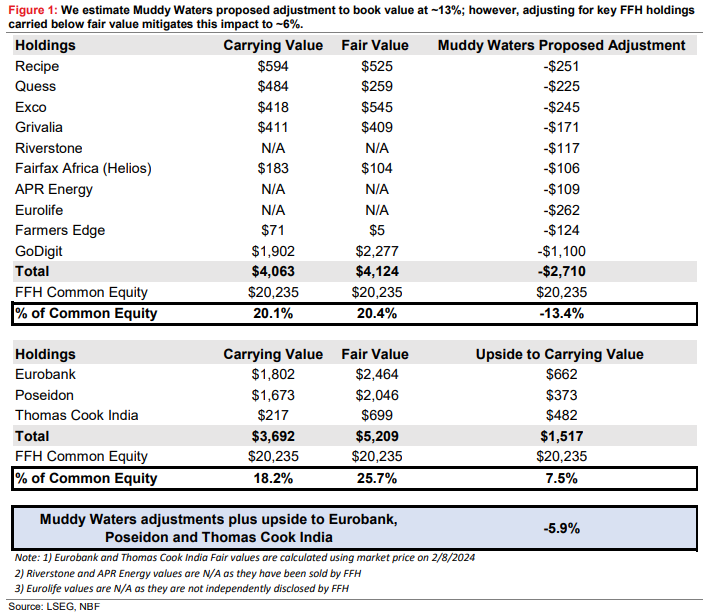

I guess simple errors of omission don't matter when you can move the market and cover the next day. Source: National Bank of Canada

-

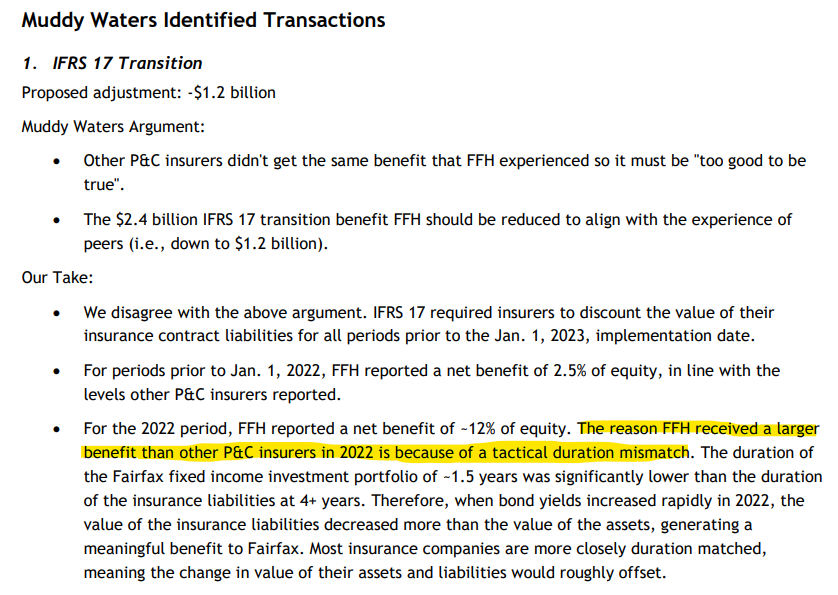

"not alleging fraudulent behavior" ... "cherry-picks" ... "standard short-seller playbook" "If we had to guess, Muddy Waters likely covered the bulk of its short position yesterday" These guys get it.

-

What's the total dollar amount? And isn't that reported on a pretty long delay? I thought it wasn't so clear and transparent on the Canadian exchanges. Thx.

-

Right. I am not a big conspiracy guy but it's well established that this is common practice nowadays and I think it pretty clearly fits the fact pattern in this case. Maybe I'm wrong.

-

Sorry, added that before I saw your comment. Same wavelength!

-

Low short interest just means it’s not a highly shorted stock and the borrow cost is probably cheap. In other words, it’s a contrarian short (at least not a crowded one) which is the best kind if you’re proven right. In this case, I think the odds are good that some big fund out there with a ~$50-100mm short decided to exit before earnings and therefore paid Muddy Waters with their big following to publish this during the quiet period. This is quite common and somehow legal, though regulatory changes are apparently in the works right now. It might also partially explain the low quality of the work vs. some others we’ve seen from MW.