Cigarbutt

Member-

Posts

3,373 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Cigarbutt

-

Thank you for elaborating but this is not what i meant. "The lesson, in all of this, is that money needs to be based on something of real value" How do 'we' decide what is something of real value? ----- i meant, like a derivative product which 'value' is based on the underlying, what is the underlying for the 'value' of a dollar (choose the denomination) that explains the gap between the value of the paper, ink and printing process etc and the value 'printed' on the paper. The Spain reference is interesting on many levels (investing climate now, money printing and equivalent etc) but it's not the amount of new 'money' that was the problem, it's what 'they' did with it. You have to wonder why England shined in comparison as they took a different (alternative) path related to a different set of social conventions.

-

Their explanation of Spain decline is oversimplified and incomplete.. "The lesson, in all of this, is that money needs to be based on something of real value" How do 'we' decide what is something of real value?

-

Gold becoming a standard was related to its intrinsic characteristics but also and mostly because of recognition of such by (older days) the ruling class and then by social convention (more democratic type). In 1717 England, the Glorious Revolution was followed by a financial revolution and, in 1717, the Master of the Mint (Sir Isaac Newton!), the guy behind calculus miscalculated the relative value of silver and gold and while aiming to maintain a bimetallic standard sort of accidentally established the gold standard as social convention came to know it. Now the responsible fiscal capacity of nations has replaced the gold standard, mostly as a result of domestic primacy. It's been messy and the 'standard' is in terrible need of institutional reform but that does not automatically mean that alternative ideas will reach a sufficient level of recognition as a social convention, given the extreme importance of shared values for units of exchange, stores of value etc. Mark Carney (of central bank fame) wrote a book recently titled Values and discusses this aspect. Obviously, he has a certain frame of mind but there are some values that need to be shared. What is value anyway?

-

^This is a developing 'story' but the excess mortality that's persisting is likely transitory (whatever transitory means). #1 reason: persisting excess covid-related deaths, trend going down #2 reason: healthcare 'distortions' due to covid and how society dealt with covid (or not), trend going down #3 reason: various factors, mostly non-recurrent ones except maybe the 2022 heat wave (which is part of a climate trend..) You may find the following short and to the point: What can explain the excess mortality in the U.S. and Europe in 2022? - Health Feedback

-

-

The Fed actually stopped buying in mid-September. The following shows graphically the evolution of MBS held on central bank balance sheet with upward movements resulting from buying and downward movement resulting from principal passthroughs (which have come down because of tightening). The point of this post is that the Fed has been a marginal player in this business (impact on credit spread as well as on 'risk-free' rate) but an important one (both ways). What is the 'right' level of home ownership in the US?

-

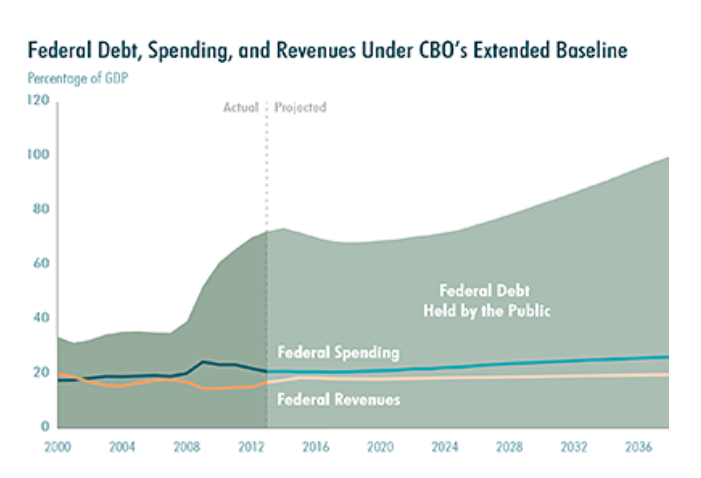

Your conclusion assumes that nominal deficits to gross GDP will not change or increase over time. That's why the CBO comes up with pictures such as those (it's been interesting to follow those projections over the years): and then, the projections in 2013: No worries, in the long run we'll all be dead.

-

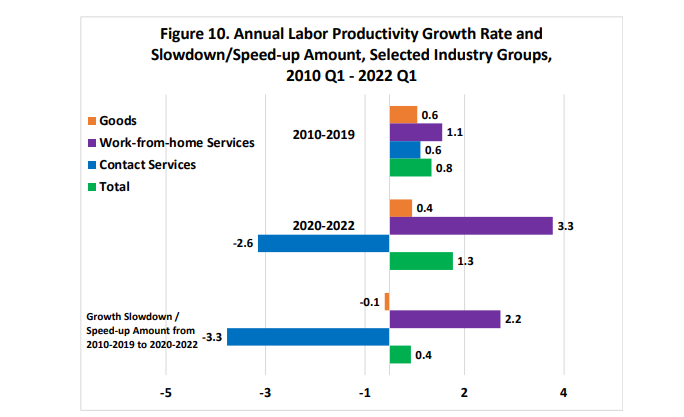

If interested in productivity (long term trend, recent noisy numbers etc), you may find the following interesting: Productivity Growth before and during the Pandemic | NBER Follow the link... ----- 30-second summary: -Productivity numbers have been generally trending down -The authors come up with a concept that explains prior productivity trends around previous recessions and more recent trends around the 2008 recession and especially around the last 'recession'. Employers have been reacting much faster with layoffs resulting paradoxically in higher productivity during recessions and lower productivity later on. For example, in 2020, there was a large number of people (mostly lower productivity workers and lower productivity industries) laid off and when the same people went back to work, output increase was lowish versus the increased number of workers. In Q1 and Q2 of 2022, this resulted (leisure, hospitality etc) in basically no growth in output during strong employment growth numbers. -The article suggests that, recently, WFH was a positive contributor and contact services, a negative one. --- Potential weak spots: The main author has high credibility in the productivity domain but is known to be tied (and maybe endowed) to the low productivity paradox school of thought of the current period. -reliable WFH data is difficult to collect, may vary across industries and often reflect 'surveys' which may be inflated? ----- To add insult to the injury, the numbers reported for 'goods' and manufacturing may be inflated also because (secular trend) the fraction of workers in manufacturing coming from staffing services (an industry i have a personal interest in and which i follow) has been increasing significantly over time. Workers hired through staffing agencies often count as payment for 'business services' and do not end up in the typical employment cost found in the denominator below output. And typically, even if staffing agency workers add to output, because of various friction costs, they are typically more costly (versus permanent workers). ----- Recently, there have been various anecdotal reports describing "labor hoarding" which should contribute to the continuation of lower levels of productivity going forward (until people are laid off).

-

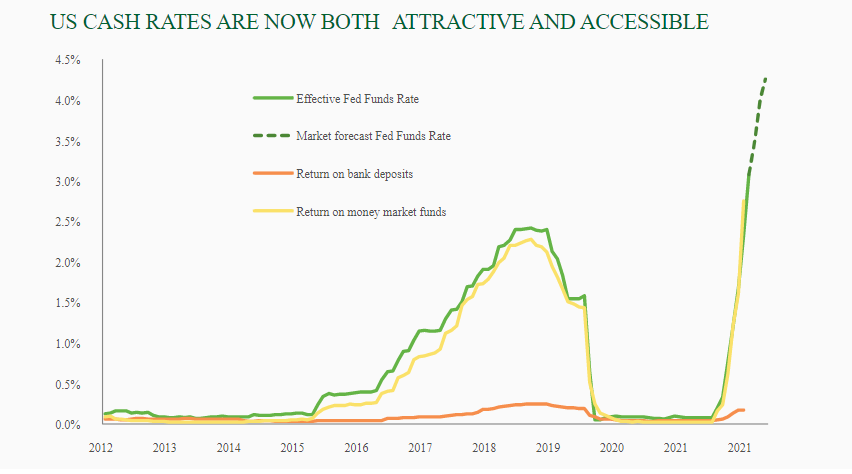

-The musical part Thanks for the info. Tension and release, interesting. To my untrained ear, your recording reminded me of Stevie Wonder (i hope you see this as a compliment). You may enjoy some of those 'progressions': 6 Stevie Wonder Back Door progression II-7 V7 examples tutorial - YouTube -The transition to RRP and TGA Using inter-disciplinary knowledge may be helpful to try to grasp some aspects of complex systems. Alternative views are fine but the Fed may be seen as some kind of orchestra conductor (maestro..). Of course, musicians (private market participants) on the floor (in the real economy) are everything but some need to write (and apply) the rules of the game. Otherwise, cacophony? -The transition to a potentially shared investment interest (US commercial banks) The Fed directly and indirectly funnelled a lot of money into the financial plumbing system in early 2020, relaxing liquidity rules for banks (similar in scale and scope to WW2 epoch) and then did not extend the SLR relaxation rule which diverted a lot of money away from the typical bank deposits to money markets funds which eventually turned to the RRP window in order to search for yield (2.2T still 'sitting' there, musical chair style). As of the end of September 2022, 6-7% of commercial banks' assets were excess reserves which earn a tightening level of interest (3.15% now and soon to increase) and banks are not really increasing rates on deposits so banks did well during easing (despite tightening net interest margins) and are poised to do even better with further money tightening (assuming some kind of soft landing..).

-

{Semi-personal note: Your post (on the noisy surface) attracted as much attention as if you'd have asked if the harmonic dualism theory applied to the increasingly more unstable equilibrium tied to monetary easing and related 'liquidity'. Isn't the theory based on the notion that since minor and major triads transcend into opposite (easing versus tightening) effects on the listener, they should be based on opposite principles? Personal note: sincere condolences for your mother's recent loss.} (Read the following only if you have excess time and your useful time may be better spent (or invested) into reading a recent WSJ piece which technically showed a tight expected correlation between the present World Series' Philadelphia-related outcome and future 'bottoms'.) ----- Short version What your substack link describes is really an attempt to ease while the main present intent is to tighten in comparison to the recent inflation episode which was the result of an attempt to tighten (RRP) while the main intent was to ease. ----- Longer version I wonder if credit and money should grow commensurate with real underlying economic activity and if attempts to compensate excessively through (financial plumbing) quasi-permanent liquidity operations may in fact delay correction of other (growing) systemic imbalances. Deposits are used here as a proxy for monetary and fiscal easing. It seems 'we' the people are getting wealthier since the early 2000s. It also seems that an attempt to wean the 'markets' from this effect in 2018-9 resulted in some discomfort (which eventually showed up in the repo window (not the reverse one that time)) much earlier than the spread of a 'natural' phenomenon which gave way to an opportunity for unprecedented additional easing. So now, there is an attempt to wean the 'markets' once again and the recent Treasury buyback option is another potential way to fine tune future and unfolding events.. Related to contemporary discussions about financial plumbing 'liquidity', there this article released (content 2021-2) and prepared by an interesting fellow (Rajan) who produced unease in an elite central banking crowd when he suggested, in 2005, that people in charge should perhaps, at times, think (independently) outside the box. Liquidity, Liquidity Everywhere, not a Drop to Use: Why Flooding Banks with Central Bank Reserves May Not Expand Liquidity | BFI (uchicago.edu) The link is probably not worth reading. Short summary follows. There is a highly quantitative component but the 'message' is really more qualitative: temporary and last-resort solutions should be temporary and last-resort? An alternative is to try to fine tune an increasingly (and potentially) more unstable equilibrium. In a presentation made available in the early 2010s, when discussing central liquidity operations and such, Mr. Brian Bradstreet (in charge of fixed income investment for Fairfax float) suggested that 'we' may simply have to take our medicine but that was before he realized that it could be very costly to be right and early.

-

Hi Bill, It seems (possibly wrong perception on my part) that this a slippery slope topic (for this Board). But this (lol thing about future receipts and outlays and growing mismatch vs underlying real economic activity) is why (opinion) central banks need to maintain a high degree of independence. Assuming here central banks are relevant and important entities? CF

-

Focusing on the potential investment implications only and using a purely accounting perspective as a blueprint, the 430B in costs that were written down was simply the equivalent of a loan being written down (because 'forgiven'). The 430B is the estimated future value of receipts tied to those loans that were expected in the future (real future cashflows). Receipts and outlays are often biased by one-offs and others and trends may be more meaningful? especially longer term ones? Of course one can focus on certain time lines when defining trends and one should use an appropriate denominator. Is GDP ok? To add another dimension, are receipts and outlays a leading, coincident or lagging indicator? And if an indicator, an indicator of what? Opinion: Financial repression can work (like post WW2 in US) but one then needs an unusual set of circumstances which are not present now. The yield curve seems to agree. Opinion: The more i read about Paul Volcker the more respect, but that may be a problem of mine (infatuation with certain ideas)?

-

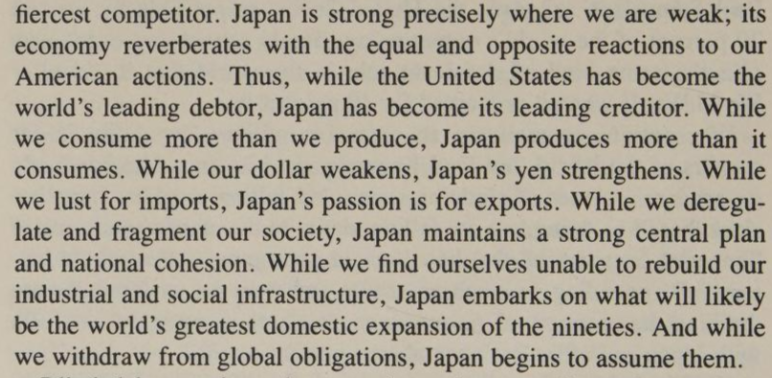

Bullish post about the US (despite some noise)! In 1988: It was felt that Japan would overtake the US (GDP wise and all). In 1988, a book was published (similar to a litany of similar others). The title was Yen!: Japan's New Financial Empire and its Threat to America and included the following: Growth in Japan in the 80s was led by credit growth linked to centrally driven "window guidance" (very similar to modern China's centrally-driven bank credit growth). The recent Fed-Treasury macroprudential framework is bizarre but is a comparative advantage versus a monopolistic central plan.

-

Philip Fischer was prescient about depressions

Cigarbutt replied to scorpioncapital's topic in General Discussion

Thanks to omagh for this thread's revival and kudos to uncommonprofits for the insights about inflation balance and potential effects of money printing. Note: the link seems to contain the complete interview. ----- This is not widely known but Philip Fisher (apparently and from his own memory) was starting out in the investment world in the 1920s and identified (in mid 1929) general price levels compatible with a major oncoming bear market but (from his own admission) failed to take his own advice and decided to protect his portfolio by buying lower multiple 'value' stocks that got decimated also. I guess it's called learning from mistakes? In the 1987 interview, it's interesting to see how one can have strong convictions about macro factors and still be able to stick to basic investment principles grounded on individual investment names. ----- Mr. Fisher's and uncommonprofits' point is that governing authorities have the ability to inflate (asset and consumer inflation) and it seems that this idea is playing out in the context of an increasingly unstable equilibrium? ----- Thoughts on why this inflation episode is about to end and how the speed of the disinflation (or even appearance of deflation) will depend on 1-extent of manifestation of underlying secular deflationary forces, 2-extent of real demand destruction and 3-extent of Fed-Treasury pivot. Movements in checkable deposits are mostly a reflection of recent monetary and fiscal policies. Using Q1 2020 to Q2 2022 (one can use slightly different end points but principle is the same): -about 20-30% of the increase in checkable deposits occurred the usual way ie through increases in loans and leases - about 30-35% of the increase in checkable deposits arose as a result of QE. Because of the asset swap, money appeared in checkable accounts (mostly in the invested groups ie top 1-10%). This had started to show up post GFC. Then, there was bound to be at least some consumer inflation from the wealth effect but the inflationary influence was drowned by other deflationary forces. The sheer size and speed of the open market operations unleashed in early 2020 made a huge difference. But this QE part mostly played out on the asset inflation side, not the consumer inflation side. -about 40-45% of the increase in checkable deposits occurred as a result of commercial banks expanding their balance sheet and acquiring government debt in the secondary market (effectively directly financing the government). This has been going on since the GFC but there was a tremendous acceleration in early 2020 (and a recent reversal). While this dynamic does not create net wealth in the private system, this allows the Treasury to effectively issue debt (to banks so bypassing the removal of money in the private system outside of banks) and add (on a net basis) money to other private market participants though the creation of a new deposit (checkable) by the commercial bank when banks buy the government debt (When you think about it, it's like if money is taken from a private market participant then redistributed to another private market participant with a higher propensity to consume when the time comes and with the initial funding private market participant being reimbursed in the process). The money (thereby 'created') that appeared in checkable deposits was mostly directed to the bottom 50% and the 50-90 percentile groups. This rise in checkable deposits fed by banks buying government debt at a rate much higher than GDP resulted in gradually higher consumer inflation with consumers having a high propensity to consume being able to take the pass-through from corporations but with wage growth lagging (lagging with accelerating inflation and, lately, lagging with decelerating inflation) and with, for a few months now, the consumers (especially lower end but trickling up) experiencing the negative effects of consumer inflation (saving rate down, consumer debt up (including credit card) and overall data points from on-the-ground corporate reports revealing behavior change at the consumer level showing stress ie less discretionary items, bloated inventories and gradually lower margins from retailers etc). Lately (from commercial banks themselves), it is said that the ‘consumer’ remains in good shape with higher than usual cash balances in their checkable accounts. It’s funny when you think about it because the increase in this wealth is perfectly matched by a decrease in wealth of the government, something which does not seem to be perceived or understood as a determinant factor in deciding (guessing?) if the present inflation is entrenched or self-fulfilling. Anyways, who knows what's next but the Treasury-Fed complex has only started to gently tighten and the yield curve is awfully flat and even somewhat inverted. -

That's an interesting question and perhaps a relevant one? It's also much easier to answer since it's a retrospective one. From data at the time versus the 'market' and what happened after, 'investors' were expecting higher growth in 'market' earnings, were using lower discount rates based on expected low interest rates and lower risk premia. Japan is only an analysis based on analogy and not on first principles so the applicability may be limited. Still, to the extent that monetary policy is relevant to this "when most people agree" idea and this "almost bottom" thread, Mr. Bernanke, in an address made in 1999 (not the recent Nobel address but the Japan "self-induced paralysis" one): "—I tend to agree with the conventional wisdom that attributes much of Japan’s current dilemma to exceptionally poor monetary policy-making over the past fifteen years (see Bernanke and Gertler, 1999, for a formal econometric analysis). Among the more important monetary-policy mistakes were 1) the failure to tighten policy during 1987-89, despite evidence of growing inflationary pressures, a failure that contributed to the development of the “bubble economy”; 2) the apparent attempt to “prick” the stock market bubble in 1989-91, which helped to induce an asset-price crash; and 3) the failure to ease adequately during the 1991-94 period, as asset prices, the banking system, and the economy declined precipitously. Bernanke and Gertler (1999) argue that if the Japanese monetary policy after 1985 had focused on stabilizing aggregate demand and inflation, rather than being distracted by the exchange rate or asset prices, the results would have been much better."

-

Book value is still a reasonable proxy (input or else) for valuation. The See's example is not exactly meaningful as the profits realized are kept in retained earnings for the whole and are reinvested. Book value still has value especially for insurance companies, banks, utilities etc. Fairfax has had a page in the early part of annual reports showing, side by side, the changes in book value vs stock price and, especially if you adjust for the change in exchange rates (the USD has been appreciating against CAD for a while now and more lately), the rates of growth are similar when looking from a longer term perspective although year-to-year variations can be very significant. Mr. Bloomstran had an interesting (and relevant?) section a few short years ago (pages 51-60): b8622c94-d42e-453d-bb67-3898a17a14c4.pdf (fmgsuite.com) He makes the point that paying for book value (and holding for a while) will result in you earning the return on equity + or - the change that may occur in the price-to-book multiple.

-

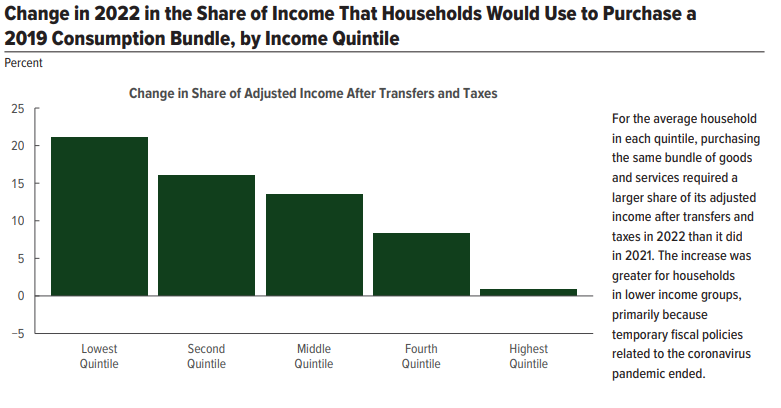

Hmm..Interesting. No idea either but it may be helpful to think separately about the two types of inflation. -Asset inflation The recent era of cheap or easy money (opinion: to which the Fed has contributed) has likely been a tail wind to asset inflation. So, to the extent general 'easing' has been a positive contributor, it can be reasonably expected that general 'tightening' would tend to be a negative contributor. But there was no rush to act for the asset inflation aspect and that's why foundational principles of central banks tend to focus on their independence and on their short-term liquidity advantages in times of stress. For those interested, Edward Chancellor (Devil Take the Hindmost fame) recently released The Price of Money. He criticizes central banks (he assumes interest rates have been artificially suppressed) and describes potential unintended consequences, one of which is asset inflation. But the intent behind the present tightening phase which has been initiated by central banks is not aimed at asset inflation (unless it's an acte manqué). And they could 'pivot' anytime. -Consumer inflation Something happened (versus consumer inflation) in 2020-2. There was an unusual and unprecedented phase of both monetary and fiscal easing. This had been brewing since the GFC and had started to go away in 2019 but there was then the equivalent of an acute and huge helicopter money experiment. This works with a lag (private money accumulates and then gets depleted; the process well advanced with saving rates down and consumer debt up lately) and the consumer inflation effects of this experiment should be over (as reported in official numbers) in early 2023 (especially with supply side effects mostly disappearing; on their own and by decreased demand). It looks like their 'transitory' definition was correct (opinion, if transitory is meant to be 12 to 24 months) but central bank mindset (in addition to the relative fiscal drag felt as a result of the transfer withdrawal) presently focus on the need to lower inflation (even if their own policies (if believed to be relevant) also act with a lag) even if inflation will take care of itself shortly. Why? This is not the 70s inflation when wages were also pulling inflation. After the initial positive effects of various transfers, for more than a year now, real wages after transfers have been coming down (negative effects). How Inflation Has Affected Households at Different Income Levels Since 2019 (cbo.gov) The above likely underestimates the 'true' CPI (CPI-essentials) that lower income groups are facing and take into account the increasing taxes paid as a result of inflation (effect on income tax brackets etc; poor trend going forward). The trend for this aspect is also following a reverse trickle down pattern. i think the Fed is reacting to this cost of living crisis and (opinion) i wonder if they are shooting in their own goal. And of course they could 'pivot' any time but will it matter at some point?

-

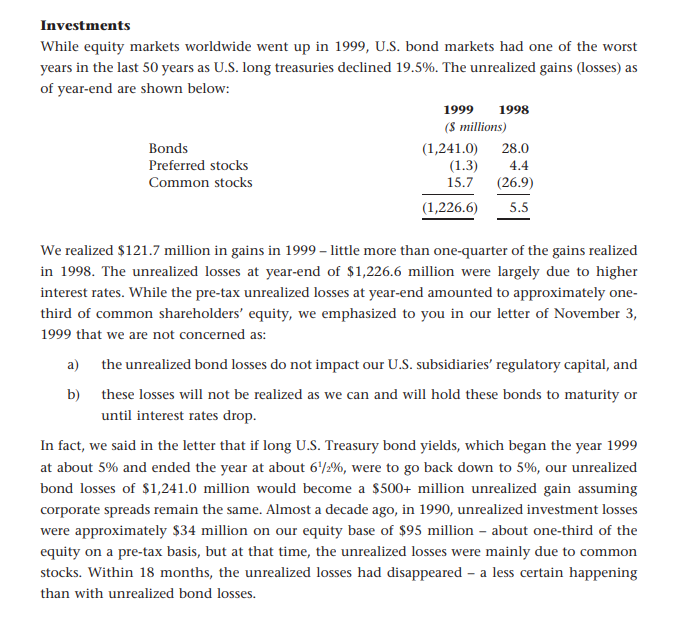

Take the following as potentially reasonable answers to your questions. Statutory accounting for bonds (at least NAIC based in US and similar elsewhere) requires bonds to be recorded at cost with an asset valuation reserve recorded immediately against surplus. For NAIC class 1 and 2 bonds (investment grade), this charge used to buffer future losses (mostly default-type losses) is between 0 and 2%. Then, unless an impairment needs to be recognized or somehow the insurer cannot demonstrate that the bonds can be held to maturity (also regulators look (and account for) idiosyncratic market exposure), there is no additional charge to surplus along the way to maturity. Note that, for the overall insurers' float portfolios in bonds, 94% of bonds are NAIC 1 or 2. Here's a decent reference for the statutory accounting part: ----- Just for fun (relevant for Fairfax now?), there was a time (annual report 1999) when potentially unsettling unrealized bond losses were not considered unsettling at head office (although the unusual concentration likely raised questions in some regulators' minds). Then, it seems that FFH wanted to protect against (and benefit from) the deflationary consequences of bu**ble bursting. That was then and now is now.

-

The Fed can influence short term interest rates (either through the fed fund rate or through open market operations changing base money; the latter option not possible at this point because of the very large inventory of government debt securities). But it appears that their influence on rates longer than 2-3 years is limited and mostly unpredictable because many other factors come into play (substantiated opinion; provide evidence to disprove). When long rates refuse to collaborate, central bankers typically refer to a "conundrum" which is simply a recognition that they have no clue. People who are shopping for houses and cars etc now face much higher monthly installments essentially because of the impact of higher short term interest rates influenced by the Fed (opinion) and not because of their open market operations at the long end (another opinion). Also note that QE and reverse QE operations are simply asset swaps: the net result is, essentially, a market participant swapping a government debt security for a virtual dollar (or vice versa), which are two relatively equivalent liabilities for the Fed (and the system). These operations do have an impact (asset inflation and wealth effect; one way or the other) but only have a marginal impact on basic consumer inflation (opinion).

-

Interesting question. This post is formulated with the following perspective: What would you do if you are calling the shots at the Fed and want to apply constraints on demand? Warning: i'm not saying the following is relevant or useful; it's only interesting. Tool #1 The above is a theoretical construct (from Keynes) but if you put short term interest rates on the y-axis and monetary base (currency + reserves deposited at the Fed) over GDP on the x-axis, you get a very strong (historically backed) relationship. The Fed has been intermittently (and to various degrees) using this correlation in order to 'control' short term rates (transformed the correlation into causation). Tool #2 The blip in the early 80s is Paul Volcker's contribution to the constraints put on the economy. Now, this seems like no big deal but then monetary base to GDP was very low (steep part of the liquidity preference curve) and only a small change in monetary base had a potentially large impact on short term interest rates. Since the GFC, monetary base per GDP has been growing irregularly but is situated so far on the x-axis of the liquidity preference curve (flat part of the curve, even practically horizontal) that changes in balance sheet holdings would result (at this rate) in an effect on short term interest rates in only a few years (perhaps not a good public relations move if there is a perception that you've fallen behind the 8 ball). To raise short term interest rates the way they recently did would have required (using only balance sheet open market operations) an incredibly massive and accelerated pseudo-liquidation of the Fed balance sheet, a potentially destabilizing move? So, to technically 'succeed' in raising rates the way they did, they had to manage rates by increasing the interest rates they pay on excess reserves and in the reverse repo window. Of course, the end result is the same if your aim is to put constraints on demand. At least that's what the housing markets (and a few other areas) are saying. ----- Can i ask then, if the Fed has become so tight, why are financial conditions not really reflecting that?

-

That's quite a strong statement.. It's been suggested that people who live to reach their 90s and centenarians (with adequate physical and cognitive ability) have an unusual collection of genes. But environmental factors do influence, at the margin, for most. Resilience (defined as an ability to do well in all environments, especially with headwinds) may also be a factor (genetic/environmental component). From references, Mr. Gottesman got the core of his BRK shares when Diversified Retailing ("a terrible mistake") was merged into Berkshire Hathaway in the early 70s. Mr. Gottesman was also reported to be an avid swimmer, well into advanced life. Interesting life. RIP

-

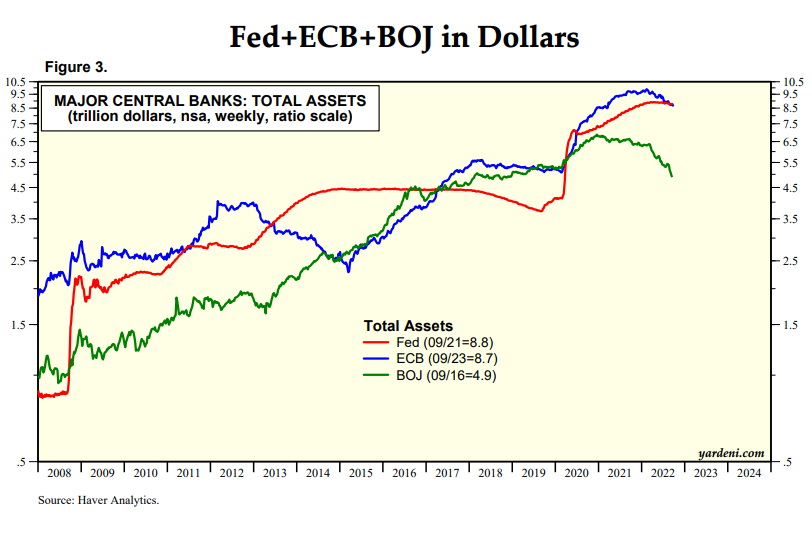

Ok, let's keep digging (there must be some flexibility here since the morality of wars is being concurrently discussed). Around 2009, profitability increased as a result of profit distribution rule changes (possibly linked to some shareholder legal pressures; although not disclosed that way) and, as you mention better underlying profitability. This is awfully complicated but also awfully simple in a way. The ECB, through pooling mechanisms and other schemes with national central banks calls the shots but shares the risk/reward outcomes on bottom lines. CBs have been expanding in a comparable fashion (ECB exposed more to some credit risks versus interest rate risk). Since 2015, the ECB has been catching up, in terms of unconventional market exposure. They (mostly), like the Fed, make their money from their NIM but there are differences with commercial banks. The ECB (and BNB) make their money when interest rates rise AND when the yield curves steepen. This goes a long way in explaining the declining seigniorage profit margins from 2010 on, despite an overall larger balance sheet expansion. In 2021, the ECB declared a double dividend (none in 2020 as a macroprudential move), as their net margins increased from the unwinding of the previous inversion. An interesting part is that ECB (and BNB and the Fed) has recently (last 20 years) tended to expand their balance sheets (and get exposure to interest rate risk) once curve tightening or inversion were well under way (especially 2006-7, also 2018-9). More recently (2020-1), the ECB (BNB doubled their balance sheet) expanded its balance sheet right before a central-bank driven tightening phase was globally prescribed. In this second fastest tightening since the Volcker era, they now have to pay more interest on their liabilities than they receive on their assets and are starting to report massive mark-to-market losses on their asset side due to longer durations. Of course, the fun part is what comes next. How can you know you've gone too far if you haven't gone too far? Don't fight the Fed, they say, even when they are doing an acte manqué?

-

That's interesting! (downside risk of private sharse 'withdrawal' by public entity) Here are some references i found (if looking for details): Press release: The BIS announces the withdrawal of all shares held by its private shareholders against payment of CHF 16,000 per share Press release: Withdrawal of privately held shares of the BIS: Final decision of the Hague Arbitral Tribunal Press release: BIS completes redistribution of shares TL:DR version BIS is not BNB but they rhyme. It turns out that central banks, working in the general public interest, can decide to withdraw shares held privately but may have to do so in a reasonable way and may accept to be challenged. Long story short: BIS shares traded in 2000 at around 4% dividend yield, BIS offered an around 2% dividend price and was eventually told to pay an around 1.5% yield price (the cost of which was eventually passed on to remaining central banks owning BIS, except the Federal Reserve who let its shares to be distributed to the remaining League-of-Nations type of global coalition). ----- Interesting also (if looking for a 'pivot' that would signal a potential return to central banks' positive net worth and unconventional profitability) is today's press release by the Bank of England which is starting to feel the inflation heat from the trickling up effect. Of course, their planned intervention should be short term in nature and should not derange their described plan to tighten when.. Bank of England to start unlimited bond purchases to stabilise market | Reuters edit: i decided to let the 'sharse' spelling in place in sympathy for your 'Swizterland'

-

Interesting topic and idea! -On the topic (have a low threshold to skip this section) Ownership structures of central banks are often awkward and difficult to change, often as a result of specific historical path dependencies, various needs to compromise among pressure groups upon formation and the usual inertia of complex structures. The US Federal Reserve is held through private shares (commercial banks) who get a fixed 6% dividend if the central bank is 'profitable', a question which has never been raised outside of hypothetical unlikelihoods. However, central banks have been unusually profitable with expanding balance sheets and do have a monopoly on seigniorage income. For 2022, the Fed, by a rapid back of the napkin calculation, will report +/- a breakeven operating income. Also, they would report a huge negative equity position but won't because, outside of its potential capacity to print money that's missing, they also have the monopoly about their own accounting standards ie they don't report mark-to-market losses (contrary to BNB whose reporting is influenced by IFRS revaluation concepts). At some point, noise will be made because a Treasury recap would constitute Fed fiscal involvement to an uncomfortable degree but it's really only technical in a way and the Fed has sort of described what it would do under the circumstances: they would create a deferred asset (based on future income) and use this asset as a contra liability to the mark-to-market losses... ----- -On the idea BNB is the typical slow moving creature reacting to events with a lag. Reading their reports during the mid 2000s bu**le years is mind boggling given their emphasis on prudence and foresight.. This could be an opportunity because of the context of a potential dividend cut. Assumptions (relatively conservative): -buy now -expect the dividend to be skipped for 3 yrs and then to come back to the avg of last 5 years for the remaining 7 yrs -expect the dividend yield to reach 4% at the end of the 10-yr period then the CAGR would be between 16-17% Potential upside -central banks' profits tend to be counter-cyclical, especially with use of unconventional tools (even anti-fragile?) Potential downside -BNB (along ECB) has expanded its balance sheet ++ and exposure to duration is high (may look bad for a while) -dependent on 'public good' policies -currency risk? (since GFC and more recently, Euro to USD depreciation has had a positive contribution to results) ----- Why was this put in the "Is the bottom almost here?" thread? Because we've been witnessing the fastest tightening ever? edited for spelling mistakes

-

Where Does the Global Economy Go From Here?

Cigarbutt replied to Viking's topic in General Discussion

Net worth is what is left after all financial assets and liabilities net out (to zero). So, net worth equals the value* of real and non-financial assets. The impression of thin air creation may be related to what Minsky described when he referred to the world built on a global set of interlocking balance sheets (which have also expanded much faster than underlying fundamentals). In my news feed this AM, there is a small note explaining how this rising net worth trend is the foundation for economic renewal. i agree *If you take "market" value, for the last twenty years or so, net worth growth has outpaced underlying growth in fundamentals but this growth has been the result mostly of valuation changes, mainly in real estate.