jfan

Member-

Posts

533 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by jfan

-

BAM

-

A couple articles for those interested: Do cryptocurrencies have a place for value-oriented investors? | Benefits Canada.com The second is an attached pdf from the Federal Bank of Reserve New York. Here is the abstract: sr1052.pdf

-

2021 Workers Compensation Financial Results Update (ncci.com) The data is slighly dated but it gives a idea of the longer term WC market. As per @Cigarbutt post above, it seems that WC has significantly turned around since 2013 and continues to have <100% CR, premium growth, and 20% operating margins. There is a slight uptick in CR, and drop in premium growth and operating margins, so maybe some slight short term headwinds, but it is my first-level thinking, that with WC suffering 20+ years poor profitability, and now has 8 years of profitability, that there might be some long-term tailwinds for Stonetrust here. Also for those interested, using 3-year rolling geometric means for Chou Associates returns since inception, it seems that he outperforms the market ~ 65% of the time. His worst 3-year rolling average return was -8%. He is ~ 10% return investor wrt to his long-term track record. I did the same with another Canadian deep value investor, for contrast, although this investor had a 3-yr average of 11%, the dispersion was quite a bit more significant, where he outperforms ~44% of the time, with gains up to 80%+ but losses -20% over time. Chou's style married to a conservative insurance business seems to a good match. <0 21% 1 to 7 15% 8 to 10 15% 11 to 15 26% >16 24%

-

thanks for the link. I assume the last part was particularly polarizing. I haven't yet read that book, but have been working through A Noble Function - How Uhaul Moved America. This one is more about the initial early years of the company's founding.

-

Do you have that video link?

-

Congratulations on your new addition! Enjoy every moment. I have a 4% position on FFH. I haven't yet earned the privilege to take concentrated positions yet. But a few thoughts about my ownership from this point on: 1) If Prem and team continue to stay in charge for the next 10 years, I think it would be reasonable to expect that they will pull interesting tricks out of their hat from time to time. They do better with value now and value not so far in the future investments. In a higher or for long interest rate environment and global reach, I feel fairly confident that they will always find something to do. 2) They don't run private non-insurance businesses or do turnaround activism very well, but they always seem to be able to attract good capital allocators to partner with. Hopefully they continue to build out this platform which might have long-term positive outcomes. 3) I'm also fairly sure that Prem and team recognize that at some point in the future, the insurance market will go soft. If they position their float now (assuming they can maintain decent retention rates) to generate a decent amount of interest, dividends, and more capital gains than losses, they will continue use those opportunities to buyback shares given that they've slowed down the expansion of their insurance geographies. If they do the above, I think I would be content to enjoy the ride and hold on to it. However if the following happens, I would trim or sell out: 1) more insurance company purchases with FFH shares 2) large macro bets 3) position sizing hard on too many turnarounds or deep value plays with too many macro externalities

-

With ffh changing significantly in terms of underwriting consistency and investment focus fixed, what will you do when it hits $1200 or 1.5-2x BV? Sell? Trim? Or hold for 10+ years? Is there a case to be made that ffh will be a compounder like brk?

-

Just a random thought... If I purchase a bunch of BTC at $15K/coin, the price runs up to $100K/coin. I use that BTC to purchase a house by transacting fully in BTC with the seller. Do I pay capital gains tax on my BTC purchases? What is the Canadian tax law surrounding this? Does the home seller declared capital gains or losses at the point they convert to the local currency?

-

Just to add some more charts to continue fuel this debate. The following is 2 charts: 1) BTC's 1 year volatility relative to other asset classes https://charts.woobull.com/bitcoin-volatility-vs-other-assets/ 2) BTC's 60 day volatility relative to FOREX https://charts.woobull.com/bitcoin-volatility/. @Parsad is correct that at the current state volatility is very high relative to other choices which makes transacting in dollar terms somewhat impractical. That said, volatility of "money" does not necessarily, according to Hayek, equate to lack of value. Hayek discusses this on page 70- 72 in his book attached here: https://nakamotoinstitute.org/static/docs/denationalisation.pdf . The biggest question is will a money over the long-term (probably measured in years to decades) be able to purchase a basket of commodities (stuff that fulfils the most basic of human needs) from point A to point B in time. The BTC bulls would say that as adoption increases, and the remaining coins to be mined are gone, that this volatility will mitigate in the future. This is obviously still speculative. The volatility charts attach above have not shown definitive proof over its lifetime. I do think that it is premature to close this aspect of this debate due to present data. As in the FFH 2023 thread, @Viking quite intelligently points out that FFH's historical ROE is not a good reflection of its future ROE. I have to run to work, will add more thoughts on illiquidity after.

-

Not that I'm a genius but Claude Shannon spent significant time and effort studying the mathematics of juggling, wrote poetry, and rode unicycles at bell Labs writing chess programs for fun. I just prefer to spend my part of time and brain cells exploring ideas even if it leads nowhere but just satisfy my curiosity. Hopefully this helps reduce the probability of developing Alzheimer's.

-

I tried to find a good link explaining the difference between a hard and soft asset but my brief search came up lacking. This was a fair one on the subject: https://fundrise.com/education/real-estate-is-a-hard-asset It seems that trying to peg assets as hard or not is similar to separating value vs growth investing. Perhaps it might be a useful exercise to examine the dichotomies of descriptors/characteristics of an asset: 1) atoms/tangible/physical vs bits/intangible/non-physical (emotive, cognitive, psychological) 2) scarce/non-reproducible/non-replaceable vs plentiful/reproducible/easy to substitute 3) directly serves a basic human need (Maslow's hierarchy of needs) vs indirectly acts as a conduit to satisfy a basic need (eg financial assets) 4) Unencumbered/Bearer asset vs Derivative of another asset/promise of an authority or institution 5) Requires energy to produce vs Requires human consensus/policy to produce These are some of the distinctions off the top of my head. Any others? BTC: 1) Intangible 2) Scarce 3) Indirect conduit 4) Unencumbered 5) Requires energy to produce

-

Thanks @Viking That makes a ton of sense. The average basic shares outstanding during this period was 25 million. So these equity and CPI hedges cost them $21-22/share each year in earnings. (I know the math is not precise) Their average EPS during this period was $21/share on an average BVPS of $406/share USD. IF we add these unforced errors back to their average EPS, this would suggest that they SHOULD have achieved 10% ROE through this time period unhedged. IF the investment team is still roughly the same and have incorporated their painful lesson for future decisions, and the current portfolio state, I am hopeful too that past is not reflective for the future. Many thanks.

-

Sorry I'm a slow learner but FFH's ROE since 2002 has averaged 8% (with a wide dispersion) and a median of 6% (IQR25 2%, IQR75 12%). With it trading at P:E of 6x, is the investment narrative here that FFH can sustain its current earnings for a longer period of time relative to its historical performance? Is then the hope here, that their PE multiple will expand to 10x?

-

what is the definition of a hard asset? physical? vs scarcity?

-

Although the BTC consensus protocol is decentralized, what is your opinion on the centralization of mining equipment manufacturers, mining pools, wallet manufacturers, and regulated crypto exchanges and wholesalers? Are these weak points in the ecosystem? Are they necessary to facilitate adoption? I have tried to put together a bitcoin node (unsuccessfully), so there are still friction points for non-programmers out there that necessitate "trusted" 3rd parties. I can imagine that running a rig is likely even more difficult. I wonder whether this limits adoption and keeps the protocol decentralized over the long-term. A discussion about money's limitation and the proposed bitcoin solution. https://www.lynalden.com/december-2022-newsletter/

-

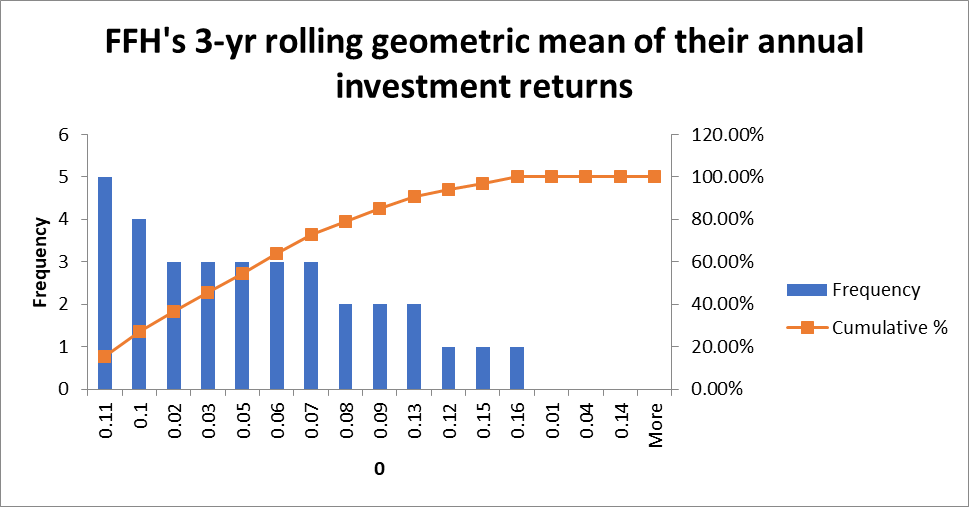

Thanks @Viking for sharing all your hard work. I take a slightly different approach to valuing FFH as long as the management team and their goals remain stable. Given that their investment returns are their primary driver to earnings power, I use an expected value framework by focusing on the following variables: 1) Investment $ available 2) median combined ratio of 97.3% (data from 2007 - present) 3) median corporate expense 4) current interest expense 5) % of earnings attributable to minority interest 6) current outstanding shares I build out a theoretical EPS for the range of all their geometric mean % investment returns and use their historical probabilities of occurrence to come to an expected EPS. Below is a graph of their return frequencies. From this I get a point estimate of their EPS of $95 USD/share. Just another approach which seems to triangulate with @Viking's more detailed breakdown. Thought this would be interesting to share.

-

Agreed. Electrical costs are likely higher. Which means the floor price is higher as well. At $0.12/kwh, you are looking at $18-19k. https://advisor.visualcapitalist.com/global-energy-prices-by-country/ The link above has a good list of electrical costs per kWh across the globe. Fooling around with numbers, 3x 100 th/s rigs that cost about $1500 each, will get a positive return at $0.12/kWh with a floor price of $12-13k. This of course assuming no friction wrt to obtaining rigs, access to hosting space, getting them up and running, no maintenance costs, etc. Obviously, the Ponzi scheme/manipulated BTC price could push below this floor. But unlike proof of stake or altcoins, proof of work and mining economics suggest there is some fundamentals at work.

-

With the least efficient miner establishing the floor price...using the following assumptions 140 th/s rig costing $5750 usd new, lasting 4 years $0.079/kwh 1.2x yoy difficulty increase 10% discount rate Purchasing the miners with BTC, will yield 1.14 mined BTC for every 1 BTC spent. Or the discounted cost of mining 1 BTC is ~ $14.5k usd.

-

Thanks for this...very interesting. Apparently Saskatchewan also has non recourse mortgages as well. A friend chatted with a CFO at one of the Canadian banks and was told that pre pandemic, 5% of mortgages had 30 year amortization whereas now, this has reached 30%. With such banking concentration, and forced renewals every 5 years, the key economic indicator may actually be unemployment rates. The Canadian housing system/politics/banking has every incentive to keep people in their homes. Keeps everything and everybody solvent. The velocity of housing transactions may slow but as long as people can keep paying something, the price correction hopefully won't be precipitous. That said, the banks will have some degree of pain, and I'm not sure all of them have this scenario priced in yet.

-

The problem I see that prevents having a rational discussion on this topic are the following: 1) Entrenched worldviews that are biased towards one's own context and experience 2) The intense emotions this debate engenders and the unwillingness to try to steel man your own arguments 3) The lack of data presentation from good information sources (ie not headline media) 4) The challenge of agreeing on what we are debating (philosophy vs technology vs macroeconomics). The resolution of these matters will eventually occur but everyone has to wait. There are a few general themes that I see might be relevant: 1) This is an early? late start venture capital/technology bet that may have various possible use cases (store of value, medium of exchange, fixed issuance, decentralized currency, etc) (at least as it pertains to BTC). This is not something that traditional value investing along the lines of Graham, Buffett, Munger, and Watsa would do well in (if there is any value in the end). 2) What is value? (traditional DCF vs shared socio-cultural understanding [eg parent's love of their children, historical works of art and music]) 3) What is useful in one society is not useful in another (eg WeChat in China vs WeChat in North America, Farmland ownership in a country with a rule of law vs a country with a dictator) 4) Cryptocurrency does not need to replace all other traditional assets. Securitization of companies was an invention of man https://en.wikipedia.org/wiki/Joint-stock_company#Early_joint-stock_companies (Here is a wiki page on early securities of companies). One has to wonder what people said of this invention when it started up. ("This is crazy. Why do you want to own a piece of paper when you can use your money to buy a piece of farmland?") I built a little excel calculator after reading https://lemoncakesinvesting.substack.com/p/lessons-from-murray-stahl#footnote-12-45570065 I quite liked inverting Kelly's Criterion to look at the implied probabilities of Bitcoin's commonly touted use cases...1) Gold substitute 2) M2 money supply substitute vs A ZERO. Anyways, no one has to plant absolute flagpoles on one side or the other. It's probably more important to just remain curious and open to ideas. No one has to lay down any money here. There are opportunities everywhere and elsewhere for everyone. Just have to pick stuff you are interested in. ** I do own a little bit of US and Canadian Farmland too Kelly Criterion for BTC .xlsx

-

Ntdoy

-

-

Thank you @SharperDingaan. I respect your opinion greatly. In fact, your posts have been particularly insightful for me. Your ideas and @Gregmal have both shaped a fair amount of my understanding on this framework. You make an excellent point that forecasting is a dynamic process and requires updating , continuous learning, and reflection of past conclusions. Matching your time frame with the 1/2 life of the relevant inputs is key. I guess a reasonable analog is we know that keeping an ideal body mass is important to good health and longevity but knowing the day to day fluctuations in weight is less impactful unless you are planning to get into your wedding suit/dress. You also make a great point on advice and advisors. The key is to have your own independent thought. I am finally grasping the fact that to function adeptly in this world requires simultaneous skepticism and keeping an open mind to people and ideas, although can be sometimes in opposition, is an absolute necessity. Again, appreciate the feedback.

-

https://thequestionableinvestor.substack.com/p/thoughts-on-decision-making-position?sd=pf Wasn't sure where to put this post...its a little bit about my thoughts on position sizing, decision making, Meta, BTC, and Francis Chou. Welcome people's feedback. Thanks in advance.

-

For those interested in btc mining economics courtesy of horizon kinetics Mining-Economics-What-Drives-the-Bitcoin-Price_Sep-2022_Final.pdf