Viking

Member-

Posts

4,922 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@nwoodman I thought this would be interesting to dig into a little: “I am in the combined ratios revert to 100 camp.” Now i should say… i am not a P/C insurance guy. So i look forward to feedback from others who know much more than me on this topic. There is a lot of discussion on the board about Fairfax’s CR normalizing to 100 because ‘that is what always happens to P/C insurance.’ When i look at ‘P/C insurance’ I don’t see a homogenous business. Rather, i see a collection of very different businesses: - Personal lines or commercial? - Reinsurer or primary insurer? - Standard or specialty? - Is the business skewed to short tail (property or auto) or long tail (professional liability or workers comp)? And then you have to overlay lots more important factors: - geographies (US, UK, Europe, MENA, India…. Etc). This is a big one (getting bigger for Fairfax.) - reserving history The bottom line, I don’t think there is a ‘P/C insurance market.’ It looks to me like there are many (hundreds?) of P/C insurance markets. Especially for a global company like Fairfax. As a result, I think it highly unlikely that global insurance markets enter a synchronized soft market. instead, maybe we get rolling soft markets? A good example is workers comp in the US. I think it has been in a soft market for the past 5 years. This is significant business for Fairfax that looks poised to start to grow again in the coming years (just not sure when). Intact Financial just warned about outsized catastrophe losses in Canada in Q3. They are the 800lb gorilla here - perhaps this extends the hard market another year here in Canada. Bond yields have come way down in recent months. Central banks are easing - so yields could move even lower in the coming months/year. Many insurers were not able to roll a significant amount of their portfolio into longer dated bonds at peak rates (perhaps they missed the window). Lower bond yields moving forward will likely result in more discipline from most P/C insurers (they will need a solid CR to deliver the ROE expected by Wall Street). WR Berkley keeps getting asked on conference calls if the ‘hard market’ is over. They keep saying the P/C insurance market (in the US) is splintering into ‘markets’, each with its own cycle (some soft, some hard and others in between). Now we could get a really bad year for catastrophes and Fairfax’s CR might temporarily pop over 100 for that year. Perhaps we get two of these in a row - anything is possible. But do we get 4 or 5 years in a row? Never say never, but that seems highly unlikely. Why? Because Fairfax looks too diversified (line of business, geography etc). The diversification is beneficial not just in terms of catastrophe exposure. It is also really beneficial in terms of the insurance market cycle (does India’s auto market run lock step with that of the US)? The other really big factor is reserving. We could see reserve releases in the coming years surprise to the upside (especially if inflation comes down hard and stays low for years) - this might actually drive CR’s even lower for Fairfax (into the low 90’s, like we saw a decade ago). Not my base case. But not crazy talk either. Bottom line, i think we have pretty good line-of-sight as to what a ‘normalized’ CR is for Fairfax in today’s environment. But 4 or 5 years from now? I don’t have a strong opinion. But that is the same for all P/C insurers (not just Fairfax). Now it could be that i am completely out of my league - i have not owned Fairfax through a brutal hard market. So my view might simply be like a Disney movie. So i will continue to closely monitor the situation. What i do care deeply about: Is Fairfax a disciplined underwriter? How disciplined/good are they? I think the insurance cycle in the US will matter for Fairfax’s stock price (and all P/C insurers). If we get word that the hard market in the US has ended and P/C insurers are losing their discipline my guess is ALL P/C insurance companies will get taken out behind the woodshed. Which would probably give Fairfax the opportunity to buy back all the shares they want at very attractive prices. What i love about Fairfax right now is their flexibility/optionality - ability to flip the script - to actually benefit from what looks like a bad thing.

-

@73 Reds sorry, i have not spent any time on what you ask. What i do know is they have been actively reducing their exposure to the catastrophe part of the business in recent years (primarily at Brit i think). I know other board members have posted on this topic in the past so hopefully they will chime in with their thoughts. ————— Here is an exchange during the Q&A from Fairfax’s Annual Meeting this year: Unknown Shareholder …my question is for Mr. Clarke, if he can answer. As a layman investor, I believe that, if a hurricane 5 catastrophic event happens to direct hit to Miami City, that might be a $500 billion event. I wonder if you agree with me. And Fairfax cost will be 1%. That's what I believe as a layman investor. And if this even happens twice in a row in 2 years, how Fairfax can see their balance sheet... V. Watsa So before Peter answers. That's exactly right. We look at stuff like that. And if it happens, how are we going to survive that? So the big [ plus ] on these events is their limits, right? And so we really focus on the worst case events, from mainly Odyssey and Allied, but Peter? Peter does all the modeling and looking at it all the time. Peter? Peter Clarke Sure. Yes, no, as Prem said, we're focused on our catastrophe exposure, of course. And it starts with our insurance operations. The #1 thing is they have to manage their risk appetite within their capital base, but on top of that, we do a lot of work at the Fairfax level aggregating the exposures. And we really look at PMLs. So this is your probable maximum losses. And over the last 3 or 4 years, from our premium growth, we've benefited greatly from the diversification we now have within that 30 billion of premium that we write. And we can really absorb -- we can absorb significant catastrophes and still show an underwriting profit. Like the last couple of years -- this past year, cat losses were marginally down, so we had a fairly good year, but the year before that, we had probably -- I think we had 1.3 billion of losses, and over 1 billion the year before, and still posted underwriting profit. So as our premium base got bigger, we have more margin in the business for catastrophe losses, but our exposure has stayed relatively flat. So we do look at it. Northeast wind is one of our largest exposures. Southeast hurricane wind again is another one, so we're all -- we're on top of that. We look at it all the time and starts with our companies, yes. We have a team at the head office that we look at it. And of course, he's all into the details as well, so... V. Watsa That's the one risk that can destroy our company, so we are all focused on it all the time. You mentioned Miami. Of course, Houston, California earthquake, right, those are all big item, but one that you worry about -- there's a windstorm coming along, what he was saying, northeast wind. It's coming along the coast and hitting New York, rarely happened. It's happened once or maybe twice. Coming along -- it doesn't come into the -- it doesn't come inland, comes along and then comes into New York, which would be the -- we think, the worst one, and -- but we look at all of that all the time. So your question is a good one. That's something you have to do. You have to survive, stuff like that.

-

I think investment gains are 'devilishly' difficult to forecast over any one or two year span. However, I think it gets easier as you build an estimate over a longer time frame (like 3 or 4 years). If you go back 10 years, it is pretty easy to calculate an average for 'investment gains.' It could be separated into large 'one-time' gains and more 'normal' mark to market changes. But Fairfax's investment portfolio is much, much larger today than 10 years ago. The size of the equity portfolio is also much larger. And the quality of the equity portfolio (in term of earnings power) is also much better. So my guess is the size of 'investment gains' coming from the equity portfolio in the coming years will be much larger than what it has been in the past. In the past, it was crazy the significant value that Fairfax was able to surface with very timely asset sales from the insurance bucket of holdings: First Capital, ICICI Lombard, Riverstone Europe, pet insurance and Ambridge. None of the significant gains from each of those sales were built into earnings models before they happened. This does not include significant asset sales that have happened in the investment portfolio. I think this is instructive. Asset sales are a great example of just how different Fairfax and Berkshire Hathaway execute their business models. Fairfax has realized significant value over the years from asset sales (and it has also been a significant source of cash for the company). The beauty of Fairfax's active management/value investing model is they simply take what Mr. Market is giving them at the time. Insurance one day. Equities another day. Fixed income another day. Sometimes the value creation is rapidly growing the P/C insurance business in a hard market. Other times it is buying an asset at a low valuation (insurance or investments). Other times it is selling an asset at a premium valuation (insurance or investments). it is a little bizarre how some investors think Fairfax’s opportunity set is going to suddenly disappear in the coming years (or that they are suddenly going to get incredibly stupid).

-

I did a small edit to my long post from Sunday. I thought it would be useful to include more details for the Fairfax portion of the post. The edited portion is below. It is timely because I am updating my earnings forecast for Fairfax for 2024 and 2025 (small changes). As I work though my earnings update, one item keeps jumping out to me - and that is the excess of fair value over carrying value for Fairfax's non-insurance associate and consolidated holdings. Something that is not even included in my earnings update. What is the problem? Over the first 6 months the excess of FV over CV had increased by more than $500 million = +$20/share pre-tax. The total is $1.5 billion = $68/share (pre-tax). When I think about 'normalized' earnings for Fairfax I include the excess of FV over CV - it is value that is being built by Fairfax over time. And as we have learned with Fairfax over the years, they will find a way to monetize this value (so that it is reflected in EPS and BVPS). When we look at published earnings forecasts for Fairfax (2024, 2025, 2026, 2027 etc) we need to remember that an important component is NOT BEING INCLUDED. As a result, EPS understates the economic value that is being created each year. Probably by about $10/share. And this gap will likely widen in future years. Why will it widen? 1.) Fairfax has a large and growing amount allocated to equity investments. 2.) The share count is materially shrinking each year. 3.) The quality (in terms of earnings power) of this collection of holdings has never been better in Fairfax's history - significant value is now being created/compounded each year by this collection of holdings and a large piece of this value creation is not being captured in EPS or BVPS. Large investment gains are coming in the future In the coming years, Fairfax will be monetizing the excess of FV to CV. And the investment gains will likely be higher when they do - because the intrinsic value of many of these holdings is higher than the FV. This is really hard for most investors to understand - it's like the 'spoon bending mind scene' in the Matrix movie. When they happen, these large investment gains will be incremental to current EPS estimates. They will catch analysts and investors by surprise. EVEN THOUGH WE KNOW THEY ARE COMING. This is one good example of how investors are underestimating future earnings for Fairfax. And estimates of future earnings determines the value of a stock. So investors continue to undervalue Fairfax's stock today - probably significantly. Of course Fairfax 'gets it.' and that is why they are being so aggressive with stock buybacks - even at a small premium to book value. Stelco is a good current example. At June 30, 2024, Stelco had a FV = $351.8 million and a CV = $277.9 million; excess of FV over CV = $73.9 million. On July 15, Stelco was sold to Cleveland Cliffs for about $668 million. Fairfax will book an investment gain of about $390 million. The actual investment gain ($390m) is significantly more than the excess of FV over CV at June 30, 2024 ($73.9m). With a CV = $277.9, Stelco was being significantly undervalued on Fairfax's balance sheet at June 30, 2024. Now that the sale has been announced, the $390 million gain will now get included in EPS and BVPS. And everyone is shocked and/or surprised... who could have know that something like this was going to happen? The 'investment gains' spring at Fairfax is getting coiled ever tighter. Lots more of these 'suprises' are coming in the future... We just don't know the timing or the details. Most investors though will continue to pretend they don't exist. This approach will simply give some investors a big advantage when it comes to understanding Fairfax (future earnings) and assessing its current valuation. Sale of Stelco Holdings Inc. (From Fairfax's Q2-2024 earning report) On July 15, 2024 Cleveland-Cliffs Inc. ("Cliffs") entered into a definitive agreement with Stelco to acquire all outstanding common shares of Stelco for consideration of Cdn$70.00 per share (consisting of Cdn$60.00 cash and Cdn$10.00 in Cliffs common stock). Closing of the transaction is subject to shareholder and regulatory approvals, and satisfaction of other customary closing conditions, and is expected to be in the fourth quarter of 2024. The company's current estimated pre-tax gain on sale of its holdings of approximately 13 million common shares of Stelco is approximately Cdn$531 ($390), calculated as the excess of consideration of approximately Cdn$910 ($668 or $51 per common share) over the carrying value of the investment in associate at June 30, 2024 of approximately Cdn$379 ($277.9). ============ Below is the edited piece from my post on Sunday. Here is the link to the complete post: https://thecobf.com/forum/topic/20517-fairfax-2024/page/75/#comment-575416 What does all of this have to do with Fairfax? Fairfax has a significant portion of its equity portfolio in equities (about 30%). Over the past 5 years, Fairfax has been shifting from mark to market type holdings to associate/consolidated holdings. The proposed Sleep Country acquisition is the latest example of this trend. A gap between the fair value and the carrying value of these holdings has been growing in recent years. It is sizeable today – at June 30, 2024, the excess of FV over CV was $1.5 billion, or $68/effective share (pre-tax). Importantly, the excess of FV over CV has increased by $508 million over the first 6 months of 2024. This value creation is not captured in EPS or BVPS. And there is likely a sizeable gap between intrinsic value and fair value, as we recently learned with the sale of Stelco (it was sold for much more than ‘fair value.’ What did Fairfax have to say on the matter in their Q2, 2024 earnings report? Excess (deficiency) of fair value over adjusted carrying value "The table below presents the pre-tax excess (deficiency) of fair value over adjusted carrying value of investments in non-insurance associates and market traded consolidated non-insurance subsidiaries the company considers to be portfolio investments. Those amounts, while not included in the calculation of book value per basic share, are regularly reviewed by management as an indicator of investment performance. The aggregate pre-tax excess of fair value over adjusted carrying value of these investments at June 30, 2024 was $1,514.5 (December 31, 2023 - $1,006.0)." Stock buybacks Fairfax has also been very aggressive with stock buybacks in recent years. And they have picked up the pace so far in 2024. "During the first six months of 2024 the company purchased for cancellation 854,031 subordinate voting shares (2023 – 179,744) principally under its normal course issuer bids at a cost of $938.1 (2023 - $114.9), of which $726.5 (2023 - $70.4) was charged to retained earnings." Fairfax Q2-2024 Report This year Fairfax has been buying back stock at an average price of $1,098/share. At Q2-2024, book value was $979.63. Fairfax is buying back a meaningful amount of stock at a price that is higher than book value. This will likely continue moving forward. Why are they doing this? Fairfax understands its book value is understated.

-

+1 I really do appreciate the opportunity to debate with other board members. We have a wonderful community of smart, thoughtful investors

-

@nwoodman you make some great points: 1.) Fairfax's past mis-adventures and scar tissue. Making mistakes can be a wonderful educator. My guess is past mistakes have actually made Fairfax a stronger company today. And they are still recent enough that management likely still is feeling their sting. And I like that. 2.) Great point about 'access to information'. Given how Fairfax thinks and operates this (they think about the economy and macro) getting real time information from the various businesses they own should help. 3.) You have spoken many times in the past about relationships/deal flow. What Fairfax did with Kennedy Wilson ($4 in real estate mortgages) last year provides perhaps the best recent example. Fairfax has spend decades building out their partnership/relationship networks. This should be another tailwind moving forward.

-

@Munger_Disciple , I don't think anyone is assuming that Fairfax will deliver a long term ROE of 20%. Today, I think there is a pretty good chance that Fairfax can deliver a 15% ROE over the next 3 years. Important: in my ROE 'calculation' I include excess of fair value over carrying value for the equity holdings. That does not show up in earnings or book value, but I think it is value creation that needs to be captured. Year 4 and further out? My guess is Fairfax will continue to do well, but I have no idea how well. There are too many unknowns. But I don't need to know what Fairfax will do in 4 or 5 years. Because in 3 years time (August 2027) I will have a very good handle on what I think Fairfax can do from August 2027 to 2030. What I do with my Fairfax position will be driven primarily by what I think I KNOW. Not what I don't know. What your analysis is missing is the reflexivity thing that George Soros is so famous for (I hope I don't get this wrong). But let's assume the CR for all P/C insurance companies go to 100 for years - not a one year blip caused by record catastrophes. If this happens, the share prices for many P/C insurers will get killed. This will likely present the perfect opportunity for a flush with cash player (like Fairfax) to make a big P/C acquisition at an attractive price. Soft insurance markets are a great time to grow via acquisition. That is exactly what Fairfax did from 2015 to 2107 - they used the then soft P/C insurance market to build out their global P/C insurance footprint (the fact they were able to do this when they were cash poor is amazing). In a soft insurance market Fairfax will also have the ability to shift capital to more productive uses. Like 2020, maybe Fairfax's share price gets taken out behind the woodshed. This will simply give Fairfax the opportunity to take out a meaningful amount of shares at a very attractive price (perhaps below book value). Whatever boogeyman we can think of for Fairfax there is a flip side to it - something Fairfax can use to its advantage. The worse the boogeyman the better the opportunity. Now could we see high volatility over the short term (say 12 to 24 months) in the share price? Yes. But that would simply create the opportunity for significant long term value creation (via significant buybacks). I am not assuming Fairfax will always make the most optimal decision moving forward and always come out smelling like roses. But I am also not doing the opposite - I am not assuming the worst because that is what Buffett says will happen. Fairfax tends to make their best investments (capital allocation) when adversity strikes. It is very counter-intuitive. Active management, volatility, unconstrained capital allocation and the power of compounding is a very potent combination. Especially when you are flush with cash - this is the new variable for Fairfax.

-

@StubbleJumper I am not trying to put words in your mouth - so please correct me if I am off base. Fairfax's future is like the multiverse in a Marvel movie. Fairfax has an infinite number of futures. 94CR is one. 4% interest rates is another. But there are an unlimited number of variables - many of which are very important. What your analysis largely ignores is management. It assumes Fairfax is a leaf getting blown by the wind - and where Fairfax goes will be determined by the wind. I completely disagree. I think the biggest factor that will determine Fairfax's future is not 'fate' (the wind) - it is management and the decisions they make. Why has Fairfax and Berkshire Hathaway performed so well over the past 38 years? Was it because of the P/C insurance cycle? Or the interest rates available on sovereign debt? Both companies excelled because of the P/C insurance model and the excellent decisions made by the management team over time. ----------- IMHO, what your mental model is completely missing is what we don't know - what the management team at Fairfax will do, especially when adversity (= opportunity) strikes. That is the same line of thinking that caused my to completely miss out on Berkshire Hathaway as an investment for decades - I couldn't see with certainty what Buffett was going to do so I way underestimated the value he was going to create in the subsequent years.

-

The problem with mean reversion is that logic assumes the past business model is largely the same as the current business model. Let's go back to 2010 when Fairfax put on the equity hedge/short trade. 'Reversion to the mean' logic would have lead a 'rational' investor to expect a 15% ROE type of performance from Fairfax over the next decade (2010 to 2020). Of course that did not happen. Fairfax significantly underperformed. Why? Mostly because of decisions made by the management team. Yes, zero interest rates was also a headwind. The Fairfax of today is very different than the Fairfax that existed 10 years ago and even more different than the Fairfax that existed 20 years ago. My view is the current version of Fairfax is the best yet (in the 20 years that I have followed the company). That suggests to me that future returns (the next 5 years) should be good, and there is a solid chance that they could be very good. Will Fairfax's results 'revert to the mean'. I have no idea. What matters to me is management and the decisions they are making (capital allocation etc). And what that is doing to the fundamentals of the business.

-

@nwoodman , what i find so fascinating about Fairfax is how much has been changing over the past 4 years. And with all the cash they are generating today (and the coming years) my guess is more good ‘surprises’ are coming. Because the historical information doesn’t help us very much - and this is what most investors rely on the most to guide them in their decisions. With my posts i am often trying to figure out and get ahead of what is perhaps coming next - stuff that is not on investors radar today that will be in another year or two. Eventually, the pace of change will slow and Fairfax will likely become a more normal, boring, simpler company to value.

-

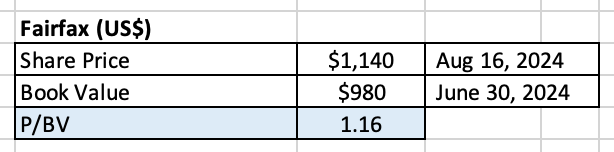

Book value is the ‘North Star’ used by Wall Street to value P/C insurance companies. Why? One big reason is it is wicked easy. Book value per share for a company is usually an easy number to find (unless you are a company called Berkshire Hathaway or Markel). Slap a market multiple on it (usually the company’s historical/past multiple) and… it’s like magic… you KNOW what a P/C insurance company is worth. Compare your estimate with the company’s current share price and you KNOW if the stock is fairly priced, undervalued or overvalued. Investing is very easy. Is investing really that easy? Maybe it is. But sometimes this approach above gets ‘it’ completely wrong. What are the big problems with the approach above? Here are a couple: Sometimes book value does not tell investors what they think it does. Sometimes the historical/past multiple is not the appropriate number to use. A great set up for an investor is to find a P/C insurance company where two things exist: Book value is materially understated. The multiple being attached to book value is too low. In this post, we will dig into book value to see what we can learn. What is book value? Book value is a proxy for what a company is worth should it be liquidated. It is calculated as follows: Assets (A) - Liabilities (L) = Equity/book value (E). The biggest asset of a P/C insurance company - by far - is its investment portfolio. For most P/C insurance companies, the investment portfolio is invested mostly in fixed income instruments, like bonds. Fixed income investments are relatively easy to value. This provides a fair amount of accuracy/certainty when calculating book value for a typical P/C insurance company. Book value and market multiple P/BV is a good measure to use to compare P/C insurance peers. The ‘rule of thumb’ when it comes to book value and multiple for P/C insurance companies is as follows: P/BV = 1 x = This is likely a low quality company. P/BV = 2 x = This is likely a high quality company. Finding a quality P/C insurance company that is trading at a P/BV multiple of 1 x is usually a very good thing - as this likely means it is being undervalued. What can cause book value to not be accurate? To answer this question, we are going to focus on the asset bucket. What if assets are being undervalued on a company’s balance sheet? This will cause book value to be understated. Markets are efficient But I can hear your response… “markets are efficient.” Mr. Market KNOWS when assets are being undervalued on a company’s balance sheet. As a result, book value, multiple and market price will reflect all that is known. Therefore it is not possible for an investor to profit from this set-up. This might be the case for most large companies. However, I doubt it is the case for all companies. Especially smaller companies that are not followed very closely by investors and the investment industry. Peter Lynch and asset plays To help him with his analysis, Peter Lynch separated all of his investments into 6 categories. One of the categories was ‘asset plays.’ An asset play is a company that has a valuable asset(s) that Wall Street is ignoring. What does this have to do with P/C insurance companies? There are lots of things that can cause book value to be understated at a P/C insurance company. Below is one example. Not all P/C insurance companies put most of their investments into fixed income securities. A few put a large chunk of their investment portfolio into equities - both publicly traded and private/consolidated holdings. The market value of some equity holdings might be much higher than their carrying value - this difference will not be captured in book value. And it could grow for years and even decades. Ok, that is enough theory. Let’s pivot to the real world. ————— Warren Buffett, Berkshire Hathaway and book value For more than 50 years, Buffett was book value’s biggest cheerleader. He educated two generations of investors to use book value as the core input to: Quickly/easily value Berkshire Hathaway (in a very rough way). Evaluate the performance of the company’s management team over time (change in BVPS). To understand the importance of book value, all an investor had to do was read the opening paragraph of Buffett’s iconic shareholder letters. Buffett wrote pretty much the same introduction every year for decades. Here is an example from Berkshire Hathaway’s 2017AR: “Berkshire’s gain in net worth during 2017 was $65.3 billion, which increased the per-share book value of both our Class A and Class B stock by 23%. Over the last 53 years (that is, since present management took over), per-share book value has grown from $19 to $211,750, a rate of 19.1% compounded annually.” Warrant Buffett - BRK’s 2017AR Warren Buffett’s very public rug-pull on Berkshire Hathaway shareholders But something suddenly changed in early 2019. In Berkshire Hathaway’s 2018AR, Warren Buffett made a very public divorce from book value. Holy shit Batman! Given book value’s importance to Berkshire Hathaway and its investors for over 50 years, this was a seismic event. Buffett is no dummy. He must have had very good reasons for doing this. Below is what Buffett had to say on the matter in Berkshire Hathaway’s 2018AR: “Long-time readers of our annual reports will have spotted the different way in which I opened this letter. For nearly three decades, the initial paragraph featured the percentage change in Berkshire’s per-share book value. It’s now time to abandon that practice. “The fact is that the annual change in Berkshire’s book value – which makes its farewell appearance on page 2 – is a metric that has lost the relevance it once had. Three circumstances have made that so. “First, Berkshire has gradually morphed from a company whose assets are concentrated in marketable stocks into one whose major value resides in operating businesses. Charlie and I expect that reshaping to continue in an irregular manner. “Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mismark that has grown in recent years. “Third, it is likely that – over time – Berkshire will be a significant repurchaser of its shares, transactions that will take place at prices above book value but below our estimate of intrinsic value. The math of such purchases is simple: Each transaction makes per-share intrinsic value go up, while per-share book value goes down. That combination causes the book-value scorecard to become increasingly out of touch with economic reality. “In future tabulations of our financial results, we expect to focus on Berkshire’s market price. Markets can be extremely capricious: Just look at the 54-year history laid out on page 2. Over time, however, Berkshire’s stock price will provide the best measure of business performance.” Warren Buffett – Berkshire Hathaway 2018AR Berkshire Hathaway changed as a company Warren Buffett purchase Berkshire Hathaway in 1965. Since then the company has changed dramatically. In 1967, Buffett purchased National Indemnity, which added the P/C insurance business model to the company. The float was invested over the years into publicly traded equities and to buy non-insurance companies. Over the years, the gap between the market/fair value and the carrying value of many of Berkshire Hathaway’s holdings has significantly widened - to the point where Buffett thought book value had lost its relevance as a useful metric for Berkshire Hathaway’s shareholders. A second important reason Buffett recently decided it was time for Berkshire Hathaway to start aggressively buying back its stock. Of course, stock would only be repurchased at prices that were below Buffett’s estimate of intrinsic value - so buybacks would be a good ‘use of cash’ for Berkshire Hathaway and its shareholders. However, the stock would be repurchases at a premium to book value (1.2 x or more). This would cause BVPS to actually go down. Over time, this ‘causes the book-value scorecard to become increasingly out of touch with economic reality.’ Buying back a significant amount of stock above book value over many years will mess up the informational value in the BVPS measure for investors. My guess is this a very hard concept for most investors to grasp. So what do you do if you are Warren Buffett? You go cold turkey and stop talking about and publishing book value and BVPS metrics. Buffett said that book value had ‘lost the relevance it once had.’ For long standing Berkshire Hathaway shareholders (of which there are many), it was like getting a bucket of ice water poured on their heads. What was an investor to use as a replacement to value Berkshire Hathaway and evaluate its management team? The change in its share price over time. Moving forward, Berkshire Hathaway shareholders should use Wall Street/ Mr. Market as their primary guide. WTF? Really? I get that book value has its flaws. But to flush in down the toilet as a useful tool and replace it with Wall Street/Mr. Market just seems a little bizarre/extreme. But I digress. And who am I to disagree with Warren Buffett? What does all of this have to do with Fairfax? Fairfax has a significant portion of its equity portfolio in equities (about 30%). Over the past 5 years, Fairfax has been shifting from mark to market type holdings to associate/consolidated holdings. The proposed Sleep Country acquisition is the latest example of this trend. A gap between the fair value and the carrying value of these holdings has been growing in recent years. It is sizeable today – at June 30, 2024, the excess of FV over CV was $1.5 billion, or $68/effective share (pre-tax). Importantly, the excess of FV over CV has increased by $508 million over the first 6 months of 2024. This value creation is not captured in EPS or BVPS. And there is likely a sizeable gap between intrinsic value and fair value, as we recently learned with the sale of Stelco (it was sold for much more than ‘fair value.’ What did Fairfax have to say on the matter in their Q2, 2024 earnings report? Excess (deficiency) of fair value over adjusted carrying value "The table below presents the pre-tax excess (deficiency) of fair value over adjusted carrying value of investments in non-insurance associates and market traded consolidated non-insurance subsidiaries the company considers to be portfolio investments. Those amounts, while not included in the calculation of book value per basic share, are regularly reviewed by management as an indicator of investment performance. The aggregate pre-tax excess of fair value over adjusted carrying value of these investments at June 30, 2024 was $1,514.5 (December 31, 2023 - $1,006.0)." Stock buybacks Fairfax has also been very aggressive with stock buybacks in recent years. And they have picked up the pace so far in 2024. "During the first six months of 2024 the company purchased for cancellation 854,031 subordinate voting shares (2023 – 179,744) principally under its normal course issuer bids at a cost of $938.1 (2023 - $114.9), of which $726.5 (2023 - $70.4) was charged to retained earnings." Fairfax Q2-2024 Report This year Fairfax has been buying back stock at an average price of $1,098/share. At Q2-2024, book value was $979.63. Fairfax is buying back a meaningful amount of stock at a price that is higher than book value. This will likely continue moving forward. Why are they doing this? Fairfax understands its book value is understated. Fairfax appears to have contracted the ‘Berkshire Hathaway disease.’ Book value is less useful than most investors realize - as a tool to use to value the company or evaluate the performance of the management team. And over time, book value will become even less useful. A couple of things suggest the impact on Fairfax will likely be more muted than Berkshire Hathaway: It is not clear that Fairfax wants to go full-on Berkshire Hathaway towards operating companies. But we will see what they do in the coming years. Fairfax has been keen over the years to surface significant hidden value via asset sales/asset revaluations. Berkshire Hathaway has largely been buy and hold forever, especially when it comes to the operating companies it owns. Fairfax’s current valuation Fairfax is trading today at P/BV multiple of 1.16 times. This is significantly lower than P/C insurance peers. This also does not include the estimated $390 million gain that is coming from the sale of Stelco. Or the earnings QTD. Or the significant undervaluation of the equity holdings (publicly traded and private/consolidated). Bottom line, despite the monster increase in the share price over the past 4 years, Fairfax’s stock looks like it continues to trade at a large margin of safety. How much is book value understated at Fairfax We can estimate some of the undervaluation for Fairfax. For associate/consolidated holdings, Fairfax does provide a fair value calculation for most holdings. This can be compared to their carrying value to come up with one measure of undervaluation for the group of holdings. But as helpful as this is, on its own it is incomplete. For some holdings, their ‘intrinsic value’ is likely much higher than Fairfax’s reported ‘fair value.’ What investments? My top 3 today would probably be: Poseidon, Grivalia Hospitality and BIAL. What about the P/C insurance holdings? Fairfax sold its pet insurance business in 2022 and realized a $1 billion gain (after tax). They also sold of Ambridge in 2023 for a sizeable gain. In 2021, Fairfax sold 10% of Odyssey for $900 million. Odyssey is NOT carried at a value of $9 billion. My guess is Fairfax's P/C insurance companies are carried on the balance sheet at a discount to their true value (and the gap could be significant for some assets). If so, this would just be another example of how Fairfax's book value is understated today. What do other board members think? Is Fairfax's book value understated? If so, how much? What is causing/driving the 'undervaluation?' Watch buybacks It will be interesting to see: If Fairfax remains aggressive with stock buybacks moving forward. The P/BV multiple they will pay. This will provide investors with important insight into how the management team at Fairfax values the company and its stock. =========== Intrinsic Value and Book Value - From Berkshire Hathaway’s Owner’s Manual The excerpt below is from Berkshire Hathaway’s Owner’s Manual - 1999 (this was the version that was on Berkshire Hathaway’s web site on August of 2024) INTRINSIC VALUE Now let's focus on two terms that I mentioned earlier and that you will encounter in future annual reports. Let's start with intrinsic value, an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life. The calculation of intrinsic value, though, is not so simple. As our definition suggests, intrinsic value is an estimate rather than a precise figure, and it is additionally an estimate that must be changed if interest rates move or forecasts of future cash flows are revised. Two people looking at the same set of facts, moreover - and this would apply even to Charlie and me - will almost inevitably come up with at least slightly different intrinsic value figures. That is one reason we never give you our estimates of intrinsic value. What our annual reports do supply, though, are the facts that we ourselves use to calculate this value. Meanwhile, we regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we control, whose values as stated on our books may be far different from their intrinsic values. The disparity can go in either direction. For example, in 1964 we could state with certitude that Berkshire's per-share book value was $19.46. However, that figure considerably overstated the company's intrinsic value, since all of the company's resources were tied up in a sub-profitable textile business. Our textile assets had neither going- concern nor liquidation values equal to their carrying values. Today, however, Berkshire's situation is reversed: Now, our book value far understates Berkshire's intrinsic value, a point true because many of the businesses we control are worth much more than their carrying value. Inadequate though they are in telling the story, we give you Berkshire's book-value figures because they today serve as a rough, albeit significantly understated, tracking measure for Berkshire's intrinsic value. In other words, the percentage change in book value in any given year is likely to be reasonably close to that year's change in intrinsic value. You can gain some insight into the differences between book value and intrinsic value by looking at one form of investment, a college education. Think of the education's cost as its "book value." If this cost is to be accurate, it should include the earnings that were foregone by the student because he chose college rather than a job. For this exercise, we will ignore the important non-economic benefits of an education and focus strictly on its economic value. First, we must estimate the earnings that the graduate will receive over his lifetime and subtract from that figure an estimate of what he would have earned had he lacked his education. That gives us an excess earnings figure, which must then be discounted, at an appropriate interest rate, back to graduation day. The dollar result equals the intrinsic economic value of the education. Some graduates will find that the book value of their education exceeds its intrinsic value, which means that whoever paid for the education didn't get his money's worth. In other cases, the intrinsic value of an education will far exceed its book value, a result that proves capital was wisely deployed. In all cases, what is clear is that book value is meaningless as an indicator of intrinsic value.

-

The CVR's from Resolute are interesting. The size of the duties on deposit with US government at the Canadian lumber producers is nuts right now. I think Canfor alone is approaching $1 billion in duties on deposit - and the softwood lumber duty just went up again. Today there appears to be no political will to get this issue resolved (in either country). But there is significant value there (duties on deposit). Tick, tick, tick... 'Duties on deposit' does not appear to be priced into any of the stocks today of the Canadian lumber producers. ---------- In 2006, the first softwood lumber dispute between the US/Canada was resolved. About 20% of the duties on deposit went to the US and 80% went to the Canadian producers. The irony is West Fraser used their windfall gain to fund/kick start their aggressive move into the US South. With hindsight, the softwood dispute/duties imposed by the US were the best thing that ever happened to the large BC producers - it motivated them to think different, which lead them to expand beyond BC. Less than 20 years later, West Fraser, Canfor and Interior have morphed from being large BC lumber companies (back in 2006) to being 3 of the top 4 lumber producers in North America today (and 3 of the largest in the world). And the BC lumber industry is in a massive secular decline (driven by mountain pine beetle and, more recently, terrible provincial government policy). https://www.westfraser.com/sites/default/files/MD%26A_2007.pdf

-

@petec Great summary - of a topic that has a fair bit of complexity and is not well understood.

-

@gfp thank fro the info. I did take a quick look at the Odyssey filing that you recently attached - lots of good information in there - but didn't think to use it here

-

Here is a quick summary of the changes in Fairfax's 13F filing. I have guessed at the average prices. The subtractions were much bigger than the additions.

-

@73 Reds The fact that Fairfax has been able to attract (and keep) shareholders of your quality gives me confidence that they are moving in the right direction. I agree with you - I think Fairfax has learned a great deal over the past 10 years. They have also had some important personnel changes (adding Wade Burton/Lawrence Chin, subtracting Paul Rivet, promoting Peter Clarke to name just a few). Lots of investors don't want to invest in Fairfax today (or hold their shares long term) because of the very visible mistakes Fairfax made in the past. Given what we have seen from the management team at Fairfax over the past 6.5 years, I think the past mistakes actually make Fairfax a much stronger company today. As an investor, given what we know today, it makes me more confident in their future - it makes me want to invest in the more. It is really counter intuitive. The cost of Fairfax's past mistakes was bourne by shareholders from 2010 to 2020 - and it was not pretty. Someone buying Fairfax shares in 2020 or later have been big beneficiaries of Fairfax's past mistakes - Mr. Market was irrationally pessimistic. What were the big mistakes? The disastrous equity hedge/short 'decision' cost the company dearly (financially and reputation ally). But it also exposed a massive flaw in their investing framework. Blackberry was an unmitigated disaster. As was Abiliti-Bowater investment. Both of these investments exposed more flaws in their investing framework. Sandridge Energy, Fairfax Africa, APR Energy, Farmers Edge were all terrible investments. These investments exposed more flaws in their investing framework. These all became great teachable moments for Fairfax. Bottom line, Fairfax looked in the mirror and didn't like what they saw - they recognized they were the problem. Ending the equity hedge in late 2016 was the start and also the most important move (it was the biggest drag on results). By 2018, it was clear Fairfax started putting a much premium on management (Seaspan/Sokol and Stelco/Kestenbaum investments). In late 2020, Fairfax closed out its last short and very publicly promised not to repeat the equity hedge/short disaster. Around 2020/2021, Fairfax also stopped being a piggy bank to underperforming equities in their portfolio - generating cash flow became the new mantra. If they got cash from Fairfax it usually required restructuring by the company, a pound of flesh (increase in Fairfax's ownership on very favourable terms) etc. Fast forward to today and you have a MUCH stronger company. Investors have never actually seen this version of Fairfax before. Fairfax today looks like a star athlete that has just entering their prime. With Fairfax, there is a good change we haven't even seen their best performance yet. And that is why I push back so much on people on this board who think Fairfax is at 'peak earnings' today. Peak? I think we are just getting a glimpse of what they can do. The crazy thing is Fairfax's stock is priced today like the company will be going into a steep earnings decline looking out 3 or 4 years. A big decline? WTF? So even if I am completely wrong in my outlook for Fairfax, the stock will likely still perform reasonably well moving forward. And if I am right... well that would result in significant upside - that I am getting for free today. What a wonderful set-up. And that is why I love investing so much.

-

@wondering A lot of the discussion points in my posts are fluid… things that looks interesting that could go in different directions in the future. I am not sure what Fairfax’s thinking is on weightings within the equity bucket (mark to market, associate or consolidated). I agree with your summary: “My thinking was always Fairfax are value hunters and they will go where they see value. Period. The way they hold the investment in secondary.” i would add a little to your comment: Fairfax also seems to like the true value of their holdings to be reflected in book value (at least looking at it from an historical perspective). Having said that, i wonder if they do not want to have some non-insurance consolidated holdings. ‘Bond type’ holdings that spit out cash. As a important offset to the P/C insurance business. But even here, if there is an opportunity to realize a big investment gain (like take take Recipe public in the future) my guess is they will do it. I think there has been a trend in the general market towards more private and fewer public holdings. Fairfax has many deep pocketed partners. Perhaps part of what is happening at Fairfax i s just a microcosm of what is going on in the larger marketplace (towards more private holdings). It might also be a reflection of Fairfax’s size - as Fairfax gets bigger it makes sense when they make investments they will own bigger stakes in companies (+20% or more) which will push more investments into the associates bucket or (50% or more) the consolidated bucket. And some holdings are just better suited to be held as private holdings - versus public. AGT Food Ingredients is a great example if this - their business is too volatile and none of their peer group are publicly traded. I think taking Recipe private was smart for the business - my guess is they needed to restructure their operations after 10 years of acquisitions and this is difficult to do as a publicly traded company (they got started on this in the 2 years before Fairfax took them out). Of interest, when i calculate Fairfax’s splits (mark to market, associate and consolidated) i include the FFH-TRS in the mark to market bucket. If you exclude that holding (it is a derivative), the mark to market bucket is even smaller. And within the remaining holdings in the mark to market bucket, you have the significant limited partnership holdings that total $2 billion - BDT, ShawKwei, JAB etc. The true mark to market ‘common stock portfolio’ is $4.5 billion out of $20 billion in ‘equities’ and +$65 billion in total investments.

-

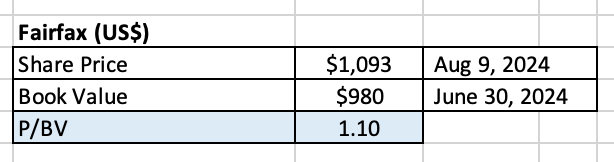

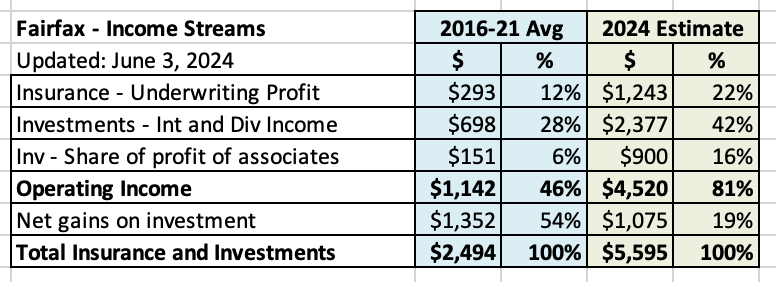

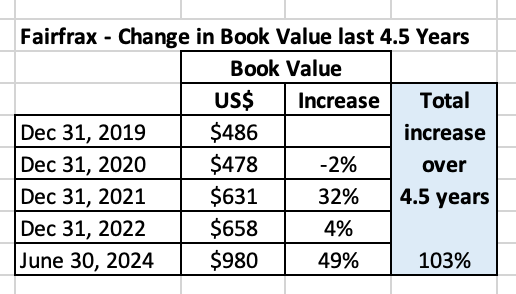

Volatility and Fairfax - Part 2 Earlier this week we began our exploration of volatility in financial markets and the different ways it impacts Fairfax. Given the size of the topic, we broke our analysis into two parts/posts. In our first post, we introduced the concept of volatility and then explored the following: Part 1: Fairfax’s ability to profit from volatility Clink the link to read Part 1: https://thecobf.com/forum/topic/20517-fairfax-2024/page/72/#comment-574244 Below is part 2 of our discussion of volatility. Part 2: The impact of volatility on Fairfax’s short term reported results ‘New Fairfax’ Fairfax as a company has undergone a number of important changes ‘under the hood’ over the past 5 years. These changes have make the company a very different animal from the company that existed previously. To help differentiate between the two versions, I call Fairfax as it exists today ‘New Fairfax’ and the Fairfax from +5 years ago ‘Old Fairfax.’ Volatility of Fairfax’s reported results The historic reported results (earnings and book value) of ‘Old Fairfax’s’ were always VERY volatile. Not just the quarterly results, but also the annual results. This was due to a number of reasons - largely related to its business model but also how Fairfax was executing the business model. Moving forward, my guess is the reported results of ’new Fairfax’ will be much less volatile than what investors are used to. Why? There has been a significant change in the size of the income streams that Fairfax generates - with a massive shift to lower volatility, higher quality operating earnings. The management team at Fairfax has been making many important changes ‘under the hood’ that suggests reported results in many of Fairfax’s individual income streams should be less volatile moving forward. Let’s dig into each of these a little more. Fairfax’s results are now being driven by high quality operating earnings Let’s first look at the time period from 2016 to 2021. Over this 6 year period, Fairfax’s biggest income stream was investment gains and it represented an average of 54% of all of Fairfax’s income streams. Operating earnings (interest and dividend income, underwriting income and share of profit of associates) averaged 46%. From 2016-2021, investment gains were - by far - the most important income stream for Fairfax. This income stream was also exceptionally volatile. In turn, this caused Fairfax’s reported results to swing quite dramatically from year to year. ‘New Fairfax’ This split - investment gains vs operating earnings - has changed dramatically over the past four years. As Prem said very loudly at the AGM this year: ‘Fairfax has been transformed.’ Operating income (interest and dividend income, underwriting income and share of profit of associates) has exploded in size at Fairfax over the past 3 years. It averaged $1.1 billion per year from 2016 to 2021. In 2024 it is estimated to come in at around $4.5 billion, an increase of $3.4 billion. This is a massive increase. Operating income is considered by Wall Street to be the ‘high quality’ source of earnings for P/C insurance companies - because they are considered to be predictable and durable sources of income. On the other hand, given their unpredictability in the short term, investment gains are considered to be a ‘low quality’ source of earnings. Today, operating income is Fairfax’s largest income stream - it now represents 81% of Fairfax’s total income streams. Investment gains now represent 19% of Fairfax’s income streams. There are two really important points: The total size of Fairfax’s income streams has exploded in size. All of the growth has happened in the operating income bucket. This has profound implications on how changes in financial markets will affect Fairfax’s reported results (earnings and book value) in the future (when compared to the past). Fairfax’s reported results will likely be much less volatility than in the past. But there is more to the volatility story. Let’s take a closer look at what has been going on under the hood at Fairfax Fairfax has three economic engines: P/C insurance Investments - Fixed income Investment - Equities Let’s review some of the changes that have happened in each of these buckets in recent years. P/C insurance Runoff is now a much smaller part of Fairfax’s total P/C insurance business. In 2016, the runoff business represented 20.5% of shareholders’ equity at Fairfax. In 2023, runoff represented 1.9% of shareholders’ equity. Fairfax has been shrinking its total catastrophe exposure (as a company) in recent years, especially at Brit. The hard market in P/C insurance has now been going on for 4.5 years - Fairfax should be well reserved. All things being equal, this suggests that Fairfax’s reported underwriting results will likely be less volatile in future years than they were in the past. Investments: Fixed income As required by regulators, Fairfax began using IFRS 17 accounting on January 1, 2023. Moving forward, when interest rates change, IFRS 17 (and how it accounts for insurance liabilities) will largely work as an offset to changes in the mark to market value of Fairfax’s fixed income portfolio. It will not be an exact offset (one goes up the same as the other goes down and vice versa). But it should smooth out the swings quite a bit. This suggests that large changes in interest rates should result in less volatility in Fairfax’s reported results (earnings and book value) in future years than in the past. Investments: Equities Since 2020, the composition of Fairfax’s equity portfolio has changed dramatically. Non-insurance consolidated (private) equity holdings has substantially increased in size in recent years. Recipe and Grivalia Hospitality were added to this bucket in 2022 and the Sleep Country acquisition was just announced. This group of holdings has increased in recent years to now represent about 20% of the total equity portfolio (including Sleep Country). Associate equity holdings has also substantially increased in size in recent years - to about 35% of the total equity holdings (not including Stelco now that it has been sold). Fairfax’s two largest equity holdings are in this bucket: Eurobank as of January 1, 2020 and Poseidon (formerly Atlas/Seaspan) as of Q1 2020. The non mark to market group of holdings has increased significantly in size over the past 5 years. The majority of Fairfax’s equity holdings (about 55%) are no longer mark to market type holdings. The quality of the equity portfolio has also improved materially Back in 2018, Fairfax’s equity portfolio was stuffed with many ‘problem’ equity holdings. Over the past 5 years Fairfax has done a great job of dealing with all of its poorly performing equity holdings. As a result, the overall quality of the equity portfolio has improved dramatically. There are two really important points: The quality of Fairfax’s equity portfolio has improved dramatically over the past 5 years. Over the past 5 years, the composition of Fairfax’s equity portfolio has shifted from mostly mark to market holdings to mostly non mark to market holdings (at about 55% in 2024). This suggests a big sell-off in equity markets should result in much less volatility in Fairfax's investment gains (losses) and reported results (earnings and book value) in future years than in the past. Remember, investment gains is now also a much smaller income stream for Fairfax as a percent of total income streams. So a much smaller income stream will also be much less volatile - this is a double impact. Summary Many important changes have happened at Fairfax over the past number of years: Operating income, at about 80%, is now - by far - Fairfax’s largest income stream. The P/C insurance business continues to improve in quality and shrink its catastrophe exposure. The implementation of IFRS 17 will smooth results in the fixed income portfolio. The equity portfolio has improved dramatically in quality and significantly shifted away from mark to market type holdings. All of these changes should make Fairfax’s future reported results (earnings and book value) much less volatile than in the past. Important: this does not mean that Fairfax's reported results will not have some volatility to them in the future. The point is the volatility should be much less than what we have seen in the past. Volatility and market multiple This is important because for Wall Street, earnings volatility and market multiple are linked at the hip. All things being equal, the stocks of lower volatility businesses (from an earnings perspective) usually receive a higher multiple. And the stocks of higher volatility businesses usually receive a lower multiple. My guess is Wall Street does not yet fully grasp the changes that have happened at Fairfax that will lower the volatility of future reported results (when compared to the past). As a result, ‘lower volatility’ is likely not yet priced into Fairfax’s stock. This provides another important tailwind for long term investors. Fairfax's Valuation Fairfax is trading today at a trailing P/BV multiple = 1.1 Fairfax has delivered the best growth in book value per share among P/C insurance peers over the past 5 years. We also know that Fairfax's book value is materially understated (gain from Stelco sale + excess of market value over carrying value of equity holdings). Fairfax is poised to deliver mid teens ROE in 2024 and the coming years. And now we know Fairfax's future reported results will likely be much less volatile than in the past (meaning they are of much higher 'quality'). All of this warrants a trailing P/BV multiple of 1.1? Really? Is it any surprise that Fairfax has been VERY aggressive taking out shares YTD in 2024 at a slight premium to book value?

-

@Thrifty3000 I think we can all agree that ‘baseline’ earnings for Fairfax will be very robust for at least the next three years. That is simply based on the facts - what we know today. I don’t think that is a controversial thing to say. Yes, there are downside risks. But there is also a good chance we get some upside surprises (one example: asset sales/revaluations resulting in large investment gains). For the next couple of years, i think the ‘risks’ are skewed to upside surprises for Fairfax. Parts of your analysis ignores what we know today. Is that a rational way to try and value Fairfax? Or put another way… if you had done this exact same analysis three years ago would it have helped you or hurt you in trying to value Fairfax? Especially when it came to position size (the ‘how undervalued’ a company is part of investing). PS: by ‘baseline’ earnings I mean earnings excluding unknown/extraordinary events.

-

@nwoodman thanks for pointing out the obvious to me... I did not realize Poseidon's earnings were tracking that high. At Fairfax's AGM in April, Sokol was sounding very optimistic about Poseidon'e near term prospects (earnings growth next couple of years)... looks like things are playing out as he expected. If Poseidon is able to earn $640 million per year, that would put Fairfax's share at about $277 million (43.3% ownership). For Poseidon, at June 30, 2024, Fairfax had a carrying value of $1.78 billion (and a fair value of $2.05 billion). Earnings yield on carrying value is 15.6% ($277 / $1.78). That is a pretty good return for a pretty stable leasing business kind of masquerading as a container shipping company. I think it might be time to do an update on Poseidon My guess is Fairfax's stake in Poseidon is worth much more than its carrying value of $1.78b. Just another example of Fairfax's book value being understated. Fairfax knows this - and this likely explains why they continue to buy back a significant amount of Fairfax shares at a premium to book value. Investors are likely underestimating how much 'hidden value' actually exists on Fairfax's balance sheet today.

-

Interesting. With the former rapid new-build growth phase coming to an end I was wondering what the next act was for Atlas/Sokol. But given the size of the company today, 27 new builds is not a crazy big number, especially looking out a few years. The delivery dates are out a fair bit at 2027 and 2028. Chug, chug, chug... It will be interesting to see where interest rates go from here. If they continue lower Atlas could be a beneficiary - they may be able to secure some reasonable long term rates.

-

@73 Reds I completely missed the big money when looking at Berkshire Hathaway over the years. Why? Largely because of what you so eloquently posted above - “yet-to-be-had ideas and acquisitions.” I way underestimated the P/C insurance model and the value that Buffett would generate over time from Berkshire Hathaway’s earnings and the power of compounding. I am trying to not make the same mistake a second time - this time with Fairfax. And that is another one of the things that i love about investing - the ability to apply lessons from the past to the present.

-

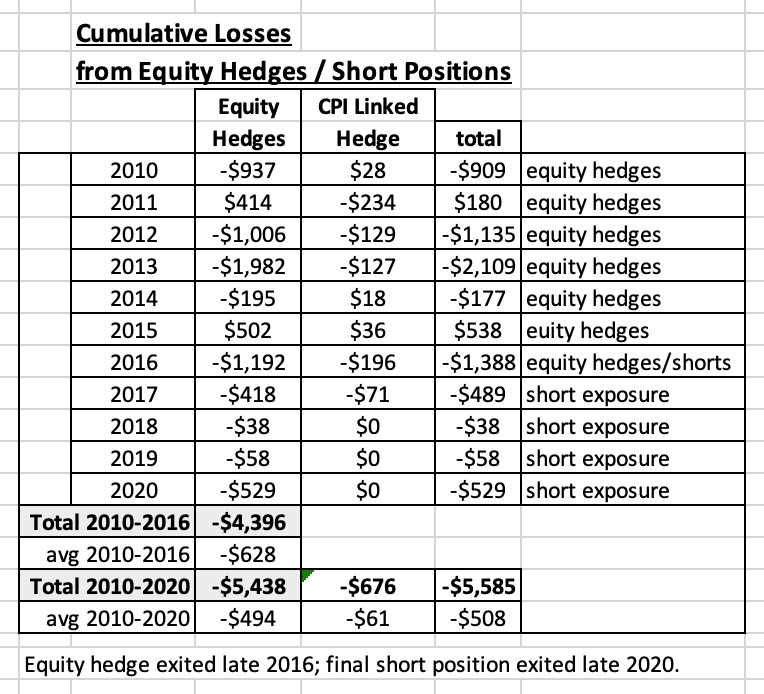

When I evaluate Fairfax's investment decisions, my watch out is an 'equity hedge/short' type decision. Something really big. From 2010 to 2020, Fairfax's equity hedge/short positions cost the company a total of $5.4 billion in losses = an average of $494 million per year. The equity hedge position was removed in late 2016. This position was the big issue. From 2010 to 2016, the equity hedge/short positions cost Fairfax a total of $4.4 billion in losses = $628 million per year. The last short position was removed in late 2020. From 2017-2020, the short positions cost Fairfax a total of $1.04 billion = $261 million per year. Exiting the equity hedge position in 2016 was a massive win for shareholders. Exiting the last short position in late 2020 was a big win for shareholders. The bottom line, at the start of 2021, the chains of the equity hedge/short positions had been completely removed from the company. It was like a $494 million annual expense that the company paid from 2010 to 2020 had been removed and Fairfax became $494 million 'more profitable' every year moving forward. The crazy thing is this 'investment' only stunted Fairfax's growth from 2010 to 2020. It really was amazing what Fairfax was able to still accomplish from 2010 to 2020 - especially the significant build out of their P/C insurance business. (The many shitty equity holdings on the books at the time was another headwind - making Fairfax's performance even more impressive.) What this shows is the incredible earnings power that exists within Fairfax - that P/C insurance (float) + active management of the investment portfolio (equities etc). Of course, 2010 to 2020 was a lost decade for Fairfax shareholders. So I am not trying to sugar coat what happened when it comes to the share price. No equity hedge/short positions. The equity portfolio has been cleaned up. The future looks bright - I can't wait to see what the Fairfax team can deliver in the coming years. What does it mean for today? Sleep Country has been a hot topic among board members - I sense lots of angst. To be honest, I don't understand all the angst. 1.) The management team at Fairfax has been executing exceptionally well since 2018. This is a long enough time for me - they have re-earned a certain amount of trust. 2.) We have no visibility into why they bought Sleep Country. There likely were many factors involved (P/C insurance capital levels, taxes, strategic fit within investment portfolio, strategic fit within total company, valuation, future prospects etc) - and we are largely in the dark. And no, I do not expect the management team at Fairfax to have to 'justify' every decision they make to investors. 3.) Sleep Country is a small purchase. It represents about 2% of Fairfax's investment portfolio and 6% of its equity portfolio. 4.) Sleep Country looks to be well managed. It is a strong franchise (in Canada - and I know this is hard for those outside of Canada to understand). It is profitable. The issue is some don't think it will earn enough (to justify the purchase price). Today, do I love the Sleep Country purchase? No. But do I dislike it? No. The bottom line, it is a non-issue for me - if Fairfax thinks this is a good decision, given their track record since 2018, I am ok with it. Done. Obesssing about small potatoes (Sleep Country) runs the risk of me losing sight of the bigger picture of why I am invested in Fairfax - I try and be careful about what (and how much) I let into my head. My watch out for Fairfax and their investments is an equity/hedge short type of decision that I don't like. Something that costs them +$500 million per year - for years. That WILL get my attention. The power of Fairfax's business model today is VERY IMPRESSIVE. Given the level of earnings, they are going to be making lots of billion dollar decisions in the coming years. They are going on the offensive. I can't wait. And I am going to try and be open minded when we learn what they are doing...

-

@73 Reds thanks for the feedback. I am going to dig into the 'company specific' part of your comment with my next post. My guess is lots of Fairfax's current shareholders are still seeing the ghosts of Fairfax's past. This will lead them to manufacture 'company-specific' issues that don't actually exist (and lead them to sell their position). This is one of the reasons why I expect Fairfax shares to be more volatile going forward (particularly to the downside). And as I said, that will likely provide Fairfax with a wonderful opportunity to take out a meaningful amount of shares in the coming years. "know what you own" - bingo! That is the key that unlocks the treasure chest.

-

Financial Market Volatility - is it good or bad for Fairfax? (And no, this is not a trick question.) “Everyone has a plan until they get punched in the mouth.” Mike Tyson After a long absence, volatility in financial markets is picking up. The next bear market in stocks is coming - we just don’t know when or how nasty it will be. A big chunk of Fairfax’s investment portfolio is in equities (25% to 30%). Therefore, extreme volatility has to be bad for Fairfax… right? Well, maybe not. In this post we will dig into the volatility thing to see what we can learn. We will look at volatility in two very different ways: 1.) Fairfax’s ability to profit from volatility. 2.) The impact of volatility on Fairfax’s short term reported results. Given the importance of the topic, we are going to break our analysis into two posts. Part 2 should be published in the next couple of days (I have some family in town so it might be delayed). ————— Volatility - Part 1: Fairfax’s ability to profit from volatility Introduction Is extreme volatility in financial markets good or bad for a Fairfax investor? Active management matters again How has Fairfax performed aver the past 4.5 years? Volatility - Part 2: The impact of volatility on Fairfax’s short term reported results. 'New Fairfax' To come in the next couple of days. ————— Introduction Wall Street defines risk in terms of volatility - the higher the volatility, the greater the risk. Warren Buffett thinks how Wall Street looks at risk/volatility is nuts. Buffett defines risk very differently - he defines it in terms of permanent loss of capital. Importantly, Buffett’s definition is also largely focussed on the long term. Buffett looks at volatility through the lens of Mr. Market - he views volatility over the short term as opportunity. Volatility is something to be exploited by an investor. And extreme volatility? Well, that is usually where you find the really fat pitches (that ‘back up the truck’ thing). Fairfax and volatility If history can be used as a guide, long term shareholders of Fairfax should be praying for a shitstorm in the coming months (in the markets in general) and for the company’s stock to get taken out behind the woodshed. Volatility in Fairfax's stock price (in both directions) has historically been a gift for long term investors. Now don’t get wrong… I loved the relentless move higher in the share price that we have seen since October 2022, when the stock was trading at $450. We saw an increase of +150% in 22 months. Fairfax’s stock was like a goat climbing straight up a steep mountain. But investing isn’t a Disney movie. Nothing goes straight up forever. Given its dramatic move higher, Fairfax will likely trade more like a regular stock moving forward. And the average stock fluctuates about 50% (lows to highs) over the course of a year. As of today (August 7, 2024), Fairfax’s stock is down about 11% over the past week or so. ‘Investors’ are trying to read the animal entrails to determine what is going on (what is causing the short term volatility). Me? I have no idea what is causing the sell off. But I love it. Why? That is what we will explore in this post. ————— Is extreme volatility in financial markets good or bad for a Fairfax investor? Now this is a great question. With lots of interesting layers. How you answer this question really depends on your time frame: Are you a short term or a long term investor in Fairfax? For example, if Fairfax’s stock dropped 20% - well, that would likely be a terrible result for a short term trader(note I did not say investor). Who wants to own a stock as a short term investment that drops 20%? No one. But is a 20% drop in Fairfax’s share price bad for a long term investor? No, I don’t think it is. But more than that, given the current set-up, I think it would likely end up being a very good thing for a long term investor. Why? Because Fairfax would be able to take out a meaningful number of shares at a very low price. Today Fairfax is generating a record amount of free cash flow. And as the hard market in P/C insurance slows, the P/C insurance subsidiaries are generating excess cash - and they are now sending it to Fairfax (as growth in P/C insurance is slowing). Fairfax is all cashed up. And this look like the case for the next 3 years or so (3 years is as far out as our crystal ball can see). What will Fairfax be doing with all that cash? On the Q2, 2024 conference call Fairfax provided an update on their capital allocation priorities: Priority #1 - maintain a strong financial position. Priority #2 - buying back a meaningful amount of stock (that Henry Singleton thing we wrote about last week). Priority #2 used to be funding the growth of the P/C insurance companies (this has been the case since late 2019). With the hard market slowing this is no longer the case. This is a big change in priorities. So far in 2024, Fairfax has reduced effective shares outstanding by 820,000 (3.5%) at an average price of US$1,098/share. Fairfax are value investors. As a result, they only buys back shares when they can be purchased at a discount to their intrinsic value. So Fairfax thinks its shares trading at $1,100 are cheap. Fairfax’s stock closed today at $1,050. It is down 11% over the past week (after hitting an all-time high of $1,178 on July 31, 2024). If it continues to fall from here, Fairfax will get a wonderful opportunity to take out a meaningful number of shares at a very low price. Buying back a meaningful quantity of shares on the cheap is a great ‘use of capital’ for long term shareholders. When it comes to share buybacks, the lower Fairfax’s share price goes the better. The timing of buybacks Does this mean Fairfax is going to buy back a massive amount of shares in Q3, 2024? No, of course not. They might. And they might not. It is impossible to predict how many share Fairfax will repurchase in any given quarter. Fairfax has lots of good uses for its free cash flow. But i think it is a good bet that if Fairfax’s shares remain at a very low valuation that Fairfax will buy back a meaningful quantity over the next 12 to 24 months. Of course, this assumes the long term fundamentals of Fairfax’s business are not deteriorating. And I don’t think they are. But there is much more to this story - it gets even better. —————— Active management matters again When it comes to capital allocation, Fairfax is an ‘active manager.’ And they use all the tools in the capital allocation toolkit (sources and uses of cash). As we learned from Warren Buffett, fat pitches usually come at times of extreme volatility. Over the past 4 years we have had 2 bear markets in stocks (2020 and 2022) and an epic bear market in fixed income (2022/2023). How did Fairfax perform over the past 4.5 years - when Mr. Market was panicking? Fairfax made many of their best investments in ‘shit storm’ type of environments: In 2020, initiated the TRS position (getting exposure to 1.96 million Fairfax shares) at $373/share). In 2021, took the average duration of their fixed income portfolio to 1.2 years. In 2021, bought back 2 million Fairfax shares at $500/share. In 2022, took Recipe private at a very attractive price. In 2023, invested $4 billion (with Kennedy Wilson) in PacWest real estate loans (with a total return of about 10%). In 2023, extended the average duration of their fixed income portfolio to about 3 years. Fairfax also made many smaller moves from 2020 to 2022, taking advantage of very low prices, to increase their ownership in well run companies they already owned (including Fairfax India, Thomas Cook India and John Keells). The bottom line, over the past 4.5 years Fairfax has been able to exploit periods of extreme volatility, making many outstanding investments that have generated wonderful returns for Fairfax and its shareholders over time. Importantly, Fairfax was able to do this when they were cash poor. That is no longer the case. Fairfax is currently generating a record amount of free cash flow - and this looks set to continue for the next 3 years (as far out as my crystal ball looks). Now when the stock market sells off 20% it generally doesn’t feel great. And we will not know in advance with certainty what moves Fairfax will be making. But if history is any guide, extreme volatility in financial markets will likely provide Fairfax with many wonderful opportunities that they can aggressively exploit. As I said earlier, long term Fairfax shareholders should welcome extreme volatility and the opportunities it presents to Fairfax - this is often when Fairfax makes its best investments. ————— How has Fairfax performed aver the past 4.5 years? We can evaluate management by looking at a simple, yet highly instructive, metric: increase in book value per share. Change in book value per share (BVPS) As a reminder, we had bear markets in stocks in 2020 and 2022 and a historic bear market in bonds is 2022/23. This should have been terrible for Fairfax shareholders... right? This is Fairfax after all... Despite the extreme volatility in financial markets over the past 4.5 years, Fairfax was able to increase BVPS by 103%. Impressively, the volatility was heavily skewed to the upside (the biggest annual decrease in BVPS was only 2%, in 2020). Given the volatility in financial markets over the past 4.5 years, are these the annual or total results you would have expected for Fairfax? No, of course not. Fairfax’s performance over the past 4.5 years was much, much better than expected. I think there is an important lesson to be learned from this - extreme volatility is not the devil that many Fairfax watchers think it is. Change in share price In 2020, Fairfax’s share price was down 28%. This was what I like to call ‘old Fairfax.’ Fairfax had just started executing its turnaround but it was not yet recognized by Mr. Market. Sentiment in Fairfax hit rock bottom in 2020. But look at what happened to Fairfax in 2021, 2022, 2023 and so far in 2024. Fairfax’s absolute and relative performance has been outstanding (putting it lightly). The management team at Fairfax has been executing exceptionally well - among other things, they have been feasting on extreme volatility in financial markets. And this strong performance is being rewarded by Mr. Market. ----------- Part 2: The impact of volatility on Fairfax’s short term reported results To come in the next couple of days...