jfan

Member-

Posts

533 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by jfan

-

Thanks SD for the details. Much appreciated. It will be very interesting to watch how things develop. Owning large areas of land servicing local carbon-producing industries creates the potential captive customers that may need long-term contracts for their carbon credits. They also mention hydrogen generation as a future opportunity both in terms of the commodity itself and the ability to generate CO2 for their oil operations. Do you have a sense of what stage they are at here? Just curious about using blockchain for carbon credits. I came across a few very nascent tokens such as XELS, Universal Carbon (UPCO2), and Climatecoin. How legitimate are these platforms? Found a couple interesting primers: https://www.globalenergyinstitute.org/sites/default/files/020174_EI21_EnhancedOilRecovery_final.pdf https://www.iea.org/commentaries/can-co2-eor-really-provide-carbon-negative-oil https://www.netl.doe.gov/sites/default/files/netl-file/co2_eor_primer.pdf Jfan

-

Thanks SD. Just curious about a few things: 1) does wcp.to already collect carbon credits and are they verified with a 3rd party agency? 2) how long do these carbon credits last before expiration? I know they vary depending on the carbon capture method. With the co2 permanently placed into the ground, will they be indefinite? 3) is it very inexpensive to purchase dry c02 from heavy industry? Thanks for your insights Jfan

-

It was interesting how Prem gives alot of air time to his insurance managers to discuss their business segments. Although he gives credit to his investment team, it would be encouraging that he has Wade and Lawrence to speak about their philosophy, learnings as well. I know that Buffett doesn't, but Fairfax isn't Berkshire. Perhaps next year?

-

I was browsing through their website and under corporate it states the Wade Burton is hwic chief investment officer. Has that always been the case?

-

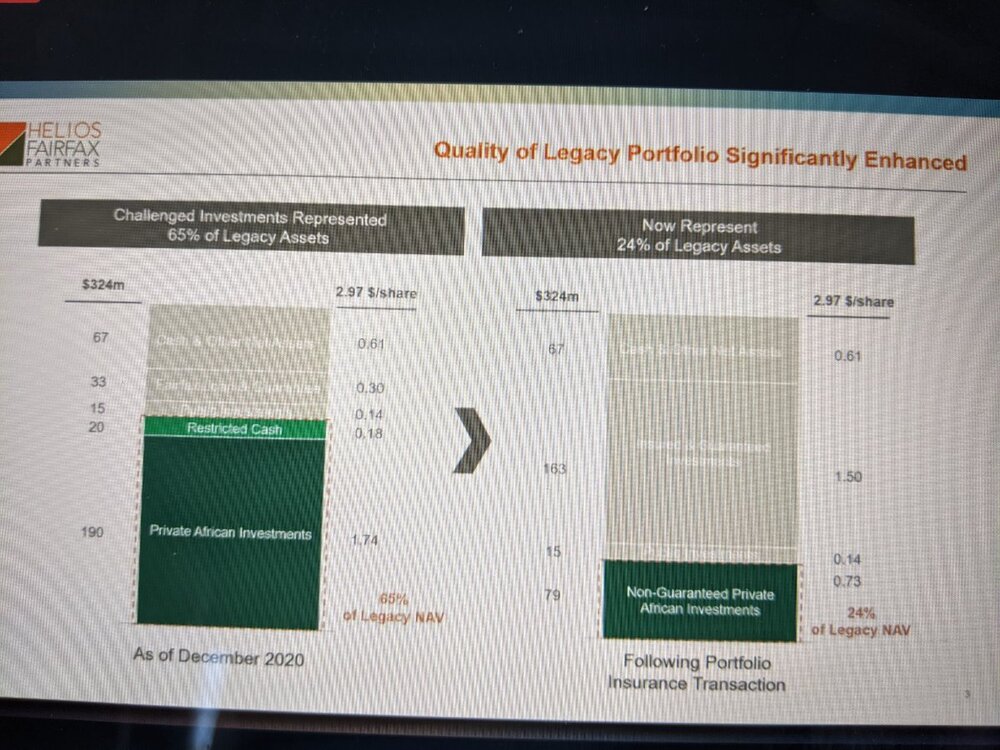

I attended. I think I was the only outside passive shareholder there. Got all my questions answered. I didn't take extensive notes but here are a few observations: 1) These guys are honest and not afraid to openly discuss the poor investments made in the past in the presence of Fairfax leadership. They said prior investments were loaded up too much with debt, poorly timed, and lacked execution. 2) In order to consummate the deal, fairfax had to provide them with insurance to set the floor on asset devaluation from their prior investments. 3) Helios brings in some existing carried interest and fee revenue that they present valued at 22% and 19% discount rates respectively. 4) I asked about the competitive landscape among asset managers in Africa. They said that it was very specific to each country. They prefer to focus on larger economies that may have lower margins. They spoke of how capital flows were very cyclical and many of the larger players are questioning their continued activities there. In their 3rd fund, they looked through 400 potential investments for 12 picks. 75% were proprietary (i guess they meant no other bidders), and of the 25% that had other offers, only a very small # were based on price. Most were based on how the asset manager can add value to the transaction. 5) I asked about stakeholder alignment. They said there are 3 parties. The fund LPs, Helios investment manager, and Helio Fairfax shareholders. Helios partners invest along side their funds (I assume personally) to align with their LPs in addition to their management fees and carried interest. Helios is aligned with HFP by being equity owners of HFP shares. HFP is aligned because fee and carried interest sharing between with Helios and LPs. 6) HFP will co-invest with all of Helio's future funds. In fact, there may be investment opportunities that would not be fitting for the funds but better within HFP's structure. 7) I asked about inflation risk management. They said they are USD return focused and of this currency risk, they manage very carefully. They look to invest in businesses that have the ability to pass on these currency risks and have less import reliance. 8 ) They are looking for secular growth or consumer non-discretionary (not cyclical), growth rates that are multiples higher than gdp, capital light except for situations of high revenue visibility. Sectors of interest include financial services and tech, clean energy and power, telecom/internet infrastructure, consumer non-discretionary. 9) Their portfolio assets now are $0.61/share in cash, $1.50/share in insured and guaranteed investments, $0.14/share in public investments, and $0.73/share in non-guaranteed private African investments. The present value of carry income was $0.81/share and present value of fee income was $1.71/share. 10) I "feel" Fairfax Africa shareholders may have gotten lucky that Fairfax Financial was able to put this one off.

-

How do you see a mine expand their operations without making large costs, exactly? I'm just thinking about the difference between an existing mine that might be underproducing, on maintenance and repair, or has adjacent brownfield expansion opportunities vs a mine that has probable reserves that requires building of infrastructure to gain access to the commodity. With commodity price inflation, wouldn't the first mine be better position to capture profit vs the second that requires rapidly inflating capex and thus be less valuable?

-

Does this depend if the asset (mine) is already existing and needs less cap ex to expand in the future vs an outdated asset that needs significant upgrading?

-

What a great discussion. Thank you for all the perspectives. This year has been a interesting/painful/hopeful experience in understanding the importance of position sizing and its effect on your portfolio. I think when it comes to position sizing it depends on a bunch of additional factors: 1) Past stock picking skill/experience that in turn depends on ability to make good decisions, process information, ability to see around the corner, mentorship, team-based vs individual-based work, full-time vs part-time 2) Recent performance - Druckenmiller in an old interview gave advice that when he had a poor performance streak, he would size down future positions to regain confidence. I suspect that he recognizes the possiblity of poor cognition or bad investment framework 3) Ability to exert control/influence the direction of the business 4) Illiquidity - I think taking large positions in illiquid investment requires a little bit of all the above or a huge degree of trust in the management of the underlying business 5) Personality - Do you enjoy high risk or are you risk adverse? Are you holding on in the volatile times because you are confident vs feeling like a deer-in-the headlight? Can you stomach the pain on selling out a large losing position after a period of under-performance? What is your time-frame preference (ie can we hold something for 3-5-10-15-20 years)? Just some of the questions I had to ask myself.

-

What resources do you use and what kind of investing method?

jfan replied to Arski's topic in General Discussion

Being in a similar situation, I would say that it depends on how this hobby is going to fit in your life/regular work. More important than the source of information is your strategy of how you are going to learn. Concentrated investing in small caps requires lots of working knowledge of the industry, a track record of correct thinking, and lots of time monitoring the situation +/- access to management. In the beginning, the best approach (after making plenty of mistakes and not listening to experienced investors coupled with an ego) in my opinion, are small bets across a continuum of styles with a structured investment process to evaluate how correct your thinking is with a 3-5 year holding period. The rest of your portfolio, just dollar-cost average in a index are regular interval. It is most probabilistic that you will have more FOMO and action at the beginning, and I would use this tendency to learn on a larger case series to inform your future self. Once you prove to yourself that you can learn from your mistakes and successes, then re-evaluate your style. The appeal to concentrated investing is you don't have to track a large number of positions, but you have be damn sure you are right in the end, you can handle the volatility, possible long periods of underperformance, and have the ability to track the right things to inform your holding. If you aren't in the industry and willing to dedicate hours analyzing, scuttlebutting, talking to management, it is probably better to have smaller positions, extremely long holding periods, learning a bit of technical analysis to placate your trading tendencies, and diversifying across very deep value <--> growth styles (or Peter Lynch's 4 different buckets). -

Gbtc

-

Appreciate your thought processes on this. I don't know if this is the right way to think about it but here is my logic. Single customer in Y1 and Y2 provides $120 each year. Assuming that after year 2, it becomes an annual subscription renewal option with a 10% churn rate (ie 10% chance of losing them as a future customer), the expected revenue in Y3 ~ 90% x $120, then in Y4 ~ 90%^2 x $120, and so on and so on. After 10 years, the probability of this customer remaining will be ~ 35%, with an expected revenue of 35% x $120. It will take until year 25, for the probability to drop down to 7%. Taking this expected revenue stream, I discounted it back to present value (10% discount rate), which would give me a present value of ~ $600 for this single customer. Assuming that there is no significant CAC, and the net profit margin once stabilized is 30% (you are right, will likely be much lower if the gross profit margin is 50%), each customer would generate a present value of ~ 30% x $600 of value = $180. If the payback period is 1 year, then the CAC will ~ $120 and the value per customer would drop to $144 or [($600-120)*30%] (This number is an over-simplication as it doesn't account for growing cash flows with increasing deferred revenues, maintenance R&D, S&M to update software versions, subscription vs usage revenue models) So in 3 years, with 100,000 customers, $180 * 100,000 = $18 million of value on $12 million of revenue or $3.6 million of earnings on a 10% churn rate. It would be more valuable if they can reduce their churn rate over time (if they can drop their churn rate to 0%, then maybe you can think about a value of 10x $3.6 million earnings = $120/0.1 *30% x 100K customers = $36 million) If there is a possibility that the churn rate increases significantly after Y3, then the product is no good, led by an incompetent management team and it would become un-investable. SAAS should be inherently sticky because it allows businesses to see how their clients are using them and give them the ability to layer on needed/desired features. If they can't do that, then trying to sell their poorly functioning intangibles is likely an impossible task. Figuring out their growth rate is more difficult and probably more qualitative than quantitative. This is where I think about the quality of leadership, focus on experimentation, innovation, solving difficult problems, customer focus and delight, open source innovation vs proprietary, degree of industry collaboration, ability to not only grow vertically in their software stack but also to adjacent markets, ease of customer adoption, organizational structure, very large TAM etc. So if I can buy it at $18 million discounted back by 7.5-10%, or at $13-15 million today coupled with a judgment about their ability to reduce their churn rate and skill to grow in a manner that it unexpected (via the above qualitative features) as the free option beyond year 3. Then there is a greater probability of having a reasonable return. (aka Shopify --> Shopify Capital, Amazon --> AWS) Welcome any push-back on my logic.

-

CCO.to

-

I'll take a stab at this: Assuming for each customer, the first 2 years of revenue is $120 each, with a 90% decrease after that. It would take ~ 25-30 years to lose that customer. The PV10 for a customer would be ~ $600. If in 3 years, there are 100K customers, the approximate value (using 30% Net margins) of the business is $18 million. This # doesn't account for any customer acquisition costs. If my personal hurdle rate is 10%, then the max value I would purchase it at would be $13 million or 11x current sales. To make the math easier, I would eliminate it (deal-breaker) if there is a potential of increasing churn rate after year 4 by filtering out maligned management teams.

-

Assuming that they don't achieve scale economics on their current roster of specialists, and other profitability measures staying the same, the fees should increase proportionally to AUM growth. So from a 3.6B fund --> 10B-15B AUM, the approximate additional growth --> ~ 10-15% on top of the 4-13% that I estimated, for a total of return of 14%-28%. Lots of assumptions obviously, with future fund performance, AUM size, and their skill in managing inflation risk. It makes sense for Fairfax to salvage their mistake and gives Helios a brand boost.

-

Did a brief scan over the management circular for the upcoming transaction with Helios. Petec summarized the transaction in a prior post quite succinctly. Thought I would add a few rough details and a bit of math. Helios generated ~ $3.6 million in base management fees (aka excess fees) on 3.6 billion of AUM. Their net profit margin margin was ~ 14% with a ~$5 million after expenses (they paid no tax). Of the 4 fund vintages (I, II, III, IV), they have closed out I completely on Sept 2020, and sold 2/8 positions from II. Fund I, had an initial value of $303M. Fund II, had an initial value of $908M. The carried interest on Helios Holdings Limited (HHL)was $11M. This amounts to 50% of total carried interest generated from the funds of which the other 50% is earned by the investment team. The hurdle rate was 8% and the performance fee was 20%. The exited positions (by my rough approximation) probably had an original capital contribution from investors at an amount of $532 M ($303M + 2/8*$908M). By my math, their achieved CAGR over a ~12 year period was 8.7%. For Helio Fairfax Partners (HFP), they will pay a base management fee of 1.5% of NAV for deployed capital and 0.5% on undeployed capital. They will have a 5% hurdle rate with a 20% performance fee. Assumptions: - if Helio's AUM stays at 3.6 Billion, running ~ 3 x $1 billion funds at any point in time - tax rate of 26% for HFP - current price of FAH being $3.50/share on 59 M shares - 9% dilution with the deal spread over 10 years 1) Total fee generation after-tax will be ~ $7.4 M (at current market price --> gives a 3.6% return) 2) With the $391 M of current FAH equity in Helios' hands compounding at 8.7% into the future, the 10-year future value after carried interest payout will be $847 M. (at current market price gives a 15% return from NAV growth) 3) 1.5% drag due to base management fee 4) 1% stock dilution drag due to one-time stock dilution over 10 years 5) African inflation ranging from 3-12% Total personal return will be 3.6% + 15% - 1.5% - 1% - (3 to 12%) = 4 - 13% annual return.

-

TIKR.com | Free Beta with Coverage of 50k+ Global Stocks

jfan replied to Garpy's topic in General Discussion

Is it possible to remove the "x" from the valuation multiple's table? -

It's taken me a while but I finally got my head around this concept. I've read through the Stephen Penman accounting textbook and his use the residual earnings model. I think this model hides the exact issue that others have been raised up, freely distributable earnings (today) that don't need to be reinvested for growth (aka FCF, owner's earnings, cash from operations less maintenance capex, etc) is very different than earnings that need to be retained in the business for future growth (eg expansion of inventory and accounts receivables, PPE, etc). I'll share with everyone my mistakes and what the lessons were: 1) Linamar - The net income of the business was growing year over year 10-15%, with an ROE of 15-20% before all the trade war stuff. However, what I failed to realize was that while it look quite good using a Penman's residual earnings model, it failed to account for the fact that in order for it to grow, it would need to take those cash earnings and reinvest all of it to working capital and capex in order to grow the next year, leaving very little free cash flow to could be distributed to me. I was not until the business started shrinking, that free cash flow (owner's earnings) was then able to be distributed via share buybacks, its meager dividend, and paying back debt. 2) Missing out on Amazon (or substitute a SAAS business, advertising agencies, insurance companies, Costco (to some degree) etc). I remember telling a colleague that Amazon is not profitable. It's net income margins are so slim, so what if it is growing revenues, it's too pricey. What I failed to realize was that by creating a marketplace with a feedback loop on supplier and buyer dynamics, it was able to receive payments from buyers before having to pay suppliers and able to grow on the backs of the supplier's money without having to put up its own capital. Then layer on the prime membership, and now it was receiving prepayment of customer's money even before providing any service. So in essence, Amazon was able to grow by using other people's money and as a result generating massive amounts of distributable cash. This potentially distributable cash was reinvested for more growth in other areas but it could have been easily paid out as a dividend or share buybacks. So it only makes sense that Amazon is much more valuable than Linamar. I guess if you can make an argument that BRK could grow 6% per year WITHOUT needing to retain its cash earnings, then BRK could be creating value for shareholder. If BRK needs alot of its cash earnings to reinvest in working capital and PPE in order to grow the cash earnings the year after by 6%, then BRK would be destroying value for shareholders. I think the nuance is in the definition of what you exactly mean by owner's earnings and how you parse out growth expenditures.

-

I wonder if part of what is broken is their investment decision "process" at Hamblin Watsa. Francis Chou and Mohnish Pabrai's harvard interview elucidates that at FFH they use a devil's advocate who is usually a senior member of the investment committee who is not going to have psychological imperatives towards deference to the portfolio managers. However, this seems to lack the ability to incorporate a diversity of opinion. Some of which may actually come from junior members or the introverted individuals on the committee who may have a different perspective or special insight that would help the decision process or at least improve their accuracy. Gary Klein and Paul Sonkin had a podcast on Capital Allocator's that was quite interesting about how to structure team discussions to make them more effective towards truth finding. Perhaps Sanjeev, you could pass this idea to them as it may have asymmetric outcomes (hopefully to the upside) and it costs them nothing. On a secondary note, who makes the ultimate decision to increase FFH's financial leverage? Is it just Prem or do the executives play a role in the decision-making process? If Paul Rivett was to remain CEO, would he make the call?

-

FAH seems to be trading quite below reasonable cash and cash equivalent values with no fund level debt. At this stage, what are the risks associated with investing at this point in time? Here is a short list that I can see: a) Sudden increasing inflation in the countries they are in b) Default risk of their underlying loans and bonds especially with CIL c) Poor future capital allocation of cash and cash equivalents d) For us Canadians, US-Canadian exchange rates e) Falling interest rates causing it to not be able to cover fund expenses Anything else?

-

But at what point in price (given that the market price has dropped as low as $230 USD/share recently) that FFH becomes attractive despite issues with Prem, capital constraints, and a portfolio of turnaround equity choices? At $230, they wouldn't have to achieve more than a 98% CR and 3-4% Pre-tax Investment return by my estimates.

-

For those interested, here is a very detailed history of pandemic influenza (of which there are 4; 3 which are described here) and a comparative experience between Italy and South Korea https://www.ncbi.nlm.nih.gov/books/NBK22148/#a2000c209ddd00098 https://medium.com/@andreasbackhausab/coronavirus-why-its-so-deadly-in-italy-c4200a15a7bf Interestingly, the UK has decided on a different strategy that I thought initially to be crazy but perhaps there is an element of validity to it. https://www.theatlantic.com/health/archive/2020/03/coronavirus-pandemic-herd-immunity-uk-boris-johnson/608065/ Prior pandemics suggest the following things occur: 1) Usually more than one wave of spread 2) novel viruses have a relatively higher mortality and morbidity for the younger population relative to themselves, but relative to the older population, the elderly person risk is much higher 3) individual immunity can develop if exposed, but the duration of effectiveness can be variable from one year to many 4) viral mutation over time can be influenced by health policy behaviors (interestingly, virulence goes down over time as less virulent strains are selected if less affected people are allowed to infect others UNLESS more virulent strains are aggregated together eg in hospitals and they escape into the public) 5) social distancing and isolation have been tried in the past with variable effectiveness (modelling suggests months to one year of social distancing may be required that would cause massive socio-economic havoc) 6) there is considerable variability of mortality between geographies and time of outbreak (1st vs 2nd waves). I am not an expert in this matter but I wonder the following especially in a resource constrained environment with limited government ability to enforce social distancing and population movement in context of COVID-19: a) instead of broad social distancing, focus this intervention on the vulnerable population (elderly, immunocompromised) to allow a natural process of selecting out less virulent strains to survive by allowing the asymptomatic or mildly symptomatic to carry on as usual with the potential benefit of developing individual and population immunity to reduce the impact of future waves b) intense testing of asymptomatic health care workers and those that support the elderly to keep them protected until a vaccine can be developed which in this case to be deployed to middle-aged and young elderly first to maximize years-of-life saved c) random population testing to monitor strain variability It will be very interesting to see what happens to this pandemic over time between countries have be successful in the 1st wave containment (Singapore, China, Korea) vs those who were not (Iran, Italy).

-

For 1), statutory surplus is determined by state regulators who typically use a risk-based capital framework (similar to banks) to reduce the value of certain elements (and increase the margin of safety for the policyholder) of the balance sheet, as reported. The discounts vary and depend on the perceived level of risk. FWIW, I've been looking at a few insurers who carry a heavy load of BBB rated corporate bonds (not the case for FFH). An interesting feature is that, in the event of a recession, on top of the decrease in market value for the bonds, surplus capital gets a double whammy because the discount factor is higher for downgraded securities. For 2), your statistical appreciation of forward returns is interesting and is in line with the idea of reversion to the mean, which has been a significant long-term feature at Fairfax (investment strategy, seven lean years analogy etc) but I wonder if such an approach is satisfactory on a forward basis as the investing environment has changed and the Fairfax investment recipe has been changing (some aspects dramatically so) so the future may not be correlated to the past. I think I read you're an MD and the following statistical "joke" came to mind when reading your post. There's this surgeon who comes to the patient waiting to be rolled in and explains that the death risk with the procedure is 1 in 2 but that the patient should not worry because the previous patient did not make it. Thanks For the detailed response. You are absolutely right if the underlying people, processes, and investing environmental context change then the underlying distribution will change and the mean reversion effect may not happen. I love the joke, as most physicians have no or little statistical training/understanding despite three decades of evidence based medicine. I guess the meta question is “has hamblin watsa adapted to the environment and learned from its mistakes. Is their devil’S advocacy before investment commitment as a effective as they think it is?” That the distribution of investment outcomes is something other than 60-40 for 7%? With so many interacting variables involving a biological system, I guess this question may be impossible to estimate with any precision. We know their value principles but how about their learning and leadership principles. Certainly it appears there are a number of individuals that no longer think they have the adaptability moving forward to make decent investment returns. But everything has its price in the market and there is an argument that the past is a sunk cost and all that matters is future behaviour. Ps You might enjoy this randomized control trial from the British journal of medicine https://www.bmj.com/content/363/bmj.k5094

-

Is this the case where you practive? If so how well did the area handle H1N1 in 2008? I was still studying at the time so I was a bit sheltered from the H1N1 outbreak, so it is hard for me to comment. However, this is the current situation that I work in everyday with worsening year by year. The Canadian hospital system is stretched beyond all imagination on the best of days. Here is a twitter feed from Italy Obviously, I'm not an expert in calculating GNP, but I don't think the loss of productivity will be as dramatic as -7%. The chances are the working age group will have mild symptoms but be able to recover and return to work (if workplaces allow them). But the working age group could contribute to protecting your healthcare resources by not exposing yourself to the elderly, wear a surgical mask if mildly ill (it won't protect you, but it will protect others from you), don't go to your local hospital for very minor coughs, sore throats and runny noses, and hopefully your employers won't need a doctor's work note to explain your absent if you are away ill.

-

Just a simple question: 1) When determining the statutory surplus, is it almost equivalent to Common shareholder's equity + preferred shares + minority interest? Just a simple observation: Referring to their annual report's total return on investment portfolio footnote, it appears that they under-perform their 7% investment return hurdle rate 39% of the time over the past 33 years. If that is true, that means under-performing 5 years in a row, would put it at less than a 1% probability.