-

Posts

5,446 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Everything posted by John Hjorth

-

@Spekulatius, Do you mean '... run out of cruise missiles?'? - - - o 0 o - - - Google Translate translates the humor here from Danish to English [for free] as 'Gallow Humor'. OT: I renewed my yearly Google One subscription today, by the way. [DKK 170.00 / year - Value for money - Absolutely awesome service and company.]

-

Crony Capitalism?

-

Mike [ @cubsfan ], Rest assured, I hear [read] you! - This is indeed a Catch-22, and a really nasty one! I may need some more time to think about it and to elaborate.

-

Off topic : - - - o 0 o - - - @Jaygo, Thank you for sharing that personal very touching story. In a way it is also a fascinating story about much that a priori may have seemed about impossiible, actually is possible and achieveable, if the right attitude and flexiblity to obtain better life conditions and social mobility is at place, or embedded and dormant, to surface, after being triggered some way. It's also a fascinating story about progress in our world over the long term. Again, thank you for sharing. - - - o 0 o - - - Now, back to topic again.

-

He is quite silent on X by now and for a period ... burnout? ... - or perhaps already started writing intensely, so perhaps 500 pages in 2025!

-

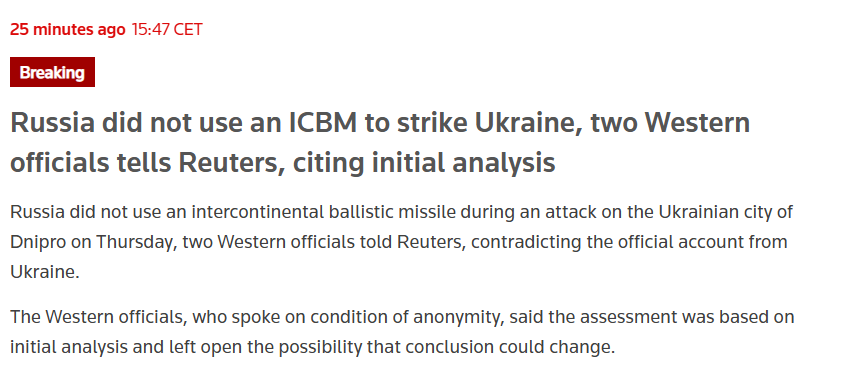

Reuters [November 21st 2024 November 21, 20248:20 PM GMT+1] : Russia fired experimental ballistic missile at Ukraine, Putin says. So, now likely not an ICBM [, we well also likely, all, consider a better alternative in the situation than the start of use of ICBMs.]

-

-

-

All that sh*te going on by now, that ship located and situated about 80 km NNE from me by right now. I'm not amused by that fact. I simply do not sleep well any longer at night because of it - worried. It has become a mental load. - - - o 0 o - - - And then suddenly it also became totally clear and evident to me, why it last year was possible to pick up some cheap Swedish listed real estate : Sweden consists of, or is stuffed up with a lot of holes!, and some land. Caution needed not to fall in one those holes!

-

Mike, [ @cubsfan ], If the above exchange between us is guiding for what's going to happen from here, as described by you above, it's just totally devastating for us Europeans what's in the works, and about what's to happen, and we'll also - on top of that - loose a very important friend, for the future. For your part, [likely - at least for you, I'm sure] the only really short term material effect is you are about to loose a lot of allies for the long term. Then it's all about distinguishing the shades between friends and allies. Friends back up friends,when needed, based on respect for already long term well working friendship, for friends' freedoms and rights to design and take responsibility for own lifes, to choose stance on whatever, Allies concur on what they agree on, and choose to differ on anything else [most likely based on agreements written on paper].

-

Yes, @Sweet, It was meant as entertaining for folks here on CoBF who do generally not need advice about what to do with their money - at all! - Simply because about all aspects of money, they are totally self-propelled and able tooption for the right solutions for them selves, based on a minimum of advice. Then there is the language by financial reporters here in Denmark who all - as far as I know - educated journalists, but autodidact [self-taught] in accounting, finance, company law etc. and all that related stuff, and in that space very fast with a flat, horisontal learning curve, never really diving into something at depth, likely never reading a new book about anything. Result and outcome : Cursory, often flawed, written publiciced stuff by a financial media here in Denmark, based on ignorance, lack of knowledge, misconceptions, misunderstandings. And it's sold for money, and there are acually sufficient subscriptioners to suck it up, to the socall honorable business going! It's now long time ago I have cut such Danish subsciptions for greener grass somewhere else, because it was waste of money. Here, as first example the use of the word 'uncertainty'. It's so lame : One element of 'uncertainty' is actually 'potential' on upside, while the other is what we partially call 'risk' the permanent part of the possibily, the rest of it we call 'volability'. The next example is the confusion of the the underlying causes and common denominators about 'investing in something 'uncertain'', and 'waiting on Corona or a geopolitical crisis'. The true real common denominator for those are the concentration risks that founders and private company owners are willing to assume, simply because such a company percieved as 'an extra, special kid' which was not carried and popped by the owner, or the spouse, partner, whatever. - - - o 0 o - - - But despite all that, the list produced is to me still interesting to study, even if it shall be taken with a grain of salt. Luckily, we have a lot of good companies living 'under the radar' here in Denmark, to contribute to make the wheels go around here.

-

I have been waiting [based on knowledge about your craft] for your reaction here today with exitement, based on great expectations of it being entertaining, which didn't miss!, @LC !

-

@Sweet and Mike [ @cubsfan ], Both situations or events are closely tied to each other, by causation and war logic. It's about leverage, when both fighting parties have run out of steam in a stalemate, where both are forced 'to the table' to talk in stead of fighting, simply they then have acknowledged there are no other feasible options available forward for any of them by fighting, because they have both run out of steam. [Friggin' ugly in it's nature and consequences, but it is so.] [Military logic is so scrary, coldhearted rational and brutal that it is almost beyond comprehension, because it's about violence.] I'll acknowledge that Putin's rationality is a huge questionmark and risk here, ref. Mikes [ @cubsfan ]s stance expressed above, which I respect. However I'm quite sure my respectful disagrement with Mike here is for Mike [ @cubsfan ] understandable, because of differences in perception of skin in the game. Because that is what it really and only is, if one thinks carefully about it. Please think of, what were the actions and thereby messages sent from USA to everyone in those two occations USA has been attacked in history. And please think of what did USA do, when it then had 100% skin in the game, because it was attacked.

-

Yes, @Sweet, and naturally all over the place here in Denmark. This one I consider fairly good and informative, almost by now updated : dr.dk - Blackout [November 20th 2024] : Danish fleet in operation for Sweden: Chinese ship closely followed after suspected sabotage. - - - o 0 o - - - Edit : Another story from Norway earlier this year, thas has skipped my attention untill now : Bloomberg - News - Video [July 11th 2024] : Is Russia Wawing War under The Seas? Btw : We also have the same weird expression in Danish : It must 'in the sea' or 'under the sea surface', otherwise it would battles in tunnels filled with water! Pretty cumbersome and hard to create such tunnels!

-

I woulden't rule out anything a priori when it's about Bernard Arnault. LVMH in the 'Others' compartment of the group chart owns a ... - shipyard! Royal Van Lent Shipyard. The year the build of his personal yacht was completed at the shipyard, a subsidiary of the shipyard, contaning 'something' naturally, was transferred internally upwards in the total group structure, from the shipyard, to the non-listed superstructure. The mere mortals of us perhaps have had dreams of a nice company car. No sweat.

-

Jyllandsposten [November 20th 2024] : The defense has not let a Chinese cargo ship in Danish waters out of sight: This is not normal, assesses an expert. I have no idea or speculation about what this Cat & Mouse thing really is about. But it is concerning to me. - - - o 0 o - - - Edit :

-

SpaceX : Starship Flight 6. Almost a complete success, though no tower grabbing of landing heavy booster! Fly, fail, fix, fly!

-

1. The family feud A look back at the top-20 list of the richest people or families in Denmark ten years ago tells the instructive story about the methods. Seven of the individuals or families who appeared on the top-20 list in 2014 are no longer in the top, and several of them are even out of the top-100 altogether. Method number 1 is probably also the most entertaining for many. Here, the method involves arguing and fighting over the money both inside and outside the courtrooms, so that the money eventually slowly disappears. In short, a method that can be called the "family feud". In 2014, the Færch family was ranked number 19 among the richest individuals or families. The following year they were completely out of the top 20 and then completely disappeared from the list. Over the years, the Færch dynasty has become the epitome of scandals on the hardwood floors in Denmark. The wealth history otherwise goes all the way back to 1869 and the founding of a tobacco factory in Holstebro and then a large plastics company. But the fights over the money have been going on for many years and were most recently trumpeted in public by leaked audio recordings from a podcast about the family dynasty, brought by the medium Frihedsbrevet. Dramatic family meetings are revealed here, where an adult daughter is heard saying to her mother: "You're putting a gun to my forehead". The podcast "Huset Færch" once again brings the drama of the wealthy family to life. For the entertainment of some. To the shame of others. 2. Start a bank Method number 2 to fall off the top can be called "Start a bank". Niels Thorborg has made his money by renting out everything to customers who didn't want or want to spend the money on buying the things. In 2014, he was so successful with the company L'easy that he was comfortably placed as number 15 among the richest people in Denmark. In fact, he was in the top 20 right up until 2021, when he dropped out. However, he is still in the top-100. But a year before, he had had the good idea that he wanted to start a bank. It became Facit Bank. And it was expensive. In 2023 alone he had to write a check three times and send more money into the bank, and again in 2024 he had to pick up his pockets. And if the concept of starting a bank is too slow, Niels Thorborg knows another and quick method to add money - buy a football club. As the owner of the club OB, he almost decides himself how quickly he wants to get rid of the money. But love cannot be bought with money. This also applies in football. 3. Bet on the uncertain Method 3 to leave the list with less money than when you entered the list, we can call "betting on something uncertain in the long term," also called the biotech industry. In 2014, the Gunnersen Harbo family was number 20 on the list of the 20 richest people or families in Denmark. Admittedly a last place in this context, but still in the top 20. The money came through the sale of the life work Dako in 2007 to a capital fund. The sale yielded proceeds of DKK 4.2 billion, and that money went into investment companies and, among other things, invested in several new life science adventures. Viggo Gunnersen Harboe has thus bought into a small diagnostic company Biostrip, which works in the same area of biomarkers that his father made billions from. But as everyone knows, that industry is precarious. The gains can be big, but they can also take a long time to come. The family dropped out of the top 20 the following year and then completely out of the top 100. 4. Give the money away Method 4 can be aptly called "give the money away". This is the method that Winnie Liljeborg has used. However, fully aware and with open eyes. Winnie Liljeborg made several billions together with her husband and later her son by first selling more than half of the jewelery company Pandora to the capital fund Axcel and then listing the rest of the company on the stock market. Her fortune is placed in the holding company Liljeborg-Gruppen, and it is from here that she distributes money for charitable purposes with a focus on helping children and young people who are vulnerable, or in other ways live under difficult conditions, so that they have the opportunity to to thrive better socially, healthily and educationally and get better opportunities in life. In 2014, she was ranked number 16 in the top 20. A few years later she dropped out, but is still on the list of the 100 richest people. A quick way to get out of the list of the top 20 is of course also to "leave the country", so the values may also disappear in the dark. Winnie Liljeborg's ex-husband and son have thus done so. In 2014, they were number 11 on the top-20 list, which thus counted as many as three Pandora billionaires. But a few years later they were out, for the simple reason that they have moved to Thailand, where Pandora has production and employs several thousand people. And although all three of them are out of Pandora, today they have a so-called family office investment company together with the name North-East Group ApS. 5. Wait on Corona or a geopolitical crisis A final but also safe method is to wait for a global pandemic. Martin Møller Nielsen with the company Nordic Aviation was a fixture on the top 20 list. But with the corona pandemic, the need to lease regional aircraft, which was the company's entire business basis, disappeared. The group came under reconstruction in the USA - in a so-called chapter 11 scheme - and when the company came out of this scheme, Martin Møller Nielsen was no longer with the company he himself had founded and led to become the world's largest lessor of regional aircraft. However, he is still on the top 100 list.' The Fleggaard family also used the same method. The family has been called Denmark's champions in cross-border sales to the Danes from their distinctive businesses just over the border. However, they were hit hard by Corona and the family fell out of the top 20. However, they are still in the top-100 and seem to be on their way up again. The Danes don't want to miss out on a good offer. 6. The day fly A glance over the past ten years at the top-20 list also reveals a few individual day flies. Denmark has never really been a big IT country. We had Navision. And then we have Unity Technologies, a 3D platform for developing games that gained global success in an instant. In 2021, one of the three Danish founders, Joachim Ante, went directly to number 10, but already the following year he was completely out of the top 20 again, as the shares in the company had fallen dramatically in value. However, all three are still on the top 100 list. Also a daily fly in this context is Morten Hummelmose, who as a successful partner in the capital fund EQT achieved a place as number 19 in 2021, only to be out again the following year. This year he has proclaimed that, like Winnie Lijleborg, he will now spend more of his time and fortune on charity. He and his wife shoot at least half a billion. DKK in a new fund for that purpose. Finally, it can be stated, for those who might have ambitions to be considered for the list of the top 20 richest people or families in Denmark, that the entrance ticket has become more expensive. In 2014, it required only 3.8 billion. DKK in wealth to squeeze into place number 20. In 2023 it required a fortune of 12 billion DKK. - - - o 0 o - - - The majority of wealthy Danes lay low and are shy of the lime light. - - - o 0 o - - - Source : Economic Weekly Letter [Danish : 'Økonomisk Ugebrev'] : Denmarks 100 Richest [p. 33 - 35]. [Unfortunately could Google Translate not handle the file, for reasons unknown to me.]

-

I acknowlege the flaw in the design of the study underlying the book. I think Collins actually also do that himself. From Jim Collins personal website : Books - Overview : The Economist - Business | Business.view [July 7th 2009] : Good to great to gone. - - - o 0 o - - - YouTube - Drucker Institute [May 14th 2010] : Jim Collins - Jim Collins Drucker Day Keynote : Listening to this actually made my day today. - - - o 0 o - - - Think old - thousands of years old - Traditional Chinese medicine. How was it developed? Normative science? - Trial and error? - - - o 0 o - - - From the webpage of one of the subsidiaries of a highly successful Dansh healthcare company, who like the main competitor really can't explain why their meds everyone wants to buy, work : Novo Nordisk Pharmatech : - - - o 0 o - - - Do I believe it? : Yes. Do I belive in it? : Yes, but not religiously. I'm professionally trained and raised to believe in it as the basis by the person [boss] taking me to the next level when the influence on me from my parents faded after I left the nest. - - - o 0 o - - - Gotham Artists : Jim Collins. [Who know how much money he has?]

-

Troels Lund Poulsen : The break in Danish politics is over. So defense budget already ramped up with DKK 200 billion, estimated need for more DKK 300 billion. Jyllandsposten - Helge Ishøy [July 2nd 1999]: 'Die Dumme Dänen' - Still stupid? [<- Damn cool story about Opel, Hitler! ][So much for collecting a large peace dividend!] - Christ, this is embarrassing ...

-

@UK, Everything is about attitude! - Especially by now for us European CoBF members, who - finally and suddenly - find our selves in deep sh*t, after cashing in 'the peace dividend' for now two decades+!

-

Thank you, @ourkid8 ! - - - o 0 o - - - [Just mentioned your response to the Lady of the House, her reaction : 'My god, you're all soo dumb!' ]

-

Small starter position in JOE [finally].

-

And likely somebody have now asked 'daddy' for permission to follow suit : RBC-Ukraine [November 17th 2024]: France and Britain greenlight Ukraine’s use of Storm Shadow missiles against Russia: Le Figaro.

-

Pretty striking, how clumsy some Russians have become as of lately.