Viking

-

Posts

4,702 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

It is great to see so many board members doing so well with their investments. Well done! The other super interesting take away is how different each of the many strategies have been. Holy shit. And i love it.

i (my family) have been living solely off our investments since i was 40 (since about 2006). I walked away from my senior management job at Saputo. My wife and i and our three kids under 6 moved back to our home town in rural BC. I needed to recharge may batteries and we wanted the kids to get to know grandparents and the rest of the family better. We didn’t have enough to retire but we had enough to pay cash for a beautiful house, no debts and enough in the bank to last a few years. My plan was to take couple of years off and then figure out what my next day job would be. I always have managed our investments and done reasonably well. But being able to focus on investing full time resulted in returns that greatly exceeded our expenses (which were about C$45,000/year… not an lie - and we lived a great life). By 2010 we had a big enough nest egg we were able to move back to Vancouver and live the same lifestyle (and we realized rural BC was a great place to raise young kids but Vancouver was likely a better place to raise teenagers). For about 10 years our investment gains roughly equalled our expenses (which had ballooned to about $120,000/year). But we owned a house in Vancouver (we had a small mortgage) so we had won the real estate lottery. Last year we sold our house. 2021 was also the best year for our investment portfolio (+60%). Bottom line, my wife and i can now officially say we are retired

Keys: i never viewed myself as ‘retired’. I never put pressure on myself to earn a big return (my target has ALWAYS been 6 or 8% per year). I always expected i would likely need to get a real job one day (i.e. my investments could run out). Investing has always been a blue job - not a pink job (my wife’s jobs) - and definitely not a purple job (what a disaster that would have been). Bottom line, my wife completely stays out of my gig and she likes that arrangement (she actually gets super stressed if i talk to her about what i am doing). Before we sold our house, all of our investments were in tax free accounts (LIRA’s, RRSP’’s, TFSA’s, RESP); not having to think about taxes was a big, big tailwind for returns. I also am happy to trade in a pretty narrow range of stocks - companies i have followed over the past 20 or so years (i keep adding a few new ones every year).How did you do it? My investment returns > my expenses (and by a lot some years). We also won the real estate lottery.

I have never traded any derivatives. The closest i got was then Ericopoly was explaining what he was doing with Fairfax when they were sitting on all their CDS gains in 2007 or 2008. He made millions (i think). I still hit a home run holding only Fairfax shares and a very concentrated position. I also have never bought a stock for a dividend yield… i only look at total return.

Do you have a part-time gig that tops it up while waiting for investments to mature? No

Do you go for some bold risk taking and make a fortune on some security each year? When i see a low risk high return opportunity i like to concentrate. I probably make one or perhaps two very big bet every year or two. And watch it like a hawk (i know, my posting on one topic likely drives some people nuts at times). My big bets often carry over for more than one year. As an example: in 2013 i was 100% Apple. We went on a family vacation to Hawaii and right before we left i put the last of our savings into Apple. Getting that concentrated did weigh on my mind; however, my conviction/logic won out. The investment ended up being one of my best ever. Go check out Apple June/July 2013 and you probably will find a bunch of posts from me

Seems to me if you make some mistakes or the equity does not compound fast enough your withdrawal rate has to be very small in the first decade or two of this activity? ‘Don’t lose what you got’ has been a key part of my investment decision making process for 20 years. I am quick to move to cash when i don’t like risk/reward situation. It works for me. Not having to think about taxes is a big benefit.

-

1 hour ago, Parsad said:

I don't consider FFH as cheap as Viking does presently. When I first started loading up, it was at 0.6 times book...and I kept buying till about 0.75 times book. I have not added since. But it made up about 60% of the portfolio at that point...now at about 30%.

Assuming FFH has risen back up to its Q1 book value of $630 USD after being down in Q2, that would give it a price to book of 0.85-0.87 or so. It's undervalued, but not dirt cheap. I personally like a larger margin of safety.

Now is it cheaper than many other stocks in the market? Maybe not significantly cheaper, but the upside looks as good if not better.

Cheers!

@Parsad I am bullish on Fairfax today primarily because i see its near term earnings power increasing quite a bit.I think price to BV is a useful rough guide to use to value an insurance stock - it is one measure. But even Buffett says price to BV is not a great way to value BRK today given its evolution and many assets worth far more than what is captured in BV (and future earnings power of the various businesses). I think Fairfax is now of a size and age that using BV is getting less useful.

Most importantly, BV can under-value legacy assets that are growing nicely over many years. Fairfax has a bunch of these. BV is also a rear view mirror measure - it reflects past results. Looking primarily at BV (to value a company) in ‘turnaround’ situations (which is how i view Fairfax today), where earnings are set to increase like a coiled spring, i think way undervalues the company. .

1.) The pet insurance sale for $1.4 billion, and a $950 million after tax gain. Where was that asset captured in BV pre sale announcement? It wasn’t. Historical cost was. And the earnings over the years. But BV messed up big time reflecting intrinsic value of the pet insurance business. Of course post sale things get trued up and BV now does reflect the value of the pet insurance business. Poof, like magic, BV will be $40 higher.

2.) Fairfax is growing its net written premiums by 20% and growth has been strong for 3 years. At the same time underwriting has been improving (CR has been coming down). That means Fairfax is now delivering record underwriting income. 2023 should be even better. Where is that reflected in BV? An investor should give Fairfax a higher price to BV multiple (if future earnings are expected to be higher).

3.) future interest income. Will also be in record territory shortly.

4.) future share of profit of associates: will be in record territory shortly (if it is not there already)

Some have commented that they think Fairfax might be cheaper today than when it was trading at US$260 in Oct 2020. From a BV perspective that is clearly not true. However, when you do the valuation in terms of future earnings power of the various businesses (growth in Digit and possible IPO etc) i think the valuation today is likely pretty close to that of Oct 2020. Very cheap and possibly crazy cheap, i would say

-

29 minutes ago, SafetyinNumbers said:

I rather FFH owns ATCO forever and earn a 10-15% CAGR rather than having to find something else that does the same thing. I imagine, ATCO wouldn't be a favored counterparty for other shippers if ONE owned all of it.

For other shippers, especially those from the other alliances (the alliances ONE is not part of), i just wonder how ONE owning 30 or 35% of Altas is all that different from ONE owning 100%? My guess is this deal makes the other shippers nervous and likely to want to do business elsewhere - which is not good for Seaspan and their future growth prospects. It appears a recent sale of a vessel did not go through for Seaspan… perhaps another shipper got wind of this deal and walked away? I am speculating (big time) but i have seen no discussion/analysis of ONE and this deal and that is surprising to me as ONE is the elephant in the room.

Regarding Fairfax, i am impatient and i like to keep things simple. An Atlas sale at +$20 would likely allow Fairfax to greatly simplify their structure and build a more fortress like balance sheet:

1.) buy out any remaining minority shareholders - eliminate those dividend payments

2.) right size total debt - if needed

-

2 minutes ago, SafetyinNumbers said:

To be fair, there isn't any deal to vote on yet. The consortium made an opening proposal that might be too low for most shareholders. Let's see what the special committee bankers comes back with and if they are able to negotiate a price that they feel comfortable recommending to shareholders.

Why is ONE not buying all of Atlas? ONE already accounts for 24% of Seaspan’s business (its largest customer). ONE earned something like $6 billion in the last quarter so they can afford to buy whole company.

Perhaps step 1 is get Atlas private. And step 2 in a year of two is to take out Fairfax at a nice premium (+$20/share). A Fairfax shareholder can dream…

-

1 hour ago, Xerxes said:

The reality is Prem is not sharing the canvas he has in mind. It all makes sense to him and his team, I am sure, but no narrative is being communicated to the shareholder base.

At a certain price you get the deep value guys in, that is all fine and well. But at a certain point to bring the long term buy-and-hold you need to build and clearly communicate a narrative.

even in the shareholder letters you are being dragged into the rabbit hole of some back story, which while fine and educational does not tell the would be buy-and-hold crowd where that canvas is going.

Contrast that to Markel simplicity when it comes to communication to shareholders. For clarity we are not talking the merit of one capital allocator to another. But the effectiveness of their communication.

That being said, looks like Greg is jumping in with both feet !!! (Or soon)

@Xerxes i am thinking along slightly different lines. I am not trying to be adversarial… i just like taking the other side of the argument. Because this is important stuff to debate.i think Prem actually communicates too much. He says too much. So the important, core message gets lost. I find he has been getting better of late.

I think Fairfax’s basic business model is pretty straight forward and is understood by most sophisticated investors: underwriting profit + Interest and dividend income + (lumpy) investment gains. They are done building out their global insurance platform so future acquisitions will be tuck in’s (like the recent Singapore Re purchase). Future cash flows will be directed at:

1.) supporting subs in hard market (nearing the end of this use)

2.) buying out minority partners: Allied World, Brit and Odyssey Re.- i.e. the Eurolife acquisition last year and the recent Allied World announcement

3.) share buybacks

- i.e. December 2021

Now Fairfax is not Berkshire or Markel. The types of businesses it invests in are often very different. And to state the obvious, even Berkshire’s stock often trades at large discounts over time. If investors don’t understand Buffett and Berkshire they certainly will not be able to understand Fairfax. Just look at the trouble most investors have when trying to explain their valuation of Berkshire… it often looks like a hot mess (so many different ways, none of which really get the job done in a neat and tidy fashion). What drives Berkshire stock is trust in Warren Buffett. And people trust Buffett because of his exceptional long term performance (yes, it has been slowing in recent years… but it is still good enough).

Fairfax’s core issue, in my humble opinion, is performance. It has sucked for the past decade. Why would Fairfax have any long term shareholders today? I do think Fairfax today is a very misunderstood animal. The core issue causing the dreadful performance has been fixed - they are no longer shorting so the last $500? million loss was taken in 2020 when they closed out the last short position. The second big issue causing underperformance (very poor equity selection) has also largely been fixed since 2018 or so. Covid then threw sand in the gears for a year or so (hitting insurance results primarily at Brit, dropping interest income through the floor - interest rates at zero - and hammering equity positions all at the same time).

Today we have an insurance business growing +20% (and has been for years) with improving underwriting results (falling CR). Spiking bond yields are spiking interest income. And the equity holdings have, for the most part, bounced back strongly. Runoff and pet insurance businesses were sold bringing in +$2 billion. Lots of equity positions have been sold. The future for Fairfax has never looked better. This has all been communicated by Fairfax to shareholders. But investors are not drinking the Kool-Aid. Yet.

As Fairfax delivers improving results i think investors will get interested again. Fairfax has been delivering for 7 quarters but clearly investors want to see further proof of improvement. And if Fairfax can string together 4 or 5 years in a row of solid results then i think long term shareholders will return.

-

4 hours ago, LC said:

My approach to Fairfax and Berkshire are slight different. Berkshire I generally only accumulate when it gets cheap, but I rarely sell. I should've sold at 360 but I'm OK not selling and holding that for a while, probably because I'm an idiot. Fairfax on the other hand I will trade in and out of.

@LC you are exactly right. The best strategy for investors in Fairfax since 2014 has been to trade in and out of the stock. That is what i have been doing since 2019 and it has worked our very well.

However, i think the better strategy for investors moving forward is likely to be to buy and hold - at least a larger core position. Of course we will continue to get lots of volatility as it is Fairfax we are talking about. But investors who sell (expecting to buy back in at a lower price) might find the stock runs away from them and keeps on going higher.

I do expect the stock to break out of its 8 year trading range (a little above or a lot below US$500). And the breakout might be meaningful (i.e. to US$650 or even $700 by end of 2023. And then US$100/share higher every year for a few years after. Fairfax stock trading over US $1000 a share looking 4 years out is not a crazy number from my perspective.

Why? Underwriting income + int & div income + share of profit of associates + investment gains + monetizing more assets. I think investors are going to be surprised how much Fairfax earns in the coming years - and how much cash comes in. And how much lower Fairfax’s share count goes. A higher multiple from Mr Market and… bingo… US$1,000/share.

-

5 hours ago, Gregmal said:

Again, yes, and again. there was plenty of other stuff to buy that did just as well if not better, especially on IRR perspective.

What Im looking at here is why FFH has so quickly again fallen out of favor. For a good while it was clearly working. Instead of going to cash you could have bought into the tender ever, and had ample opportunity to sell at high prices and at significant premium to what an index or cash would have provided. My post was trolling for sure, but the objective not really to agitate anything other than some qualitative assessment. Ive gotten really close to getting back in, but first want to see if I have a handle on the jigsaw puzzle that is Mr. Markets relationship with FFH. History has shown that when it works, it works, and when it doesnt...youre probably even better off being in cash.

I really have no idea why Fairfax’s stock trades the way if does. Current sell off might be driven by:1.) disappointment over Q2 results (significant fall in equity holdings)

2.) $750 million debt offering with no information as to how much Allied World will be bought back and at what price

3.) Recipe take private: another example of Fairfax doubling down in a big way on a terribly performing long term legacy holding?

4.) peak hurricane season?

—————

What will get the stock moving?

1.) pet insurance close: will result in a $950 million after tax gain = $40/share increase in BV.

2.) Allied World details: clarity on Allied World purchase of minority shareholders. Are they buying it all back? Or just part of it? How much? Pet insurance likely needs to close before they can announce anything. But given they just did the debt offering my guess is the pet insurance sale is close.

3.) Stelco dutch auction which closes Aug 31: Fairfax would receive C$455 million if they tender their shares. My math says they will need to come up with C$475 million to take Recipe private. If i was Fairfax i would make this trade in a heartbeat. Recipe should be able to deliver a pretty steady stream of C$125 million/year in free cash flow to Fairfax in perpetuity… i would sell a cyclical business cheap to buy what should be a predictable cash cow even cheaper.

4.) another big Fairfax stock buyback: if Fairfax tenders its Stelco shares (to pay for Recipe) then i think that puts another big stock buyback of Fairfax shares back on the table for later this year. Fairfax is earning about $500 million a quarter in operating income. That is $1 billion in 2H. Of course, we need to get through hurricane season first.- A reminder: Fairfax still has exposure to 1.96 million Fairfax shares via the TRS. Fairfax is HIGHLY motivated to get the share price higher. So i think it is highly likely we get another very large dutch auction type buyback in 2H. Or Fairfax starts to max out the NCIB.

5.) Fairfax: when does Prem pull the next rabbit out of Fairfax’s hat? Fairfax is sitting on lots of valuable ‘hidden’ assets. More will be monetized and at surprisingly high prices. Like the recent pet insurance deal. We just don’t know when Fairfax will pull the trigger.

We are just entering the fun stage of owning Fairfax shares. It has been years and years in the making.

—————

Digit IPO: Looking a little further out it is looking more and more like this will happen. My guess is perhaps 1H 2023 (but it could be 2H 2022). If Digit completes its IPO and at a valuation at or higher than where it is currently carried on books at Fairfax then i think this will be a big catalyst for Fairfax shares.

-

49 minutes ago, glider3834 said:

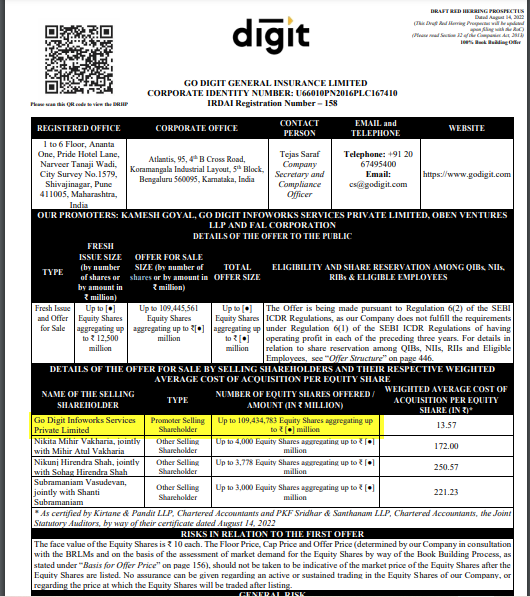

Here is the Digit IPO Draft Prospectus lodged today

https://www.axiscapital.co.in/uploads/equity_documents/dhrp/go-digit-general-insurance-limited.pdf

In Apr-22, Go Digit Infoworks (through which Fairfax owns its stake) had approx 729 mil shares out of total of 838 mil shares in Digit. The draft prospectus has Go Digit Infoworks proposing to sell up 109 mil shares. (These amounts could change - its just a draft!)

https://www.reuters.com/markets/deals/fairfax-backed-digit-insurance-files-draft-papers-india-ipo-

@glider3834 great news and thanks for posting. This has the potential to be a big, big win for Fairfax. However, given how slow things move in India i have low expectations as to how quickly the IPO will receive approvals. Also importantly, the CEO has said they will wait for the right time to execute the IPO (once it is approved). Given the current state of financial markets it might be best to execute the IPO in 2023 when, hopefully, EM financial markets are more settled. I am trying to keep my expectations in check. The silver lining with any delays is Digit will continue to grow its business over time and increase the value of the company even more. -

2 hours ago, Gregmal said:

Not long ago there was a thread about Berkshire and some claimed it wasn’t cheap enough at 265 but FFH was definitely worth owning. Any updates thoughts?

i don’t think i was commenting on that thread (maybe i was?)… but the short time BRK traded at $265 i think Fairfax was trading around US$485 (June). So since then Fairfax is up about 6% and BRK is up about 14%. So if you had bought BRK at its absolute low of $265 in June instead of Fairfax you would have done better.

Now a discussion I was part of was pounding the table to buy Fairfax in late Oct 2020. To be fair, lets not pick Fairfax’s low… lets go with a price of US$280. A buy and hold investor would have earned an 85% return to today.

A BRK investor? From a cost of about $210 the return would have been about 44% to today. Good. A little more than 1/2 the return delivered by Fairfax.

What an investor really wants to know (who is all cashed up) is which company is the better buy on Wed Aug 17? From current prices, and looking out a year or two my guess is Fairfax continues to outperform BRK and by a wide margin. Now is it more fun following Warren than Prem? Yes, most times it is. Fairfax is definitely a more hairy type of investment.

-

1 hour ago, Parsad said:

Hi Viking,

I agree. That's why I said those picks are more in line with Wade/Lawrence and relatable to the way Tom Gaynor invests MKL's portfolio. That's probably better for Fairfax and Fairfax shareholders long-term.

Unfortunately, it's hard to teach old dogs new tricks, and the bulk of the portfolio will be managed the "old" Fairfax way as long as the "old" dogs control the votes. Not a bad thing, just more volatile.

Cheers!

@Parsad I think ‘old Fairfax’ has also changed. Compare the RIM/Blackberry purchase to Seaspan/Atlas. RIM/Blackberry was a technology play (Fairfax clearly had no idea) and was badly run by founders (who, yes, were brilliant creators). Seaspan was a finance company (something any good insurer should be able to understand) run by a new all star team with a very good track record (headed up by Sokol). As things got worse at Blackberry, Fairfax doubled down and spent more. As things got better at Atlas, Fairfax spent more. There is no comparing the two other than they were both the largest investments for Fairfax of their day.

The other billion $ investment Fairfax has made recently (in terms of exposure) was the TRS giving Fairfax exposure to 1.96 million Fairfax shares when they were trading wicked cheap. Did Fairfax understand… Fairfax? Yup. Low risk. Very high return potential. Creative. Opportunistic. Ballsy. Maybe old dogs can learn new tricks…

So i think ‘old Fairfax’ is also doing some important things differently. And i love it.

—————Now before everyone thinks i am a complete Fairfax fanboy (probably too late) there are things i do not like. Looking from the outside, i wish they would move on from problems quicker. The fact they still own Blackberry? (Sorry if i caused anyone to vomit). Farmers Edge just got a $75 million loan earlier this year (ignore that thing i said earlier about legacy holdings not suckling on Fairfax’s hind teat anymore). The Recipe take private is a watch-out for me (given its size) - but i think it is the minority shareholders who poured money into the company the past 10 years who are the actual losers - Fairfax is getting a decent collection of assets at a rock bottom price (so hopefully limited downside).

My view is Fairfax is now hitting on way more of their investment decisions than pre-2018. So i can cut them some slack on the misses. Or some of the legacy position they want to keep around. Resolute Forest Products was a massive win for shareholders in that regard.

-

19 minutes ago, Parsad said:

Yeah, I would agree with that. The (2)'s are probably Wade and Lawrence/team picks...similar to positions that Tom Gaynor/team at MKL would pick. The (1)'s are probably more Prem/Brian/committee specific...big positions...Wade and Lawrence are involved, but hold two of the six/seven votes of the committee. Cheers!

How much money did Wade/Lawrence manage 5 years ago? How much are they managing today? My guess is they are managing significantly more money today - perhaps $1 billion more. Because they are delivering great long term results. They are investing largely in US large caps (look at the portfolio they have been building out the past few years). That is not ‘same old Fairfax’.

Old Fairfax was buying Reitmans. And Torstar. And APR. And AGT. And Exco (2016 version). And Farmers Edge. And Mosaic Capital. And launching Fairfax Africa. And just about any Canadian Restaurant chain available for sale (Fairfax was largely bankrolling Recipe’s rapid expansion).

-

1 hour ago, Xerxes said:

That is very far-fetched Viking.

Fairfax's equity portfolio has two buckets: (1) the big longs and (2) the rest of portfolio

The (2) portion broadly follows the market, are trading positions and are really not Prem specific. I dont think he even manages those. The bulk of weight is in the (1) bucket, and those are #neversell like deep value or quasi deep value names.

I am personally am in Fairfax for its (1), and like it the way it is, and could not care less about (2).

@Xerxes my thesis is Fairfax, starting about 5 years ago, has been making much better decisions with its portfolio of equity holdings. My view is that something actually changed at Fairfax around this time (2017-2018). There was a recognition of past failures (that stop digging thing) and a come to Jesus type of recognition that Fairfax/Hamblin Watsa was not a turnaround shop. Each turnaround usually involved a significant financial cost to Fairfax (sometimes running into the hundreds of millions) and required significant time from the small senior team at Fairfax/Hamblin Watsa. Fairfax simply did not have the resources or the expertise to do this on a large scale. But that was the hole Fairfax was standing in at the time. Change was needed. And, i think, changes were made in how Fairfax selected equity buys and how it managed the group of equities it owned/controlled. (A similar pivot on the insurance side might have happened in 2010 when Andy Bernard was promoted from running Odyssey Re to VP in charge of all of Fairfax’s insurance operations.)So Since 2018 or so we have seen what i like to call the ‘new Fairfax’:

1.) new equity purchases are higher quality and better risk/reward. Quality of management team is weighted much higher than past years (perhaps now at the top of the lost of criteria). Avoiding high risk of failure type investments is another.

2.) legacy holdings were looked at with a fresh set of eyes. Fairfax correctly concluded that there were serious problems with lots of the legacy holdings and set to work fixing them. Some were merged with other organizations (replacing management with a better team). Some were restructured.

3.) Legacy equity holdings were told the bank of Fairfax was closed. Over were the days were poorly run companies could keep going to Fairfax for a costly bail out. Or for funds to grow. Holdings were told to get their financial house in order (including debt levels) and get profitable (that was how they could fund their future growth).

4.) significantly more funds were given to Wade Burton/Lawrence Chin and their team - because of their very good performance5.) significantly more funds were given to private equity partners (BDT Capital Partners, ShawKwei & Partners etc) - because of their very good performance

So we now have a Fairfax where a performance culture is becoming entrenched on the equity side of the business. Fairfax is feeding/rewarding the top performers. New capital is getting allocated to the best opportunities. Year after year.

But shareholders are yelling (and have been for years): SHOW ME THE MONEY. When will we see the improvements from ‘new Fairfax’ actually hit reported results? Covid, unfortunately, set things back about a year. But I think we are ‘there’ today. And have been ‘there’ for about at least a year now.

—————My view is Fairfax is largely done with the fixes so the significant hit to results year after year from this issue is largely done. There will always be some restructuring charges happening at a company the size of Fairfax - with the collection of businesses they own - but the number and amounts involved will be easily digested moving forward.

For new equity purchases it usually takes about 4-5 years for an equity holding to blossom (or not). Of course, this is highly variable. If i am right then moving forward we should see performance from Fairfax’s equity holding slowly improve. Some will be harvested. Others will continue to grow in value on Fairfax’s balance sheet.

We could very well see all three legs of the Fairfax stool perform very well all at the same time: underwriting + interest & dividend income + investment portfolio. Trading today at $515/share, Fairfax is not priced for that outcome.

—————

In the past too much new capital went to fix problems at legacy holdings (bail outs). $500 million (on average) for 8 or 9 years was also burned up due to the disastrous short macro bet. For many years Fairfax was burning up $700-$800 million each year. That is a big hole to dig out of. And the opportunity cost (loss of future compounding of that $700-$800 million) was what caused Fairfax results to grossly underperform for almost a decade. The good news is the opposite is happening now - and has been for a few years. This bodes very well for future returns.

-

4 hours ago, glider3834 said:

@glider3834 thanks for posting. So what did we learn? Fairfax now has positions worth $200 million in 3 US companies that Buffett loves. Is this yet another example of Fairfax continuing to slowly upgrade the quality of its equity portfolio?

At current market prices here are the adds:

1.) new BAC $93 million

2.) new OXY $58 million

3.) add CVX $25 (total is $49)

4.) new INTC $22 million

5.) add BABA $$14 (total $27)

-

17 hours ago, glider3834 said:

@glider3834 Gulf Insurance Group is growing into quite a large player in MENA. The big AXA acquisition that closed last year is looking like a home run. Based on the link you provided, GIG is on track to earn around US$100 million in 2022. Fairfax owns a little over 40% of GIG so their share of earnings is about $40 million. Attach a 12 multiple and you get a value of $500 million (15 multiple = US$600 million) for Fairfax’s stake in GIG. A holding Fairfax has been cultivating for over a decade now. Another under-appreciated solid Fairfax investment. -

1 hour ago, Eng12345 said:

Viking - any idea on how many barrel per day delta from current market conditions we would need to be at to reach $150 oil?

@Eng12345 Great question. I am definitely not an expert on the oil market. So no, i do not have a precise or even good answer to your question. However, after doing a fair bit of reading on energy markets over the past 9 months my thesis is the oil market is exceptionally tight right now. So tight it will not take much to move oil prices in either direction.

Global demand is about 100 million barrels per day. Global supply seems to be about 99 or 99.5 million barrels (small deficit). The deficit is being made up from drawing about 1 million barrels from SPR (combined with other countries also tapping reserves). OPEC excess capacity appears very limited (Saudi Arabia and UAE) and what little is left will likely not be used (it will be held for a true emergency… and $100 is not an emergency).

So my view is the price of oil will be VERY volatile moving forward. Where the price goes from here will depend more than ever on short term events. My base case is oil averages something in the $90’s in 2H 2022. At this price oil companies will continue printing cash. I also think, given how tight the current market is, it would take very little to spike oil to $150. Of course oil companies would make insane money if that happened.

And i don’t think $150 oil is that high of a price. Oil traded over $100 for 5 or 6 straight years not that long ago. We managed just fine when that happened. House prices have doubled the past 5 or 6 years. Why not oil? Why is $200 such a crazy number (given the significant inflation we have seen in ALL other asset classes the past past decade).

The current demand/supply set up is also much more bullish for oil than when it last traded over $100 (we were still heavily investing in supply back then). Bottom line, i like the risk / reward set up. My time horizon is looking out 3-6 months. My oil positions are not long term holds. I have no desire to become an oil bug. I subscribe to @SharperDingaan ‘s view that you rent not own commodity holdings. That advice has served my very well over the past year (with steel, lumber and more recently oil).

—————

Demand

- how much will global oil demand continue to grow as countries exit covid?

- where does the Chinese economy and oil demand there go from here? Will the zero covid policy ever end?

- how much substitution of nat gas/coal to oil happens in Europe this fall?

Supply

- do we have an active hurricane season in Gulf of Mexico forcing oil wells offline?

- does US end SPR drawdown later in October as currently planned? That would cut 800,000 barrels from supply immediately.- what happens to Russian supply moving forward? I see the risk here to the downside (not a big decrease… but a slow decline over years).

- what does Putin want? In a tight oil market one large producer has a lot of leverage in the short term. And Russia is one of the largest producers.

- do we get a deal with Iran? Even if we do how much incremental oil will actually be added to global supply (versus oil already coming to market from Iran via the black market).

- how much new supply comes from US? What does new supply from shale look like? Have we seen peak production from shale (or are we close)?

- does Venezuela ever come back on line? This is likely a medium term opportunity (not a near term fix).

- Saudi Arabia / US relations: i also think Biden’s/the Democrats very public call out of the Saudi crown prince over the Khashoggi killing is a big deal. Saudi Arabia is NOT looking to do the US and favours right now when it comes to the price of oil.

- Western governments are doubling down on current energy policies (that are resulting in less investment in oil production).

- ESG is the new religion and is not going away (resulting in less investment in oil production).

- do we get a surprise? Does Libya go back off line? Or some other surprise no one is anticipating? Oil is produced in lots of countries with unstable political/economic situations. There is always a problem somewhere… that is why OPEC excess supply has been so important in the past to keep pricing stable in the oil market. As i said in a previous post… the shock absorbers have been removed… the ride is about to get a whole lot bumpier! -

19 hours ago, LC said:

Well dropping oil prices may bring down the dreaded “inflation” and which would give our federal banksters pause to continue raising rates…which would see equity/housing+consumer markets rise…could be a built in hedge but frankly the world never works so directly. So just something to keep in mind.

The current narrative is inflation is rolling over. A key driver of this theme is falling oil prices - and falling gas prices. So we are getting a nice rally in the stock market. The bond market (longer end of the curve ) is also rallying with the 10 year bond down to 2.8%. Inflation is licked! Sweet!Now how does the narrative change if oil goes to $150 a barrel at some point in the next 6-12 months? The problem with high inflation is just when you think you have it licked (it turns lower for a few months) something happens (like another commodity price spike due to a decade of underinvestment) that causes inflation to spike again. That was the frustrating experience of the 1970’s (inflation numbers came in for a decade like a never ending roller coaster ride at an amusement park). Just like that Groundhog Day movie. Except we are only at the beginning of the movie. Bill Murray is just now going to bed… and when he wakes up again (3-6 months from now) will we see inflation spiking again? Or will Bill get the girl after just one sleep? (Like Bill, the Fed would love to get this outcome.)

The Fed is in a bit of a pickle right now. Do they take their foot off the throat of the economy? Do they slow rate increases and wait and see what is going on with the economy? If they do this the stock market will continue to rally… and the rally could be epic (another 20% or more higher from here would not surprise me) which will loosen financial conditions… which will then lead to a stronger economy… that wealth effect thing. Which will then lead to higher inflation.

Big stock market rally + stronger economy = higher demand for commodities = rising inflation (act 2) = big, big problem for Fed. If the Fed pivots policy too early and inflation turns higher then Fed credibility will be shot. And Powell might need to start looking for a new job. I continue to believe that the Fed is the key variable in where the stock market averages go over the next 6 months. Do they stay hawkish or do they begin to pivot?

-

3 hours ago, petec said:

Viking, have you run a “normalised” scenario assuming long run underwriting at say 98% or 99%?

No i have not. Do you think this is likely? If you think it likely what is your normalized forecast for interest rates? My view is the two are tied together at the hip.

—————Past normalized underwriting at 98 or 99% is one of the key drivers of the current 3 year hard market. Low interests rates (leading to low investment returns) is another. Not making enough money on underwriting AND investment returns and you have profit falling off a cliff. And with the US 10 year treasury trading around 2.8% low investment return are likely here to stay. So underwriting will have to be sub 95 to keep profitability just ok.

Management teams at P&C insurance companies need to hit return targets to keep their jobs. Double digit ROE and double digit growth in BV/share. Investors need a decent return or insurance stocks will get punished.

I like to listen to WRB’s conference calls. Lots of good discussion on the P&C insurance market and where things are going. Right now analysts feel insurance companies are being too conservative with their loss picks and padding reserves (meaning they should be reporting lower CR). If true this means we should see growing reserve releases in the future (leading to lower CR).

when i look at history underwriting tends to follow very long dated trend lines up and down (similar to housing). The trend for underwriting right now is lower. And i think it runs for a few more years.

—————10 years ago I think Fairfax had a 4 year stretch where underwriting averaged in the low 90’s. I wonder if they can get there again for a couple of years.

—————Inflation is probably the big unknown right now. Will it average 8% the next 5 years or 4%? Or lower? My guess is the uncertainty will keep the hard market going for another year or perhaps even 2. Until insurers get a better handle on the trend in inflation.

—————

What gives me some confidence with Fairfax and underwriting is Andy Bernard. I think he is pretty good. Fairfax stopped big insurance acquisitions about 5 years ago and they have spent the last decade digesting all the many insurance acquisitions made from 2012-2017. I am hoping this means we see Fairfax continue to post improving underwriting results.

—————

i also do not look too far into the future at these sorts of things (too many unknowns). I like the set up for the next 12 months. Beyond that i will remain open minded and keep learning…

-

44 minutes ago, ander said:

$100 per year in income. What do you think downside risk is to that number on average?

The biggest downside risks:1.) underwriting: above average hurricane season (number and/or severity) or some other big catastrophe (they will happen). Or inflation remains much higher for longer than currently expected (resulting in insurance companies not charging enough).

2.) interest and dividend income: Fairfax is still extremely low average duration with its bond portfolio at 1.2 years at June 30. If short term interest rates crater that will, over time, bring interest income down.

3.) share of profits of associates: severe recession/bear market or Eurozone crisis (affecting Eurobank)

—————

There are also upside opportunities. Fairfax could hit $3 billion per year from the 3 buckets below. With a lower share count $140/share is not a crazy number looking 3 or 4 years out.

1.) underwriting: we could get a below average hurricane season this year. If future years CR could fall below 93 driving underwriting income over $1.4 billion. Hard market could stretch into 2024.

2.) interest and dividend income: Fairfax is able to extend duration and lock in higher interest rate driving interest and dividend income north of $1.2 billion per year3.) share of profit of associates: could materially increase in coming years +15% over multiple years given growth prospects of companies.

-

2 hours ago, StubbleJumper said:

My disappointment is that the stock has been more buoyant than I would like. Mr Market really didn't hate the headline EPS number that they released two weeks ago. Here we are halfway through August and all is quiet in the Atlantic basin, so the typical angst about hurricanes hasn't affected the market at all. How is a guy supposed to get a bargain around here?!! Maybe if Jen Allen would resign quietly with little explanation the stock would sell off as they always seem to do when the CFO suddenly quits.

I was hoping for a buying opportunity in the low to mid $400s....

SJ

US$500 was my buy zone. $450 was my back up the truck price. There is a chance we see Fairfax in the $450 range if stock markets re-test bear market lows and/or we get a couple of bad hurricanes the next 6 weeks. But i am starting to think i am getting too anchored to past prices that are simply too low (and not likely to be seen again - except under truly exceptional circumstances). Especially when US$511 (where it closed today) is wicked cheap. Why? Fairfax is executing very well. So the super cheap price of 2021 is likely no longer a realistic price (the super cheap price is now $50-$100 higher).

So i was adding to my position late today. Fairfax is, once again, my largest holding (now larger than my collective oil holdings). The turnaround that has been happening at Fairfax for the past 4-5 years is largely done. The company is positioned better than it has ever been before - insurance and investments. And it is firing on all cylinders / executing exceptionally well. And the financial results have been very good the past 7 quarters and this solid performance should continue to run for years. The problem is many Fairfax investors have been burned so badly over the past decade they do not recognize or appreciate the company Fairfax has become in Aug 2022.

The big reason why i like Fairfax so much right now is its insurance businesses. And spiking interest and dividend income. And improving results at associates. Underwriting income + interest and dividend income + share of profits of associates = +$100/share ($25/share/quarter) on a go forward basis. Investment gains (lumpy - over time) should more than offset interest and corporate expenses and taxes.

Fairfax also has many hidden assets which will get liquidated over time. First Capital. ICICI Lombard. Riverstone UK. Pet Insurance. Resolute Forest Products. Lots more remain hidden on Fairfax’s balance sheet. Waiting to be monetized in the coming years.

I think Fairfax book value will be around US$700/share by year end 2022 (up from $588/share today) and over US$800 by year end 2023. With shares trading today at $511 that puts price/BV at 2023YE at 0.65. Too cheap - even for Fairfax. At some point in time investors will connect the dots and Fairfax shares will pop another 30-40% in one year. So i am happy to get my position size right today… and then simply sit tight and wait.

—————

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

― Edwin Lefèvre, Reminiscences of a Stock Operator————-

“Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.”

― Edwin Lefèvre, Reminiscences of a Stock Operator -

1 hour ago, backtothebeach said:

Not much love in the market for Fairfax these days ...

I agree. However, most insurers have been dead money for the past 6 months or so. Likely driven by concerns: 1.) the hard market is coming to an end 2.) high inflation increasing loss cost trends.

What i focus on is what is going on under the hood. Looking at the past 12 months Fairfax is hitting the ball out of the park. With Fairfax shares closing today at US$511 that is called wonderful opportunity. So I was buying more late today (redeploying proceeds from lightening up on oil yesterday).

Fairfax is like a coiled spring. That just keeps on getting coiled tighter and tighter. The stock price will respond. In Oct 2020 Fairfax was trading US$260 and 7 months later it was up 75% to $460. Everyone who followed the company KNEW it was crazy cheap at $260 (it traded at this level for 7 months so people had time to pull the trigger). Most did not buy.

No doubt in my mind Fairfax is crazy cheap today at US$511. I am also convinced the shares will be much higher at some point in the next 3 years. What I don't know? When Mr. Market will drive the next spike in the stock price. As long as Fairfax continues to execute well and deliver exceptional results I will be patient.

-

Here is an update on Fairfax equity holdings at about the 1/2 way point through Q3. My math says equity holdings (tracked in the spreadsheet below) are up $1.21 billion since June 30. About $250 million is mark to market ($10.50/share) and $950 million ($40/share) is not mark to market. (The $950 million more than offsets the $803 million deficiency of fair value over carrying value of investments in non-insurance associates and consolidated non-insurance subsidiaries that existed at June 30.)

Movers:

1.) Atlas $430 million

2.) Resolute FP $237

3.) Blackberry $140

4.) Recipe $123

-

Some new news from EXCO Resources. 2 new additions to the board. Sale coming? Or is EXCO looking to perhaps be a buyer?

EXCO is largely a natural gas producer. If nat gas prices spike further this fall (as Russia puts the screws to Europe) nat gas producers will continue to make windfall profits. Could be a great time for Fairfax to unload an asset like EXCO (i think Fairfax owns 44%).

————-

August 10, 2022

DALLAS, TEXAS – EXCO Resources, Inc. (“EXCO” or the “Company”) announced that the Board of Directors has increased in size to seven members. Paul Aronzon and Harold L. Hickey have been appointed to the Company’s Board of Directors.

Mr. Aronzon has over 40 years of experience, as lead advisor, in mergers and corporate reorganizations, including extensive experience advising companies, boards and board committees, independent directors, sponsors, debtors, creditors, parties acquiring debt, assets or companies and other parties in corporate transactions. From 2008 to 2019, Mr. Aronzon was the co-managing partner of the Los Angeles office of Milbank LLP, an international law firm, and co-leader of Milbank’s Global Financial Restructuring Group. Mr. Aronzon was also the Executive Vice President and Managing Director of Imperial Capital from 2006 to 2008. Mr. Aronzon has advised companies, boards, board committees, independent directors, sponsors, parties acquiring assets, debt or companies and others in transactions across a wide array of industries.

Mr. Hickey is Chief Executive Officer and President of the Company and has more than 40 years of experience in the oil and gas industry. Mr. Hickey has been the Chief Executive Officer and President of the Company since 2015. Since he joined the Company in 2001, Mr. Hickey has served in various senior management roles, including President of North Coast Energy, and Chief Operating Officer, President and Chief Executive Officer of EXCO. Before joining the Company, Mr. Hickey worked at Mobil Oil Corporation, in various technical, commercial and managerial roles from 1979 to 2000. Mr. Hickey has extensive knowledge of the Company and the oil and gas industry as well as significant operations, engineering, and executive leadership experience, including senior management roles in multiple acquisitions and divestitures and complex energy joint ventures.

About EXCO Resources, Inc.

EXCO Resources, Inc. is an oil and natural gas exploration, exploitation, acquisition, development and production company headquartered in Dallas, Texas with principal operations in Texas, North Louisiana and the Appalachia region. EXCO’s headquarters are located at 12377 Merit Drive, Suite 1700, Dallas, TX 75251. -

Not sure if this interview July 25 with Digit CEO has been posted. Good update. There is so much going on with Fairfax today it is easy to forget about Digit. This company is shaping up to be a real game changer for Fairfax shareholders.

——-

In FY22, Kamesh Goyal’s startup Go Digit General Insurance became the fastest general insurer to cross Rs 5,000 crore in annual gross written premiums. The next pit stop for the company, backed by Canadian billionaire investor Prem Watsa’s Fairfax Holdings, is to go public soon after the company completes five years in business this October. Per Insurance Regulatory and Development Authority of India (IRDAI) norms, promoters cannot sell a stake before five years.

However, the insurance industry veteran has larger plans to build an insurance conglomerate. Digit has applied to the IRDAI seeking licences to set up a life insurance and a reinsurance entity.

Valued at $3.5 billion, the company raised a total of $284 million in 2021. Besides Fairfax Holdings, the company counts Sequoia Capital India, A91 Partners, Faering Capital, TVS Capital and cricketer Virat Kohli as its investors.

In an interview with Moneycontrol, Goyal said that the company will assess the timing of its IPO at the end of the five-year tenure, based on market conditions. Meanwhile, he believes that the tough macro environment owing to rising interest rates and inflation will slow down the pace of growth for the general insurance industry.

Goyal worked in both life and general insurance before founding Digit in 2017 and has 32 years of experience in the space. Digit is an insurance manufacturer and provides motor, health, travel, fire and other small-ticket insurance. The company has an overall market share of 2.4 percent and a share of 4.7 percent in the motor insurance space.

-

Dexterra reported Q2 results. Top line is growing nicely; profitability was off due to modular issues (expected) and inflation. Based on how the stock traded, results likely hit expectations.

When Dexterra did the reverse takeover of Horizon North right before covid hit the management team set an annual goal of $1 billion in revenue and $100 million in EBITDA. Beginning in Q3 Dexterra could hit $250 million in revenue (for sure they will be there in Q4). And my guess is they could be close to $25 million in EBITDA in Q4. Dexterra also expects EBITDA conversion of 50% to free cash flow.

Modular has been a big disappointment but should return to profitability in Q3. And inflation pressures have hit the business hard but cost increases are coming so this headwind should slow some. My guess is inflation will remain a headwind.

Bottom line, despite experiencing their fair share of adversity Dexterra looks to be on track once again to growing both its top and bottom line. And as a Fairfax shareholder i am happy they will be funding their growth internally with free cash flow.

- https://dexterra.com/wp-content/uploads/2022/08/Q2-2022-Analyst-Presentation-Final-Aug10-2022.pdf

Fairfax 2022

in Fairfax Financial

Posted · Edited by Viking

@This2ShallPass great question. My focus with Fairfax is earnings. Trying to predict multiple is even more difficult. My thesis is Fairfax is going to deliver VERY good earnings the next couple of years. It makes sense that Mr Market would also reward the stock with a higher multiple as Fairfax delivers.

—————

So i think it is likely that Fairfax stock delivers a trifecta for investors in the next couple of years:

1.) rapidly growing earnings and BV

2.) Mr Market rewarding the stock with a higher multiple

3.) much lower share count (via stock buybacks)

If this happens then Fairfax at US$1,000 in 4 years is likely too low.

I also do not get too anchored in what might happen in 3 or 4 years. That is too far away to really know much. My focus is this year (2022) and next year (2023) and getting that right.