-

Posts

302 -

Joined

-

Last visited

longterminvestor's Achievements

-

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Headline: Marsh Buys McGriff (ACTUAL STORY-MIDDLE MARKET IS WHERE THE MONEY IS) FACTS ON WHAT IS HAPPENED: Stonepoint Investment Group purchased Truist Insurance Holdings (TIH) with an implied value at $15.5B – deal was closed May 7th 2024 – it was an ALL CASH transaction which McGriff was the “retail facing brand” inside TIH who is a “middle market agency”. Stonepoint Investor Group players to include: United Arab Emirates’ Sovereign Wealth Fund named “Mubadala Investment Company” & other PE name Clayton Dubilier & Rice. Enter Big Daddy Marsh using their middle market brand Marsh McLennan Agency (MMA) to buy McGriff for $7.75B IN CASH 6 MONTHS LATER?!? – EXACTLY 50% of the value of Truist Holdings deal previously closed. This takes 50% of the implied value out of the Truist Holdings deal. I mean, imagine being a producer at McGriff right now, their heads must be spinning. Marsh needed a big uppercut to AON after their purchase of NFP, which was AON’s entrance into true middle market. MY OPINION: If ultimate goal of Stonepoint Investor Group is to IPO this thing, why sell off the retail facing piece? If the deals are all cash, there are no issues with debt, why not just keep the retail facing business inside? 2 ideas I have: #1 Gotta be transactional fees/fees/fees for the funds incentivized to “do deals” and #2 – Stonepoint may have gotten VERY expensive debt on the backend and needed to pay it off fast….only 2 conclusions I have at this time. This transaction cements my feelings towards the short/medium/long term outlook for Middle Market Brokers (BRO is the best of the lot). For many years they have stayed under the radar in middle market allowing the big 5 to chase after each other for the Fortune 500. The secret of middle market is no longer a secret. Everyone figured it out, PE backed brokers, Big 5, and others know the institutional accounts are a race to the bottom comp wise so now the big broker cohort has turned their cannons to the “middle market” which BRO/other middle market specialists have been feasting on for years. Short term BRO and other middle market brokers are fine, medium/long term they will face increased competition for accounts as the big brokers deploy sales force to take their biz/future biz. Marsh McLennan to acquire McGriff Insurance Services _ MMA.pdf -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

TWFG (The Woodlands Financial Group) – it’s a Personal Lines outfit I have built this mental model in my head for competitors in a certain class of business, I am always looking for the dual monopoly, for example there is “a Coke” and “a Pepsi” and then everyone else. If Goosehead is Coke, then TWFG is Pepsi. The metaphor is for when a business model works, there will be a competitor. The metaphor is not to compare financial staying power/market dominance of a Coke/Pepsi debate. TWFG does do commercial insurance where Goosehead is strictly Personal Lines. TWFG is based in Texas, so is Goosehead. TWFG, founded by Richard “Gordy” Bunch, III. $180M topline revenue in 2023. The revenue comes from “Agencies in a Box” Captive Agencies, MGA’s (captive to TWFG and sell to non-TWFG agents), “independent branches”, and corporate branches. With over 400 Agencies in a box representing 77% of revenue and 14 Corporate Branches representing 4% of revenue and 2 MGA’s representing roughly 18% of revenue (over 2000 appointed agencies with TWFG’s owned MGA facility). Average commission for TWFG on a deal is 12% - fine/solid – could be cut or could grow. TWFG has pre-set calculation to buy agency in a box and become a corp branch. Has done this in the past. Branches over $1M revenue and geographically desired could be a target. TWFG does not bear expense of running the branches but sends the revenue to them. Seems like each branch has a direct split bases on (taken from S-1):“Unlike some other insurance distribution models, the operating costs incurred by our Branches do not transfer to TWFG. Instead, we receive all commission revenue and subsequently pay and record a commission expense to each Branch based on the relevant exclusive Branch agreement”. The Parent company retains 20% of revenue and cedes 80% to branch. Found this language interesting in S-1: Exclusive Branch agreements We enter into exclusive Branch agreements with our Branches under which the Branch operates as an independent contractor. TWFG receives 100% of the commission revenue on the Branch’s Book of Business that is paid by the insurance carriers and typically remits 80% of the commission revenue to the Branch, while typically retaining 20%of the commission revenue and 100% of all contingency commission revenue. The Branches are responsible for all of their operating costs, including fees for technology, E&O premiums and other services charged by us. The exclusive Branch agreement requires the Branch to exclusively sell insurance products through TWFG’s insurance carrier relationships. Our exclusive Branch agreements are straight-forward and written in plain English. When the Branch reaches a minimum term and threshold of commission revenue, the Branch is granted the right to require TWFG to purchase the Branch’s Book of Business upon termination of the Branch agreement at a negotiated price. The Branch agreement remains in force indefinitely, unless earlier terminated by either party with 30 days advance notice or immediately by TWFG in the case of fraud, bankruptcy, death and other events. Upon termination of the Branch agreement, the Branch must sell its Book of Business related to P&C products to TWFG or another TWFG-approved Branch at an agreed upon valuation, or if the parties cannot agree, at a valuation determined by independent appraisal. TWFG also has a right of first refusal on any proposed sale of the Branch to a third party. Our Branch agreements require confidentiality of all Client information and include Client non-solicitation clauses that generally stay in effect for two years following termination of the Branch agreement and our purchase of the Branch’s Book of Business. Within TWFG’s product offerings, each Branch may utilize the products that best serve its Clients. Branch principals also have a high degree of autonomy in which to operate their business and expand their footprint. Branches use our comprehensive technology and agency management system, benefiting from enterprise group rates that we believe are typically lower than agents would receive on their own or from leading agency management system vendors. Branches also participate in TWFG’s group professional liability E&O insurance policy, benefiting from a reduced group rate, as TWFG passes these savings on to our Branches. TWFG is jumping on the dislocation of insurance agencies in the small business/personal lines marketplace. TWFG has GREATLY benefited from the hard market and wondering if the growth they have had in the past is sustainable. People shop when they get non-renewed, canceled, price increases significantly, ect. That’s been happening a lot in the past 3 years, if the insurance market stabilizes, wonder if TWFG (or Goosehead as well) will get the looks on accounts like they have over the past 3 years. TWFG has scale now so total destruction is not what I am talking about, its just can it grow in the same manner it has for the previous few years. A bet on TWFG is a bet on Gordy – he controls the business with 3 classes of shareholder stock. It is profitable (I’m shocked). Same Up-C, Tax Receivable Agreement as Baldwin. I guess TRA’s are socially acceptable now. At 40X earnings, its pricey for me – however people like Goosehead at 49X earnings. I will be watching it. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

little chatter on AJG. vid starts there. its not that long but wanted to keep the thread alive. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

@dwy000 - "why the brokers are worth so much of the industry vs the companies actually providing the underlying product?" I asked this same question in previous posts with "what other business models are like this?" - Closest thing I can find is mutual fund sales but now have been obliterated with indexes/ETF's, I guess now that I am thinking about it 2 & 20 as a hedge fund seems pretty close if not exactly what I am asking for! I still search for other PUBLIC business models where these super interesting market dynamics are in play. (Help! - want to find!!!). Here is my answer knowing my incentives as a broker are highly aligned to brokers staying at the top of the insurance food chain: Simple, better business model with reduced volatility. No capital required to run the broker business. Brokers own the client relationship. Look at attached 2013 McKinsey write up where "smart money" explains the carriers want to kill off the brokers and now 11 years later, the brokers have only grown their businesses. If insurance is the toll road of the American economy, brokers take their percentage of the tolls collected and do not have to put down any capital to build the roads. In the office we have been talking about relating to selling an account as an act of magic. It really is magic, your phone rings, you take some notes, call some underwriters, fill out some paper work, get quotes, present your deal, get the order to bind, and boom - you get a check for $100 or $1,000 or $10,000 or $100,000 or more! and the only risk is losing the client (they could sue you, and clients do, but lets say they just leave and go buy elsewhere). The insurance marketplace system is set up so carriers pay brokers for market access to take risk such that carriers get an upfront premium today in exchange for a promise to pay a claim tomorrow. The buyer is reducing/eliminating balance sheet risk with a 1 time, fixed premium expense - and they have to re-up in a year - incredible! Its the carriers who want access to the market of broker represented buyers (insureds) where high commissions/low premiums drive flow into particular markets. The extra pleasures of the model are the contingents, bonus payouts on loss ratios, guaranteed supplemental commissions, and more. If insurance companies decided tomorrow to kill off all broker relationships and said "we will only talk to clients, no brokers allowed", the buyers (smart buyers, not all buyers are smart) would pay an insurance expert for negotiation/terms/conditions/fees/language to advise the buyers on the trade and would gladly pay a fee for service directly to the broker, separate and apart from any premium paid to a carrier. The premiums (and ensuing commissions) on the small, middle market, large commercial transactions (where the money is) are paid with corporate, untaxed dollars. Its monopoly money. Buyers want rock solid contracts transferring balance sheet risk to insurance market while demanding excellence from their insurance broker to curate such contracts. The dynamics are awesome. Mr. Buffett has told us, "If you are willing to do dumb things in insurance, the world will find you. You can be in a rowboat in the middle of the Atlantic and just whisper out, “I’m willing to write this,” and then name a dumb price, and you will have brokers swimming to you, with their fins showing, incidentally. It is brutal. I mean, if you are willing to do dumb things, there are people out there, and it’s understandable. But they will find you, and you will get the cash up front. You will see a lot of cash and you won’t see any losses, and you’ll keep doing it because you won’t see any losses for a little while. So you’ll keep taking on more and more of this, you know, and then the roof will fall in." That should tell you all you need to know what brokers are willing to do, (Mr. Buffett started with "the world will find you" along the lines of "Praise by name, criticize by category", there's almost a slip of the tongue when Mr. Buffett names brokers later). The insurance companies seem pretty sure about what they are doing (they hope anyway, gulp) and they also know brokers are grease that make the wheels of risk turn. INSURANCE NERD ALERT, if a retail carrier has a fixed deductible on a reinsurance deal with unlimited ceded risk, then its the reinsurer thats stupid, not the retail insurer. People will do dumb things in all businesses, its the brokers job to find the dumb insurance company who whispers a stupid price and bind it for the brokers client. Here is the video with quote (incidentally BILL ACKMAN asked the question): agents_of_the_future_the_evolution_of_property_and_casualty_insurance_distribution.pdf -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

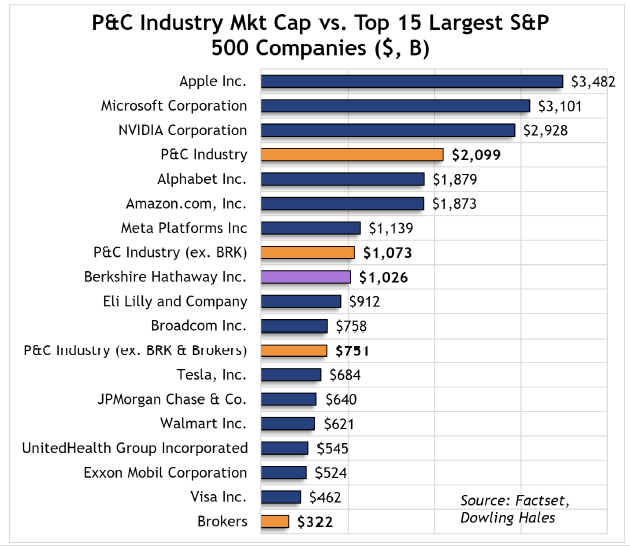

Market cap is market cap so would not include mutuals (which really only have value if they are de-mutualized and converted to stock). State Farm and Liberty are mutuals, Axa and Allianz are publicly traded in Europe. Lloyds is tough to value. Just saw the chart and thought I would share. and my math was right, I guess the rounding or something didn't work on the chart. makes me want to distrust the chart more. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Pretty incredible. Didn't know where to post, here or the Berkshire threads. This chart says the entire P&C market is $2.1T including Berkshire @ $1Tish. The entire P&C market excluding brokers & BRK is $751B. Putting Brokers at $275B. So the entire industry is worth $2.1T and a significant part of the value of the industry comes from brokers valued at call it 10% of the industry. Found that to be awesome and wanted to share. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Amazon threat to Duracell and other Berkshire brands

longterminvestor replied to LongTermView's topic in Berkshire Hathaway

I saw that too! Instead of taking your tack on it being out of date, I was thinking "hhmmm, someone at headquarters gave us their thoughts on the intrinsic valuation of just the hold co not including the subsidiaries...." Only a Berkshire shareholder can appreciate both sides of that coin, and the humor in them. Here here for $1T, lets go for $2T! -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Amazon threat to Duracell and other Berkshire brands

longterminvestor replied to LongTermView's topic in Berkshire Hathaway

Duracell Expands Portable Power Lineup With New Offerings 09:03:00 AM ET, 08/26/2024 - Business Wire The new M100 Portable Charging Hub, G-Series Portable Power Stations, and M-Solar Panel offer flexible power solutions for every aspect of life - at home or on the go! BETHEL, Conn.--(BUSINESS WIRE)--Aug. 26, 2024--Duracell, the #1 trusted battery brand, today announced the new M100 Portable Charging Hub, an everyday power companion for people who want to live a fully charged life untethered from the wall. The M100 keeps phones, tablets, earbuds, and other small devices charged and ready to go wherever life takes you. Staying connected — and fully powered — has never been easier. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240826926648/en/ The new Duracell M100 Portable Charging Hub, an everyday power companion for people who live a fully charged life untethered from the wall (Photo: Business Wire) Lightweight and compact, the M100 weighs in at just over one pound and features a tiltable lid with magnetic charging that allows users to position their phone at the ideal angle for taking video calls or consuming content hands free. A second charging platform underneath the lid allows for two devices (e.g., earbuds and a phone) to wirelessly charge simultaneously. Smaller in size than Duracell’s other power products, the M100 Charging Hub offers the same powerful flexibility and stylish design that users have come to know from the M150 Portable Charging Hub and M250 Portable Charging Hub Duracell launched in 2023. “Small portable devices are at the center of every aspect of people’s lives — from work to play — and the need to have an agile power solution to charge on the go and around the house is more important than ever,” said Richard Wessler, General Manager, Power Stations at Duracell. “The Duracell M100 Charging Hub helps users enhance the power of their homes and offers them the versatility to power their passions whenever and wherever they need.” With a low profile and sleek look, Duracell’s included M-Dock is discreet enough to keep in your home on your kitchen counter, bedside nightstand, living room end table or shelves, so the M100 Charging Hub is fully charged and ready when you need extra power. In addition to the charging dock, users have the option to charge the M100 with a standard USB-C cable or with the new M-Solar Panel, perfect for recharging the device while away from home. The Duracell M100 Portable Charging Hub will fully charge in approximately three hours and joins the other M-Series Charging Hubs available at PowerStations.Duracell.com for $99.00. For those looking for more power without losing any of the distinct Duracell style, the M150 Portable Charging Hub offers 150 watts of power and four charging ports, charges in three hours and is available for $139.00. The M250 Portable Charging Hub, with 250 watts of portable power, an AC adapter port to charge larger devices and a charging time of approximately five and a half hours, is available for $199.00. The new M-Solar Panel is a convenient way to charge the M100, M150 or M250 charging hubs when not near a power source, like a wall or car outlet. The lightweight solar panel is easy to fold and transport, making it an easy option for users on the go. For those who need even more power, Duracell is also launching the G-Series Portable Power Stations lineup, including the G350 and the G800. Thoughtfully designed for families with an appetite for the outdoors, the G-Series units are outfitted with a lightweight charging cable that can be stored in the unit and can be used as an extension cord. The G-Series units can also charge with any standard extension cord, if needed. With a 360-degree lantern light, a five-color intuitive built-in display, and a soft grip handle for an easy and comfortable carry, power station lovers can rely on the G-series for supercharged outdoor adventures all year long. Fully charged in just four and half hours — and with two AC Ports (350W each; 2 ports share a total of 350W), three USB-A ports (3 ports share a total of 7.2A), and one USB-C port (100W output) — the G350 can power string lights, speakers, fans, drones, mini coolers, computers, tablets, phones, fans, and other devices to enhance gatherings with family and friends. When life calls for more, the Duracell G800 Power Station answers. While it can handle the same small electronics as the G350, the G800 can also power more intensive devices such as most slow cookers and CPAP machines and can also be used for emergency home backup. The G800 includes two charging speeds — fast charge and quiet cool, which extends battery life and make the G800 Power Station much quieter than traditional generators. Power is provided through three AC ports (800W per port, three ports share total 800W), three USB-A ports (three ports share total of 7.2A), two USB-C ports (100W output per port, total 200W), and car charger output of 120W max. Both G-Series Power Stations can also be charged with the G-Solar Panel, a 100W solar panel. Just unfold it, connect it to a Duracell G-Series power station and point it at the sun to access clean and reliable power. In full sun, the G-Solar Panel will fully recharge the G350 in five to eight hours and the G800 in 10-12 hours. For more information on the next generation of portable power, please visit powerstations.duracell.com. About Duracell: The Duracell brand and company was acquired by Berkshire Hathaway Inc. (NYSE-BRK.A, BRK.B) in 2016 and the iconic brand is known to the world over. Our products serve as the heart of devices that keep people connected, protect their families, entertain them, and simplify their increasingly mobile lifestyles. Berkshire Hathaway Inc. is a $250B holding company owning subsidiaries that engage in diverse business activities. Visit www.duracell.com for more information; follow us on TikTok, X (Twitter), Instagram and like us on Facebook. View source version on businesswire.com: https://www.businesswire.com/news/home/20240826926648/en/ duracellmedia@citizenrelations.com Source: Duracell -

It will commoditize the product even more so. Independent agents throw the insured, client, prospect information into a rater (its like a website for agents that provide quotes for every market with a couple clicks) and then chose to present which options are "competitive". Competitive is relative because sometimes broker may chose to only present the highest commission option to client or in turn the lowest premium - you have to trust the broker. Years ago when PGR set up the direct channel it scared alot of agents - big brother is gonna steal "our clients". Yes that did happen however the true "shoppers" will always want to go direct - they enjoy shopping. Its like a game. So agents were able to cull the heard for the clients that were wasting their time anyway. However clients who want advisory services from a broker will take the brokers advice and no need to shop the market now that a broker can bring GEICO to the table. Before, agents would look at a new client who was with State Farm lets say, and quote with Progressive, Travelers, Liberty, and a host of others. If the client wants to ensure absolute best pricing, they would have to, in addition to getting their renewal from State Farm, call All State, Farmers, Erie, and GEICO, take all those quotes retrieved individually and compare with what the independent agent channel provided and make a decision. THATS A TON OF WORK to do every 6 months to ensure best price. Now, its one less call because GEICO will be apart of the independent channel - IF THEIR agent has a contract with GEICO. The actual coverage is really not an issue with personal auto - the policies are so highly regulated by individual state insurance commissioners that they basically read the same. Talking actual contractual language, sure, you can include rental reimbursement, med pay, lower/higher limits - that's not the contract - those are just limits/coverages available - and all carriers have those options. So an independent agent is not have to explain the mechanics of the policy triggers for personal auto - its really just price (and commish...heheh).

-

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Only place in risk bearing vertical I can think BRK not materially present is the fronting model (Trisura - publicly traded in Canada, State National which is Markel, there are some others) - which is the sexy vertical. Do not see BRK fronting deals as a business. BRK being the deepest pocket and courts would make BRK pay even if there was not a financial default. Fronting kinda goes against the principals of Mr. Buffett as well - its insurance bearding. They may some some on the books but have not seen Berkshire market fronting as a business like others. Mr. Buffett has steered away from writing Homeowners policies as well. They do it but not at scale. He is quoted as saying the base policy Homeowners limits are deceiving (in favor of insured, not the insurance company). If you take all HO policy limits including all the coverage extensions with state mandatory endorsements - the risk per policy is too large to support paltry premium ergo not a profitable enterprise. I agree by the way. Mr. Jain has also said Cyber Liability is of no interest and thats all the rage today for growth, growth, growth. Good news for Berkshire is rise and marketability of Excess & Surplus Lines insurance brought by wholesale brokerage will bring more unique risks (agnostic to line of business) to Berkshire's table without having to spin up new subsidiaries/change in model, Berkshire gets to just sit back and have brokers serve up deal after deal and wait for Berkshire's price to hit the bid. -

Dont need to buy PGR, just need to "clone" PGR. GEICO is starting to use independent agents to sell their products. HUGE sea change for GEICO. PGR has proven a direct channel and a brokerage channel works becoming #1 or #2 in every market. Mr. Buffett has championed GEICO's no broker commission moat since before I was born however GEICO is now investing in a new model and excited to see how this play out. Prediction is it works fine and GEICO gets back on track. GEICO using agents is slowly starting to hit the news, product has not rolled out in my market. Our agency is getting contract with them so will now be able to offer PGR and GEICO - may the best price win - consumer wins.

-

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Blaspheme for Berkshire owners to be talking about stock splitting (haha) - of any equity BRK.A or otherwise. I do understand why BRK.B has split over time and there were valid reasons each time - one being the Burlington transaction. Splitting stocks is for promoters. Used to help retail stock salesman make more brokerage commission, now comes in the form of payment for order flow from Robin Hood/Schwab. One could make argument for management if you want to buy a lot of stock back, splitting will create more liquidity. I just don't know enough to fully unpack stock splits but curious if others have more insight. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

-

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Will take a all these into one post. Game within the game: clients (and slick brokers) play with exposures to "keep premium" low - its 1 function of the 2 part equation. Clients do it cause no one has explained rate X exposure conversation or they are "cheating the system". Carriers see it too cause multiple brokers will submit the same account with different exposures "to get premium down" (imagine that? HA!) For example, slick brokers cheat by dumping the exposure estimates to get premium down when clients shop and then client figures it out 15 months after they renewed TWICE during the audit for the previous term. So imagine that, broker dumps exposures to "save account", client is happy cause premium is low, then 12 months later, client renews, then 3 months after that they get an audit notice about the policy term 2 years ago. seen it many times. Happens less with sophisticated clients because they understand the game. Some policies are "non-auditable" - those are gold for clients! Any prediction about rate environment is the same exact thing as predicting interest rates. do you have a gut feel? maybe but no one knows. its a market based system where new carrier comes into a class to "buy accounts" and drives pricing down, that's also called new capacity to the market. Inverse is when capacity leaves the market, "lots of buyers, no sellers" ie Hard Market. Same philosophy with exposure units. Its based on economy or accounts. If a broker only has Contractor accounts in their surrounding area, drywall guys, roofers, concrete guys, stucco guys, framers, carpenters, and plumbers/electricians who service new construction and that region has Toll Brothers or Lennar dumping money into new builds, all those accounts will have huge jumps in exposures and premiums will be up big. Conversely, if Toll Brothers/Lennar shut off new builds for 18 months, those exposure units will fall off cliff and all clients premiums will be down to peanuts for that broker. Broker will be renewing the same accounts just at 1/10th the price because the contractor has laid off staff and skinned down the business. Again, economy might be doing fine and booming in other areas however that brokers book is tied to construction in that area - so they are gonna be hurting until construction comes back or that broker figures out how to go after other classes of business. Think all brokers who have specializations - one might be 100% cannabis niche - that was a move for a while but now seems like its dried up (basically just like capital chasing those classes of business for investment). AJG has a policy NO CANNABIS accounts - acts kinda like big banks who wont open bank accounts for cannabis. Back in 2008-2009 Brown got a boast from Wall Street because of the Proctor business (insures bank owned property) - wall street called it "counter cyclical" so while Brown was seeing red, Proctor was booming inside Brown! Broker book makeup, how diverse or how niched, VERY much goes into valuation of the business from an acquisition standpoint. Also the carrier diversification, kinda like putting all eggs in one basket. If that carrier gets downgraded, broker will have to move all the accounts to new markets and that takes time/effort/energy. Look at US Assure business that RYAN bought, its very much a niche business however its SO NICHE that it gets a boast in valuation. And its all written up with Zurich. You might think it would get dinged but no, because its so niched and engrained in how people buy, they basically own the vertical they are in - call it a moat. They get a boast in multiple. If both Rate/Exposure go down, only way for broker to stay flat revenue wise would be to sell NET NEW accounts - take an account from someone else. There really is not a disclosure for NET NEW with public brokers - they all track internally but don't share. Just look at the brokers revenues for 2008-2009-2010, they are flat to down. Again, no reason to speculate where market will be - if i knew, I would not tell you, I would tell clients and I would be a god of insurance. No one knows, they say they do but the don't. Lets say an AON or Marsh knew, then they would just tell carriers/clients and AON/Marsh would insure the world, and they defiantly do not (they think they do ). The key to being a good broker is to be an advisor to client and help them manage their balance sheet risk with risk transfer insurance that will be there when they need it. Don't be a transactional broker, be trustworthy and clients will stay. Price is price and good clients understand the market rates and exposures drive premium spend - can not control either. If clients sales are up 40% and they have to pay more in premium, they are happy to pay. Good clients want an insurance company who will stay with them through the cycles and the brokers job is to find THAT carrier fit for THAT particular account - and all accounts have unique individual needs - "there's always something funky" cause if it was vanilla - State Farm would write it. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

@Spekulatius you are half way there with growth being tied to market cycle, hard or soft, and beneficial to broker organic revenue. There is another part of that equation that is equally important. Premium is a function 2 items. RATE (as you said @Spekulatius) and EXPOSURE (Cost, Payroll, Sales, # of Units, ect). Unpack for the interested: Year 1 you have a business that does $10M sales and the rate is $5.00 / $1000 of sales, premium will be $50,000 (broker revenue anywhere from 10-15% of premium). If exposures are flat at Year 2 renewal (Same $10M sales) and the rate increases 30% to $6.50 (the market "hardens" as it has over the past 3 years), premium will be $65,000 (Broker commission is same, does not change). Lets just say Year 3, the ECONOMY tanks or that particular account lost revenue for whatever reason , AND MARKET SOFTENS, the account's expiring $65,000 premium turns south quick. BOTH rate and exposure down 20% from $6.5 rate to $5.20 and $10M sales drop to $8M, premium would be $41,600. This is the real killer to brokers - happened is 2008-2009 - super soft market and exposure were down huge. So put the above in revenue dollars to broker (10% commission for easy math): YEAR 1: $10M sales at $5.00 rate = $50,000 premium is a $5,000 broker commission YEAR 2 (exposure flat, market hardens): $10M sales at $6.50 rate = $65,000 premium is a $6,500 broker commission YEAR 3 (exposure down, market softens): $8M sales at $5.20 rate = $41,600 premium is a $4,160 broker commission Year 1 to Year 2 is a 30% increase in revenue. Year 2 to Year 3 is a 36% reduction in revenue. The inverse of the above is what has been happening to brokers over the past 2-3 years, hence revenues just coming in huge quarter after quarter, both RATE and EXPSOSURE have been up (rate more so in property). This is true for all lines of business sold in the insurance industry, truck fleets have a "cost per unit". The rate is unit cost and the exposure is number of units on the road, if the business is doing well, they buy trucks and premium goes up, if the business is doing poorly, they sell trucks, and endorse the policy for a credit. Rate is "LOCKED" for the year, the exposures are "AUDITED" at the end of the year. Same with payroll for employees, subcontract costs, Health insurance, ect. Everything in the insurance business has a rate and exposure. Imagine the games slick clients play with exposures? ha! That's a game inside a game. Brown does an EXCELLENT job of explaining this on the quarterly's, both rate and exposure are part of discussion. Brown "gets it". Brown is not alone, others do to - I just know Brown the best. Investor community LOVES "ORGANIC GROWTH" on the way up however on the way down, read the disclosures - will be interesting to see how management's explain "Lack of Organic Growth". I will be watching closely. Last little nugget, just cause I can not help myself, CARRIERS put language in policies called "minimum earned premium" and "Minimum & Deposit". Language benefits the carrier and hinder client from leaving midterm or getting a credit at audit. THEY ALSO benefit the broker because the commission for the minimum earned is "locked" as well. The E&S market loves this kind of language where as the "admitted" market typically has no minimum earned and premiums are not minimum and deposit. Small nuance and language is buried in 200 pages of the contract that clients (sometimes brokers) do not read. Regarding Acquisitions, you alluded to same @Spekulatius, my opinion is AJG and BRO are disciplined in valuations and market for acquiring has gone from folding in arbitraged deals to overpaying for deals. Will be fun to watch as the pool for sellers continues to get smaller driving up valuations for buyers to pay higher multiples - that's what the past has shown us. Future could be different. Already shared RYAN buying US Assure for a NOSEBLEED 8.13X REVENUE - $1B on $123M revenue. This excludes performance bonus up to an additional $400M. 8X revenue is the highest I am aware of ever ever ever.