MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

from deep in the archives... Vol 1 Santangel's Review - Teton Capital.pdf

-

Recent VIC writeup on Eurobank by Quincy Lee of Ancient Art/Teton Advisors (one of my favorites to track) https://www.valueinvestorsclub.com/idea/Eurobank/7301771925 "In the two years since my last Eurobank writeup, the stock has doubled while the Nasdaq is down 8%. The same thing will probably happen again the next two years to be quite honest. Probably none of you bought it, and probably won’t this time either. Anyway, I still like it today and haven’t sold a single share." Prem is right there with you Quincy... And same thing applies to FFH...

-

Berkshire’s “bond” portfolio is really the utility and the railroad. Need to get outside the narrow accounting definitions to compare the two. Rising discount rates probably wouldn't be kind to the valuations of those businesses if they were individually publicly traded. I'm guessing FFH is taking advantage of current rates to extend duration a bit closer to peers with real mid term rates now at ~2%+, but I'm operating under the assumption that inflation has been ~2-3% for a while now and that FFH knows it too.

-

Style drift in what sense? (I thought they were just doing the same old thing and it was falling more and more out of popular favor in a ZIRP world - but I have been a shareholder for less than three years)

-

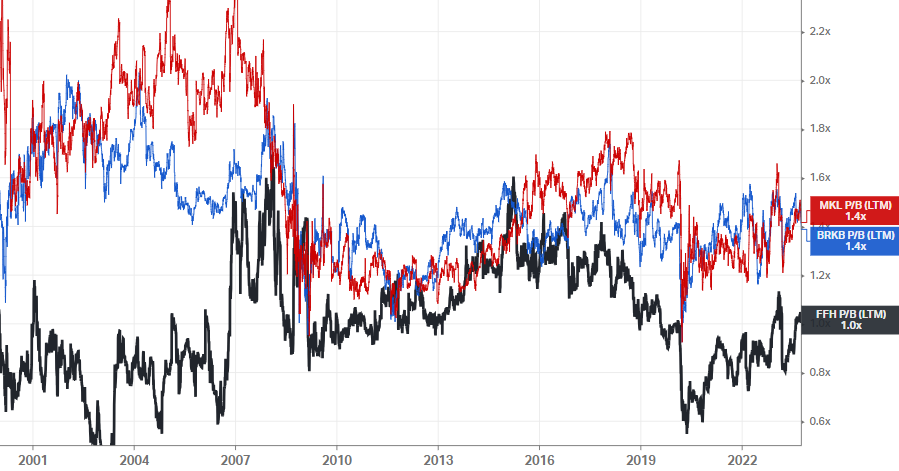

Here's the corresponding updated valuation on P/B (for what it's worth) with MKL thrown in. BRK (~1.5x) and FFH (~1x) are both valued at roughly the same multiples now as they were to start the millennium. I think to some extent it speaks to the fact that most investors prefer a smooth ~10% to a lumpy ~15% (long term looking forward IMHO) because it's just easier to sleep at night and hold on through thick and thin.

-

@gfp yeah I guess so - I would just say BRK’s portfolio is still much longer duration overall when you include the equities and think about it from an overall asset allocation perspective. BRK is more sensitive to higher discount rates lowering the NPVs of AAPL, GEICO, the utility, and the railroad, but of course still a cash machine and can reinvest at lower valuations so still arguably a counter cyclical element to intrinsic value. FFH is still more than half cash and short term bonds and a much higher proportion of ~0 cost float. So while historically they haven’t had anything close to BRK’s FCFE (vs market cap) to redeploy, it seems to me that’s changed over the past couple years and FFH is in a similar position of strength now, albeit with both 1) an overall “lower risk” portfolio heavy in cash and short term bonds and 2) higher float leverage so still inherently much more downside in a 100 year flood (and much higher upside too especially from this valuation) Am I way off with this?

-

I meant WR Berkley but might have that wrong!

-

Plus big picture FFH is still positioned so short duration vs all but maybe WRB, right? If rates keep rising they are most likely a net beneficiary vs competition and can keep expending our duration. We aren’t talking a long duration bond portfolio down 50% the past 3 years.

-

Sorry, I don't follow. If that post came off as too much of a troll... my bad. Most of the melodramatic posts were happening in late 2020 / early 2021 by guys who thought Prem was a confirmed dinosaur and the stock was never going anywhere, but maybe that's just my selective memory! Seems cheaper today than it did then, but I'm just a guy on the internet and I'm wrong about half the time. Let's not take ourselves too seriously.

-

“May you live in interesting times. May you also own Fairfax Financial, with its massive short duration fixed income portfolio, when interest rates spike off the lower bound and they then go on offense, growing and redeploying that capital without a huge hole in their balance sheet like competitors who for some reason get to wave it all away as short term losses (those 30yr 3% coupon bonds are held to maturity, everyone!), but it takes years for the market to notice the implications because of liquidity or indexing or blackberry or something, and you get buy at a huge discount to a step change higher intrinsic value. You’re welcome.” I heard that was inscribed on some tablets in 3000 BC.

-

Don’t get me wrong @Parsad Intrinsic value ~3x higher doesn’t mean I think it’ll trade there next year or that I’d pay that price for it. But if I did pay you that price, I bet I’d do just fine over a decade. That’s really my point. My main point though is that a persistent discount to intrinsic value and above market IV *per share* growth what makes a long term hold compounder, right? A high teens multiple of normalized earnings is a reasonable proxy for intrinsic value of a low-mid teens compounder with good aligned management and good capital allocation…and a long runway… because it pencils to a ~10-12% per share compounding from there. This is in a world of ~5% fixed income and ~7% long term expected returns in global equities. Do we agree on all that? Will I be surprised if this trades at 2x BV after a few more years of great execution in a good enough market and a ~$1300-1500 BVPS? No, because the market has proven to be so reactive and backward looking in this one. A longer stretch of good results tends to bring out the incremental buyers. The buyers are higher. I won’t be convinced otherwise by arguments about historical trading ranges. I will continue to ignore backward looking measures of value and see if that keeps paying off And i’ll continue on over here on Fairfax island with the weirdos and misfits. Enjoy the weekend everyone.

-

I’m gonna take this at face value and just say thanks. I still think the stock is trading at about a third of intrinsic value… I know some here think that’s funny but I’m deadly serious and here for the ride.

-

Mine is US$869.420 and stock hits US$1000 by Dec or we get another big dutch auction.

-

It's really just investing through a permanent owner lens, right? Invert P/E and you get an earnings yield. Let's say 20x p/e = ~5% earnings yield. If they pay all the earnings out to you as a dividend, you're getting your 5% dividend yield. If they instead retain 100% and reinvest at ~2x over ~5 years type incremental returns and then start paying that out at year 5, well, you end up with a much bigger dividend, but starting in year 5. And then it's a question of whether there's some massive terminal value or whether it's a runoff, or somewhere along that spectrum, and how you discount all that back. It all comes down to a DCF and if you're paying 60x earnings you just have to be aware that you're betting on huge earnings growth and a massive terminal value. A BAT with a ~18% earnings yield and ~12% dividend yield or whatever it is nowadays might not have the terminal value of a COST, but you probably don't need that to do very very well as a shareholder, maybe even ~2-3x market returns, as long as management allocates capital in a shareholder-friendly way and doesn't incinerate the ~1/3rd that they're retaining and reinvesting. I think something like a BAT should be a winner with good enough capital allocation, even if that's just a stable dividend and debt paydown. I'm guessing the same is true of many other stocks like it nowadays. I'm not sure how many people really grasp that a stock could go to 0 over two decades and you could end up with a satisfactory total return. I think many may have lost sight of this basic framework for investing during the zero interest rate environment last decade. So an approach like yours makes a lot of sense to me, as long as management is sufficiently aligned and rational (or just has a huge sustainable dividend on autopilot).

-

Yeah, I guess I'm conflating replacement cost with market prices, but you'd think one would follow the other. Property values down -> weakening demand for building materials and labor and so prices down -> replacement costs down -> insurance rates down. Maybe not the best logic.

-

https://www.wsj.com/real-estate/commercial/commercial-real-estates-next-big-headache-spiraling-insurance-costs-604efe4d?st=jtyozjrpfikx3at&reflink=desktopwebshare_permalink So, all else equal, what happens to insurance pricing if property values actually do reset down ~20-30%, with mortgage rates being what they are and the markets actually starting to price in higher rates for longer? Obviously don't want to read too much into SF office prices down 50%+ or whatever it is exactly from peak. Just trying to poke holes in the FFH thesis...

-

Gas cars? Implied value of VW core biz is like -70B on SOTP basis. Similar dynamic for STLA within Exor.

-

The time to sell some shares is probably when the stock is trading at 2-3x book and most people accept this characterization without a second thought.

-

I’m really trying to understand why we’re coming up on two years (?) of delays on FFH’s conversion from 49% to 74% ownership in Digit. What’s actually going on? Are the bureaucrats trying to extract a pound of flesh and Prem not having it? Are we about to find out that, sorry, no, Canadians can’t actually own Indian assets without some beyond extortionate fees/taxes? Just seems like more and more of a shitshow and I’m genuinely wondering how Fairfax India investors get comfortable with worsening political dynamics when protectionist bureaucratic nonsense was already a major risk. Is that too reactionary? I am genuinely wondering what Fairfax India investors think about all this right now. I am frustrated with it as a FFH investor, but Digit is still only a few percentage points of FFH GAV, so it’s annoying but doesn’t break the thesis.

-

So what exactly is India going to do? Nationalize Fairfax’s investments? Do they or do they not own ~74% of Digit? What a bureaucratic farce.

-

More broadly, I've come to the conclusion that most investors won't give Fairfax a fair look. For most, it's either outside their circle of competence or they're indexers/quants who will never care or will need to see the transformation if in the reported numbers for at least this year. Others have too much baggage and can't look at the company anew. Still others for the sake of conservatism will simply use arbitrarily low estimates that imply a dim view of the company's transformation. Therefore, the stock will have to continue climbing a wall of skepticism. That's fine. Without any heroic assumptions, it might give the company the chance to take out 20%+ of the shares at a steep discount to IV over the next few years, depending of course on alternative uses of capital. I'm just here for the ride unless it triples overnight or something fundamental changes out of left field.

-

Yes, I'll continue to assume Fairfax will not light capital on fire

-

I agree that we should look at normalized earnings. But I don't agree that we should look through what could be a few years of ~$160+ earnings, which is what your methodology implies, because I don't expect them to light those earnings on fire like most cyclical commodity management teams. And that quantum of earnings, even if peak earnings, will be ~95% retained and so should mean a step function in "normalized" earnings a few years out with reasonable capital allocation. I think it's fair to look at it both ways and capitalize Year 4 "normalized" earnings and discount all of it back. That gets me to $2500+ IVPS.

-

Respectfully, I think this is a fallacy and applying this mental model to Fairfax now is one reason it remains so cheap to intrinsic value. 1) We're not talking about the market paying a market or above-market multiple of peak earnings (if they're even peak earnings). We're talking ~5x, arguably a ~8-10x multiple of mid cycle. "Fair" in that simple sense is probably 50-100% higher anyway. 2) We are not talking about the man with a hammer syndrome that affects many cyclical commodity management teams. Fairfax management are value investors and can literally just park the cash flow (again, we're talking about them potentially adding an absurd ~50%+ to shareholder equity over ~3 years) in short term bonds at 5% and go on offense when it makes sense. And I mean, this isn't speculation - we literally just saw them do exactly that going into this hiking cycle. I think many investors overlook this point, maybe because they don't agree that Fairfax management are great capital allocators. If you have management like OXY's that sends back capital at $90 oil... well, then you see Buffett averaging up!