Viking

-

Posts

4,696 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

Bond yields are spiking and most maturities are at or near decade? highs. Market is now forecasting Fed funds rate of 4.25% in March 2023.

Higher rates are very good news for Fairfax and their $35-$36 billion bond portfolio (1.2 year avg. duration). Fairfax said in Q2 release the current annual run rate for interest and dividend income was $950 million. This will be higher when they report Q3 results. If they are able to get an average yield of 4% on their bond portfolio = $350 million/quarter = $1.4 billion/year.

Dividends tracking at $35 million/quarter = $140 million/year

investment expenses tracking at $15 million/quarter = $60 million/year

Add the 3 items and we could see Fairfax earnings in the interest and dividend bucket $375 million/quarter = $1.5 billion/year = $63/share.

—————So what could Fairfax earn in operating income in 2023?

1.) underwriting (95CR) = $1 billion2.) interest and dividend income = $1.5 billion

3.) share of profit of associates =$500 million (primarily Atlas + Eurobank)

Total = $3 billion/year = US$127/share (pre-tax)

Fairfax shares are trading at US$498 = 4 x estimated 2023 operating earnings (pre-tax). Any gains on the significant equity portfolio (much of which is priced today at bear market prices) is just gravy.

—————

Hard market is boosting underwriting income. Rising bond yields is spiking interest and dividend income. Associate earnings are chugging along (Atlas/Eurobank). Stock is wicked cheap. Got it!

—————

My number above for underwriting does not include runoff, which will likely be a drag of $150 million/year = $6/share.

-

1 hour ago, crs223 said:

… things can be stopped quickly too

https://globalnews.ca/news/8164763/china-ban-sissy-men-effeminate/

China continues to crack down and reveal their true colors. And not surprisingly China's 'new' values (text book definition of totalitarian) look to be almost an exact match to Apple's values as a company. I wonder how all of this also plays into a companies ESG score? How do you even score a totalitarian regime like China's on ESG? What a mess...

-----------

Macho, macho man.

China wants to be a country of macho men, and it’s trying to make that happen by banning “sissy” boybands and “effeminate” males from all media in the nation.

Broadcasters must “resolutely put an end to sissy men and other abnormal esthetics,” the National Radio and TV Administration wrote in a new set of rules released Thursday. It also used the term “niang pao,” an insult for effeminate men that means “girlie guns.”

The new rules call for broadcasters to enforce a “correct beauty standard” and to boycott “vulgar” internet celebrities and celebrations of wealth, while promoting “traditional Chinese culture, revolutionary culture and socialist culture.” They also ban all “idol audition shows” and recommend blacklisting anyone who has broken the law or offended public morals.

Additionally, the rules say that broadcasters should avoid airing anything that is “overly entertaining.”

The Chinese Communist Party’s propaganda department announced the new media masculinity rules on Thursday, in its latest effort to police morality through censorship.

President Xi Jinping has essentially pledged to Make China Great Again with a “national rejuvenation,” which he is trying to pull off through strict control of all business, education, culture and religion in the country.

The CCP has racked up a long list of censorship and human rights abuses in recent years, from the persecution of ethnic Uighurs in Xinjiang, to the complete denial of the 1989 massacre at Tiananmen Square, to new rules that ban certain karaoke songs or limit children from playing more than three hours of online video games a week.

Even Winnie the Pooh has been banned, after the character was once used to mock Xi.

-

5 hours ago, Ballinvarosig Investors said:

https://www.foreignaffairs.com/china/xi-jinping-china-weakness-hubris-paranoia-threaten-future

Must read article on what's going on in China politically. Is Xi really the man you want to hitch your wagon to?

Anyone who doesn’t understand how China works needs to read that article. What a messed up political system. As China’s economy continues to get bigger, just like with the former Soviet Union, allocation of scare resources gets much more difficult with a communist model. Thanks for posting. -

If you look under the hood stock average returns the last decade (2010-2020) were likely largely driven by a handful of mega stocks: Apple, Microsoft, Amazon, Google, Facebook, Tesla etc. If you did not own these stocks you likely had a lost decade.

If these mega stocks go sideways the next 3-5 years then stock indexes likely will go sideways as well. Can investors make money? Of course. How? Picking the right stocks. And there is the rub…

-

India is one country i know very little about. So i have been trying to change that. Below are three videos from a German TV station that discuss some of the current themes.

Outside of the US and Canada, India is the next most important country for Fairfax: Fairfax India, Digit, Quess and Thomas Cook. Prem also has very aggressive growth plans for Fairfax investments in India to increase materially in the coming years. Bottom line, India will be an increasingly important part of the Fairfax business mix in the future.

-

On 9/3/2022 at 8:03 AM, wondering said:

Interview with Tope Lawani from March 2022

- first 26 minutes about his background and personal history

- 26 minutes onward talks about starting Helios and the investments

- telecom towers in Africa, and the barriers to entry in Africa

- Oil investments

- banking in Africa. It's ripe for e-banking or phone-banking. It's cost-prohibitive for the average African to have a traditional savings account

My current thinking on Helios Fairfax (note - I am greatly influenced by the other contributors to the discussion eg. Viking, Petec and others)

- HFP is still cleaning up the mess left behind original Fairfax Africa team

- in the last year or so made a new investment in a Morrocan grocery chain

- emerging markets is getting killed right now with rise of US dollar etc.

- a few questions - when will the US dollar adjust downward? When will institutional investors start investing in Africa and emerging markets in a bigger way?

- once Wall Street returns to Africa, Helios is positioned way to capture some of that money. and therefore, more management fees for Helios Fairfax

- note - I am invested in Helios Fairfax but I am down a lot

@wondering thanks for posting the link. It certainly looks like Fairfax has picked the right long term partner to get exposure to Africa.

Fairfax Africa and Helios Fairfax is a great example of what i like to call ‘old Fairfax’ and ‘new Fairfax’. Fairfax Africa was started because Paul Rivette saw what Fairfax India was doing (quite successfully) and felt it could easily be duplicated in Africa. In theory, sounded like a great idea. In practice, it was a disaster.

There was significant financial damage done directly to Fairfax. Does anyone know what the actual financial hit has been so far? My guess is more than $200 million (i actually have refused to do a deep dive on Fairfax Africa because it was such a shit show). There was also significant reputational damage done to Fairfax. Investors in Fairfax Africa got taken out behind the woodshed. And yes, it was Fairfax’s fault. Because Fairfax was borderline negligent in how it handled the whole Fairfax Africa affair. This was not some outside company… Fairfax Africa was Fairfax’s baby.

“Trust takes years to build, seconds to break, and forever to repair.” One of the reasons Fairfax stock trades at the low multiple it does today is because many investors no longer trust Fairfax. The ‘equity hedge/short’ fiasco was the big screw up with an 11 year impact on results. Fairfax Africa was another, smaller, screw up.

Helios Fairfax is the ‘new Fairfax’ part of the story. After a few year, Fairfax recognized its mistake with Fairfax Africa. It found the right partner to get exposure to Africa (Helios). It paid a heavy price (write downs). But Fairfax now looks well positioned to benefit over the coming decade as Africa develops.

The reason i keep bringing up the equity hedges and today, Fairfax Africa, is so we - and Fairfax - do not forget the very serious mistakes made by the management team at Fairfax in the still recent past. Because those (and other) past mistakes cost Fairfax (and Fairfax shareholders) hundreds of millions of dollars every year for over a decade. Those mistakes also eviscerated any trust that existed between Fairfax and much of their former shareholder base.

I really like what i have been seeing from Fairfax the past 4 or 5 years. I probably come across as being quite the fan boy. I don’t think i am… my eyes are wide open. It will take years of good decision making, communication and performance for Fairfax to earn back the trust it has (deservedly) lost with investors.

-

Big move in US treasury yields today. 10 years is up to 3.34%, up 15 basis points. Close to its 10 year high reached in June of 3.5% since hitting 2.65% the end of July the 10 year has increased 70 basis points in the last 5 weeks. That is a massive move. I think where the 10 year goes from here will be a key data point to monitor moving forward. Higher long bond yields = lower stock market multiple (generally speaking).

3 year, 5 year and 7 year are all also up 15 basis points. Yield on 3 year is up to almost to 3.6%, a decade high. If bond yields get close to 4% my guess is a fair bit of money will start to move in to bonds.

If US bond yields continue higher, especially further out on the curve, get out your pop corn. This month we also are just beginning Phase 2 of QE (with the amount of treasuries the Fed is letting run off doubling in size to $95 billion per month).

Joseph Wang (the Fed Guy) is of the opinion that the higher supply of treasuries (from QT and increased issuance from the large federal deficit) in the coming months could push treasury yields higher…

-

9 hours ago, Spekulatius said:

I think companies worth owning are Deutsche Post, Porsche Holding (POAHY) and Exor Holding for example. For exposure to the German market, I would get an MDAX ETF , which gives you more exposure to Midcap German companies for example.

I don’t know French business all that much, but I think choosing the Midcap route may be the way to go. FWIW, most European Midcaps have an international business focus, so they are not necessarily limited to doing business in Europe only.

@Spekulatius thanks

-

3 minutes ago, Spekulatius said:

Most European companies make only a fraction of their business in Europe. The actually numbers depend, but the multinational companies in Europe are closer to a 1/3 Europe, 1/3 NA and 1/3 Asia/ EM business mix than 100% European. So, I think there are great opportunities out there to get a double whammy from both a lower valuation as well as a currency kicker eventually.

Likewise, a lot of US companies have significant revenues in Europe as well as in China (both secularly challenged).

@Spekulatius if a North American investor wanted to get exposure to Europe in the future do you think it is better to try and pick a basket of stocks or keep it simple and buy an ETF? My problem is i do not follow European companies closely enough to go the company route. Do you have a short list of European companies you think are world class and very well positioned for the next decade? -

A key question an investor needs to answer is Europe in secular decline today? After its asset bubble popped in the late 1980’s Japan has fallen into a 45 year downward spiral. So Japanese assets have looked cheap for decades. The problem Japan has is the country never dealt with its core issues… because they did not want a severe recession/unemployment/businesses failing. That ‘model’ is not part of Japanese culture (employment for life etc). So we will see how Europe responds to its current energy crisis… do they double down on failed past strategies… or do they get rational and pivot energy policy at least in the near term to nuclear/hydrocarbons.

What made the US so investable in 2010-11 is they dealt with their issues. 5% of the population (my guess) got financially wiped out in the housing crash. The economy tanked. Unemployment skyrocketed. Banks were forced to recapitalize. Investors lost billions. Everyone shouted ‘god bless America’ and the economy pivoted. Not perfect. But what i like about the US model is its capacity to change. Europe i am not so sure…

-

My rule of thumb has been to focus on finding the right investment set up. Currency factors have not been a key driver (on their own). Now what is interesting is it is usually severe economic weakness that causes a currency to plunge. And severe economic weakness usually causes profits to plummet which causes lots of well run companies to plunge in value. In this situation, cheap currency + cheap stocks = wonderful opportunity. John Templeton would be licking his chops.

This was the exact situation existed in 2008-09 in the US. Currency got crushed. Stocks got crushed. In hindsight, non-US investors were given the buying opportunity of a life time (funny how these kind of mouth watering opportunities keep popping up every 5 or 10 years…). However, it did take a few years to play out (versus months).

I got lucky. Back in 2013 i was backing up the truck with Apple. Being a Canadian investor my portfolio shifted mostly to US$ assets when the Cad$ was close to parity with the US$. By 2016 the Cad$ was back down to $0.75 so i picked up a nice 20-25% currency gain in addition to my gains in Apple over a couple of years. The currency gains were largely dumb luck…

I know a few Canadians who bought US real estate in 2012-13 and have since made out like bandits (getting big currency gains as well as big asset appreciation). My sons hockey coach actually backed up the truck with Apple in 2013 (i was managing the hockey team and we would talk about investing pre-game) and then took his big winnings on Apple and used it as a down payment on a nice property in Arizona (his retirement plan). Lucky. Smart. Opportunistic.

The Cad$ has also significantly appreciated in value versus the Euro and Yen over the past 18 months (yes, not as much as the US$). Given we are likely still in the early innings of the energy crisis in Europe my guess is the Euro could go lower and perhaps much lower; i have seen some estimates that the Euro could fall from parity today to the US$ to the 0.80 level. If that happens my guess is lots of well run European companies will also be dirt cheap - they might already be there… What about European real estate? Probably also getting dirt cheap (in US$ or Cad$ terms) but i am not sure the investment angle here for most people.

But i am going to be patient. What drove the Cad$ in 2009-10 was a strong economy lead by a commodity boom (and quick rebound in housing). If we are in the early innings of another commodity super cycle then the Cad$ should perform reasonably well in the coming years (with housing perhaps being a drag this time).

-

Well energy markets got two important pieces of news today:

1.) The main Nord Stream pipeline will not be restarted

2.) OPEC cut supply by 100,000 barrels/day

What to think?

1.) The energy crisis in Europe looks to be entering its next phase.

2.) OPEC wants to keep oil prices in the $90 to $100 range

What does it mean?

1.) Gas prices in Europe are going higher. The European economy is going to weaken further. If Russia cuts off gas from the pipeline flowing through Ukraine to Europe then things will get much worse for Europe. What a crazy set up.

2.) even if we get a global recession oil prices might not correct much (perhaps to $80).

-

1 hour ago, Cigarbutt said:

You are directionally correct and the idea is to guess if the 'excess' reserves being built now (something which we will find out in the future) are enough to compensate for the developing realization (something that we will find out in the nearer future) that previous years were characterized by deficient reserves.

-----

Longer answer

In the reference above, there is this graph which shows what is known now about the past but which, for the last 2 to 5 years, will significantly change within the next 2 to 5 years:

If history is any guide, the years 2016 and after will likely deteriorate and this deterioration will be recognized in future years.

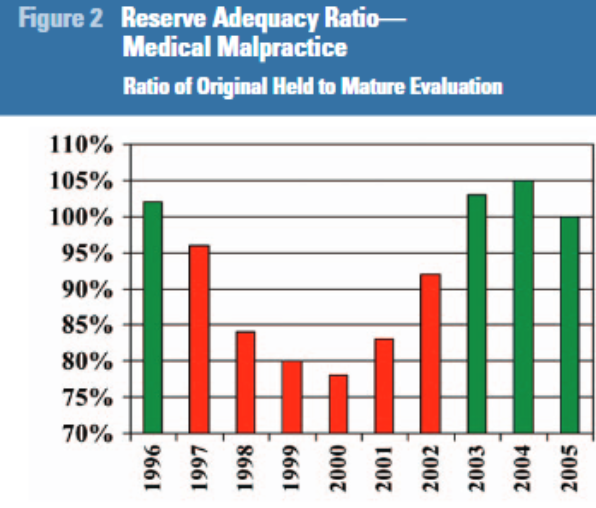

For fun (historical fun), let's look at what happened to the medical liability market before, as quite a representative example of most commercial lines (although typically more volatile ie more of this guessing about the past and the future). So what was known around 2001:

What happened (recognition of the past) after a couple of years:

The graphs are not quite comparing oranges to oranges but enough to draw some insights. Around 2001, it was reported that reserves were determined to be sufficient up to and including the year 2000. around 2005, it was realized that from 1997 on, policies had been underpriced and reached maximum adverse development in 2000, when things started to look better.

Anyways, usually there is relative pain as a result of this transition (typically negative underwriting income for a while) but this is variable and this time may be different (the market has turned relatively early versus the typical triggers ie large losses, threatened surplus, companies leaving market etc) and FFH has shown to be slightly better than peers (underwriting discipline, higher growth during hardening etc) which is why there is an expectation of only a moderately negative effect on underwriting profitability during the next 2 to 5 years.

Also, out of transparency and in support of your (at least my understanding) assertion that the future will compensate for the past, when the market turned in the early 2000s, against all odds, negative trends abated significantly (number of claims, payout per claim etc) and the medical liability market was quite profitable for a while (partly as a result of reserve redundancies and subsequent releases that more than compensated market players hurting from the residue of the previous underwriting softness).

-----

Irrelevant addition:

Cycles are fascinating (underwriting etc and this could be applied to investing in general (not to be discussed during a perma-bull environment versus the bezzle phenomenon (as described by JK Galbraith))) and it also applies to fraud occurrence and discovery. Frauds typically peak at tops of economic activity, especially at points of critical turning points (before the crowd notices) as some 'managers' get more pressure than usual along the usual incentives to reach targets. Of course, frauds 'incurred' are not reported contemporaneously. Frauds are typically uncovered, against some resistance, later on and this 'development' typically leads to investigations, committees and such that then look into the matter when a new bull market is largely under way.

-----

The underwriting cycle is dead. Long live the underwriting cycle.

Charles VI of France was first thought to be 'beloved' but then it was realized that he was 'mad' (i guess some kind of adverse development) and people, at his death, sort of knew that cycles were cycles.

@Cigarbutt thanks for posting in detail on this important topic. Could your concerns (developing losses on longer tail lines) be a key driver of the current hard market (especially when combined with falling interest income due to low bond yields)? My understanding is the hard market began in 2H 2019 - if true, that means we have just finished year three. And everything i am reading suggests the hard market will continue to run well into 2023. My guess is 4 years of hard market price increases should be able to provide a fair bit of cover for mistakes made in past years. But i will readily admit i do not understand this aspect of P&C insurance very well.

————-This topic has been discussed on past WRBerkley conference calls. The question is usually something like “given hard market has been running a couple of years already, why are we not seeing larger numbers for prior year positive development?” WRB answer: “we are being conservative”. My interpretation: “it is coming, just not yet”

-

Below is an update of Fairfax's equity holdings two months into Q3: +$860 million. Mark-to-market holdings are up slightly (essentially flat) to June 30. And the remaining holdings are up about $850 million (@$35/share pre-tax), erasing the $800 million deficit they were in at June 30. Not surprisingly, Atlas (take private), Resolute (sale) and Recipe (take private) are the three big movers driving $800 million of the gain Q3YTD.

-

@maxthetrade i am waiting for:

1.) for the pet insurance sale to close (hopefully Sept Oct)

2.) end of hurricane season

I think the table is set for another large stock buyback in Q4. Prem often telegraphs what Fairfax’s plans are during the Q&A portion of quarterly calls. Below is what he said July 29 on the Q2 call.

—————

Fairfax thought their stock was crazy cheap 12 months ago and happily paid US$500 for 2 million shares. Fairfax is trading today at US$485 and it is a more valuable company 12 months later:

1.) 20% growth in net written premiums

2.) interest and dividend income run rate close to 2X what it was 12 months ago

3.) sale of pet insurance business for $1.4 billion

4.) sale of Resolute for $600 million

5.) large stable of equity holdings continue to build intrinsic value

—————

Tom MacKinnon: Yes, thanks. Good morning, Prem. Just a question with respect to the proceeds that are probably going to be coming in associated with the Pet Insurance deal. It looks to be about $1.2 billion in cash now. You're buybacks, I mean, he did the SIB. But since then they've been still relatively modest. What are your thoughts as to what to do with this $1.2 billion in cash from that Pet Insurance deal?

Prem Watsa: So, Tom, we are always flexible, of course, and we look at all the possibilities. We, in terms of acquisitions in the property casualty business, we are not focused on it. Because our business now is running at about $28 billion, Tom, that US dollars, of course, in 2015, it was $8 billion and in 2018 it was $15 billion and now it’s running at for 2022 , $28 billion. And that's not including the GIG, and the Middle Eastern company that we've got, which is another $3.9 billion digit close to $4 billion. So we've got a significant amount of operations decentralized all over the world and running at an underwriting profit, and very good reserving, I may add, so no acquisitions, I mean, small acquisitions here, and then Asia or Latin America, but nothing significant. And so we look at obviously, buying back our stock, that'll be the number one thing that we'd look at, but not at the expense of our financial position. I've said that many times for you, not at the expense of our financial position, but we would look at buying back our stock.

-

The 'holy grail' of investing is finding a company that is:

1) growing total earnings meaningfully (above trend/expectations) each year

2.) decreasing share count meaningfully each year

3.) getting a higher multiple from Mr Market (as investors, over time, move from hate to love).

When one of these happens, investors usually do well. When two of these happen, investors usually do very well. When all three happen at about the same time, investors hit the ball out of the park (#3 can happen with a bit of a lag).

----------

So what has been happening with share count at Fairfax? From 2008 to 2017 Fairfax increased ‘common stock effectively outstanding’ from 17.5 to 27.8 million = +60%. This was done to fund the expansion of its insurance business: Zenith (2010) - and then internationally - Brit, Eurolife, ICICI Lombard (2015), Indonesia, Eastern Europe, Latin America, South Africa (2016), Allied World (2017). These were the years Fairfax was taking massive losses with its ‘equity hedge’ positions so expansion had to be funded largely with share issuance.

The surprising thing is the price Fairfax was able to issue shares at. From 2015-2017 Fairfax issues a whopping 7.2 million shares at an average price of... US$462. Not that far away from where shares are trading today at US$485. And all shares issued from 2008 to 2017 were issued at an average price of US$425. Interesting.

What has happened since 2017? The share count has fallen for 4 straight years (2018-2021). Share count has fallen by 3.8 million = 14%. That is a meaningful amount. What price were shares bought back at? 2 million were bought back in 2021 at $500 so this is likely a good average number to use.

So Fairfax issues shares at $462 to fund a couple of big acquisitions and then buys back a big chunk of the shares 5 years later at $500. Meanwhile i think it is safe to assume the insurance businesses purchased back in 2015-17 are now worth (in aggregate) at least 2X what was initially paid.

What will we see from Fairfax moving forward: more issuance? Or more buybacks? The answer is easy: more buybacks… and perhaps one or more large buybacks, like what happened in 2021.

Why so confident Fairfax is done issuing new shares? Because that is what Prem has been telling us for years. In the past new shares were issued to fund Fairfax’s international expansion. Today Fairfax is happy with its global insurance footprint. There will be no more large, transformative acquisitions - just small bolt on acquisitions like Singapore Re in 2021.

Prem also had this to say in his 2018 letter to shareholders (written in early 2019): “I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years. We began that process by buying back 1.1 million shares since we began in the fourth quarter of 2017 up until early 2019 – about half for cancellation and half for various long term incentive plans we have across our company.” The pandemic hit in early 2020 and this effectively stopped any material buybacks at Fairfax for the next 12 months. But 2021 saw a big buyback and i think we will see another of size over the next year or two. Prem’s reference to Henry Singleton was done for a reason.

Bottom line, owners of Fairfax can expect the share count to continue to fall in the coming years - and perhaps by a lot!

----------

Common Stock Effectively Outstanding

Dec 31 change 2021 23,865,600 -2,310,906 2020 26,176,506 -654,563 2019 26,831,069 -406,878 2018 27,237,947 -513,126 2017 27,751,073 4,657,507 2016 23,093,566 879,707 2015 22,213,859 1,037,691 2014 21,176,168 -23,834 2013 21,200,002 954,591 2012 20,245,411 -130,385 2011 20,375,796 -79,451 2010 20,455,247 466,377 2009 19,988,870 2,502,045 2008 17,486,825 -

21 minutes ago, LearningMachine said:

Has anyone looked into how much impact vehicle color has on risk of crash?

Monash University in Australia looked at the data and found that White significantly decreases probability of crash depending on type of vehicle.

For example, a low-visibility vehicle like a Black 4WD in dark is 53% more likely to be involved in a crash than a White 4WD. During the day, Black 4WD is 24% more likely compared to White 4WD.

See An Investigation into the Relationship between Vehicle Colour and Crash Risk (monash.edu)

There was another study published in British Medical Journal in 2003 that the Monash study references as well, but the BMJ study is not as thorough, covers much much smaller data-set, and doesn't distinguish between vehicle types and time of day, etc.

Any thoughts? Wonder if insurance rates take this account for some auto insurers?

Makes sense. But living in Canada i have always questioned why anyone would want to own a white vehicle in the parts of the country where the winters are bad. So my guess, is the ‘best’ colours will vary somewhat by geography. -

China is a wolf in sheep's clothing (politically and economically). It is run by a communist government and its core values are diametrically opposed to those of Western nations. This was ignored for decades… China’s political and economic clout was small so who cared? That is no longer the case today: China is a political and economic gorilla. And for some strange reason it has also decided to shed the sheep’s clothing. The wolf is now in plain sight for all to see.

Western governments and companies are slowly and finally starting to understand the reality of China. It is a formidable adversary who plays by very different rules (THERE ARE NO RULES in a communist system… think about that). Liberal democracies are at a big disadvantage (in terms of playbook).

Over time, political and economic relations between the West and China will continue to get worse. For 2 reasons:

1.) the West has woken from its stupor and recognizes China for the threat that it is

2.) China has decided it will kowtow to the West no more - in economic, political and military terms it has reached ‘critical mass’

So that means game on.With chips, the US is not poking China in the eye. Rather, the US is simply recognizing the current reality and acting accordingly (better late than never). We now have Cold War Book 2. The West vs the authoritarian block (lead by China).

Western companies operating in China better get their heads out of their ass. Nvidea is just another example of what is coming for companies who refuse to deal with reality.

-

2 hours ago, Spekulatius said:

Belated reply - but this is something I don't like about FFH. The Holdco seems to be constantly cash poor and there is considerable leverage at a Holdco level as well, both in terms of preferred stock (~$1.3B), as well as with debt, (the latter I am not sure about how much).

In Q2, they had about $1B i n Holdco cash but this has been going down for several quarters. it was north of $1.5B last year.

A big reason i like Fairfax today is the dramatic increase we are seeing in operating income:1.) underwriting income: at a 95 CR = $1 billion/year

2.) interest and dividend income: current run rate is $1 billion

$500 million per quarter ($2 billion per year) from these two items will provide Fairfax with a level of predicability and stability when it comes to quarterly cash flow that we have not seen in quite some time.

The pending deals (when they close)will provide even more cash:

- pet insurance sale = $1.4 billion (almost $1 billion after tax gain)

- Resolute sale = $600 million (pre tax $200 million gain)

A successful Digit IPO would be icing on the cake. And we likely will see more asset monetizations in the next 6-12 months (EXCO Resources?). They could tender their 13 million Stelco shares at $C$35 if they wanted to monetize another asset at a fair price.

Yes, the money will need to find its way to hold co. But given we are nearing the end of the hard market i would expect the insurance subs to be dividending more to hold co in the coming years.

Given the size of Fairfax today i do think it makes sense for them to hold more than $1 billion at hold co.

-

Me three (FFH)

-

I have put together a list of Fairfax's investments since 2010 (the Excel file is attached below). It is by year with insurance and non-insurance transactions captured separately. It is a pretty eclectic list (stuff I found interesting). It is also a work in progress. And not definitive. And it likely has errors.

Bottom line, I wanted to better understand the decisions Fairfax was making with their investment portfolio over the years.

As I said in my previous post, I think the collective decisions from 2018-2022 are much better than those made from 2014-2017. And that should lead to improved results from investments (both realized/unrealized gains) in future years (than past years).

----------

The 2014-2017 period also saw sizable losses from both equity hedges and CPI derivatives. The equity hedges were largely removed at YE 2016 with the last position sold in 2020. Sorry to pick that scab...

-

On 8/24/2022 at 8:01 PM, petec said:

This is an interesting mental exercise but I’m not sure Fairfax think about their investing in these buckets. In fact, I think you could simplify the whole thing dramatically. In my view they aim for two things when they invest: value and great people.

They do not aim for certainty of outcome, unlike some. They’re perfectly happy to lose money on some, and make spectacular gains on others. (And it shows!)

My read is Fairfax continues to evolve over time with how it is managing its investment portfolio. Prior to 2018 they had a 4 year stretch where they were making lots of mistakes with their equity purchases (buying value traps/bad companies - some run by poor management teams). For the past 5 years (2018-2022) Fairfax's success rate on new equity purchases has improved dramatically - generally they have been buying value run by good to great management teams.

Examples from 2014-2017? CIB Bank, Eurobank, EXCO Resources, APR Energy, Fairfax Africa, Farmers Edge, AGT Food Ingredients, Mosaic Capital, Astarta Holdings.

My guess is Fairfax has had to take write downs of around $1 billion on its investments in these companies the past couple of years. Fairfax's initial investment in Eurobank of $444 million evaporated in months. CIB is a great bank (and Egypt has a currency problem), EXCO went bankrupt in 2019 and Fairfax took a $300 million loss over 2 years (2018 & 2019). Both APR Energy and Fairfax Africa each had to have had at least $200 million write downs. Farmers Edge? Fairfax just announced a $107 million write down. AGT? As its financial situation deteriorated it was taken private by Fairfax in 2019 (not sure how it is doing but given there has been very little news on the company the past year I am not optomistic).

This is not to say Fairfax did not make some good to very good investments from 2015-2017:

2014: Praktiker

2015: Fairfax India IPO, Boat Rocker

2016: Golf Town (bankruptcy), Davos Brands, Blue Ant Media

2017: Altius, Performance Sports (Bauer)/Peak (bankruptcy)

How does the above compare to the 5 years from 2018 to 2022?

Clunkers? I come up with one in the past 5 years: 2020 - John Keells. And the issue was not the company but the country - Sri Lanka.

Winners?

2018: Atlas ($500 million), Carillion (bankruptcy), Toys “R” Us (bankruptcy), Stelco (post bankruptcy), Ensign Energy

2019: Atlas ($500 million more)

2020: Fairfax total return swap (1.4 million shares + 500 million added Q1 2021);

2021: Fairfax share buyback (2 million shares @ US$500/share), Foran Mining (small bet on copper)

2022: Grivalia Hospitality, BAC, OXY, CSX, BABA ($210 million), Recipe take private ($370 million)Most importantly, most of the ‘problem children’ owned by Fairfax have been dealt with - and the financial hit taken by Fairfax. After years of solid management, Eurobank looks well positioned (let's hope Europe doesn't have an economic crisis driven by high energy prices), EXCO is now a rising phoenix (thanks to spiking nat gas). in 2019 APR Energy was offloaded to Atlas for 22 million shares in ATCO. In 2020 Fairfax Africa was folded into Helios. Farmers Edge was just written down this past quarter. AGT?

Bottom line: Past problems in its portfolio of investments have largely been fixed and recent purchases look solid. Fairfax shareholders should see solid growth in its large portfolio of equity investments in the coming years which bodes well for future investment gains.

—————Recipe is perhaps a good example of ‘new Fairfax’: Fairfax wants to take Recipe private today because they think it is crazy cheap. EXCO/APR/AGT are all examples of ‘old Fairfax’: Fairfax took them private because they were in severe financial distress.

Today Fairfax is spending money because they see opportunity not because they have to bail out a failing/struggling business. That has big ramifications for Fairfax shareholders over a few years. Fairfax is able to spend new money on growth opportunities (not fixing problems). The more holdings that compound in value each year the more value Fairfax is building…

-

One key question, likely to be answered over the next year, is will the Fed be able to achieve its goals primarily via communication or will it take much higher interest rates.

So Powell gets very hawkish with his communication. Financial markets react and tighten financial conditions sufficiently for the Fed to achieve its goals (lower inflation). This is what we saw happen earlier this year - financial markets did lots of the initial work for the Fed (before the Fed even started tightening).

Or, do financial markets not tighten financial conditions enough. Like what was happening up until a week or so ago (bond yields falling and stock market rallying).

Moving forward, the Fed might have largely exhausted the communication tool. And will now need to rely primarily on rate increases to accomplish its goals. The Fed might have to raise interest rates higher than financial markets expect or want. The employment report on Friday will be important. Continued strong job growth suggests the Fed has more wood to chop.

-

Fairfax India at US$10.15; small anount.

My hope is they do another dutch auction later this year ($200 million in cash plus proceeds from IIFL Wealth sale when it closes).

The rub is if interest in IDBI Bank is real… perhaps that is where the cash goes.

- https://www.thehindubusinessline.com/money-and-banking/prem-watsas-fairfax-shows-interest-in-idbi-bank/article65496966.ece

Fairfax 2022

in Fairfax Financial

Posted · Edited by Viking

At current bond yields insurers will be taking another significant hit to earnings (mark to market losses) and book value when they report Q3 earnings. We could see three quarters in a row where many P&C insurers report very large hits to book value. Will regulators start to care? Does this result in hard market continuing into 2023?

Does Fairfax’s positioning of its bond portfolio (1.2 year average duration) start to benefit its underwriting (it can keep the petal to the metal on growth)? Will other insurers have to slow their growth?

—————

US Treasury Yields

Dec 31. June 30. Sept 13

1 month. 0.06. 1.28. 2.48

1 year. 0.39. 2.80. 3.88

2 year. 0.73. 2.92. 3.74

3 year. 0.97. 2.99. 3.75

5 year. 1.26. 3.01. 3.58

10 year. 1.52. 2.98 3.43

Most P&C insurers have an average duration of around 4 years on their bond portfolio. Fairfax, at 1.2 years, and WR Berkley, at 2.4 years, are the two outliers.