jfan

Member-

Posts

539 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by jfan

-

How much would you pay for untapped pricing power?

jfan replied to jfan's topic in General Discussion

It seems to me that the persistence of some of these luxury brands is their ability to say NO to their very wealthy customers who are not accustomed to being denied anything they want in life. It is less about the actual product but the mindshare/relationship between the heritage of the brand with customer themselves. All these products (bags, watches, collector cars) are essentially commodities, and will have competing products that deliver more utility at a lower cost, but the truly successful brands are selling the ability to belong to an exclusive club more than they are selling these items. It seems that companies that rely on their brand, are especially maniacal about maintaining this relationship. Costco's membership, as @gfp, pointed out is similar. Their promise to deliver high-quality low cost products that we use daily is carefully nurtured and cutting out that membership would be inconceivable in our household (and I suspect many other households). Perhaps the acid test is the number of people that would utter the statement (as my wife does often), "I love Costco". I'm no brand/marketing expert, but after studying a few of these brand-dependent businesses, it seems the successful ones understand their relationship and take certain elements to the extreme and maintain that over time. They then calibrate their funnel to find the next generation of customers at the same time optimizing their most avid supporters (ie super-fans) life-time customer value (ie minimize retention costs, increase share-of-wallet, reduce churn). It is very interesting that many of these luxury brands have existed decades owned by families or non-profit foundations. I think it requires the caretakers of these brands to be particularly long-term focused and have significant abilities to defer gratification to ensure brand mindshare and survival. -

How much would you pay for untapped pricing power?

jfan replied to jfan's topic in General Discussion

thanks...that means a lot of sense. I've been looking at some luxury companies out there, and it seems that for those with secondary re-sell markets (or at least a demand for such) have a significant 2-4x consumer surplus that is left uncaptured. Certainly, this might suggest that their financials are under-earning to a degree with the caveat that full capture of this surplus would be long-term detrimental to its brand value over time (ie the barrier to a purchase commitment is raised if the expensive Birkin, Patek-Phillipe, Chanel, Ferrari item can't hold "value" into the future). With the valuation of these luxury companies routinely trading at lofty numbers, is it just the fact that the market recognizes this untapped pricing optionality or is it massively over-estimating the growth potential/re-investment runway for these companies (ie ubiquity being the enemy of luxury, # of HNWI out there and the growth of their net worth, barriers to exit for failing legacy brands, and fickleness of end customers)? I guess these particular companies and their securities should be viewed as alternatives to inflation-protected long-term treasuries coupled with the share scarcity in the float as part Rembrandt if the brand can survive multi-decades into the future. -

I appreciate that untapped pricing power could be used strategically as a means of delivering more value to customers than its costs in order to maintain customer loyalty. As an outside passive minority shareholder, would you pay a premium for this untapped pricing power and if so, how much? (in light that you won't have control on the pricing itself) Would this be different if you could acquire the entire company and influence pricing?

-

I think there is potentially a lot of validity to this statement. It really depends on who is in the receiving end of these BTC payouts. Only the fervent retail HODLer or long crypto expert investor who is going to hold on this. If the majority of these claims are held by asset managers that have promised their LPs a massive gain on payout, their LPs will expect return of capital, which means liquidation of BTC in the spot market. PS @ValueArb quite enjoyed your post on China's history!

-

Joe, BTC

-

Re-listening to my audio book again. Kahneman separates decision making errors into bias (systematic deviations) and system noise. System noise from level noise (differences between people) and pattern noise (variation within people). Pattern noise from stable pattern noise (internal variance that result from an individual's past experiences and personality and their interactions with specific situations) and occasion noise (random events that affect decisions). Interestingly, in DK's studies, he found that system noise is a larger component of decision error than bias; pattern noise accounts (50-80% of system noise) for more than level noise; and finally stable pattern noise (4x larger in a study of model judges) is often greater than level noise which is greater than occasion noise. Level noise can be addressed with eg guidelines, rules. But stable pattern noise is much more challenging to address because it is due to people's uniqueness in judgment abilities. This got me thinking about the overall effectiveness of the market price aggregation mechanism over the long-term especially in the light of indexing, gamification of investing, in effect lowering the barrier to entry of non-expert investors and deluge of information. I can see how the search bubble and algorithmic feeding of information based on past searches, can super-charge the homogeneity of thinking and in turn bias the market participants. But what about noise, especially stable pattern noise, since it makes up so much of the error in decisions. With fewer and fewer people doing primary work (eg indexing), and more and more retail non-experts participating (more level noise, more pattern noise, momentum buying, short-term trading), it seems that the implication is that the quality of judgment has reduced. What are the implications here? I would think that there should be more volatility (more violent up and downs, coupled with longer than average over and under-valuation of markets than history). This coupled with Gigerenzer's concept of wicked environments, and Max Bennett's (A brief history of intelligence) discussion of how humans learn (neocortex's ability to simulate their own & other minds, and future needs; humanities ability to communication ideas from generation to generation, the propensity of tribalism is a form of punishing and rewarding those that don't conform to consensus values to maximize survival of the species as a evolutionary teaching mechanism) makes me think that successful investing from an individual level will require increasingly more patience (slow down decision-making, more incrementalism in building positions), persistent efforts to learn and understand the few deep factors (in the businesses) that on the balance of probabilities will favor survivability and resilience (thereby maximizing time arbitrage ie target very deep value or very high quality, less in-between), and the 2 analytical skills that are the most important is the ability to change your mind with changing data and ability to filter out useless information. Perhaps, the other implication is that the old adage of time in the market is more important than timing the market is less applicable today. Perhaps, sitting in cash, taking time to really understand what you are buying is more important now, than before.

-

-

This is from a private business that Murray Stahl is invested in via his Renn Fund.

-

Home - Outcast Beta This is a interesting blog that Corey Hoffstein supported on his podcast. He interviewed the author. I read through some of his articles and there are some interesting insights on portfolio management. He discusses the interaction between portfolio concentration, investment styles, & time and their effect on geometric outcomes and minimum threshold of required alpha. Long-story short: 1) more concentration portfolios (<=5 (concentrated), 6-10, <20, >20) requires more alpha and increases risk of portfolio drag 2) probability of loss is less as time goes by but the magnitude of loss increases 3) probability of loss is less than expected < 5 years, but the magnitude of loss is greater than expected in < 5 year time frame according to real world data 4) microcap, high valuation, non-profitable companies, low momentum require much more alpha whereas as large cap, low valuation (E/B, E/P), profitable, high momentum require much less alpha So Buffett's punch card of 20 stocks of profitable, value strategy is quite rationale, but with his concentrated approach, it makes alot of sense to keep lots of cash for opportunities. For an investor that likes to be fully invested all the time, it would be rational to take more of a diversified approach > 15-20 stocks and consider diversifying across styles to avoid any portfolio drag when a particular strategy is not in fashion. The author also mentions alpha consistency is a hard to measure variable but will contribute to portfolio drag, hence focusing on a repeatable process to optimize investment decisions tilts the table in your favor over the long-term. I'm not a quant, but I did find the articles helpful in quantifying what I felt over time were key decisions in portfolio construction. The web address to the blog is above, and I've attached the author's thesis for those braver than I to dissect the mathematics behind it. Portfolio concentration, style, and alpha needed (thesis).pdf

-

Just listening to it now as well. I'm quite enjoying it as well. There were a few of interesting author observations that I took away that were useful. 1) In fast moving industries were products iterate and change rapidly, there needs to be a critical mass of secular trends to tilt the probability towards success, these include (but not comprehensive): - free market competition with a profit motive and entrepreneurial spirit - general low cost of capital in the manufacturing region (hint of this: high savings rates, business friendly environment, governmental backing, skilled workforce and quality educational funnel) - ability to take advantage of Wright's law to gain tacit process knowledge in production - friction-free flow of IP - recognition of success to maintain the talent funnel - large capital providers (ie governments (DARPA, Japanese govt, subsidies, conglomerates (like Samsung), venture capital) 2) The interplay between geopolitical needs (eg defense) and application of these technologies to larger consumer markets. Military budgets stimulate products but government bureaucracy stifles innovation, where as consumer markets stimulate innovation but have difficult funding cutting edge technology. 3) When nationalistic sentiment rises, it seems to forecast an economic downfall. 4) Beware of Clay Christenson's low cost producer with low margin customers in these industries in the right setting, can scale up and innovate quickly to be a competitive threat. Also thanks for the recommendation on Bionomics. I thoroughly enjoyed it. Picked up Shorting the Grid as well. Looking forward to getting through it.

-

Found this article from the IMF on Cross-Border Bitcoin Flows. Have not read it yet but looks informative. A Primer on Cross Border Bitcoin Flows.pdf

-

Thanks @Cigarbutt. Your post was very helpful. I came across a blog (only glanced at it) discussing converting calendar year to accident year which I've linked below: Calculating an insurer’s accident year and calendar year reserves | kitchensinkinvestor (wordpress.com) At my stage (can only trust but not yet verify), I can only take Prem's words that they are underwriting conservative and consistently with the goal to survive. From a top down view, the following "soft" items suggest this is taking place: 1) Not letting go of employees when there is a soft market 2) Not acquiring turnaround insurance operations 3) allowing insurance subs to operate in a decentralized manner to flatten barriers to information flow 4) facilitating fun competitions to innovate between organizations, to share best practices 5) tenure of insurance presidents in the organization 6) cautiousness in entering new territories ie cybersecurity (small exposure, recognizing Cat-like behaviours) 7) the obvious data trends for combined ratio/loss ratio, net premium written:surplus ratios, reserve triangle patterns Last but not least, the kindness of the CoBF board to scrutinize Fairfax

-

https://www.cbc.ca/news/politics/federal-budget-2024-main-1.7175052 This might have an impact on Fairfax....

-

Thanks @Cigarbutt and @Tommm50 for your replies and insight. The idea of writing policies in a soft market with just adequate pricing (with the expectation of some adverse loss developments) when there are good opportunities to use those premiums to invest in their portfolio for more attractive returns was helpful. Spending the morning watching videos on insurance triangles, paid/case reserves/incurred but no reported, basic methodologies to estimate of IBNR to derive loss reserves (case reserves + IBNR), and how to interpret loss development trends was particularly stimulating. Looking back at the 2 tables that I posted. A few amateur observations were made: 1) looking down the columns for each calendar year: a) It appears that ~ 70% of cumulative paid losses occur within 6 years (6-year cumulative payment divided by 6-year re-estimated reserves) b) Unfortunately, they don't report the entire table in 2023 AR, in the 2022 AR, after 8-9 years, the proportion of cumulative payments is mid-to-high 70% of re-estimated reserves). This suggests to me a fairly long-lag of actual payout to claimants. I'd assume this is because of the longer-tail nature of their specialty insurance focus. c) Eyeballing the re-estimated reserves down each calendar year, there is little variability year-to-year as time goes by, within ~ $500 M at most up or down (in the range of $100 - 300 M most the time). Coupling what was said earlier about the soft market, it seems that there is not much pricing power, or too much social/judicial/cost inflation to be able to adjust reserves in a favorable manner. 2) Looking at the diagonals for cumulative payments (gross table, not net) a) The sum of diagonal (latest) minus the sum of the diagonal (previous year) = the payment made for losses in the most current calendar year. Using the 2022 AR, they paid out $25.5 B and had a final year end reserve of $38.3 B (ie ~ 66% or for every $1 of reserves set aside, they paid ~ $0.66 that year). Using the 2023 AR (which of there are only 6 years), they paid out $28.1 B and had a final year end reserve of $41.2 B (ie ~ 68%). This seems to me that their baseline underwriting assumptions are that 2/3 of their reserves will be paid out ~ 6 - 9 years. I have not compared to their prior years nor other insurance companies, but is this in the opinion of the experts here, conservative? I would imagine that if their underwriting deteriorated and they were not re-estimating their reserves properly, then these ratios should deviate from their baseline over time. I think this might be more useful than just looking at the reported magnitude of adverse/favorable loss reserve developments which is more retrospective than prospective.

-

I was just looking at their reserve triangles and it seems they are reporting a number of years of adverse developments (gross undiscounted calendar numbers). I've attached 2022's and 2023's triangle. Just wondering if someone can provide me so insight and whether this is something to watch more carefully (percentage-wise it doesn't seem to be very large relative to their policy liabilities)

-

Found a couple of interesting resources looking at how the value ($) of stocks traded as a % of a countries' GDP. World Development Indicators | DataBank (worldbank.org) Animation: Stock Market vs. GDP Share, by Country (1900-2022) (visualcapitalist.com) - This one had an interesting visual over >120 years of data. The US stock market has roughly had a stock market share 2x their GDP share since 1930s. It fluctuates between 2-3x then compresses. Japan at one point had a stock market share 4x their GDP before collapsing. I know this is a very top down view, but seems like US dominance of the stock market has been quite persistent and China is still quite nascent in its development and is only 0.25x their GDP (if you believe their GDP numbers?).

-

It seems that the HK exchange and clearing Ltd is a holding company that owns the exchange and a clearinghouse as subsidiaries. It's unclear if they use their own clearinghouse for their own corporate funds or someone else's. They have a significant amount of corporate cash that they use to fully manage internally. In 2016-2017, they started allocating to external fund managers. They call this their "external portfolio" or "collective investment scheme". They started with 15 funds but at one point had ~ 32 managers. They are at ~30 right now. They also have clearinghouse funds that they manage using liquid, short-term investment grade instruments. This was found in their annual report. I've included their most recent YE income statement, and their investment revenue is not an insignificant portion of their overall revenues. Hence, the question of conflict-of-interest and "insider"-like information regarding fund flows being an exchange and clearinghouse itself.

-

I was just looking at the Hong Kong stock exchange and came across something odd. They have a significant amount of cash and decided instead of providing shareholders with special dividends, they opted to invest this cash in an investment portfolio (70% bonds, 30% equities that are short-dated and liquid). This seems like a conflict of interest, ie visibility in the data coupled with investing their own cash coffers. Is there something else I'm missing here? Should the regulators have stopped this? Is this common practice among exchanges?

-

The Silk Road admin sentenced to 2 life sentences. The Alpha-bay admin committed suicide in a Thai detention center. The Welcome to Video admin got 18 months in a South Korean jail. The BTC-e admin sentenced to 25 years. Don't do illicit things on the blockchain.

-

Some interesting tidbits from "Tracers in the Dark" 1) 2021, as per Chainalysis - $14 billion of criminal transactions - 0.15% of crypto transactions are illicit - 400 employees - 600 customers (law enforcement, tax agencies, financial institutions, exchange companies) - Chainalysis' valuation $8.6 billion - Their competitor - Elliptic 2) During the takedown of Welcome to Video, a South Korean run child abuse darkweb site, it was discovered that a US homeland security border agent was an active participant on this site. He was abusing his girlfriend's daughter and posing as a moderator for the site to steal login/passwords of other users to obtain videos. He plead not guilty because he argued that his BTC transactions were surveilled without his consent and violated his privacy. Courts turned down that argument because all transactions on the blockchain are public and therefore not subject to privacy laws. 3) Ransomware gangs are trending to the use of Monero and Z-cash where "privacy" is much harder to break using more traditional blockchain cluster analysis techniques. This got me thinking about Jason Lowery's Softwar book and how BTC given its transparency and proof-of-work protocol, could help impose a real-world cost to ransomware gangs to access centralized database system.

-

Chainalysis has a plethora of information on its website. This is their latest report. I like this little snippet, unfortunately, I couldn't find a publicly traded company in this industry. The 2024 Crypto Crime Report.pdf

-

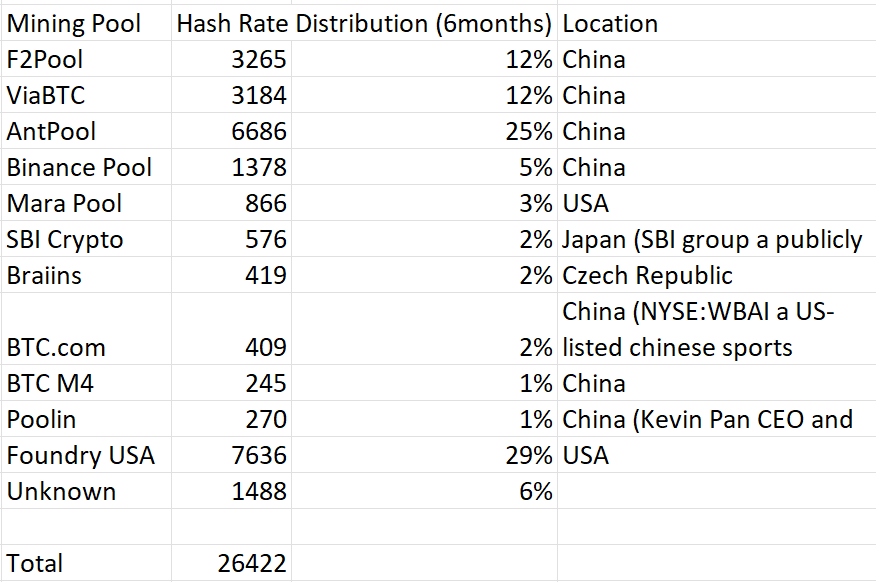

Couple of old academic articles 1) On the traceability of BTC due to its open ledger system (A Fistful of Bitcoin) - misconception that large illicit activities are best done with BTC 2) On the fallacy of BTC immutability and a different form of governance/risk of 51% attack - BTC was smaller at the time of this article, but highlights that governance of BTC just in a different form Recommend reading Tracers in the Dark on the history of Silk Road, Mt Gox, Alpha-Bay, BTCe, Chainlysis and FBI investigations/corruption. A Fistful of Bitcoin.pdf The_Economics_of_Bitcoin_Mining,_or_Bitcoin_in_the_Presence_of_Adversaries.pdf

-

4.4% at cost 8.1% at mark-to-market 13.7% cash

-

lol...already running one and a nerdminer. It would interesting to see if people start contributing to the hash rate in a small scale non-economic manner. Better than spending money buying lottery tickets weekly.