-

Posts

5,482 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Everything posted by John Hjorth

-

@dealraker, These overriding themes, dwarfing, overriding and overshawing everything [well, naturally not everything] and creating a certain negative sentiment has been going on pretty constantly also here on CoBF, as long as I've been around [, and that's now more than decade], which I think is somewhat mentally unhealthy to adopt to. To which degree do they matter? Well, naturally it matters in respect to how one is invested. So if these macro things keeps one awake at night, perhaps the solution would be to invest differently than what one already does? Based on the "Pro Business" attitude I posses based on education and professional training etc., I'm a firm beiever in the on CoBF former technical platform signature by @Spekulatius : [This is not nice, but] I find it striking that some CoBF members are more active in these kind of topics than in the Investment Ideas forum. Keep the eyes on the ball. The ball here is your own portfolio. This not the same as as stating all "macro-talk" on CoBF has no relevance, i.e. for real estate is matters a lot.

-

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

@dealraker, Personally, I don't think there is anything wrong with the work provided and shared - public - Mr. Bloomstran. There may be shades and nuances, - here and there, where you may be left at on your own discretion - till example last year, Mr. Bloomstran handicapped the Berkshire AAPL position by USD 50 B - talk to me about variant perception! - Or was that the year before?! To me, in the end, it is all about aiming for return vs. patience and risk taking. I do not consider Mr. Bloomstran bad in that regard. He just has some preferences outside my own circle of competence [, in general called energy], that causes me to never really *click* with him. And after all, - in the end - he is just another money manger, - with a personal agenda - that applies to such people. - - - o 0 o - - - The only difference compared to Mr. Buffett [the younger version of him] I've personally been able identify is a swimming pool [, but what do I know, I may be wrong here]. -

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

@Xerxes, To me, it appears as somebody - has - more or less - forgotten - who to serve first [clients]. Because I'm not actually a customer, my perception may thus be totally wrong. To me, it's just dishonest and disingenious to allocate a material part of capital from limited partners to Berkshire, instead of asking the limited partners buying Berkshire stock themselves to hold. Maybe the content of this post can be boiled to that I'm about to have had enough of Mr. Bloomstran. By further thoughts, I may be absolutely unreasonbly here, because actually, not much really material happens at Berkshire during a year, forgetting the material leaps in some years. -

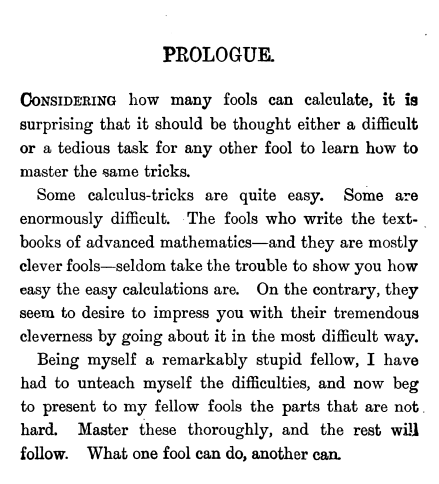

Backdrop I follow a Twitter account. It's one of those thingies on the Web, that - at least to me - just keeps on giving and giving, while I deliver nothing. Here, I'm almost hit by bad conscience by things being so. A person just "by nature" wired to share good and interesting stuff - never even asking for anything in return [here, for me, Substack and SA comes to mind]. The Twitter handle is Massimo, and the Twitter account is @ Rainmaker1973. The combination of a visible curiosity and an enourmous intellectual capacity to adapt and adopt across multiple sciences [mathematics / physics / chemistry / biology / astronomy ], combined with high energy levels can create something outstanding, to the benefit of other people, if the sharing mindset is based on sincerety and honesty, without no other - perhaps not so honorable - motive, likely based on some kind / shade / dimension of egoism. Book: Today, I was - again - handed a gem - by Massimo - for free : Silvanus P. Thompson - Calculus made easy [pdf-file]. Open source project for sharing : Calculus made easy. Personally, I think every investor being serious about their doings should read the chapter: On true Compound of Interest and the Law of of Organic Growth . - - - o 0 o - - - As an advid book collector, I will not try to search for physical specimens of this book. I have a feeling the price asked - if any even available - will be in a major conflict with my scope of not committing large outlays to unproductive assets. I may even not afford it. If this post has caught your interest, I hope you may enjoy your experience. Teaser 1: Teaser 2:

-

This is soo funny to me! Personally, I have experienced quite a bit here on CoBF in the last decade [yes, now more than a decade - many other still active on here and esteemed CoBF members beat that by multiples!] - During that period ,in wich I've been a CoBF member, I have experienced quite a lot on here, all things not always a pleasant experience. I've actually from time to time had thoughts about "leaving" / logging out for good [I would never delete my CoBF account] - that has been when the posting style from someone [or several someones] has been confrontational, personal, here including namecalling and I don't know what. Those periods in the existence of CoBF are fortunately over now, and has been so for many years now - and will hopefully not come back again. - - - o 0 o - - - Just to share here my experience from back then here on CoBF when you may be in personal trouble, based on your posting : I have always thought that a CoBF member should in any circumstance just "be your honest inner self" while posting.

-

Phenomenal businesses that don't require any capital

John Hjorth replied to LearningMachine's topic in General Discussion

@Sweet, It happens from time to time, that you may be undecided about certain companies, from what you may read here CoBF from other board members and other stuff. Do you really need a firm and high conviction of your own then to engage? It's all about making yourself comfortable with regard to position sizing, based on "if you don't try, you'll never get to grasp the knack of it!" I've now owned for many years V, MA & CSU [based on reading the respective topics of those investments back then in time here on CoBF] [each their own indivial investment cases], based on that approach. Pretty awesome experience, I might say [I and - naturally - should add : Thank you! - to the CoBF posters sharing their work and thoughts with me back then]. It is about dividing your own conviction more granular, the "too hard" pile divided from : "Too hard", in to "Too hard" and "Perhaps too hard for me", but if you don't try, you'll never learn it." It is all about personal adaption, adoption & improvement over time, to get better. -

Is Concentration a better strategy than Buy and Hold?

John Hjorth replied to Viking's topic in General Discussion

@Spooky, I think it may have to do with a large deferred tax surfacing while disposing the BAC position, and taking that fact into consideration while assessing the risk involved continuing holding and thereby continuing deferring that tax versus whatever available investment alternative considered while reinvesting the BAC sales proceeds after that tax. -

@Luca, There is actually a very good discussion of PAH3 lately in the Volkswagen topic here on CoBF. Porsche Holding SE is by it's basic nature by now a much different beast than Ferrari, uncomparable Ferrari, simply because it owns a large stake in Volkswagen, which holds brands totally different than Porsche and Ferrari [no element of really top class vehicles / luxury].

-

@Whensthepaintdry?, Time will tell. As always, it will depend on the share price compared to other available opportunities at a given moment.

-

Who will join the board in 10+ years?

John Hjorth replied to yesman182's topic in Berkshire Hathaway

Honestly, too many money managers brought in play to my taste above [, including you, @Spooky ]. Please give me some European industrialists [two or three] with a proven track record. Jacob Wallenberg, chairman, Investor AB, Sweden, as an example. He does not qualify right now, because he's not mature yet - he hasen't yet left the diapers stage in life [born 1956]. -

@WayWardCloud, From the "no kids" I perceceive it as if you have a siginificant other. Please accept my deepest and sincere sympathy for living a life with 4 rulers, among them 3 owners of you.

-

I Need a Laugh. Tell me a Joke. Keep em PC.

John Hjorth replied to doughishere's topic in General Discussion

BREAKING: Fed Chair Jerome Powell Delivers Surprise Message for the Bulls . -

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

@dymanojbabu, With all respect and politiliness, we don't need - blank - links to substack items here on CoBF. What we may demand is your personal comments to such, expressing your opinion at the matters at hand. Otherwise, we all drown in posts here on CoBF about etc. how many shares has Mr. Abel acquired this week et. al.- or what do I know. In short, please put our own personal angles to your postings to spice things up, and those will be met by a lot constructive interaction. -

And a photo of the phone Bill Ackman has been tweeting from about the whole mess, calling for Ms. Yellen to save the world:

-

I must admit that I have spent quite some time in the weekend thinking about all this fuzz about Jets parked in Omaha Airport posted on Twitter etc. Also reading *BS* about Mr. Buffett "saved the US banking system under the GFC", while he made two preferred deals of USD 5 B each with banks, and openly in interviews afterwards admitted that he ran out of funds available to engage in 2009. Personally, I have a hard time to imagine that Mr. Buffett would consider it attractive to do a long row of preferred deals [with warrants attached] with a row of small banks and a line of regional banks. Berkshire had approx. USD 125 B in liquidity YE2022 [ex. liquidity in railroad, utility & energy], deduct from that USD 30 B as cash reserves for a "rainy" [<-?] day in the insurance operations, which leaves approx. USD 95 billion. [I haven't even included a deduction for adding to Pilot here - was it approx. USD 8 B?] Would even a material part that figure make any difference in the US banking system somewhere? I think not really. Could it be a potential business opportunity for Mr. Jain to provide insurance to all these banks for insurance of deposits - some way - above FDIC coverage? I'm thinking like NICO years ago provided coverage for Lloyds in London [I know, yes, that was technically reinsurance, not insurance...].

-

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

Here is the link to a tweet containing an article by Max Olson about See's Candies from September 2007, which I don't recall to have seen before. Max Olson is the guy who in 2015 made a compilation of the Berkshire Shareholder Letters with a foreword by Mr. Buffett. The compilation is still available on www.lulu.com here . Max is a CoBF member btw. -

@Xerxes, This tweet is for you.

-

Reuters [March 17 2023] : ICC judges issue arrest warrant for Putin over war crimes in Ukraine . The article mentions : Kremlin says arrest warants 'outrageous und unacceptable' Putin is third serving head of state to get ICC arrest warrant Yes, it places the man in a certain leage, almost of his own. However not like getting an Oscar for best permance or Nobels Prize for Peace. Mr. Browder must be overjoyed.

-

This market movement on this Friday appears pretty wild. My monitor tells me -9.38% for the day. But a lot of bank stuff moved 3% - 4% downwards this Friday. -Perhaps just a result of advancing panick? And then there is the fact that Mr. Buffett has been offloading this bank during the last three quarters, by now almost entirely, after owning it for ages [I haven't checked for how long]. To me, that has been a mystery since the reduction of the position started at Berkshire. I looked at it - and M&T Bank - some months ago. Both appear well run with each their own raison d'être in the US banking landscape. USD 462 billion in deposits YE2022. Let's hope this not "yet another one - counting".

-

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

Thank you, @yesman182, Good one. Thanks for sharing the calculation. Yes, let's hope Berkshire really starts shovelling shares in while the stock is following the market downwards, in periods of time even below 300 for the B. And your post also informing us the proxy is here. -

Basket of Large Cap US Financials - No Brainer Buy Today?

John Hjorth replied to Viking's topic in General Discussion

Yes, @Gregmal, In general, formation of oligopolies strenghening of such tends to reduce competition. -

NPR.org [ March 16th 2023] : Poland will send fighter jets to Ukraine, the first NATO country to do so .

-

Basket of Large Cap US Financials - No Brainer Buy Today?

John Hjorth replied to Viking's topic in General Discussion

What @Xerxes posted here is correct. At the time of acquisition of the HTM security, a IRR pre tax is implied and calculated by basis of the price paid and the stipulated future cash flow of the security. This calculated pre tax IRR is then apllied while calculating the NPV of the future remaining cash flow of the security at any future reporting point in time untill the NPV of future cash flow of the security reaches zero at time of redemption of the security. -

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

Posted by James [ @james22 ] in the topic about the war in Ukraine, about Mr. Tilson : https://assets.empirefinancialresearch.com/uploads/2023/03/My-trip-to-Ukraine-last-week-Whitney-Tilson-3-13-23-1.pdf Some interesting stuff is mentioned on p. 43 about the Howard Buffett Foundation, mentioned here for those who not read the topic about the war.