MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

I'm not so sure... might be a blessing in disguise bringing more attention to both.

-

well, if he’s not long already, he probably will be shortly - and having added a bit today, I’m along for the ride. I guess reasonable minds can disagree on whether this should be legal and is part of well functioning capital markets, but I think it’s pretty clearly manipulation at that point. I’d personally advocate for at least massive capital gains taxes in such scenarios.

-

+1 and that’s just the tip of the iceberg.

-

I’ll get back you but read eg this https://www.institutionalinvestor.com/article/2bsxbe3qsygknlfaolibk/portfolio/the-dark-money-secretly-bankrolling-activist-short-sellers-and-the-insiders-trying-to-expose-it and this https://www.afr.com/wealth/investing/short-seller-carson-block-the-stock-s-rocketing-i-want-to-vomit-20220718-p5b2f6 “There’s a multibillion-dollar fund out there going around with a short report trying to pay people to publish it on their behalf,” Fichthorn recalls the man saying. ——————————————- Marc Cohodes, a former hedge fund boss who now manages his own money from a chicken ranch in California, calls it “smash and grab”. It works like this: a prominent short seller stands on a stage and unveils research on a target company. The stock plunges 10 per cent, 20 per cent or 30 per cent before anyone has time to digest the report. By the time the public can debate the merits, the short seller has already closed out positions and is tallying gains. Cohodes has become outspoken in the short-selling community about his disdain of such practices. He and Block have seen their once-cordial relationship sour into a deeply personal Twitter feud. “There’s no place in the investment landscape for people who encourage others to trade one way and then take the other side of that position,” Cohodes says by phone. “When the government is done looking at this, people will know the proper rules on what you can and can’t do.” Block doesn’t hide that he takes money off the table quickly. “What he calls ‘smash and grab,’ we call risk management,” he says of Cohodes.

-

Pretty naive about who's getting paid by whom and the twisted incentives involved.

-

Here's the hard hitting analysis from everyone's favorite FFH analyst... "Short-seller Muddy Waters released a report outlining a bear case on no-moat Fairfax. At a high level, we don’t disagree with its take, and we do think the stock is materially overvalued right now. In our opinion, Fairfax is a hit-and-miss investor, a relatively poor underwriter, and has an overly complicated structure. We would agree that the company’s book value growth target of 15% is unrealistic, and it has generally fallen well short of this level since the financial crisis. As to Muddy Waters' claims that Fairfax is mismarking investments, we don’t think it is necessary to believe that to think the stock is overvalued. We will maintain our CAD 970 fair value estimate."

-

Just not a fan of the smash and grab... and seems clear that this is probably one of those, no? Need regulation around minimum holding periods for short sellers who choose to go public.

-

"P/E of 6.3x (using 2024 consensus EPS) versus U.S. peers that trade at 14.7x on average. The integrity of underwriting margins or investment income is not in question. In our view, quibbling about the perceived variance between fair value and carrying value of balance sheet assets overlooks the significant expansion of earnings power that is clearly not getting the same degree of recognition in the public markets as peers."

-

This is where the tyranny of the book value people gets ridiculous. I can personally come up with twice his 18% number in fair value over carrying value and show that book value is at least 18% understated. He ignores the fact that cash flow has exploded 3-4x structurally higher over the past few years and that the stock is now trading at 6-8x those cash flows. All of the historical transactions can be explained by the fact that they were short on cash for a few years... but they're not anymore. The irony is he nailed the GE comparison... in the Danaher / Culp era. Decentralization, quality upgrades, massive turnaround, and now a well-run cash machine.

-

Obviously I agree with your assessment. I can’t borrow your conviction but I can borrow your 250+ page book to help build my own and my family is grateful for that. Now let’s see if the TSX 60 inclusion arbitrage crowd (and closet/ indexers themselves) drive it to fair value.

-

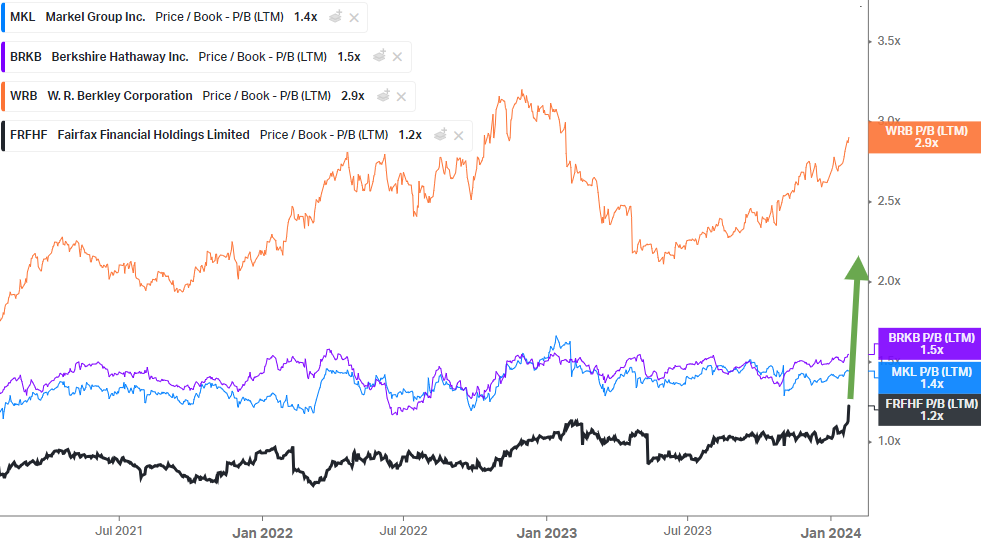

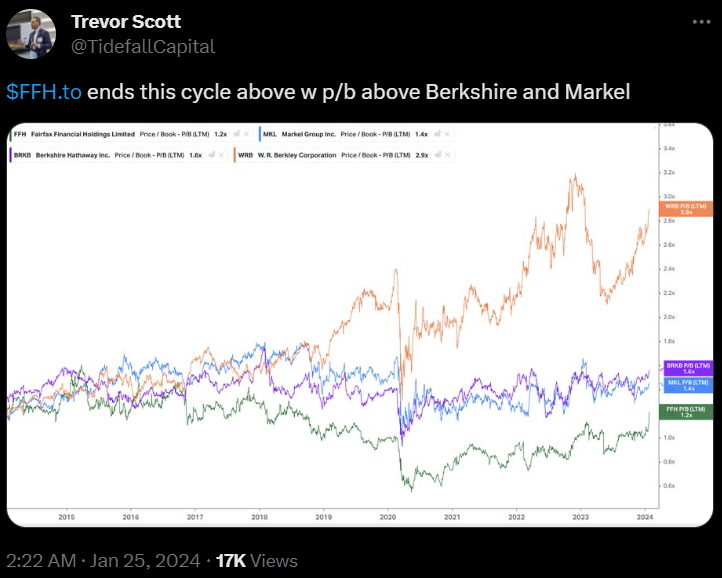

It’s just crazy that after this run it still trades at a discount. I figured your point was that FFH should trade at a premium to BRK and MKL by the time this hard market ends… which seems like a good bet.

-

I demand attribution for my super original and incredible chart, Mr. Tidefall Capital And you left out the best part - the green arrow. It's looking roughly right so far!

-

this was posted Dec 13th - might explain some of the move? https://www.valueinvestorsclub.com/idea/FAIRFAX_INDIA_HLDGS_CORP/5333839892

-

So my friend with the big FFH position decided to take a cue from Fairfax and create his own dividend (and sell his last share if the stock triples tomorrow). FFH’s earnings yield is ~15-18% these days, and they pay out ~1/10th of it as a dividend. So selling ~6-7% of your position basically amounts to taking out about half your share of earnings to reinvest yourself and leaving the other half to get reinvested by the great capital allocators at Fairfax. Right? This is some mix of: “The first rule of compounding is never to interrupt it unnecessarily.” - Charlie Munger “One of my smartest friends in venture capital is constantly getting huge clumps of stocks at nosebleed prices. And what he does is he sells about half of them always. That way, whatever happens, he feels smart. I don't follow that practice. I don't criticize it either." - Charlie Munger I figured this might be a good middle ground / regret minimization framework for others in a similar situation.

-

I think most of us agree, but we also know survivorship bias is real and context matters. Yes, the valuation on normalized earnings hasn’t really changed over the past 3-4 years even as the stock has 3-4x’d, and we know book value understates economic reality. But let’s say someone bought this back then at 0.5-0.6x book and has let it grow to nearly half their retirement portfolio or kids college fund or whatever and now the risk inherent in such concentration is keeping them up at night - let’s say the risk of The Big One, or of Prem keeling over tomorrow, or that Eurobank is a big fat fraud, or some true black swan. Would you blame them for cutting this in half this year if it keeps running up? Investing is never easy, right? Asking for a friend.

-

WSJ: Insurers Rake In Profits as Customers Pay Soaring Premiums https://www.wsj.com/finance/insurance-companies-profits-stock-ebae7fd1?

-

-

This is great advice when paired with a focus on business quality. The mistake people can make is ending up with a bunch of melting ice cubes or highly levered and fragile high current yields. Fairfax seems like a great example of both a high earnings yield (seemingly now structurally robust, if volatile) and high future eps growth - possibly for a pretty damn long time. Hey, maybe the market will eventually catch on.

-

Weird. From Koyfin.

-

-

many will scoff at 2.5-3x P/B but that roughly equates to intrinsic value IMHO

-

So... is this enough to extend the hard market another couple years? https://www.wsj.com/articles/u-s-saw-record-breaking-thunderstorm-damage-in-2023-e42fa775 Thunderstorms in 2023 caused $76 billion in losses in North America and Europe, a record for such weather events, which have in recent years begun to rival hurricanes in terms of the damage they collectively mete out to businesses and homes. The weather events, formally known as severe convective storms, in North America destroyed assets valued at $66 billion, according to an analysis of the year’s natural catastrophes released Tuesday by reinsurer Munich Re. About $50 billion of that was insured. In the U.S., two thunderstorm series—a Midwest storm in March and a Texas storm in June—together caused $17 billion in losses, contributing to the highest level of total thunderstorm losses the country has seen, Munich Re said. Though insurers classify thunderstorms as “secondary perils,” behind primary perils such as hurricanes and earthquakes, their volume in 2023 led to cumulative losses that outstripped those caused by a season of hurricanes. Beyond rain and thunder, severe convective storms can spawn damaging phenomena such as hail, tornadoes and straight-line winds.

-

Tom Gayner has this figured out. Sounds like you want MKL.

-

I'm reluctant to wade in here b/c it probably won't be productive, but I can't help but point out that accounting book value still has almost nothing to do with intrinsic value (and therefore the wisdom or folly of various capital allocation decisions) for Fairfax and almost every other company nowadays. The fact that even smart investors still think this way is probably part of why Fairfax remains so cheap. Fairfax's recent transformation into a cash machine isn't really reflected in the historical accounts and that's *still* the whole opportunity in a nutshell. "Thank God we don't design bridges and airplanes the way we do accounting." -Munger

-

Would love to debate this point over at the BAT / PM threads