Cigarbutt

Member-

Posts

3,373 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Cigarbutt

-

Opinion (opportunity cost aspect): over the next 10 years, BRK has a very reasonable chance to outperform the S&P 500. My guess would be by 5 to 10% at the end of the following ten years. As for the future, the challenge is always to move from the short term to the long term. Easier said than done. A table was included showing the 20 largest companies in the world (market cap) in 1989. Then, 13 of the 20 companies were based in Japan (6 of the 13, banks). The future is indeed unknowable and BRK is also likely to be less risky (both the traditional and 'modern' definitions of risk).

-

Stonetrust is privately held so the info is incomplete but, from various public disclosures, it appears that the period under Wantaai's ownership was unusually favorable (industry-wide). Reserve development has been unusually favorable and combined ratios have been unusually low. In 2020, on a net basis, the Covid impact has been positive. You have a combination of lower earned premiums and more (excess) capital. From regulatory report in 2016: Capital and surplus: 56.2M earned premiums: 55M From the Forbes article (2020 year numbers): BV (GAAP): 110M earned premiums: 45M https://www.fitchratings.com/research/insurance/us-workers-comp-insurance-underwriting-profits-to-normalize-in-2021-23-10-2020 Workers comp insurance is one of the rare sectors not participating in the current hard market.

-

Question If your approach entails to minimize delegation to others for the purpose, why not maximize the tax deduction and use the tax saved to contribute to the next year's allocation?

-

The conclusions suggested are hard to prove or disprove and the easiest explanation is cyclical and related to automatic mechanisms during recessions with people tending to save more and public entities stepping in to fill the gap. If one accepts this explanation, it's interesting to see that public entities are pulling the trigger more and more rapidly with each succeeding recessions since 1990. This public compensating for private saving or vice-versa is applicable for a given level of net saving (or equivalent net investment). Economies like the US are mature and are "settling" into something else but there is no absolute reason why the net saving or net investment should continue to go down over time and, as a mature economy and with the population shifts accelerating in the next ten years, it seems to me this would be a good time to increase savings and not the opposite but what do i know? The following graph shows gross savings to (gross) income in order to account for the 'noise' caused by depreciation (and its various controversial interpretations). When the gross number gets to be below 20%, it usually means that trade deficits need to reach unsustainable levels and means that net capital stock is degrading which would indicate the perception (which is correct) that infrastructures need to be upgraded. Note: the domestic net savings has become negative (apart from the 2020 anomaly and M2-related spike). Settling is part of the process but unfortunately this means less dynamism. Still, my bet is on the USD.

-

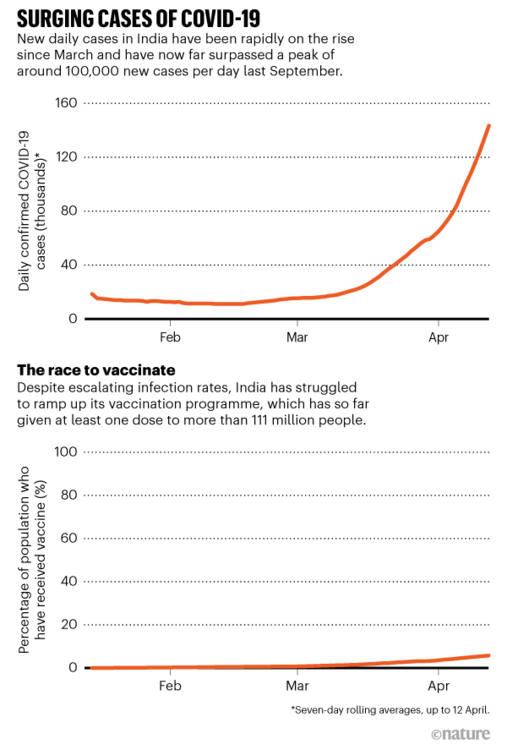

Warm thoughts and good luck to India. Reaching herd immunity has proven to be a tough challenge in correlation to the speed of vaccine rollouts. In many places, results have shown various levels of resurgence but the hospitalization numbers have tended to show variable levels of muted impact in correlation to vaccine rollouts (priority rules vs age groups). Opinion: it's not the inefficacy of vaccines that was a primary factor for recent India's developments (it was the residual distance to herd immunity) but the virus (and variants) is benefiting from an unusual opportunity to create new variants (from mutations and recombination). It's a natural experiment with basic biology as the driving force and variable levels of human behavior having a marginal impact. 'Triple mutant' coronavirus variant discovered in India? What it means - The Week From an odds basis and applying what is known presently about Covid-19, it's unlikely that the new variants will significantly escape vaccines (or variants of vaccines) but the odds are not zero.

-

A comment about the indentured slavery. There are many factors behind the short term wage inflation pressures in Florida but people are often efficient at integrating opportunity costs. The potential pool of able-bodied workers is (still) large. In my area and for years now (it's worse this year), people in the agriculture industry (basic manual farm work, fruit picking etc) cannot find domestic workers that will do the job even when wages are increased, bonuses are offered etc. Instead, it's less expensive to arrange for workers from Central America to be flied, roomed and boarded and paid for the season and this work importation program is subsidized (generously) by the federal government. Is this inflationary after the bullwhip bump?

-

When the growth stops - global population peak and decline

Cigarbutt replied to tede02's topic in General Discussion

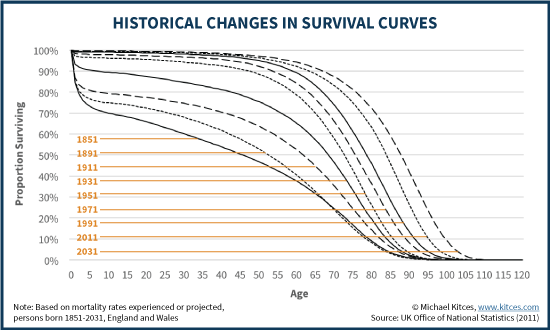

From a demographic point of view, the defining feature of the 20th century was a very unusual growth in population and life expectancy (global). For the 21st century, the defining feature is an ageing population. Neonatal mortality has gone way down but fertility rates have gone down even further. Population ageing is a global phenomenon but developed countries are more ahead than others. China had done an incredible job at catching up economically but this has been linked to a demographic catch up which makes their ageing population outlook even more challenging in the next few decades. There will be three features: 1-rectangularization of survival (life expectancy) 2-compression of morbidity in last years 3-old age-dependency ratio 1- Recently, life expectancy at large has started to plateau (and even reverse at times) while maximum human lifespan seems to have reached some kind of natural limit. Rectangularization pretty much has reached its maximal optimization. 2-Compression of morbidity in later years has occurred to some extent in Japan on a net basis but overall, in western countries (and also China),this has not occurred because the improved productivity profile of some has been more than canceled by the deteriorated status of many. As the Covid-19 episode showed, the population health status profile (age and co-morbidities) in developed countries is relatively poor ('improved' very slightly as a result of the viral passage) even for younger cohorts (age 60+ and even 50+). Also (expressed in a neutral way), the improved level of care has allowed a significant sub-group of the population to survive (for a long time) while remaining relatively unproductive and even dependent. 3-This ratio has been moving higher globally and most of the 'economic' impact is coming for developed countries. So far, this aspect has been dealt with by unfunded liabilities and debt. It's interesting to note that many European countries rely more on a public safety net (transfers) compared to others (USA, UK, South and Southeast Asia) which tend to rely more on accumulated assets. The key issue is that the growing sub-group of 'dependents' will tend to not produce and to consume and will tend to rely on younger age groups becoming more productive. It's reasonable to suggest that 1-, 2- and 3- will be figured out eventually. It's just that secular trends have been slowly grinding their way and 'solutions' are not visible yet. Also, it's unlikely that the digital printing press is the answer. It's not clear how these trends can be useful in public stock picking but i've made money on this in the past through private ventures and am planning for more in the next 20 to 30 years. An area which i thought would be promising are retirement homes but capital is so abundant and cheap making the investing environment incredibly competitive. The future may lie more in asset-lite 'services'. -

Question So which index would you use or do you think such aggregate measures have no use? Reason for the question This week, i spent some time on railways and BNSF and, dissecting the info, there were several aspects that relied on aggregated measures like CPI (commercial contracts with multi-year inflation escalators, contract clauses with workers for gradual wage inflation, actuarial reports about large pension plans (discount rate , rate of compensation increase, rate of inflation for medical costs etc)). Also, do you think CPI should include asset inflation components as well which are a significant 'concern' for individuals ("in the real world")? For example, Since the late 1990s, the ratio of market value of the residential real estate and domestic equities to nominal GDP ranged between 2.5x and 3.75x times, nearly twice the level that existed in the prior 50 years (end of 2020, the ratio at 3.75x). Or do you think these asset inflation measures are useless as well?

-

Let's push this even further (for BNSF present valuation and future prospects), based on fundamental (not relative) aspects. For the railways to continue present trends (bottom line, free cash flow growth), a component will have to come from pricing power related to concentration and there may be problems there. This is not an improvised move by CN and they may be ready to divest parts of the acquisition, as part of the regulatory process defining the goal posts for concentration. And CP could simply react with a higher bid.. Kansas City Southern (KSU-N) Quote - Press Release - The Globe and Mail Just for fun, using BNSF as an example of the oligopoly, let's look at previous trends and what it means for the future (and present valuations), using 2008 (results had not deteriorated much before the GFC) to 2019 (avoiding 2020 as an anomaly, with some impact on profitability), all unaudited CAGR. Revenues grew 2.5% (note: CPI during the period: 1.5%). Operating income grew 6.8%, reflecting better efficiency ratios (is there much juice left in the lemon?). During the period, interest expense relatively went down, reflecting this era (BNSF is unusual here because Mr. Buffett engineered a 13.7B increase in low rate debt (they just SEC announced (30-yr 925M 3.30%) more) and 'acquired' 37.0B in dividends, allowing SE (accounting for acquired goodwill) to grow only slightly). Still, debt went up by 2.4 and interest expense went up by 1.95 (despite a much higher adjusted debt to equity ratio). Also, during the period, tax rates went down significantly and deferred taxes went up significantly. However, for publicly listed railways, the biggest driver of returns has been multiple expansion which should also reflect forward going trends and i wonder if those future trends have been reasonably discounted. Growing through concentration may have entered the vicinity of a limit also. i've missed the train on this one but (absolutely and relatively) offer the opinion that present valuations are unusually optimistic.

-

@n.r98, this was interesting. Thank you. It seems every time Mr. Pabrai comes up, there seems to be a bimodal distribution of opinions. In the book you mention, the author describes the difficulty with the definition of Quality. Instead of one uniform definition, one could focus on two aspects, the 'hip' (more emotional) and the 'square' (more rational). The potential issue here is that the person is both a teacher and a seller (often simultaneously) and both aspects perhaps require a separate (and more flexible) type of assessment.

-

^The BoC (like all central banks) doesn't mark to market its assets and lives according to its own rules; it's an artificially deconsolidated government subsidiary with an underlying ability to print money/capital and to change the rules of the game, if felt necessary. And some central banks function with a negative balance. So... The duration risk for the BoC is low. Last year, they absorbed 95% of all federal bills and bonds and, of the bonds, 86% were 5-yr or less (the 5-yr at 0.95% now). But with rates this low, in theory, the BoC could report negative income and be technically insolvent. They now pay 0.25% on "settlement balances" (reserves) and this rate could rise although it remains controlled by the BoC. Speaking of technical insolvency, there was a recent report describing a little discussed consumer aspect, a picture which is only marginally worse than before the virus crisis response: https://www.globenewswire.com/news-release/2021/04/08/2206577/0/en/Over-Half-53-of-Canadians-Within-200-of-Not-Being-Able-to-Cover-Their-Bills-and-Debt-Payments-Up-10-Points-Since-December-Reaching-a-Five-Year-High.html A recent message from the central banker in chief (CDN version): hard work and ingenuity will get us through. ----- Concerning the last CDN budget, a realization has been made that some kind of shift has definitely occurred. Recently looking at fiscal Italy (Mr. Draghi is now leading), they have decided to go all-in and the market is willing to underwrite the recovery. Commenting on the plan, Mr. Draghi said: "Judged with the eyes of yesterday it would be very worrying. Today’s eyes are very different because the pandemic has made the creation of a great deal of debt legitimate...Debt is good...". Enough said.

-

Just for fun here, it's interesting to read what Mr. Buffett included in the 1977 AR, under "Insurance Underwriting": Chairman's Letter - 1977 (berkshirehathaway.com) There were a lot of trials and errors and of course the Geico acquisition was a calculated risk which required a careful "handling" of regulators. In the latter part of the section, there's a reference to Cypress Insurance, a workers comp, recently acquired then. In a move that is relevant for the short term ownership of Stonetrust and the discomfort with regulators around 2015-6, Cypress had to deal with the regulators concerning an unusually large purchase of Apple stock in November 2016. The regulator's limit was largely surpassed (10% of excess admitted assets, so by about by 2.5x). Answer from the person knowing by heart to two decimal places the expenses incurred when manually distributing newspapers decades earlier: Oups, we promise we won't do it again, in the future. Since then the Apple stake has been multiplied by 4-5 (just on price appreciation). From the: REPORT OF EXAMINATION OF THE CYPRESS INSURANCE COMPANY AS OF DECEMBER 31, 2016 note 1: "On November 28, 2016, the Company purchased 681 thousand shares of Apple, Inc. stock for a total cost of $75.9 million. This purchased exceeded the limitations prescribed by California Insurance Code (CIC) Section 1198, which states in part that “excess funds investments shall not be made in purchases of or loans upon shares of the capital stock of any one corporation in an amount exceeding 10 percent of the excess of the admitted assets of the investing insurer over the liabilities and required reserves of such insurer.” At the time of purchase, the Apple, Inc. stock exceeded the limitations by approximately $45.4 million, pursuant to CIC Section 1198. Upon the request of the Company, the California Department of Insurance allowed for the admittance of the excess investment of Apple, Inc. stock; however, it is recommended that the Company implement procedures to ensure future compliance with CIC Section 1198. During the course of the examination, the Company agreed to the CDI recommendation and will implement procedures to ensure compliance with CIC Section 1198." (my bolds) ---) Back to the sponsored Q&A sessions

-

This was discussed a bit then. If into relative value investing, you may want to further adjust the BNSF's implied valuation. CN just offered a 21% premium, with a much larger component in cash vs stock, an offer CP calls inferior and illusory.. Canadian National Makes $30 Billion Topping Bid for Kansas City Southern -- 3rd Update | MarketScreener

-

When the growth stops - global population peak and decline

Cigarbutt replied to tede02's topic in General Discussion

Secular demographic changes have not been kind to productivity growth in developed countries and Japan is leading the way. Of course, things could change.. Some suggest that productivity seeds have been planted and will be eventually harvested and recognized even if the population ages and the pool of productive workers decreases. In fact, developed societies have built war-time public debt levels and more with that premise in mind. It's an interesting bet: will it happen? will the timing be right? If interested in this population issue, AI, etc Artificial Intelligence and the Modern Productivity Paradox: A Clash of Expectations and Statistics (nber.org) Anecdotal addition (which may be relevant: healthcare technology projects and productivity). i went to the hospital to visit my father-in-law who was in an emergency room bed. i reached directly the information station where a clerical person told me to go back 20 steps behind the line on the floor and use the phone in order to ask the question i had just asked (she added that this was the new protocol as a result of the advanced information technology communication system that had been put in place). So i go back and use the phone. i realize the same person i just talked to starts to talk to me through her microphone-headset piece. So i ask my question (where is Mr. ...?). Answer: Please walk forward and i will help you. My oldest daughter is deep into artificial intelligence and is less bullish than me on the topic She mentions that humans will have to be part of the AI process, for better and for worse. -

^For those interested into the Stonetrust 'story', here are some references that may help in providing answers to questions asked here. It's not clear what has happened since Mr. Chou has acquired the company. TL;DR version: The insurer, at the relevant time period, was a small player in a tough industry (workers' comp) and, when acquired by Dhando Holdings, 30M was added to surplus and the investment profile of float changed significantly (increased stock exposure, up to a maximum area as suggested by RBC-based indicators). It's hard to grow profitably in a commoditized market and regulators/credit rating agencies will tend to focus on non-conventional players. In 2016, AMBest did put a negative outlook on the business. Insurance is simple but not easy. Stonetrust.profile.DT.pdf (stonetrustinsurance.com) Stonetrust examination report as of December 31 2016 Final Version_0.pdf (nebraska.gov) PressReleaseWintaaiStonetrustOctober2017.pdf (stonetrustinsurance.com)

-

It looks like it was a decision based on a more basic level of (mis)understanding. Insurers are regulated at the state level but the risk-based formula used for the regulatory assessment of portfolio's (or float's) safety is standardized through NAIC's model (formula and levels of regulatory intervention). This is kind of basic knowledge before one would commit 150M for the purchase of a US-based insurer. i guess it would be similar to buying a regional bank and then being surprised that capital and liquidity ratios need to be met as a going concern when aiming to manage the asset side of the portfolio.

-

Additional perspective. The perception is that FFH divested RiverStone UK/Barbados and an argument could be made that the goal of the transaction was to monetize the asset for liquidity at head office. Paying back the revolver with the funds and the structure of buybacks through a total-return swap support that perception. The above does not negate the possibility to obtain a fair or even attractive valuation but it appears that CVC had negotiating leverage for the assets/liabilities transfer. It's not clear if this went through a typical (UK) part VII transfer but such a transaction requires a regulatory third party to approve from the point of view of the runoff policyholders (assets and liabilities). The contingent value instrument seems to be a typical example of a component protecting CVC from further and unexpected negative reserves development. Let's say you buy a runoff entity (or even any insurer) and you don't like the portfolio (the asset side). For example, you think that exposure to long term bonds is too high. How do you negotiate the transaction? The easiest way is to ask the the seller to swap the assets for cash. An alternative would be to buy a derivative product to protect against interest risk post acquisition. The other option would be to have an 'option' inserted into the contract requiring the seller to buyback the securities at a agreed price if the buyer decides that it's necessary. i think FFH like the assets (and selling such large positions would be difficult over a short period) and would be happy to own them when cash levels become sufficient but it appears that CVC sits on the right side of the option (especially regarding timing).

-

Additional perspective. The Fed often only reacts to pressures in the financial plumbing and typically applies technical solutions (band-aid type of solutions). The reverse repo activity has seen unusual action since February. Contrary to during 2019 (especially September) where the reverse repo rate was shooting up, the reverse repo rate has now tried to cross the zero bound (negative yield, yes some market participants are ready to pay a borrower money in order to lend money). Note that the title of this thread is The Fed can't keep rates low and the consensus expectations seems to be for more inflation. Anyways, the Fed, at least so far and despite the Japanese and European experiences, have remained allergic to negative rates in their 'managed' instruments. i guess there is an apprehension about perception and potential distortions. Anyways, a lot of what they've been doing (offering more risk-free securities against cash, augmenting the per-counterparty limit from 30B to 80B) in the reverse repo market appears to aim to keep those rates at a minimum of zero. The underlying problem of course is too much cash in the system. Banks are showing some reluctance to accept deposits and some of the excess cash ends up in places like money market funds which may enter the reverse repo window to obtain risk-free securities. The Fed is again facing a conundrum where players in the reserves market are refusing to benefit from risk-free arbitrage opportunities. Banks get paid only 0.1% now on excess reserves and they are getting squeezed by the SLR. JPM is at 5.5%. The per-counterparty move appears to be aimed at increasing the supply of cash at the reverse repo window and explains the rise in various accounts, including the Foreign National and International Accounts. The technical answer would simply be to increase the interest paid on excess reserves and to soften the SLR requirements but this would mean another unrecognized admission that we are moving even further in uncharted waters. ----- i guess the definition of "slow" or "unaggressive" depends on perspective. Since mid January 2021, the TGA has gone down by more than 700B. i wonder if we are not becoming desensitized.

-

^In Q1 2021, PNC's NIM was at 2.27%, 5 basis point below Q420 and 51 basis points below Q42019 (they do expect some NIM increase this year). There is some kind of implicit bargain between the Fed and large banks where the banks accept to increase the size of their balance sheet with close to zero-interesting earning assets but it will be hard to bring deposit rates lower than zero, although this is sort of happening through various fees showing up in the non-interest income. Here's a longer term trend table of PNC's NIM (a slightly different methodology is used but trends hold): PNC Bank Net interest margin Historical Data (usbanklocations.com) ----- Previously, we had an exchange where i had suggested that the asset cap for WFC may have (positive) unintended consequences. JPM and a few others have been complaining (directly and indirectly through CFOs) about the relevance of all this deposit growth. JPM's last SLR: 5.5%, down from 6.3%. WFC has offered resistance to deposit growth in relation to the asset cap. Result: SLR of 6.9%. For all the big banks (and especially the big central one), a good outcome really needs to see a significant and sustainable pickup in real world loan originations (productive ones if possible). Another area of potential disagreement. At least, WFC may have a relative advantage in selecting when to grow (or at least obtaining the green light to do so). Fiscal dominance has many definitions but one of them is to choose a path characterized by an inability to sustain higher interest rates. Who cares since this is a long term solvency question and all that matters now is 'liquidity'?

-

^About the Q1 combined ratios of years past: avg last 5yrs: 95.5, last 3yrs: 96.6 avg cat CR points last 5yrs: 2.1, last 3yrs: 2.2 It is expected that this year's cat CR points will be slightly higher than years past ?around 3.5-4, suggesting slightly better underwriting in a hardening market.

-

For those interested in this book, the Big Three had authored a previous collection of essays and had used the label of "firefighters". It looks like some suggested that they were fighting, to some extent, something that they had started (some even used the label arsonists). So, since controlling the message is so important, using the first responders' image in this day and age makes a lot of sense. Don't fight the Fed, they say.

-

^ -Costs related to restrictive measures (from spontaneous at individual levels to mandated) have been very high. -"Best I can tell, policy choices matter much less than many people think"---) yes and the 'color' of the state/jurisdiction has limited impact. -Also, we can agree on the value of small and limited government. But to suggest that restrictive measures have no significant effect or even a negative effect on the burden of a contagious disease is very unusual and hard to reconcile with a logical process... Take a look, from a US relatively comparable neighbor (see image): This is not to say that Canada's approach has been superior (that is another debate and perhaps not one worth having here: costs, benefits trade-offs etc), this is to say that restrictive measures applied more homogeneously and improved at the margin can reduce the burden of a contagious disease at the population level (yes other factors are also at play). Let's say you're the CEO, the President or something, when dealing with an issue (about which your knowledge is limited), in order to take the best decision, will you go strictly by instinct or will you rely (as inputs) on weighted, balanced and diversified sources of information, including 'expert' advice? If one cannot build on the very basic assumptions that humans somehow can improve the outcome of a contagious disease at the group level, it will be difficult to get somewhere useful. This is not about running a hedge fund, it's about the process guiding assembly of inputs and decision-making. In a way, this feels like the demand to 'prove' that vaccines prevent community transmission when the weight of evidence (and common sense) heavily suggests so. At some point, it becomes pointless.

-

^ 1-Have NY, NJ and MA applied more restrictive measures vs the virus? Yes 2-Have NY, NJ and MA reported the highest covid-19 deaths per capita in the US? Yes There is a huge problem however with the cause and effect between 1- and 2-. The following is based on very concrete on-the-ground inputs as well as other sources that have aggregated the data over time. When New Jersey reported its first COVID-19-related death, a 69-year-old man from Bergen County, concurrently New York unveiled the most stringent measures seen in the US and deployed the National Guard, but most of what was coming was already baked in the cake because the Trojan Horse had already been introduced and freed of its content. By the time the restrictive measures were considered, the die had already been cast, especially for communities of color, high-poverty areas, and among persons aged ≥75 years or with underlying conditions. During February 29 to June 1st, 2020, a total of 203,792 COVID-19 cases were diagnosed and reported among residents of NYC, including 54,211 (26.6%) in persons known to have been hospitalized and 18,679 (9.2%) in persons who died. Concerning what happened over time, the relation between contagious disease spread and various restrictive measures is not exactly a new or esoteric topic. Comparing NY to others should at least take into consideration the very unusual confluence of circumstances (location as international transport hub, density, social landscape, one of the first real hits in the US) that led to the initial surge that preceded the restrictive measures that were elaborated and applied after. Otherwise, using the same reasoning template, one would tend to conclude that Vermont has had the best policies in place to mitigate community spread, once established. ----- Here is a piece of international news that may interest some. There was this leading voice (he was the owner of a large gym in the second most populated city in my province) against ‘experts’ and had a very low threshold to call others stupid. The city is now going through a Covid surge (vaccine rollout has been much slower around here) and a significant fraction of the developing surge has been linked to the gym that this gentleman owns. So far, at least one dead (young and healthy), over 100 documented cases and growing in clusters (different work environments) etc etc. The owner is no longer available for interviews because he apparently has a tube in his throat. I would bet that he has now put his confidence in subservient ‘academics’ who can regurgitate whats in the books. ----- Back to the vaccines, there is mounting evidence that there is potential for variants (especially the South African variant) to escape, at least partially, the vaccines. Also, the variants seem to have a higher propensity to re-infect people who had previously contracted the initial variant of Covid, an evolution that is similar to previously known coronaviruses that have previously connected with humans. This development is not that significant for now and vaccines could be ‘tweaked’ and effectively targeted but this is another factor suggesting longer term endemicity.

-

^There was this 'case' a while back and one of the lawyers asked the two (opposing view) 'experts' how they could make sure that bias was not clouding their judgement. One of the two answered that this was not a problem because he did not have a bias problem. The other answered that bias was a significant issue and explained constructive ways to minimize the impact on reasoning. As a consumer of general information, which 'expert' do you rely on? ----- @Investor20 The Lancet article is interesting (thanks). The asthma inhaler (steroid-derived) story is relevant to this specific discussion. At first, 'they', on the ground, had concerns about using steroids (an immune depressant) to people becoming very sick with a Covid infection. This was not a political stance, a sign of weakness or of stupidity. It's sort of common sense to question the use of something that potentially decrease your immunity potential at a time when your immune system is tested. The last thing 'they' tell you before graduating is to go ahead and try not to kill 'them'. Anyways, it was established that steroids, on a net basis and because of the peculiar covid interactions with the immune system, were beneficial at various stages and steroid use became standard of practice to help alleviate consequences of the disease. Last summer when this knowledge was being refined, some took the microphone and announced that steroids (inhaled or else) were the 'magic bullet', without sufficient support for those claims. Over time, the picture is becoming clearer and the research you mention helps in further defining the role of steroids in covid. ----- @wachtwoord You are allowed to decide what you want for the vaccines, whatever your reasons. However, if you enter this space and aim to rationally prove your point with data and analysis, i'm open to be convinced but you should reasonably expect reasonable pushback. ----- The above comments about Michigan aim to divide, insult etc but there is something to learn. Comparing different regions is a challenge (multi-variable including many soft inputs) so one could get away with weird claims and grotesque conclusions. A few posts above, there was a reference to a fairly balanced comparison between Sweden and neighbors and it seemed like there was something to learn (the offered definition of learning is becoming less idiot but i'm open to debate on that one too). After all this time, it's become fairly clear that once the covid virus is allowed to circulate (to various degrees), there is some kind of trade-off between the economic cost and the virus burden (direct and indirect). There are many factors that can confound the picture but the trade-off implies to balance a higher (lower) economic cost to the 'we' in order to result in a lower (higher) virus burden to some. It's a hard discussion but one that could be constructively handled. Arizona and Michigan are very similar along most parameters but they are examples of what marginal differences can produce. Arizona (with changes at the margin) exchanged a lower economic cost (GDP hit, unemployment etc) with a higher disease burden. The covid cumulative cases for AZ and MI are quite similar but AZ took the lead (towards herd immunity) and MI is sort of catching up. Last summer, Arizona and a few comparable southern states, had very high community spread with a very clear pattern of first spread in the younger, active and mobile cohorts and then spread into older and more frail populations. It is what it is. Numbers (all per 100K population) covid deaths covid cumulative cases flu deaths (average last 3 years) covid vaccination rate MI 174 8000 14 53800 AZ 234 11600 11 55700 Arizona and Michigan have much more in common than what separates them and this current year (whoever sits in the governor's office), both states achieved similar (and remarkable) decreases in flu cases, hospitalizations and deaths. It appears that the influenza virus cannot distinguish between a Republican and a Democrat but it sure seems to fail to adapt to systematic changes in bipartisan human behaviors.

-

i think what we disagree about is the lack of motivation. A lot of the confusion is about semantics. The Fed does 'create' currency (but as a swap to an asset of different duration which is also recorded). As a coincident evolution or as a contributory effect, central banks' fixation on low interest rates have been linked to gradually lower real yields. It's still not clear what this means. https://ggc-mauldin-images.s3.amazonaws.com/uploads/newsletters/Image_11_20210410_TFTF.png Your reserves management hypothesis may be partly or even mostly correct. Only a handful of people would know. Last March, there were many questions (that remained unanswered) concerning potential mark to market adjustments (write-downs) and many 'precautionary' moves were activated in the direction of further easing. Of note, in the last week, reserves in the US financial plumbing system increased by 438B. When housing prices declined during the GFC, the Fed strategy was to increase reserves. When housing prices record record YoY price increases, the Fed strategy is to increase reserves. Go figure. When everything looks like a nail...