Viking

-

Posts

4,702 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

Here is an interesting article reviewing Buffett’s investment history and oil. A picture is sometimes worth 1,000 words…

Buffett Buys Oil & Gas Stocks- https://bisoninterests.com/content/f/buffett-buys-oil-gas-stocks

Today, Chevron and Occidental are generating enormous free cash flow, have upside to higher commodity prices, offer inflation protection, and are returning part of their free cash flow to shareholders via buybacks and dividends. These companies generated strong cash flow in 2019 and 2020, when Buffett initially bought preferred shares of OXY and common stock of CVX. By the time Buffett added massively nearly 40B to these positions, making oil & gas one of the largest positions on the Berkshire book, their free cash flow yields had increased substantially.

In the past, Buffett saw oil and gas businesses as beneficiaries of inflation, subject to attractive valuations, at times where he saw very few other similar opportunities in the market. Buffett appears to have the same approach this time around, buying inexpensively while embracing inflation protection from oil price exposure, stating that these purchases are “a bet on oil prices over the long term, more than anything else.”

And in contrast to the prevailing green transition narrative, Buffett’s partner, Charlie Munger, made his view on oil clear in their most recent shareholder conference in Omaha: “I like having big reserves of oil. If I were running … the United States I would just leave most of the oil we have here and I would pay whatever the Arabs charge for their oil, and I’d pay it cheerfully and conserve my own. I think it’s going to be very precious stuff over the next 200 years.”

-

13 hours ago, Parsad said:

Highly unlikely we see $200 per barrel.

The only oil and gas stock I bought in the last 18 months was XOM around $54 and sold out at $96.

Gas prices in Vancouver hit a peak of $2.42 a liter a couple of weeks ago...today down to $2.069 a liter based on recession fears.

The recession, or perceived recession, may cool demand enough to keep oil at these levels for a while.

Cheers!

Oil averaged about $120 for about 7 years (2007-2015 or so). Adjust for inflation and you get something like $135 today. So not very long ago oil averaged around $135 for close to a decade.

Today demand continues to grow at 1 million barrels/day every year like clock work (people in China, india, indonesia etc all want a better life and that is ONLY POSSIBLE with increased use of hydrocarbons = oil). The supply picture today is much worse than 15 years ago. So i think $150 oil is a pretty reasonable expectation. Not my base case. But it also would not surprise me. What is interesting is gas prices recently actually reflected $170 oil (if you normalize current $60 crack spreads) and consumption did not miss a beat (people complained but did not materially change their behaviour). I think the demand destruction argument is overplayed at oil under $150.

$200 oil is also not my base case. But i would not rule it out. Especially given war in Europe and the high uncertainty what happens to energy prices in Europe as winter approaches. Putin is no dummy and he has Europe over a barrel. Saudi Arabia hates Biden/Democrats (and their calling out of Khashoggi affair etc) so they are going to do the US no favours. The third big producing region is US/Canada and ESG will ensure muted production growth there FOREVER. Clearly, the risk to oil prices is skewed big time to the upside.

A mild recession will do little to slow demand. The only solution that i can see to high oil prices (in the near term) is a bad recession (like 2008). And i don’t think that is in the cards. Regardless, post recession we would likely be in the exact same demand/supply imbalance mess we are currently in.

How governments are responding to to high inflation/oil prices is also very instructive. Populism is driving the political response:

1.) stimulate demand: lower gas taxes. Cut more checks to the poor.

2.) constrain supply: demonize producers. Tax producers (windfall tax). Double down on ESG practices (do nothing to incentivize oil companies to make necessary long term investment decisions to grow production).

Bottom line, governments are doing nothing to either reduce oil demand or increase oil supply. Or accelerate the energy transition to renewables. In fact they are doing the opposite. This will result in higher oil prices in the future. Which of course is good for oil company profitability.

—————The really interesting thing is the stocks of most oil companies (and i am talking about the Canadian producers as they are the only ones i follow closely) are priced today for about $65-$70 oil. And as they aggressively de-lever they will all soon have fortress balance sheets (little debt). +$100 oil and they are making obscene amounts of money. $90 oil and they are making greedy bastard money. $80 oil they are making great money. $70 oil they are making very good money. $150 oil? They will be making King Midas money.

-

10 hours ago, Parsad said:

Beating the Street by Peter Lynch was the first investing book I read...around late 1994. I went on to lose all of the money I put in the markets between 1995 and 1997!

Then in 1998, I read the Annual Letter on Berkshire's site that had just gone live. I went on to meet Buffett, start the original COBF, meet Prem and Francis, start my own fund, take over PDH and become financially independent.

Thus I'm extremely partial to one. Neither Beating the Street, nor One Up on Wall Street, sit on my bookshelf! Cheers!

i discovered Buffett first and then i overlayed Lynch… The other person who was really influential way, way back was Burton Malkiel and A Rondom Walk Down Wall Street. I did not agree with Malkiel’s perscriptions but i absolutely ate up his academic vs real world discussions. -

7 hours ago, Parsad said:

You are comparing apples to oranges. Lynch ran a fund. Now if you compare apples to apples:

The original Buffett Partnership over 12 years compounded at 31.6% annualized with no down year...the S&P500 did only 9.1% annualized during the same period. Buffett handily beat the S&P500 in each of those 12 years.

http://warrenbuffettoninvestment.com/buffett-partnership-performance/

Not to discount Lynch's performance, as it was nearly as extraordinary. But he compounded at a lower rate and was outperformed by the S&P500 in 2 of the 13 years he ran the Magellan Fund. Lynch was also extremely stressed out when he left the fund...Buffett is as fresh as a baby 60 years later!

Cheers!

Both Buffett and Lynch were two people who got me started on my ‘successful investing’ journey… so i will be forever grateful to both men. I still read One Up On Wall Street pretty much every year (different chapters). And i am a Buffett junkie. Might as well ask a parent who their favourite kid is… not going there

-

I think the next inflection point for the Canadian producers will be when they have hit their net debt targets. Much of what they are earning right now is largely masked because it is going to debt reduction - and the real benefit to shareholders is seen over the long term. (The opposite of what happens to companies that take on a bunch of debt - which usually boosts short term results).

It looks to me like the sweet spot will be Q2 of 2023. By that time most Canadian producers likely will have hit their final net debt targets. And at that time 100% of what they earn will likely be returned to shareholders. And it oil continues to trade +$100 the returns for shareholders will be crazy. If oil goes to +$150… well, we can all dream…

—————

The fly in the ointment might by M&A. We are already seeing some of it. Cenovus recently purchased assets from BP; but so far these purchases look pretty rational and at fair prices (cheap if oil prices stay elevated). We know most non-Canadian publicly traded producers are desperate to exit their Canadian oil sands assets so there are lots of sellers. The problem for Canadian producers is they have been aggressively paying down debt over the past 18 months which has been delaying the big payback for shareholders. And if they now start making big acquisitions before shareholders get more fully rewarded it will create quite the optics problem (unless the price is low and/or the strategic fit is compelling).

-

@jfan i was just about to post the same video (just watched it). Lyn Alden pointed listeners to Josh Young in one of her recent video’s so she obviously follows him. Anyone who wants to understand the current state of the oil market would be well served to watch Josh’s presentation. It is a fantastic summary of the current state of the oil market with lots of good historical information. Logical. Fact based. Not promotional.

For those wanting to understand why Warren Buffett just dropped tens of billions into oil companies, paying what look to be peak prices… watch the video. There is a structural imbalance today in the oil market (demand > supply) that cannot be addressed in the short term (absent a severe recession like 2008). So oil prices will remain higher for longer… And there is a very good chance oil prices will go much higher. $150 oil is not a crazy number. And expect crazy volatility (like we are currently seeing).

-

3 hours ago, backtothebeach said:

It occurred to me that everybody is really looking at wrong numbers all the time, by not adjusting for inflation. People KNOW about inflation, but don't mentally adjust every number for it.

For example with earnings coming up, company X growing sales by 10% yoy does not really mean much, if (real) inflation is already around 10%.

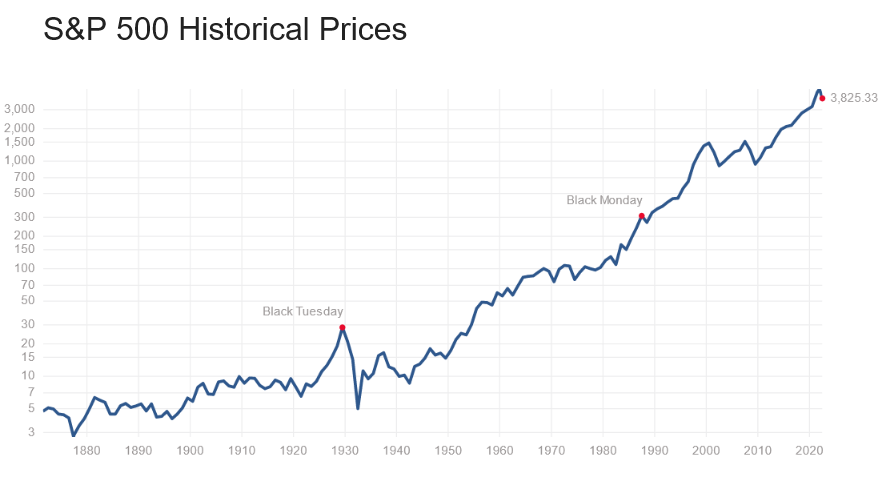

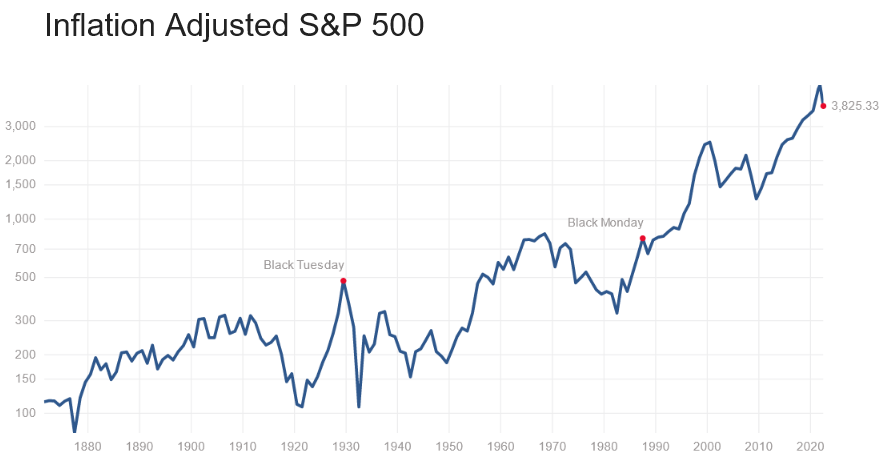

Or compare this chart, a more or less smooth ride since 1940, right?

https://www.multpl.com/s-p-500-historical-prices

To this one:

https://www.multpl.com/inflation-adjusted-s-p-500

The inflation adjusted chart shows just how excrutiating the period from 1968 to 1982 was, which was nominally just a sideways market. It does not included dividends however, which softened the loss of purchasing power somewhat I suppose.

And the current bear market is already down close to 30%, once you factor in inflation.

Sorry if this was obvious to people here...

@backtothebeach you make a great point. And one that i struggle with. What is the proper way to look at historical data/information when trying to value assets today and into the future in a high inflation environment? Investors have been working in a falling/low inflation environment for +40 years so have not had to think much about this.

I like to look at 5 year stock price charts to get a quick idea of how a cheap a stock is trading (i.e. i love it when i see profitable and well run companies trading at or near a 5 year low). Obviously doesn’t mean i buy them… but it often helps identify opportunities. And when buying real estate, looking at historical prices is important. Yes, there are lots of other important things to consider when buying assets. But how useful is historical information in a high inflation environment that runs for years?

A real life example: i starting to look for a 2 bedroom unit in a popular part of Vancouver (Kits). These units average about 850 sq ft and cost about C$850,000. Now if inflation is running at 8% for a year and prices stay at $850,000 does this mean the unit a year later is now really worth about $780,000 (in inflation adjusted money)? And if inflation runs 6% in year 2 does this mean the units is now worth $735,000? Meanwhile i am waiting for a 10% correction in nominal prices… which might never come. Now if inflation was running at zero and 2 years later that $850,000 unit was selling for $735,000 i likely would be running to buy it. (For real estate in Vancouver WE KNOW cost to build is going up at least at the rate of inflation. We also know rent is going up at rate of inflation - especially in Kits).

And if nominal prices actually come down 10 or 15% is that not a beautiful thing in a high inflation world for people looking to buy assets? (Falling nominal prices is NOT a good thing for asset owners in a high inflation world.)

-

Added to SU and re-established position in CVE (their refinery business should be printing money).

My cash weighting is still around 55%; I sold some Fairfax to fund my move back into energy.

-

The current sweet spot for energy looks to be refining where margins are nuts and look like they may stay high for a while. Q2 earnings for anyone with refining in their mix will be huge. Time to learn more about refining.

—————Looking way, way out… like to the fall (4 whole months away…. an eternity away for Mr Market) what will Europe (entering winter) and the nat gas picture look like?

-

1 hour ago, Dinar said:

I agree with everything that you are saying, I would add a couple of points: a) Demand is still down a couple of million barrels a day from 2019 probably caused in part by Chinese lockdowns; b) Iran and Venezuela have potential to increase production materially, may be as much as 1.8MM barrels per day from Iran, and a million or two from Venezuela (unless I screwed up my math.)

@Dinar the supply side of the equation is super interesting. The deficit today is very large:1.) inventories are at historic lows (and they keep coming down)

2.) OPEC spare capacity is very limited

3.) Russian supply is constrained due to war

4.) to try and lower prices, governments are releasing massive amounts of oil from strategic reserves. This cannot go on forever and the barrels released will need to be replaced.

- https://science.howstuffworks.com/environmental/energy/us-oil-reserves-last.htm

Yes, new supply from Iran and Venezuela would help increase supply. This is something to monitor moving forward. Bottom line, we have a pretty severe supply problem today that is likely to get worse in the near term. And this supply problem is keeping oil prices over $100.

—————On the demand side, it is worth noting we have a severe demand/supply imbalance with China (and large parts of its economy) in lockdown as a result of its zero covid policy…

-

5 hours ago, Sweet said:

Performance of energy stocks this last month have been woeful.

A little more than three weeks ago the broad sector was up nearly 70% for the year. It was an unsustainable move that was sure to correct.

Today it is up 25% having given up most of its gain these past three weeks.

We are exactly 6 months into 2022. Oil was my top pick to make money in 2022.And oil has performed spectacularly well (especially when compared to the overall stock market which is down 20 to 30%). Russia’s invasion of Ukraine was gas on the fire. However, oil was a trade for me: i actually started exiting my very oversized position in late January and was largely out of oil in Feb/March. Since then i have bought oil a number of times on big sell offs and sold a short time later for a nice quick gain.

Over the past week i have been doing a fair bit of reading on oil and gas. And today a light bulb went off for me: i think oil is poised to do well for YEARS. i am starting to drink the secular bull market Kool-Aid. So I was buying oil again today and now oil is 4% of my portfolio. And if oil continues to sell off i will likely buy more.

Why do i like oil as a secular investment:

1.) global demand will continue to grow each year by about 1 million barrels per day for the next decade. Demand is doing what it has done for all eternity: grow. People want to live a better life. The best way to do that TODAY (and the next 5 years at least) is hydrocarbons.

2.) supply, already in a deficit, WILL NOT be able to increase production by anything close to 1 million barrels per day for the foreseeable future. The supply function has permanently changed in Western countries. Thank you ESG (oil is a hated and villified industry… who in their right mind wants to work for an oil company today. Good luck attracting young talent).

Investors do not appreciate what this now means for oil prices. PERMANENTLY HIGHER PRICES. Yes i know… that is a crazy thing to say… but i think it might be true (at least for the next few years). This means oil companies are going to keep earning outsized profits.

Right now profits are going mostly to pay down debt (that ESG thing… banks can’t lend to dirty oil)). Once the debt is paid down shareholders will get paid. By the middle of 2023 the payouts to shareholders could be absolutely NUTS (10-15% dividends based on todays stock prices).

Here is an update from Amrita Sen… very smart lady: -

On 6/24/2022 at 11:41 AM, SharperDingaan said:

Depends on your time horizon, and your directional degree of certainty; Speculation (1 day-2 quarters) vs investment (1-6 years); the longer the hold, the greater the certainty. The short-term community is just trading headlines, and today the news feed is negative. Speculative manic depression at work.

Energy is not manufacturing, and vendors are not price makers; applying a multiple to historic earnings just doesn't work. Multiples are used, but it is on a FFO, FCF, etc - a forecast 12 months out. and NOT eps. Price moves up/down, primarily because future cashflow is expected to be higher/lower; the FFO/FCS multiples themselves move much more slowly. Investment speculation at work.

Know your swim lane, then stay in it.

SD

Energy right now is looking like steel and lumber did a year ago. The energy companies are making obscene amounts of money. But unlike steel and lumber it looks to be like the profits for energy companies will likely remain higher for longer. If we get a further sell off of energy stocks (on recession fears) it might be time to increase exposure again. Energy has been my best ‘buy the dip’ trade the past 3 months (paid out every time)…My usual buy is Suncor. But i am starting to look at a few of the smaller producers. MEG is looking interesting but might not get much love until more debt is paid down. I like that they are unhedged.

What smaller energy producers are board members big on right now?

-

Where this discussion gets really interesting is if we get a recession around Nov and oil goes back to $60. You could see inflation drop dramatically. The Fed would be able to pivot. Or we could get that same recession around Nov and oil could go to $150 (due to geopolitical situation). This would keep inflation high and likely prevent a Fed pivot.

So the range out possible outcomes really are quite large. And the impact on financial markets will vary depending on how things play out. Keep the popcorn coming… the movie is not nearly over yet.

—————

For most investors probably 70% of total returns is likely driven by successfully anticipating/negotiating Fed policy. Capitalism 2.0. This has been true since 2008.

-

I have been trying to better understand India’s posture on the war in Ukraine. The speaker in the video below succinctly explains one of the key factors driving India’s response: security. Go to the 35:40 mark of video (discussion of India starts at 32:30 mark). China is India’s primary external threat. India’s security/military is built around managing the Chinese threat. And pretty much all of India’s military equipment is supplied by Russia - including munitions and spare parts. (Vietnam is in the exact same situation). And it would be massively expensive for India to pivot away from Russia (the speaker said it would not be like a consumer pivoting from Apple to Android when deciding to switch smartphone platforms

which got a good laugh from the audience).

which got a good laugh from the audience).

—————Viking’s additional comments: There are also significant economic benefits to India of supporting Russia: cheap oil, cheap fertilizer and first in line for grain shipments. All important for a country looking to raise much of its population out of poverty. And also wanting to avoid an all too possible political crisis (driven by high energy prices and lack of food).

—————

-

I voted yes, inflation will start to come down. Why? I expect global economic growth will continue to slow in 2H (it is already happening). Now my guess is also that we see inflation come down only a little - from +8% to 6%. So still a big problem. And where inflation goes from there will depend on the Fed. My guess is they capitulate (and pivot). And that, of course, will likely result in inflation picking up again later in 2023. Bottom line, i think inflation likely remains uncomfortably high for years (with low interest rates). Financial repression like the late 1940’s - that is how you solve a too much debt problem. Which might actually be the Feds end game.

-

10 hours ago, Parsad said:

I would imagine it would be at least a 10% drop the day the news is announced and 20-40% drop over a period of time as hedge fund managers, small investors mull it over and sell.

It will also depend on how much cash Berkshire has and how much support the stock gets from BRK buybacks when it starts dropping. As well as value fund managers probably buying stock too.

It would be back up near fair value within 12-18 months once sellers clear and equilibrium returns and people realize the stock will still do reasonably well long-term. Cheers!

The biggest challenge for Berkshire post Buffett will be the scrutiny of every decision AND THE FREE PASS BUFFETT GETS WILL BE GONE (decisions, corporate structure, governance etc).

Sub par returns for a decade? With Buffett around you tolerate it (even celebrate it)… because it is managed by Buffett. Sub par return for a decade post Buffett? Why would a rational investor hold it any more?

—————For years now Buffett has been primarily focussed on preserving the wealth of existing shareholders (the ones who bought in early). This is very different from how most companies are managed today.

-

The rental market in Vancouver is absolutely bonkers right now: super tight supply and spiking rents (for new rentals). +$1,500 for one bed and +$3,000 for two bed - if you can find them (and then beat out other applicants to secure the place). Prepandemic it was not unusual for landlords to get +30 applicants when listing units onto the market… and i think we are probably back to those market conditions.

—————In my neighbourhood (i rent a house) my guess is rents have increased 20% in the past 18 months (18 months ago supply for rentals was highest in many many years due to covid). Crazy thing here in Vancouver is we have rent control. My landlord was ‘allowed’ to increase my rent 1.5%. Nuts.

-

I am starting to buy into the thesis that we get an earnings recession in the coming quarters and perhaps not an actual economic recession (although growth is slowing). Why? We have a labour shortage. Still. High inflation and a strong labour market = higher than expected interest rates. Maybe we actually see interest rates close to 4% across the curve in the coming months. We will see

Earnings recession + flattish growth + high inflation + solid labour market

-

1 minute ago, modiva said:

I think there is a good chance of a recession (if we are not in one already, statistically at least). Wouldnt banks be negatively impacted during recessions? Lower loan volumes, higher defaults etc. I am looking to avoid bank stocks until the air clears.

Yes, recessions are not good for banks. With BAC selling off close to 40% i think its current share price already discounts a slowing economy. If we get a mild recession it will probably sell off another 5-10%. If we get a severe recession perhaps it sells off another 15-20%. Or maybe the narrative shifts and stock pops 10-15% higher. Maybe the stock at $31 already discounts a mild recession? We just don’t really know. I would love to bottom tick all my purchases… but i don’t think that is a realistic objective. -

43 minutes ago, Parsad said:

I was nearly 60% cash back in November 2021, and now finally I'm getting close to 100% invested...probably about 95% right now. That usually happens as we approach the bottom...I'm usually early, but we must be starting to get close if I have that many ideas in my portfolio! Cheers!

https://finance.yahoo.com/news/jpmorgan-says-retail-investors-finally-125001587.html

Care to share your top 3 holdings (highest conviction ideas as of todays prices)? -

I am down to 40% cash. I am going to be patient until we see what happens with earnings season in July. I think earnings estimates are too high… spiking interest rates, oil and US$… and now a slowing economy… will hit corporate margins at some point in time. If i am right and earnings and earnings outlooks come down as companies report Q2 then analysts will be bringing down their 2022 and 2023 earnings estimates. And this will give us perhaps the final flush down in equity prices (or at least the next leg down).

If not, i am 60% invested. Regardless i am confident Mr Market will serve up more wonderful opportunities in the coming months.

—————Normal bear markets take about 18 months on average to play out. We are what, about 6 months into this bear market… and inflation (the reason we are having a bear market) is not yet under control…

-

51 minutes ago, no_free_lunch said:

These are some good picks but with the financials, how do you get comfortable with them in an inflationary environment? Or maybe you don't see inflation as persisting? I just ask as I have a couple bank stocks on my radar as well but am not sure how well they do given it seems they will lose against inflation.

I think there are lots of puts and takes with financials today. My decision to buy today is more driven by my belief that these 2 stocks (BAC, FFH) will be trading much, much higher in 2-3 years. Yes, lots of volatility, especially for the next 6-12 months. I think the stock prices today bakes in lots of the downside. Will they get cheaper? Probably. But when they move higher it will likely be quick and i do not want to try and get too cute with my positioning. I do have lots of cash to buy more should they continue to sell off.

I bought BAC today at $31.40 (my average cost is around $34). This is close to 40% off its recent high and the same price it was trading 4.5 years ago. They are a cash machine with most of the cash buying back stock (so its market cap at $260 billion is much lower than it was 4.5 years ago). BAC is morphing into a tech play (best in class). And it is levered to the US consumer (who are in great financial shape). 2 to 3 years from now (if not sooner) the stock should be back to $50. I will be buying more if it keeps going down.

Fairfax just sold a largely unknown pet insurance business for US$1.4 billion (10% of its market cap of $14 billion). Fairfax shares today are trading at US$480, LOWER than where they were trading 8.5 years ago. Fairfax is also a big winner from rising interest rates (given average duration of bond portfolio was 1.4 years at end of Q1). We are are also in a hard market so top line growing nicely and should continue to increase to offset risks of inflation. Yes, Fairfax’s equity portfolio will be down substantially in Q2 but that is normal for equity holdings. My guess is BV will be up nicely in 2022 to something north of US$675-$700 at year end so shares are trading at about 0.70 x 2022 YE BV. The YE BV will have equities priced at distressed values. And in 2023 interest income will be much higher (perhaps $1 billion) and underwriting income could be stellar as well. I will be buying more if it keeps going down. (I did have US$450 as my ‘get aggressive’ price. The pet insurance sale pushed this higher.)

-

FFH, BAC, SU

-

@Spekulatius makes sense. I did re-establish a small position in Suncor today (my usual go to for oil). Along with Buffett I am drinking the oil Kool-Aid. I also am going to look more closely into Potash given the wars large impact on this specific commodity. Everything else (metals, lumber, steel) i am going to just monitor given the near term outlook (not good should we get a slow down). As compared to 2 years ago lots of commodity producers have reduced debt and are sitting on substantial cash piles creating a very interesting set up should the shares continue to go lower.

Crazy how quickly sentiment changes.

Fairfax stock positions

in Fairfax Financial

Posted · Edited by Viking

Since my last update on June 5 equity markets have continued to sell off and Fairfax's equity portfolio, not surprisingly, will be hit hard. From March 31 to June 30 my guess is their equity portfolio is down a little over $2 billion. Please note, my estimate is incomplete (it is not able to capture all positions accurately or what Fairfax has been doing during the quarter). Please note, investors need to due their own due diligence (my spreadsheet could contain material errors). Please let me know if you see any errors.

Largest changes (these 4 stocks = 65% of decline):

- Atlas -$520

- Eurobank -$350

- Stelco -$220

- Blackberry -$210

Of the $2 billion total, my guess is about $725 million is mark to market. Given the strong move higher in interest rates in Q2 my guess is Fairfax will book about $275-$300 million in fixed income losses. So we could see $1 billion (pre-tax) in investment losses in Q2 = $42/share.

In Q2 I do expect Fairfax to report very good underwriting results and increasing interest income. So these will help cushion losses from the investment portfolio. And the pet insurance sale will result in a significant increase in BV (not sure if this transaction will hit the financials in Q2 or when it is expected to close in Q3). Bottom line, I continue to think Fairfax will grow BV for the full year which, if it happens, would be quite the accomplishment given the carnage we are seeing in both bond and equity markets so far in 2022.

Fairfax Equity Holdings June 30 2022.xlsx