-

Posts

4,795 -

Joined

-

Last visited

-

Days Won

13

Content Type

Profiles

Forums

Events

Posts posted by John Hjorth

-

-

18 hours ago, Gmthebeau said:

Never heard of this guy, but a search on the internet seems to reveal he has totally blown up multiple times. ...

Well @Gmthebeau,

Harris Kupperman is what he is, with his 'corner' at the Praetorian Capital website, his Twitter account, with among other things photos from his finca, and all that, 'finca' in Spanish simpy translates to English by 'property'.

Source[s] for the above?

-

I hope you like it and that you are satisfied with the quality, when it arrives, for your personal skeptical inspection and scrutiny.

I think I was if I remember correctly for both my orders charged USD 30 per copy plus freight back then some years ago [2016 or 2017?].

I was initially personally highly skeptical towards this 'print on demand' concept used at lulu.com, ['never tried it before' + 'old conservative bugger'] but ended up very surprised - in a positive way! - at delivery of the first one copy-order.

-

4 hours ago, nwoodman said:

and they kept going up

Well, @nwoodman,

-So he is averaging up, also think about what he has not only said, but actually written about allocating capital to your 5th or 10th best ideas in the 1993 Letter, now using basket approach of 5, and now also implementing leverage

[J/K, actually! - It all relative ..., among other things to who you are and what you are working / operating with! - Situational flexibility!]

-

Much in line with the last post by @gfp above :

-

42 minutes ago, ValueArb said:

You can't spend what you don't have and you can't build what you can't make. Where are they going to get all the washing machines they need to strip for military CPUs?

Secondly, how long can Russia devote such a huge amount of their GDP to military spending without shrinking the economy and triggering internal unrest?

Denmark, Sunday : "Connected, commited, for the Kingdom of Denmark!",

Russia, Sunday :"Connected, commited, for Putin!".

The man does not give a damn about the people of Russia, his people.

-

37 minutes ago, ValueArb said:

... My point on Russia is they are trapped, and we should not let them out of the trap. The fact they have a tiny GDP is important because it means that replacing the military equipment they are losing (esp. the most advanced) will take them years, if not decades. ...

Reuters [27 November 2023] : Putin approves big military spending hikes for Russia's budget.

QuoteMOSCOW, Nov 27 (Reuters) - Russian President Vladimir Putin gave his official approval to a significant increase in military spending that will see around 30% of fiscal expenditure directed towards the armed forces in 2024 as he signed draft budget plans into law on Monday.Moscow is diverting ever more resources towards prosecuting its war in Ukraine. Spending on defence and security combined is set to reach around 40% of all budget expenditure next year.Spending on defence is set to increase by almost 70% in 2024 from 2023.Russia has an ambitious 2024 revenue target of 35.1 trillion roubles ($391.2 billion) next year, a 22.3% planned increase year-on-year, based on assumptions of high oil prices. Analysts say the government may be forced to hike business taxes if those assumptions should prove optimistic.The budget plans had already been approved by lawmakers in both houses of parliament, the State Duma and Federation Council.So a budget shock, and balance based on expections of continued high oil prices. [Not mentioned, but plan B : To tax the hell out of the businesses owned by the oligarchs ! [because there are no money other places] ... wonderful - just wonderfull!]]

-

-

-

Thanks @gfp,

So this ended up exactly according to your expressed and expected playbook, ref. one of your earlier posts here on CoBF about it.

All good.

-

Ordered this book today, based on that it is mentioned in Howard Marks latest memo : Easy Money in a positive way.

-

7 hours ago, Luca said:

Thanks for sharing John, it surely is a bedrock of a company. Id also put it on my 30 year list, including Exor.

Thank you, @Luca,

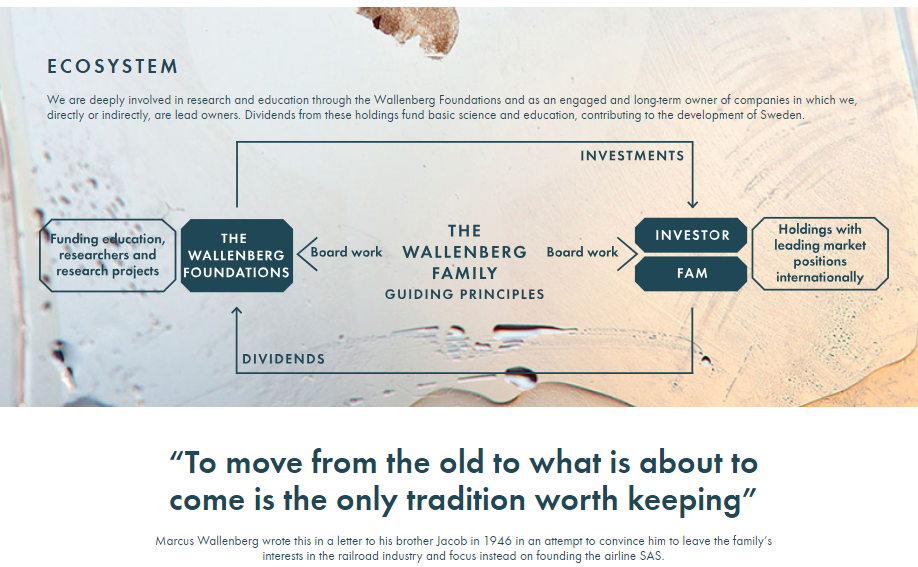

It was actually not so much - here, in this context - about Investor AB as such, but more about the overall mindset at Investor for how to choose [pick], invest in and run businesses. As shown by me above, the particular mindset was first crystalized in writing in 1946 at Investor AB, and still saturates everything there.

Another way to phrase it conceptually is the following :

"Stagnation is not stagnation - stagnation is regression"

"'Good' is the worst enemy of the great company"

Long term it is more about quality and growth than price [paid], @Spekulatius wrote in a post upstream. I don't think anyone here on CoBF would disagree with that.

It is about a business simply breaking the 'usual business life cycle' to stay alive and also prosper and staying relevant going forward, no matter its age, instead of it to die. On the rim, it's about staying relevant due to innovation and development by investments in the future. Such businesses actually aren't few, nor seldom. They're just about everywhere. The World is actually stuffed with them. We just need to find them and pick them, carefully, to our best [not easy!] avoiding loosers and laggards.

Mr. Buffett in his 50 years anniversary Berkshire letter from 2014 calls such a good company 'sprawling', and calls Berkshire sprawling, too, in that letter.

Personally, It think we have quite some fairly young CoBF members by now who have the potential to take this really far for themselves, if they early on get it right and don't become subscription paying members of the foolish crowd by avoiding and stearing clear of serious and material mistakes early on, ref. the basics of compounding.

-

1

1

-

-

1 hour ago, Spekulatius said:

Current valuations a actually should not matter that much over a 30 year period, it all about growth and longevity.

Personally, I think the right answer over such a period is to buy and index or something that is likely to renew itself over time. The reason why I think renewal is critical is because the future over such a long period like 30 years is unknowable. my concern with some time like Berkshire is that the leadership as we know it will be gone (even Abel is not going to hang around that long) and they also have the coffee can approach which could end up burdening Berkshire with a lot of deadwood, unless they start to dump some business or spin them off over time.

So my choice would be QQQ, or SPY or perhaps something like Investor AB or Exor which is designed as a Holdco and probably will refresh their holdings over time.

I think some structural advantaged business like Railroads could work too, because I don’t think they will be disrupted in the next 30 years.

I think the nifty fifty have

Thank you, @Spekulatius,

This is to me personally just such an awesome post of yours, - as already mentioned, in my personal opinion.

It basically isen't about names & tickers, but more about principles, basic criterias and considerations from which to specifically allocate capital to names, companies & groups, based on their respective modus operandis. And we should discuss exactly that in this topic in stead of, picking names or tickers with no reason or overall rationale mentioned to supporting it.

For Investor AB [, Sweden] :

English :

Swedish :

The Wallenberg family isen't wealthy as such in private, because pretty much all fortunes built over time has gradually been given to foundations, while the mantra for the family is - it's obsessed with it :

"To move from the old to what is about to come is the only tradition worth keeping."

-

1

1

-

-

-

12 minutes ago, Cevian said:

I write as someone who is looking at his Russian sanctioned shares (Lukoil, Gazprom, Sberbank, etc.), purchased at incredible valuations but now sitting in frozen accounts with regular emails from brokers asking me to move the positions which no one wants to custody. The interesting part is that all of these positions have large unrealised gains when looking at Moscow exchange prices.

BTW, I'm a sucker for deals so I'm long BABA/TCEHY and they are a large part of the portfolio. I never learn I guess.

#metoo.

I have moved all that trash / breadcrumbs for a few family members to a taxable account of mine personally, containing such stuff, to avoid *noise* intrafamily.

Luckily all minors, not much above trackers. What still strikes me is, that these losses are caused by sanctions imposed by the West, not Putin & Co. in his ongoing doings related to warfare. *sigh*. No PTSD over the loss, though. Just move on, and something learned.

-

-

3 minutes ago, RedLion said:

... I think our bigger problem right now is that the entire younger generation want to be influencers rather than pickup any of the highly paid trades right in front of them. ...

@RedLion, this one is almost killing me!

- Here you have the palmes for the post of this week :

- Here you have the palmes for the post of this week :

-

-

1

1

-

-

Thank you for sharing, Tilman [ @ebdem ] !

-

7 minutes ago, longterminvestor said:

Basis is the transactions that have been done over the last 15years in the US market.

Thanks, @longterminvestor,

There exists a world outside the US. And there is a lot money to be made there.

-

It's not even a joke [, naturally depending on ones actual mood].

- - - o 0 o - - -

Next thing is that I'll have to dig up the story behind the phrase 'Die dumme Dänen'.

-

2 hours ago, longterminvestor said:

I have thought deeply about future of large acquisitions. There is a market for businesses in size, it does exist, maybe less in terms of "businesses inside circle of competence", however market for the type of owner/the people who control those businesses is different today than 30 years ago. The elephants are out there, just the incentives have changed for the people that own them. There are far fewer Al Ueltschi's (Flight Safety) , Mrs. B's (Nebraska Furniture Mart) , Clayton Family (Clayton Homes), and Paul Andrew's (TTI) today - to name a select few. I believe Mr. Buffett used to tell Paul Andrews that his executive comp was too low, and Andrews used to say "We can talk about that next year Warren". These people cared about their companies, their employees, and the legacy mattered. Today, the legacy is how much can I get? And the "I" is not the founding family, the "I" is the PE firm that levered the business and needs to transact for the fees and "fund performance". The sellers incentives have changed. People are scared to do "deals on a hand shake" today - the attorney wont allow it (no fees!). For the select few that still do, Berkshire is a permanent home. And Berkshire will see some deals in the future, it will happen – just gotta be patient.

Similar issue has occurred in the large insurance placements (what was once called "super cat" business) where there was once ready market and now the moat has deteriorated. There was a time where large limits could only be put up by 1 or 2 players (AIG/Berkshire) - getting multiple insurance companies to take slices of risk quickly was difficult. That moat has eroded today with technology, spreadsheets, ease of transferring large amounts of PML data and getting layered deals much much faster in consortiums.

Where Berkshire was once a home for big insurance and big businesses, things are changing. Berkshire rode the wave to where it is today. There was a time when Berkshire was manufacturing textiles....became a dinosaur. I have opened my eyes to the fact that Berkshire may have to pivot to new businesses/models/opportunities in a similar fashion that Berkshire left textiles for insurance. Do not know what that iteration looks like but I am open to it because of the culture inside the enterprise. I think on iteration that has occurred is Berkshire moonlights as a “Merchant Bank” franchise. Mr. Buffett can throw down billions fast with no strings and extract his terms.

Regarding Pilot lawsuit, things are not always complete bliss in Omaha even with a Mrs. B for example. Mrs. B never sued, but she was disgruntled. Reports were she was unhappy with grandsons but who really knows. She left to start her own shop down the street that quickly grew to be #3 seller of carpet in Nebraska in a few short years. Mr. Buffett and Mrs. B did kiss and make up, the business was eventually purchased by Berkshire. Things happen - Mr. Abel will deal with them moving forward.

What is your geographical scope and / or basis for your considerations above?

-

Terry Smiths track record is indeed quite impressive. Almost by coincidence a few years ago [likely by looking at Dataroma, I think], I found out, that I had a sweet tooth for the same things as Mr. Smith.

One can read his stuff on and on. [Personally I'm still doing it.]

But no matter how you process his stuff and think about it, my observations are as follows :

1. Never any specific talk about new additions, untill they already are built to wanted /desired size, &

2. No tangible and / or specific comments related to what may have gotten the boot out of the boat [<- I'm not totally sure about the 'No' [ever] here, it may be incorrect, or just inaccurate.]

- - - o 0 o - - -

No matter how ones modus operandi or ones investment style, stock picking isen't an easy, nor trivial, thing.

Mr. Smith appears to have found his way forward. He has so far been damn good at doing what he says he's doing. [This label is certainly available for every money manager, for a variety of reasons.]

-

Now I'll stop derailing this topic from its purpose by intent of the topic starter [Greg [ @Gregmal ]], and start brewing on a new topic about the major Canadian banks, for separate discussion of them there.

-

Thank you for sharing, @ICUMD & @KJP,

For starters - related to large Canadian banks -, I'll try to find if there already exist separate topics for and about them individually in the Investment Ideas forum here on CoBF.

- - - o 0 o - - -

Just a personal comment here about taxes on dividends from North American banks - both Canadian and US banks : I get credit releif for withheld dividend taxes on dividends in both Canada and in US by the calculation of my local Danish taxes on dividend income in both taxable and tax deferred accounts, so I do not personally have any issues [tax leak] with withheld canadian dividend taxes.

Kuppy on Inflation

in General Discussion

Posted

@Gmthebeau,

Peace.

- But in my personal opinion - going forward here on CoBF, I think we all need to think about to be very specific [and careful] about very negative statements [here, in casu, such as yours, like "blown up multiple times" [you haven't posted even evidience here] and the likes], unless you can provide specific evidence and on a very specific level substanciate your findings, naturally according to what you're posting.

If you are expressing your personal opinions in writing here on CoBF, it's not a bad idea also just to write about the causes / basis you are opinionated about that particular matter, and your reason behind your why!