-

Posts

879 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by formthirteen

-

I understand your viewpoint, but the easiest off-ramp is Russia leaving Ukraine and Crimea. Russia's propaganda machine is able to spin that as a victory to the people of Russia, for example, ”We were right, NATO attacked us but we are still here”. Also, Russia does not respect any contracts or treaties, only power and force. Putin is Russia. Invading and destabilizing neighbors is Russia's culture (https://en.wikipedia.org/wiki/List_of_wars_involving_Russia). Removing Putin will not change that culture. Basically, it's a war of memes and cultures: A war of Borscht (see video): No opinion on the war, other than ”it is what it is”.

-

ChatGPT is terrible news for accountants: Accountants that use ChatGPT are going to be in trouble...

-

I just spoke to ChatGPT's CIO and got some tips about the market conditions and penny stocks. Sharing it with you all FTW:

-

MSGE and probably to one of you. You're welcome. Too difficult for me. IMO, the change in plans means the original thesis is bust. I prefer to cut losses and move on instead of doubling down.

-

Toilet paper is 50% more expensive than last year so revenue must be up 50*x%? Gregmal's valuation method is probably better than mine.

-

The 51st Mounted Vodka Brigade is already celebrating the victory over Poland: No opinion on the war other than it will be a long one and both sides seem to be losing.

-

$SWMAY

-

Pain index = 0 and hope it stays at zero. YTD about +10-15%. Avoided popular covid stocks & fintwit pumps and mostly avoided tech. Dumped stocks that went down before they crashed (META, BABA, SPOT, some UK small caps, etc.), bought more of what went up. Avoided falling knives and doubling down. Lots of tobacco stocks, but have sold about 50% now.

-

-

China is uninvestible, but it's still possible to speculate in the Chinese stock market. If Xi passes the Marshmallow test, the stock market should do well. If not he will (try to) invade Taiwan and continue to do stupid things (from foreign stock speculators' point of view). Nobody talks about the Chinese invasion of the Philippines (Spratly). They have roughly the same playbook as Russia, first the green men arrive, then the tourists: However, it seems China is not the only one invading, LOL:

-

Sabre Insurance Group plc (SBRE.L), which is based in Dorking and owns a brand named ”Go Girl”, seems very interesting. £355m in dividends and share buybacks (2001-2018) vs. £199m in EV right now. There is one article on VIC: https://www.valueinvestorsclub.com/idea/Sabre_Insurance/3638099628 Stock price plummeted in June due to inflation: Quickfs profile: Inflation sent shares in car insurers tumbling: https://finance.yahoo.com/news/car-insurers-see-shares-tumble-115140995.html Is this a falling knife? Risks include GBP, inflation, competition, robocars (LOL), etc.

-

Bought ATCO earlier this and last week below 14. Seemed like a good deal at the time. Also bought some BAM and ONEX. Not sure BAM is a good buy, it might start trading like a REIT. Have pretty much avoided the meltdown in REITs so far by selling early but should probably start getting back in. REITs in Europe are not looking good...

-

”Protect the motherland”. In a way they are right for the wrong reasons. The Czech have already annexed Kaliningrad https://visitkralovec.cz/

-

I wonder what the new king has to say about the GBPUSD price chart: I've been trying to dip my toes into the UK stock market, but have so far only managed to lose money. The falling currency is the biggest culprit. BTC is probably a more stable currency, LOL.

-

Movies and TV shows (general recommendation thread)

formthirteen replied to Liberty's topic in General Discussion

Investors here might find Gold with Matthew McConaughey to be interesting: -

Invert, always invert. Xi is testing the loyalty of CCP members. Just kidding. I kind of hope it's true.

-

What are you doing? - (Hobbies Thread)

formthirteen replied to Longnose's topic in General Discussion

Wow, impressive library of learning material. You are clearly helping a lot of people to learn electromagnetics. This is far more important than investing and will benefit society 100 years from now, IMO. -

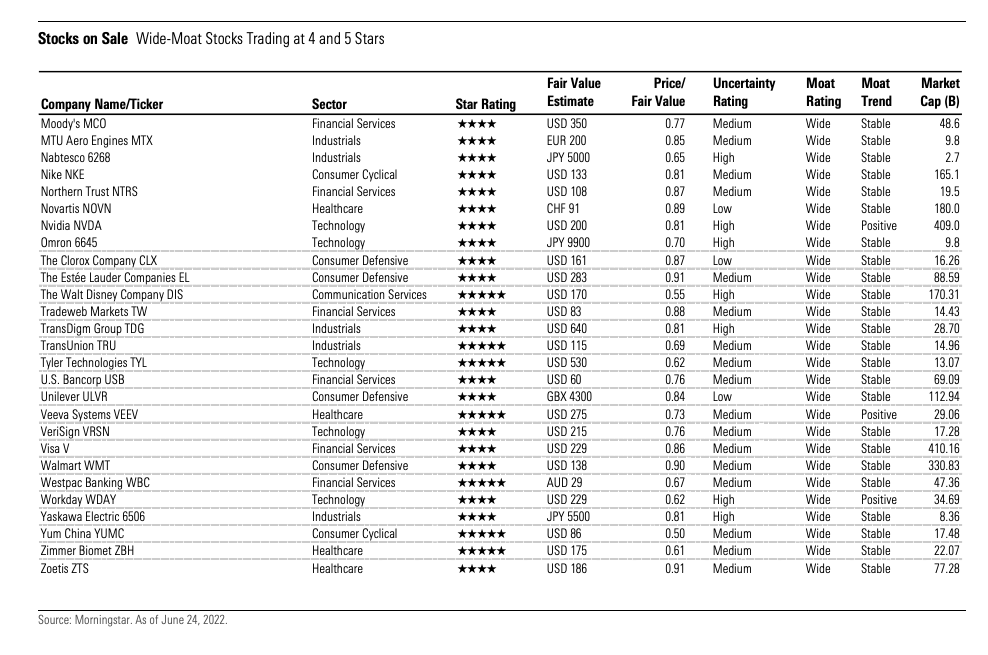

Wasn't INTC Bruce's favorite investment and example of a company having a moat 10-15 years ago? Morningstar also has an opinion on moats:

-

I have tried to buy and hold small positions in STNE, ANGI, RDFN, OPEN, Z, and some other tech stocks this year, but exited quickly every time. Still holding on to one share of UPST. #neversell Even sold most of my META shares. Wake me up when it's time to buy tech stocks again.

-

Seems like a small issue. One of the VIC write-ups had this to say about ICE revenue composition: 35%: Market data (pricing & analytics, exchange data feeds, etc.) 27%: Derivatives trading & clearing (Brent oil and other energy futures, agricultural and metals futures, European interest rate futures, etc.) 10%: Transaction-based mortgage revenues (Ellie Mae, MERS, and Simplifile revenues tied to mortgage volumes) 7%: Recurring mortgage revenues (Ellie Mae subscription revenues not tied to mortgage volumes)

-

ICE

-

Movies and TV shows (general recommendation thread)

formthirteen replied to Liberty's topic in General Discussion

Black Bird on Apple TV is great. One of Ray Liotta's last roles, RIP. -

As a not-yet-retired five-star armchair general with combat experience from Desert Storm and later wars, my prediction is that Nancy just pulled the rug out from under Xi and China. Nobody (I) will be able to trust or respect a leader that is upset over visitors to a neighboring country. Oh wait, VIX still at 23.93. Forget what I said.

-

OPEN, RDFN, and Z. Not an endorsement of any one of them.

-

I like philosophical questions... He destroyed the Facebook brand. Hence the rebrand to Meta. Their websites and apps Zuck from a UX point of view. I don't think the organization can build new products so he should just buy something. The government doesn't like Meta: https://www.forbes.com/sites/alisondurkee/2022/07/27/ftc-sues-meta-to-block-acquisition-of-vr-company-within/ He should do something about that. Maybe resign. Not that any of this matters. FCF after SBC etc matters. Zuck is doing quite well there but getting worse.